Established in the early 1990s, Kingston Financial Group has experienced tremendous growth by the support from our clients and partners. We are a leading financial institution in Hong Kong which provides a full range of financial services including securities trading, futures trading and corporate finance.

What is Kingston Financial Group?

Kingston Financial Group is a diversified financial services provider based in Hong Kong. It offers a range of services including securities trading, futures brokerage, and corporate finance advisory. The group is regulated by the Securities and Futures Commission (SFC) of Hong Kong, ensuring compliance with financial regulations. It caters to both individual and corporate clients, providing robust trading platforms and mobile applications for real-time market access.

Pros and Cons of Kingston Financial Group

Kingston Financial Group, regulated by the Securities and Futures Commission (SFC), ensures robust compliance and operational integrity, providing investors with a secure environment. The group offers a broad array of services, including securities trading and corporate finance advisory, catering to diverse client needs. Additionally, it supports mobile trading, enhancing accessibility and convenience for users on-the-go. However, the company's fee structure may be complex and less transparent, which could deter potential clients looking for straightforward costs. The range of financial products is somewhat limited, particularly in mutual funds, which may not meet the needs of all investors. Furthermore, the absence of promotions might make it less attractive compared to competitors offering incentives.

Is Kingston Financial Group safe?

Kingston Financial Group, operating under entities such as Kingston Securities Limited and Kingston Futures Limited, appears to be a regulated entity under the Securities and Futures Commission (SFC) of Hong Kong. The regulatory status and compliance with the rules set by the SFC contribute to its overall safety. Each entity has a specific license number (Kingston Securities Limited: ABL789, Kingston Futures Limited: AAZ082) and their services are regulated by the SFC, ensuring adherence to financial standards and oversight.

What are securities to trade with Kingston Financial Group

Kingston Financial Group, through its subsidiaries, primarily offers services in stocks and futures trading. Kingston Securities Limited handles stock trading, including securities dealing, brokerage, and IPO financing. Kingston Futures Limited specializes in futures brokerage. Additionally, Kingston Corporate Finance Limited provides corporate finance advisory, focusing on transactions such as IPOs and mergers and acquisitions.

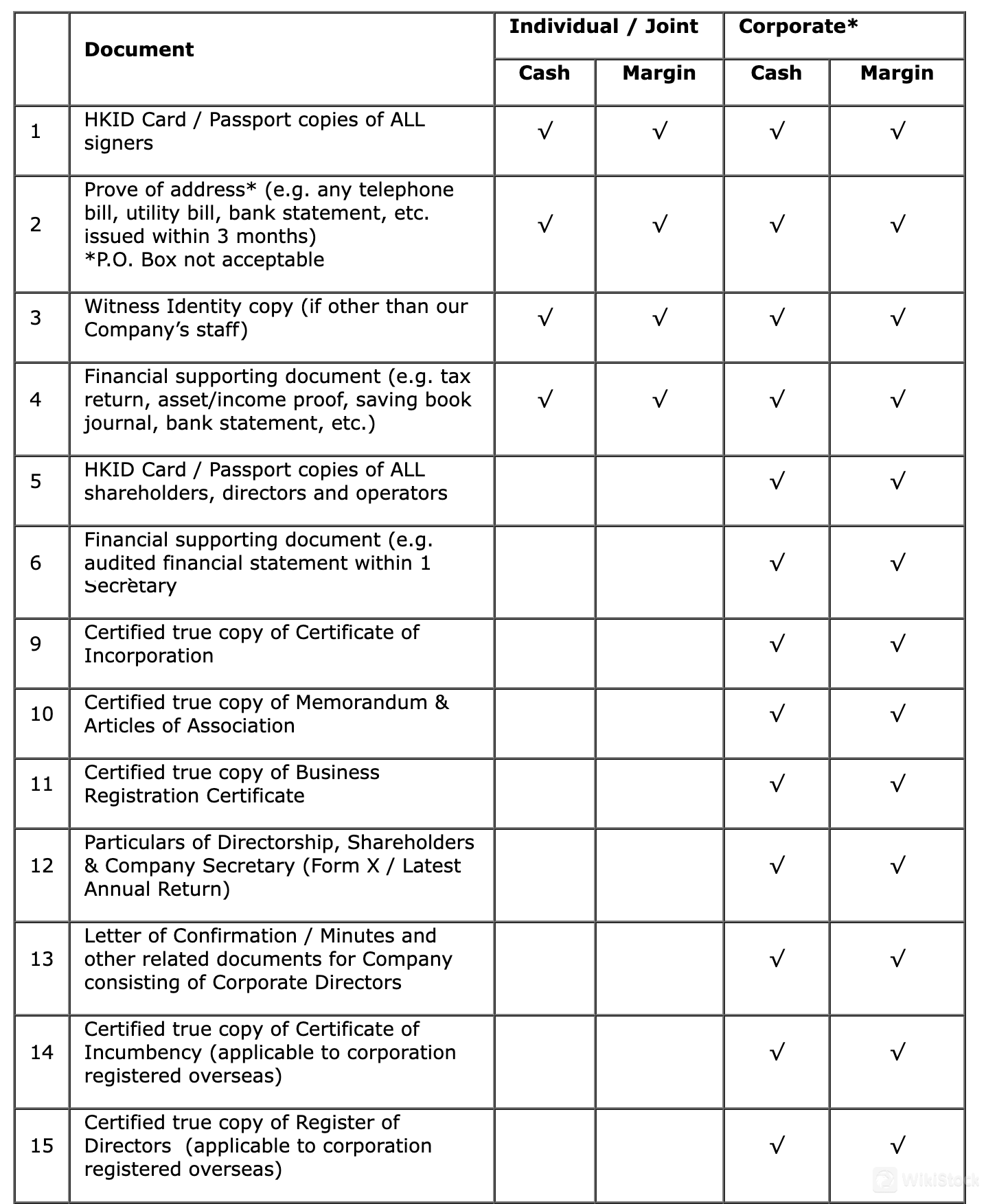

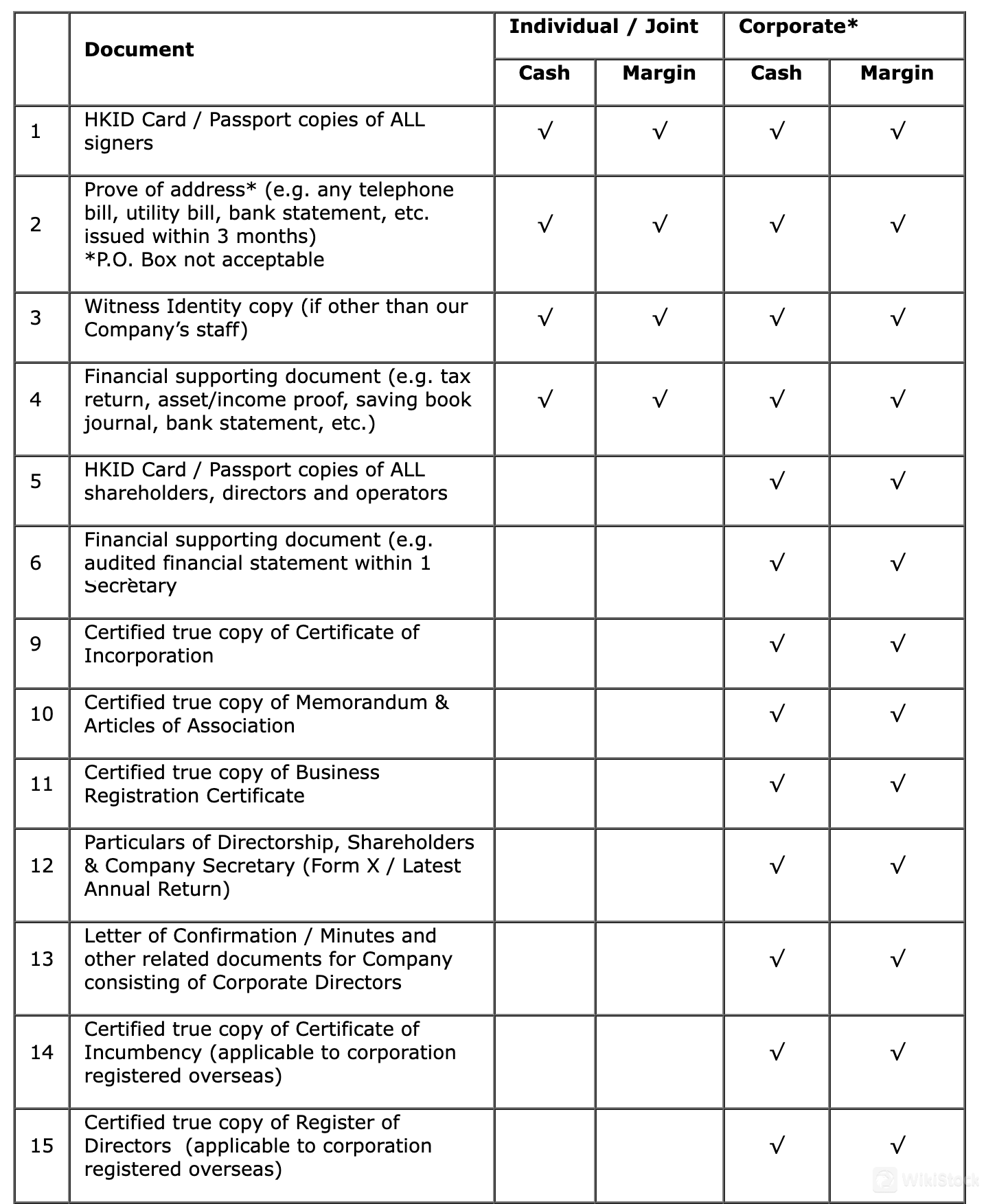

Kingston Financial Group Accounts

Kingston Financial Group offers both individual/joint and corporate accounts, supporting cash and margin trading. The account opening process requires comprehensive documentation to ensure compliance and security. This includes identity verification (HKID or passport), proof of address, financial documents (like tax returns and bank statements), and identity verification by a third-party witness. Corporate accounts require additional documents such as the Certificate of Incorporation, Memorandum and Articles of Association, Business Registration Certificate, and details of directors and shareholders. These measures ensure thorough vetting and regulatory compliance for all account types.

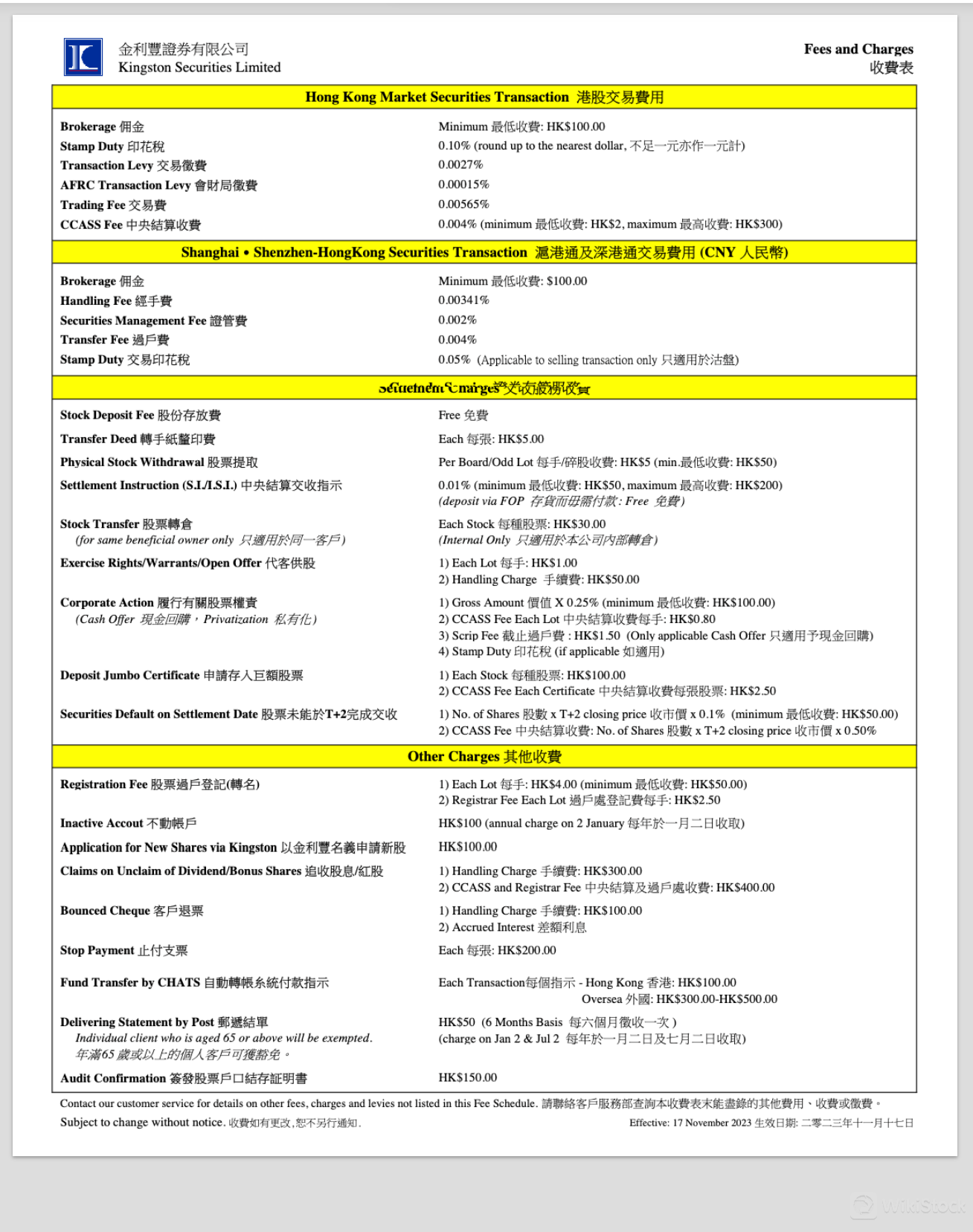

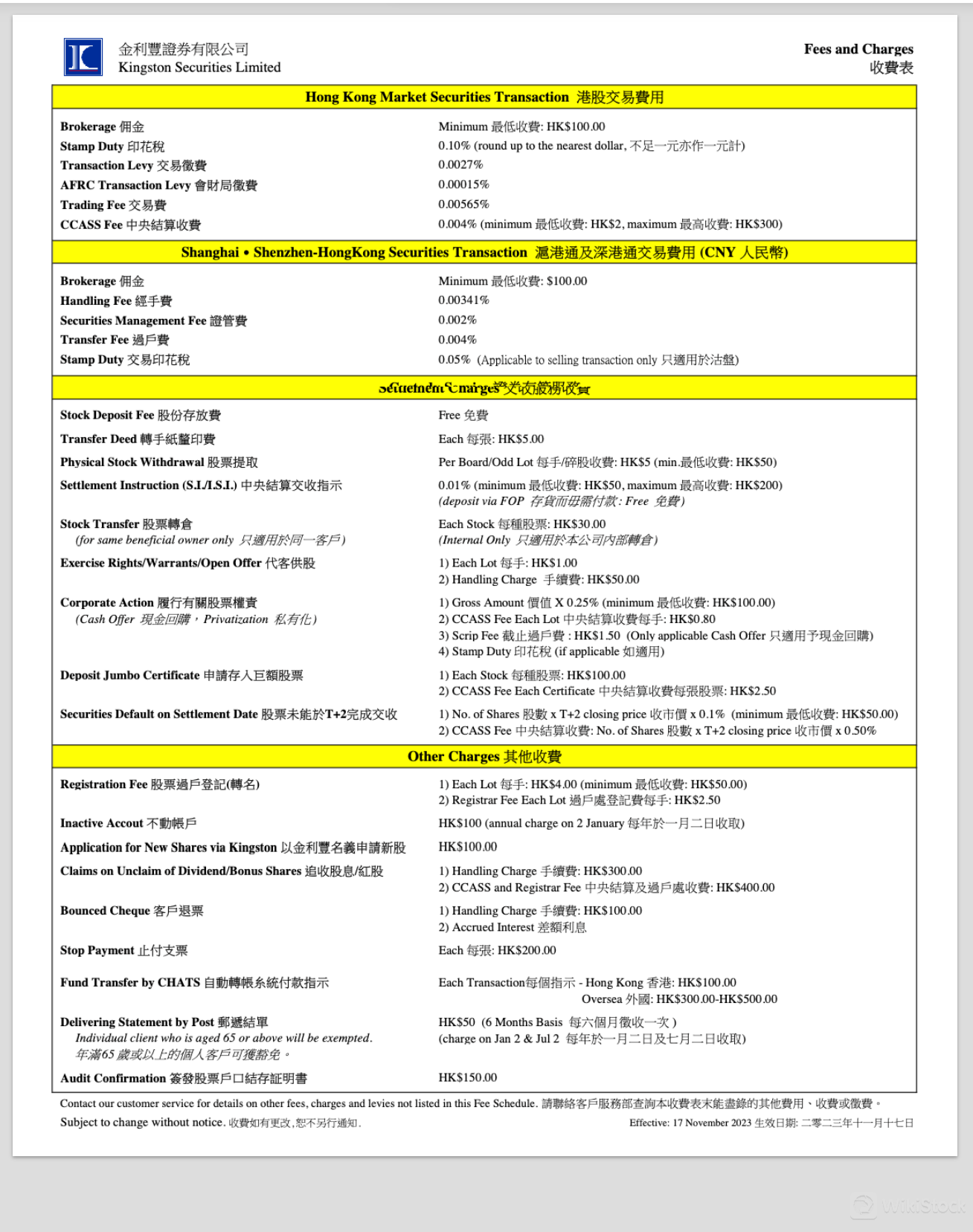

Kingston Financial Group Fees Review

Kingston Financial Group charges a variety of fees for securities trading, custody services, settlement, and other miscellaneous activities:

1. Securities Trading Fees:

Brokerage: Minimum charge of HKD 100.00.

Stamp Duty: 0.10% per transaction.

Transaction Levy: 0.0027%.

Trading Fee: 0.00565%.

CCASS Fee: 0.0046% (with a minimum and maximum limit).

2. Custody Services:

Portfolio Fee: 0.008% per period, calculated monthly.

Stock Custody Fee: Based on the odd lot fee and dividend collection fee.

3. Settlement and Transfer Fees:

Stock Deposit Fee: Free.

Transfer Deed Fee: HKD 5.00 per deed.

Physical Stock Withdrawal Fee: HKD 5.00 per board lot.

4. Other Charges:

Registration Fee: HKD 40.00 per lot.

Inactive Account Fee: HKD 100 annually.

Application for New Shares: HKD 1000.00.

Bounced Cheque Fee: HKD 100.00.

Stop Payment Fee: HKD 280.00.

Fund Transfer by CHATS: HKD 100.00 per transaction.

Delivering Statement by Post: HKD 50 every six months.

Audit Confirmation Fee: HKD 150.

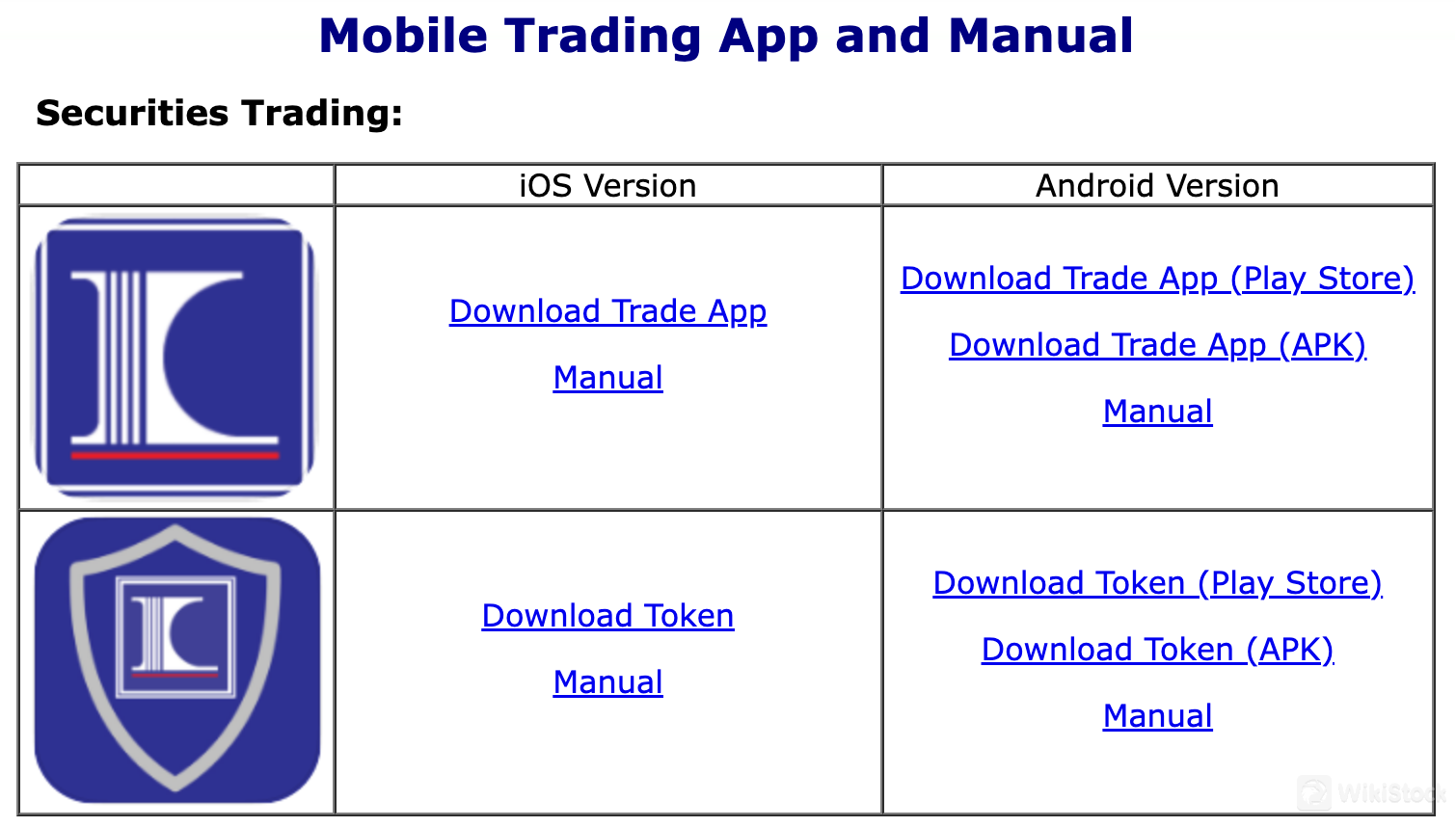

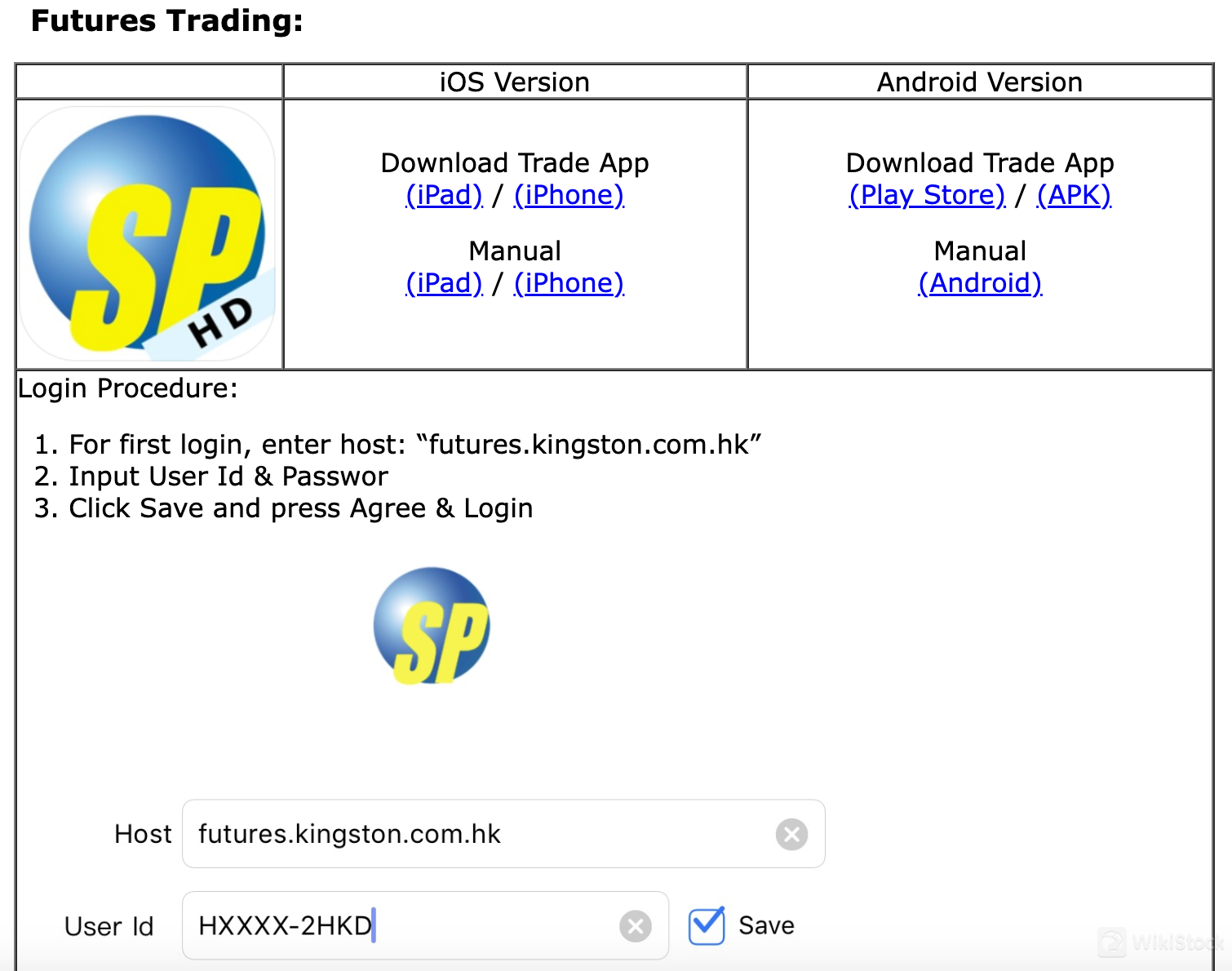

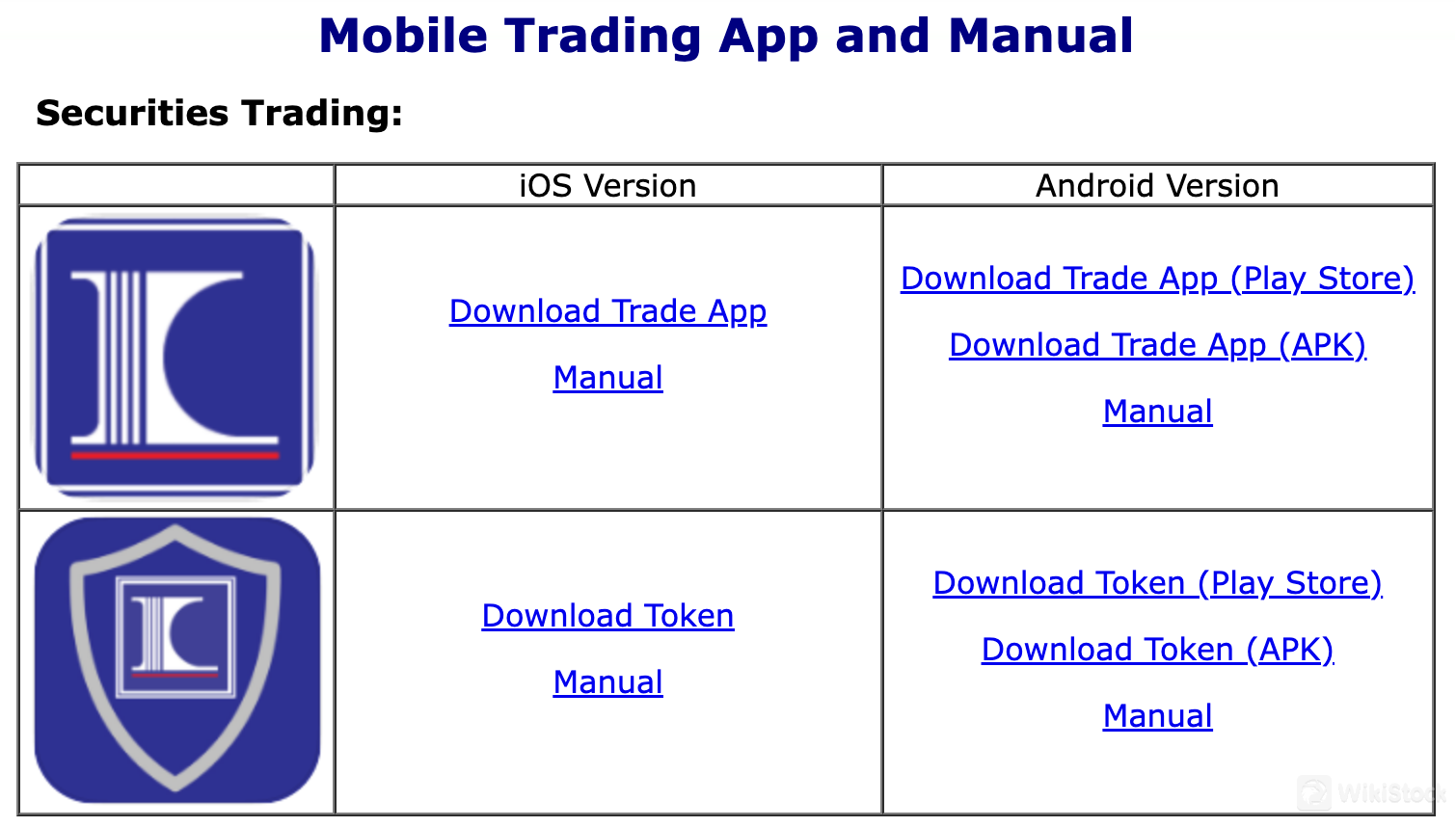

Kingston Financial Group App Review

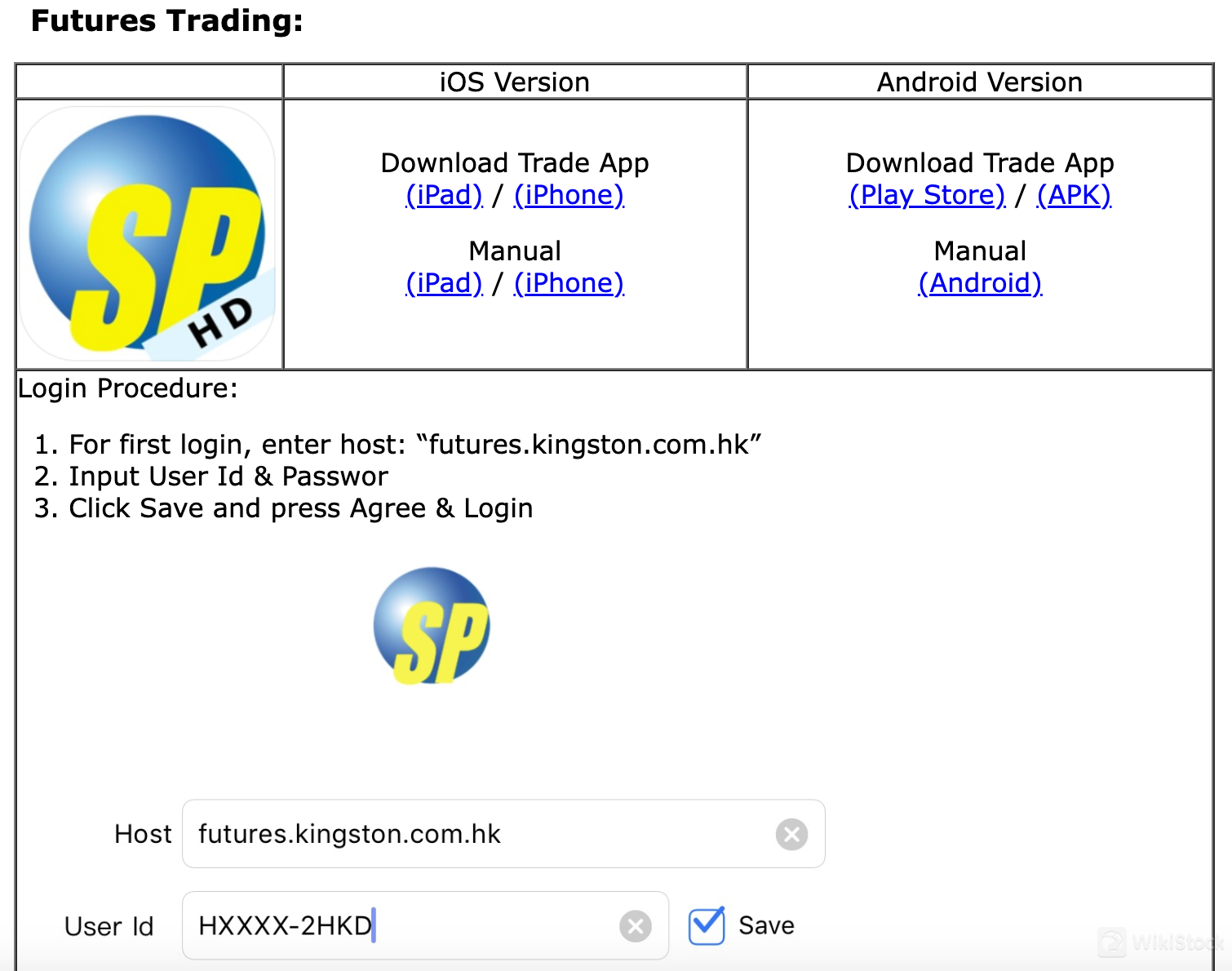

Kingston Financial Group offers mobile trading applications for both securities and futures trading. These apps are available for iOS and Android devices. For securities trading, the apps can be downloaded from the iOS App Store or as an APK for Android, with separate tokens and manuals available for download to guide users. For futures trading, the apps, branded as SP HD, provide a similar availability and include specific login procedures for secure access. These apps enable users to trade, monitor markets, and manage their portfolios directly from their mobile devices, providing convenience and real-time access to financial markets.

Research and Eduation

Kingston Financial Group provides research and educational resources to its clients. Their offerings include market analysis, investment opportunities, and expert commentary published regularly on their platform. The research covers a wide range of topics, including stock performance, industry trends, and market forecasts, helping clients make informed investment decisions.

Customer Service

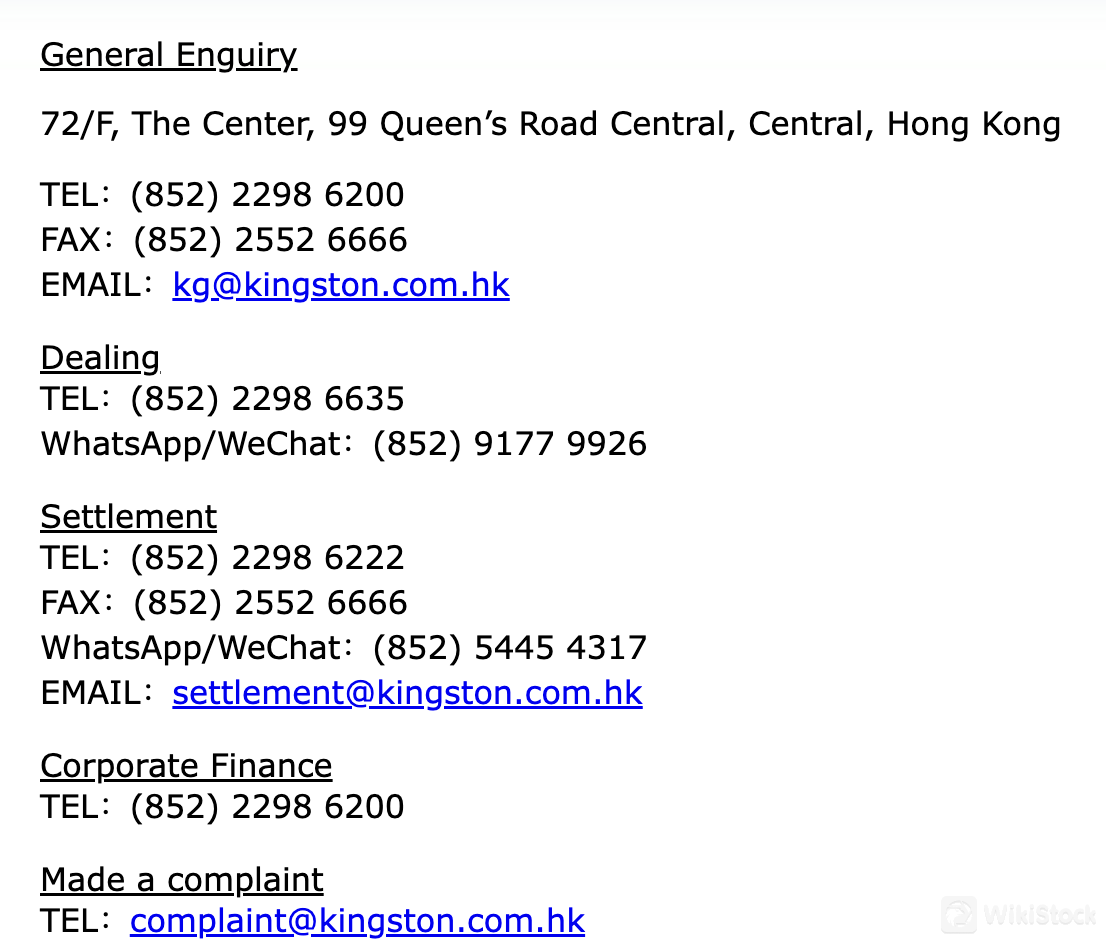

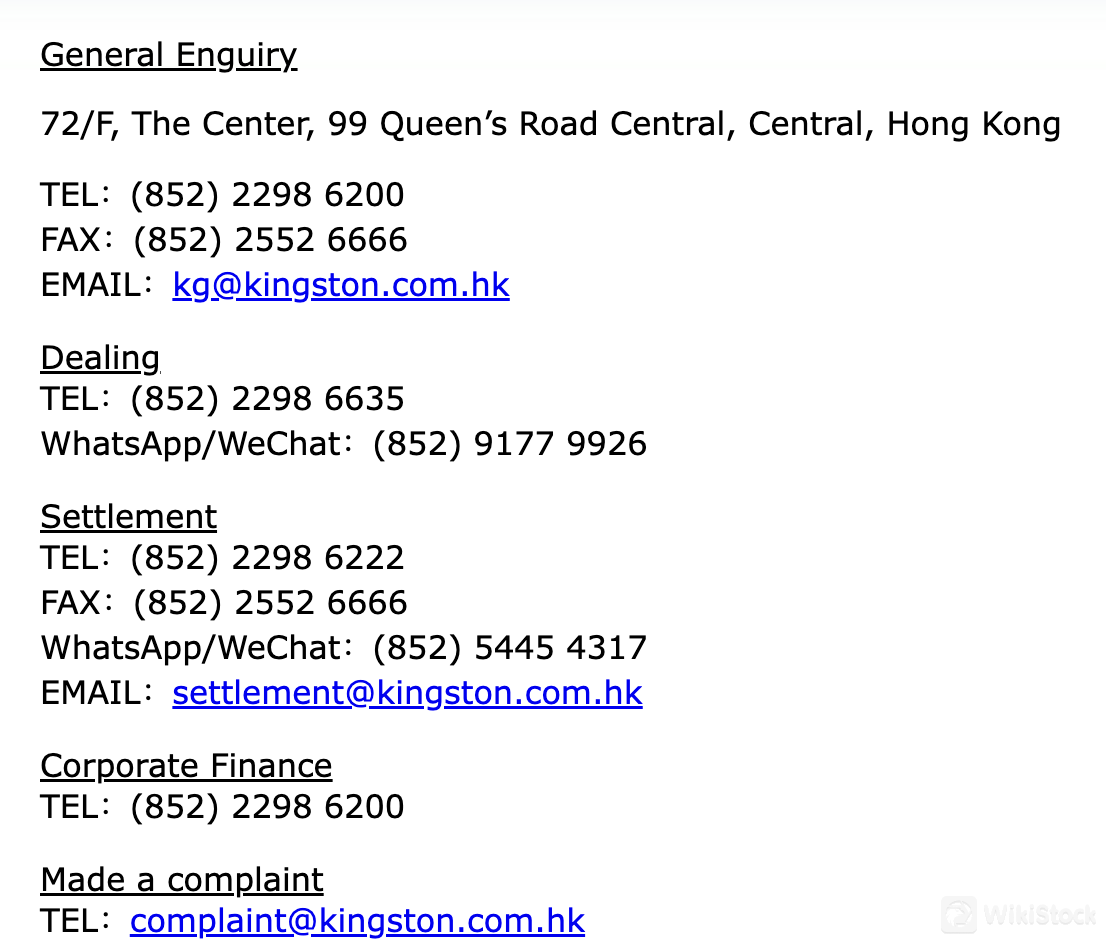

Kingston Financial Group provides a comprehensive set of contact options for various departments, ensuring accessibility and responsive customer service for its clients. Here are the specific contact details:

General Inquiry

- Address: 72/F, The Center, 99 Queens Road Central, Central, Hong Kong

- Telephone: (852) 2298 6200

- Fax: (852) 2552 6666

- Email: kg@kingston.com.hk

Dealing

- Telephone: (852) 2298 6635

- WhatsApp/WeChat: (852) 9177 9926

Settlement

- Telephone: (852) 2298 6222

- Fax: (852) 2552 6666

- WhatsApp/WeChat: (852) 5445 4317

- Email: settlement@kingston.com.hk

Corporate Finance

- Telephone: (852) 2298 6200

Complaints

- Email: :complaint@kingston.com.hk

Conclusion

Kingston Financial Group offers a comprehensive suite of financial services, including robust trading platforms and detailed market research, making it suitable for seasoned traders and institutional clients. However, the complexity of its fee structure and the limited product offerings in areas like mutual funds may deter some potential clients. Despite these downsides, its regulatory compliance and wide service range provide a solid foundation for investment and trading in Hong Kong and beyond.

FAQs

Is Kingston Financial Group safe to trade with?

Yes, Kingston Financial Group is regulated by the SFC, providing a secure environment for trading and investments.

Is Kingston Financial Group a good platform for beginners?

While Kingston offers extensive resources and customer support, the complexity of its offerings and fee structures might pose challenges for beginners.

Is Kingston Financial Group good for investing/retirement?

Kingston offers several services suitable for investing; however, potential clients should consider the lack of mutual funds if these are a desired part of a retirement portfolio.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

China Hong Kong

China Hong Kong Obtain 2 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)

China Hong Kong

China Hong Kong

Positive

Positive