Waton Securities International is a licensed securities broker (central number: AAK004) that holds the 1/4/5/9 licenses granted by the Hong Kong Securities and Futures Commission and strictly complies with the requirements of the SFO. Waton Securities International is licensed to carry on the following regulated activities: dealing in securities, advising on securities, advising on futures contracts, and asset management. The assets are subject to internal and external audits, strict supervision and regular reviews.

What is Waton Securities International?

Waton Securities International offers a comprehensive and user-friendly trading platform with competitive fees and extensive market coverage, including real-time data for HK, US, and A-share stocks. The platform is highly secure, regulated by the SFC, and supports a wide range of trading instruments. However, the fee structure can be complex, with various charges that investors need to be aware of.

Pros and Cons of Waton Securities International

Waton Securities International stands out for its comprehensive trading platform, extensive market coverage, and robust research and educational resources. The firms regulation by the Securities and Futures Commission (SFC) of Hong Kong ensures a high level of security and compliance, providing investors with confidence in the safety of their funds. Additionally, the integration of advanced encryption technologies and account security measures further enhances the safety of client data and funds. However, the platform's fee structure, while competitive, includes various charges that investors need to be aware of, and the complexity of leveraged products may pose risks for inexperienced traders.

Is Waton Securities International safe?

Regulation

Waton Securities International is regulated by the Securities and Futures Commission (SFC) of Hong Kong, a stringent regulatory body known for its rigorous standards and oversight. Being under the SFCs regulation (Central Number: AAK004) ensures that Waton adheres to strict compliance requirements, protecting investors' interests and maintaining market integrity. This regulatory oversight includes regular audits, compliance checks, and the enforcement of rules designed to ensure fair and transparent trading practices.

Funds Safety

To safeguard clients' funds, Waton Securities International takes several measures. Client funds are typically held in segregated accounts, separate from the company's operational funds. This segregation helps protect client assets in the unlikely event of the firm's insolvency. Moreover, Waton may provide insurance coverage for client accounts to further enhance security, although specific details regarding the coverage amount should be verified directly with the firm. This level of protection ensures that client funds are safeguarded against potential financial risks.

Safety Measures

Waton Securities International employs advanced encryption technologies to ensure the security of client data and funds. These technologies help protect against unauthorized access and cyber threats, providing a secure trading environment. Additionally, the firm implements robust account security measures, such as two-factor authentication (2FA), to prevent unauthorized access to user accounts and to safeguard sensitive information. These measures collectively ensure that clients' personal and financial data are well-protected against potential security breaches.

Overall, Waton Securities International is a safe and secure platform for investors, backed by rigorous regulatory oversight, strong fund protection policies, and advanced security measures to protect client assets and data. For more detailed information, clients are encouraged to visit Watons official website or contact their support team directly.

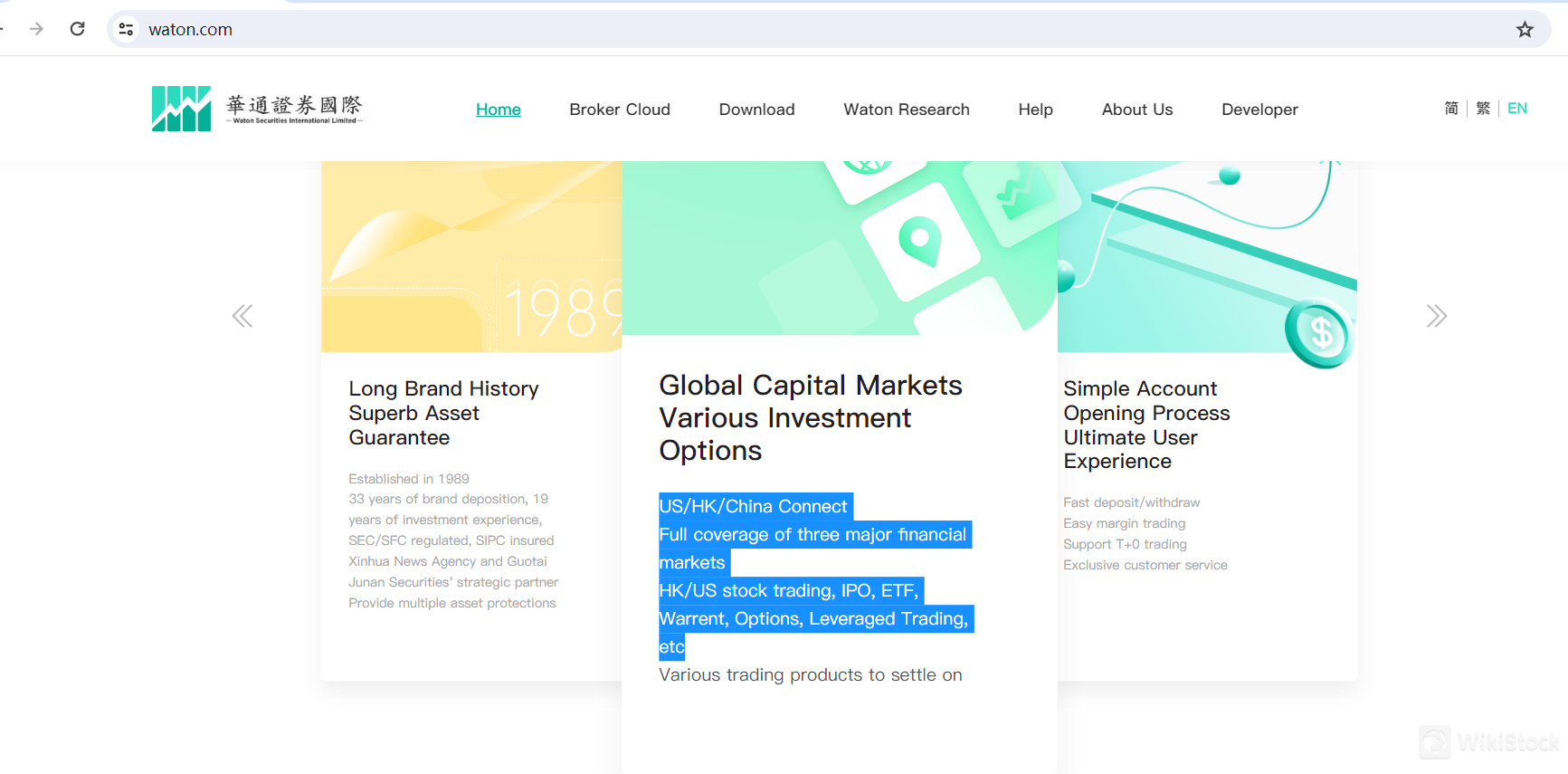

What are securities to trade with Waton Securities International?

Waton Securities International offers a comprehensive platform that bridges the financial markets of the United States, Hong Kong, and China. This extensive coverage opens up a plethora of trading opportunities for investors looking to diversify their portfolios across these major financial hubs. Here's an in-depth look at the various securities you can trade with Waton Securities International:

HK/US Stock Trading

Stocks: One of the primary offerings is the ability to trade stocks listed on major exchanges such as the Hong Kong Stock Exchange (HKEX) and the New York Stock Exchange (NYSE). Investors can buy and sell shares of leading global companies, tapping into the growth potential of both established and emerging markets.

Initial Public Offerings (IPO)

IPOs: Waton Securities International provides access to initial public offerings, allowing investors to participate in the early stages of a companys public listing. This can be a lucrative opportunity as it enables investors to buy shares at the offering price before they are traded on the open market.

Exchange-Traded Funds (ETF)

ETFs: For those looking to invest in a diversified portfolio with a single transaction, ETFs are an excellent option. Waton offers a wide range of ETFs that cover different sectors, industries, and geographical regions. These funds are designed to track the performance of a specific index, providing investors with a balanced exposure to various asset classes.

Warrants

Warrants: These are derivative instruments that give investors the right, but not the obligation, to buy or sell a security at a predetermined price before the expiration date. Warrants can be an effective tool for leveraging investments, hedging risks, or speculating on the future price movements of the underlying assets.

Options

Options: Similar to warrants, options are contracts that allow investors to buy or sell an asset at a set price before a specified date. They are versatile instruments that can be used for hedging, income generation, or speculating. Waton Securities offers a variety of options on different underlying assets, providing traders with numerous strategies to manage their portfolios.

Leveraged Trading

Leveraged Trading: For those looking to amplify their potential returns, Waton Securities offers leveraged trading options. This involves borrowing funds to increase the size of a trading position beyond what would be possible with the investor's own capital. While this can enhance profits, it also increases the risk, making it suitable for more experienced traders who understand the intricacies of leverage.

With Waton Securities International, investors can navigate the dynamic landscapes of the US, Hong Kong, and Chinese financial markets. Whether you are interested in stock trading, participating in IPOs, or utilizing advanced instruments like options and warrants, Waton offers the tools and support needed to capitalize on a wide array of investment opportunities.

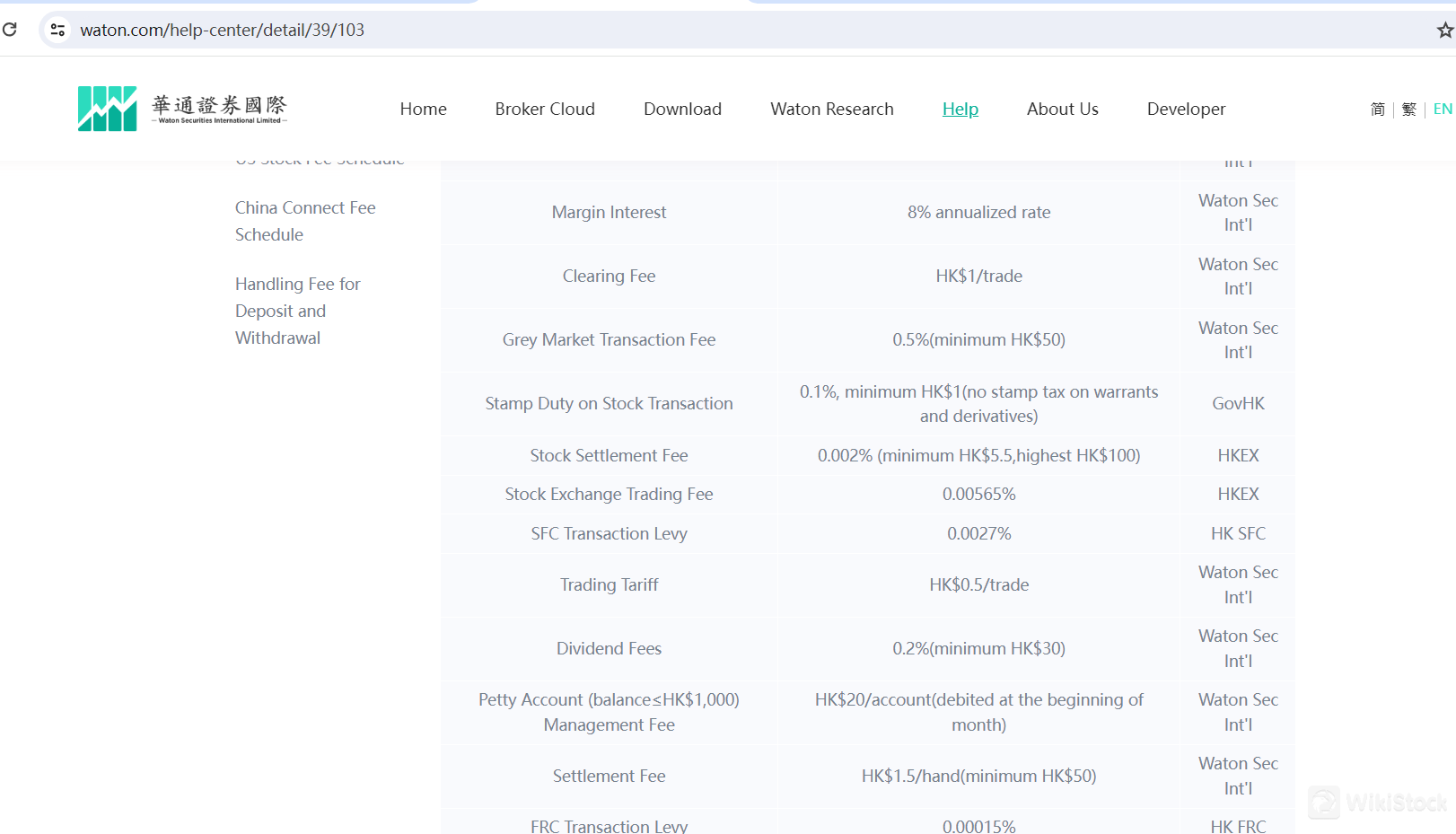

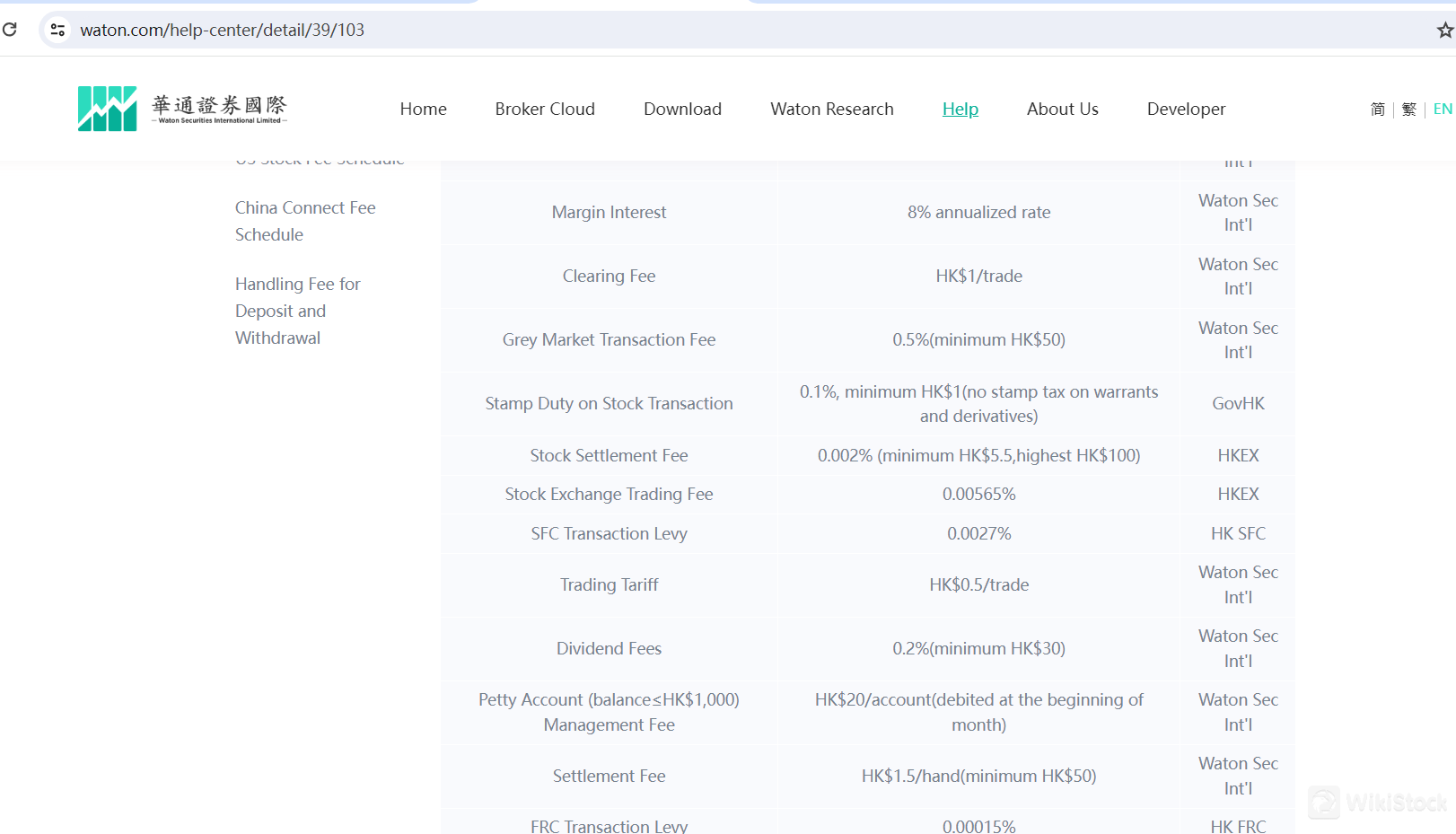

Waton Securities International Fees Review

Waton Securities International offers a comprehensive and competitive fee structure designed to accommodate the needs of various investors. For those trading Hong Kong stocks, Waton charges a commission of 0.25 percent of the transaction amount, with a minimum fee of HKD 100 per transaction. In addition to the commission, there are several mandatory charges including a stamp duty of 0.1 percent, a transaction levy of 0.0027 percent, and a trading fee of 0.005 percent of the transaction amount.

For U.S. stock trading, the fee structure is slightly different. The commission is 0.02 USD per share, with a minimum fee of 2 USD per transaction. Additionally, traders must pay a Securities and Exchange Commission (SEC) fee, which is 0.00051 percent of the total transaction amount, as well as a Financial Industry Regulatory Authority (FINRA) trading activity fee of $0.000119 per share. These fees are designed to ensure compliance with U.S. regulatory requirements while providing competitive pricing for traders.

Investors interested in participating in Initial Public Offerings (IPOs) can expect to incur additional handling fees. These fees vary depending on the specific IPO and are typically detailed in the IPO prospectus. Trading Exchange-Traded Funds (ETFs) follows the same commission structure as regular stock trading, although the exact fees can vary based on the ETF and its market listing.

For derivatives trading, including options and warrants, Waton offers competitive fees. The commission for Hong Kong-listed options is 0.5 percent of the transaction amount with a minimum fee of HKD 30 per contract. For U.S. options, the fee is $0.65 per contract. Warrants trading incurs a commission similar to stock trading, usually around 0.25 percent of the transaction amount with a minimum fee of HKD 100.

Leveraged trading, which involves borrowing funds to increase the size of a trading position, may involve additional interest charges on the borrowed funds. These charges vary depending on the amount borrowed and the duration of the loan. This type of trading allows investors to amplify potential returns, but it also increases the risk.

Waton Securities International also imposes account maintenance fees. Custodian accounts, for example, may incur an annual maintenance fee, typically around 0.02 percent of the asset value held in custody. While deposits are generally free of charge, withdrawal fees can vary, especially for international transfers, which might typically be around HKD 100 per transaction.

Accessing advanced trading platforms and premium data feeds through Waton may also involve additional charges. These fees can range from HKD 100 to HKD 500 per month, depending on the services and tools utilized. These platforms provide robust tools and real-time data necessary for making informed trading decisions.

Waton Securities International App Review

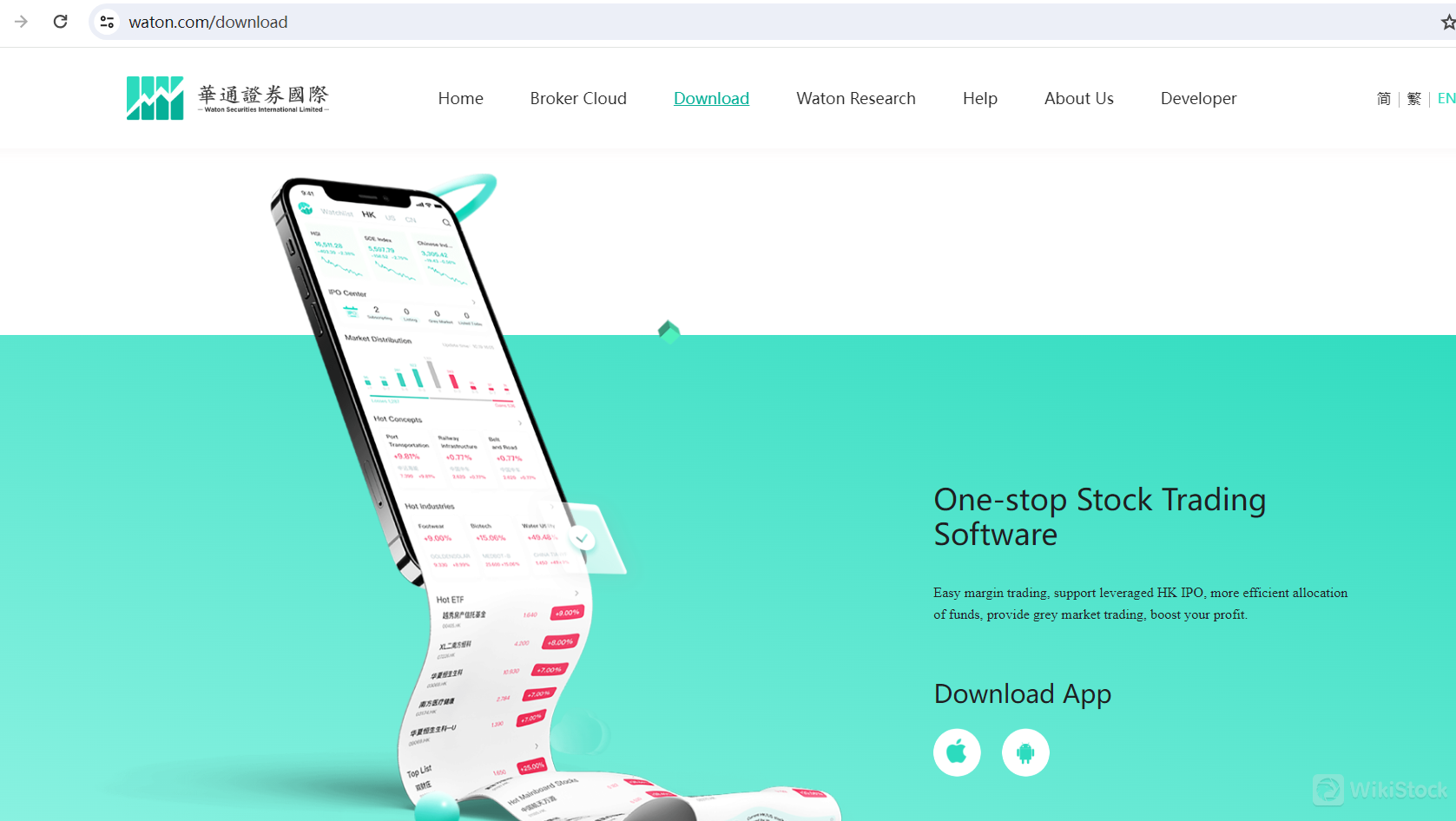

Waton Securities International provides an integrated stock trading platform that is highly suitable for investors of all levels. The platform offers free real-time market data for Hong Kong, U.S., and A-share stocks, allowing investors to stay informed and make timely investment decisions easily.

One of the key features is the one-stop stock trading software, which supports margin trading and leveraged trading for Hong Kong IPOs. This enables investors to efficiently allocate their funds and potentially boost their profits. The platform also offers grey market trading, allowing users to trade shares before they are officially listed on the exchange.

The user-friendly interface ensures that all trading activities, from executing trades to managing portfolios, can be handled within a single application. The availability of a mobile app means that investors can trade on the go, keeping track of their investments and market movements anytime, anywhere.

Research and Eduation

Waton Securities International places a strong emphasis on research and education to support its investors. The company's research capabilities have been significantly strengthened to meet the increasing demand for in-depth analysis, particularly regarding Chinese assets. Waton's research institute focuses on various sectors including technology, media, telecommunications (TMT), consumption, new energy, and real estate. By building a team with deep research expertise and employing scientific data analysis, the institute aims to provide high-quality insights to its clients.

Watons approach to research is distinct as it leverages its partnerships with international brokers to distribute research reports through established trading systems. This collaboration ensures that their research is deeply integrated into the trading workflow, providing timely and actionable insights to investors. The company is committed to developing its talent and enhancing its databases to ensure long-term stability and continuous improvement in its research outputs.

In addition to its research services, Waton Securities International also focuses on investor education. The platform provides a variety of educational resources designed to help investors understand market trends and make informed decisions. These resources include detailed market analysis, educational articles, and interactive tools available through their trading platform and mobile app. By combining comprehensive research with robust educational support, Waton ensures that investors are well-equipped to navigate the complexities of the financial markets and seize investment opportunities effectively.

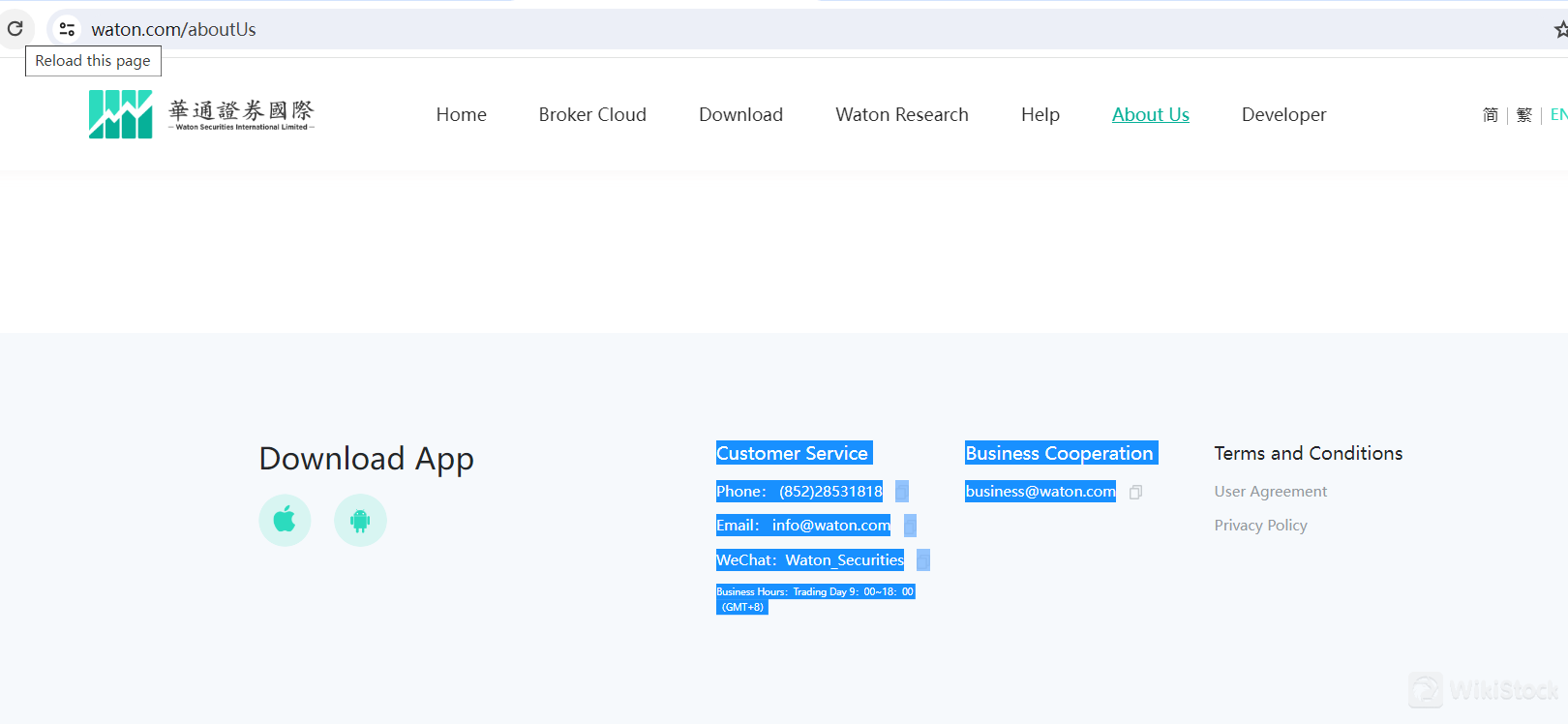

Customer Service

Waton Securities International is dedicated to providing exceptional customer support to ensure that clients have a seamless and efficient trading experience. Their customer service team is available during trading days from 9:00 AM to 6:00 PM (GMT+8), offering support via multiple channels. Clients can reach the support team by phone at (852) 2853 1818, or through email at info@waton.com. Additionally, Waton leverages the popular messaging platform WeChat, where they can be contacted under the handle Waton_Securities. This multi-channel approach ensures that clients can get timely assistance in a manner that is most convenient for them.

For business inquiries and cooperation opportunities, Waton Securities provides a dedicated email address, business@waton.com, ensuring that such communications are handled efficiently by the appropriate team. This structured approach to customer service and business cooperation reflects Waton's commitment to maintaining strong client relationships and fostering business growth. By offering reliable and accessible support, Waton Securities International not only enhances client satisfaction but also builds trust and confidence in their services (FinanceFeeds) (TNGlobal).

Conclusion

Waton Securities International offers a comprehensive, user-friendly trading platform with competitive fees and extensive market coverage, including real-time data for Hong Kong, U.S., and A-share stocks. Regulated by the Securities and Futures Commission (SFC) of Hong Kong, it ensures high standards of security and compliance. The platform supports a wide range of trading instruments and provides strong research and educational resources. However, the fee structure can be complex, with various charges that investors need to be aware of.

FAQs

Is Waton Securities International safe to trade?

Yes, Waton Securities International is safe to trade. It is regulated by the Securities and Futures Commission (SFC) of Hong Kong, ensuring compliance with rigorous standards and oversight. The firm also employs advanced encryption technologies and robust account security measures to protect client data and funds.

Is Waton Securities International a good platform for beginners?

Waton Securities International can be a good platform for beginners due to its user-friendly trading platform and comprehensive educational resources. The platform provides real-time market data and various tools that help new investors understand market trends and make informed decisions. However, beginners should be aware of the fee structure and consider starting with simpler investment options.

Is Waton Securities International legit?

Yes, Waton Securities International is a legitimate brokerage firm. It has a long history, established in 1989, and is regulated by the SFC of Hong Kong. The firms compliance with stringent regulatory requirements and its adoption of robust security measures further attest to its legitimacy.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

China

ChinaObtain 1 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)