Stock market news today: Nasdaq, S&P 500 slide into the close, capping volatile day on Wall Street

US stocks attempted an unsuccessful rebound on Thursday as the Nasdaq and S&P 500 added to Wall Street's latest Big Tech sell-off, fueled by concerns the artificial intelligence trade could be losing steam.

The Nasdaq Composite (^IXIC), which wobbled between losses and gains throughout the trading day, closed down about 0.9% after coming off the worst day for the tech-heavy index since October 2022.

The benchmark S&P 500 (^GSPC) dropped 0.5%, while the Dow Jones Industrial Average (^DJI) remained the only major index in the green, up a modest 0.2%.

Stocks are running into a wall as Wall Street starts to question when tech companies' huge investments in AI will start to pay off. Unimpressive earnings from Alphabet (GOOGL, GOOG) and Tesla (TSLA) earlier in the week have dented hopes that Big Techs can live up to their AI-fueled sky-high valuations.

At the same time, concerns about the robustness of the US economy are emerging as big-name earnings misses cast doubt on how consumers are holding up in the face of historically high borrowing costs.

Given that, traders are now pricing in bigger cuts by the Federal Reserve — a reduction of about 30 basis points by September, and of almost 70 basis points over 2024, according to money markets. Odds on an earlier-than-expected rate cut in July have also ticked up, CME FedWatch data showed.

Read more: 32 charts that tell the story of markets and the economy right now

Still, an advance estimate of gross domestic product (GDP) showed the US economy grew at an annualized pace of 2.8% during the second quarter. That was well above the 2% growth expected by economists surveyed by Bloomberg.

The Personal Consumption Expenditure Price Index update for July on Friday will give the Federal Reserve another data point to consider regarding rate cut timing.

Live13 updates

- Fri, July 26, 2024 at 4:04 AM GMT+8

Alexandra Canal

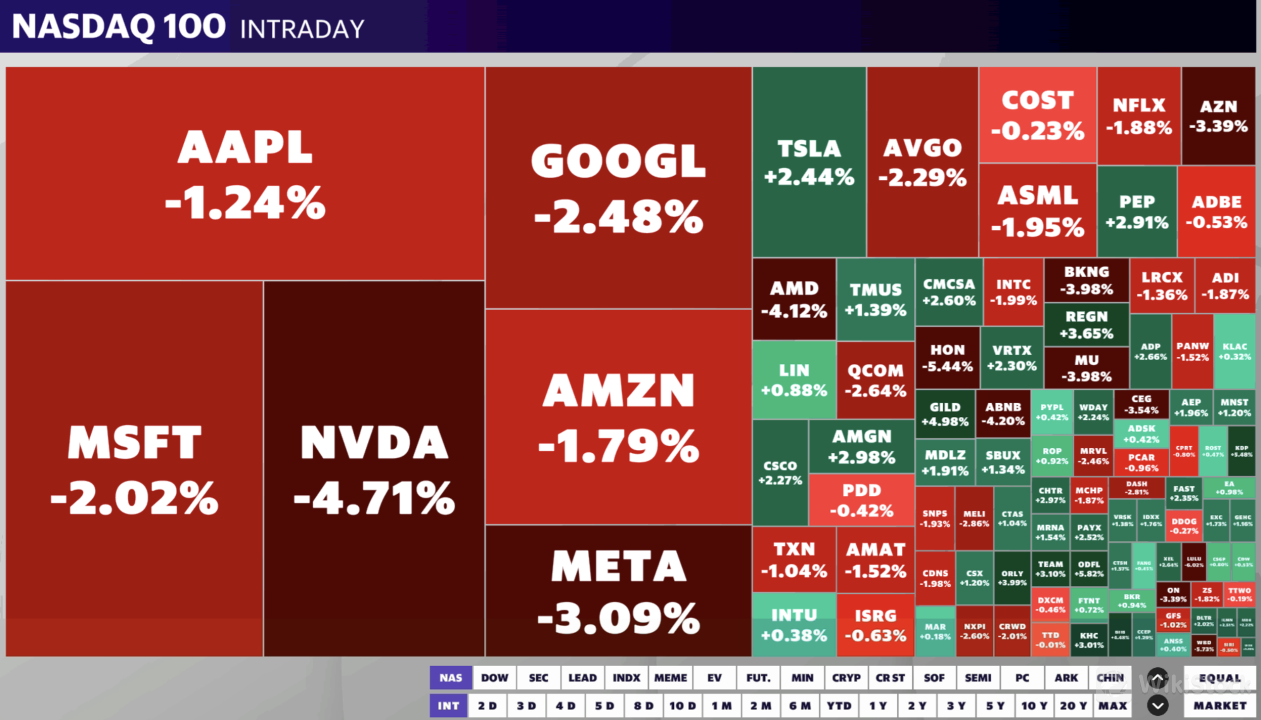

Nasdaq, S&P 500 sell-off deepens

And the Big Tech sell-off continues...

Despite the stock market's attempt at a rebound, the Nasdaq Composite (^IXIC) closed down about 0.9% on Thursday, after coming off the worst day for the tech-heavy index since October 2022.

The benchmark S&P 500 (^GSPC) dropped about 0.5% while the Dow Jones Industrial Average (^DJI) remained the only major index in the green, up a modest 0.2%.

- Fri, July 26, 2024 at 3:30 AM GMT+8

Alexandra Canal

Disney, Warner Bros. launch streaming bundle in US

Disney and Warner Bros. officially launched its streaming bundle in the US, the companies announced on Thursday. The bundle, previously announced in May, brings together Disney+, Hulu, and Max streaming service at a price point of $16.99 a month with ads or $29.99 for the ad-free version.

The developments come as media companies face pressure from investors to scale their streaming services and achieve profitability. At the same time, the companies are dealing with more competition from tech giants like Amazon (AMZN) and Apple (AAPL), which are gobbling up streaming deals.

The consumer has also become more picky. On average, US consumers subscribe to four streaming services and spend about $61 per month, according to the latest Digital Media Trends report from Deloitte. That means fewer opportunities to retain loyal subscribers over time.

Warner Bros. Discovery CEO David Zaslav previously said the upcoming bundle will lead to several benefits for the company, including incremental subscriber growth and longer-term retention.

“Ultimately, you've got to follow the consumer,” he said in May. “We need to come together ourselves and provide a better consumer experience, a more compelling and exciting offering, or there will be other companies who'll do it for us.”

“The ability for us and Disney together to reach out to consumers, it's a stronger business,” he said at the time.

The concept of bundling isn't new. Companies in the space have been doing it with their own services for years. Apple, for instance, offers Apple One, which combines Apple TV+ with other services like Apple Music and Apple Arcade. The bundle launched globally in late 2020.

Disney, which has also been offering a bundle with Disney+, Hulu, and ESPN+, officially began its domestic rollout of a one-app experience late last year that incorporates Hulu content via Disney+ — a similar play to Paramount's Showtime combination as well as the integration of HBO Max and Discovery+, which both merged their respective services last year.

The move toward partnerships among competing media companies, though, has gained traction.

Earlier this year, Warner Bros. announced a sports streaming partnership with Disney's ESPN and Fox (FOXA), set to debut later this fall. In December, WBD partnered with Netflix (NFLX) on a $10, ad-supported bundle offered through Verizon (VZ)..

- Fri, July 26, 2024 at 2:45 AM GMT+8

Josh Schafer

Stock market pullback ahead?

The roaring stock market rally of 2024 has finally hit a pause.

The S&P 500 (^GSPC) and Nasdaq Composite (^IXIC) tallied their worst one-day drops since 2022 on Wednesday. The losses reversed slightly on Thursday, but still, over the past 10 days the benchmark S&P 500 remains down about 2% while the Nasdaq is down more than 4%.

The recent pause in the rally's chug higher aligns with calls from equity strategists in our recently released third volume of the Yahoo Finance Chartbook. Truist Co-CIO Keith Lerner noted that in years when the S&P 500 rose more than 10% in the first half of the year, the second half usually sees an average pullback of about 9%.

“This choppier market action of late, which we have been anticipating, likely has further to go in terms of price and time,” Lerner wrote in a note to clients on Thursday.

Tech has been the clear leader of the recent market drawdown. Information Technology and Communication Services are the only two of the eleven sectors in the S&P 500 with negative returns over the past month. In an interview with Yahoo Finance, Lerner reasoned that the recent sell-off in Tech made sense given how far up the sector had run.

In late June, tech had outperformed the S&P 500 on a rolling two-month basis by the most since 2002, per Lerner's research. Lerner reasons that, like a rubber band that becomes overstretched, there's usually a snapback from extreme levels of outperformance in markets.

“When we get that stretched, a little bit of bad news can go a long way,” Lerner said.

The “little bit of news” came via earnings reports from Alphabet (GOOGL, GOOG) and Tesla (TSLA) after the bell on Tuesday leading into Wednesday's selloff. Lerner noted that the earnings weren't bad but failed to impress investors, who had a high bar entering this reporting season.

Earnings from Apple (AAPL), Meta (META), Microsoft (MSFT) and Amazon (AMZN) expected next week will prove the next test for investor sentiment in the tech sector. Lerner reasoned that after the market reset over the past few trading sessions, there's a chance technology sees the latest swath of earnings can surpass investors' now-trimmed expectations.

“I think the secular story of this bull market is still intact,” Lerner said. “Money will come back there. I just think more likely you need a resting period and kind of a pause that refreshes.”

- Fri, July 26, 2024 at 2:00 AM GMT+8

Alexandra Canal

Ford, Nvidia, Chipotle: Stocks trending in afternoon trading

Here are some stocks trending in afternoon trading on the Yahoo Finance homepage:

Ford (F): Shares of the automaker plunged more than 15% in afternoon trading after its second quarter performance disappointed investors, particularly its big profit miss. As Yahoo Finance's Pras Subramanian reports, Ford blamed rising warranty and recall losses for the miss, but said its guidance for the rest of the year was intact. Ford also lost over a billion dollars in adjusted EBIT in its Model e EV business, however the companys EV sales were still strong.

Nvidia (NVDA):Shares of the chipmaker climbed back from earlier losses, up about 1%, as the Nasdaq Composite flipped into positive territory by mid-afternoon trading. The stock is battling against investor fears that the artificial intelligence trade, which has buoyed big tech and megacap names, could be losing some steam. On Wednesday, Nvidia stock tumbled nearly 7% — its worst day since April following a mixed second-quarter earnings report from Alphabet (GOOGL).

Chipotle (CMG): Shares pared earlier gains to fall more than 1% Thursday despite the company beating earnings expectations in the second quarter. The company said a faster burrito rollout helped boost sales, but warned it expects margins to be under pressure for the next couple of quarters. Chipotle's restaurant-level operating margin rose to 28.9% from 27.5% a year ago but management said it expects margins to tick lower to around 25% in the third quarter.

Warner Bros. Discovery (WBD): Shares of the media giant dropped about 5% after the media giant lost a “key” media rights deal with the National Basketball Association (NBA). Warner Bros. said it will “take appropriate action” against the NBA after the league denied its matching rights in favor of Amazon's bid. In total, the NBA secured a media rights package worth around $77 billion over 11 years with new partners that include tech giant Amazon (AMZN) and Comcast's NBCUniversal (CMCSA). It was also able to strike a new agreement with its other current media partner, Disney (DIS).

Universal Music Group (UMG.AS): Shares of Netherlands-based Universal Music Group (UMG.AS), which represents A-list artists like Taylor Swift, Drake, Justin Bieber, and Adele, dropped more than 20% in afternoon trading on Thursday. The sharp decline came after the company unveiled sluggish results for its streaming and subscription businesses. The stock is on track for its biggest one-day loss ever.

- Fri, July 26, 2024 at 1:15 AM GMT+8

Dani Romero

Mortgage rates tick up from previous week, prompting homebuyers to hold back

Mortgage rates edged up from last week, adding pressure to potential homebuyers.

The average rate on the 30-year fixed-rate mortgage rose to 6.78% from 6.77% a week prior when they hit the lowest level since mid-March, Freddie Mac reported on Thursday. A year ago, the average rate on a 30-year fixed-rate loan was 6.81%.

Separately, the average rate for the 15-year fixed mortgage was 6.07%, up from 6.05% a week prior. The rate on a 15-year loan was 6.11% a year ago.

Rates still remained lower than in late April and May when they topped 7%.

Mortgage rates essentially remained flat from last week but have decreased nearly half a percent from their peak earlier this year, Sam Khater, Freddie Macs chief economist, said in the press release.

That hasn't been enough to spur buyer appetite. Applications for a mortgage to purchase a home fell 4% from the prior week on a seasonally adjusted basis.

Investors are optimistic a Federal Reserve rate cut is on the horizon. Market observers are confident that the first rate cut of the year will be September amid a slowdown in inflation and a cooler labor market. However, some predict that the Fed‘s actions won’t have a dramatic influence on mortgages immediately.

“Mortgage rates aren't likely to move meaningfully lower over the second half of 2024, even if the Fed starts cutting rates in September as the market currently expects, ” said Parker Ross, global chief economist at Arch Capital Group. He added that's because markets are already pricing in about six cuts over the next year.

- Fri, July 26, 2024 at 12:45 AM GMT+8

Ines Ferré

Dow leads rebound, up 500 points

The Dow Jones Industrial Average (^DJI) led a market rebound on Thursday, rising more than 1.2% or roughly 500 points.

The S&P 500 (^GSPC) also rose after falling earlier in the session while the Nasdaq Composite (^IXIC) clawed back into green territory after declining as much as 1.6% in early trading.

The major averages rallied following steep closing losses on Wednesday as investors seemed fatigued by the AI trade.

- Fri, July 26, 2024 at 12:00 AM GMT+8

Ines Ferré

Southwest rises after scrapping unassigned seating, ending decades-long practice

Southwest Airlines (LUV) announced Thursday that it will get rid of open seating in a sweeping change from its decades-long practice. Instead, it will begin assigning seats and offer premium seating with extra leg room.

Shares of the domestic carrier rose more than 5% during the session.

The changes come amid mounting pressure from activist investor Elliott Management, which earlier this month warned of a proxy fight as it seeks a “new, truly independent” board of directors.

Read more here.

- Thu, July 25, 2024 at 11:24 PM GMT+8

Ines Ferré

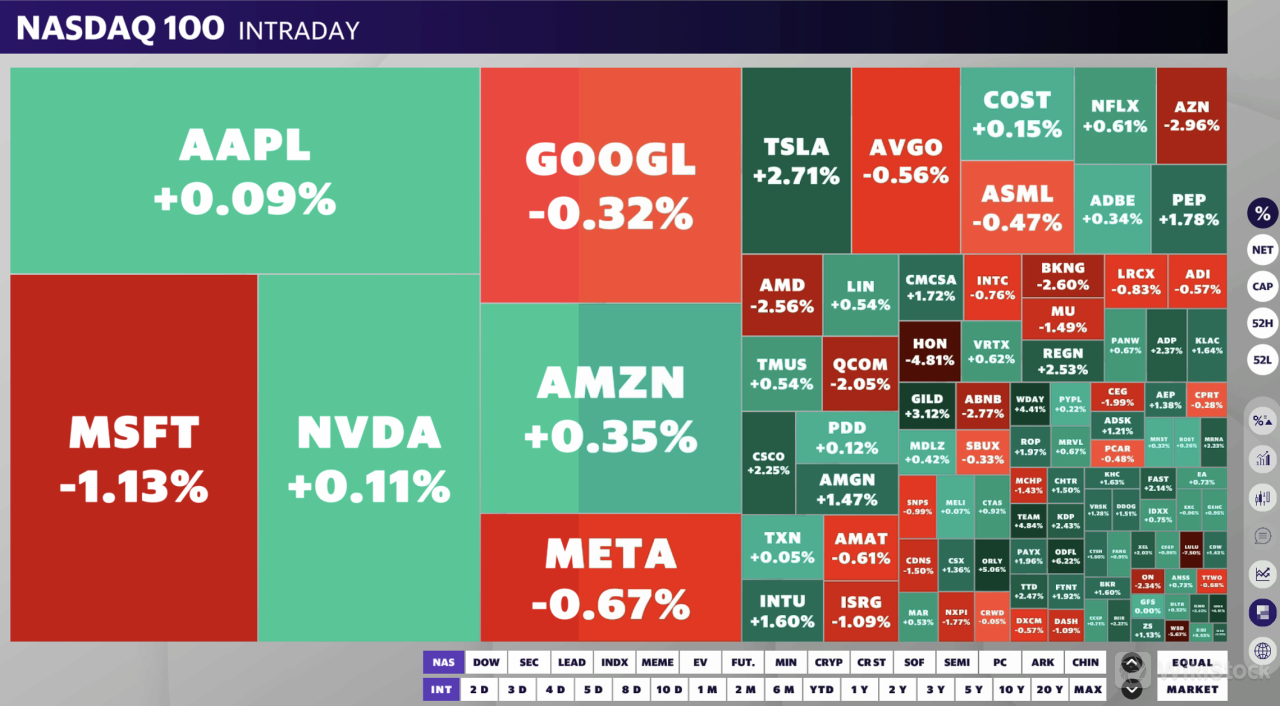

Nasdaq flips into green territory, erases early session losses

The Nasdaq Composite (^IXIC) erased early session losses of more than 1.5% to climb into green territory.

The tech-heavy index was up 0.2% by 11 a.m. ET. Shares of Nvidia (NVDA) erased early session declines of more than 4.5% to hover near the flatline.

Stocks were volatile on Thursday. Nvidia climbed back above the flatline after falling as much as 4.7% during the session.

- Thu, July 25, 2024 at 10:50 PM GMT+8

Ines Ferré

Russell 2000 gains 1% as small caps resume rally

Small-cap stocks outperformed the major averages on Thursday.

The Russell 2000 (^RUT) index rose more than 1%, rebounding after a broad market sell-off on Wednesday.

The small-caps index has outperformed in recent weeks after significantly underperforming the broader market for the first half of the year.

Meanwhile, the tech-heavy Nasdaq erased early session losses of more than 1.5% to hover near the flatline.

- Thu, July 25, 2024 at 10:22 PM GMT+8

Ines Ferré

Nasdaq losses accelerate, Nvidia down more than 4%

More losses for Nasdaq Composite (^IXIC) on Thursday as the tech-heavy index fell more than 1%, coming off the worst single-day slide since October 2022.

Big Tech continued its sell-off, with shares of AI chip heavyweight Nvidia (NVDA) down more than 4%. Meta (META) shares also lost more than 3% and Alphabet (GOOGL, GOOG) declined more than 2%.

Big Tech stocks under pressure as Nasdaq slides

- Thu, July 25, 2024 at 9:30 PM GMT+8

Ines Ferré

US stocks steady after steep sell-off on Wall Street

US stocks were steady Thursday after a tech-led wipeout in the prior session.

The Dow Jones Industrial Average (^DJI) opened flat, while the S&P 500 (^GSPC) also hugged the flatline following steep closing losses. The Nasdaq Composite (^IXIC) opened slightly higher after losing more than 3% in the prior session.

The sell-off came after unimpressive results from Google parent Alphabet (GOOGL, GOOG) and EV giant Tesla (TSLA) earlier in the week.

On Thursday, Ford (F) shares tumbled after the automaker posted a quarterly profit miss.

Investors assessed a hotter-than-expected second quarter GDP reading released prior to the market open.

An advance estimate of second quarter US gross domestic product (GDP) showed the economy grew at an annualized pace of 2.8% during the period, more than the 2% growth expected by economists.

- Thu, July 25, 2024 at 8:40 PM GMT+8

Josh Schafer

GDP: US economy grows at faster-than-expected pace in second quarter as inflation eases

The US economy grew at a faster-than-expected pace in the second quarter.

The Bureau of Economic Analysis's advance estimate of second quarter US gross domestic product (GDP) showed the economy grew at an annualized pace of 2.8% during the period, well above the 2% growth expected by economists surveyed by Bloomberg. The reading came in higher than first quarter GDP, which was revised down to 1.4%.

Meanwhile, the “core” Personal Consumption Expenditures index, which excludes the volatile food and energy categories, grew by 2.9% in the first quarter, above estimates of 2.7% but significantly lower than the 3.7% gain in the prior quarter.

- Thu, July 25, 2024 at 5:11 PM GMT+8

Brian Sozzi

What to watch on Chipotle

Chipotle (CMG) had a great quarter no doubt, but some chatter out this morning from the Street is voicing a couple of concerns.

For one, the burrito company called out slowing sales growth quarter to date. There was consumer resistance mentioned to higher prices in California following the state's wage hikes. And margin guidance was pulled in a bit as Chipotle invests in portion sizes to quiet the worries of TikTokers.

So, some food for thought for the bulls!

Byte refutes rumors of speculation on A-share Doubao concept stocks

How to develop a low-altitude economy

Doubao concept surges, IPO economy booms

5G enters the "second half", which stocks are the best to buy

Check whenever you want

WikiStock APP