A subsidiary of cdbbank, Global Capital Securities and Financial Services Ltd, is a Cyprus based Investment Services firm specializing in the provision of such services to individuals and corporations alike. It is regulated by the Cyprus Securities and Exchange Commission (License 15/03), is a Member of the Cyprus Stock Exchange and a Remote Member of the Athens Stock Exchange.

What is Global Capital?

Global Capital is a brokerage firm rated three stars by WikiStocks, known for offering a diverse range of trading platforms including marketOrder, Interactive Brokers, XNET, and Swissquote, satisfying various trading preferences.

The firm charges a reasonable commission fee of 0.50% with a minimum of €5 and offers access to mutual funds, with an account opening fee of €20.

However, it does not offer interest on uninvested cash, which might be a drawback for clients looking to earn from their idle balances.

Pros & Cons

Pros:

Global Capital offers a suite of investment services including brokerage and asset management, meeting diverse investor needs. The firm is regulated by CYSEC, ensuring compliance with financial regulations and providing a layer of security for its clients. Additionally, Global Capital features a unique trading platform, the marketOrder platform, which enhances the trading experience with its specialized functionalities.

Cons:

However, Global Capital has higher commission rates at 0.5%, which are steeper compared to some of its competitors, potentially deterring cost-sensitive investors. The firm also charges a €20 account opening fee, which might be seen as a barrier to entry for new clients. Moreover, the scope of direct trading is limited to funds only, restricting options for investors interested in a broader array of direct securities.

Is Global Capital Safe?

Regulations:

Global Capital is regulated by the Cyprus Securities and Exchange Commission (CySEC) under License No. 015/03. CySEC is an independent supervisory authority responsible for overseeing the investment services market and transactions in transferable securities in the Republic of Cyprus.

Funds Safety:

Global Capital enhances fund safety through strict adherence to CySEC regulations, including mandatory segregation of client funds from company assets.

Their rigorous Order Execution Policy ensures optimal transaction conditions for clients by prioritizing factors such as price, cost, speed, and likelihood of execution.

This commitment to best execution and regulatory compliance solidifies Global Capital's reputation as a trustworthy and secure platform for financial trading.

Safety Measures:

Global Capital employs stringent security measures to protect the integrity and confidentiality of client information and funds.

This includes the use of encryption technologies to secure online transactions and storage of funds, as well as internal security policies to prevent unauthorized access to client data.

The company also emphasizes the confidentiality of client information, assuring that personal data is not sold, rented, traded, or disclosed to third parties, which further supports the overall safety of using their services.

What are securities to trade with Global Capital?

Global Capital offers clients the opportunity to trade in various securities through their involvement with alternative investment funds (AIFs). Specifically, they provide access to two distinct types of AIFs:

IRIS London Property AIF V.C.I.C PLC: This fund focuses on real estate investments in London, offering a structured vehicle for investing in property markets authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) under License No. AIF55/2018.

Interorient Shipping Fund AIF V.C.I.C PLC: This fund specializes in the shipping industry, with compartments like the Interorient Handy Fund, Interorient Fund II, Interorient MR Tanker Fund, Interorient Handymax Bulker Fund, and Interorient Handy Bulker Fund. It is also regulated by CySEC under License No. AIF66.

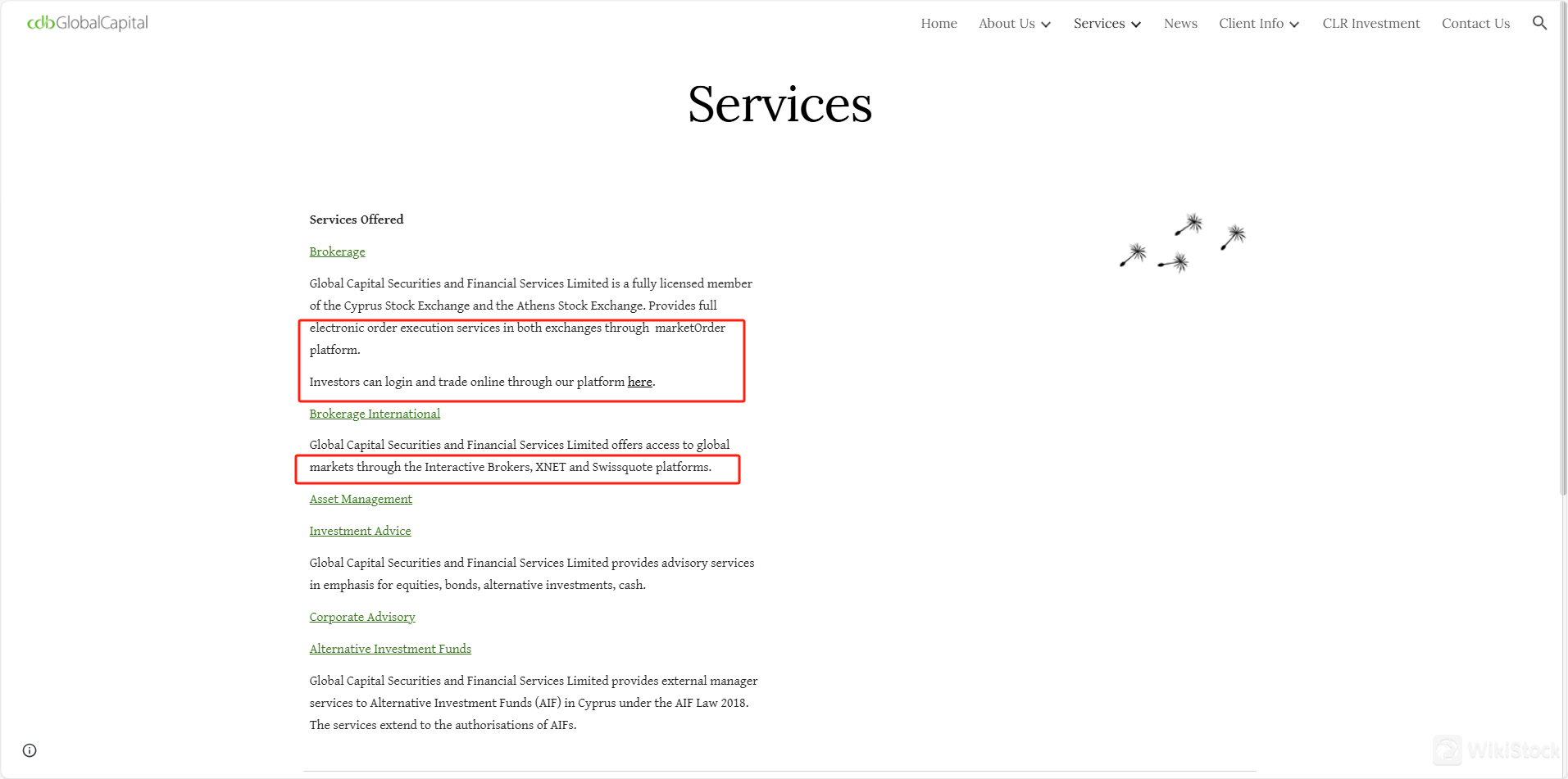

Services

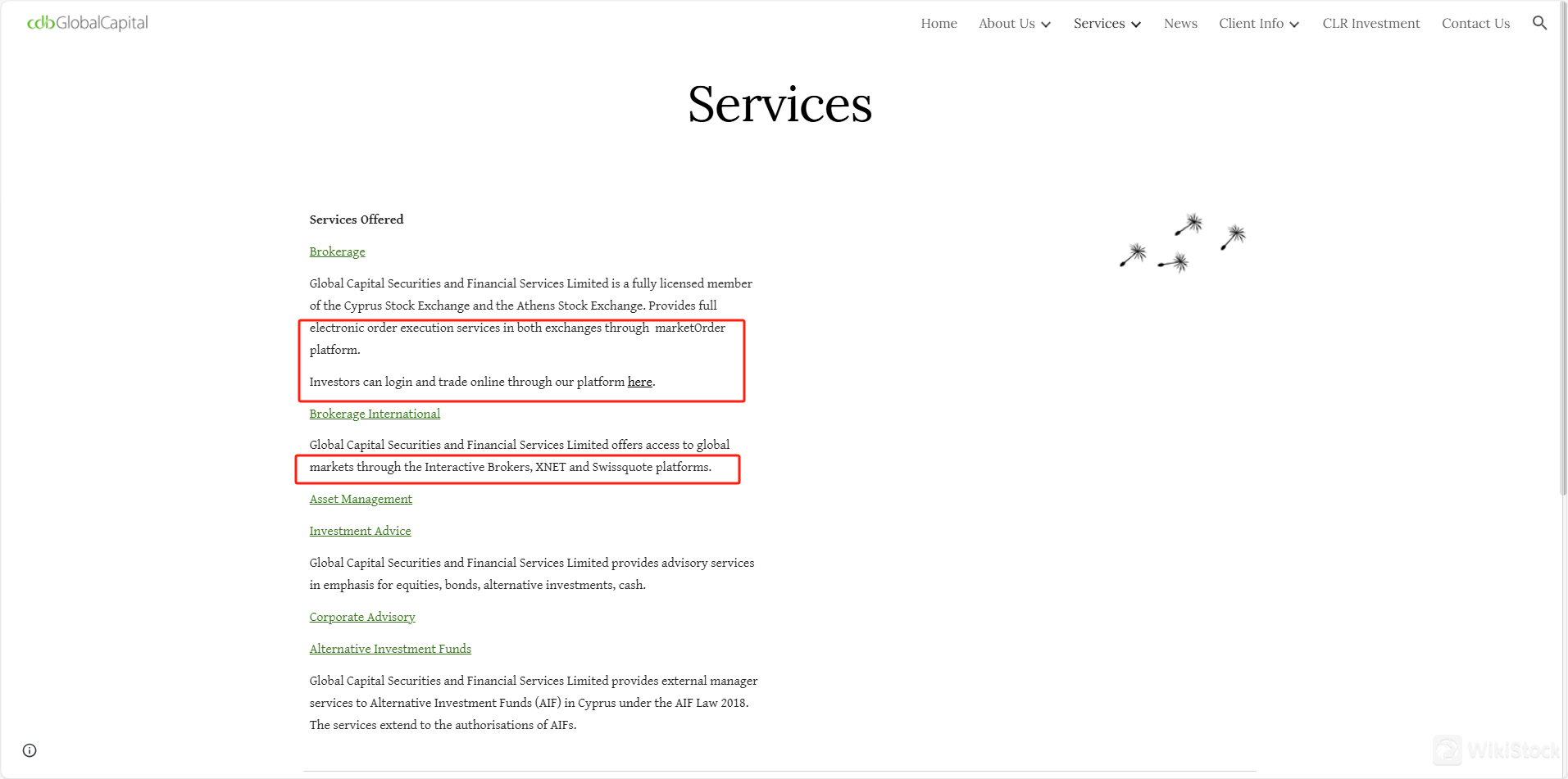

Global Capital Securities and Financial Services Limited offers a range of services designed to meet the diverse needs of both individual and institutional investors. Here are the key services they provide:

Brokerage Services:

Offers personalized and online brokerage services for trading on the Cyprus Stock Exchange (CSE), Athens Stock Exchange (ASE), and major international exchanges.

Executes transactions directly for customers at competitive costs, with access to platforms like Swissquote and XNET for global financial instruments.

Asset Management:

Manages themed funds and discretionary portfolios tailored to achieve returns that match or exceed benchmark returns, focusing on capital growth without excessive risk.

Provides segregated accounts where individual portfolios are managed on a discretionary basis, allowing customization based on client-specific needs and risk tolerances.

Investment Advice:

Specializes in serving institutional clients such as pension funds and investment companies.

Offers systematic monitoring and assessment of asset portfolio performance, aiding clients in planning, applying, and adjusting their investment policies.

Corporate Advisory:

Provides a range of services including capital markets access, capital raising, mergers and acquisitions, structuring of financial instruments, and corporate restructuring.

Assists with business strategy and planning, performing company valuations, and developing methodologies for strategy implementation.

Trading and Account Services:

Supports opening and closing of trading accounts, transferring securities, and managing depository account information.

Facilitates over-the-counter (OTC) transactions for government and corporate bonds through associates like 7Q Financial Services and Athlos Capital Investment Services Ltd.

Global Capital Account Review

Global Capital categorizes its clients into three main types in accordance with the Directive 2014/65/UE of the Markets in Financial Instruments (MiFID II). These categories are established based on the clients knowledge, experience, and expertise in the investment field, relevant to the specific type of product or service offered or demanded. Here are the three client categories:

Professional Clients:

These are clients who possess the experience, knowledge, and expertise to make their own investment decisions and properly assess the risks involved. This category includes entities such as credit institutions, investment firms, insurance companies, pension funds, national and regional governments, and large undertakings that meet specific size requirements.

Eligible Counterparties:

This category includes clients who receive the least protection and are typically major institutional investors such as investment firms, credit institutions, insurance companies, pension funds, and supranational institutions like the World Bank and the IMF. These clients are exempt from certain obligations related to conduct of business, best execution, and client order handling, except when receiving investment advice or portfolio management services, where they are treated as Professional Clients.

Retail Clients:

These are clients who do not fall into the Professional or Eligible Counterparty categories and thus receive the highest degree of investor protection. Retail clients are typical individual investors who do not possess the same level of market knowledge or experience as Professional or Eligible Counterparties.

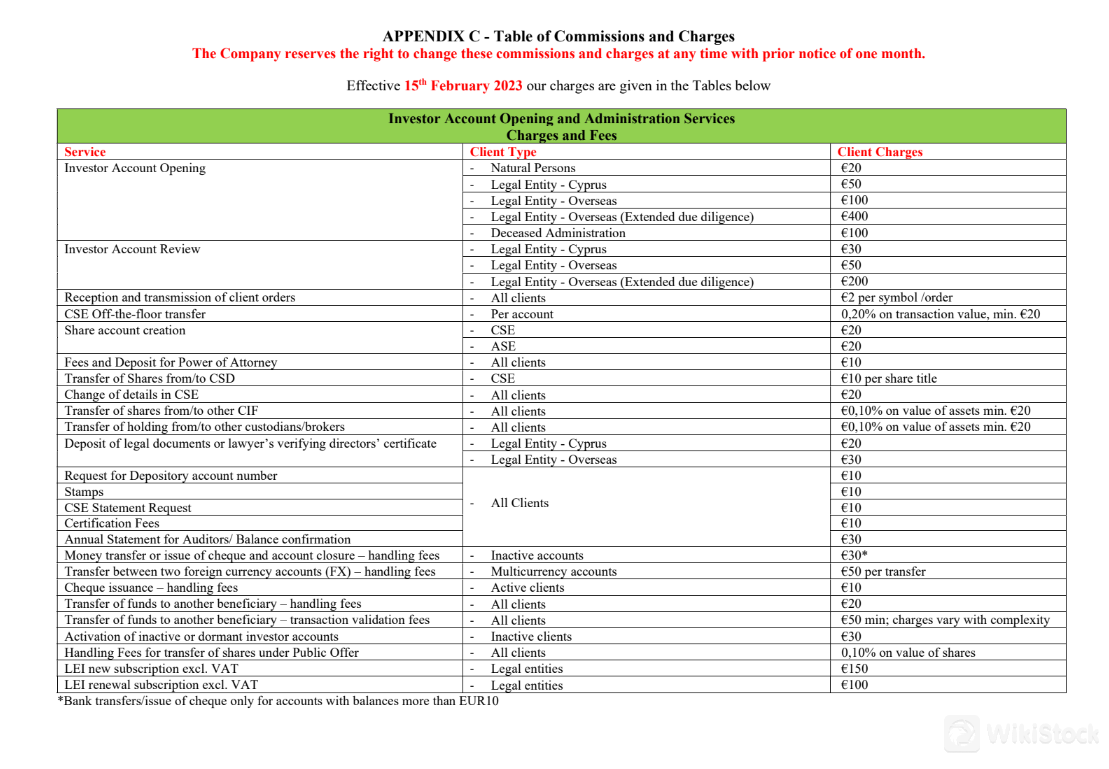

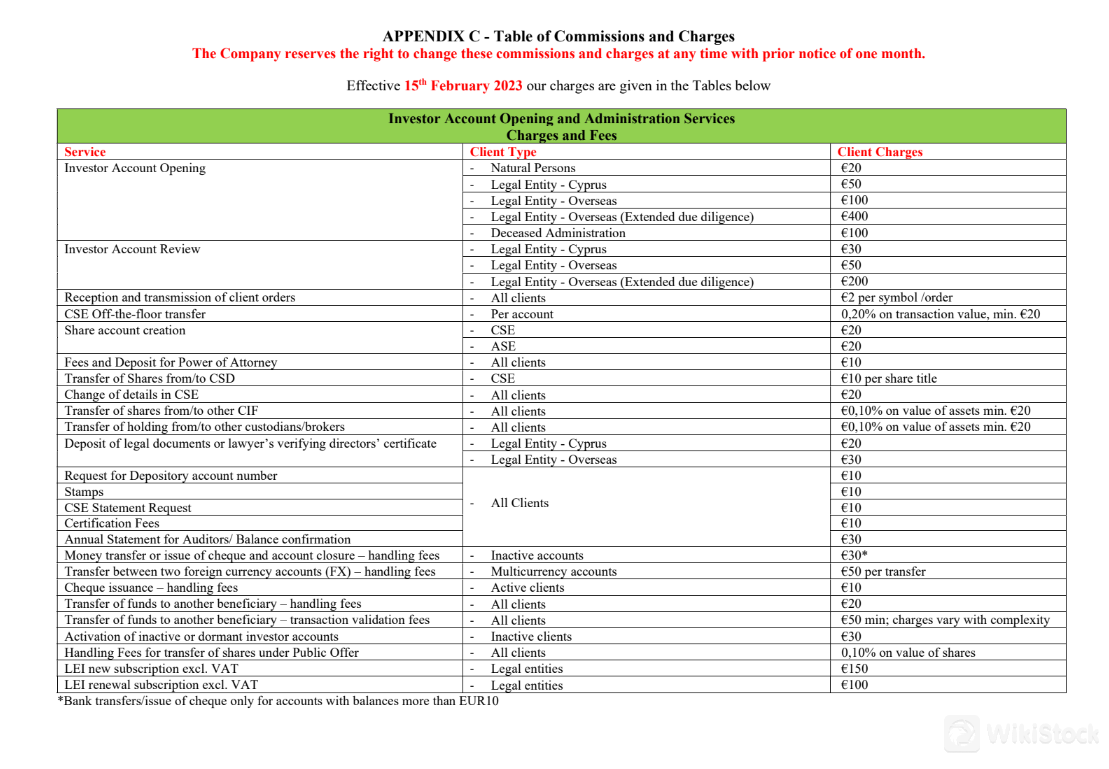

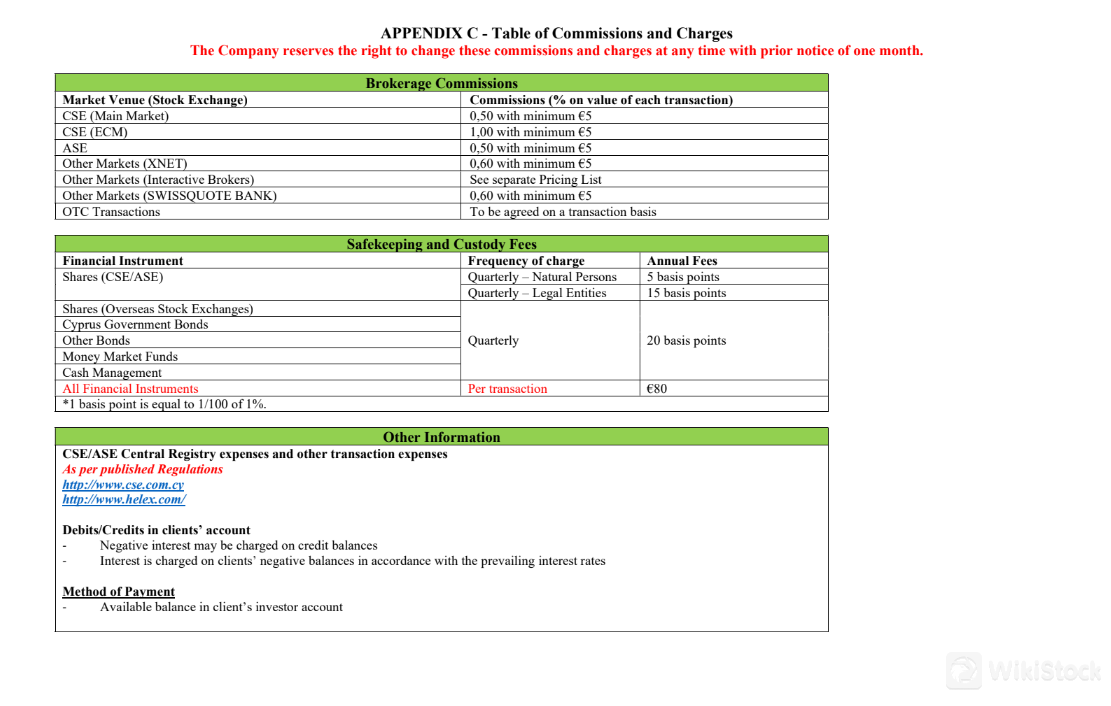

Global Capital Fee Review

The fee structure of Global Capital is detailed across several categories of services, including investor account services, brokerage commissions, and custody fees.

Investor Account Services: Global Capital charges fees for opening and administering investor accounts. The fees vary depending on the client type, ranging from €20 for natural persons to €400 for overseas legal entities requiring extended due diligence. Account review fees are also applied, ranging from €30 to €200.

Transaction and Handling Fees: The company imposes various transaction and handling fees, such as €2 per symbol/order for order transmission, and a range of fees for share transfers and account changes. Additionally, there are specific charges for legal document deposits and other administrative requests like certification and depository account number requests.

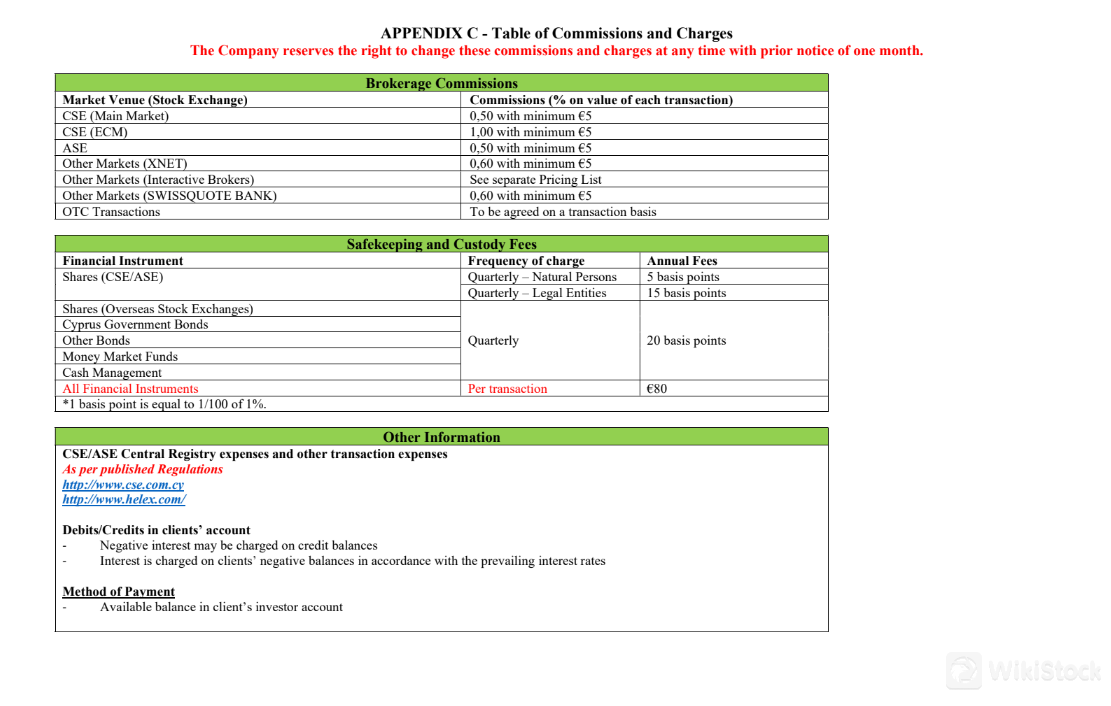

Brokerage Commissions: Brokerage fees vary by market venue, with a general rate of 0.50% to 1.00% on the transaction value, maintaining a minimum charge of €5. Specific rates apply for different exchanges and services like Interactive Brokers and Swissquote, where details are provided in a separate pricing list.

Custody Fees: Custody fees for holding various financial instruments are charged quarterly, with rates depending on the type of instrument and client. Shares on CSE/ASE have a rate of 5 to 15 basis points for natural persons and legal entities, respectively, while shares on overseas exchanges are charged at 20 basis points.

Global Capital Trading Platform Review

Global Capital provides access to multiple trading platforms to meet the diverse needs of its clients. These platforms include:

Interactive Brokers: Known for its robust technology and broad access to global financial markets, Interactive Brokers allows clients to trade a wide variety of instruments including stocks, bonds, forex, and more across over 120 market centers in 31 countries.

XNET: This platform offers online access for the execution of client orders on a wide range of financial instruments traded globally. XNET is praised for its market access and competitive transaction costs.

Swissquote: A platform that emphasizes secure and flexible trading, Swissquote provides access to stocks, options, and derivatives, with a strong focus on forex trading. It's known for its user-friendly interface and analytical tools.

Research & Education

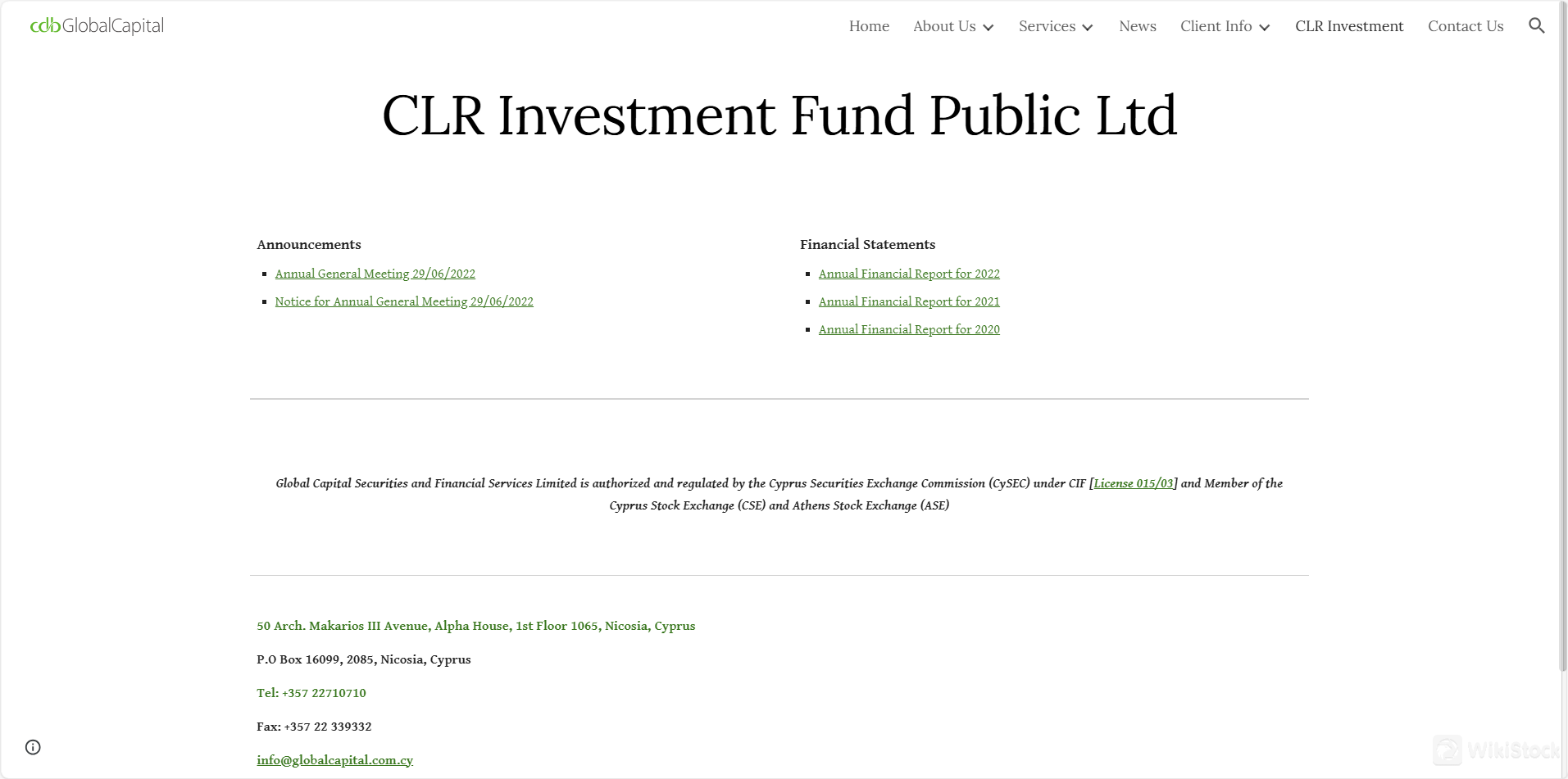

Global Capital Securities and Financial Services Limited appears to provide its clients and the public with financial information and updates, primarily through the publication of annual financial reports and announcements related to significant company events such as Annual General Meetings (AGM). Heres a summary of the research and educational resources provided:

Annual Financial Reports: Global Capital makes detailed annual financial reports for the years 2020, 2021, and 2022. These documents offer insights into the company‘s financial health, operational achievements, and strategic direction, serving as valuable resources for investors to understand the company’s performance and market position.

AGM Announcements: The company keeps its stakeholders informed about important meetings, such as the Annual General Meeting scheduled for June 29, 2022. Notices for these meetings are made available to shareholders, providing transparency and ensuring that investors are well-informed about significant decisions and discussions that affect the company.

Customer Service

Global Capital Securities and Financial Services Ltd offers dedicated customer support from their office located at Alpha House, 50 Arch. Makarios III Avenue, 1st Floor, 1065 Nicosia, Cyprus.

Clients can reach the support team by calling +357 22 710 710, sending a fax to +357 22 339 332, or emailing through info@globalcapital.com.cy for general inquiries.

For specific concerns requiring attention, such as complaints, clients are encouraged to email complaints@globalcapital.com.cy.

Conclusion

Global Capital Securities and Financial Services Limited provides a range of financial services, including brokerage, asset management, and corporate advisory, tailored to meet the needs of both institutional and individual investors.

Located in Nicosia, Cyprus, and regulated by the Cyprus Securities Exchange Commission (CySEC), Global Capital offers robust client support and a structured approach to client categorization, ensuring appropriate service levels and protection for all investor types.

Their commitment to transparency and client satisfaction is evident in their responsive complaint handling and diverse service offerings.

FAQs

Turkey

TurkeyObtain 1 securities license(s)