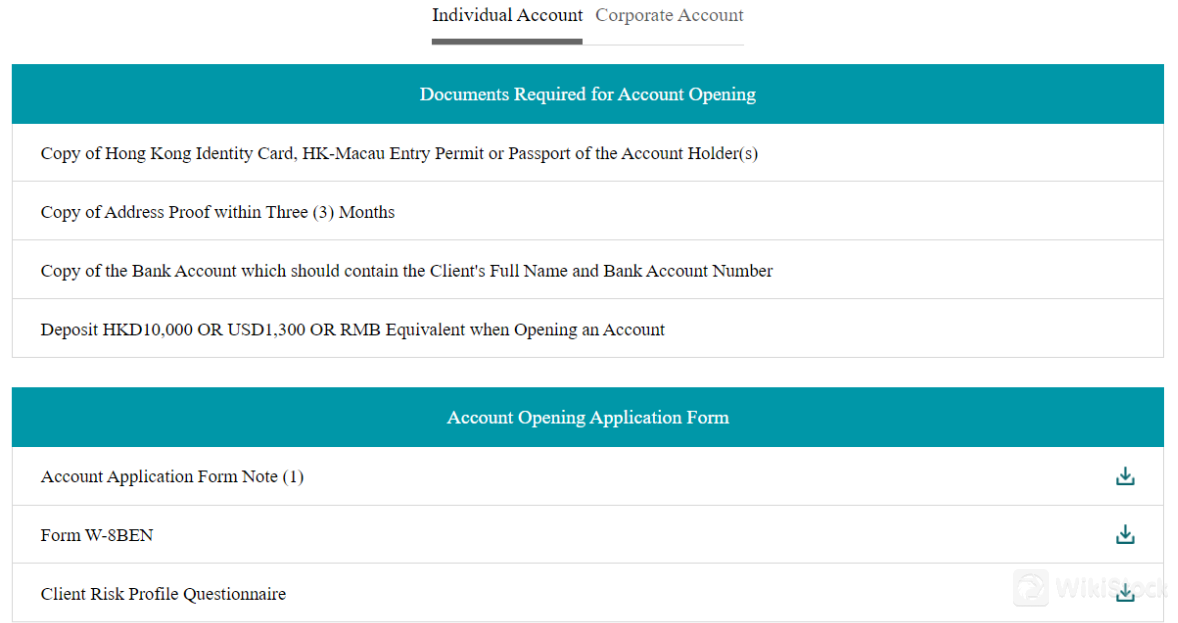

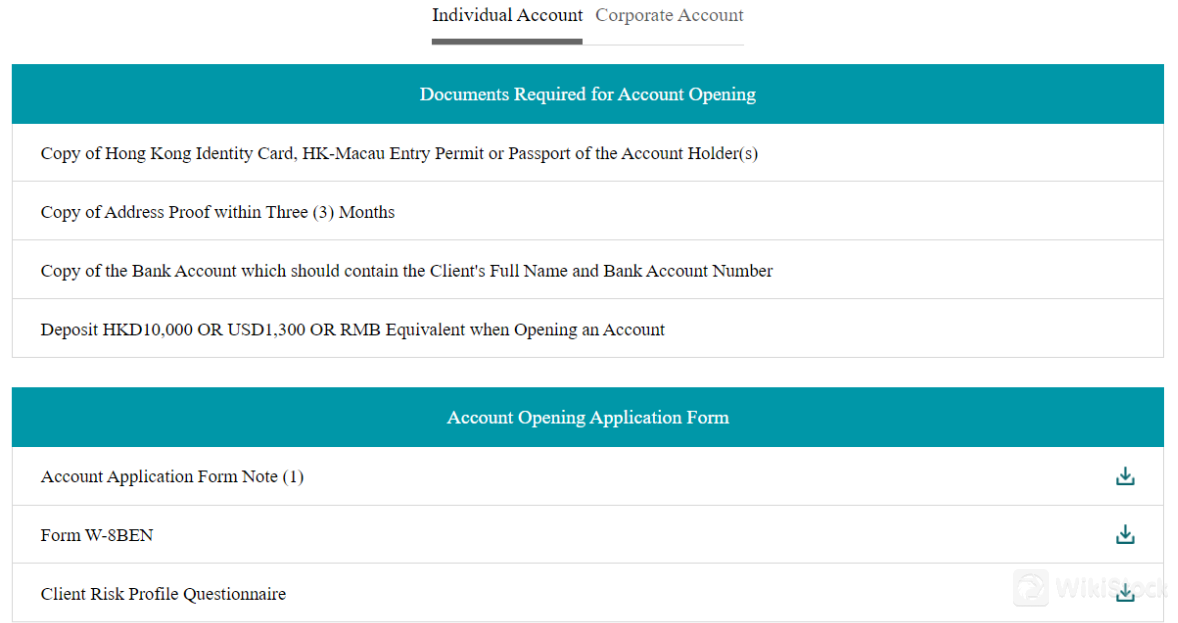

Account Application Form Note (1): This form must be signed by the account holder and witnessed by a licensed staff member of QMIS Securities Limited or its Affiliates. If witnessing through licensed staff is not possible, a qualified person (such as a Justice of the Peace, Certified Public Accountant, Lawyer, or Notary) should authenticate the form and relevant identification documents.

Form W-8BEN: This is required for tax purposes, especially for non-US residents to claim tax treaty benefits.

Client Risk Profile Questionnaire: This questionnaire helps determine the risk tolerance and investment profile of the client.

Note (1): The client is required to have the Account Application Form witnessed by a licensed staff member of QMIS Securities Limited or its Affiliates. If the client cannot witness through the licensed staff, they should arrange for a qualified person to sign and authenticate the form and relevant identification documents. Eligible persons include Justices of the Peace (JP), Certified Public Accountants (CPA), Lawyers, or Notaries.

In summary, QMIS Financial Group provides an Individual Account type, requiring specific documents and forms for account opening, ensuring compliance with identification and financial regulations.

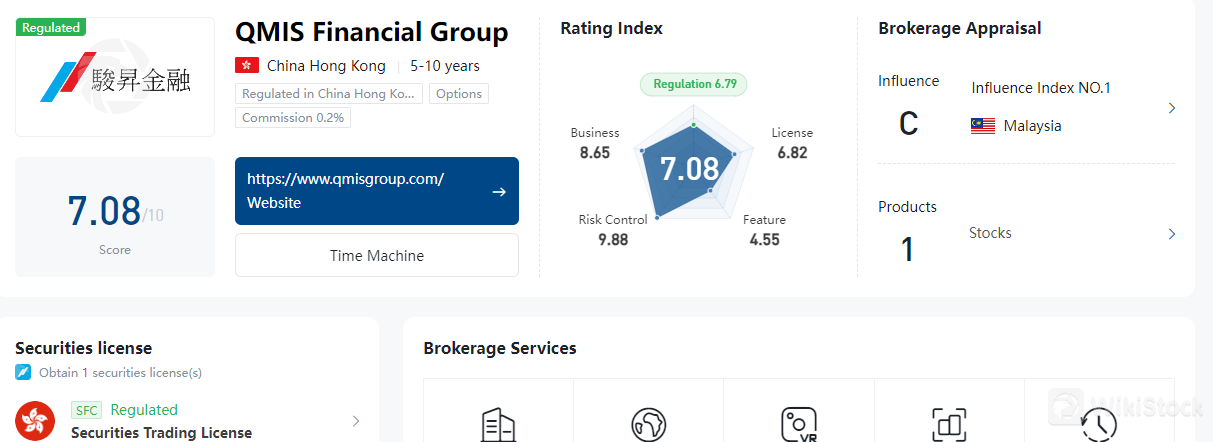

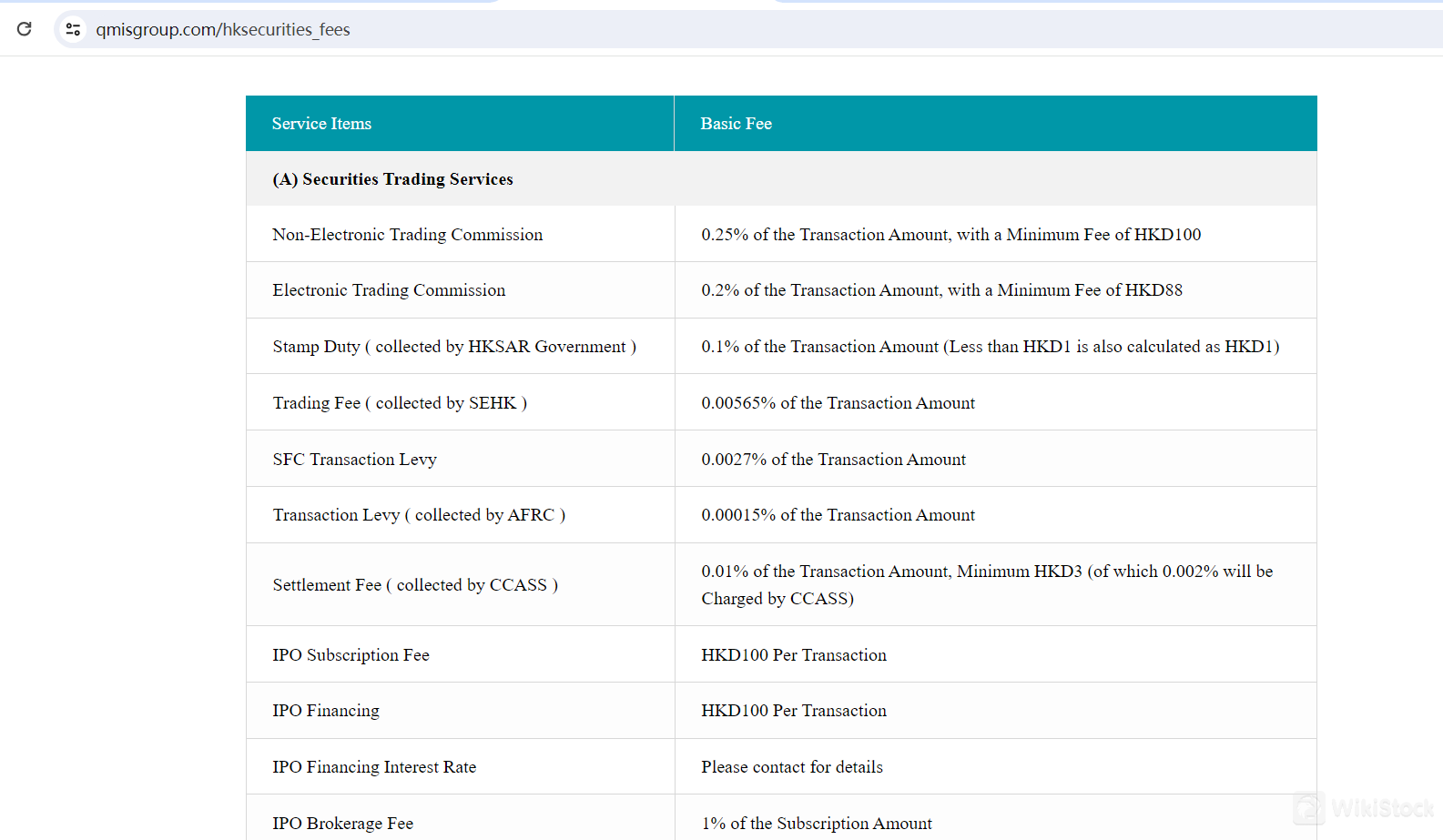

QMIS Financial Group Fees Review

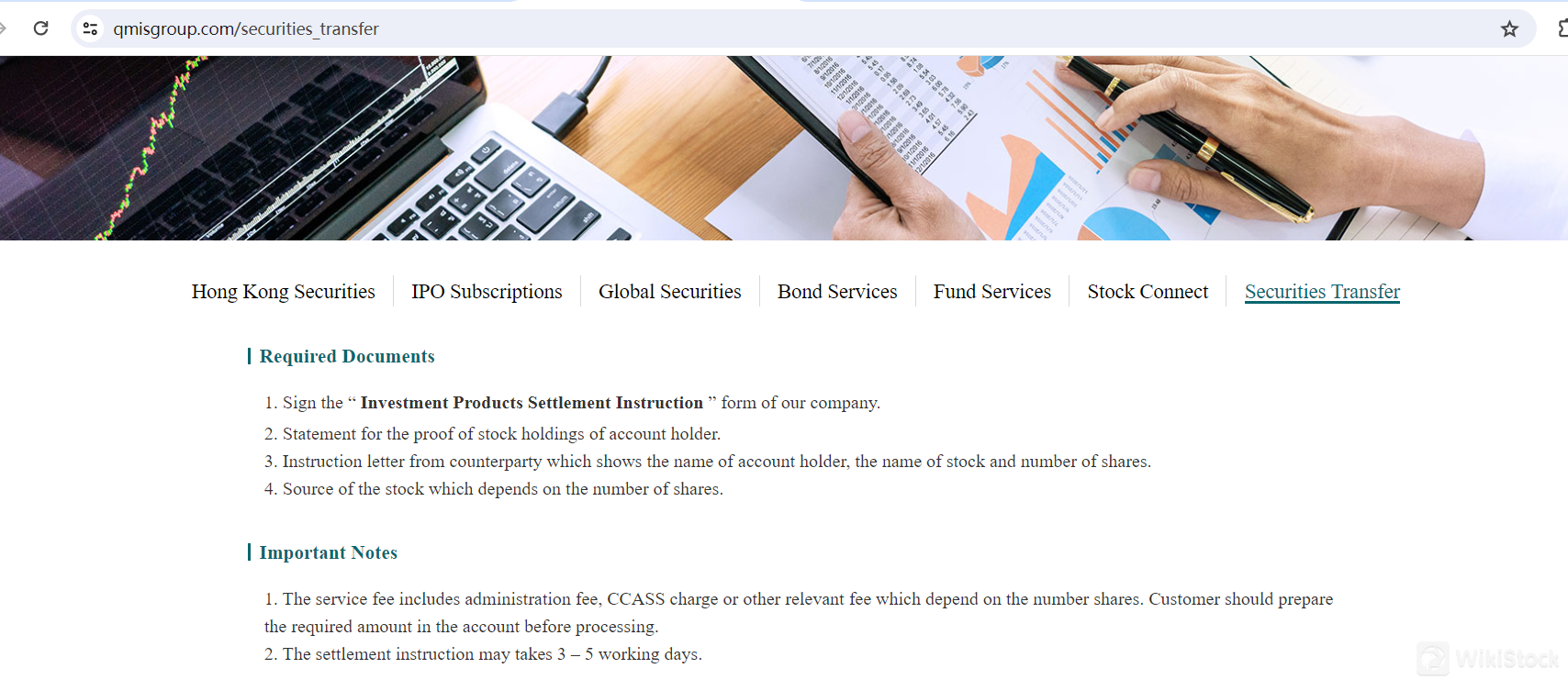

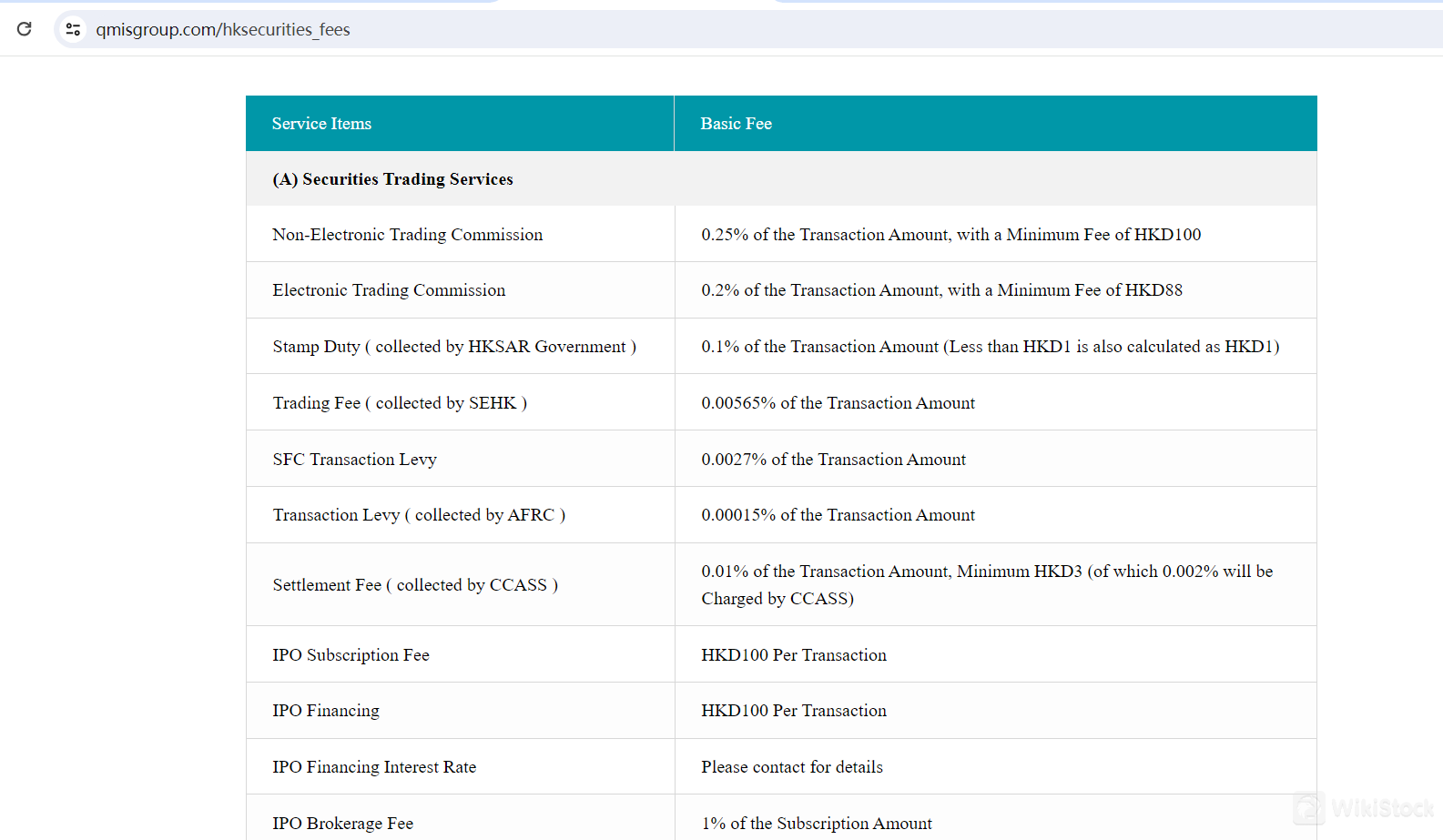

QMIS Financial Group charges various fees for its services, categorized into securities trading, physical securities handling, and account services.

For securities trading services, there are different fees based on the type of transaction. The non-electronic trading commission is 0.25% of the transaction amount, with a minimum fee of HKD100, while the electronic trading commission is slightly lower at 0.2% of the transaction amount, with a minimum fee of HKD88. Additionally, a stamp duty collected by the HKSAR Government amounts to 0.1% of the transaction amount, with a minimum calculation of HKD1. The trading fee, collected by SEHK, is 0.00565% of the transaction amount, and the SFC transaction levy is 0.0027% of the transaction amount. Another levy, collected by AFRC, is 0.00015% of the transaction amount. The settlement fee, collected by CCASS, is 0.01% of the transaction amount, with a minimum fee of HKD3, of which 0.002% will be charged by CCASS. For IPO-related transactions, there is an IPO subscription fee of HKD100 per transaction, an IPO financing fee of HKD100 per transaction, and an IPO brokerage fee of 1% of the subscription amount. The IPO financing interest rate is available upon request.

In terms of Hong Kong physical securities and settlement, depositing physical securities incurs a fee of HKD5 per security, while withdrawing physical securities costs HKD8 per lot, with a minimum charge of HKD100. The settlement instruction deposit fee is waived, but the settlement instruction withdrawal fee is HKD8 per lot, with a minimum charge of HKD100. Additionally, there is an investor settlement instruction fee for rollover withdrawals, which is also HKD8 per lot, with a minimum charge of HKD100.

For custody, agent services, and corporate actions, QMIS Financial Group waives the custody fee. However, dividend collection (whether cash or scrip) costs 0.5% of the dividend amount, with a minimum charge of HKD30. Bonus shares collection fees are HKD30 per case. The scrip fee, collected by HKSCC, is HKD1.5 per lot. Fees for subscription or automatic rights issue, warrants, and reserve warrant fees are HKD0.8 per lot, with a minimum charge of HKD100. The same rate applies for open offers and cash offers, with a minimum charge of HKD100. For cash offers, there is also a stamp duty of HKD1.3 per HKD1,000.

Regarding account services and other charges, terminating a cheque payment or dealing with a bounced cheque deposit incurs a fee of HKD200 per instance. Local transfer withdrawal fees are HKD150, applicable for HKD, USD, and RMB transactions. There is a remittance fee of HKD200 for local processing. Monthly statements or advice mails cost HKD20 per document, while supplementary account monthly statements incur a fee of HKD50 per document.

QMIS Financial Group App Review

QMIS Financial Group offers a mobile application for account opening, providing a convenient and speedy alternative to traditional methods. The app can be downloaded from the App Store, Google Play, and also as an Android APK. This 24/7 service eliminates the need for clients to be physically present at a brokerage office to open an account.

Key Features:

24/7 Availability: Clients can open an account at any time without any limitations.

Convenience: The app allows for a seamless account opening process, which can be completed entirely online.

Accessibility: Available on multiple platforms including the App Store for iOS devices, Google Play for Android devices, and as an Android APK for direct download.

User-Friendly Interface: The app features a straightforward interface where users can enter their telephone number, receive a verification code, and complete the account opening process.

This mobile app is designed to enhance the client experience by providing a quick, easy, and efficient method to open an account with QMIS Financial Group.

Customer Service

QMIS Financial Group provides comprehensive customer support to address various client needs. For general enquiries, clients can reach the support team at (852) 3971 6919. This line is dedicated to providing information and assistance on a broad range of topics related to QMIS Financial Group's services and offerings.

For transaction-specific issues, clients can use the transaction hotline at (852) 3971 6928, ensuring that any transaction-related queries or problems are handled by specialists. Additionally, there is a mainland toll-free number available at 4001 206 046 for clients calling from mainland China, which provides a cost-free option for obtaining support. For document submissions or other fax-related services, the fax number is (852) 3971 6989. Clients can also reach out via email at cs@qmis.com.hk for written communication, ensuring a versatile range of contact methods to suit different preferences and needs.

Conclusion

QMIS Financial Group is a regulated and secure financial services provider offering a wide range of investment options, including global securities, IPOs, bonds, and mutual funds. It features a user-friendly mobile app for convenient account opening and provides robust customer support. However, some fees may be higher compared to competitors, and certain details like interest rates on uninvested cash are not specified. Overall, QMIS is a solid choice for investors seeking diverse financial products and strong regulatory compliance.

FAQs

Is QMIS Financial Group safe to trade?

Yes, QMIS Financial Group is safe to trade with as it is regulated by the Securities and Futures Commission (SFC) in Hong Kong. The company ensures fund safety through segregated client accounts and employs advanced encryption and security measures to protect user information and transactions.

Is QMIS Financial Group a good platform for beginners?

QMIS Financial Group is suitable for beginners due to its user-friendly mobile app, which simplifies account opening and trading. However, potential users should be aware of the various fees associated with the platform.

Is QMIS Financial Group legit?

Yes, QMIS Financial Group is a legitimate financial services provider regulated by the SFC. It adheres to strict regulatory standards, ensuring transparency and fairness in its operations.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Malaysia

MalaysiaObtain 1 securities license(s)

--

--