Score

ClickTrades

https://clicktrades.com/

Website

Rating Index

Brokerage Appraisal

Influence

A

Influence Index NO.1

Ecuador

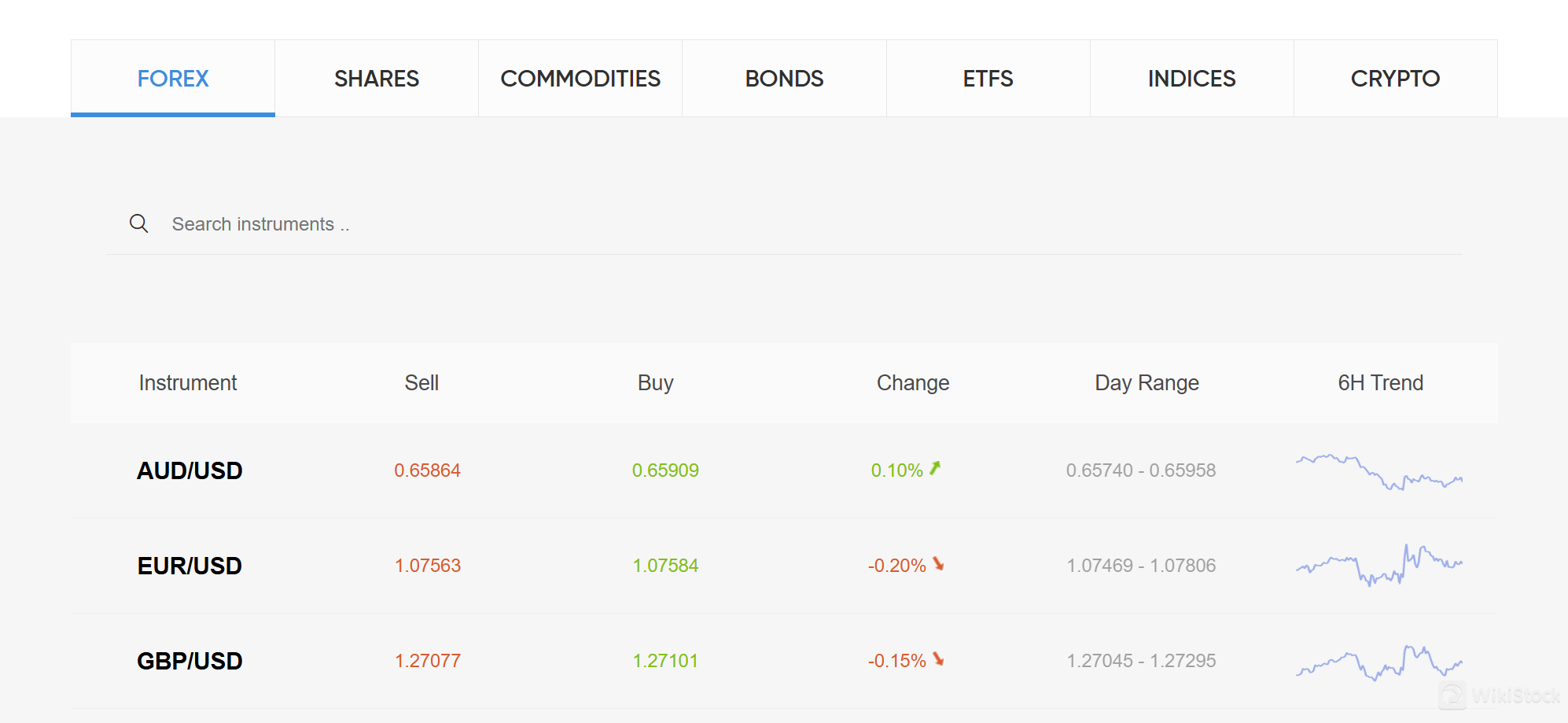

EcuadorProducts

4

Bonds & Fixed Income、Futures、Options、Stocks

Surpassed 67.51% brokers

Securities license

Obtain 1 securities license(s)

FSAOffshore Regulated

SeychellesSecurities Trading License

Brokerage Information

More

Company Name

KW Investments Limited

Abbreviation

ClickTrades

Platform registered country and region

Phone of the company

Company address

Company website

https://clicktrades.com/Check whenever you want

WikiStock APP

Previous Detection: 2024-12-22

- The Seychelles Financial Services Authority regulatory, license No. SD020, is offshore regulated. Please be aware of the risk!

Brokerage Services

Internet Gene

Gene Index

APP Rating

Features of Brokerages

Commission Rate

0%

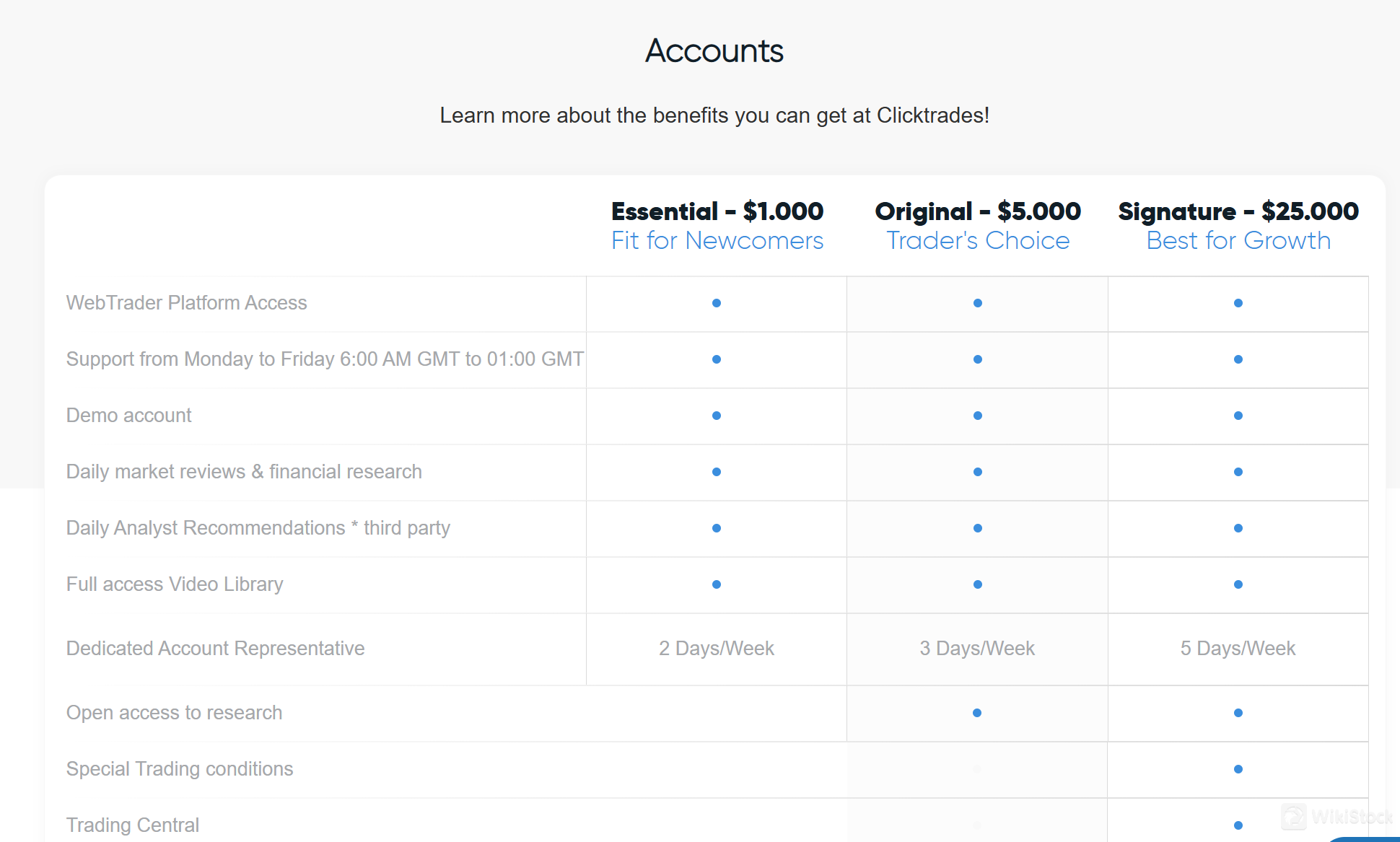

Minimum Deposit

$1,000

New Stock Trading

Yes

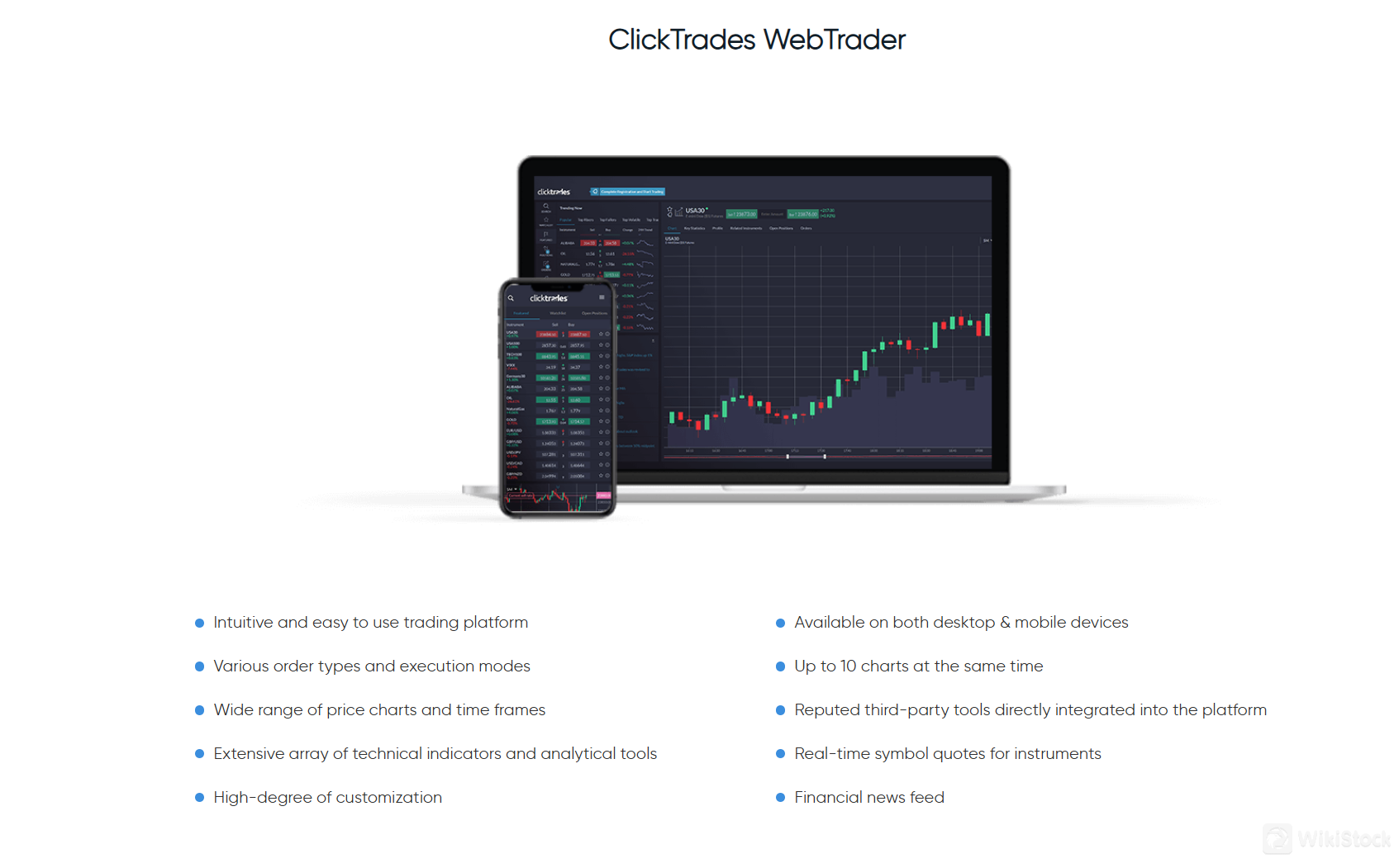

Margin Trading

YES

Others

Registered region

Seychelles

Years in Business

5-10 years

Products

Bonds & Fixed Income、Futures、Options、Stocks

Relevant Enterprises

Countries

Company name

Associations

Cyprus

Key Way Solutions Ltd

Parent company

Download App

Review

No ratings

Recommended Brokerage FirmsMore

Taurex

Score

FXON

Score

Traders Trust

Score

4T

Score

Littlebee

Score

OpoFinance

Score

InterStellar Global

Score

Alvexo

Score

Zenstox

Score

Fivehills

Score