Fidus investments Cyprus limited is a new brokerage firm launched with the specific goal of providing excellent trading conditions in the fast moving and volatile financial markets. Our team is composed of highly educated multi-lingual professionals that are always ready to go above and beyond to help clients with all their trading needs.

Note: The information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

In this review, if there is a conflict between the image and the text content, the text content should prevail. However, we recommend that you open the official website for further consultation.

What is FIC?

FIC, or Fidus Investments Cyprus Limited, is a reputable financial institution dedicated to providing comprehensive trading and investment solutions to its clients. Operating under the regulatory oversight of the Cyprus Securities and Exchange Commission (CYSEC), FIC offers access to a diverse range of trading securities, including foreign exchange (FX), contracts for difference (CFDs), exchange-traded funds (ETFs), stocks, bonds, and derivatives.

Pros & Cons

Pros Regulated by CYSEC: FIC operates under the oversight of CYSEC, ensuring compliance with stringent standards for investor protection.

Diverse Range of Trading Securities: Investors have access to various trading options, including FX, CFDs, ETFs, stocks, bonds, and derivatives.

Transparent Fee Structure: FIC maintains transparency in its fee structure, with clear charges for commissions, administrative fees, and closure fees.

Multiple Trading Platforms: FIC offers flexibility with its multiple trading platforms, catering to different preferences and needs of investors.

Comprehensive Customer Support: Clients benefit from a comprehensive customer support network, enabling easy access to assistance and guidance.

Cons No Promotions Available: The absence of promotions or incentives for new clients can make the brokerage less attractive compared to competitors who offer bonuses or reduced fees as part of promotional campaigns.

Is FIC Safe?

FIC is regulated by the oversight of the oversight of the Cyprus Securities and Exchange Commission (CYSEC), holding license No. 326/17. This regulatory framework ensures that the company adheres to stringent standards designed to protect investors and maintain the integrity of the financial market. By adhering to the regulations, FIC ensures that its operations are conducted with the utmost professionalism and accountability, instilling confidence in its clients and stakeholders.

What are Securities to Trade with FIC?

FIC provides investors with access to a diverse range of trading securities through its multiple trading platforms and phone desk execution services. Whether clients are interested in foreign exchange (FX), contracts for difference (CFDs), exchange-traded funds (ETFs), stocks, bonds, or derivatives, FIC offers the necessary tools and resources for trading across various asset classes. Additionally, FIC's phone desk execution service further enhances accessibility, allowing investors to execute trades conveniently and efficiently.

FIC Fees Review

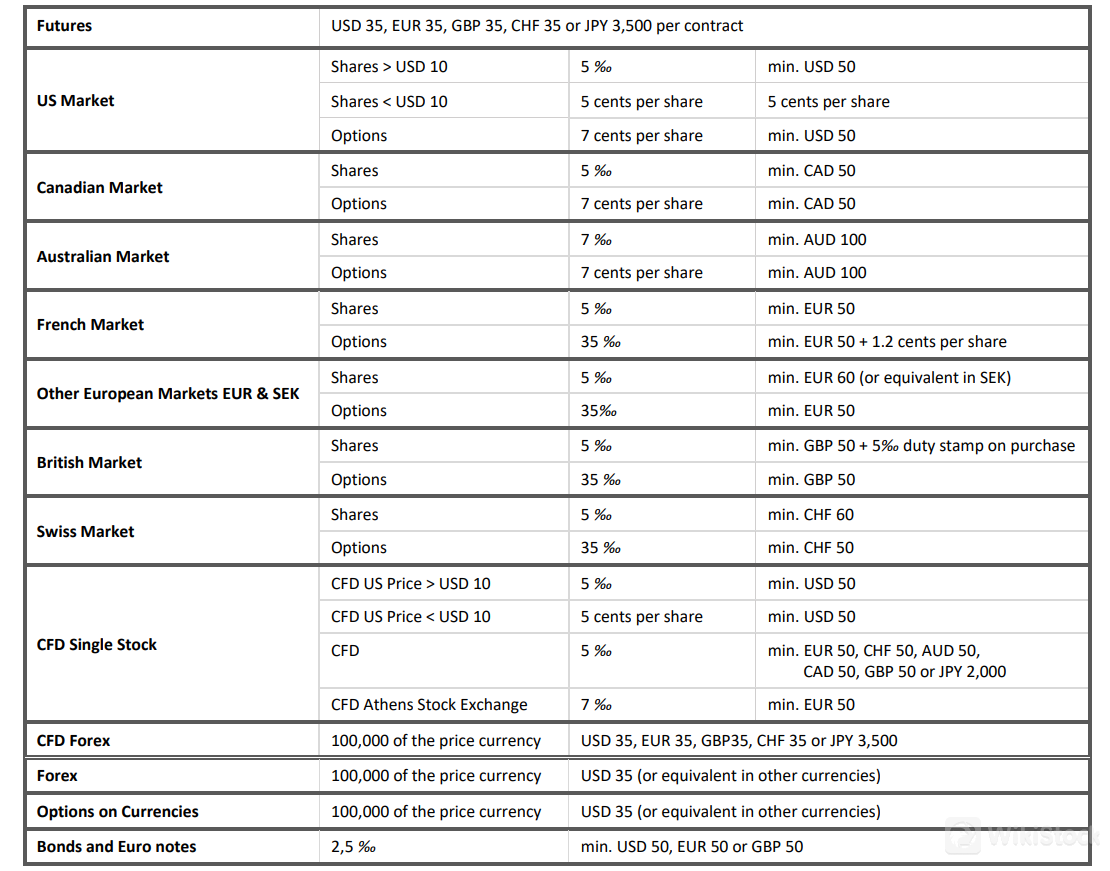

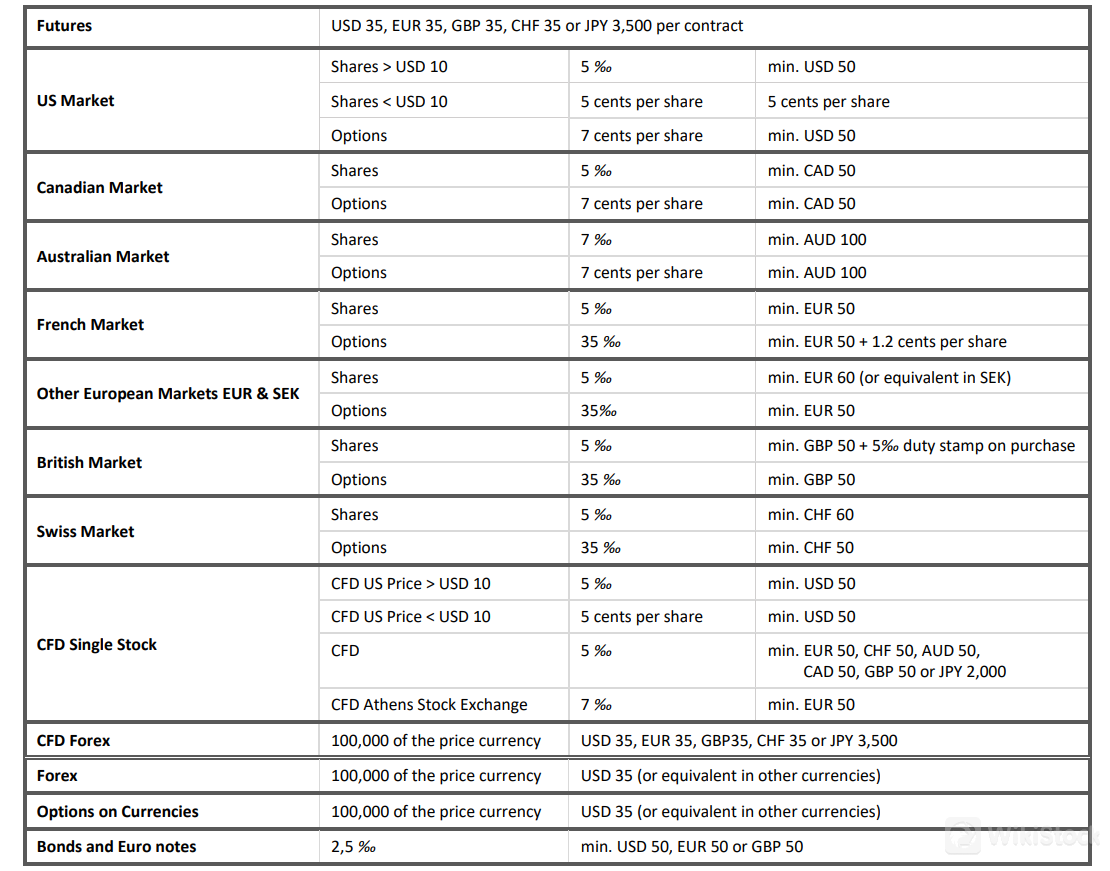

FIC's fee structure is designed to provide transparency and clarity to investors, ensuring they understand the costs associated with their trading activities.

For administrative purposes, FIC charges a monthly fee of USD 5, providing ongoing support and account maintenance services. In the event of an account closure, a one-time fee of USD 20 applies. Additionally, for dormant accounts, there is a monthly fee of USD 2 to cover administrative costs.

Commission rates vary depending on the type of trade: for futures contracts, the commission is USD 35 (or equivalent in EUR, GBP, CHF, or JPY) per contract, while for CFD forex and forex trading, the commission is USD 35 (or equivalent) per 100,000 of the price currency. Options on currencies also incur a commission of USD 35 (or equivalent) per 100,000 of the price currency. For trading bonds and Euro notes, FIC charges a minimum fee of 2.5‰, with a minimum charge of USD 50, EUR 50, or GBP 50.

More specific fee structures can be found on their official website through the provided link: https://www.fidusinvestments.eu/wp-content/uploads/2020/11/APPENDIX4-FEES-SCHEDULE-2.pdf or the attached screenshot.

FIC Platform Review

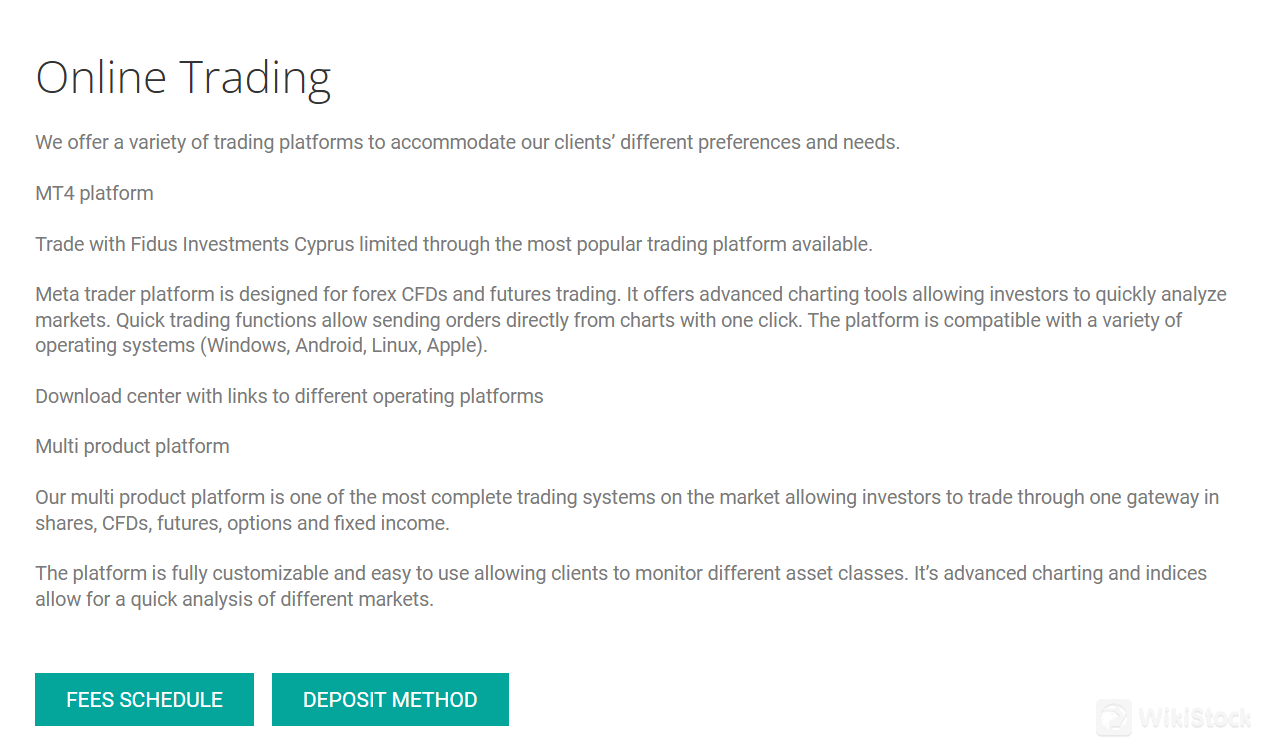

FIC provides its clients with the convenience of accessing their stock trading platform through MT4 Platform and Multi Product Platform.

FIC offers the MT4 platform, popular for forex, CFDs, and futures trading. It features advanced charting tools for quick market analysis and one-click trading directly from charts. Compatible with Windows, Android, Linux, and Apple, it ensures flexibility for traders on different devices. FIC provides a download center for easy access to the platform.

FICs Multi Product Platform allows trading across shares, CFDs, futures, options, and fixed income through one gateway. It offers a fully customizable interface with advanced charting tools for efficient market analysis. This versatile platform is ideal for managing a diverse portfolio effectively.

Customer Service

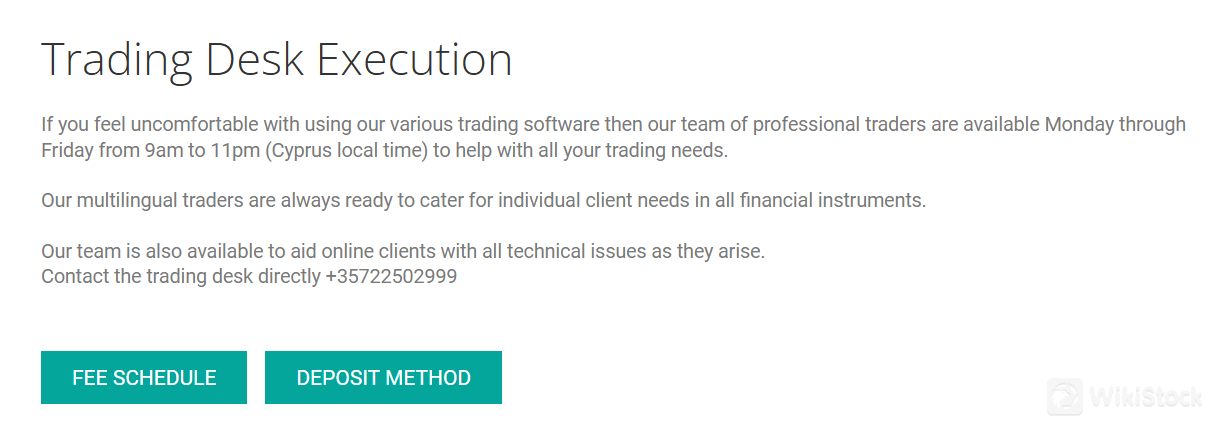

FIC provides a comprehensive and accessible customer support network. Their support team can be reached through different channels for ultimate convenience.

Address: 16 Kennedy Ave. 3rd Floor, 1087, Nicosia, Cyprus

Main Line: (00357) 22 502900Trading Line: (00357) 22 502999, (00357) 22 502960

Email: info@fidusinvestments.eu

Contact form

Working hours: Monday - Friday, 09:00 – 23:00 (Cyprus local time)

Back office processing hours: 08:00 – 13:30 (Cyprus local time)

Conclusion

In conclusion, FIC emerges as a regulated brokerage firm with a diverse range of trading securities and multiple trading platforms, catering to the varied needs of investors. Regulated by the CYSEC, FIC ensures adherence to stringent standards, instilling confidence in clients regarding the safety and integrity of their investments. Now, the ball's in your court when it comes to choosing whether to go with this broker or explore other options. Hopefully, this review has shed some light on your decision-making process.

FAQs

Is FIC suitable for beginners?

FIC can be suitable for beginners, as it offers multiple trading platforms and provides access to a diverse range of trading securities, including foreign exchange, contracts for difference, stocks, and more. Additionally, FIC offers comprehensive customer support to assist clients.

Is FIC legit?

Yes, FIC is regulated by the Cyprus Securities and Exchange Commission (CYSEC).

What trading securities are available with FIC?

FIC offers access to various trading securities, including FX, CFDs, ETFs, stocks, bonds, and derivatives.

What trading platforms does FIC offer?

FIC provides access to multiple trading platforms, including the MT4 Platform and Multi Product Platform.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Russia

RussiaObtain 1 securities license(s)