Enhanced Securities Limited (“ESL”), a wholly owned subsidiary of G-Resources Group Limited (HKEX: 1051), was established in 2011. ESL is an Exchange Participant of the Hong Kong Stock Exchange and an SFC approved Licensed Corporation (SFC ID: AWP684). We are licensed with the SFC to carry out Dealing in and Advising on Securities (Type 1 & 4), Dealing in Futures Contracts (Type 2), Advising on Corporate Finance (Type 6) and Asset Management (Type 9). With our experienced management team and the financial resources support from our holding company, we offer our clients quality, practical and reliable financial / securities trading services along with a comprehensive and secured online securities trading platform. ESL can also provide margin financing to our clients to meet their needs.

ESL Information

Enhanced Securities Limited(ESL) is a Hong Kong-based brokerage firm that offers a wide range of financial services, including securities trading and investment advisory. The firm caters to both individual and institutional clients, providing access to various financial markets, particularly focusing on the Hong Kong and A-Share markets.

The firm provides multiple account types, including individual and joint accounts, to cater to different investor needs. Additionally, trading fees are structured transparently for both markets, with specific fees for various transactions and services.

Pros and Cons of ESL

ESL, regulated by the Securities and Futures Commission (SFC), ensures a high level of oversight and reliability, providing clients with confidence in the firm's operations. The brokerage offers a transparent fee structure, allowing investors to clearly understand the costs associated with their trades. Clients have access to diverse trading opportunities in both the Hong Kong and A-Share markets, catering to various investment strategies. Additionally, the firm prioritizes the safety of client funds by implementing segregation and advanced security measures, such as multi-factor authentication and encrypted data transmission.

Despite its strengths, ESL has several areas where improvements are needed. There is a lack of detailed information about the trading platform, which may cause hesitation among potential clients who rely on specific platform features for their trading activities. Additional charges, such as the stock custody fee and dividend collection fee, can accumulate over time, potentially impacting profitability. Furthermore, the firm does not provide sufficient information about its research and educational resources.

Is ESL safe?

Regulations

ESL is officially licensed and regulated by The China Hong Kong Securities and Future Commission (SFC) under license number AWP684.

Funds Safety

Enhanced Securities Limited places a high priority on the safety of client funds. The firm segregates client funds from its operational accounts, ensuring that clients' assets are protected in the event of financial difficulties faced by the company. This practice aligns with regulatory requirements set by the Hong Kong Securities and Futures Commission (SFC), which mandates strict guidelines for the handling and segregation of client funds.

Safety Measures

In addition to fund segregation, Enhanced Securities Limited implements several advanced security measures to protect client information and transactions. These include multi-factor authentication for account access, encrypted data transmission, and regular security audits to identify and mitigate potential vulnerabilities. The firm also adheres to stringent regulatory standards, ensuring compliance with local and international financial regulations to maintain a secure trading environment.

What are securities to trade with ESL?

Enhanced Securities Limited offers a diverse range of securities for trading, catering to different investor preferences and strategies. Clients can trade in the Hong Kong market and the A-Share market, providing access to a wide variety of financial instruments.

- Hong Kong Market: In the Hong Kong market, Enhanced Securities Limited offers trading in equities, bonds, exchange-traded funds (ETFs), and warrants. This market is known for its dynamic and liquid environment, allowing investors to engage in active trading with numerous opportunities for profit.

- A-Share Market: The A-Share market, representing shares of mainland Chinese companies, is another key offering by Enhanced Securities Limited. This market includes equities traded on the Shanghai and Shenzhen stock exchanges. The A-Share market provides investors with exposure to one of the world's largest and most rapidly growing economies.

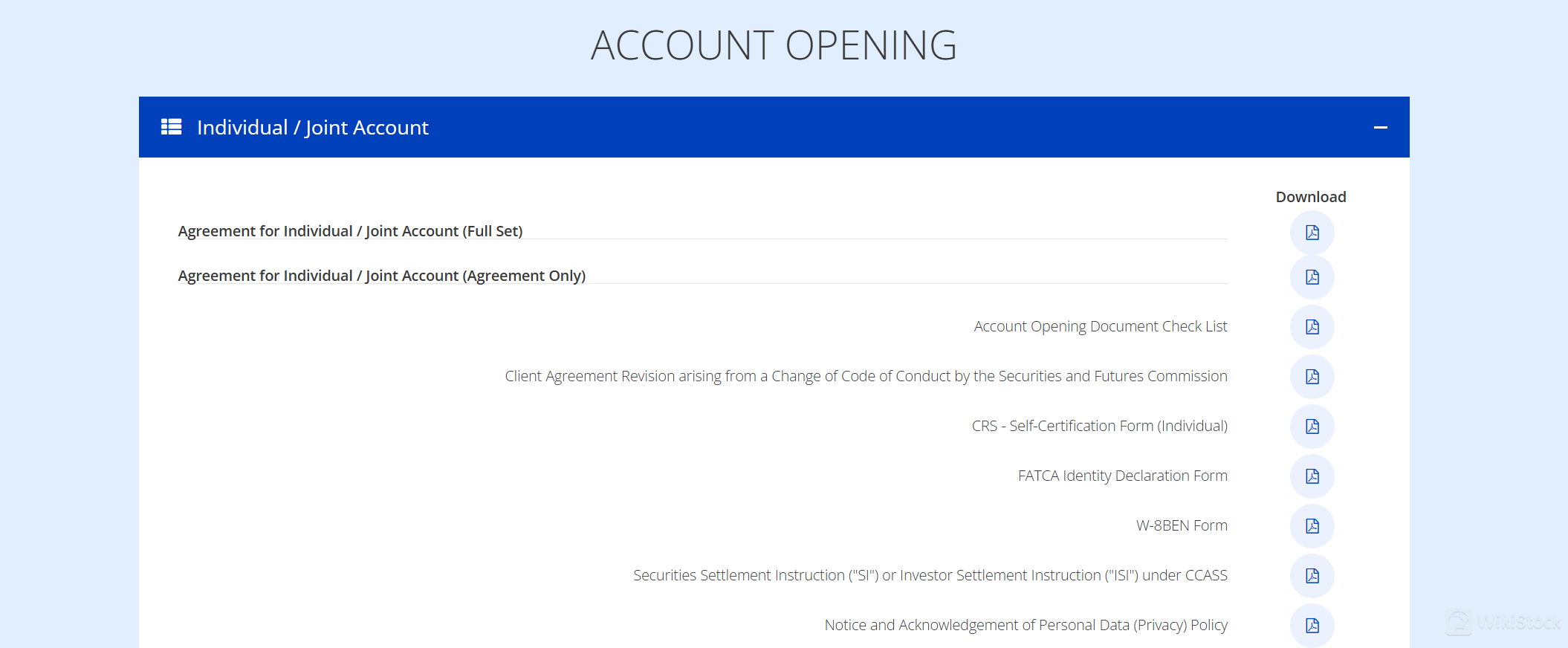

ESL Accounts

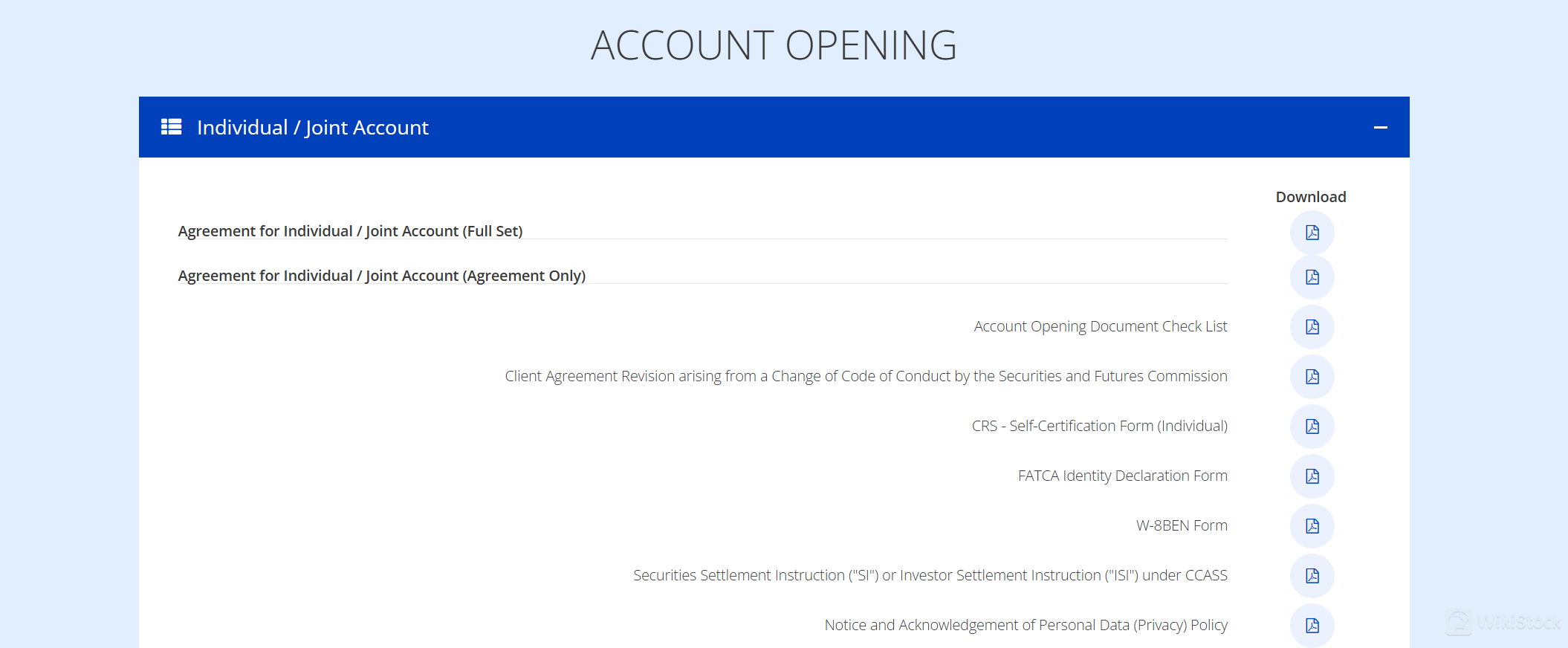

Enhanced Securities Limited provides several account types to meet the needs of different clients. These include individual accounts and joint accounts. Each account type comes with specific features and benefits, tailored to the unique requirements of individual investors, families, or institutional clients.

- Individual Accounts: Individual accounts are designed for solo investors looking to manage their investments independently. These accounts offer access to all trading platforms and financial instruments provided by the firm.

- Joint Accounts: Joint accounts are suitable for families or partners who wish to manage their investments together. These accounts provide the same access as individual accounts, with the added benefit of shared ownership and management.

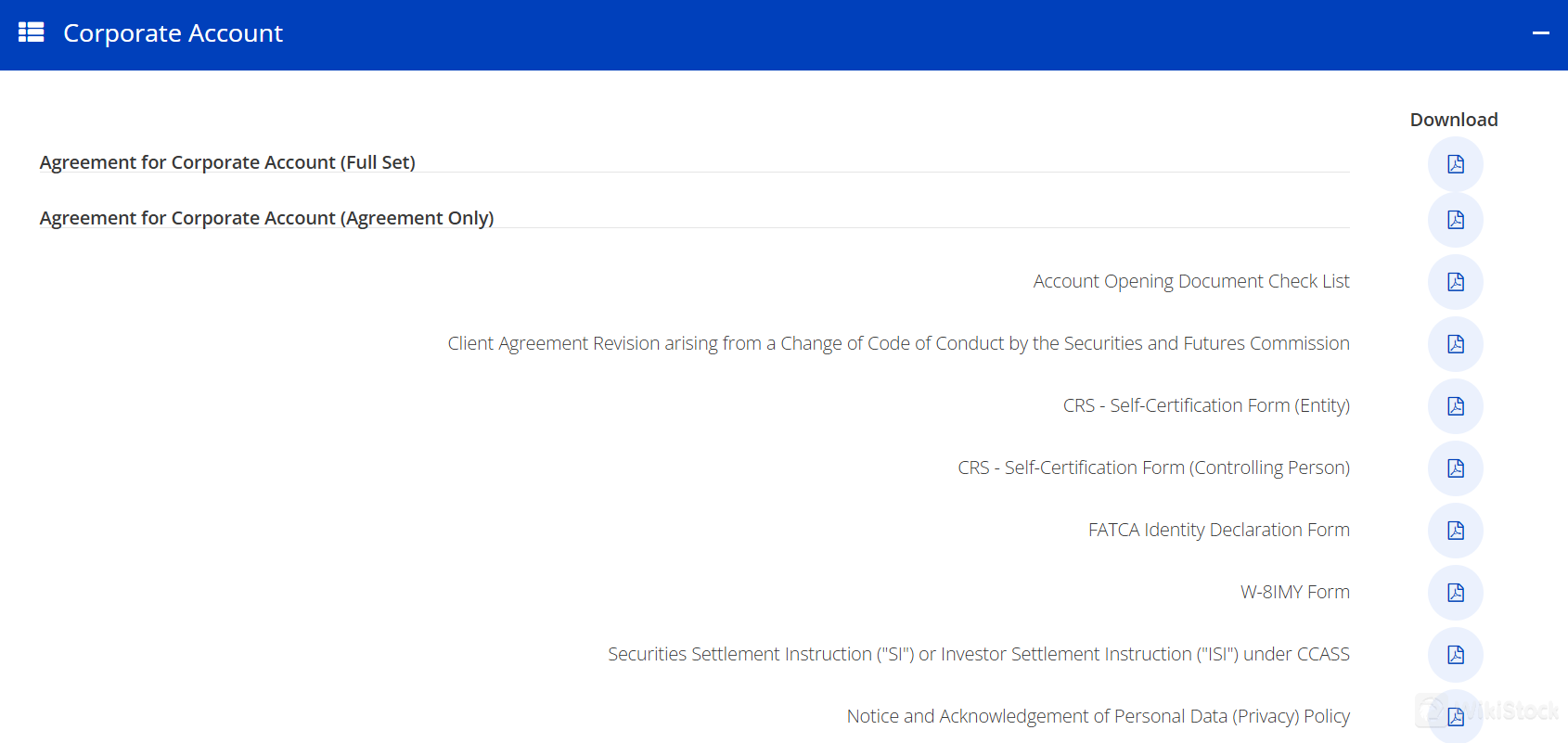

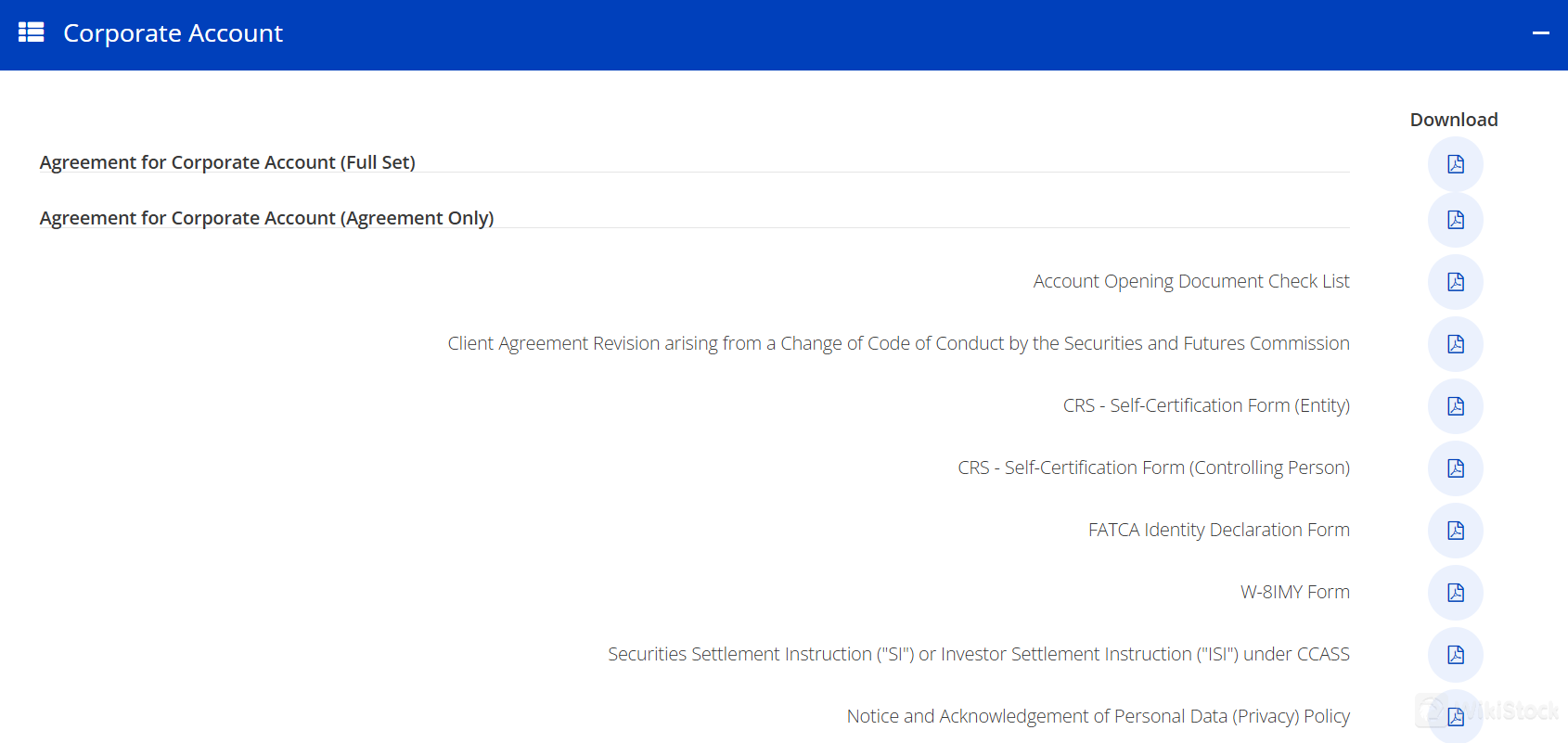

- Corporate Accounts: Enhanced Securities Limited offers corporate account services tailored to meet the specific needs of businesses and institutional investors. The corporate account services include a range of features designed to facilitate efficient and effective trading and investment management.

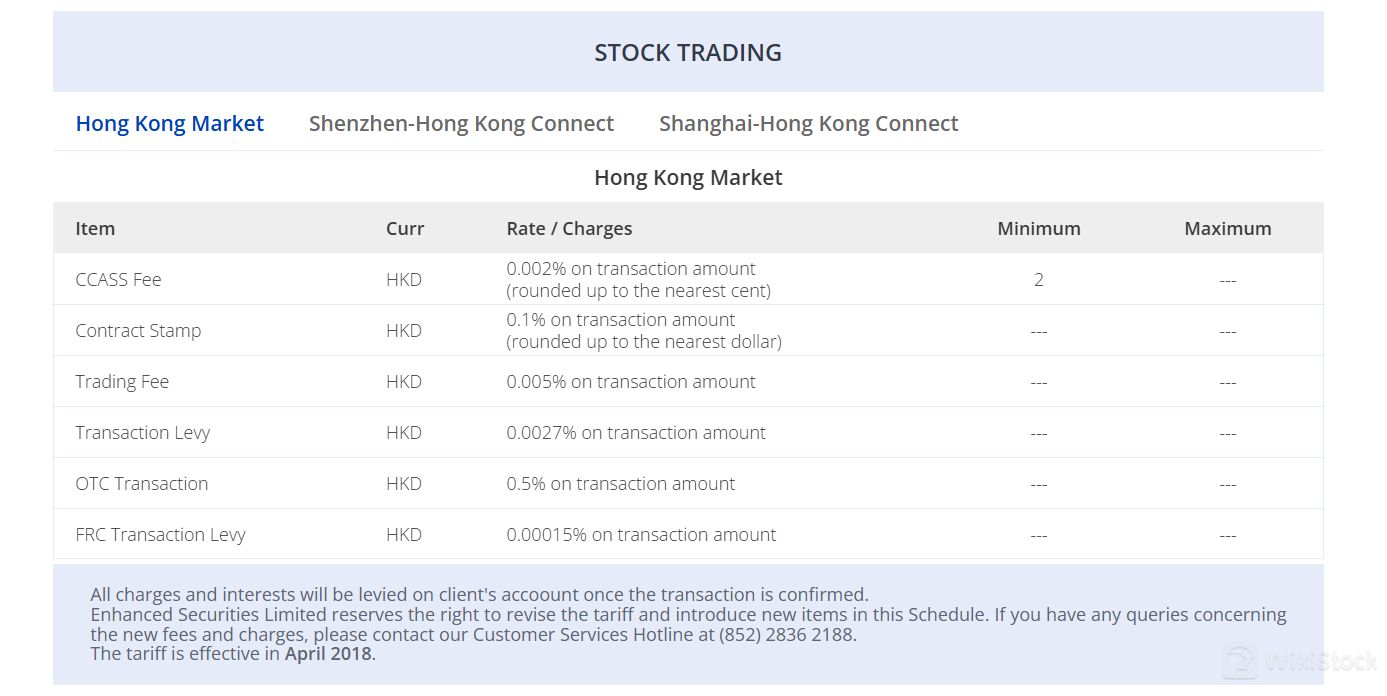

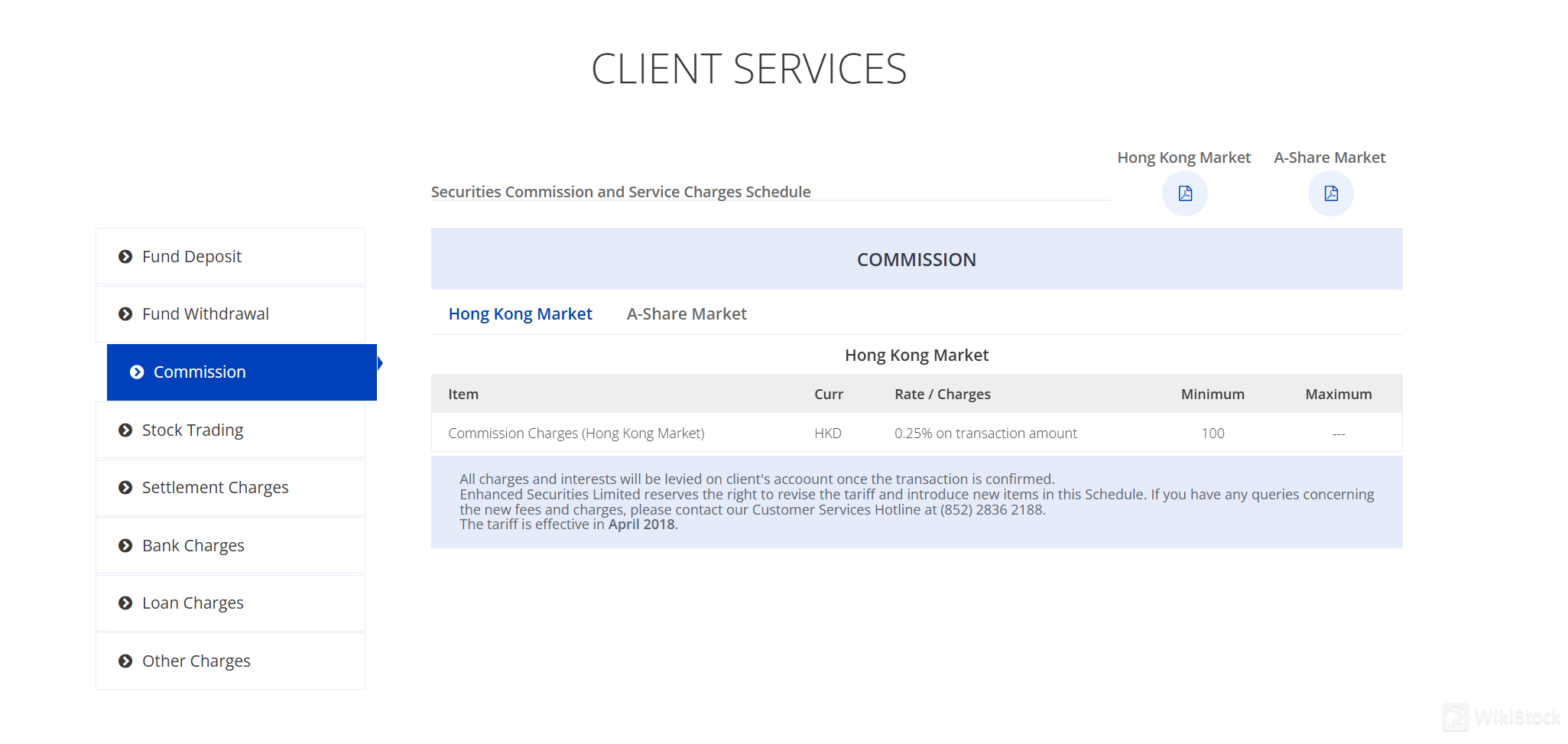

ESL Fees Review

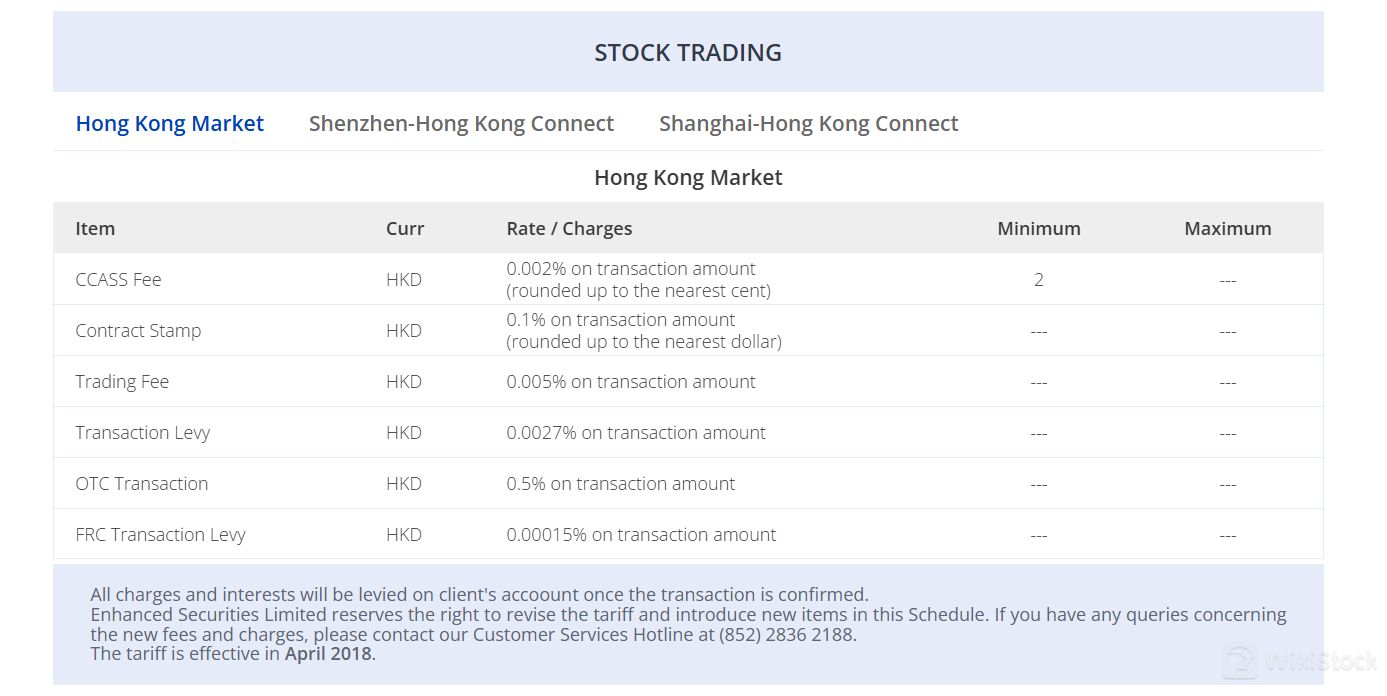

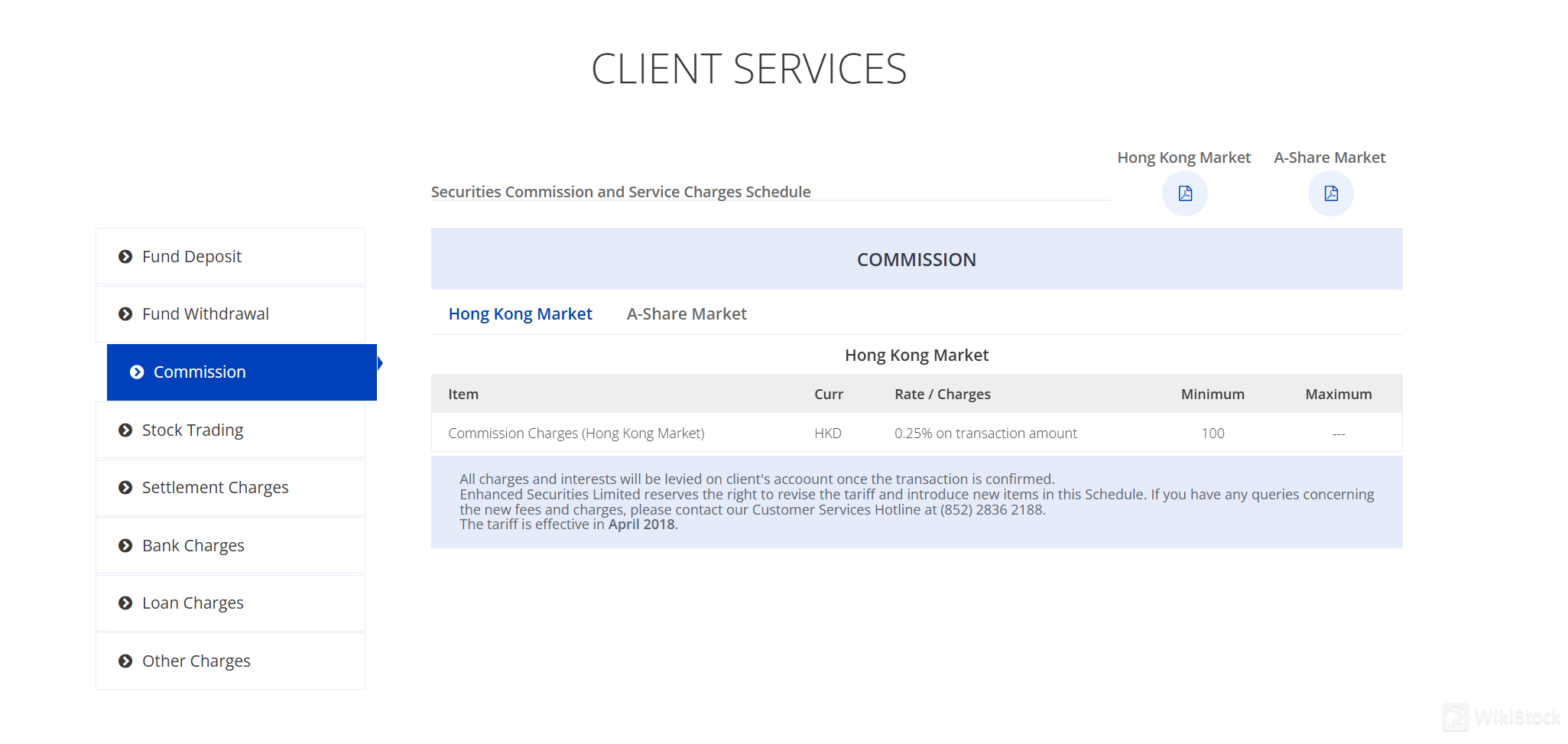

The broker's trading fees for the Hong Kong market are structured as follows: a brokerage commission of 0.25% on the transaction amount with a minimum charge of HK$100; a CCASS fee of 0.002% on the transaction amount, rounded up to the nearest cent, with a minimum of HK$2; a contract stamp duty of 0.1% on the transaction amount, rounded up to the nearest dollar; a trading fee of 0.005% on the transaction amount; and a transaction levy of 0.0027% on the transaction amount.

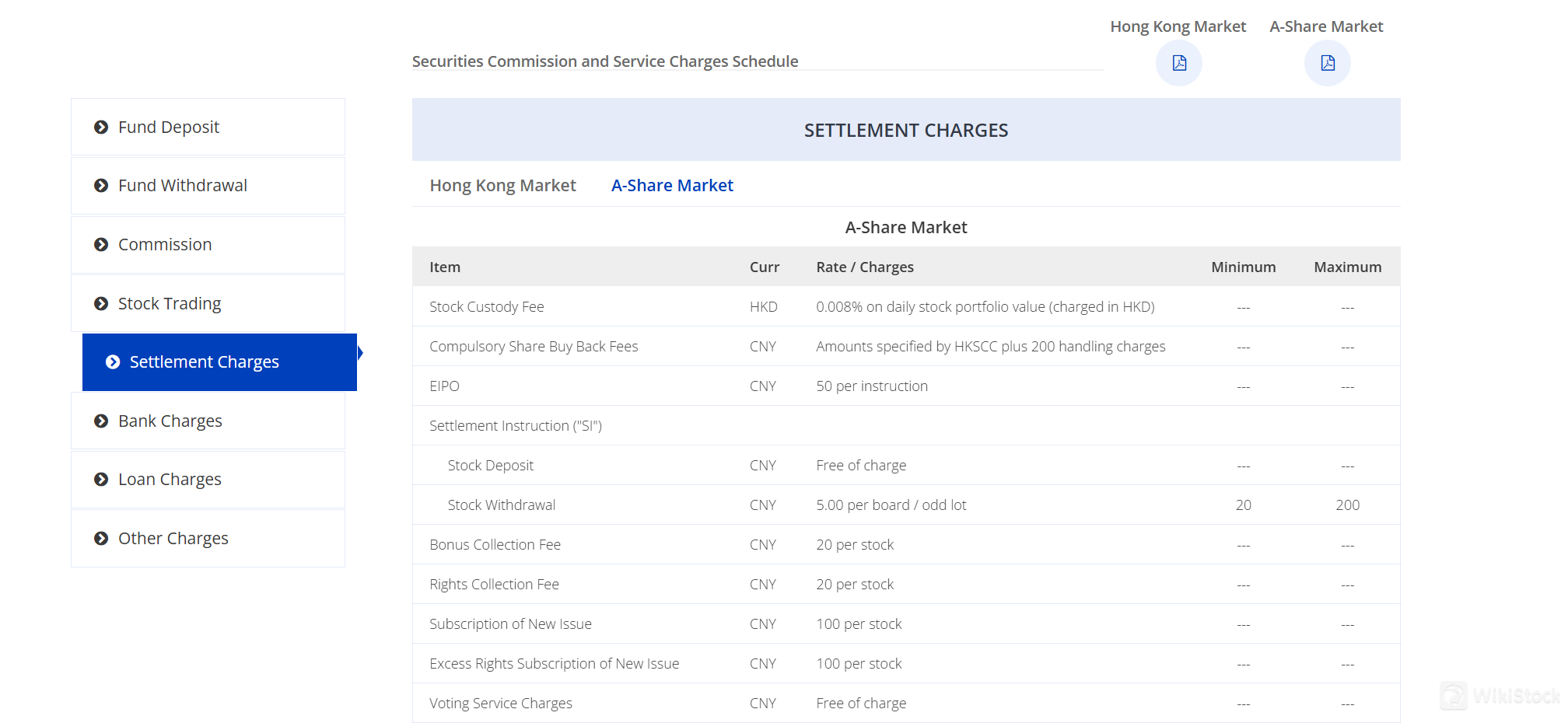

The broker's trading fees for the A-Share Market include a brokerage commission of 0.25% on the transaction amount with a minimum charge of CNY 100. For Shenzhen-Hong Kong Connect, the handling fee charged by SZSE is 0.00487% of the transaction amount, the securities management fee charged by CSRC is 0.002%, the transfer fee charged by China Clear & HKSCC is 0.004%, and the stamp duty charged by SAT is 0.1% on the seller's transaction amount. The same rates apply for Shanghai-Hong Kong Connect.

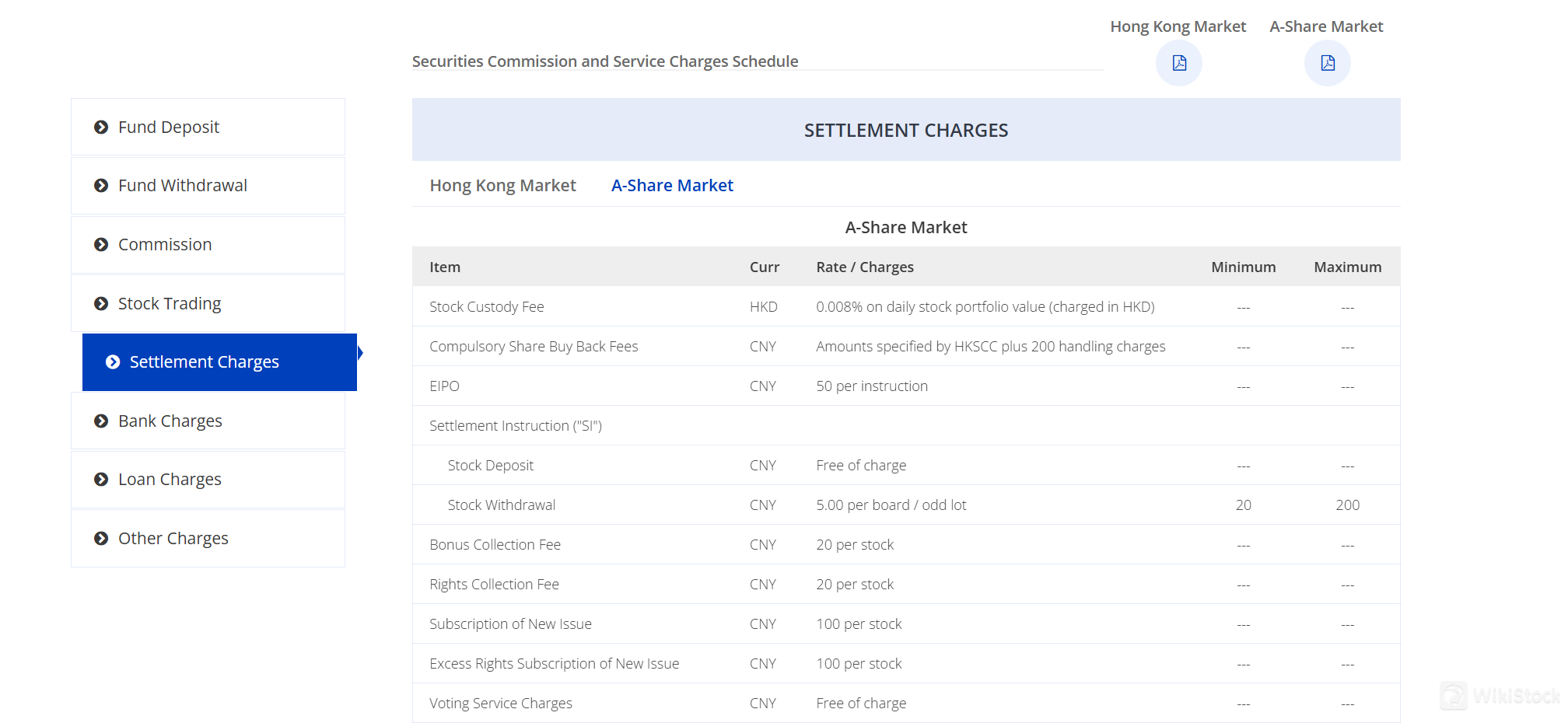

Additional charges include a stock custody fee of 0.008% on the daily stock portfolio value, various service charges like stock withdrawal at CNY 5 per board lot with a maximum of CNY 200, and a dividend collection fee of 0.5% of the dividend amount with a minimum of CNY 20. Bank charges include CNY 200 for local bank transfers and CNY 300 for telegraphic transfers. Loan charges vary, with cash account late interest at 13.50% per annum and margin account loan interest at 8.50% per annum.

Customer Service

ESL prides itself on providing excellent customer service. Clients can reach the support team through various channels, including email(cs@enhancedsec.com) and phone(+852-2893-1277). The customer service team is responsive and knowledgeable, assisting clients with any issues they may encounter. This high level of support ensures that clients can resolve their problems efficiently and continue trading with minimal disruptions.

Conclusion

ESL, is a Hong Kong-based brokerage firm regulated by the Securities and Futures Commission (SFC), ensuring high safty and regulatory compliance. The firm offers a transparent fee structure and access to diverse trading opportunities in both the Hong Kong and A-Share markets, appealing to various investor strategies. With multiple account types and advanced security measures, ESL prioritizes client safety and provides a secure trading environment. However, there are areas for improvement, such as the lack of detailed information on the trading platform and research and educational resources. Additionally, extra charges like stock custody and dividend collection fees can accumulate, potentially impacting profitability.

FAQs

Is ESL a regulated broker?

Yes, ESL is regulated by the China Hong Kong Securities and Future Commission (SFC), ensuring compliance with strict financial standards and oversight.

What are the main markets accessible through Enhanced Securities Limited?

A: Clients can trade in the Hong Kong market and the A-Share market, providing access to a wide range of financial instruments.

How can I contact HK ESL customer service?Clients can reach the customer service team via email at cs@enhancedsec.com or by phone at +852-2893-1277.

Risk Warning

WikiStock's expert assessment of the brokerage's website data is subject to change and should not be taken as financial advice. Online trading carries substantial risks, including the potential loss of all invested capital, and it's crucial to fully understand these risks before investing.

Obtain 1 securities license(s)

China Hong Kong