The Core Securities Company Limited understands the importance of providing professional wealth management solutions to our clients, The Core Securities combines personalized approach, in-depth expertise, and financial planning tools and resources to build and protect your wealth. Our global market team has a wealth of knowledge, resources, and solutions for all investors. Through our accredited professional advisors, our clients benefit from the expertise of our capital market research, global portfolio advisory, and wealth management services.

The Core Securities Information

Core Securities is a financial services provider that features negotiable commission rates tailored to client-company negotiations and a fixed transfer fee of $50 per trade, meeting diverse trading needs.

The company offers a unique trading app, Wilson Securities APP, and supports both fund and stock online trading through its platform, My Smart Advisor.

However, a notable limitation is the lack of promotional offers that could attract new clients or reward existing ones.

Pros & Cons

Pros:

The Core Securities streamlines account opening and is regulated by the SFC, ensuring a secure trading environment. It offers a diverse range of tradable securities on its unique MySmart Advisor platform, with the added benefit of negotiable commissions.

Cons:

However, the firm charges a $50 transfer fee and offers limited account types and investment services, such as wealth management. Additionally, its official website lacks information, which will impact client decision-making.

Is The Core Securities Safe?

Regulations: The Core Securities is regulated by the Hong Kong Securities and Futures Commission (SFC) under the Type 1 and Type 4 licenses, which authorize them for dealing in and advising on securities. The license number is AVO854.

Funds Safety: The Core Securities adheres to regulatory guidelines set by the Hong Kong Securities and Futures Commission (SFC) for safeguarding client assets. As a licensed broker, they are required to keep client funds in segregated accounts, ensuring that these funds are distinct from the companys operational funds. This segregation protects client assets from being used for any unauthorized or unrelated company activities, thereby offering an additional layer of security against financial mismanagement or insolvency.

Safety Measures: The Core Securities employs robust security protocols to protect client data and funds. This includes encryption technologies to secure fund storage and the implementation of the Investor ID Model for Northbound Trading under the Stock Connect, which necessitates compliance with the Personal Data (Privacy) Ordinance. This ensures that personal data is collected, stored, and used in compliance with strict privacy standards, minimizing the risk of data leakage and unauthorized access.

What are securities to trade with The Core Securities?

The Core Securities provides a diverse range of securities for trading, facilitated through its participation in the Shanghai-Hong Kong Stock Connect Northbound Service.

Stocks: The Core Securities enables its clients to trade a variety of stocks listed on the Shanghai Stock Exchange (SSE) through the Northbound Trading link of the Shanghai-Hong Kong Stock Connect. This service provides access to a broad market, allowing investors from Hong Kong and overseas to participate actively in the Chinese stock market, offering opportunities for portfolio diversification and exposure to one of the world's largest economies.

Funds: While specific details about mutual funds are not mentioned in the provided information, The Core Securities, as a participant of HKEx, likely offers opportunities to trade in various mutual funds. These funds could encompass a range of sectors and markets, providing investors with options to diversify their investments further and manage risks through professionally managed portfolios.

Structured Products: The reference to securities and structured products suggests that The Core Securities will also offer trading in structured products. These financial instruments are typically designed to facilitate highly customized risk-return objectives, tailored to meet specific needs that cannot be met from the standard financial instruments available in the markets.

Gold and Other Commodities: Although not explicitly mentioned in the details provided, as a broker, it is possible that The Core Securities could offer opportunities to trade in commodities like gold. This would allow investors to hedge against inflation, diversify their portfolios, and take advantage of movements in commodity prices.

The Core Securities Fee Review

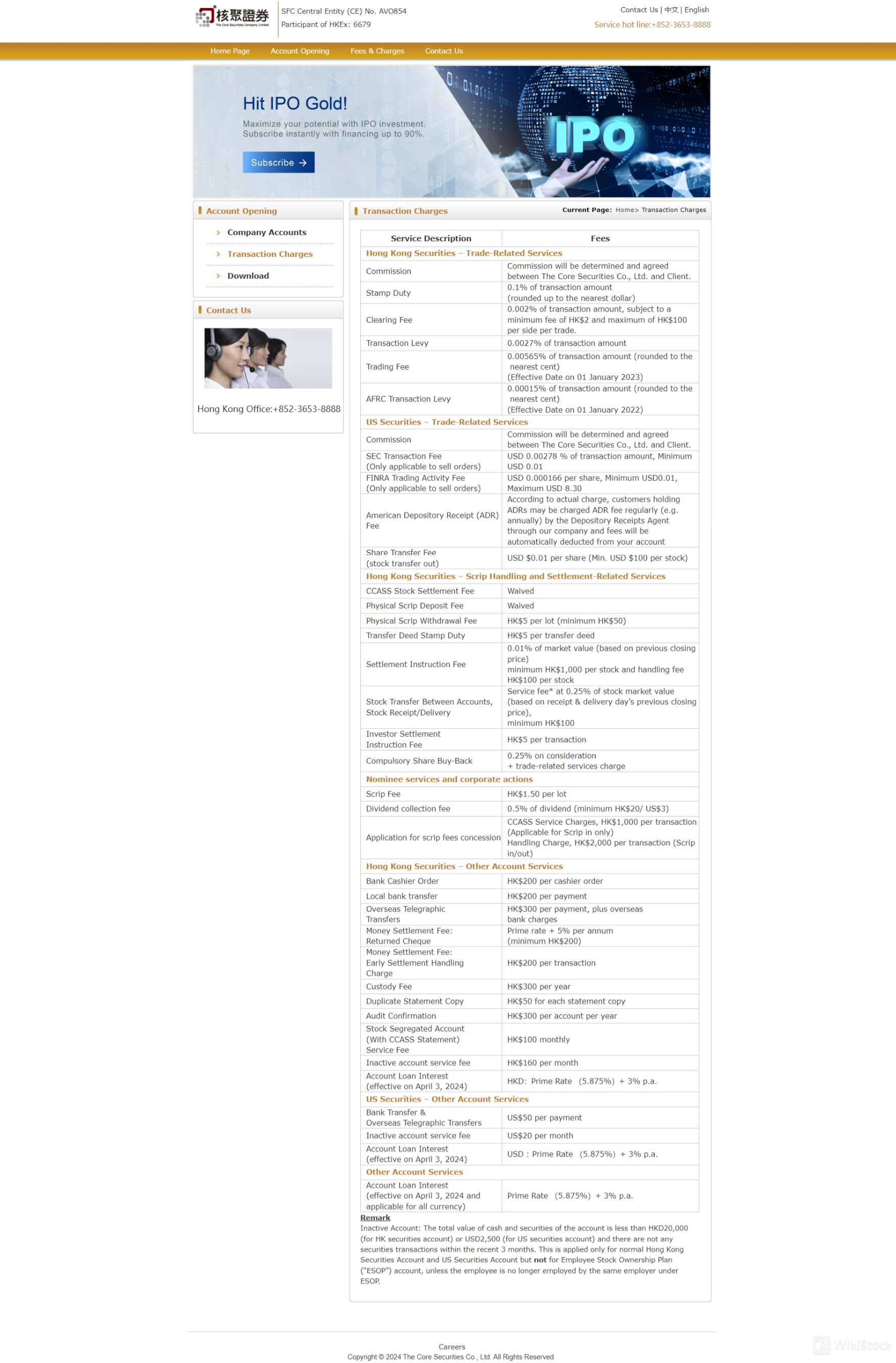

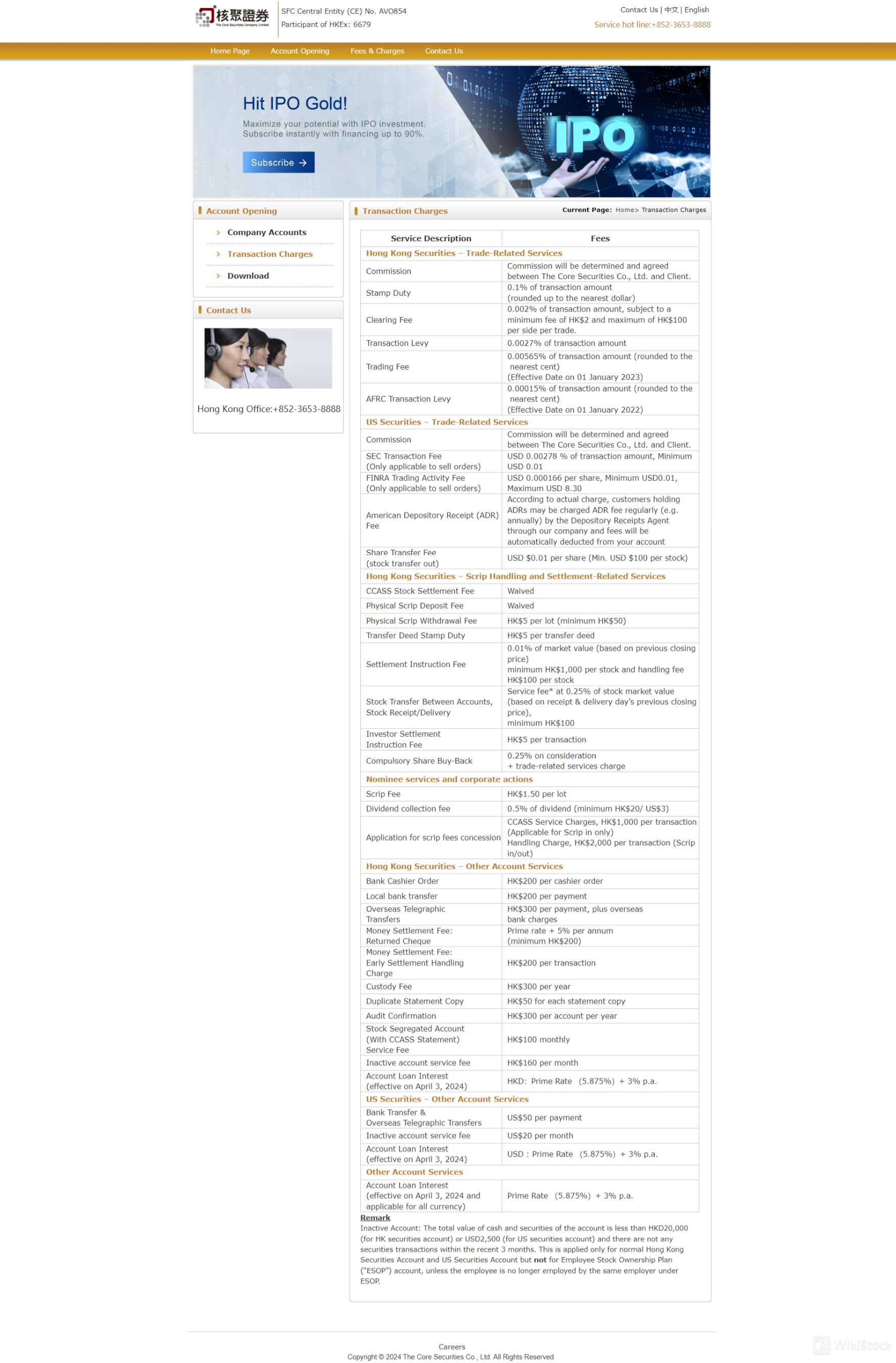

The Core Securities Co., Ltd. offers a flexible commission structure for trading Hong Kong and US securities, supplemented by a range of transaction, settlement, and account service fees, including waived fees for specific services and additional charges for scrip handling and overseas transactions.

Hong Kong Securities - Trade-Related Services:

The Core Securities offers a negotiable commission structure tailored between the company and its clients. Additional transaction-related charges for trading Hong Kong securities include a 0.1% stamp duty, a clearing fee ranging from HK$2 to HK$100, a transaction levy of 0.0027%, and a trading fee of 0.00565%. There is also an AFRC transaction levy of 0.00015%, emphasizing the firm's compliance with regulatory cost structures.

US Securities - Trade-Related Services:

For US securities, commissions are similarly negotiable. The SEC transaction fee for selling orders is 0.00278% with a minimum of USD 0.01, while the FINRA trading activity fee is USD 0.000166 per share, with limits ranging from USD 0.01 to USD 8.30. Clients holding ADRs will incur regular ADR fees, and a share transfer fee of USD 0.01 per share is charged, with a minimum of USD 100 per stock.

Hong Kong Securities - Scrip Handling and Settlement-Related Services:

Scrip handling and settlement-related fees for Hong Kong securities are minimal, with CCASS stock settlement and physical scrip deposit fees waived. Physical scrip withdrawal incurs a fee of HK$5 per lot, with a minimum of HK$50. Transfer deed stamp duty is fixed at HK$5 per deed, and settlement instruction fees are 0.01% of the market value with additional handling charges.

Other Account Services:

The Core Securities charges HK$200 for local bank transfers and cashier orders, with overseas telegraphic transfers costing HK$300 plus any applicable overseas bank charges. Money settlement fees for returned checks are calculated at the prime rate plus 5% per annum, with a minimum of HK$200. The custody fee is HK$300 per year, and inactive account service fees are set at HK$160 per month for Hong Kong securities accounts and US$20 per month for US securities accounts. Additional fees include HK$50 for duplicate statement copies and HK$300 for audit confirmations annually.

The Core Securities Trading Platform Review

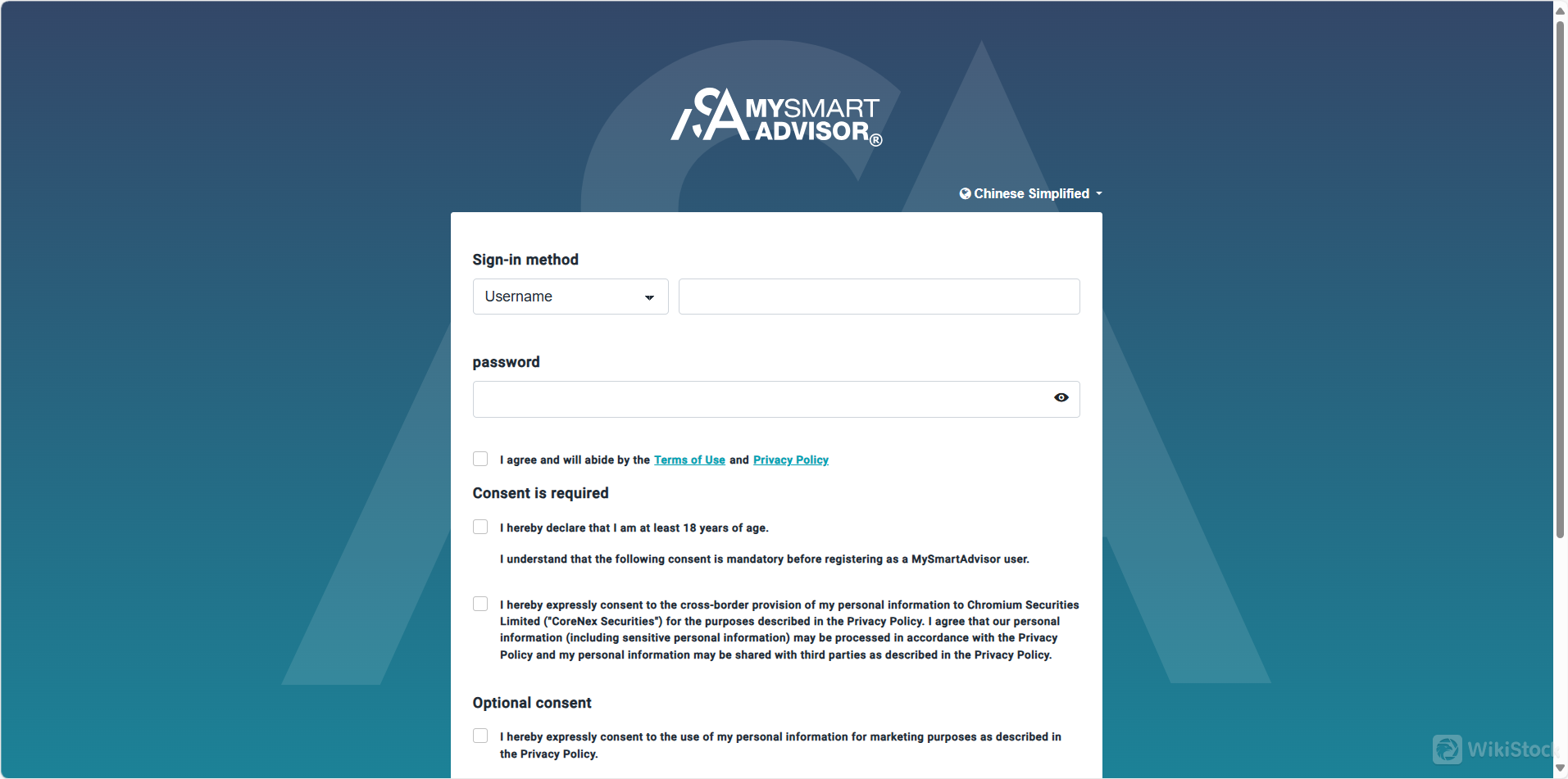

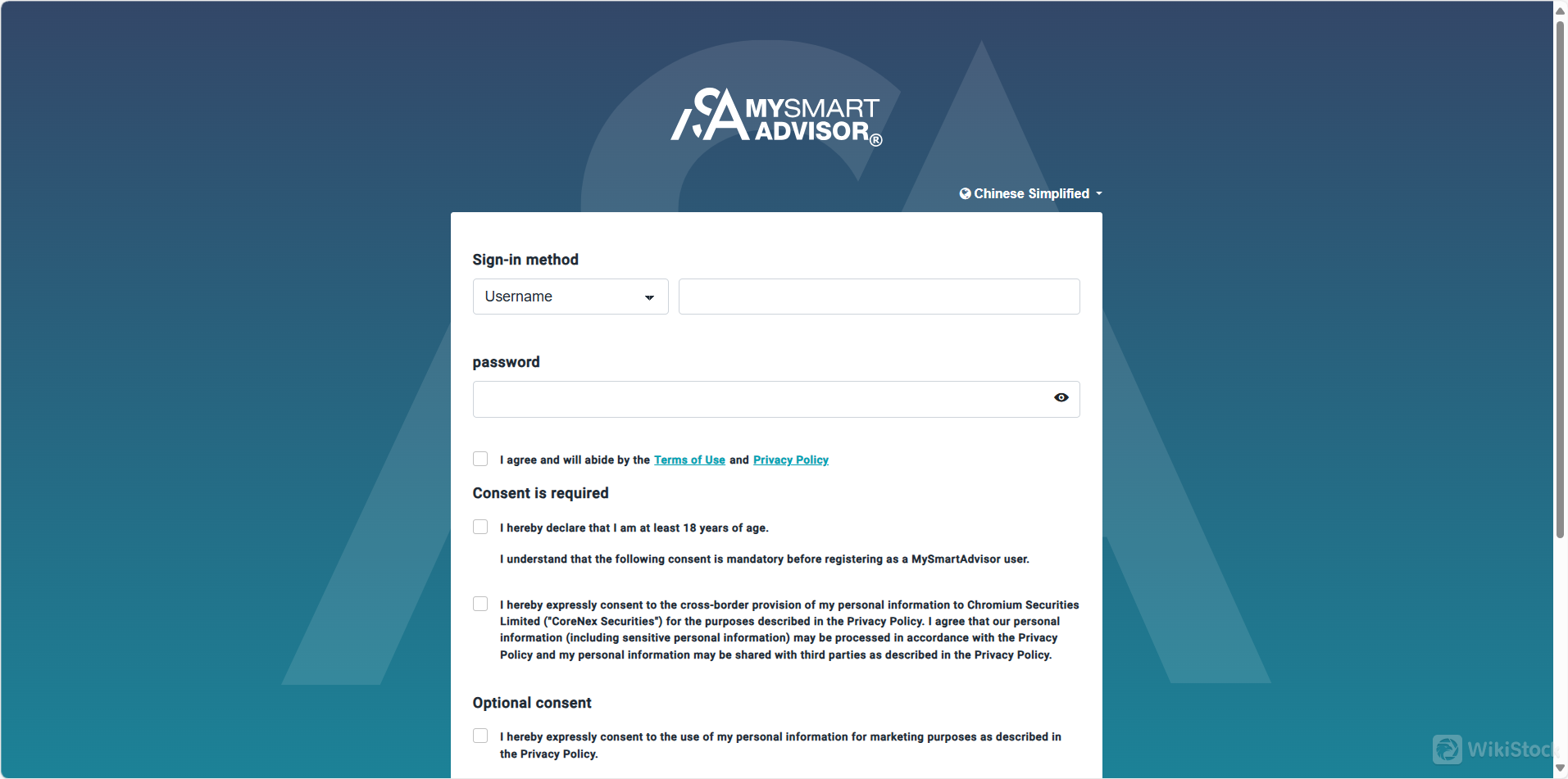

The Core Securities utilizes a trading platform called “MySmart Advisor” for online trading, which supports both fund and stock trading.

This platform is designed to meet the needs of modern investors by offering user-friendly navigation, real-time market data, and analytical tools to enhance trading decisions.

The integration of advanced security features ensures that client transactions and personal data are protected effectively.

Customer Service

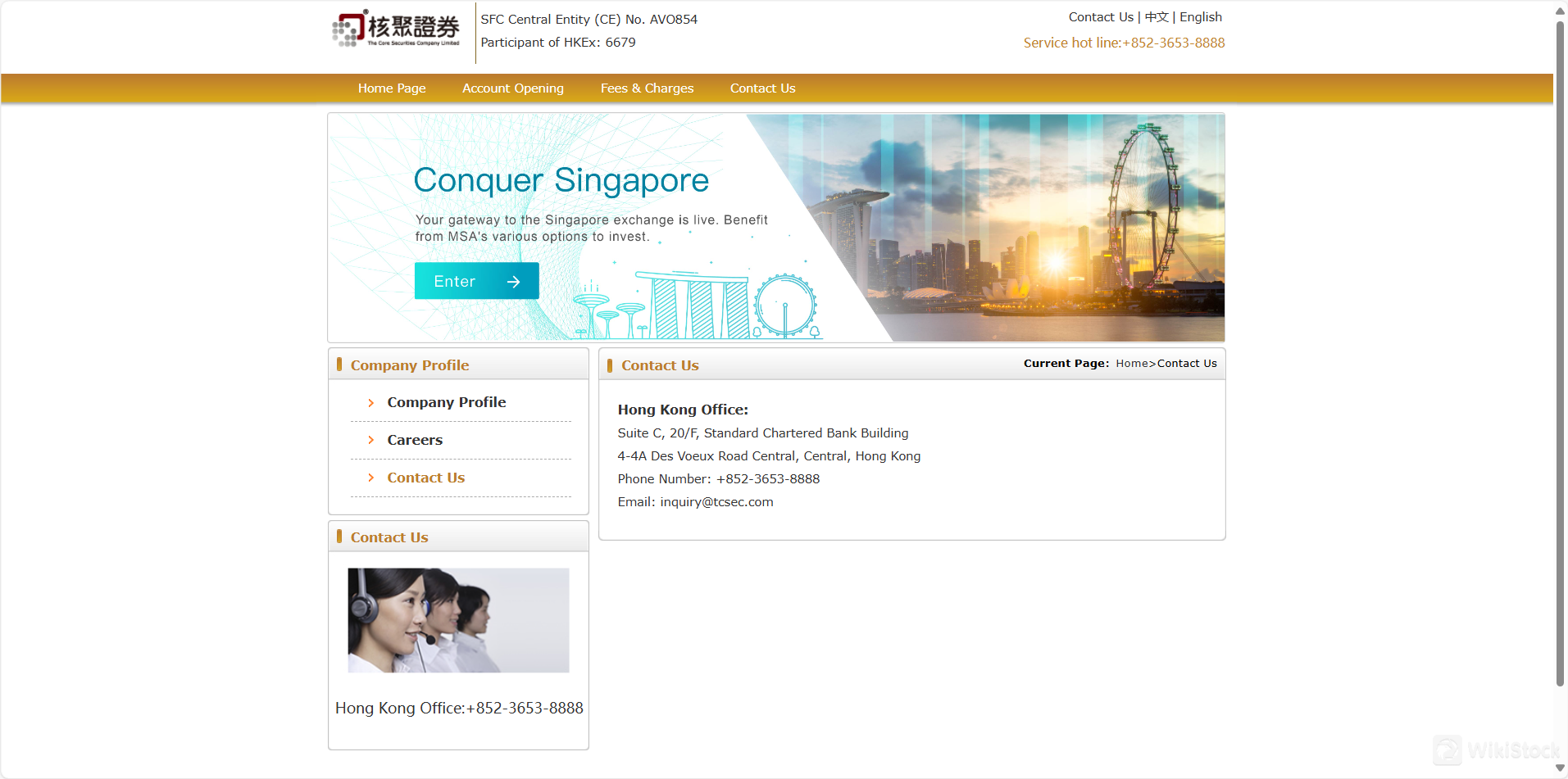

The customer support for The Core Securities is based in their Hong Kong office, located at Suite C, 20/F, Standard Chartered Bank Building, 4-4A Des Voeux Road Central, Central, Hong Kong.

Clients can reach their support team by phone at +852-3653-8888 for immediate assistance or via email at inquiry@tcsec.com for queries that will require detailed responses or documentation.

Conclusion

The Core Securities Co., Ltd. is a financial services provider based in Hong Kong, offering a wide range of trading opportunities through its participation in platforms like the Shanghai-Hong Kong Stock Connect.

With a flexible and detailed fee structure, the company attracts both local and international clients, providing negotiable commission rates and various transaction-related services.

Its customer support is readily accessible via a dedicated office in the Standard Chartered Bank Building and through communication channels like phone and email, ensuring effective client engagement and support.

FAQs

What types of securities can I trade with The Core Securities?

You can trade a variety of securities including Hong Kong stocks, US securities, and participate in Northbound trading opportunities through the Shanghai-Hong Kong Stock Connect.

How can I contact customer support at The Core Securities?

Customer support can be contacted at +852-3653-8888 or via email at inquiry@tcsec.com. Their office is located at Suite C, 20/F, Standard Chartered Bank Building, 4-4A Des Voeux Road Central, Central, Hong Kong.

What are the trading fees at The Core Securities?

The Core Securities offers a negotiable commission structure for trading. Other fees include a stamp duty of 0.1% on transactions, a clearing fee ranging from HK$2 to HK$100, and various other service-related charges depending on the type of transaction and securities involved.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

China

ChinaObtain 1 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)