FXORO, a financial services provider, operates under the regulatory oversight of the Seychelles Financial Services Authority (FSA) under License No. SD046, which is the body responsible for governing non-bank financial services within the Republic of Seychelles. This regulatory framework ensures that financial institutions like FXORO adhere to strict standards of conduct, transparency, and security in their operations. The FSA's primary objective is to protect the interests of investors and maintain the integrity of the financial services industry in Seychelles.

Besides, FXORO offers the security and protection of its clients' funds. These include Negative Balance Protection, which is a binding policy guaranteeing that clients' accounts cannot fall into negative balances. The company's Careful Risk Management approach involves a team of trained financial experts who oversee operations to ensure that clients and the business are not overly exposed to financial disruptions. Instant Margin Protection is another key feature offered by FXORO. By utilizing automatic safeguards and advanced technology, the company ensures that clients have full access to their trading account margins while monitoring limits to prevent negative balances effectively.

FXORO provides a range of securities and financial instruments:

- Contracts for Difference (CFDs):

CFDs are derivative products that allow traders to speculate on the price movements of underlying assets without owning the assets themselves.

FXORO offers a wide range of CFD products, including forex, commodities, indices, and cryptocurrencies.

- Exchange-Traded Funds (ETFs):

ETFs represent a collection of securities (such as stocks, bonds, or commodities) that are traded on an exchange like a stock.

FXORO provides access to a selection of ETFs, allowing traders to diversify their investment portfolios and gain exposure to specific sectors or markets.

- Forex (Foreign Exchange):

FXORO enables traders to trade a variety of major, minor, and exotic currency pairs in the forex market.

Forex trading involves speculating on the exchange rate fluctuations between two currencies, offering opportunities for profit from price movements.

- Commodities:

Traders on FXOROs platform can access a range of commodity CFDs, including precious metals (gold, silver), energy commodities (oil, natural gas), and agricultural commodities (wheat, corn).

Commodity trading allows traders to speculate on the price movements of raw materials and resources in global markets.

- Indices:

FXORO offers CFDs linked to major stock indices from around the world, such as the S&P 500, FTSE 100, DAX 30, and Nikkei 225.

Trading index CFDs provides traders with exposure to the broader stock market performance without having to trade individual stocks.

- Cryptocurrencies:

FXORO allows traders to access a selection of popular cryptocurrencies, such as Bitcoin, Ethereum, and Litecoin.

Cryptocurrency trading offers opportunities to speculate on the price movements of digital assets in a volatile and dynamic market.

FXORO Fees Review

FXORO Fees Review

FXORO charges various fees that traders should be aware of when engaging in trading activities on their platform.

Margin is the required amount in the base currency of the trading account needed to open or maintain a position.

For forex trading, the Required/Used Margin is calculated as Number of Lots * Contract size / Leverage, with the result converted into the base currency of the trading account.

For gold and silver trading, the margin requirement is calculated as Lots * Contract Size * Market Price / Leverage, with the result in USD and then converted into the base currency of the trading account.

For CFDs, the required margin is Lots * Contract Size * Opening Price * Margin Percentage, with the result in USD and then converted into the base currency of the trading account.

Margin level is calculated as Equity/Margin * 100%.

Free margin is the equity minus margin, representing the available funds that can be used for opening new positions or maintaining existing positions.

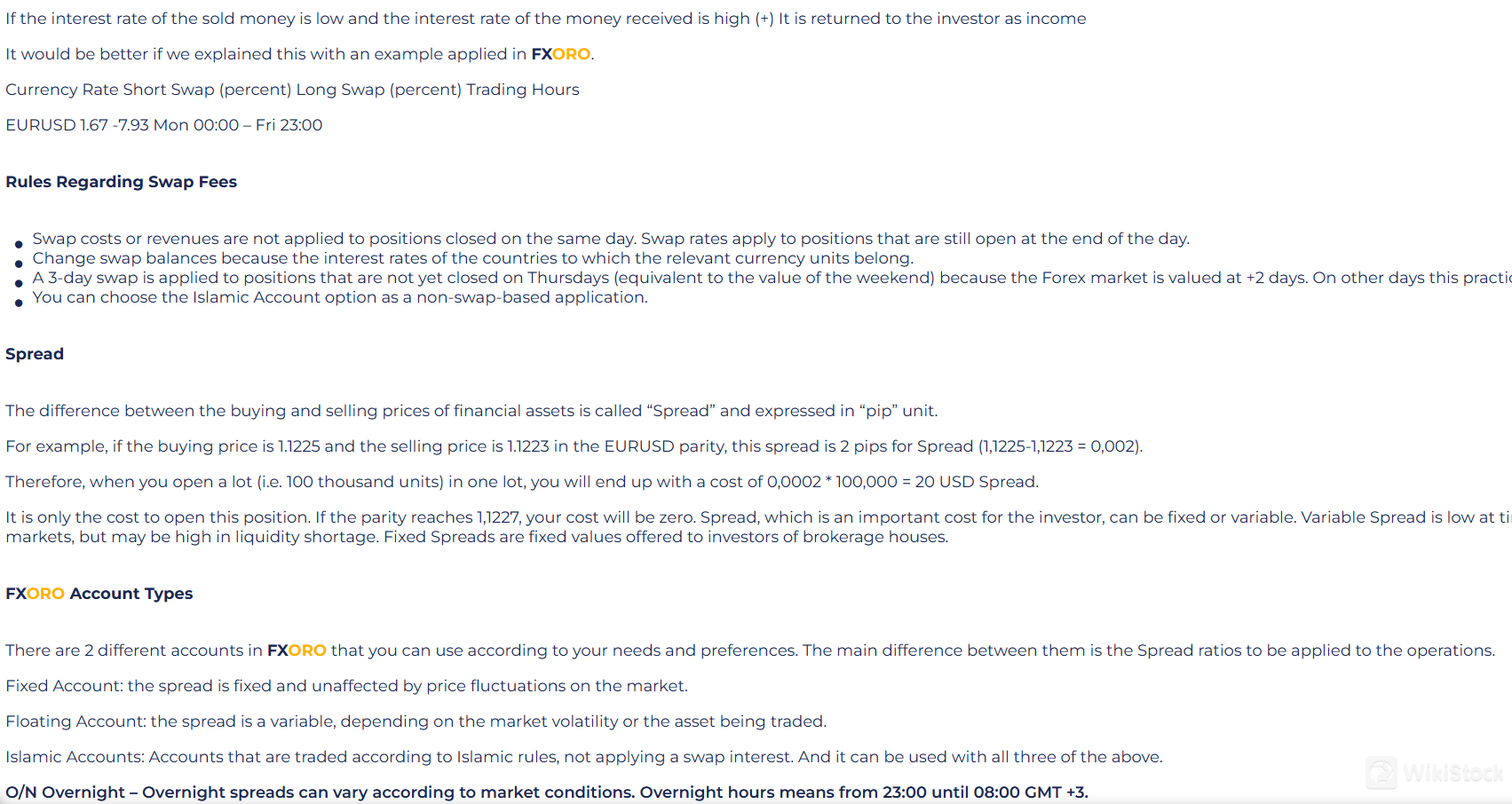

Swaps are charges or revenues incurred for holding positions overnight.

The formula for calculating swaps is Pip value x Number of lots x Swap rate x Number of nights.

Swap rates apply to positions that are still open at the end of the day and can vary based on interest rates of the relevant currency units.

A 3-day swap is applied to positions not closed on Thursdays to account for the weekend, as the Forex market is valued at +2 days.

After three consecutive months of non-use, an inactivity fee of €25 or its equivalent in the customers relevant currency is deducted from the trading account.

The inactivity fee is deducted for every successive Inactivity Period.

Overnight spreads can vary based on market conditions.

Overnight hours are typically from 23:00 to 08:00 GMT+3.

FXORO Platforms Review

FXORO Platforms Review

FXORO offers the popular MetaTrader 4 (MT4) trading platform for Windows, Android, and iOS devices, providing traders with a seamless and user-friendly experience across various devices.

For Windows users, they can download the MT4 application to their personal home computer or laptop to stay connected to the trading platform. The MT4 for Windows app allows traders to access a wide range of trading tools and features, making it convenient to analyze markets, execute trades, and manage their accounts efficiently.

Android users can download the MT4 app from the Google Play Store, enabling them to trade on-the-go with their smartphones or tablets. The MT4 Android app supports all types of execution models and allows traders to place trades directly from the chart, providing flexibility and convenience for trading on mobile devices.

For iOS users, FXORO offers the MT4 platform for iPhone and iPad users. The platform is designed to work seamlessly on all iOS devices and provides a full set of trading orders, including pending orders. Traders can enjoy a smooth trading experience on their iOS devices, accessing essential trading features and tools to make informed decisions while on the move.

FXORO Accounts Review

FXORO Accounts Review

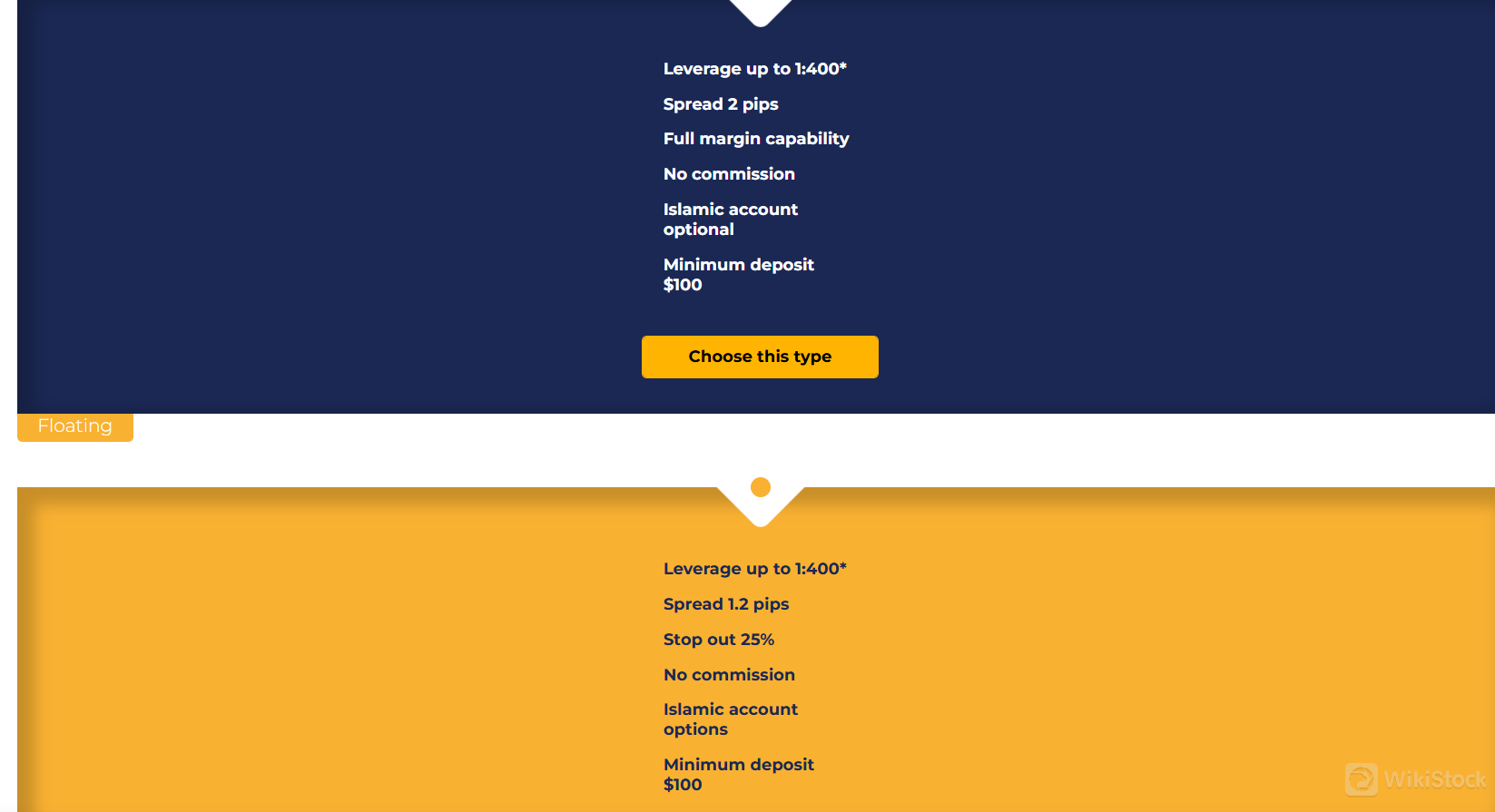

FXORO offers three main types of trading accounts to cater to the diverse needs of traders: Fixed spread account, Floating spread account, and Islamic account.

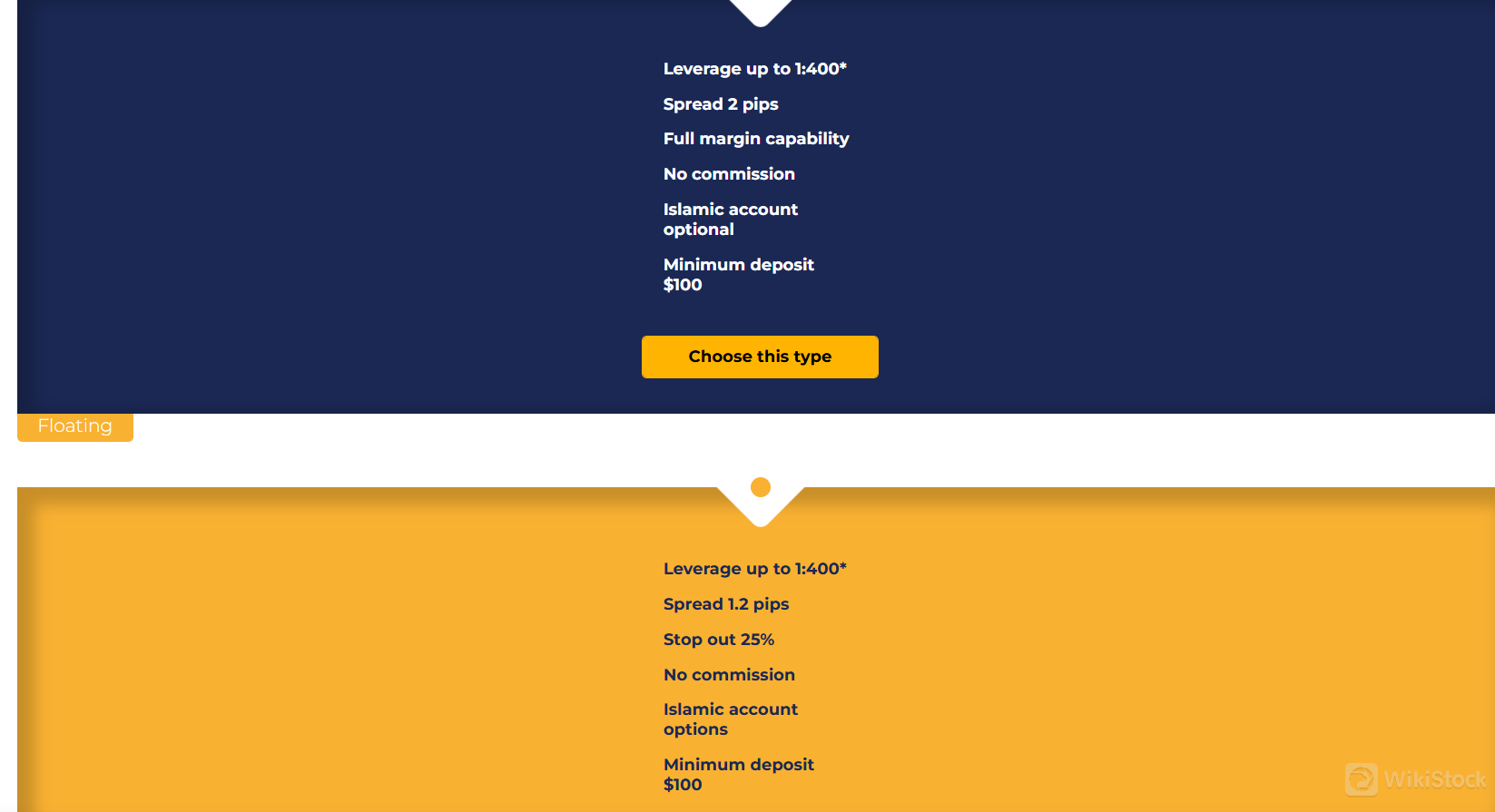

- Fixed spread account: The Fixed Spread trading account is ideal for forex traders who prefer trading with fixed spreads. This account type is designed to provide traders with a consistent spread throughout most trading conditions, offering a sense of stability and predictability. Traders using this account can benefit from a fixed spread that typically remains constant, providing a better spread than the variable alternative on average.

- Floating spread account: The Floating Spread account at FXORO allows clients to trade with tight bid/offer spreads that can range from as low as 0.3 pips to as high as five pips, depending on the instrument being traded and the level of market volatility. This account type offers flexibility in spread pricing, allowing traders to benefit from potentially lower spreads during periods of lower volatility.

- Islamic account: In addition to the Fixed and Floating spread accounts, FXORO also offers an Islamic account that complies with Islamic finance principles. Islamic trading accounts, also known as swap-free accounts, cater to traders who adhere to Sharia laws that prohibit the accrual of interest on overnight positions. FXORO's Islamic account allows traders to participate in the financial markets without incurring or receiving any interest, making it suitable for traders seeking to trade in accordance with Islamic finance guidelines.

Research & Education

Research & Education

FXORO provides a Research and Education section for traders looking to enhance their knowledge and skills in the financial markets.

- Basic Courses:

Beginner-friendly courses designed to introduce fundamental concepts and principles of trading in easy-to-understand formats.

Suitable for new traders looking to build a solid foundation in trading.

- Advanced Courses:

In-depth and advanced courses tailored for experienced traders seeking to deepen their understanding of complex trading strategies, analysis techniques, and risk management.

- Ebook:

Access to educational eBooks covering a wide range of topics related to trading, including market analysis, strategies, and trading psychology.

Provides traders with valuable insights and knowledge in a convenient digital format.

- Glossary:

A comprehensive glossary of trading terms and definitions to help traders familiarize themselves with industry-specific terminology and concepts.

- Webinars:

Interactive online seminars conducted by industry experts and market analysts.

Offer valuable insights, market analysis, trading tips, and live Q&A sessions for traders of all levels.

- Economic Calendar:

A tool that provides information on key economic events, data releases, and market-moving news.

Helps traders stay updated on important events that may impact financial markets.

- News and Signals:

Regularly updated news articles, analysis reports, and trading signals to keep traders informed of market developments and potential trading opportunities.

- FAQs Center:

A repository of frequently asked questions and answers regarding trading, account management, platform usage, and more. Helps traders find quick solutions to common queries and concerns.

Customer Service

Customer Service

Customers can visit their office or get in touch with customer service line using the information provided below:

Telephone: +442031290670

WhatsApp: +91 11 7127 9567

Email: info@global.fxoro.com

Address: Suite 3, Global Village, Jivans Complex Mont Fleuri, Mahe, Seychelles

FXORO offers online messaging as part of their trading platform. This allows traders to communicate with customer support or other traders directly through the platform.

Conclusion

Conclusion

In conclusion, FXORO is a financial services provider that offers a secure and reliable trading environment regulated by the FSA. With a focus on security measures, a diverse range of financial instruments, educational resources, and the popular MT4 trading platform, FXORO caters to the needs of traders looking to diversify their investments and enhance their trading capabilities. While the platform has regional restrictions and traders need to consider the fee structure and withdrawal processing times. Overall, FXOROis a popular choice for traders looking for a reliable and trustworthy broker or beginners.

Frequently Asked Questions (FAQs)

Is FXORO regulated?

Yes. It is regulated by FSA.

How long after selling can I withdraw from FXORO?

Your withdrawal request is processed by thier back office within 48 hours and you will receive your money via bank wire or credit/debit card between 3 – 10 business days. Saturday and Sunday are not considered business days.

What are platforms offered by FXORO?

It provides MT4.

What is the minimum deposit for FXORO?

The minimum initial deposit to open an account is $100.

At FXORO, are there any regional restrictions for traders?

Yes. It does not provides services for the residents of the United States.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Salvador

SalvadorObtain 1 securities license(s)