Score

Acorns

https://www.acorns.com/

Website

Rating Index

Brokerage Appraisal

Influence

AAA

Influence Index NO.1

United States

United StatesProducts

1

Investment Advisory Service

Surpassed 93.75% brokers

Securities license

Obtain 1 securities license(s)

SECOver-Operation

United StatesInvestment Consulting License

Brokerage Information

More

Company Name

Acorns Securities, LLC

Abbreviation

Acorns

Platform registered country and region

Phone of the company

Company website

https://www.acorns.com/Check whenever you want

WikiStock APP

Previous Detection: 2024-12-22

- The United States U.S. Securities and Exchange Commission (License No.: CRD # 165926/SEC#:801-78602), 投资咨询牌照 held goes beyond their business, please be aware of the risks!

Brokerage Services

Internet Gene

Gene Index

APP Rating

Features of Brokerages

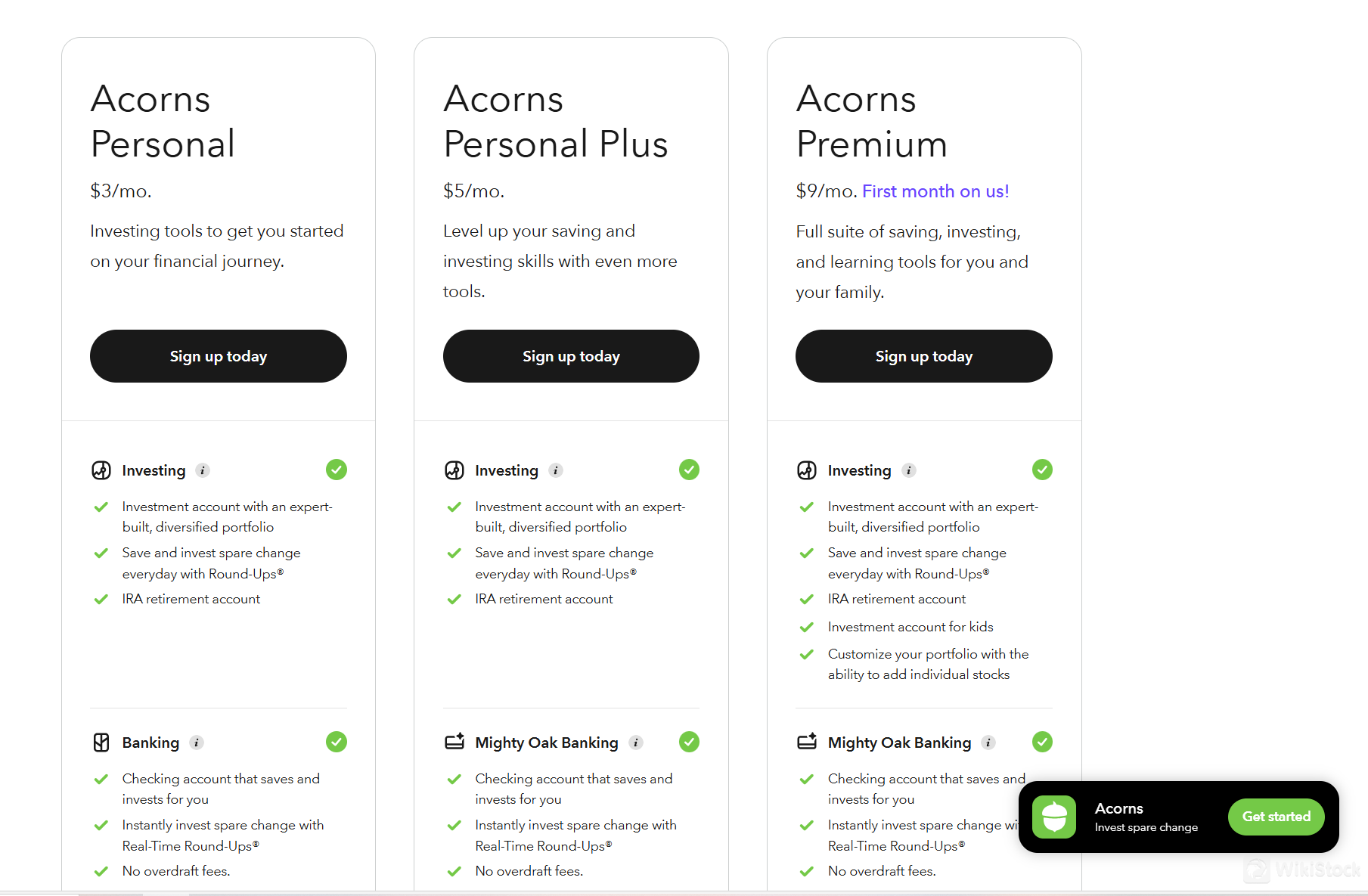

Trading Fee

$3

Platform Service Fee

$3

Minimum Deposit

$100

Regulated Countries

1

Pros and Cons

Pros

Risk-appropriate, low-cost investment portfolio options

Automatic savings features help nudge investors to save more

Easy-to-navigate interface

VS

Cons

Fees are on the high side, depending on your total balance

No tax-loss harvesting or access to human advisors

You have to pay fees to access the checking account, unlike other leaders in the robo-advisor space

Others

Registered region

United States

Years in Business

More than 20 year(s)

Products

Investment Advisory Service

Relevant Enterprises

Countries

Company name

Associations

United States

Acorns Advisers, LLC

Group Company

Review

No ratings

Recommended Brokerage FirmsMore

Marcus

Score

WealthFront

Score

PNC

Score

BTG

Score

Axos

Score

Wellington Shields

Score

AVENTURA CAPITAL MANAGEMENT, LLC

Score

BBAE

Score

Allaria

Score

Dimensional

Score