We are a participant of the Hong Kong Stock Exchange and offer stock trading, securities custody, margin financing and other services. Our company was incorporated in 1994 and our founding principal was one of the original members of the Hong Kong Stock Exchange.

What is ACS?

Audrey Chow Securities Limited (ACS) is a well-regulated trading platform offering a wide range of securities, user-friendly mobile apps, and strong customer support. It provides robust client education resources and ensures transaction security. However, it has a detailed fee structure with various charges.

Pros and Cons of ACS

Audrey Chow Securities Limited (ACS) offers a secure and comprehensive trading platform regulated by the SFC. It provides a wide range of securities and a user-friendly trading experience, including mobile apps. ACS emphasizes client education and offers strong customer support. However, it has a detailed fee structure with various charges, high handling fees, and high late payment interest rates. The specifics of fund insurance are not explicitly detailed.

Is ACS safe?

Audrey Chow Securities Limited (“ACS”) is committed to ensuring the safety and security of its clients' investments and personal information through rigorous regulatory compliance, robust funds safety measures, and advanced security technologies.

Regulation: ACS is regulated by the Securities and Futures Commission (SFC) of Hong Kong. The SFC is a reputable regulatory body that oversees financial institutions to ensure they operate with integrity, transparency, and in the best interests of their clients. This regulatory oversight provides clients with the assurance that ACS adheres to strict standards of conduct and financial management, enhancing trust and confidence in the company's operations.

Funds Safety: ACS takes the safety of client funds very seriously. The company ensures that client accounts are protected, although specific details regarding insurance coverage and the insured amount should be directly confirmed with ACS for the most accurate information. Generally, reputable firms like ACS maintain segregated client accounts to safeguard client funds from company liabilities, providing an additional layer of protection for clients' investments.

Safety Measures: To guarantee the security of client funds and personal information, ACS employs advanced encryption technologies. These measures ensure that all transactions and data exchanges are securely encrypted, preventing unauthorized access and potential breaches. Additionally, ACS implements comprehensive account security measures, including multi-factor authentication and continuous monitoring, to protect against unauthorized access and information leakage. These proactive steps demonstrate ACSs commitment to maintaining a secure trading environment for its clients.

Overall, ACS's adherence to regulatory standards, commitment to funds safety, and implementation of advanced security measures highlight the companys dedication to providing a safe and secure platform for its clients.

What are securities to trade with ACS?

At ACS, a comprehensive range of securities is available for trading to meet the diverse needs of its clients. The stock trading services allow investors to buy and sell shares of companies listed on the Hong Kong Stock Exchange, encompassing a wide array of industries that provide opportunities for growth, income, and diversification.

In addition to stocks, ACS offers Exchange-Traded Funds (ETFs), enabling investors to invest in a diversified portfolio of assets. ETFs combine the benefits of mutual funds and individual stocks, offering both diversification and flexibility in trading.

For those seeking fixed income investments, ACS provides access to a variety of bonds, including both government and corporate bonds. These bonds offer a stable income stream and can be an important part of a balanced investment portfolio.

ACS also caters to more sophisticated investors with its warrants and derivatives trading services. Warrants offer a leveraged way to gain exposure to specific stocks, while other derivative products provide opportunities for hedging and strategic trading.

Moreover, ACS facilitates participation in Initial Public Offerings (IPOs), allowing clients to invest in new stock offerings before they are available on the secondary market. This range of securities ensures that ACS can support the diverse trading and investment strategies of its clients.

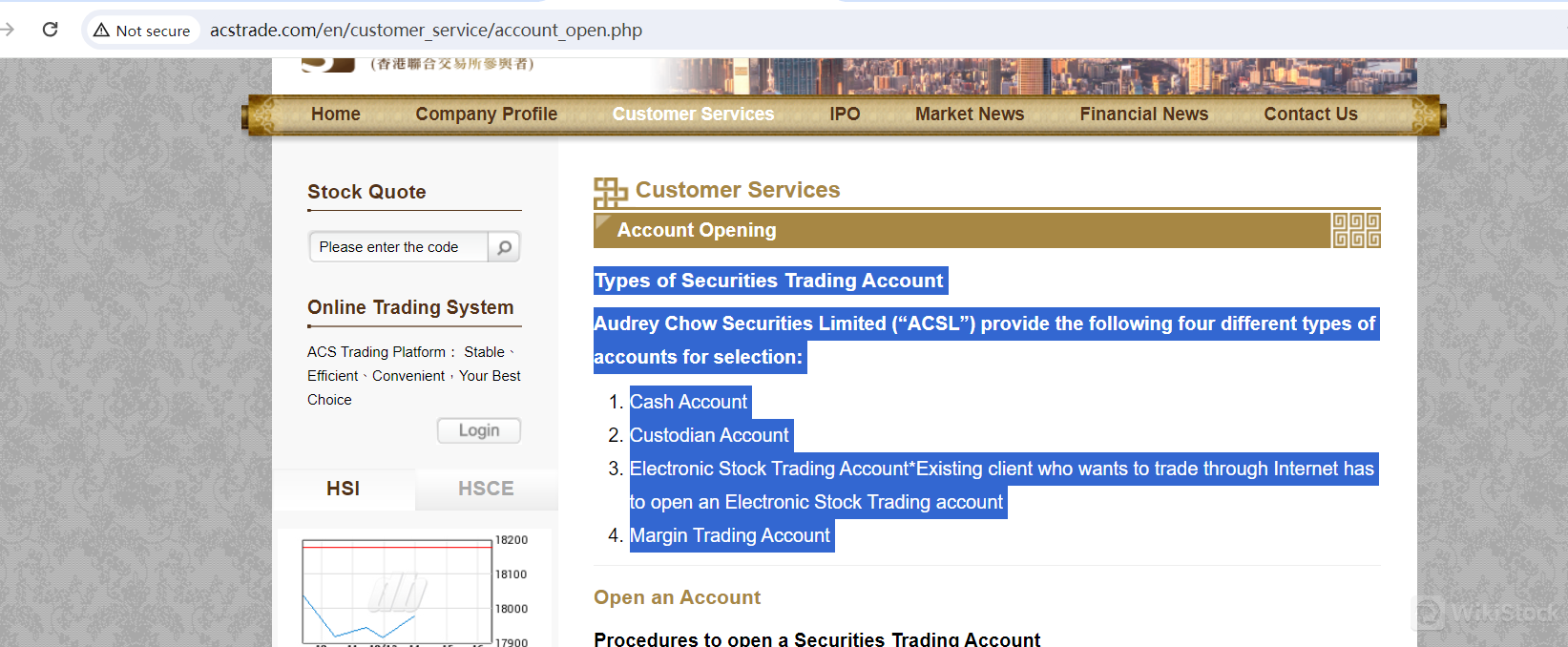

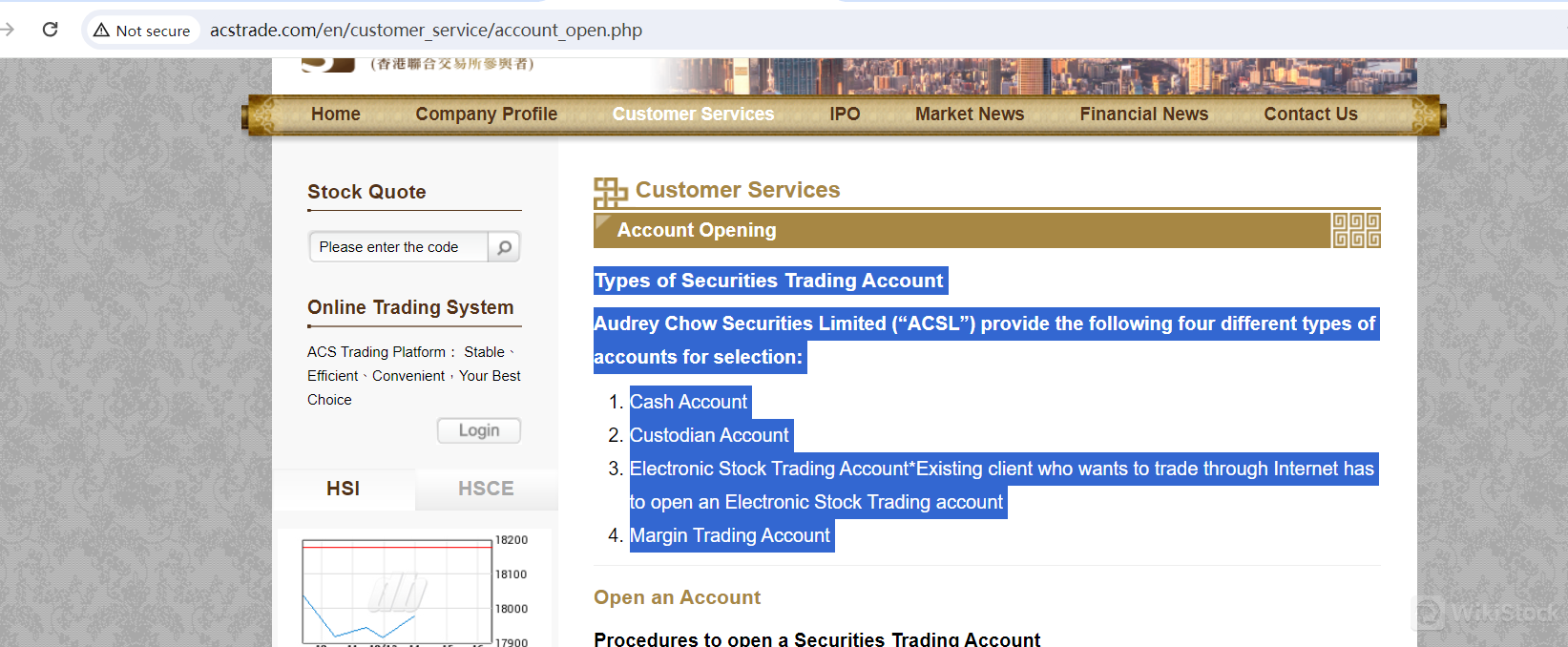

ACS Accounts

Audrey Chow Securities Limited (“ACS”) offers a variety of account types to cater to the diverse needs of its clients. The Cash Account is a straightforward option for investors who prefer to fund their transactions entirely with cash. This account type is ideal for those who wish to avoid the complexities and risks associated with margin trading. It allows clients to trade stocks and other securities with the assurance that their transactions are fully backed by their available cash balance.

The Custodian Account is designed for clients who seek a secure and efficient way to hold their securities. This account type provides safekeeping for stocks, bonds, and other investments, ensuring that clients' assets are protected and managed with the highest level of fiduciary responsibility. It is particularly suitable for investors who prioritize the security of their holdings and want to simplify the management of their investment portfolio.

For clients who prefer the convenience and flexibility of online trading, the Electronic Stock Trading Account is an excellent choice. This account allows existing clients to trade securities via the Internet, offering a seamless and efficient way to manage their investments from anywhere in the world. Clients can monitor market trends, execute trades, and access their account information in real-time, making it a highly convenient option for the tech-savvy investor.

The Margin Trading Account is tailored for investors who are looking to leverage their investment capital. This account type enables clients to borrow funds from ACS to purchase securities, thereby increasing their purchasing power and potential returns. Margin trading is suitable for experienced investors who understand the risks and rewards associated with leveraging their investments. The account comes with competitive interest rates, making it an attractive option for those seeking to enhance their trading strategies and maximize their investment opportunities.

Each of these account types is designed to meet specific investment needs and preferences, ensuring that ACS can support a wide range of trading activities and client goals.

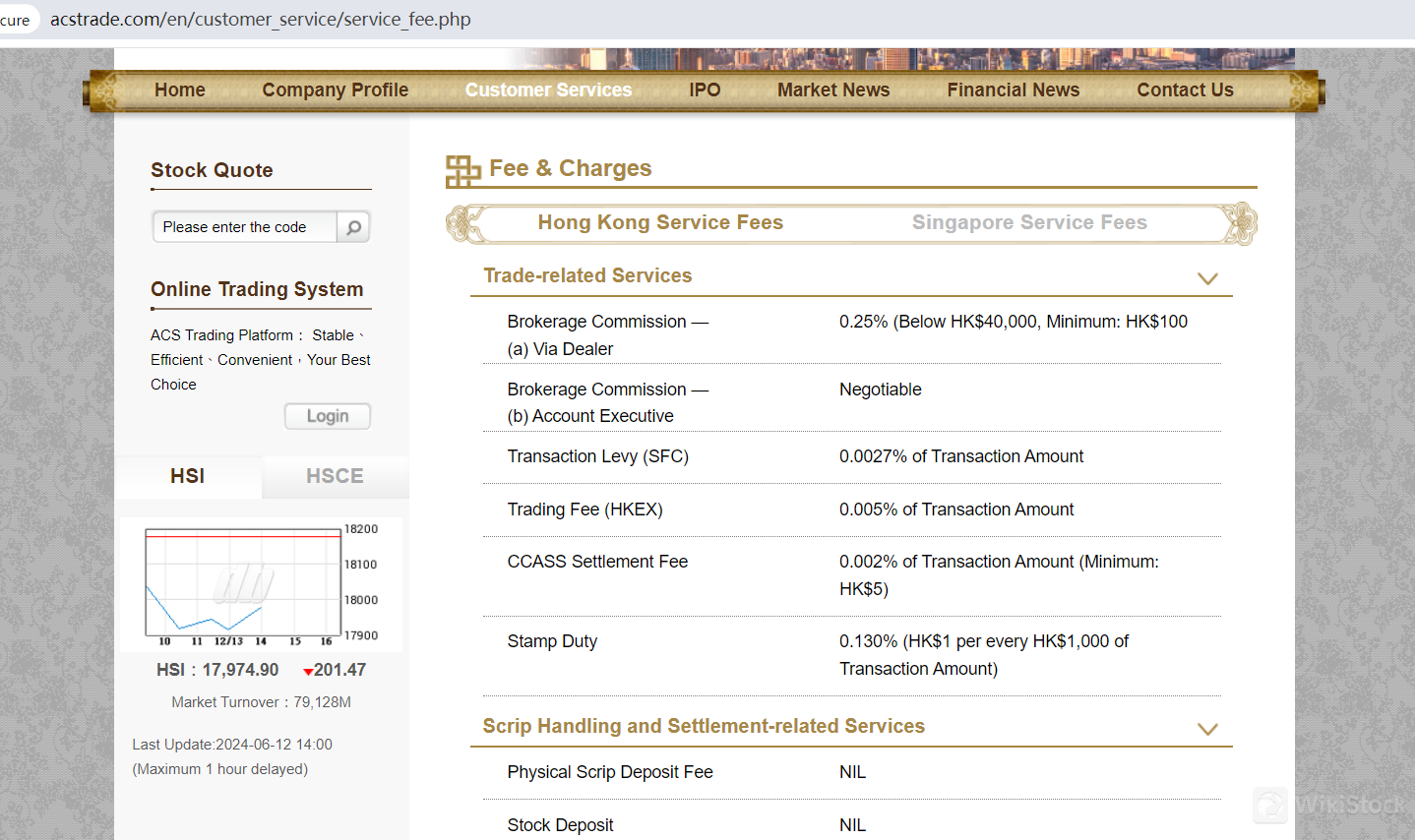

ACS Fees Review

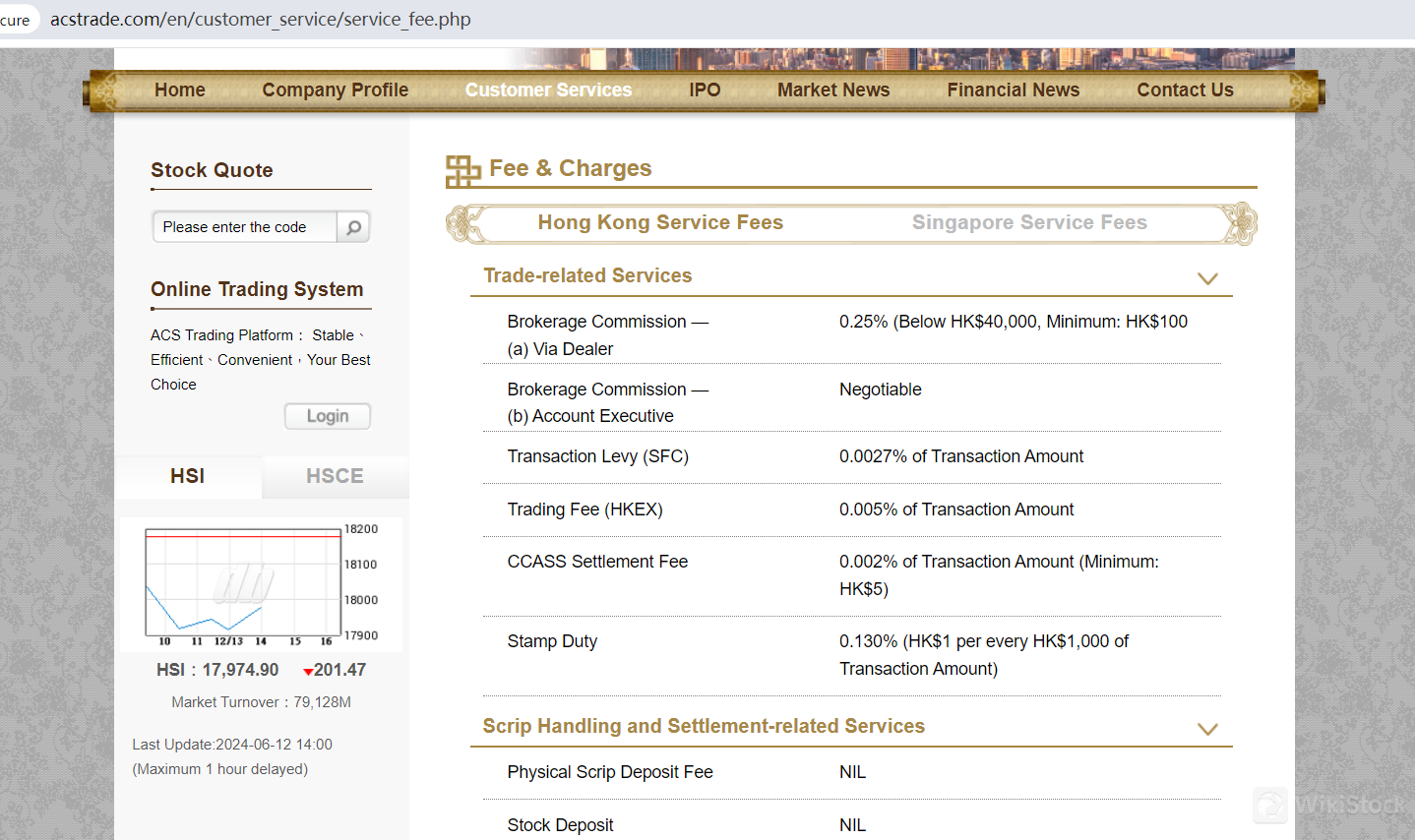

Audrey Chow Securities Limited (“ACS”) has a structured and detailed fee schedule to ensure transparency and clarity for all its clients. For trade-related services in Hong Kong, the brokerage commission varies depending on the method of transaction. When trades are conducted via a dealer, the commission is set at 0.25% of the transaction amount for trades below HK$40,000, with a minimum fee of HK$100. For trades handled by an account executive, the brokerage commission is negotiable. Additional charges include a transaction levy imposed by the Securities and Futures Commission (SFC) at 0.0027% of the transaction amount and a trading fee charged by the Hong Kong Exchange (HKEX) at 0.005% of the transaction amount. The Central Clearing and Settlement System (CCASS) settlement fee is 0.002% of the transaction amount, with a minimum fee of HK$5, and stamp duty is set at 0.130%, calculated as HK$1 per every HK$1,000 of the transaction amount.

For scrip handling and settlement-related services, ACS does not charge for the deposit of physical scrip or stock deposits. However, the withdrawal of physical scrip incurs a fee of HK$5 per board lot, with a minimum fee of HK$50. Handling charges for settlement instructions are free when receiving shares, but for delivering shares, the charge is 0.05% of the stock market value from the previous trading day per transaction, with a minimum fee of HK$50 and a maximum fee of HK$500. The handling charge for investor settlement instructions, when delivering shares, is HK$20 per transaction. Transfer deed stamp duty is HK$5 for the seller on each new transfer deed, and there is a compulsory share buy-back fee charged by the company at HK$100 and by CCASS.

Nominee services and corporate actions also come with specific fees. A scrip fee on the net increase in the aggregate balance is HK$1.5 per board lot for ordinary entitlement. The collection fee for cash dividends is 0.12% based on the collected amount, with a minimum fee of HK$20, and a company charge of 0.38% based on the collected amount, with a minimum fee of HK$10. For rights or warrant issue entitlements, the charge is HK$100 per transaction. Handling charges for rights subscriptions, warrants exercises, subscriptions, or privatizations are HK$0.80 per board lot.

Interest rates and penalty charges for late payments are also clearly outlined. The interest rate for late payments is 12% of the transaction amount, with an additional penalty charge of HK$200 for late payments.

Account maintenance fees include a stock balance or account confirmation fee of HK$100 per account. Monthly securities statement duplication costs HK$300 per calendar year or HK$30 per month. Copies of contract notes are HK$30 per trade day within one year and HK$50 per trade day over one year. Trade record enquiries cost HK$20 per trade record. To claim dividends on each unclaimed entitlement of each stock, the charge is 0.5% on the gross dividend, with additional charges from CCASS at HK$200 and from the company at HK$300. A stop payment charge is HK$300 per transaction.

For IPO applications, the electronic application fee without margin financing is HK$50. If margin financing is included, the fee increases to HK$80, with the interest rate for IPO margin financing determined on a case-by-case basis. The interest for IPO subscription financing is charged at the prevailing market rate. This comprehensive fee structure ensures that ACS clients are well-informed about the costs associated with their trading and investment activities.

ACS App Review

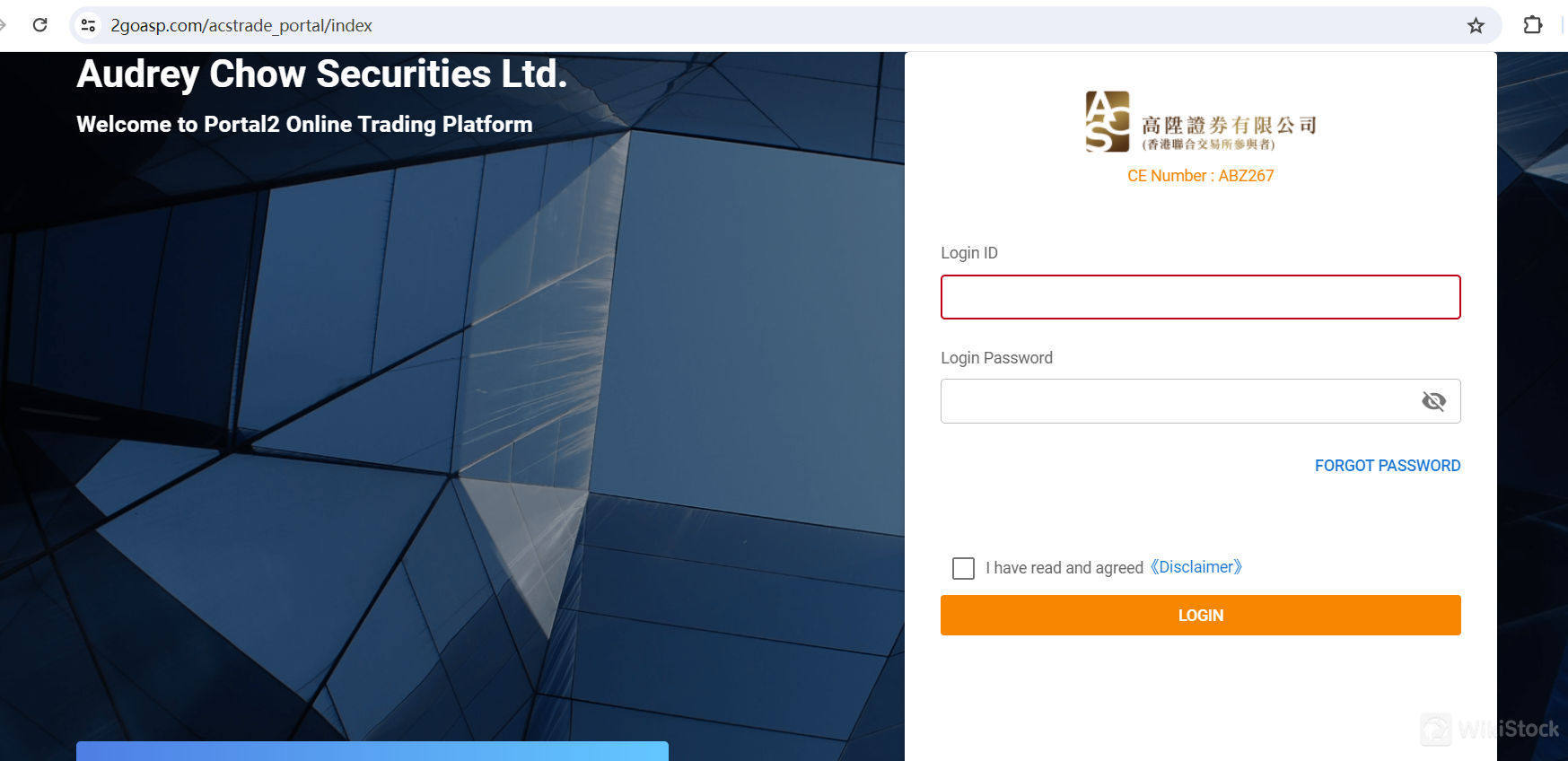

Audrey Chow Securities Limited (“ACS”) offers a robust online trading system designed to meet the needs of modern investors. The ACS Trading Platform is renowned for its stability, efficiency, and convenience, making it an excellent choice for both novice and experienced traders. This platform provides a seamless trading experience, allowing clients to execute trades quickly and reliably without concerns about system downtime or performance issues.

One of the key features of the ACS Trading Platform is its user-friendly interface, which makes it easy for clients to navigate the various functionalities and tools. Investors can monitor market trends, analyze stock performance, and manage their portfolios efficiently. The platform is equipped with advanced charting tools and real-time data feeds, providing users with the insights needed to make informed investment decisions.

To ensure maximum accessibility, ACS also offers mobile trading apps available on both Google Play and the Apple Store. These apps bring the full functionality of the ACS Trading Platform to mobile devices, allowing clients to trade on-the-go. Whether clients are using a smartphone or a tablet, they can access their accounts, execute trades, and stay updated with market developments anytime and anywhere.

Overall, the ACS Trading Platform, with its combination of stability, efficiency, and convenience, along with its mobile app offerings, provides a comprehensive solution for all trading needs. This commitment to technological excellence ensures that ACS clients can trade with confidence and ease.

Research and Eduation

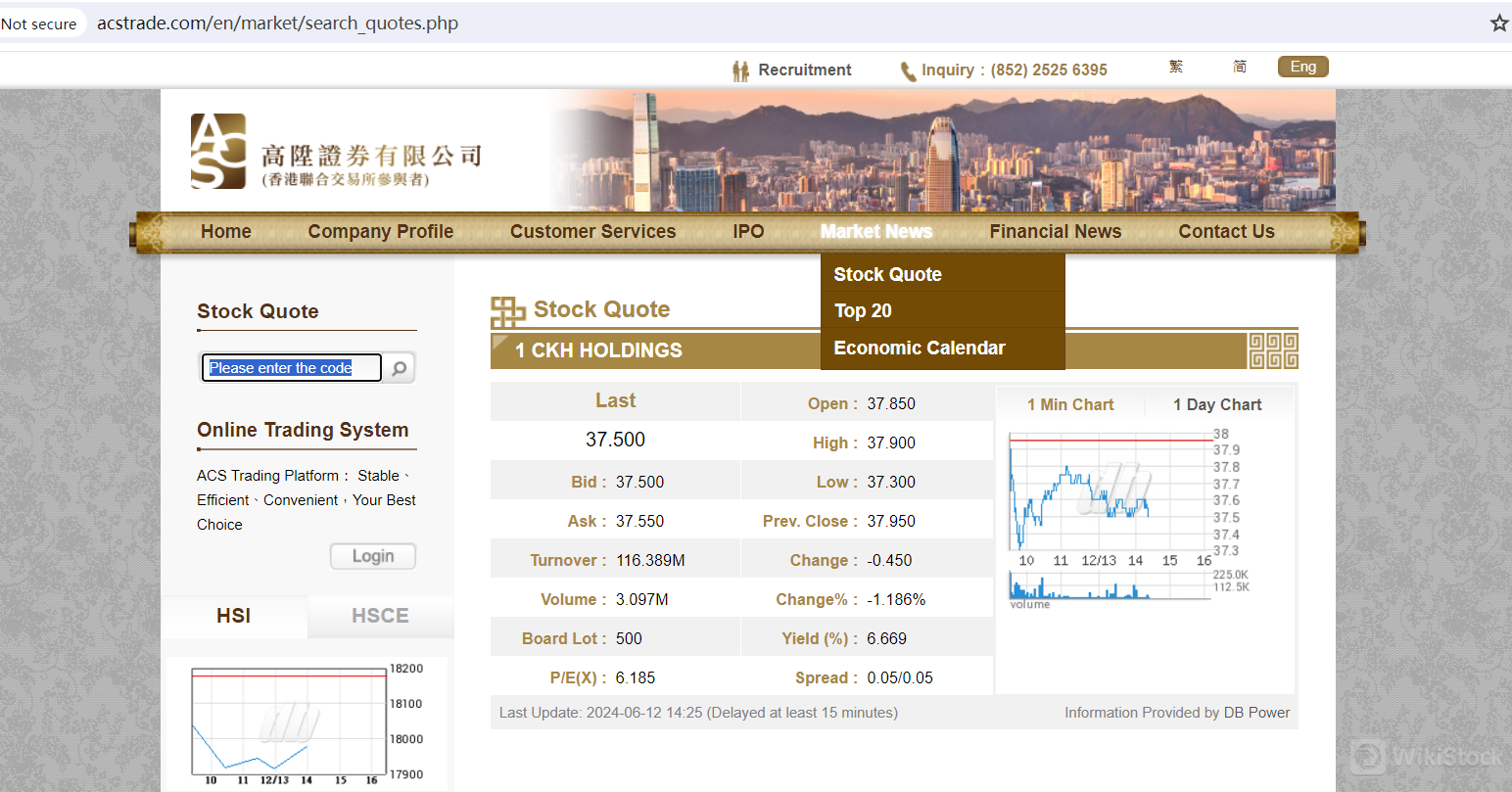

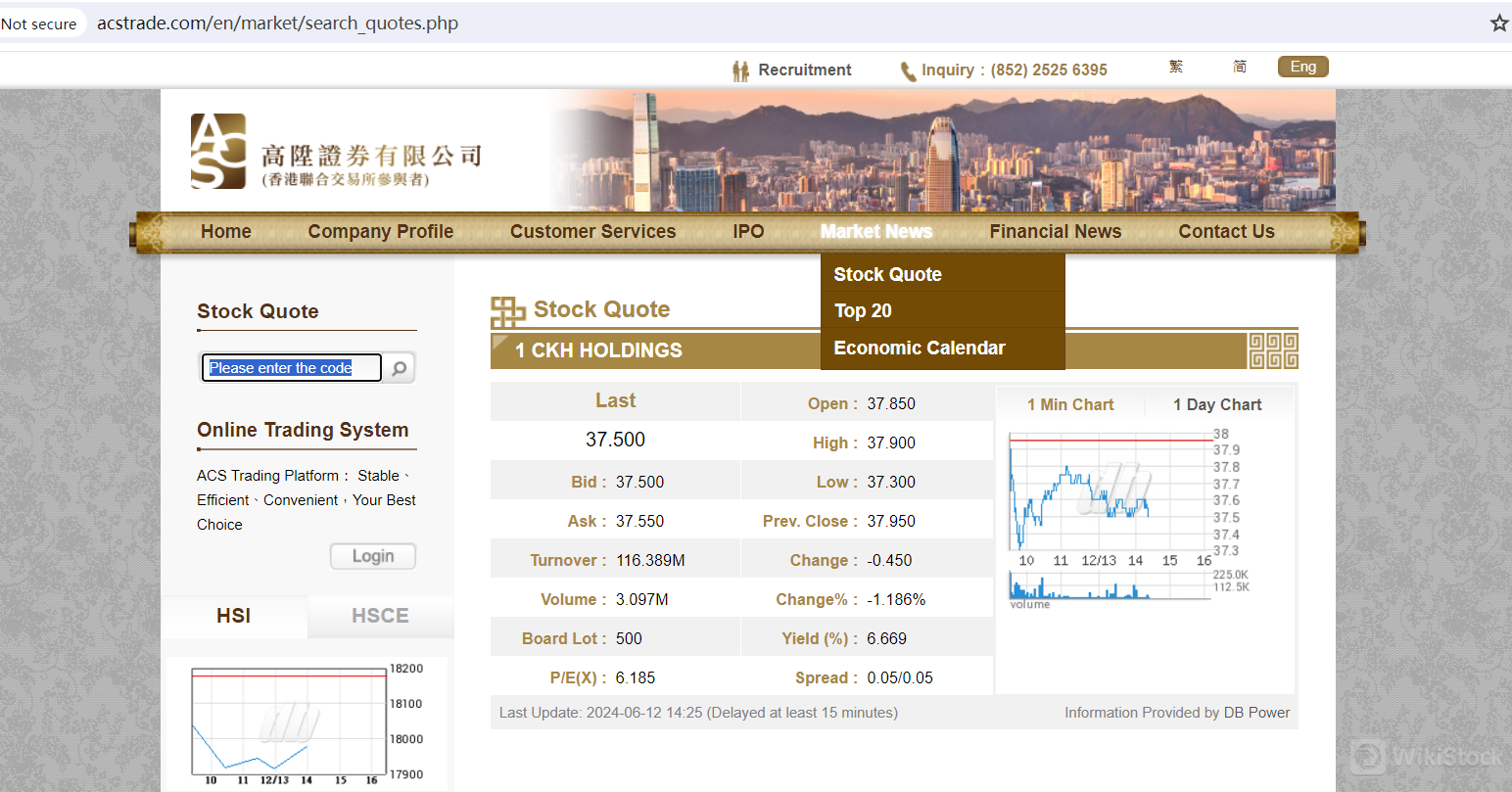

Audrey Chow Securities Limited (“ACS”) is committed to providing its clients with the resources and tools necessary for informed trading and investment decisions. As part of this commitment, ACSs trading platform includes a dedicated 'Market News' section and an 'FAQ' section aimed at educating and supporting investors.

The 'Market News' section is an invaluable resource for clients who want to stay abreast of the latest developments in the financial markets. This section provides real-time updates on market trends, significant economic events, and key financial news. By accessing this information, investors can make more informed decisions based on current market conditions and emerging opportunities. The market news is curated to ensure relevance and timeliness, covering a broad spectrum of topics from global economic indicators to specific stock performance insights.

In addition to market news, ACS offers an extensive 'FAQ' section that serves as an educational resource for clients. This section addresses a wide range of common questions and provides detailed explanations on various aspects of trading and investment. Topics covered include account setup, trading procedures, market terminologies, and platform functionalities. The FAQ section is designed to help both new and experienced investors navigate the complexities of the financial markets and make the most of the ACS Trading Platform.

Together, the 'Market News' and 'FAQ' sections underscore ACSs dedication to empowering its clients through education and timely information. By providing these resources, ACS ensures that investors are well-equipped to make knowledgeable and strategic investment decisions.

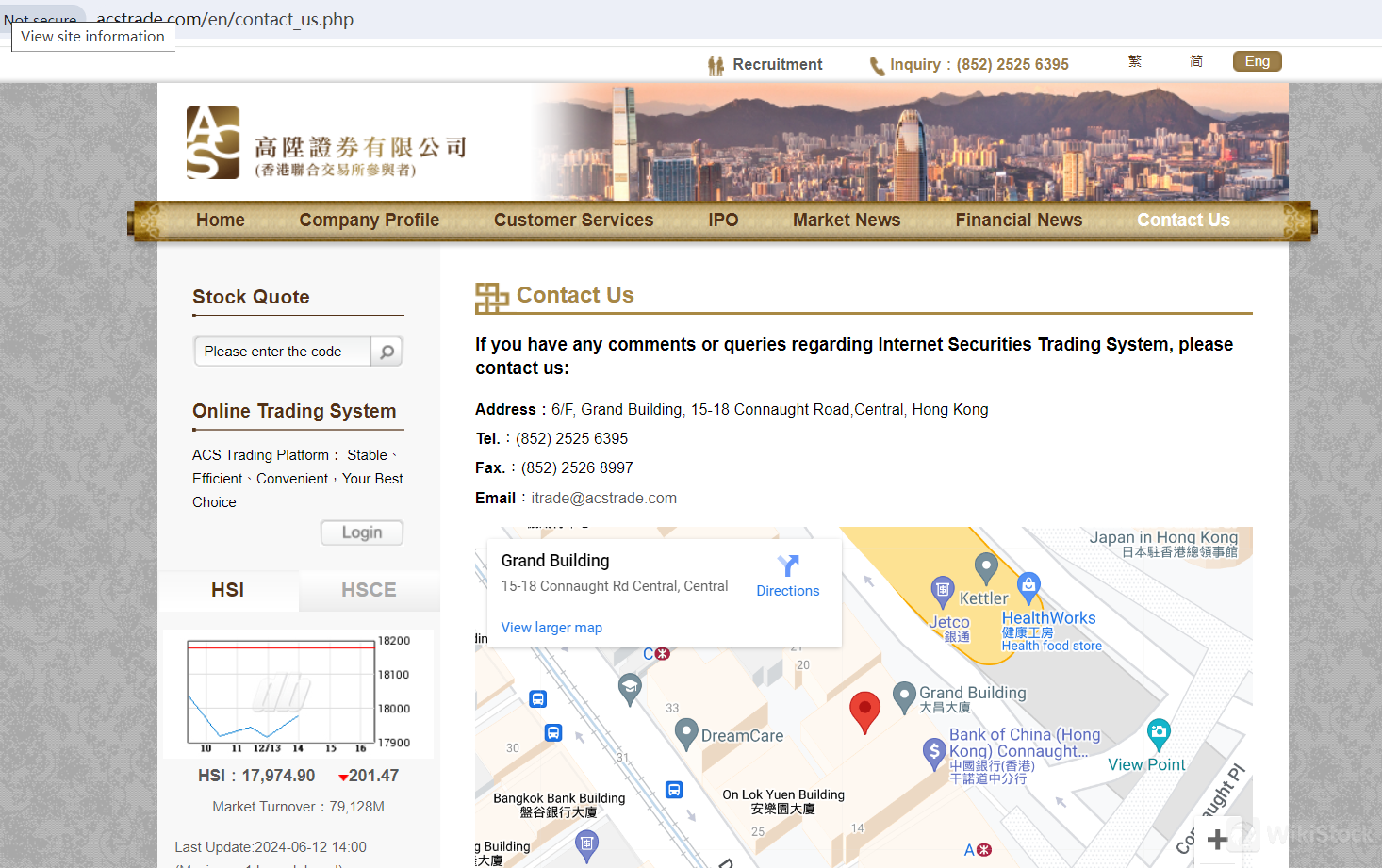

Customer Service

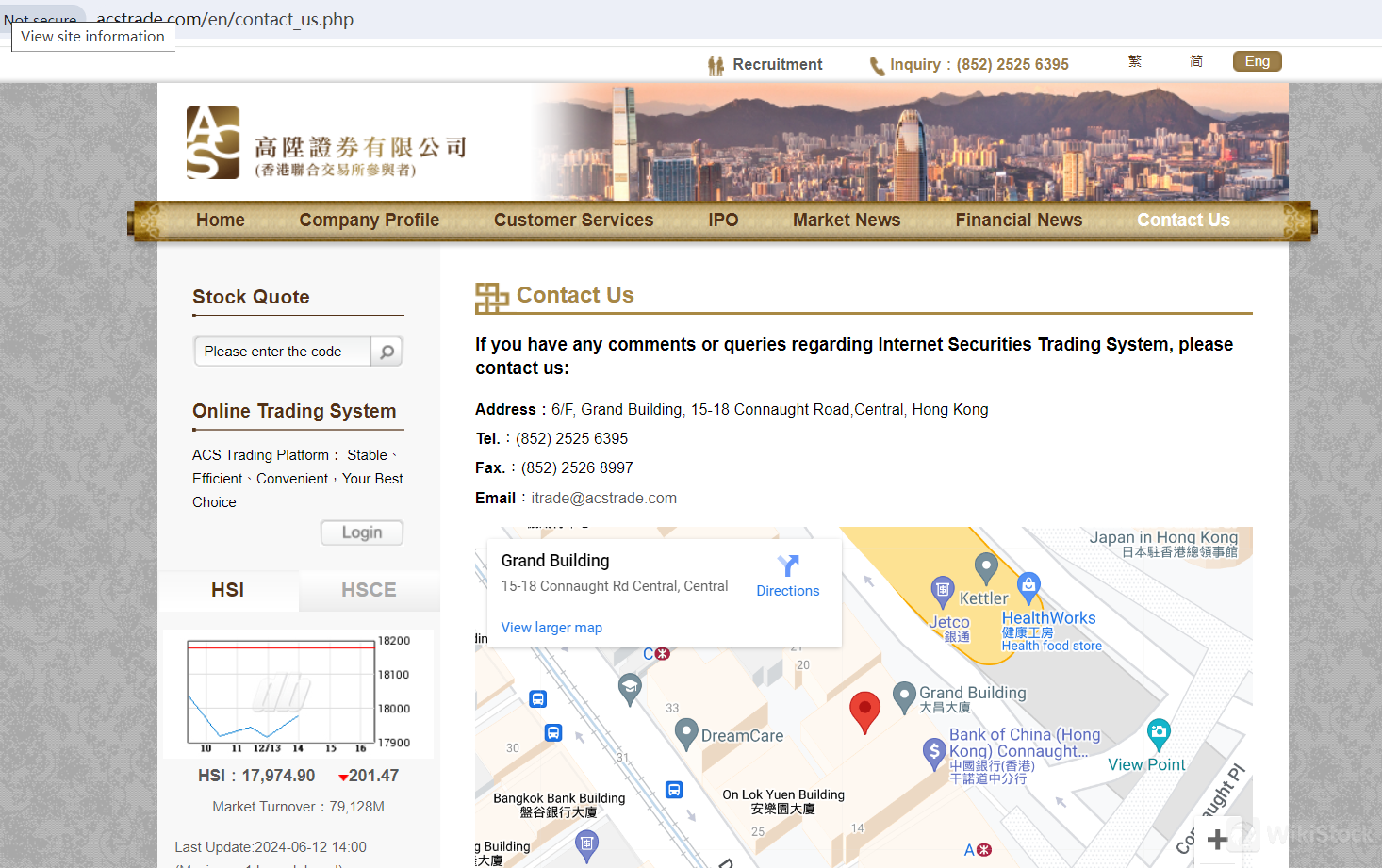

For any comments or queries regarding the Internet Securities Trading System, clients can reach out to ACS through multiple channels. The company's physical address is located at 6/F, Grand Building, 15-18 Connaught Road, Central, Hong Kong, offering a convenient location for in-person consultations and support. Clients can also contact ACS via telephone at (852) 2525 6395, where dedicated support staff are available to assist with any questions or issues related to their trading accounts and transactions.

In addition to phone support, ACS offers assistance through fax at (852) 2526 8997 and email at itrade@acstrade.com. The email support service is particularly useful for detailed inquiries and documentation, providing a written record of communications for clients. The customer support team at ACS is well-trained and knowledgeable, ensuring that clients receive prompt and accurate responses to their queries. This multi-channel support system underscores ACSs commitment to maintaining high standards of service and ensuring that clients have access to the help they need, whenever they need it.

Conclusion

Audrey Chow Securities Limited (ACS) is a well-regulated brokerage offering a diverse range of securities and a user-friendly trading platform, including mobile apps. Known for strong customer support and robust educational resources, ACS ensures secure transactions. However, its detailed fee structure and high handling fees may be a consideration for frequent traders.

FAQs

Is Audrey Chow Securities Limited (ACS) safe to trade?

Yes, ACS is regulated by the Securities and Futures Commission (SFC) of Hong Kong, ensuring a secure and transparent trading environment. The company employs advanced encryption technologies and robust security measures to protect client funds and personal information.

Is Audrey Chow Securities Limited (ACS) a good platform for beginners?

Yes, ACS offers a user-friendly trading platform with mobile apps, making it accessible for beginners. The platform also includes educational resources like the 'Market News' and 'FAQ' sections to help new investors learn and make informed decisions.

Is Audrey Chow Securities Limited (ACS) legit?

Yes, ACS is a legitimate and well-regulated brokerage firm. It adheres to strict regulatory standards set by the SFC, providing clients with confidence in its operations and services.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

China Hong Kong

China Hong Kong Obtain 1 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)