Solomon JFZ (Asia) Holdings Limited ("Solomon Securities") is a financial company, hold the licenses issued by the Securities and Futures Commission of Hong Kong (SFC). We strive to provide comprehensive investment and wealth management service and help our clients achieve more through cross-border, cross-product, cross-service and cross-platform services. Our low trading coats, quick and convenient trading systemscaters to all your investment needs, and keeps you up with the first-hand market information to seize the opportunities.Solowin Holdings (Nasdaq: SWIN) was listed on Nasdaq on September 7, 2023, turning over a new leaf for the global development of Solomon Securities.

What is Solomon Securities?

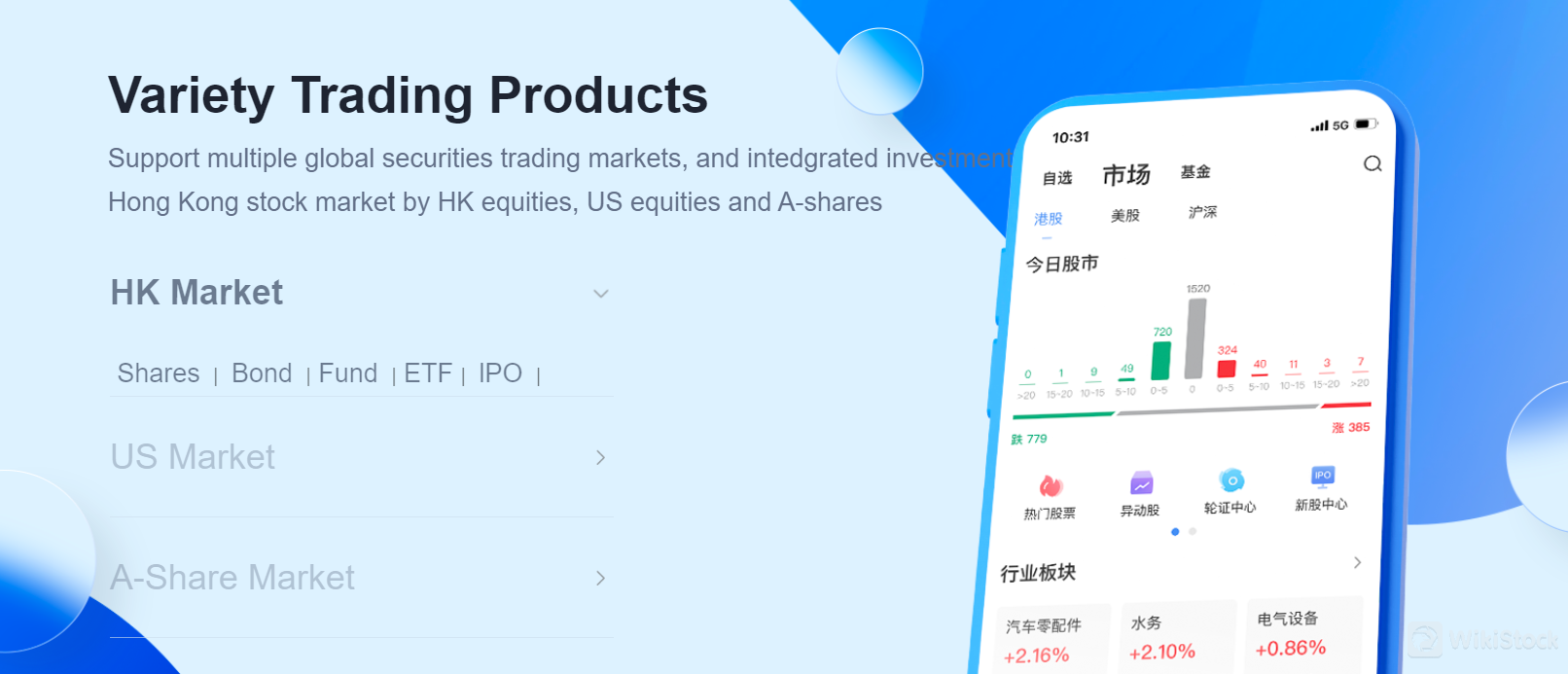

Solomon Securities, part of Solomon JFZ (Asia) Holdings Limited, is a licensed financial services provider regulated by the Securities and Futures Commission (SFC) of Hong Kong. It offers comprehensive investment and wealth management services through its user-friendly trading platform, Solomon Win. The platform supports trading in Hong Kong, US, and China A-share markets, providing access to shares, bonds, funds, and ETFs.

Pros & Cons of Solomon Securities

Pros:

Regulated and Licensed: Solomon Securities operates under the stringent regulatory framework of the Securities and Futures Commission (SFC) of Hong Kong, ensuring high standards of compliance, transparency, and investor protection.

Comprehensive Services: The platform supports a diverse range of financial products, including shares, bonds, funds, ETFs, and IPOs.

Competitive Fees: Solomon Securities offers low trading commissions for Hong Kong securities at 0.1%, along with minimal additional fees such as a 0.1% stamp duty and a 0.00565% trading fee. These competitive rates make it an attractive option for cost-conscious investors.

User-Friendly Platform: The Solomon Win is designed for ease of use, providing a good trading experience with quick execution speeds, real-time market data, and a range of tools to assist investors in making informed decisions.

Cons:

Lack of Transparency: Certain crucial details, such as account minimum requirements, margin interest rates, and the availability of mutual fund offerings, are not found. This lack of transparency can make it difficult for clients to fully assess the platform's suitability for their needs.

Limited Promotions: Some promotional offers, such as the welcome reward and stock transfer-in reward, have ended, reducing the appeal for new clients looking for immediate financial incentives.

Is Solomon Securities Safe?

With a license of No.BIF175, Solomon Securities operates under the stringent regulatory framework of the Securities and Futures Commission (SFC) of Hong Kong, which is known for its rigorous oversight and high standards of compliance. This ensures that Solomon Securities adheres to strict regulatory requirements, offering a significant level of protection for investors.

Additionally, client funds are segregated and held in custodian banks, which means they are kept separate from the firm‘s operational funds. This segregation helps protect client assets in the event of the firm’s financial difficulties. The Hong Kong Investor Compensation Fund (ICF) provides an extra layer of security, offering compensation of up to HK$500,000 in the event of broker default, further safeguarding investors' interests. As a part of Solowin Holdings, which is listed on Nasdaq (Nasdaq: SWIN), Solomon Securities benefits from the added transparency and credibility that come with being part of a publicly traded company.

What are Securities to Trade with Solomon Securities?

Solomon Securities offers a diverse array of securities for trading across different markets.

In the Hong Kong market, investors can access a wide range of securities, including shares, bonds, funds, ETFs, IPOs, warrants, and bull/bear certificates. This comprehensive selection provides ample opportunities for investors to build well-rounded portfolios tailored to their risk tolerance and investment goals. Whether seeking stable income from bonds, long-term growth potential from stocks, or diversified exposure through ETFs, Solomon Securities facilitates access to various investment instruments in the Hong Kong market.

In addition to the Hong Kong market, Solomon Securities enables trading in the US market, allowing investors to access shares of US-based companies listed on prominent exchanges such as the New York Stock Exchange (NYSE) and the NASDAQ. Clients can also invest in US corporate and government bonds, as well as mutual funds, providing exposure to the world's largest economy and a diverse range of investment opportunities.

Furthermore, Solomon Securities facilitates trading in the A-share market, allowing investors to access stocks listed on China's Shanghai Stock Exchange (SSE) and Shenzhen Stock Exchange (SZSE) through the China Connect program. This enables clients to participate in the dynamic Chinese market and capitalize on the growth potential of leading Chinese companies. Additionally, investors can access bonds issued in mainland China, further diversifying their investment portfolios and tapping into opportunities in the Chinese fixed-income market.

Solomon Securities Fees Review

Solomon Securities offers a comprehensive range of services for trading securities in various markets, including Hong Kong, the US, and A-shares. However, the fee structure can be quite intricate, encompassing different charges that investors should be mindful of.

In the Hong Kong market, Solomon Securities charges a commission of 1% of the Allotment Amount, with a minimum fee of HK$0.01, along with a Transaction Levy of 0.0027% of the Allotment Amount and a Trading Fee of 0.00565% of the Allotment Amount. For IPO applications, there's a Handling Fee of HK$10 per application for cash transactions and HK$100 per application for margin financing, which increases to HK$120 for 20 times financing.

In the US market, Solomon Securities applies a US SEC Fee of 0.00278% transaction amount, with a minimum of US$0.01 per trade for sells only, as well as a Transaction Activity Fee of $0.000166 per share, with a minimum of US$0.01 per trade and a maximum of US$8.30 per trade for sales only. An ECN Fee of US$0.003 per share is also applicable, but only for pre-market and after-hours session orders.

For A-shares trading, there's a commission of 0.1% transaction amount, with a minimum charge of ¥60, along with other fees such as Stamp Duty and Handling Fees.

Aside from trading fees, Solomon Securities also charges for other services such as Mailing Statements at a cost of HK$100 per statement per month, Reissue of Historical Statements (via email) with a fee of HK$100 per statement per month beyond the past 6 months, and Account Certification for HK$200 per request.

Solomon Securities App Review

Solomon Securities offers a comprehensive platform, Solomon Win, for trading Hong Kong and US stocks, providing investors with a range of tools and features to manage their investments effectively. The platform is available as a mobile app and a web-based version.

The Solomon Win mobile app is designed to assist customers in managing their accounts easily, understanding the latest trends, and providing one-stop trading for Hong Kong and US stocks. It offers real-time streaming quotes, enabling investors to capture investment opportunities promptly. The app also provides professional financial news and information updates throughout the day, helping investors stay informed about market trends.

Research & Education

Solomon Securities provides materials on various topics related to stock trading in the “Classroom” section. The available classes cover subjects such as “Stocks” and “Commonly Used Financial Market Indices.” These resources aim to educate investors and traders about the basics of stock trading and important financial market indicators.

Customer Service

Solomon JFZ (Asia) Holdings Limited, located at Room 1910-12A, Tower 3, China Hong Kong City, 33 Canton Rd, Tsim Sha Tsui, Hong Kong, serves customers from 9:00 to 18:00.

For inquiries, contact their China hotline at 400 1200 390 or their Hong Kong number at +852 2115 9486. You can also reach them via fax at +852 3428 3660 or email at cs@solomonwin.com.hk for customer service or feedback at feedback@solomonwin.com.hk.

Conclusion

Solomon Securities is a reputable brokerage in the financial industry. Regulated by the Securities and Futures Commission (SFC) of Hong Kong, Solomon Securities offers a user-friendly trading platform, Solomon Win, which allows investors to trade stocks, bonds, funds, and ETFs in the Hong Kong, US, and China A-share markets. While the platform lacks some transparency regarding account minimums and margin interest rates, it compensates with its comprehensive range of services and competitive fees. Therefore, Solomon Securities remains a solid choice for investors seeking a regulated and reliable trading platform.

Frequently Asked Questions (FAQs)

Is Solomon Securities regulated?

Yes, Solomon Securities is regulated by the Securities and Futures Commission (SFC) of Hong Kong.

What markets can I trade with Solomon Securities?

Solomon Securities allows trading in the Hong Kong, US, and China A-share markets, providing access to stocks, bonds, funds, and ETFs.

What fees does Solomon Securities charge?

Solomon Securities charges various fees, including a 0.1% commission rate for Hong Kong securities, stamp duty, trading fees, and other charges depending on the service.

Does Solomon Securities offer a mobile trading app?

Yes, Solomon Securities provides the Solomon Win mobile app, available for iPad, iPhone, and Android devices.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

United States

United StatesObtain 1 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)

--