Score

東海國際

https://www.longone.hk/

Website

Rating Index

Brokerage Appraisal

Influence

D

Influence Index NO.1

China Hong Kong

China Hong Kong Products

5

Securities Lending Fully Paid、Investment Advisory Service、Stocks、ETFs、Mutual Funds

Securities license

Obtain 2 securities license(s)

SFCRegulated

China Hong Kong Securities Trading License

SFCRegulated

China Hong Kong Fund Management License

Brokerage Information

More

Company Name

東海國際金融控股有限公司

Abbreviation

東海國際

Platform registered country and region

Company address

Company website

https://www.longone.hk/Check whenever you want

WikiStock APP

Brokerage Services

Internet Gene

Gene Index

APP Rating

Features of Brokerages

Commission Rate

0.25%

New Stock Trading

Yes

Margin Trading

YES

Regulated Countries

1

| Donghai International Securities (Hong Kong) Limited |  |

| WikiStock Rating | ⭐ ⭐ ⭐ |

| Fees | Hong Kong stock trading: 0.08% commission for electronic orders (min HK$50); 0.25% commission for phone orders (min HK$100) |

| Mutual Funds Offered | No |

| App/Platform | “Hong Kong Express” trading platform |

| Promotions | Not available yet |

What is Donghai International Securities (Hong Kong) Limited?

Established in August 2015, Donghai International Securities (Hong Kong) Limited operates as a wholly-owned subsidiary of Donghai Securities Co., Ltd. (stock code: 832970). The firm operates under robust regulatory oversight by the Securities and Futures Commission (SFC) in Hong Kong, ensuring strict compliance and investor protection standards. Donghai International Securities offers investors convenient access to initial public offerings (IPOs) and does not levy fees for opening Hong Kong securities investment accounts, which is advantageous for cost-conscious investors. However, the absence of live chat support and limited educational resources may present challenges for clients seeking real-time assistance and comprehensive learning opportunities in investment strategies.

Pros and Cons of Donghai International Securities (Hong Kong) Limited?

Donghai International Securities (Hong Kong) Limited is a regulated brokerage under the oversight of the Securities and Futures Commission (SFC) in Hong Kong, ensuring adherence to regulatory standards and investor protection. While the firm offers convenient access to initial public offerings (IPOs) for investment opportunities, it does not support trading in forex or cryptocurrencies, limiting options for clients interested in these markets. Additionally, Donghai International Securities does not provide live chat support, which may affect customer interaction and immediate query resolution.

On a positive note, there are no fees associated with opening Hong Kong securities investment accounts, making it cost-effective for new investors to start trading. However, the brokerage's educational resources are somewhat limited, potentially posing challenges for clients seeking comprehensive guidance and learning materials.

| Pros | Cons |

|

|

|

|

|

|

Is Donghai International Securities (Hong Kong) Limited safe?

Regulations

Donghai International Securities (Hong Kong) Limited is licensed by the Securities and Futures Commission (SFC) under license numbers BGV506 and BGW874.

Funds Safety

Under Hong Kongs Securities and Futures Ordinance (Cap. 571), specifically aimed at safeguarding client investments, qualified licensed corporations like Donghai International Securities are covered by the Investor Compensation Fund. This fund is designed to compensate clients who suffer financial losses due to a licensed corporation's misconduct or insolvency related to securities or futures contracts. Misconduct can include insolvency, bankruptcy, liquidation, breach of trust, embezzlement, fraud, or other improper conduct. The Investor Compensation Company Limited, a wholly-owned subsidiary of the Securities and Futures Commission (SFC), is responsible for determining whether a misconduct event has occurred and whether claimants are eligible for compensation. The compensation limit for each investor is capped at HKD 150,000 per investor for products traded on Hong Kong exchanges.

Safety Measures

In accordance with the Securities and Futures (Client Money) Rules (Cap. 571I), Donghai International Securities is required to segregate client funds from its own. Client money must be deposited into separate accounts at recognized financial institutions in Hong Kong, such as banks, deposit-taking companies, or restricted license banks. These accounts are designated as trust accounts or client accounts and are maintained separately from the companys own bank accounts.

If client funds collected or held in Hong Kong are to be transferred to places outside Hong Kong for separate custody, Donghai International Securities must obtain written instructions or standing authorization from the clients.

What are securities to trade with Donghai International Securities (Hong Kong) Limited?

Donghai International Securities (Hong Kong) Limited provides a wide array of trading opportunities, encompassing stocks like Cheung Kong Holdings, HSBC, China Mobile, Tencent, Xiaomi, and Cinda Biotech. Investors can also engage in trading derivatives, ETFs, REITs, and CBBCs. The firm facilitates access to Shanghai-Hong Kong and Shenzhen-Hong Kong Stock Connect, enabling trading across a broad range of mainland China stocks. Additionally, Donghai International offers diverse fund products such as fixed-income funds, equity hedge funds, and private equity investment funds. They also provide bond trading services, allowing clients to diversify their investment portfolios. The firm supports IPO subscription services but does not facilitate commodities or cryptocurrencies trading.

Donghai International Securities (Hong Kong) Limited Accounts

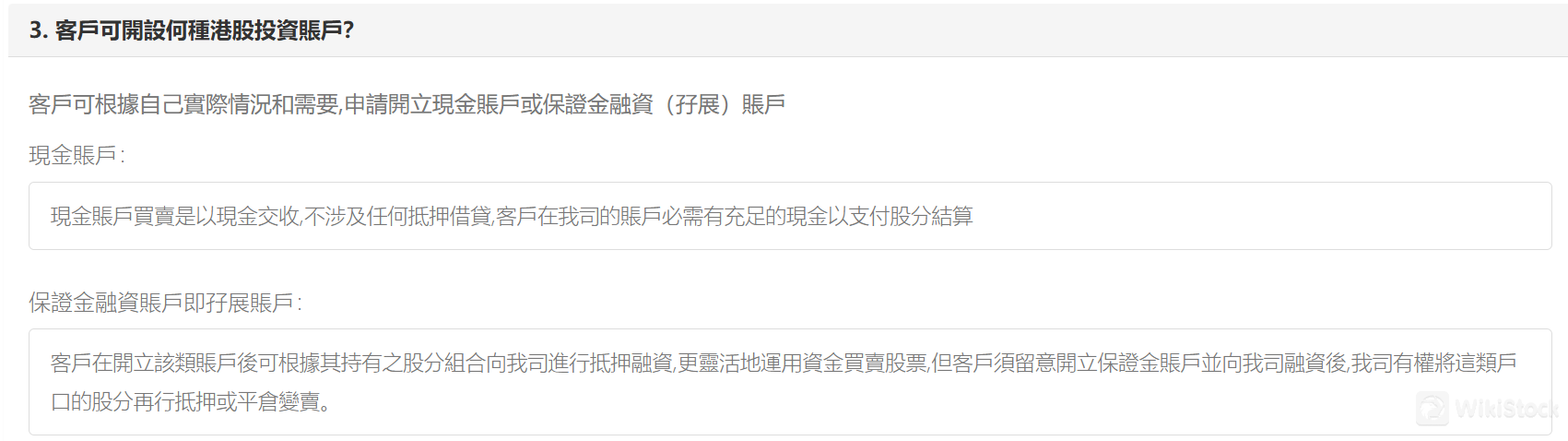

Donghai International Securities (Hong Kong) Limited offers two types of accounts for Hong Kong stock investments: Cash Accounts and Margin Accounts.

Cash Accounts:

Transactions in a cash account are settled with cash, without involving any collateral or loans. Clients must ensure they have sufficient funds in their account to cover the settlement of their stock transactions.

Margin Accounts:

A margin account allows clients to leverage their stock holdings for collateralized financing. This provides greater flexibility in using funds for trading. However, clients should be aware that after opening a margin account and securing financing, the brokerage has the right to re-pledge or liquidate these stocks if necessary.

There are no fees charged for opening Hong Kong securities investment accounts with Donghai International Securities.

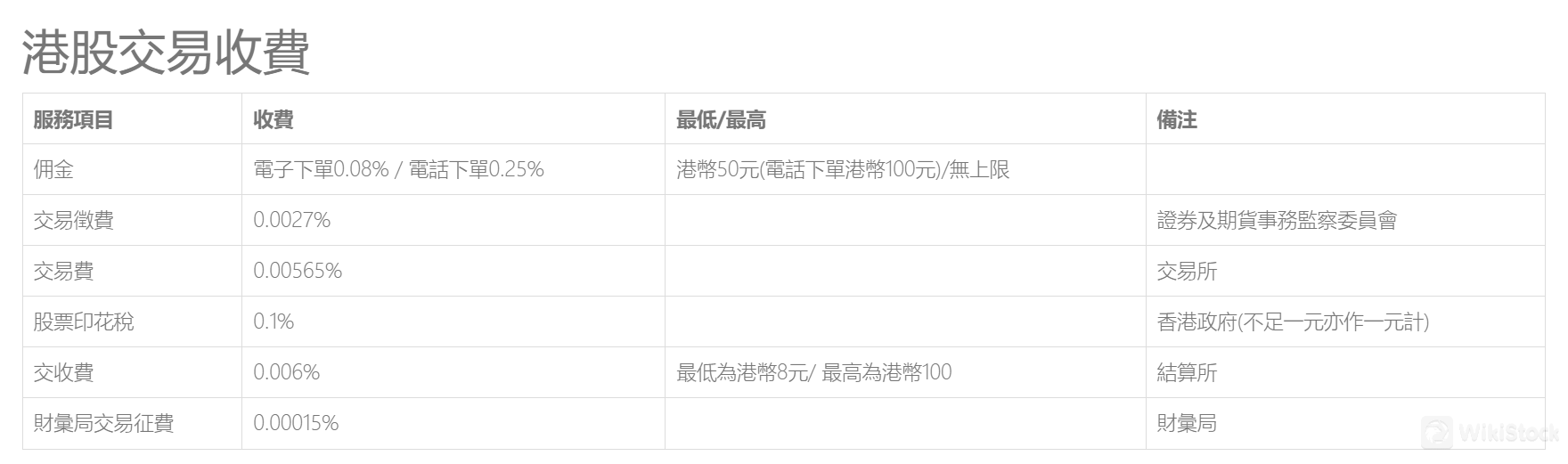

Donghai International Securities (Hong Kong) Limited Fees Review

Donghai International Securities (Hong Kong) Limited offers a transparent fee structure for Hong Kong stock trading. The commission for electronic orders is set at 0.08%, while phone orders incur a higher commission of 0.25%, with minimum fees of HK$50 for electronic orders and HK$100 for phone orders, both having no upper limit. Additional fees include a trading levy of 0.0027%, a trading fee of 0.00565%, a stamp duty of 0.1%, and a settlement fee of 0.006% (ranging from a minimum of HK$8 to a maximum of HK$100). Additionally, the Financial Reporting Council (FRC) transaction levy is set at 0.00015%.

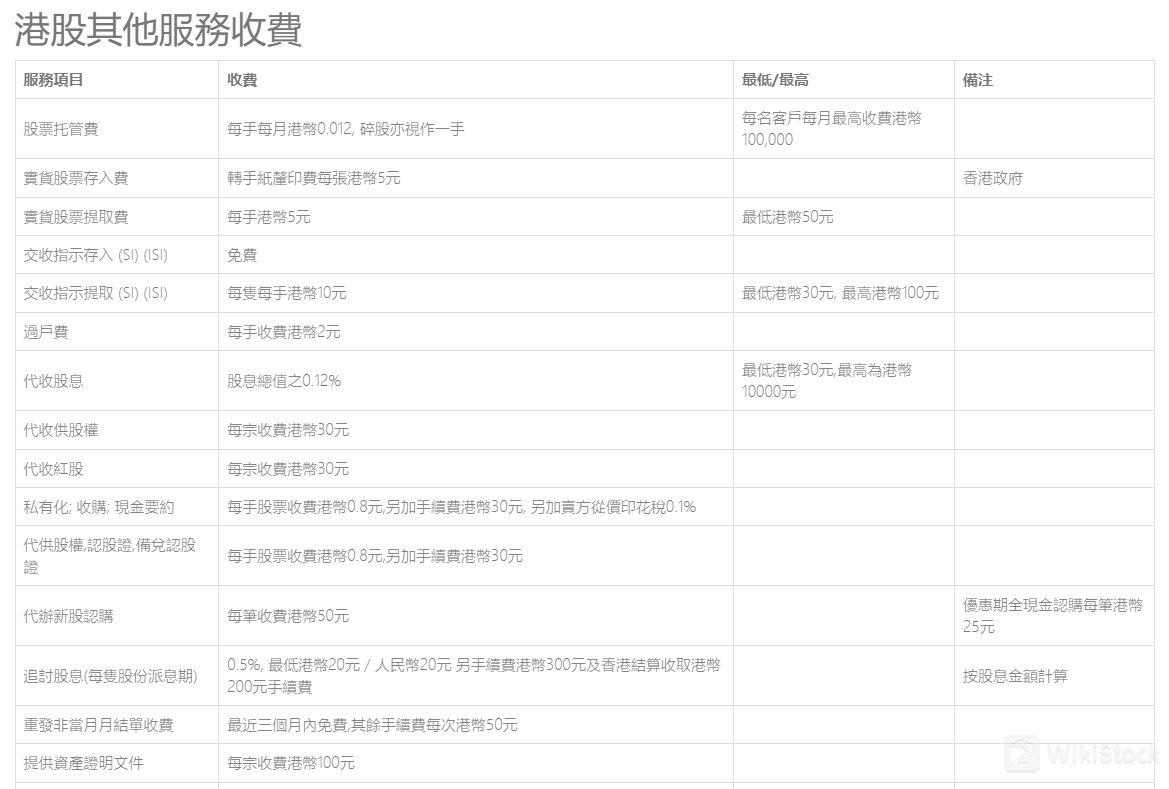

Donghai International Securities (Hong Kong) Limited applies a structured fee schedule for its services related to Hong Kong stocks, ensuring clarity and transparency for clients.

Firstly, custodian fees are charged at HKD 0.012 per board lot per month, with a cap of HKD 100,000 per client monthly, covering all types of shares including odd lots. For physical stock transactions, there's a HKD 5 charge per share certificate for deposits, and a HKD 5 per board lot fee for withdrawals, with a minimum withdrawal fee set at HKD 50.

Handling settlement instructions (SI) incurs no fee for deposits but involves a HKD 10 charge per board lot for withdrawals, with minimum and maximum fees set at HKD 30 and HKD 100, respectively. Transfer fees amount to HKD 2 per board lot. When collecting dividends, clients are subject to a fee equivalent to 0.12% of the dividend value, with minimum and maximum charges at HKD 30 and HKD 10,000, respectively.

For specific transactions like rights and bonus issues, the company charges HKD 30 per transaction. Handling privatizations, acquisitions, and cash offers incurs a fee of HKD 0.8 per share, along with a HKD 30 handling charge and an additional 0.1% stamp duty for sellers. Rights, warrants, and callable bull/bear contracts are similarly priced at HKD 0.8 per share, with an additional HKD 30 handling fee.

Regarding new IPO subscriptions, the handling fee is HKD 50 per application, reduced to HKD 25 during promotional cash applications. When recovering dividends, a fee of 0.5% of the dividend amount is charged, with a minimum fee of HKD 20 (or RMB 20), and additional charges of HKD 300 and HKD 200 from the Hong Kong Securities Clearing Company (HKSCC).

Reissuing non-monthly statements costs HKD 50 per instance, while providing asset proof documents incurs a fee of HKD 100 per document.

Donghai International Securities (Hong Kong) Limited App Review

Donghai International Securities (Hong Kong) Limited offers the “Hong Kong Express” trading platform, available in multiple versions to suit various devices. The platform is accessible on PC, providing a robust and comprehensive trading experience with advanced features and tools. Additionally, the platform is available as a mobile app for both Android and iPhone users, ensuring that clients can manage their investments and execute trades conveniently while on the go.

Customer Service

Donghai International Securities (Hong Kong) Limited provides multiple channels for customer support to ensure clients receive prompt and effective assistance. Clients can reach the securities customer service team via phone at +852 3180 6058 or send a fax to +852 3180 6079. For email inquiries, securities-related questions can be directed to cs.sec@longone.hk, while asset management inquiries can be sent to info_am@longone.hk. Additionally, clients are welcome to visit their office located at 20/F, Shanghai Commercial Bank Tower, 12 Queen's Road Central, Hong Kong, for in-person assistance.

Conclusion

Donghai International Securities (Hong Kong) Limited stands out with its strong regulatory framework overseen by the Securities and Futures Commission (SFC), ensuring reliability and investor protection. The brokerage offers smooth access to IPOs and does not impose fees for opening Hong Kong securities accounts, making it particularly attractive for cost-conscious investors seeking new market opportunities. However, the lack of live chat support could be a drawback for clients needing immediate assistance, and the limited educational resources might pose challenges for beginners looking to enhance their trading knowledge.

FAQs

Is Donghai International Securities (Hong Kong) Limited safe to trade?

Donghai International Securities (Hong Kong) Limited is licensed by the Securities and Futures Commission (SFC) under license numbers BGV506 and BGW874. Under Hong Kongs Securities and Futures Ordinance (Cap. 571), Donghai International Securities is protected by the Investor Compensation Fund, covering losses up to HKD 150,000 per investor due to misconduct or insolvency. Per the Securities and Futures (Client Money) Rules (Cap. 571I), client funds must be kept in separate trust accounts at recognized Hong Kong financial institutions, with transfers outside Hong Kong requiring client authorization.

Is Donghai International Securities (Hong Kong) Limited a good platform for beginners?

While Donghai International Securities (Hong Kong) Limited offers convenient trading platforms, it lacks sufficient educational resources, which could be challenging for beginners seeking guidance and learning opportunities.

Is Donghai International Securities (Hong Kong) Limited legit?

Yes, Donghai International Securities (Hong Kong) Limited is licensed by the Securities and Futures Commission (SFC) under license numbers BGV506 and BGW874.

Risk Warning

The details are derived from WikiStock's expert assessment of the brokerage's website information and are subject to updates. Online trading involves significant risks, including the potential loss of invested capital, underscoring the importance of understanding these risks thoroughly before participation.

Others

Registered region

China Hong Kong

Years in Business

2-5 years

Products

Securities Lending Fully Paid、Investment Advisory Service、Stocks、ETFs、Mutual Funds

Relevant Enterprises

Countries

Company name

Associations

--

东海国际资产管理(香港)有限公司

Group Company

--

东海国际金融控股有限公司

Parent company

--

东海证券股份有限公司

Parent company

Review

No ratings

Recommended Brokerage FirmsMore

Lukfook Financial

Score

Wing Fung Financial

Score

HGNH International

Score

Arta Global Markets

Score

PC Securities

Score

昊天國際金融

Score

名匯集團

Score

越证控股

Score

Kingston Financial Group

Score

Sinofortune Group

Score