We, Sunfund Securities Limited, are licensed to carry out Type 1 (Dealing in securities) and Type 4 (Advising on securities) regulated activities as defined under the Securities and Futures Commission Ordinance by the Securities and Futures Commission since January 2017. Meanwhile, we are participants of The Stock Exchange of Hong Kong Limited and Hong Kong Securities Clearing Company Limited. Aim at becoming a leading global financial institution, we are committed to connect China to the capital markets of the world and to offer a comprehensive range of financial products and services covering securities brokering, securities margin financing, fixed-income products trading, underwriting and placement of securities and securities research to our institutional, corporate and retail investors.

Sunfund Information

Sunfund Securities, a Hong Kong-based brokerage firm, offers a diverse range of financial services tailored to meet the needs of individual and institutional investors. The company provides access to various financial products, including stocks, bonds, and funds, catering to various trading requirements.

Built on a foundation of transparency and integrity, Sunfund Securities offers user-friendly trading platforms and competitive fee structures, empowering investors to make informed decisions.

Pros and Cons of Sunfund

Sunfund Securities stands out for its diverse range of financial products, including stocks, bonds, mutual funds, and ETFs, catering to both individual and institutional investors. The company offers user-friendly trading platforms, including a robust mobile app and Electronic Trading Services (ETS). Sunfund is regulated by the Securities and Futures Commission (SFC) of Hong Kong, ensuring compliance with stringent regulatory standards and offering segregated accounts. Additionally, the brokerage provides competitive trading fees, particularly for Hong Kong stocks and negotiable bond trading commissions.

While the company offers a range of customer service channels, their availability is limited to specific hours, which may not cater to all clients, especially those in different time zones.

Is Sunfund safe?

Regulations

Sunfund is officially licensed and regulated by The China Hong Kong Securities and Future Commission (SFC) under license number BHV050.

Funds Safety

Sunfund Securities prioritizes the safety of clients' funds by implementing stringent measures to protect financial assets. The company is regulated by the Securities and Futures Commission (SFC) of Hong Kong. Client funds are kept in segregated accounts, separate from the company's operational funds, ensuring that they are protected in the event of the broker's insolvency. Additionally, the broker is a participant in the Investor Compensation Fund, providing an extra layer of security for clients' investments.

Safety Measures

Sunfund Securities employs a range of security measures to safeguard clients' personal and financial information. These include advanced encryption technologies, multi-factor authentication, and secure socket layer (SSL) protocols to ensure secure communication channels. The broker also conducts regular security audits and compliance checks to detect and mitigate potential threats. Moreover, Sunfund Securities adheres to strict regulatory standards set by the SFC, ensuring that all trading activities are conducted in a fair and transparent manner.

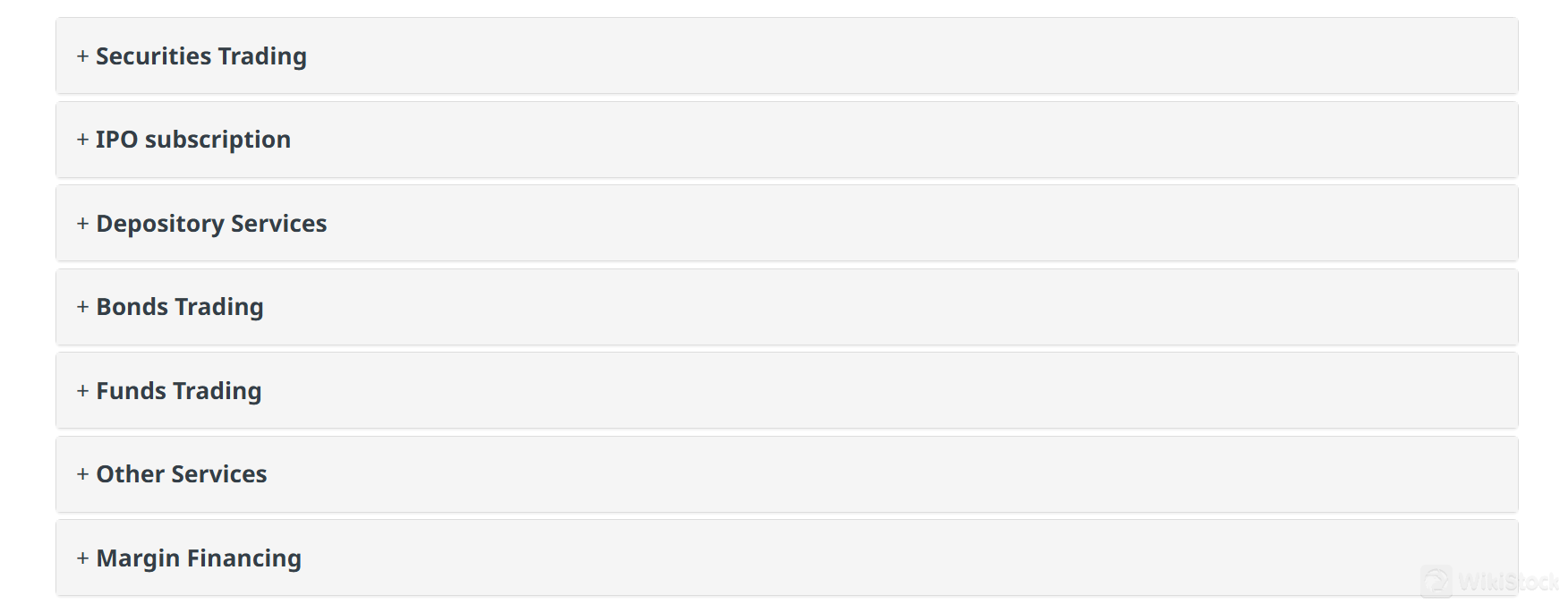

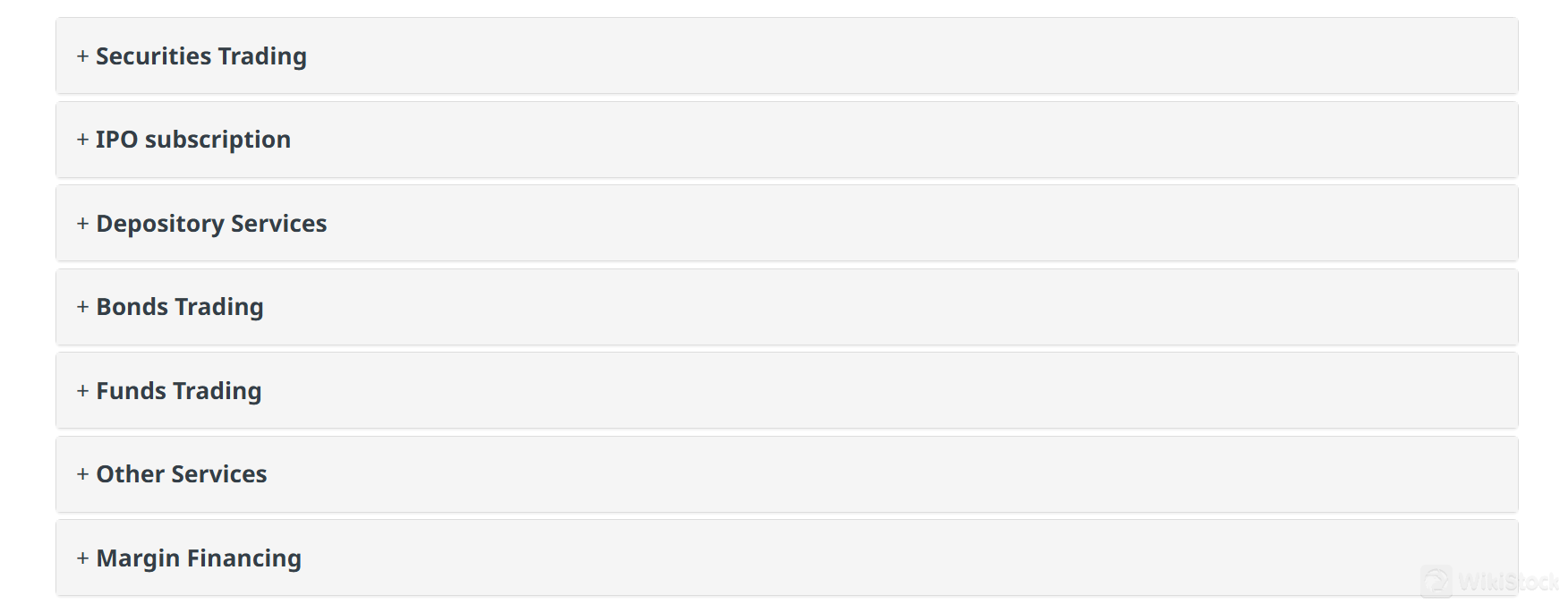

What are securities to trade with Sunfund?

Sunfund Securities offers a wide array of securities for trading, catering to both local and international investors. The broker provides access to:

- Stocks: Clients can trade a vast selection of stocks listed on major exchanges, including the Hong Kong Stock Exchange (HKEX), the Shanghai Stock Exchange (SSE), and the Shenzhen Stock Exchange (SZSE). This diverse offering allows investors to capitalize on opportunities in various markets, including blue-chip stocks, small-cap stocks, and emerging market equities.

- Bonds: Sunfund Securities offers trading in various types of bonds, including government bonds, corporate bonds, and convertible bonds. This allows investors to diversify their portfolios with fixed-income securities that provide regular interest payments and lower risk compared to equities.

- Mutual Funds and ETFs: Sunfund Securities offers a selection of mutual funds and exchange-traded funds (ETFs) that cover a broad range of asset classes and investment strategies. These funds provide an easy way for investors to gain diversified exposure to different markets and sectors.

Clients also have the opportunity to participate in initial public offerings (IPOs) through Sunfund Securities. The broker provides access to new listings on the HKEX and other major exchanges, allowing investors to invest in companies at the early stages of their public market journey.

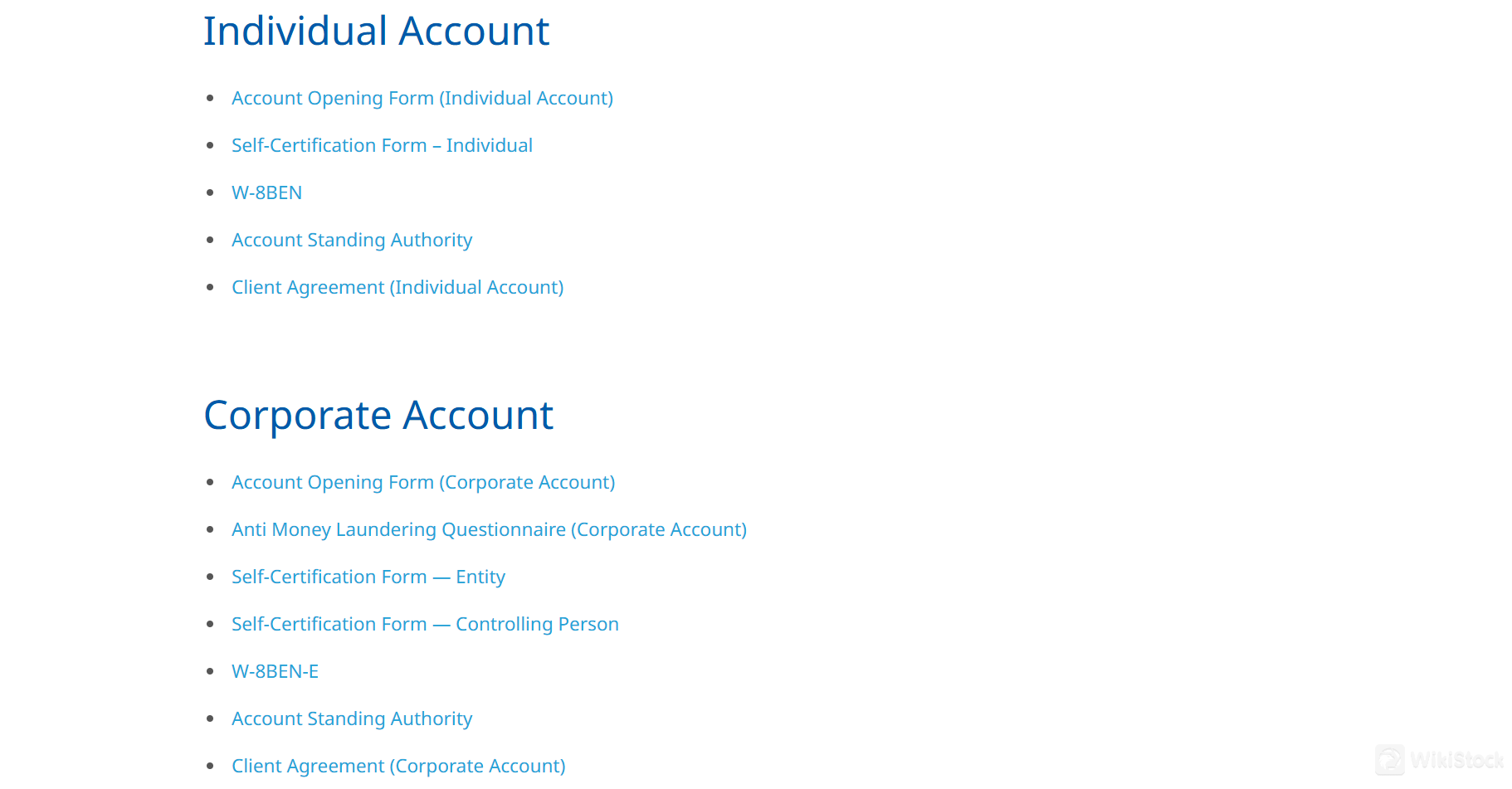

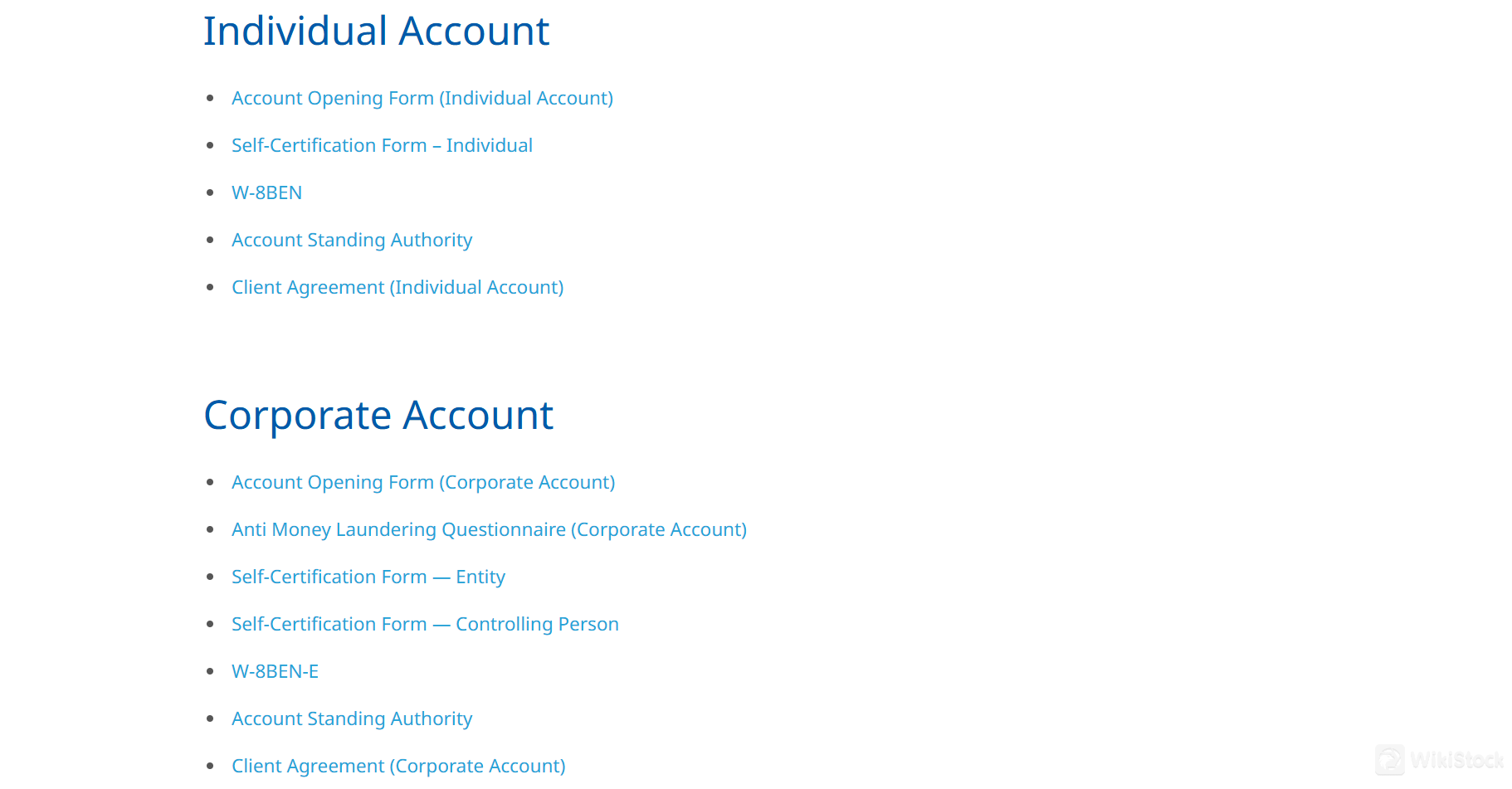

Sunfund Accounts

Sunfund Securities offers two account types to meet the diverse needs of its clients. These include:

- Individual Account: Designed for individual investors, this account type provides access to all available trading services and products. Clients can manage their portfolios, execute trades, and access research and educational resources through the broker's trading platforms.

- Corporate Account: Corporate accounts are tailored for businesses and institutional investors. These accounts offer advanced trading features, higher transaction limits, and access to a dedicated account manager.

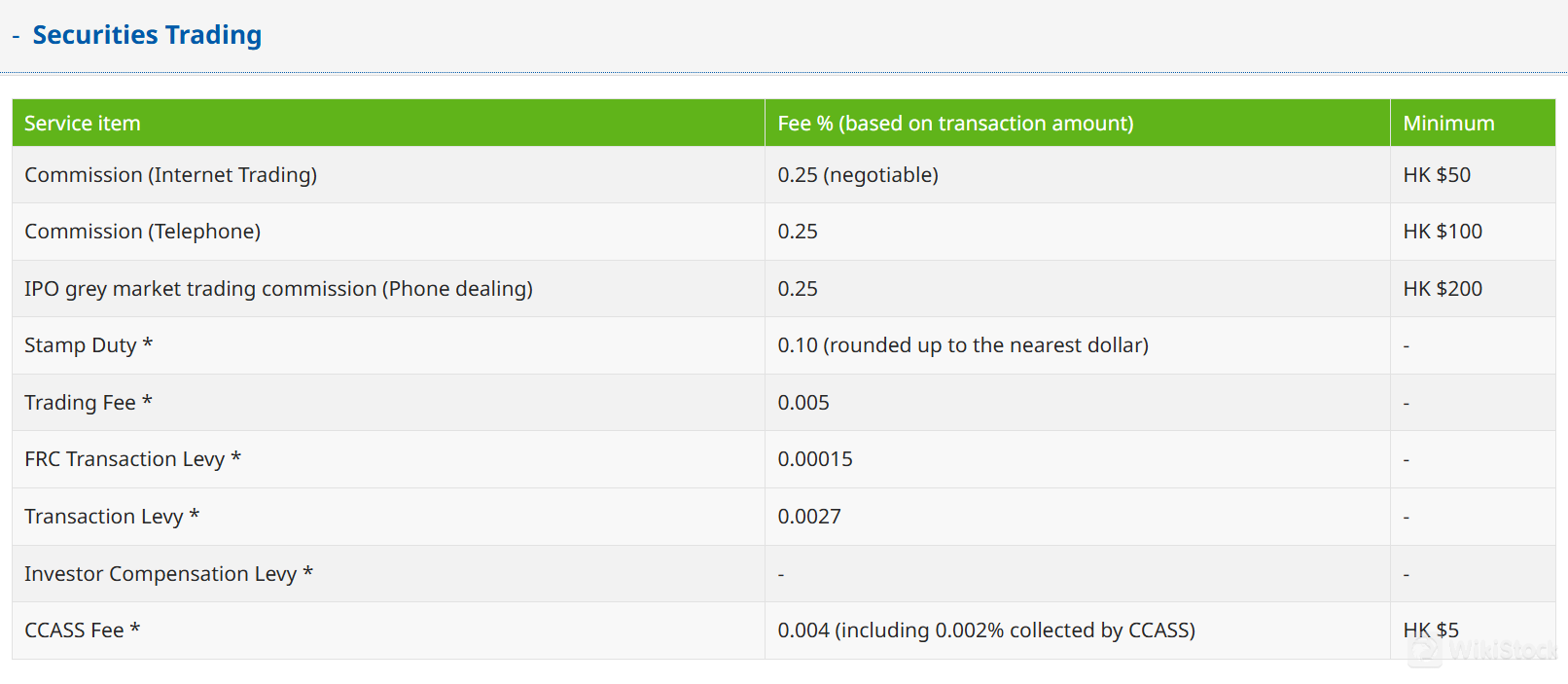

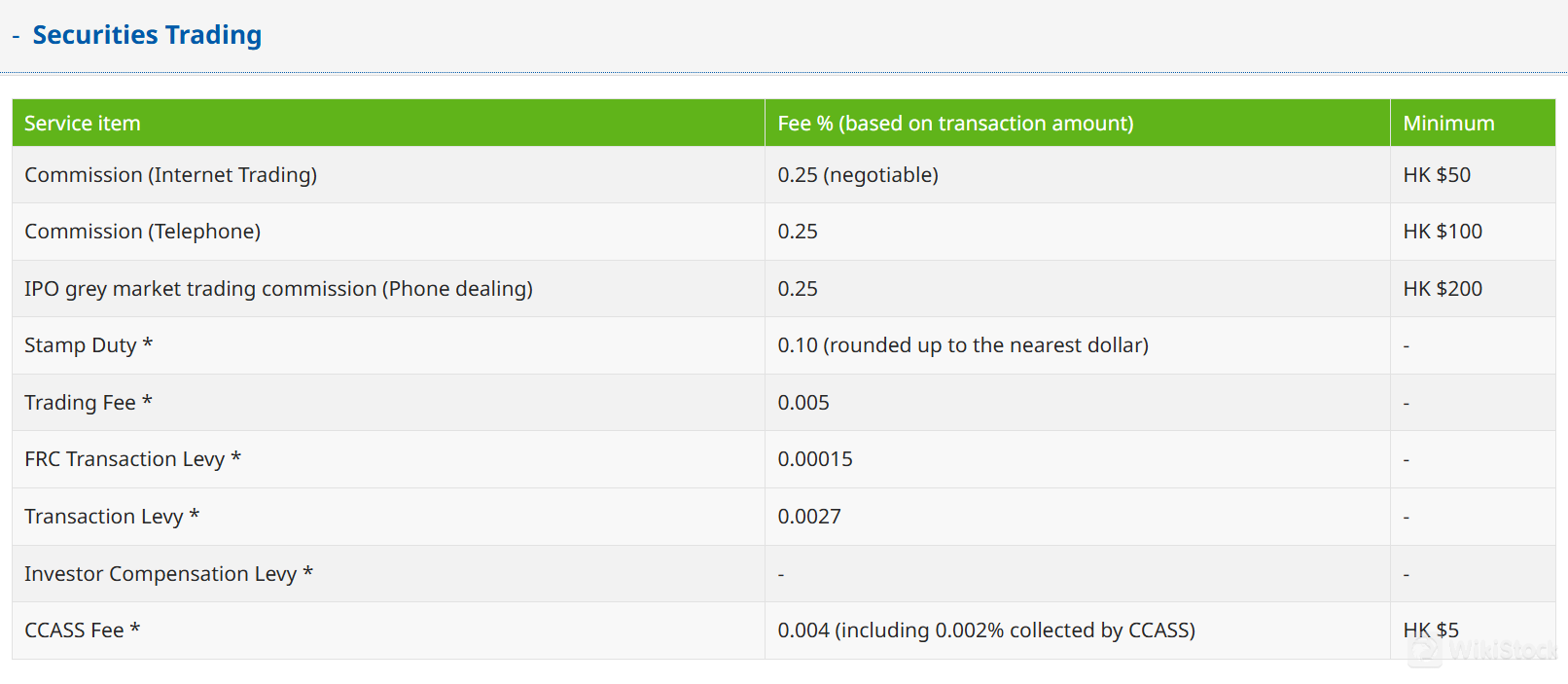

Sunfund Fees Review

Sunfund Securities charges a commission on stock trades, 0.25% of the transaction value with a minimum fee of HKD 100 per transaction for Hong Kong stocks. Additionally, a stamp duty of 0.1% is levied on the transaction value, along with a transaction levy of 0.0027% and a trading fee of 0.005% for trades on the Hong Kong Stock Exchange (HKEX).

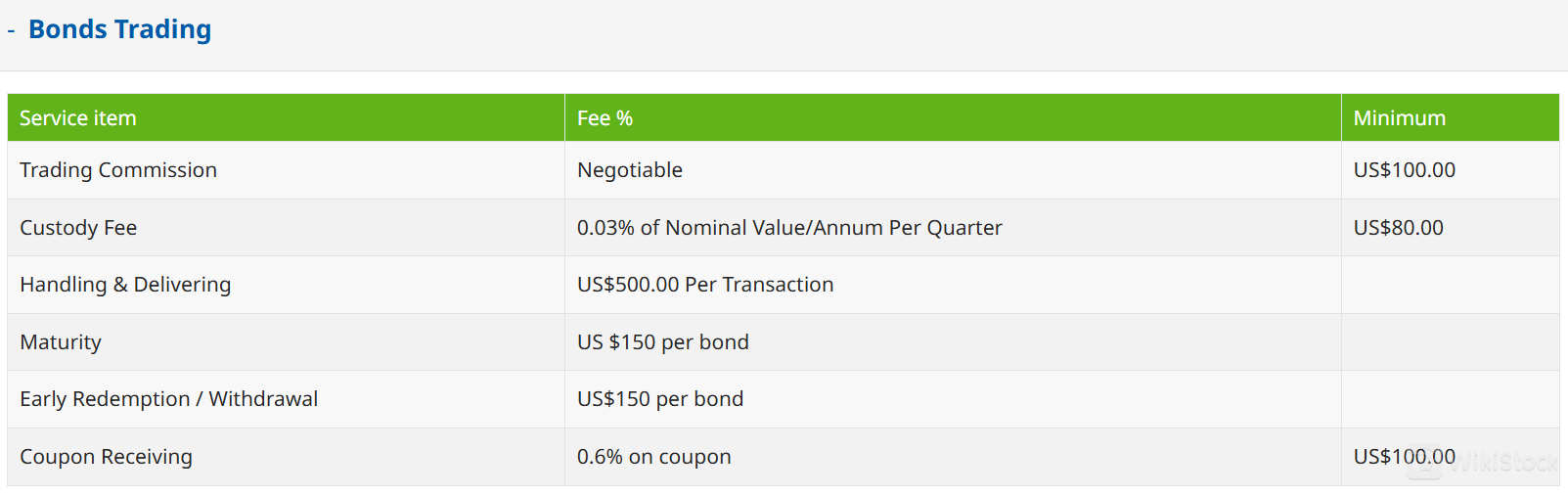

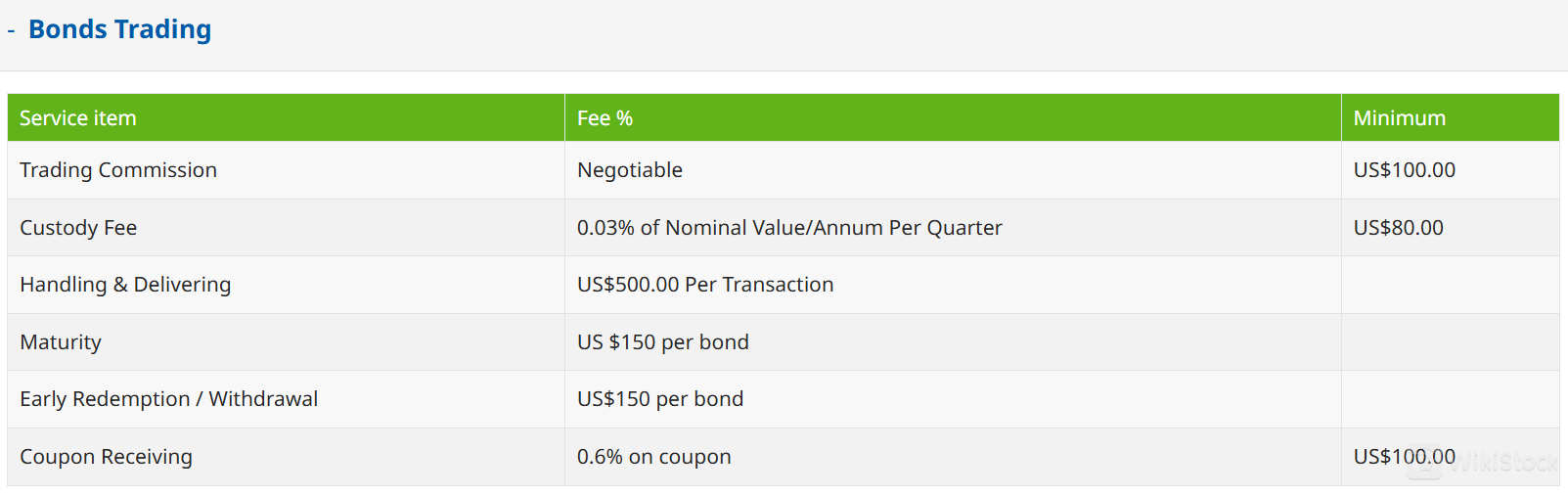

Sunfund Securities offers negotiable trading commissions for bond trading, with a minimum charge of US$100. Custody fees are 0.03% of the bond's nominal value per annum, billed quarterly with a minimum of US$80. Handling and delivery incur a fee of US$500 per transaction. Maturity processing costs US$150 per bond, and early redemption or withdrawal also costs US$150 per bond. Additionally, receiving bond coupons is subject to a fee of 0.6% on the coupon amount, with a minimum charge of US$100.

Sunfund App Review

Sunfund offers both online and mobile access to its brokerage accounts.

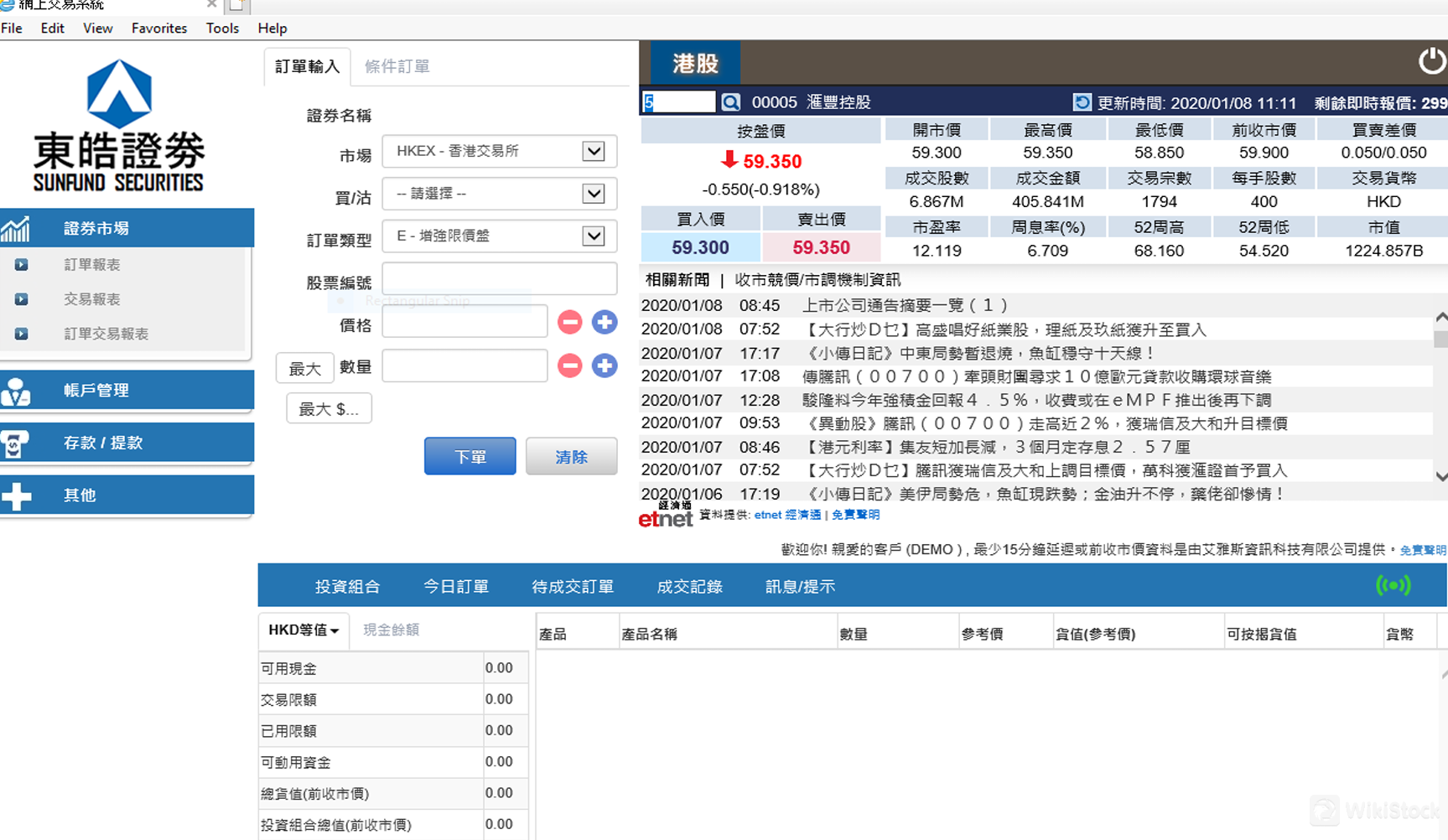

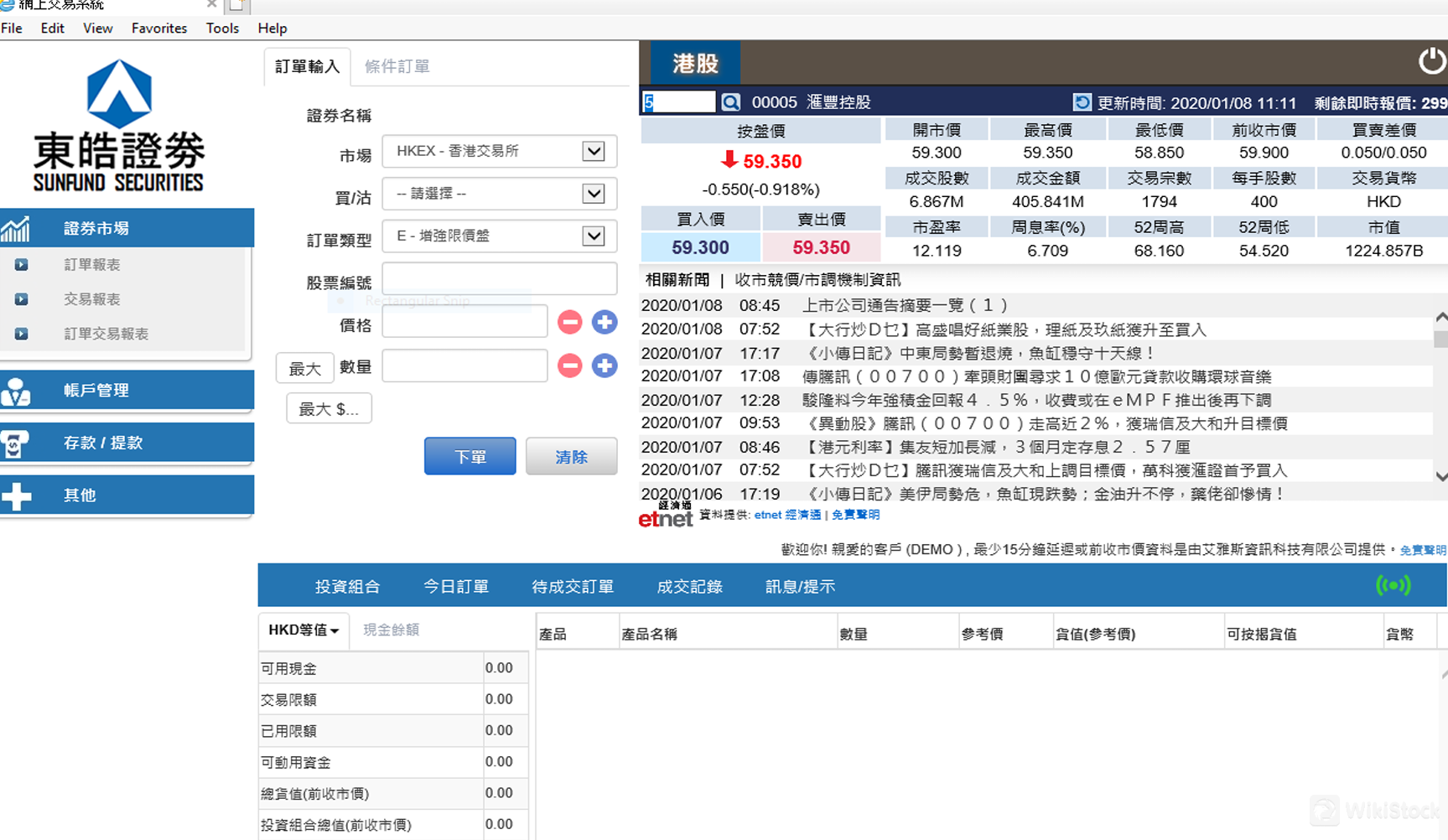

- Mobile App: Sunfund Securities offers a mobile app designed to provide users with an efficient trading experience. The app features a user-friendly interface that allows easy access to a wide range of financial instruments and markets. It includes real-time market data, advanced charting tools, and various order types to facilitate informed trading decisions. Additionally, the app supports secure account management, enabling users to monitor their portfolio, deposit and withdraw funds, and access customer support.

- ETS: Sunfund's Electronic Trading Services (ETS) online trading service allows customers to trade directly online through the official website and manage their accounts, providing users with convenient access anytime, anywhere.

Research and Education

Sunfund Securities offers a diverse suite of research and educational resources designed to support clients in their investment journey. These include:

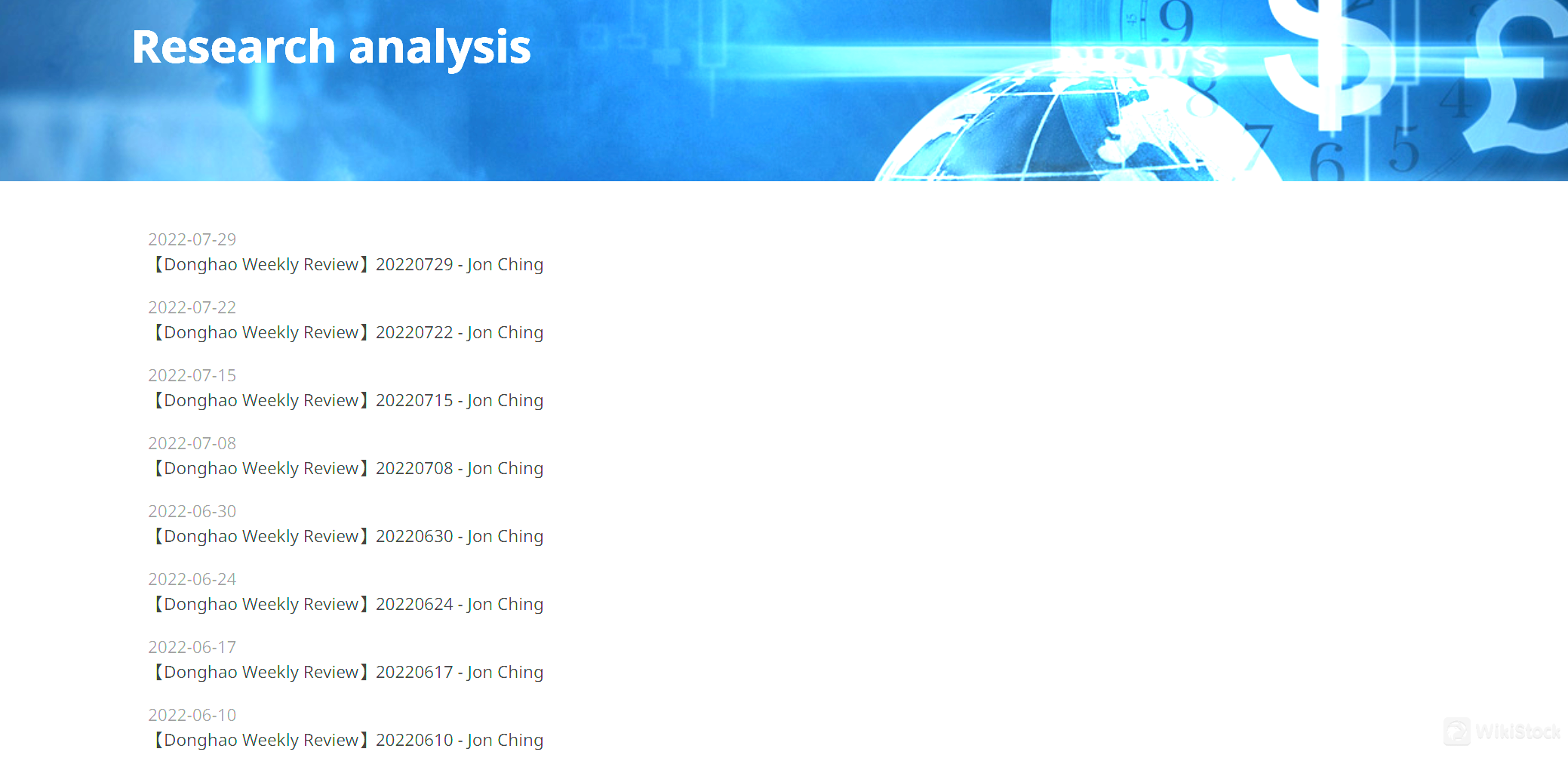

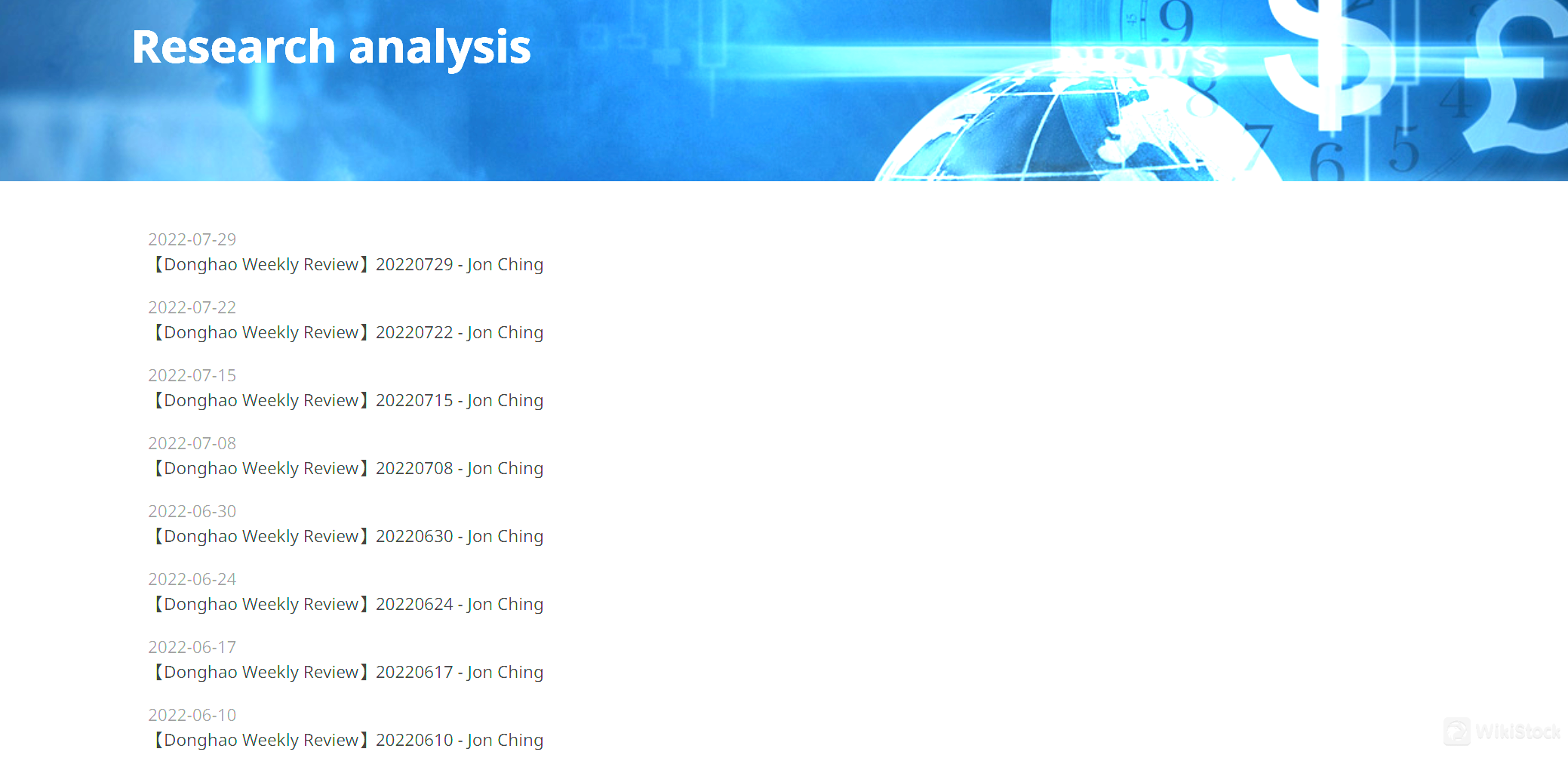

- Research Reports: The broker provides in-depth research reports covering market analysis, stock recommendations, economic outlooks, and sector trends. These reports are prepared by experienced analysts and are available to clients on a regular basis.

- Trading Guidelines: Sunfund also offers Trading Guidelines for online trading systems and the Mobile APP.

- FAQs: Sunfund provides a FAQ section to answer questions about account management and deposit & withdrawal.

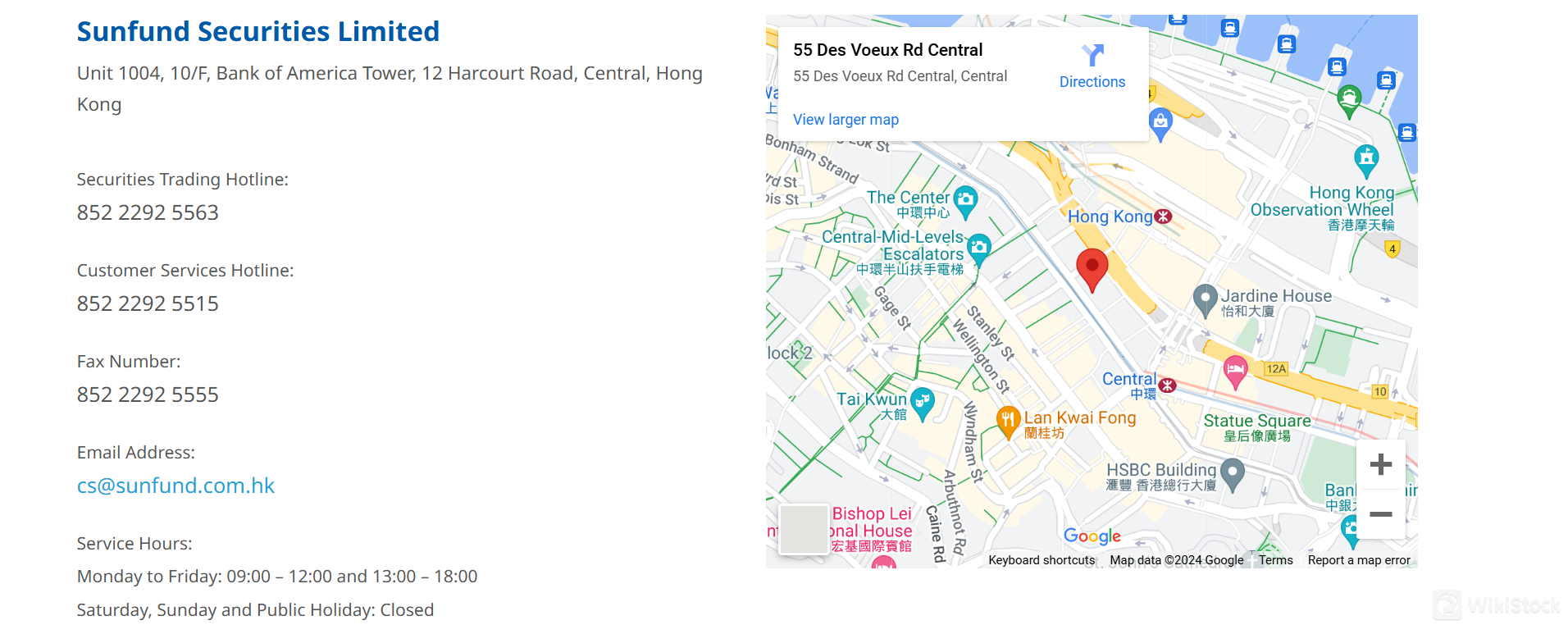

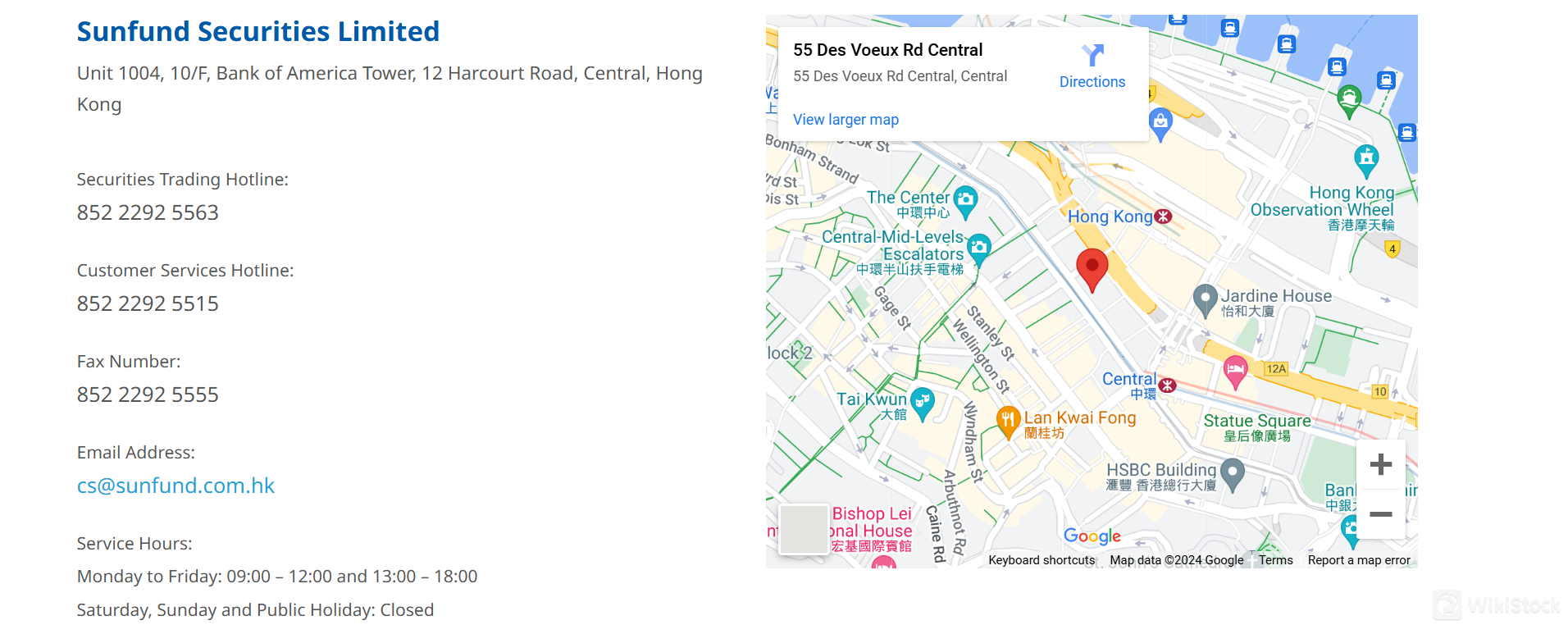

Customer Service

Sunfund provides excellent customer service, available Monday to Friday: 09:00 - 12:00 and 13:00 - 18:00 through various channels, including email ( cs@sunfund.com.hk ), and phone support (852 2292 5515). The brokers support team is responsive and knowledgeable, assisting clients with any issues they may encounter.

Conclusion

Sunfund Securities is a well-rounded brokerage firm offering a wide array of financial products, including stocks, bonds, mutual funds, and ETFs, to individual and institutional investors. The firm is regulated by the Securities and Futures Commission (SFC) of Hong Kong, ensuring compliance with strict regulatory standards and providing robust security measures. Sunfund's trading platforms, including a mobile app and Electronic Trading Services (ETS), are user-friendly and feature-rich.

FAQs

Is Sunfund regulated?

Yes, Sunfund Securities is regulated by the SFC in China Hong Kong.

What types of accounts does Sunfund Securities offer?Sunfund Securities provides individual accounts for personal investors and corporate accounts tailored for businesses and institutional investors. Each account type offers access to a wide range of trading services and products.

What customer support does Sunfund Securities provide?Sunfund offers customer support from Monday to Friday, 09:00 - 12:00 and 13:00 - 18:00, through email and phone. The support team is knowledgeable and responsive to client needs.

Risk Warning

WikiStock's expert assessment of the brokerage's website data is subject to change and should not be taken as financial advice. Online trading carries substantial risks, including the potential loss of all invested capital, and it's crucial to fully understand these risks before investing.

Obtain 1 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)