Freetrade is an award-winning investing app with over 1.4 million users.

Our mission is to get everyone investing by making it simpler and more affordable.

Freetrade is authorised and regulated by the Financial Conduct Authority (FCA) in the UK and the Swedish Financial Supervisory Authority (FSA) in Sweden.

Freetrade Information

Freetrade offers a user-friendly platform with a low account minimum of £2 and zero commission fees. They provide various account tiers with different fee structures to cater to different investor needs. Depending on the size of your gains, you may earn interest on uninvested cash. They do not offer margin trading but do provide access to mutual funds. Their app and web platform ensure accessibility and convenience for investors. Additionally, they run promotions periodically, providing further incentives for users.

Pros and Cons of Freetrade

Freetrade offers several advantages, including commission-free trading, making it cost-effective for investors to trade stocks and ETFs. The platform's ease of use and inclusion of fractional shares make it accessible for both beginners and experienced investors. However, Freetrade's asset types are limited primarily to stocks and ETFs, which may not cater to those seeking a broader range of investment options. Additionally, while the platform's simplicity is beneficial, its research tools are relatively basic, potentially limiting in-depth analysis. Another notable drawback is the absence of retirement accounts, which may be a disadvantage for investors planning long-term financial strategies.

Is Freetrade safe?

Regulations

Freetrade is currently licensed and regulated by the United Kingdom LSE under license number FREEGB00.

What are securities to trade with Freetrade?

Freetrade provides a diverse range of investment products including stocks, Exchange-Traded Funds (ETFs), Fractional Shares and Investment Trusts. However, it does not currently offer options, futures, mutual funds, retirement accounts, investment trusts,limiting the scope for investors interested in these specific asset classes.

Stocks: Freetrade offers access to a wide range of individual stocks, allowing you to buy and sell shares of publicly traded companies.

Exchange-Traded Funds (ETFs): ETFs are investment funds that hold a diversified portfolio of assets such as stocks, bonds, or commodities. Freetrade provides access to a selection of ETFs for investors looking to diversify their portfolios.

Fractional Shares: Freetrade allows users to buy fractional shares of both stocks and ETFs, enabling investors to own a portion of expensive assets with smaller amounts of money.

Investment Trusts: Investment trusts are closed-end funds that are publicly traded on stock exchanges. They invest in a diversified portfolio of assets and are managed by a professional fund manager. Freetrade offers access to a selection of investment trusts.

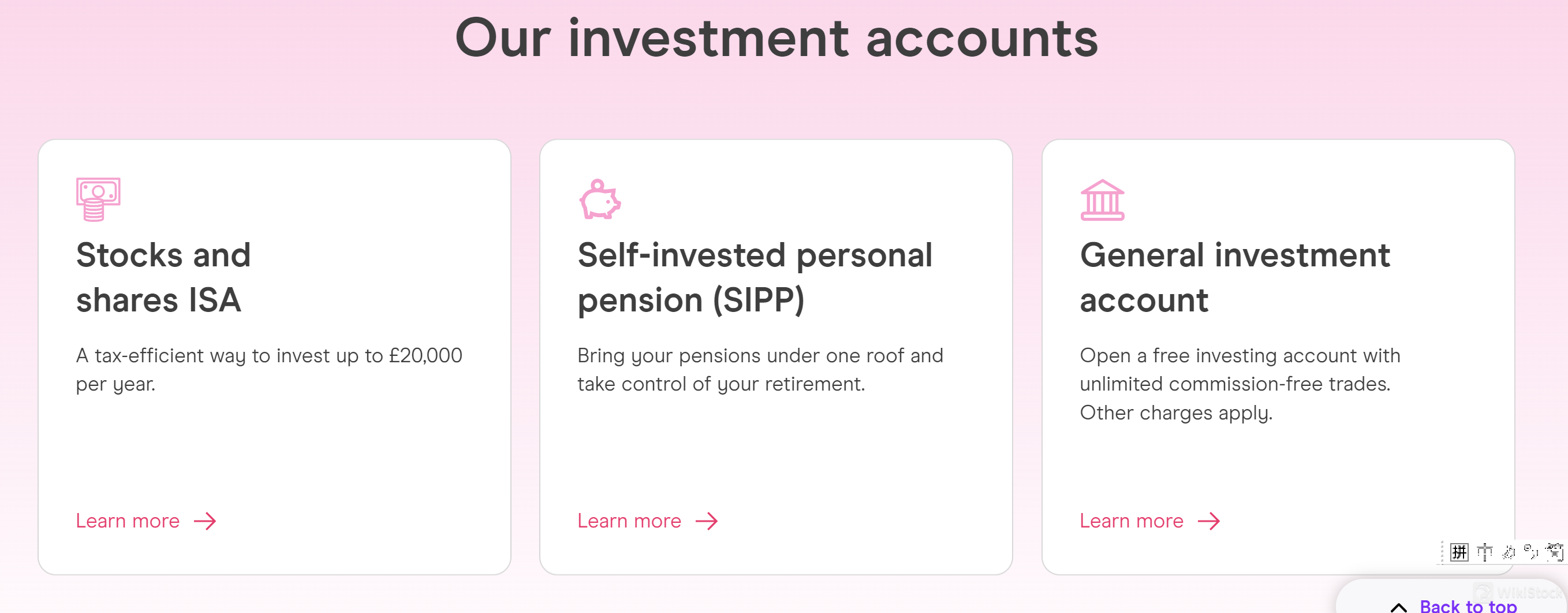

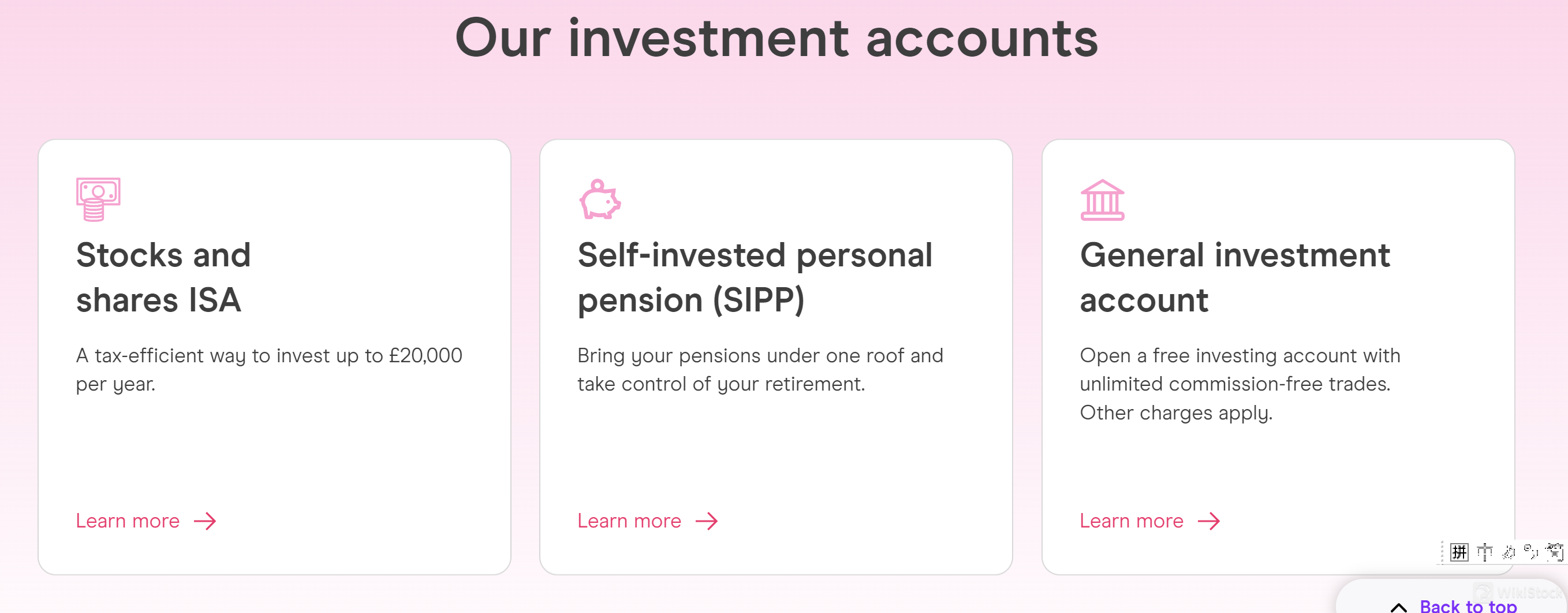

Freetrade Accounts

Freetrade offers a variety of account types. The Stocks and Shares ISA provides a tax-efficient way for UK residents to invest in stocks, bonds, and funds up to the annual ISA allowance without incurring capital gains tax or income tax on dividends. The Self-invested Personal Pension (SIPP) is designed for retirement savings, allowing individuals to manage their own pension investments with tax benefits. The General Investment Account offers flexibility for investing in a wide range of assets without the tax advantages of ISAs or SIPPs.

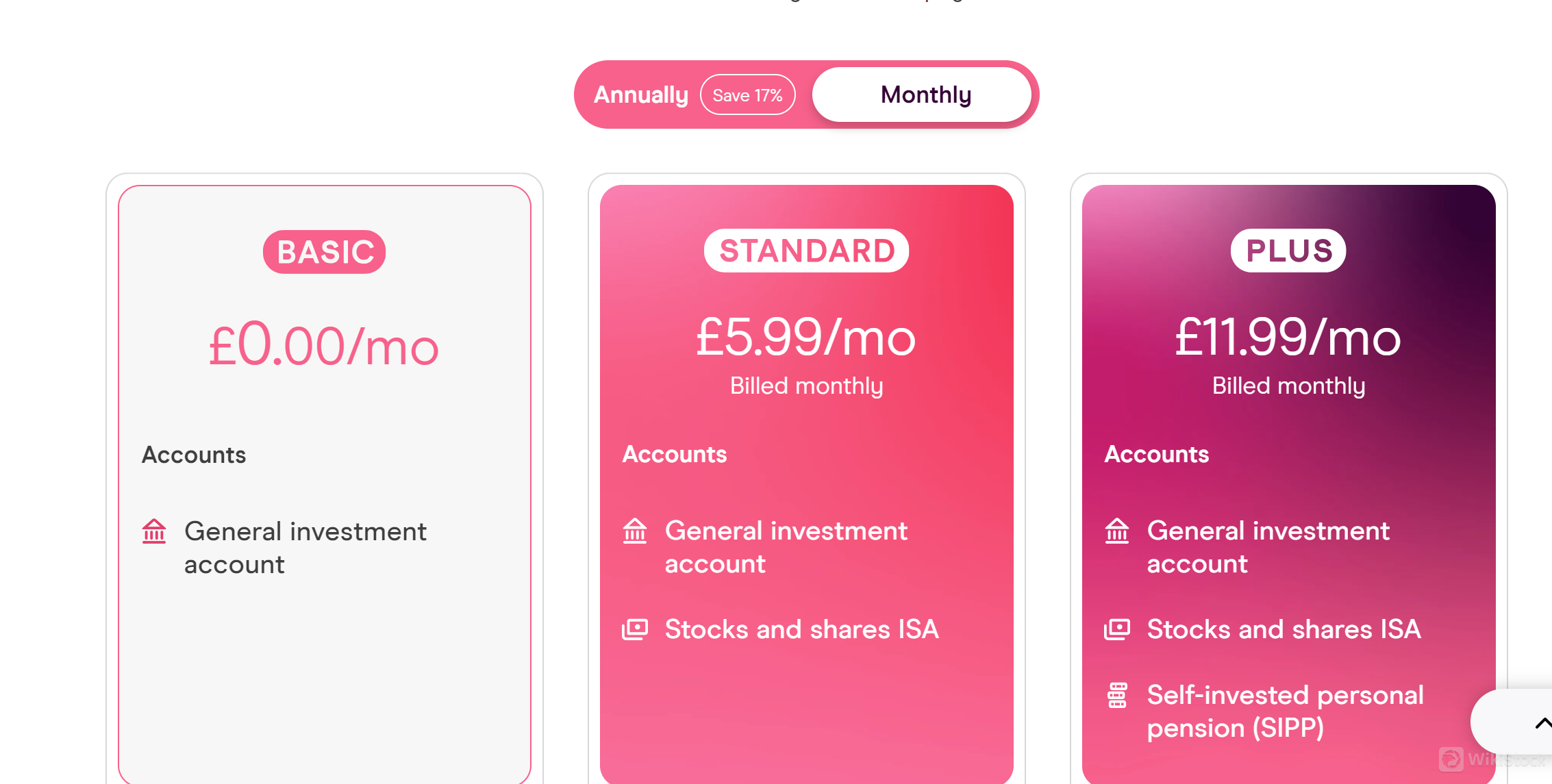

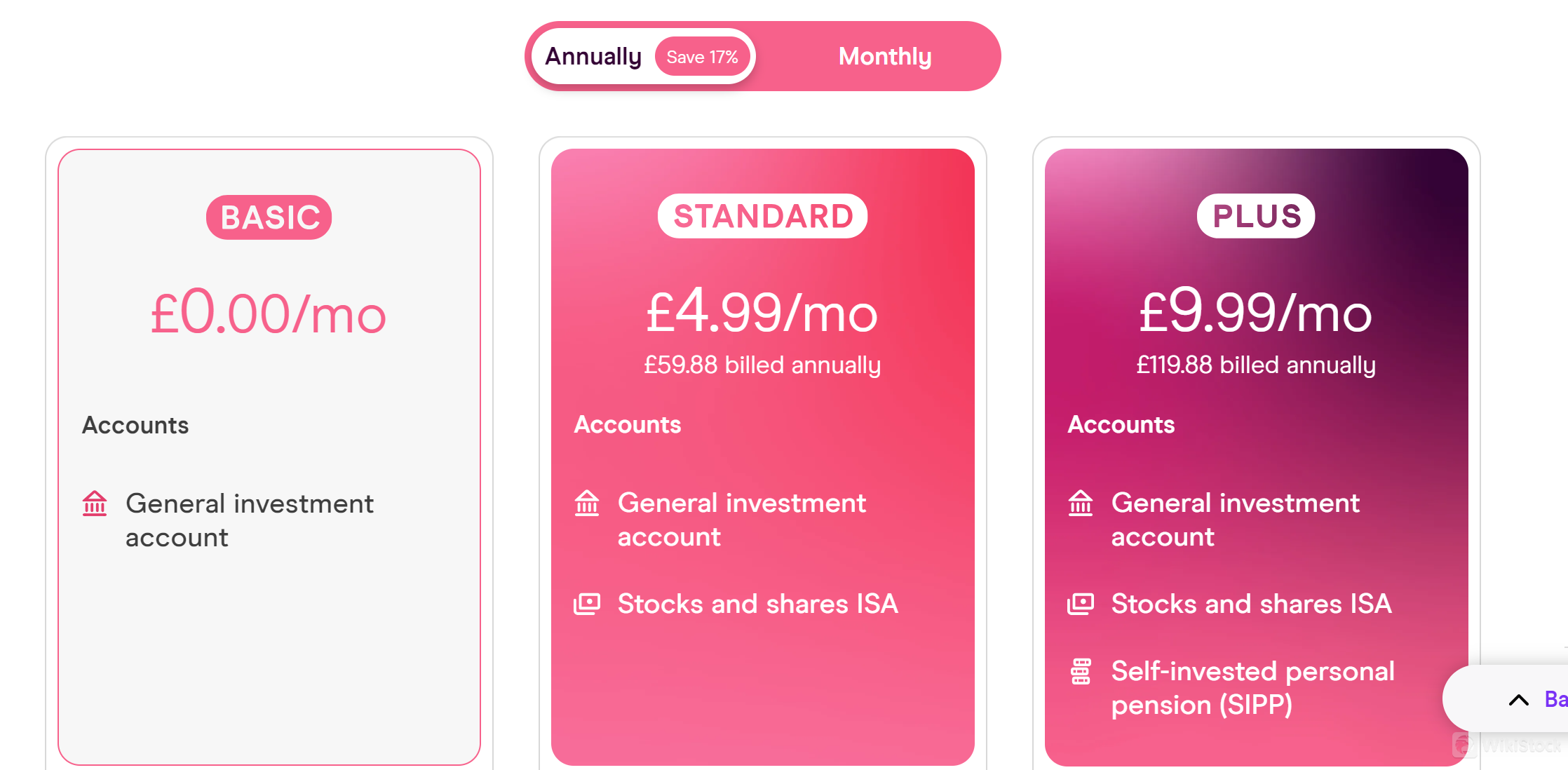

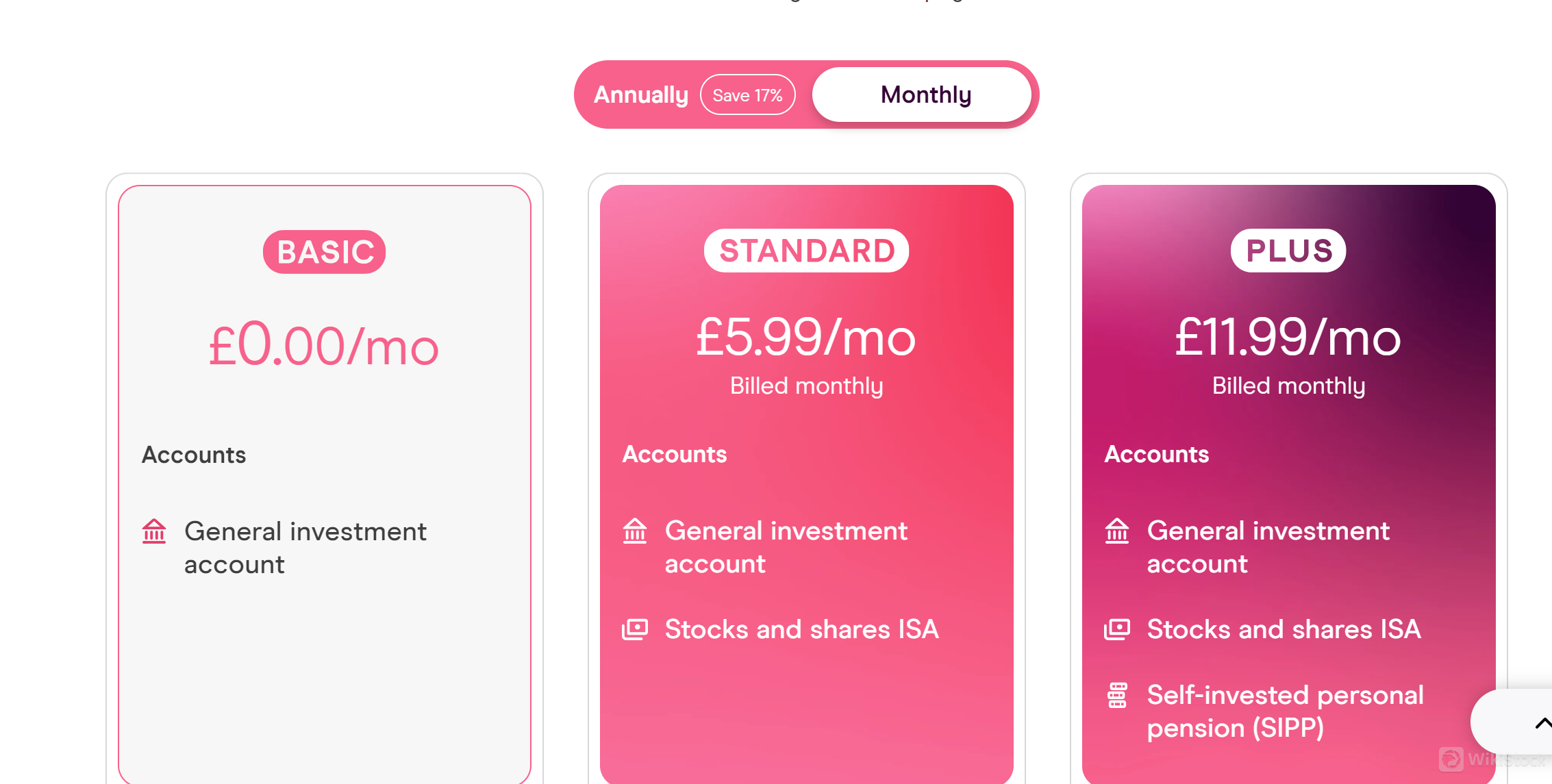

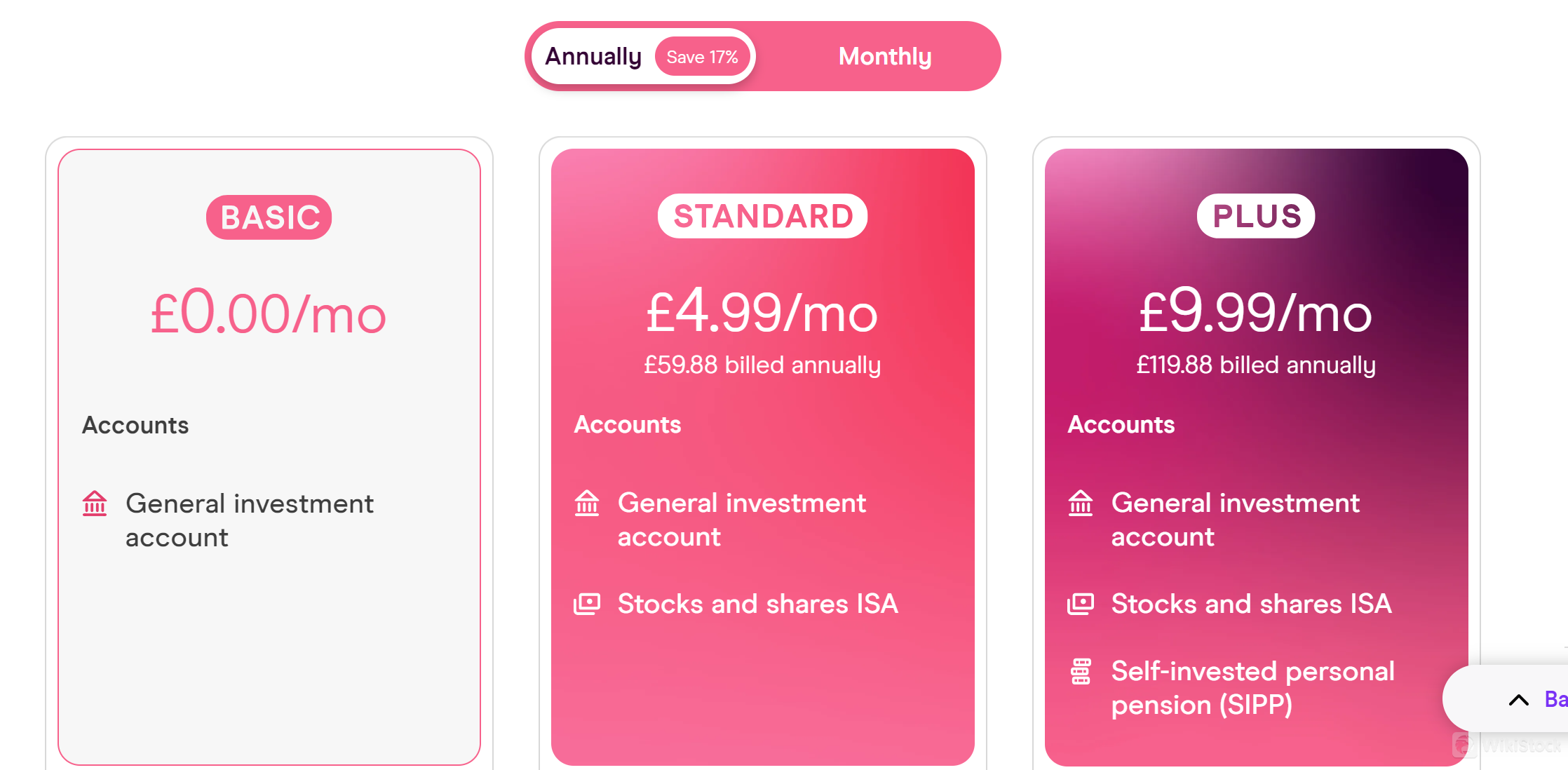

Freetrade Fees Review

Freetrade offers a tiered account structure tailored to different investor needs. The basic account comes with no monthly fee, providing access to commission-free trading of stocks and ETFs. For users seeking additional features and benefits, Freetrade offers a standard account for £4.99 per month, which includes perks like limit orders and a wider range of stocks. The plus account, priced at £9.99 per month, offers even more advanced features such as priority customer support and an expanded stock universe. These account options allow users to choose the level of service that best aligns with their investment goals and preferences.

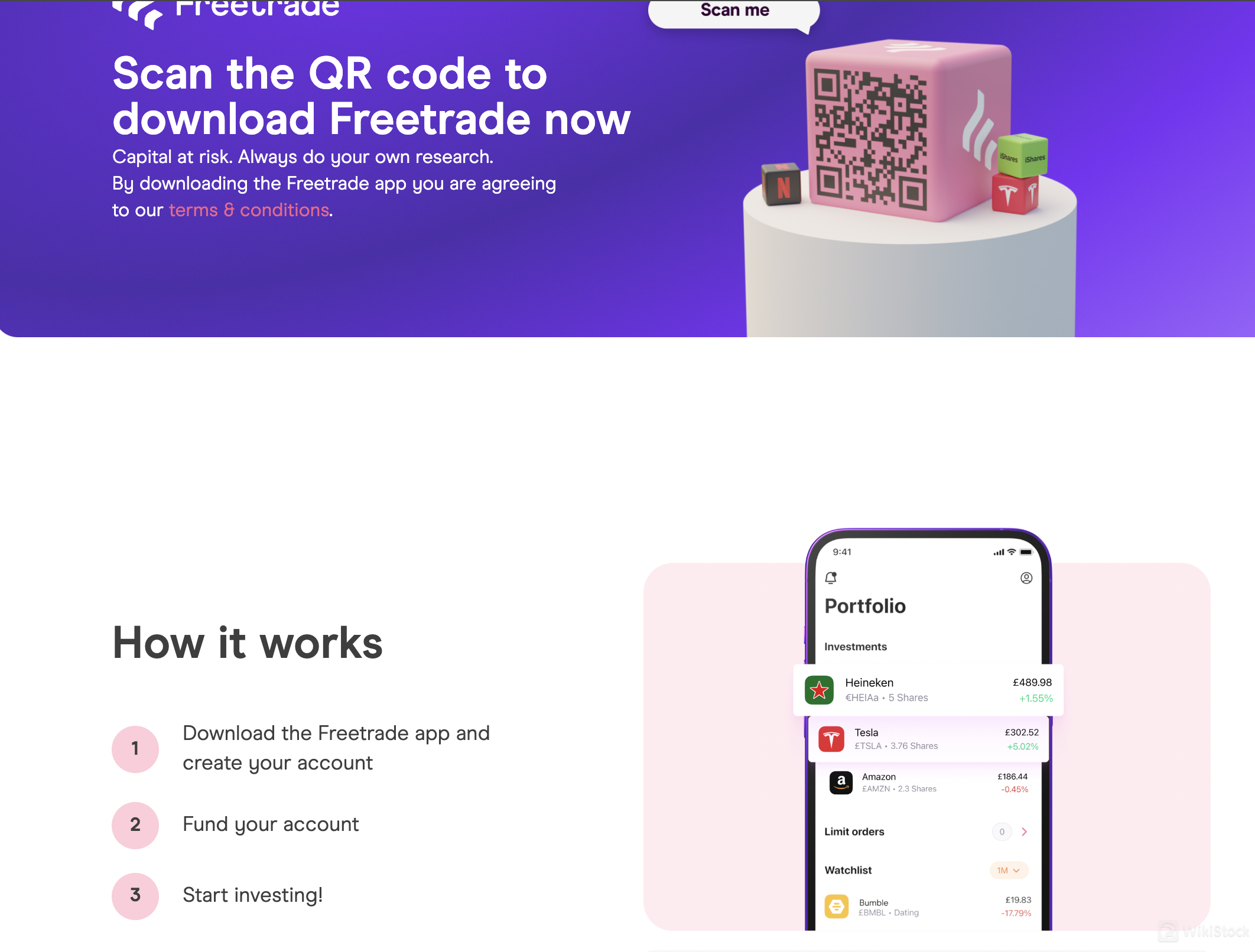

Freetrade App Review

Freetrade's app provides users with convenient access to their investment accounts on both mobile devices and web browsers, offering flexibility and accessibility. With the app available for download via QR code scanning, users can easily install it on their smartphones and tablets, ensuring seamless trading experiences on the go. Additionally, the web version provides a robust platform for users who prefer managing their investments on desktop or laptop computers. This multi-platform accessibility underscores Freetrade's commitment to empowering investors with intuitive and versatile tools for managing their portfolios across various devices.

Research and Eduation

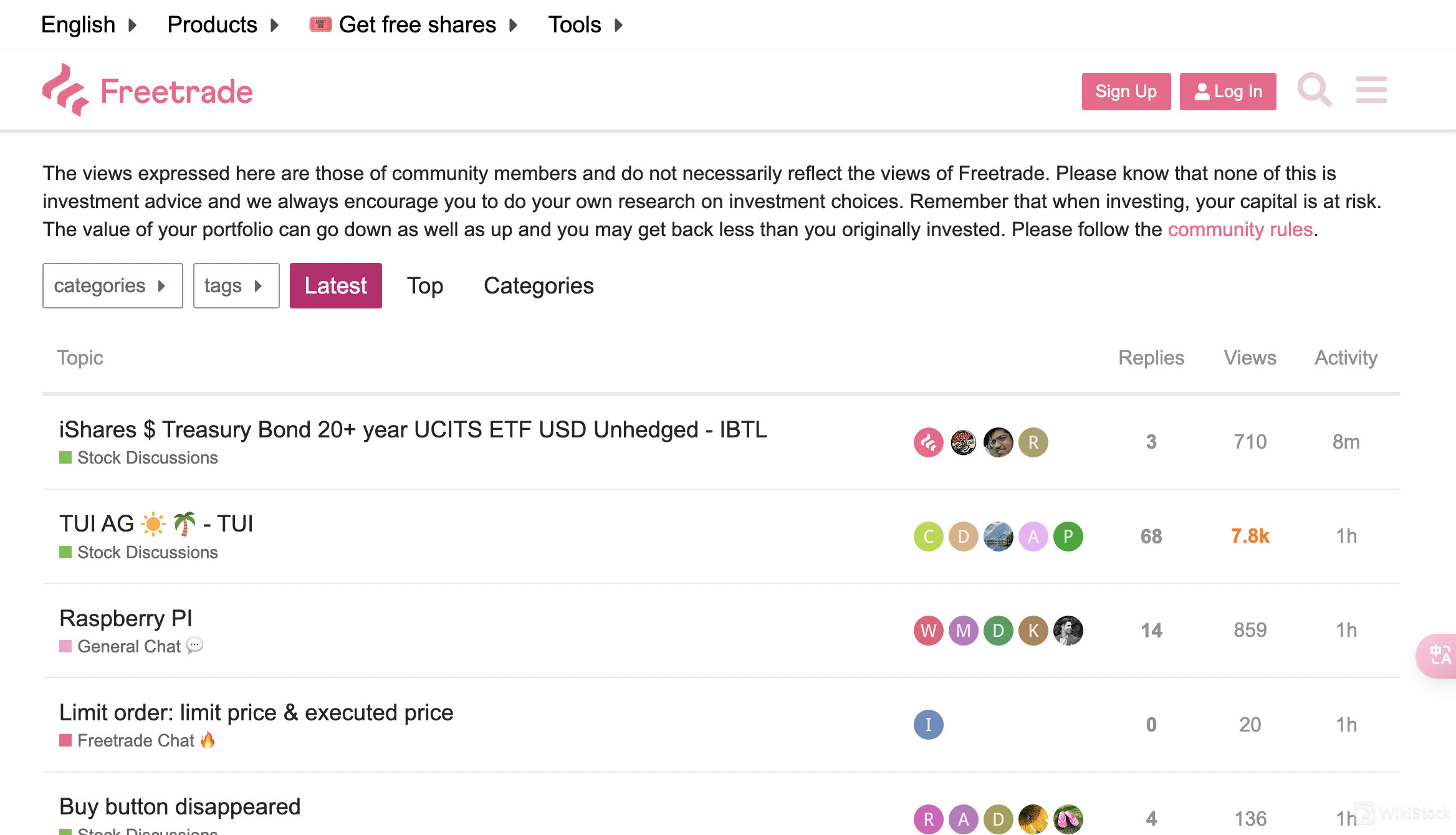

Freetrade provides a community for investors to engage in research and education, fostering an environment for knowledge sharing and collaboration. With access to a vibrant community of investors, users can exchange insights, discuss investment strategies, and learn from each other's experiences. This community-driven approach enables investors to stay informed, make more informed decisions, and deepen their understanding of the markets. By facilitating collaboration and learning opportunities, Freetrade empowers users to enhance their investment skills and achieve their financial goals.

Customer Service

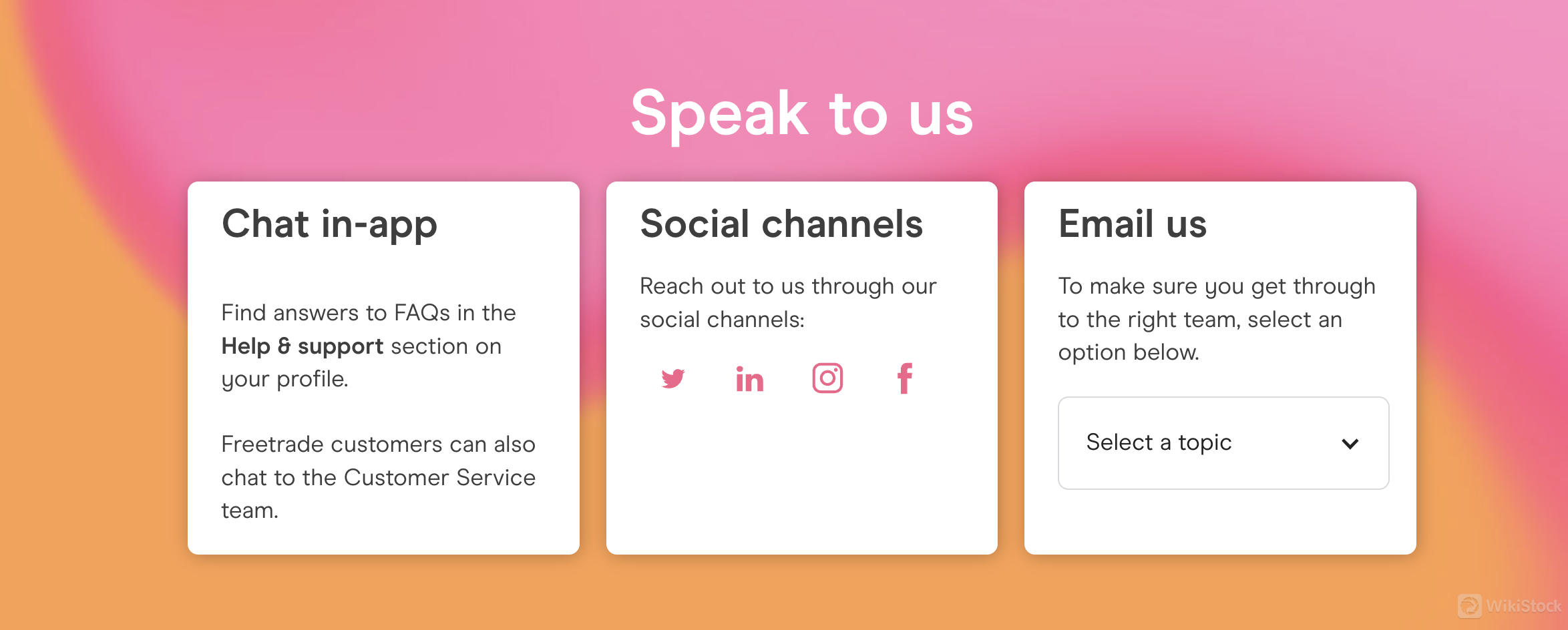

Freetrade provides comprehensive customer support options to assist users with their inquiries and concerns. Customers can conveniently seek support and assistance directly within the app:Help&Support. Additionally, Freetrade maintains a strong presence on various social media platforms, including Instagram, Facebook, LinkedIn, and Twitter, where users can engage with the company and receive timely updates. For more personalized assistance, users also have the option to reach out to Freetrade via email.

Conclusion

Freetrade offers a user-friendly platform for commission-free trading. Its intuitive interface and extensive selection of stocks and ETFs appeal particularly to novice investors. However, the platform's limited research tools and lack of certain advanced features may deter experienced traders. Overall, Freetrade presents a compelling option for those seeking low-cost investing but can not fully satisfy the needs of more sophisticated investors.

FAQs

Is Freetrade safe to trade?

Freetrade is generally considered safe to trade with. It is authorized and regulated by the Financial Conduct Authority (FCA) in the UK. Additionally, they offer a range of security measures such as FSCS protection and encryption to safeguard users' investments and personal information.

Is Freetrade a good platform for beginners?

Freetrade is often recommended as a good platform for beginners due to its user-friendly interface, educational resources, and commission-free trading. It simplifies the investment process, making it accessible for those who are new to investing.

Is Freetrade legit?

Yes, Freetrade is a legitimate platform. It operates under strict regulations set by the FCA in the UK. It has gained trust among users and has a growing user base, indicating its legitimacy in the investment market.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

United States

United StatesObtain 1 securities license(s)

![]() Owns 2 seat(s)

Owns 2 seat(s)