Regulated

0123456789

. 0123456789

0123456789

/10

Score

Earn

CyprusWithin 1 year(s)

Regulated in CyprusStocksCommission 0.1%

https://earn.eu/

Website

Rating Index

Brokerage Appraisal

Products

6

Securities Lending Fully Paid、Futures、Investment Advisory Service、Stocks、ETFs、Mutual Funds

22 514 442

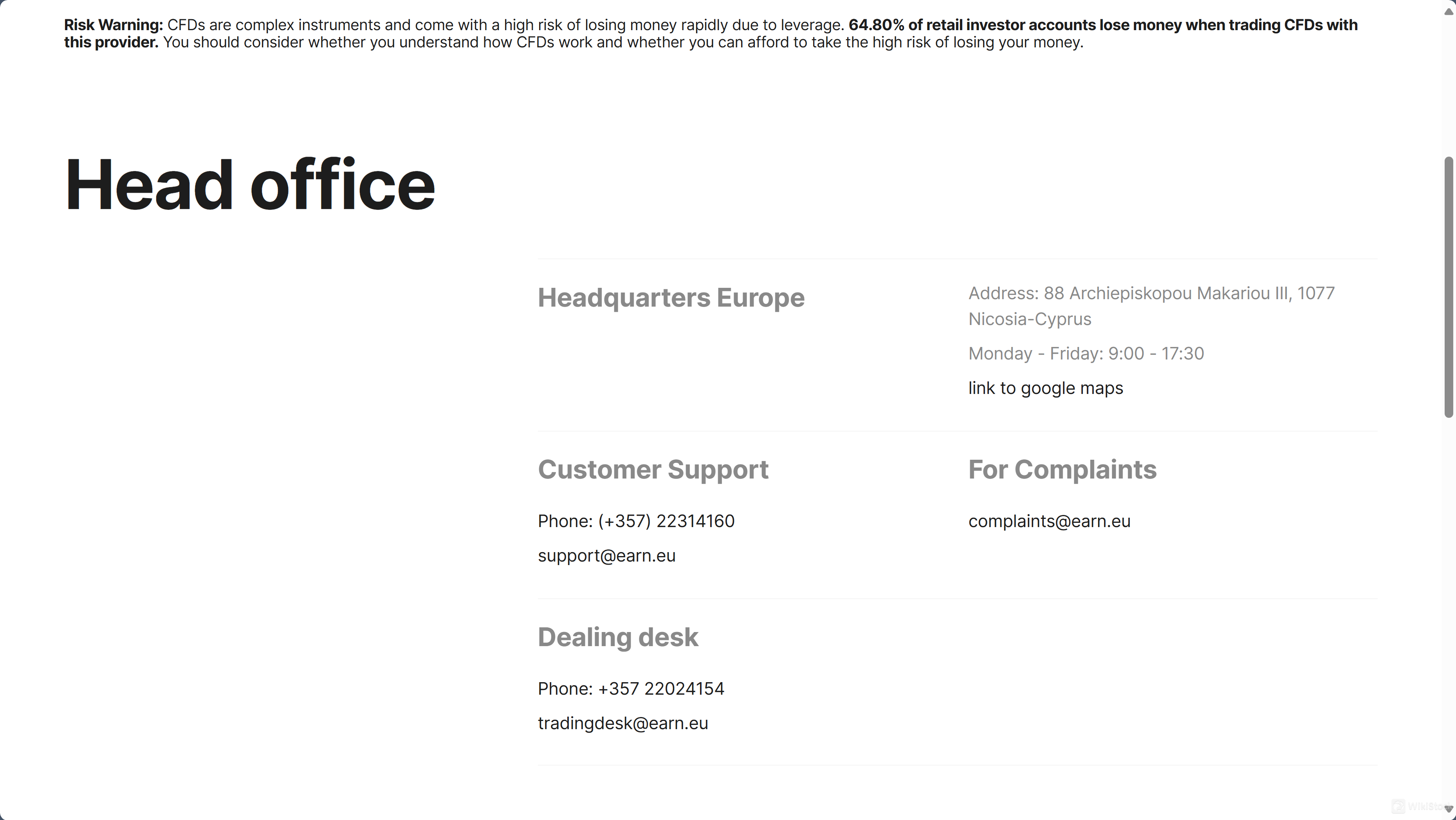

support@earn.eu

https://earn.eu/

88 Archiepiskopou Makariou III, 1077 Nicosia-Cyprus

Securities license

Obtain 1 securities license(s)

CYSECRegulated

CyprusSecurities Trading License

Brokerage Information

More

Company Name

Top Markets Solutions Ltd

Abbreviation

Earn

Platform registered country and region

Phone of the company

22 514 442

Company address

88 Archiepiskopou Makariou III, 1077 Nicosia-Cyprus

Company website

https://earn.eu/Check whenever you want

WikiStock APP

Brokerage Services

Internet Gene

Gene Index

0

020406080100

The gene index is Poor, worse than 0% of brokerage firms.

APP Rating

0

01.02.03.04.05.0

The APP rating is Poor, worse than 0% of peers.

Features of Brokerages

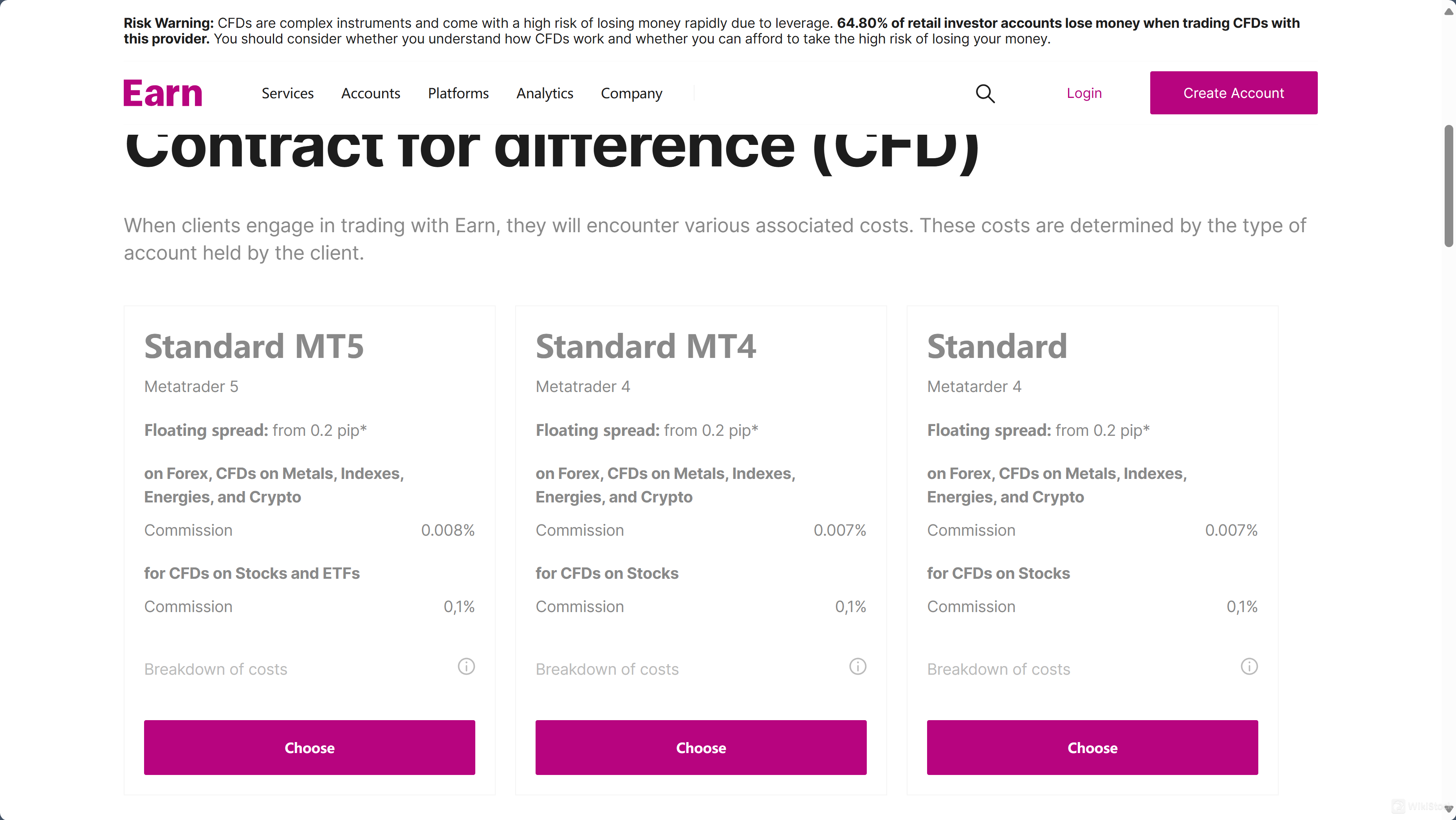

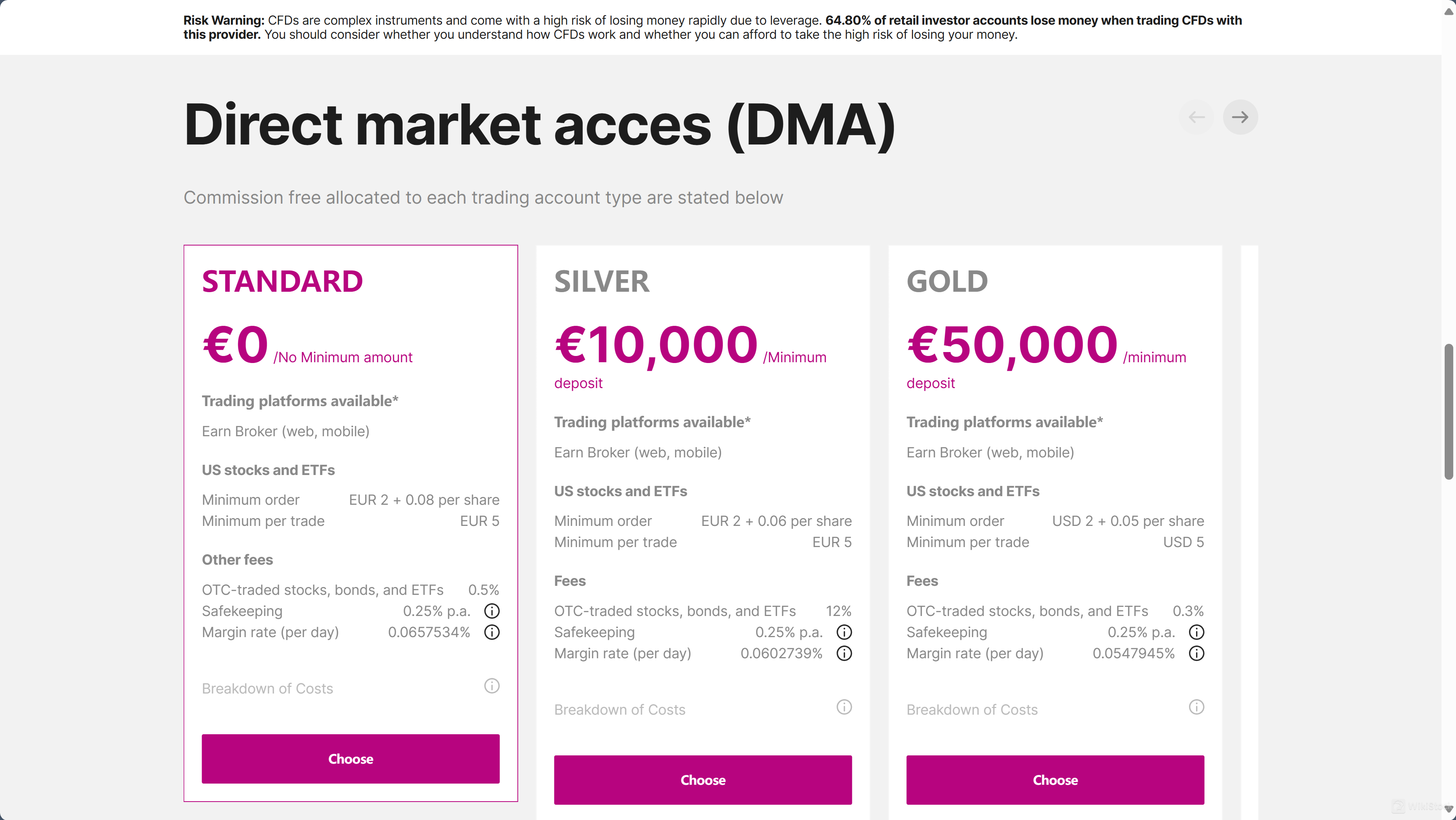

Commission Rate

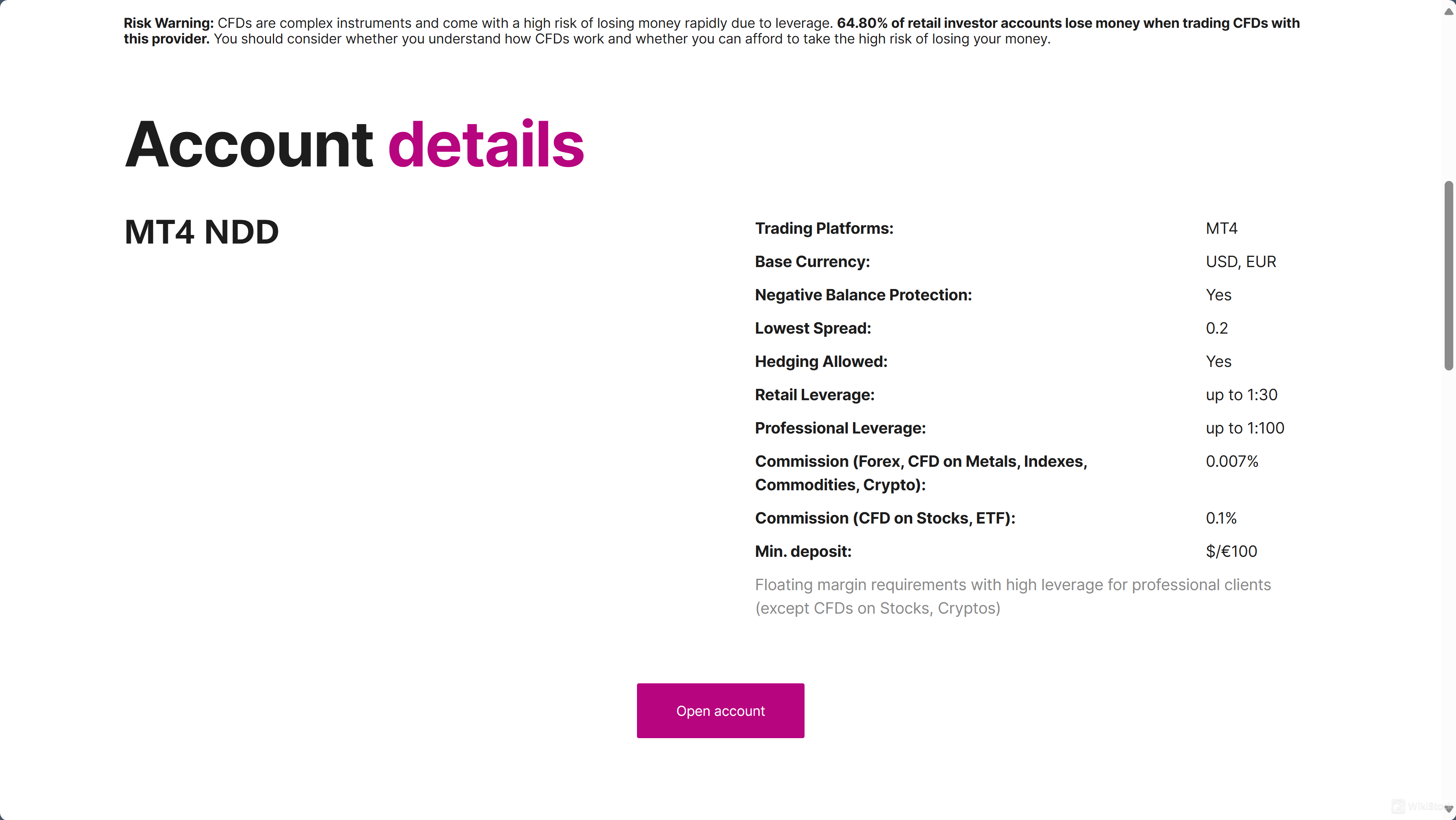

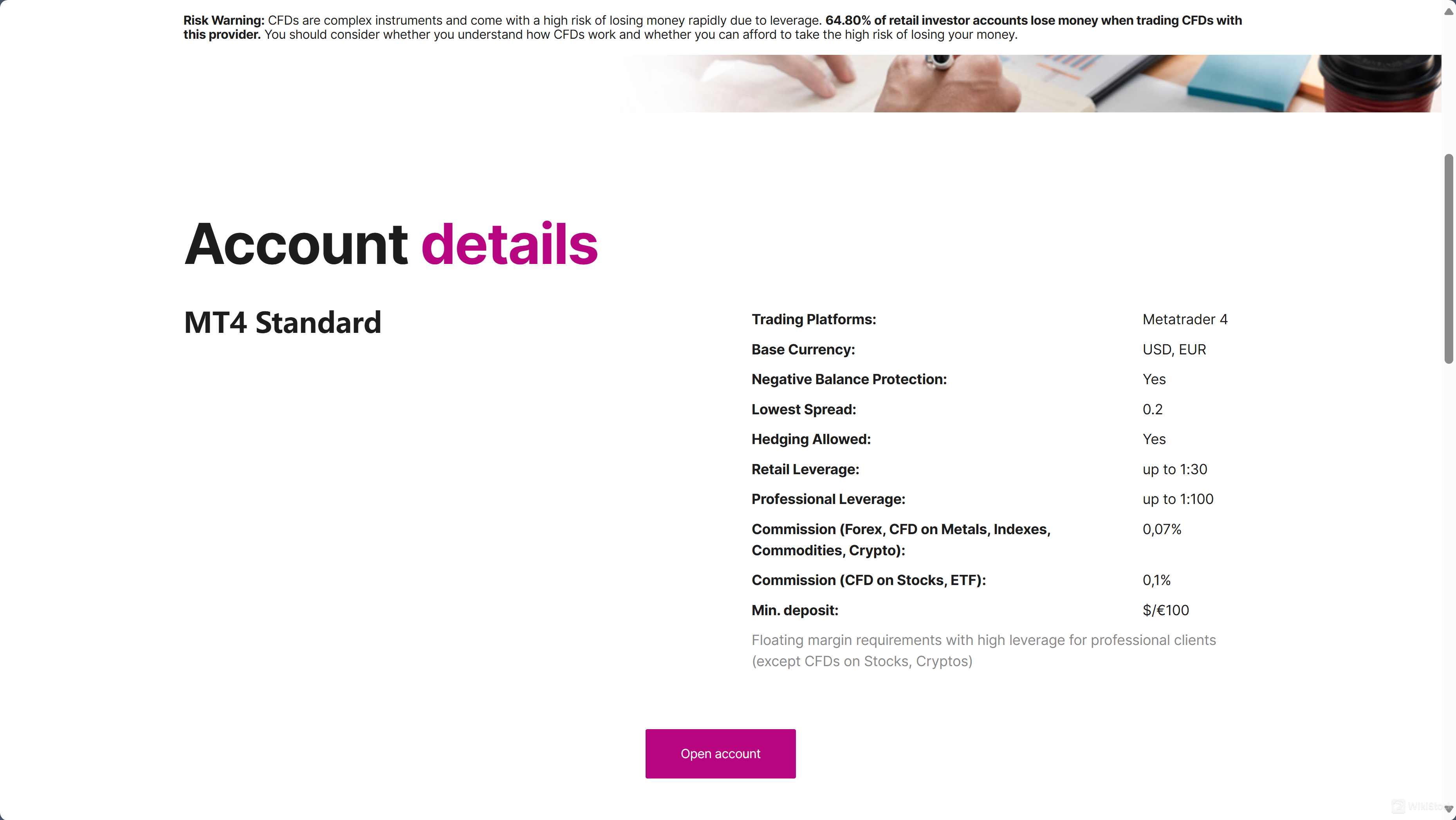

0.1%

Minimum Deposit

$0

New Stock Trading

Yes

Margin Trading

YES

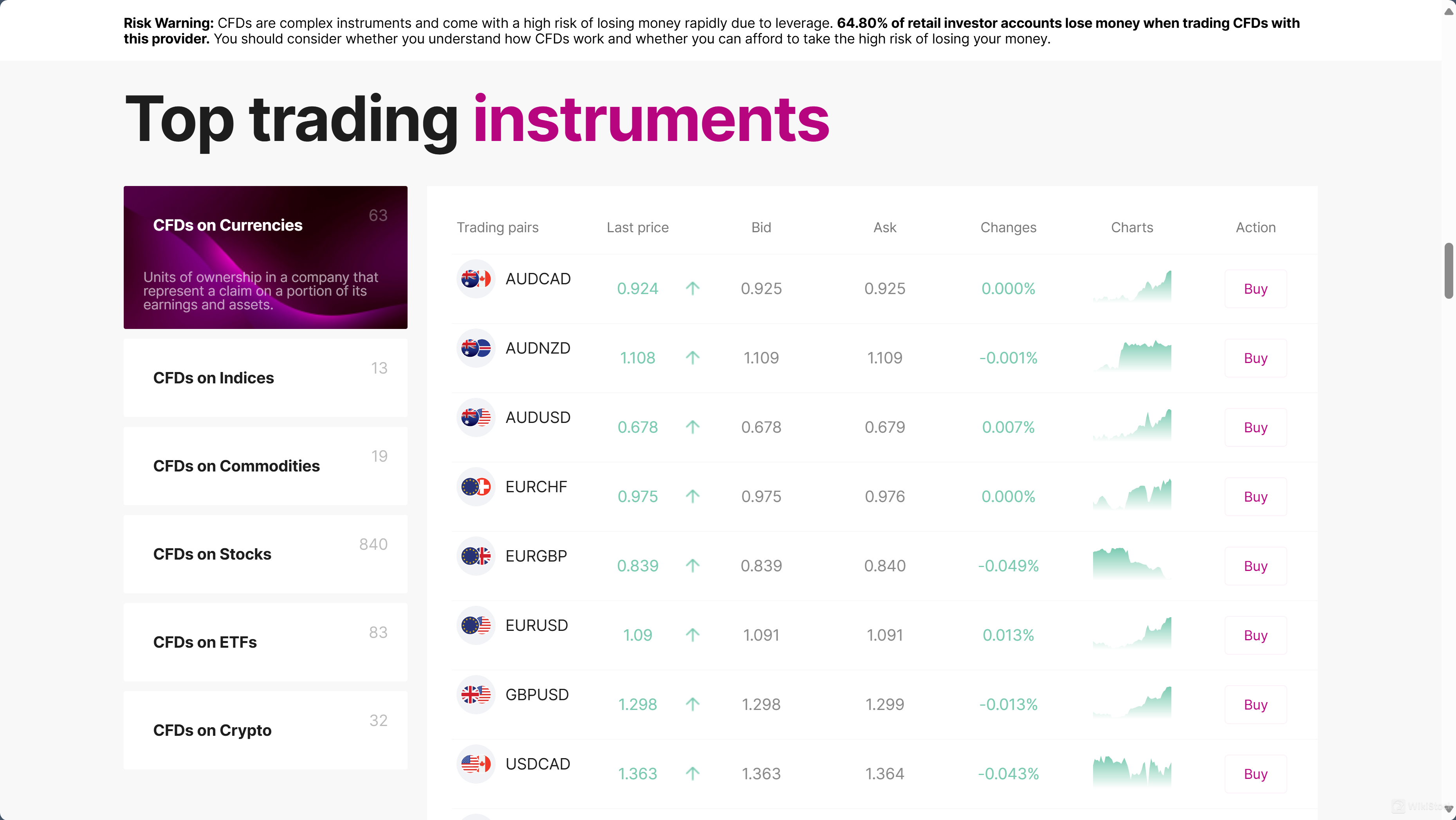

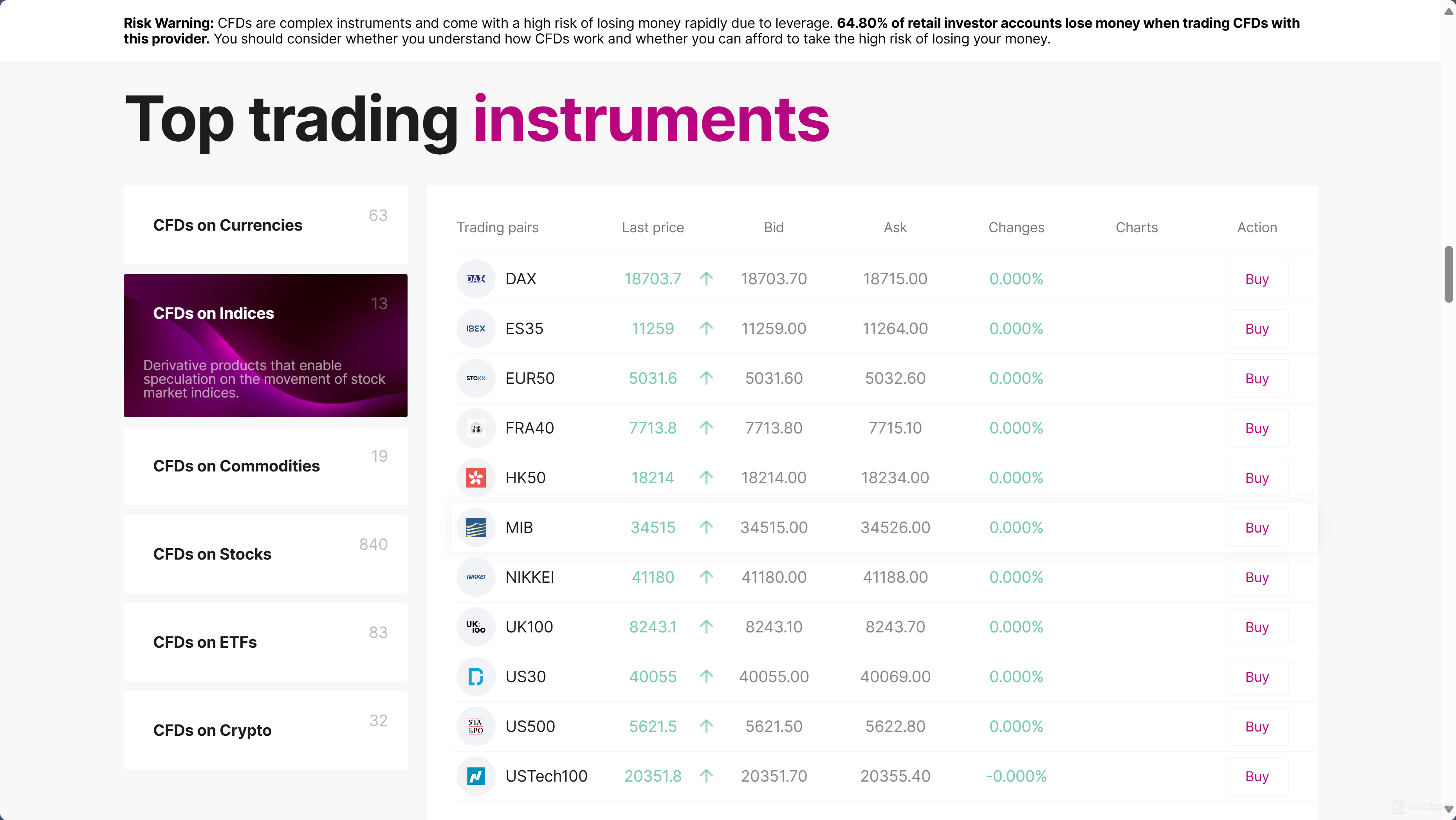

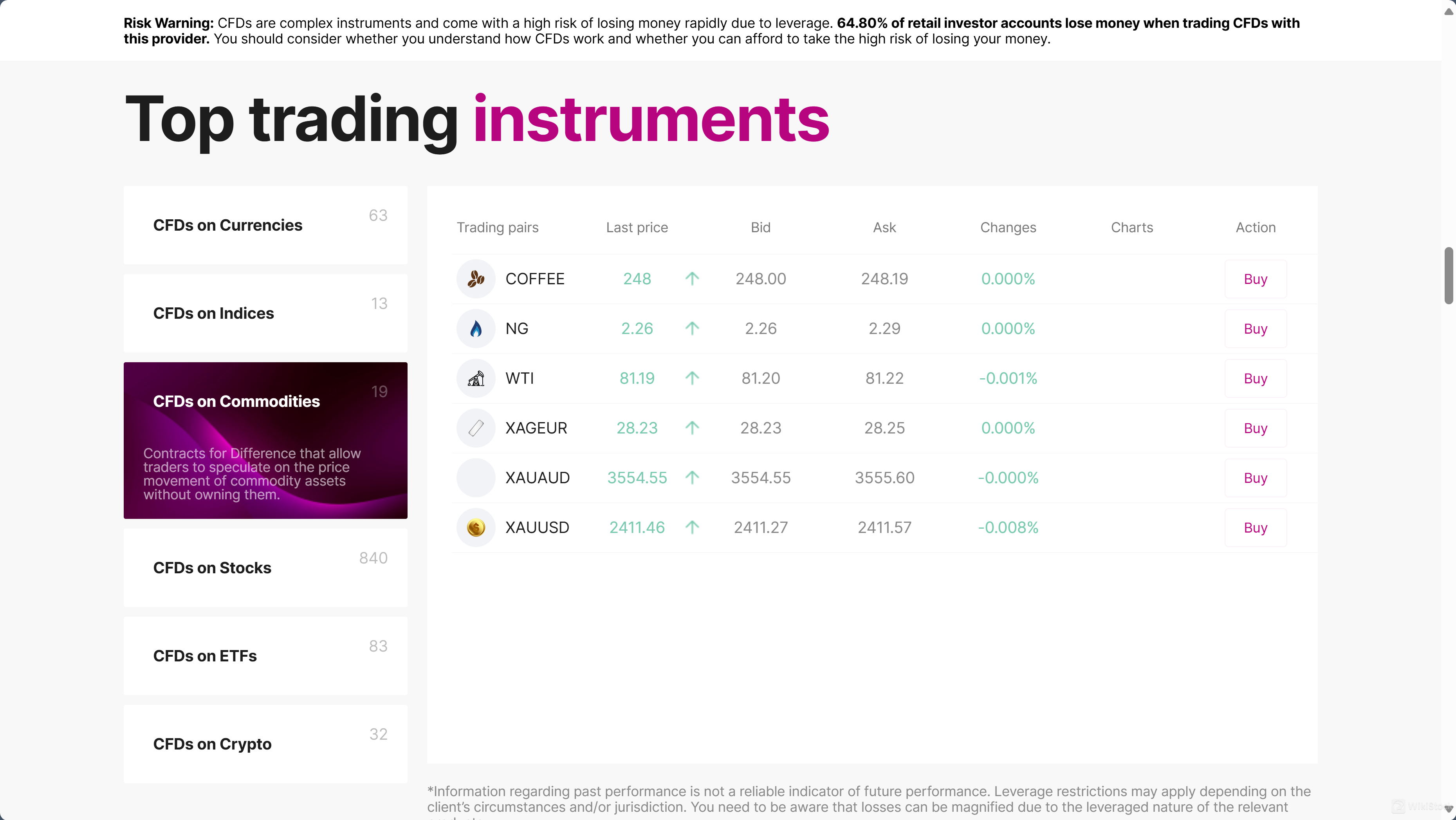

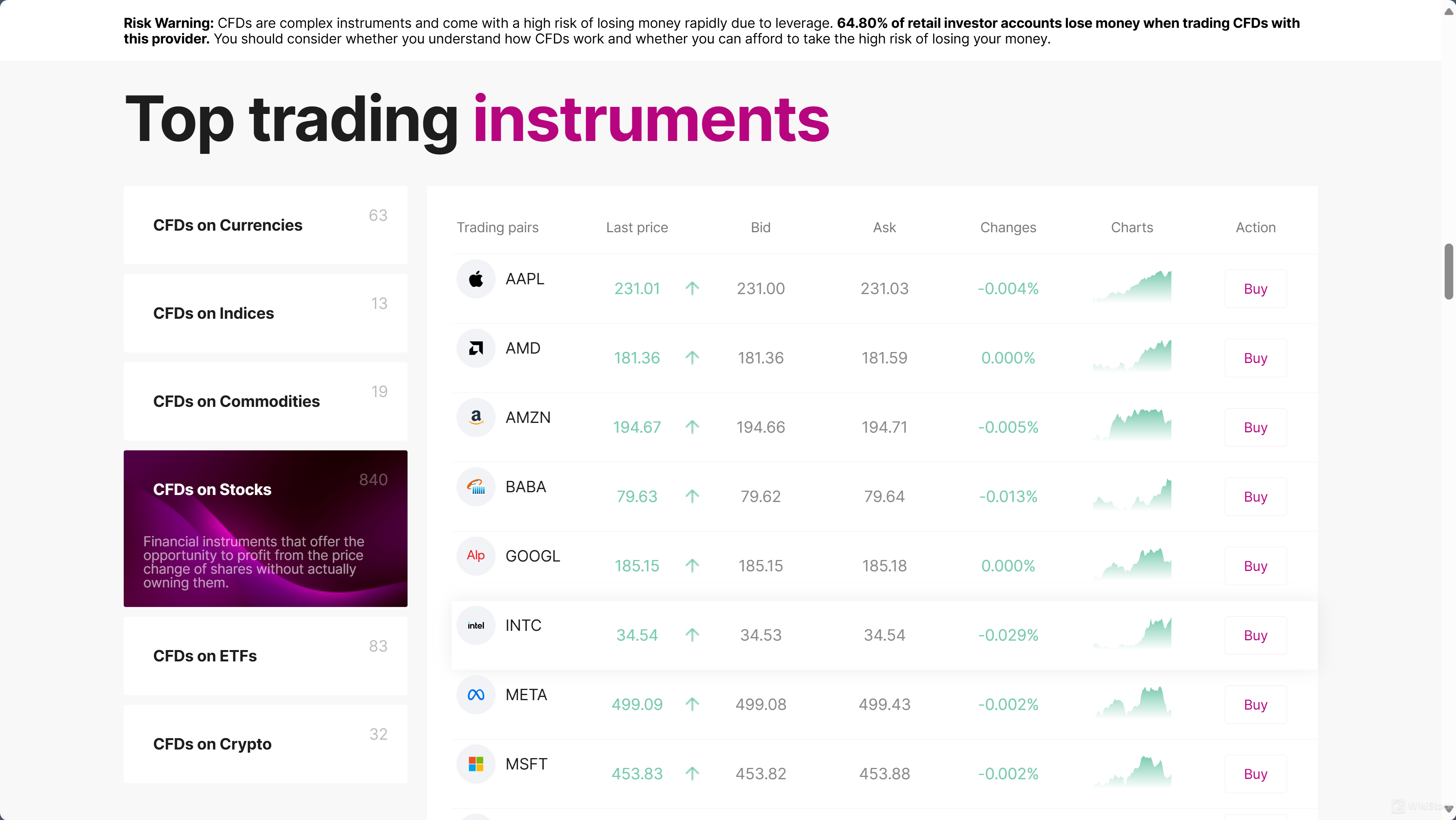

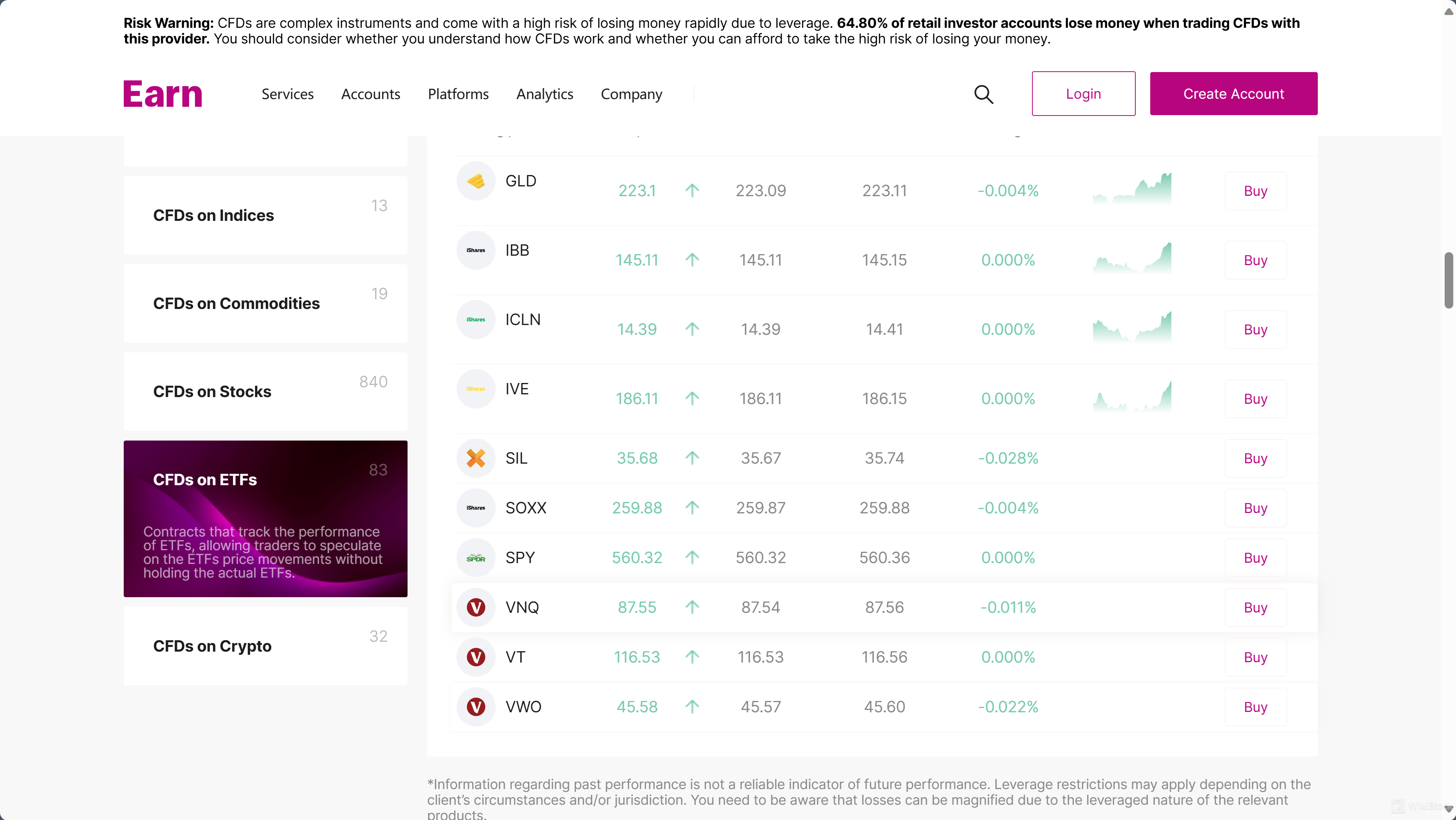

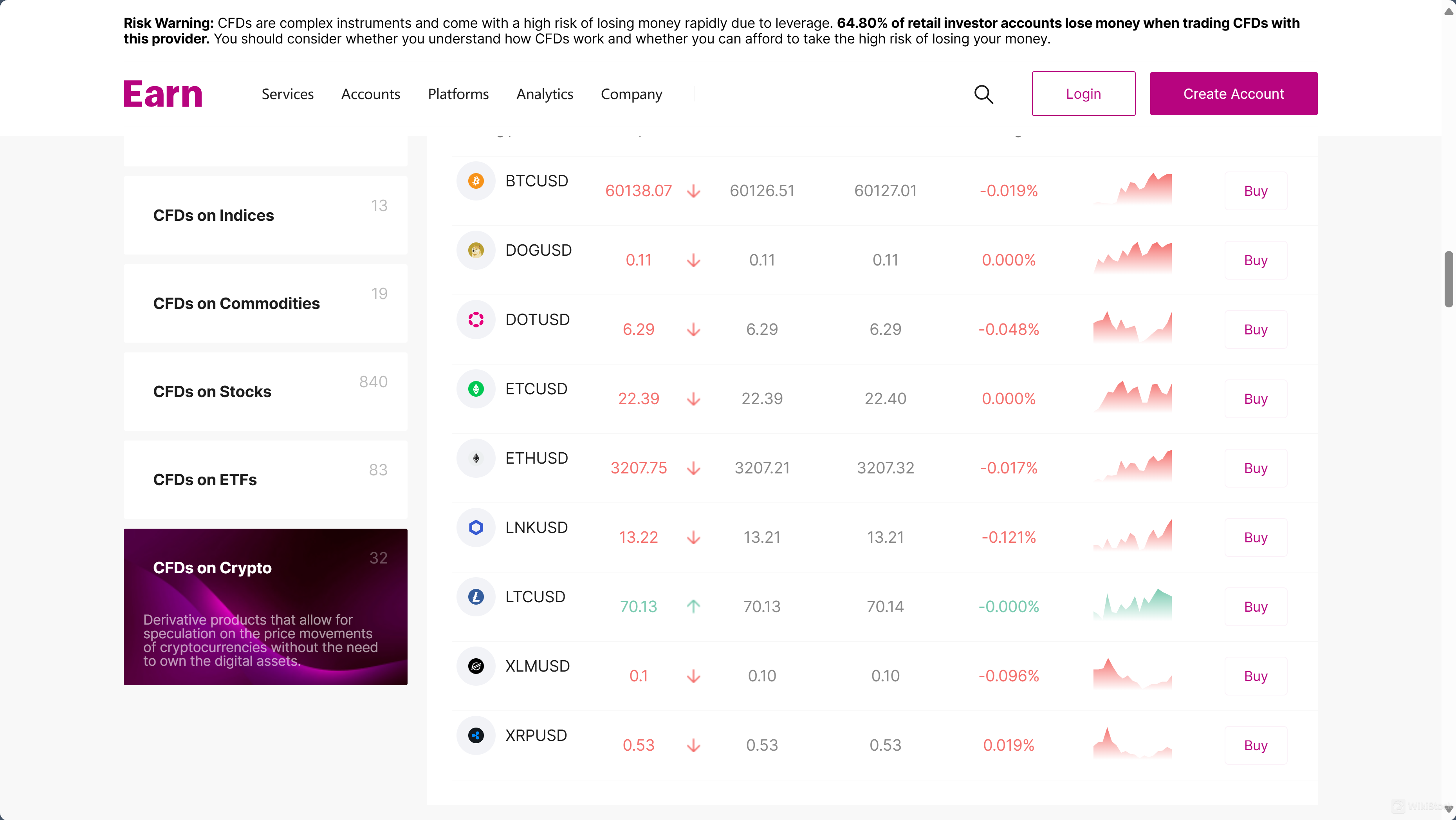

Earn is a brand operated by Top Markets Solutions Ltd multi-asset broker and investment firm with over 13 years of experience in the financial markets. With a team of qualified and experienced professionals, we offer cutting-edge technology, fast and reliable trading platforms, and comprehensive support. Whether it's Forex, CFDs on stocks, ETFs, indices, commodities, or other instruments, we provide access to a wide range of investment opportunities.

Others

Registered region

Cyprus

Years in Business

Within 1 year(s)

Products

Securities Lending Fully Paid、Futures、Investment Advisory Service、Stocks、ETFs、Mutual Funds

Download App

Review

0 ratings

Write a comment

No ratings

Recommended Brokerage FirmsMore

Regulated

Freedom24

License Level AAA

Regulated in CyprusStocks0 Commission

7.20

Score

Regulated

Colmex Pro

License Level AAA

Regulated in CyprusStocks0 Commission

7.19

Score

Regulated

Atlantic Securities

License Level AAA

Regulated in CyprusStocksCommission 0.4%

7.17

Score

Regulated

RoboMarkets

License Level AA

Regulated in CyprusStocks

7.15

Score

Regulated

NAGA

License Level AAA

Regulated in CyprusStocks

7.12

Score

Regulated

InstaForex

License Level A

Regulated in CyprusStocks0 Commission

7.11

Score

Regulated

Global Capital

License Level AAA

Regulated in CyprusStocks

7.09

Score

Regulated

Mind-Money.eu

License Level AAA

Regulated in CyprusStocksCommission 0.1%

7.09

Score

Regulated

FXGlobe

License Level A

Regulated in CyprusStocks0 Commission

7.08

Score

Regulated

Mega Equity

License Level AAA

Regulated in CyprusStocksCommission 0.1%

7.07

Score