Minerva Holding Financial Securities offers a regulated, secure trading environment with user-friendly apps, comprehensive customer support, and robust research and educational resources. However, some fees may be higher compared to other brokers, and specific details on fund insurance coverage are not clearly provided.

Minerva Holding Financial Securities Limited provides a well-regulated and secure trading environment with a variety of securities options and robust customer support. Their user-friendly mobile apps and extensive educational resources further enhance the trading experience. However, potential users should be aware of certain fees and the lack of explicit details on fund insurance coverage.

Minerva Holding Financial Securities Limited prioritizes safety and regulatory compliance in several dimensions:

Minerva Holding Financial Securities Limited offers a variety of securities for trading, primarily focusing on stocks, bonds, mutual funds, and ETFs (Exchange-Traded Funds).

Stocks: Investors can trade shares of publicly listed companies on major exchanges such as the Hong Kong Stock Exchange. This allows investors to gain partial ownership of companies and potentially profit from price appreciation and dividends.

Bonds: These are fixed-income securities issued by corporations or governments. Bonds pay periodic interest and return the principal at maturity, making them attractive for those seeking regular income and capital preservation.

Mutual Funds: These pooled investment vehicles allow investors to diversify their portfolios by investing in a variety of assets managed by professional fund managers. They can include a mix of stocks, bonds, and other securities.

ETFs (Exchange-Traded Funds): Similar to mutual funds, ETFs offer diversification but trade like individual stocks on exchanges. They provide exposure to a specific index, sector, or commodity.

The platform provided by Minerva is user-friendly and designed to facilitate seamless transactions. Additionally, Minerva's adherence to regulations set by the Hong Kong Securities and Futures Commission ensures that all trading activities are conducted within a secure and transparent framework, enhancing investor confidence.

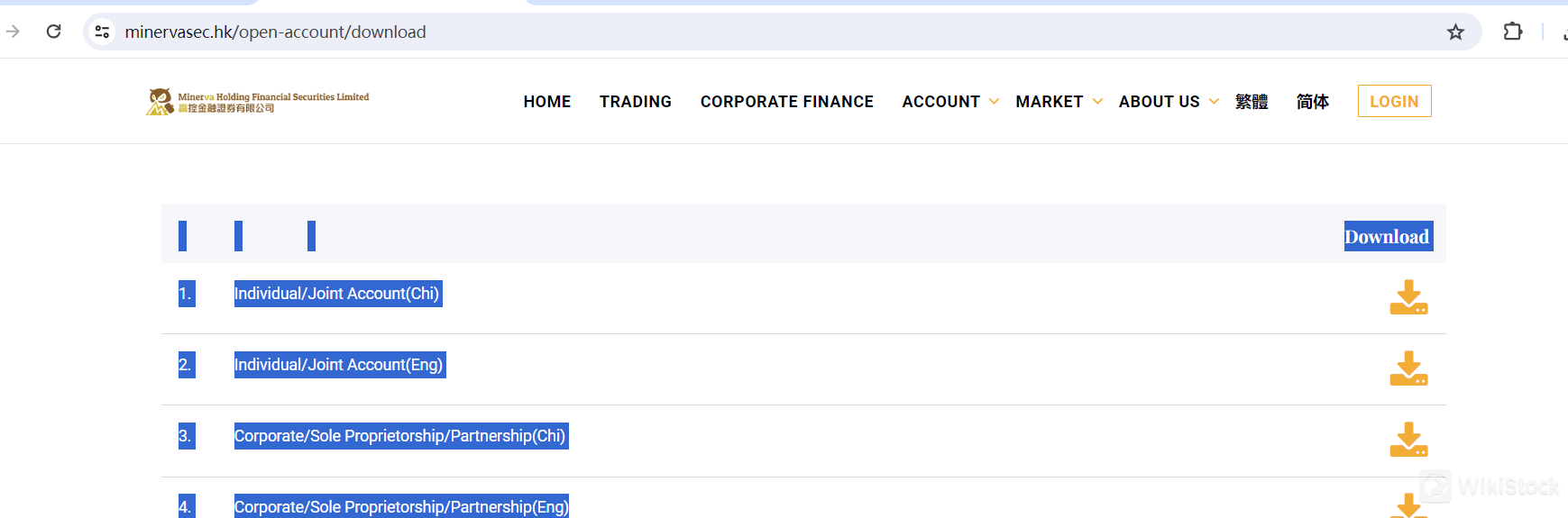

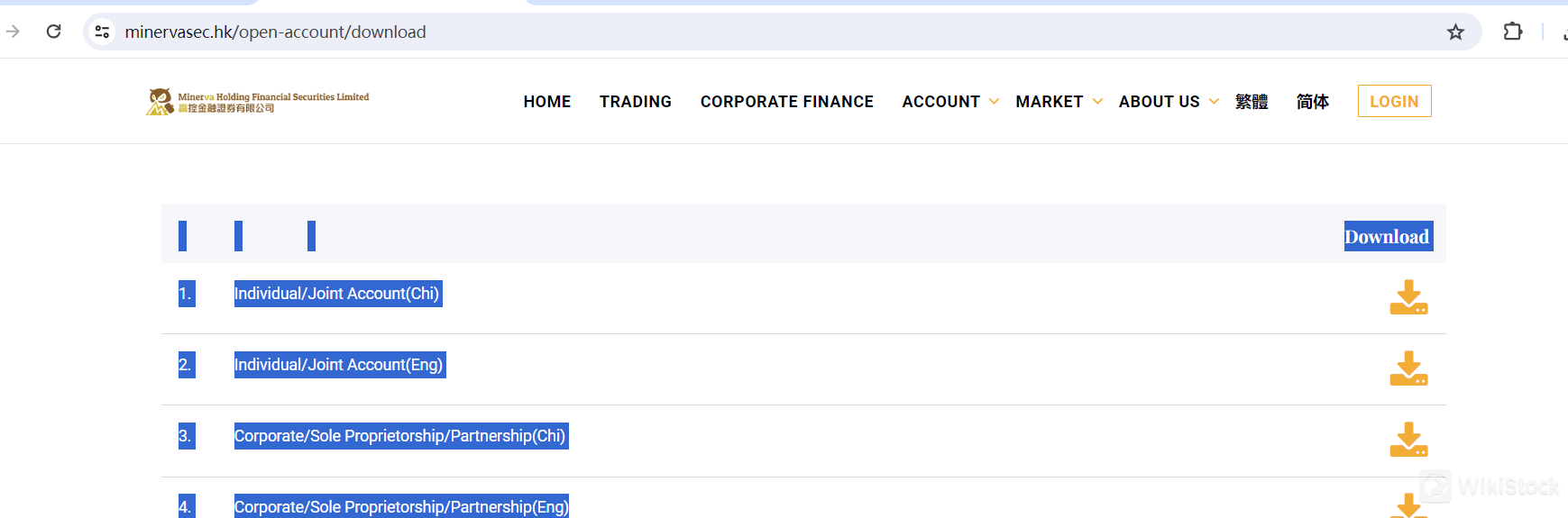

Minerva Holding Financial Securities Accounts

Minerva Holding Financial Securities Limited offers various account types to cater to different client needs. These include:

Individual/Joint Account (Chinese and English): These accounts are designed for individual investors or joint investors who want to trade securities. They come in versions that cater to both Chinese and English-speaking clients.

Corporate/Sole Proprietorship/Partnership Account (Chinese and English): These accounts are meant for businesses, including corporations, sole proprietorships, and partnerships, allowing them to engage in securities trading. Versions are available in both Chinese and English to accommodate different language preferences.

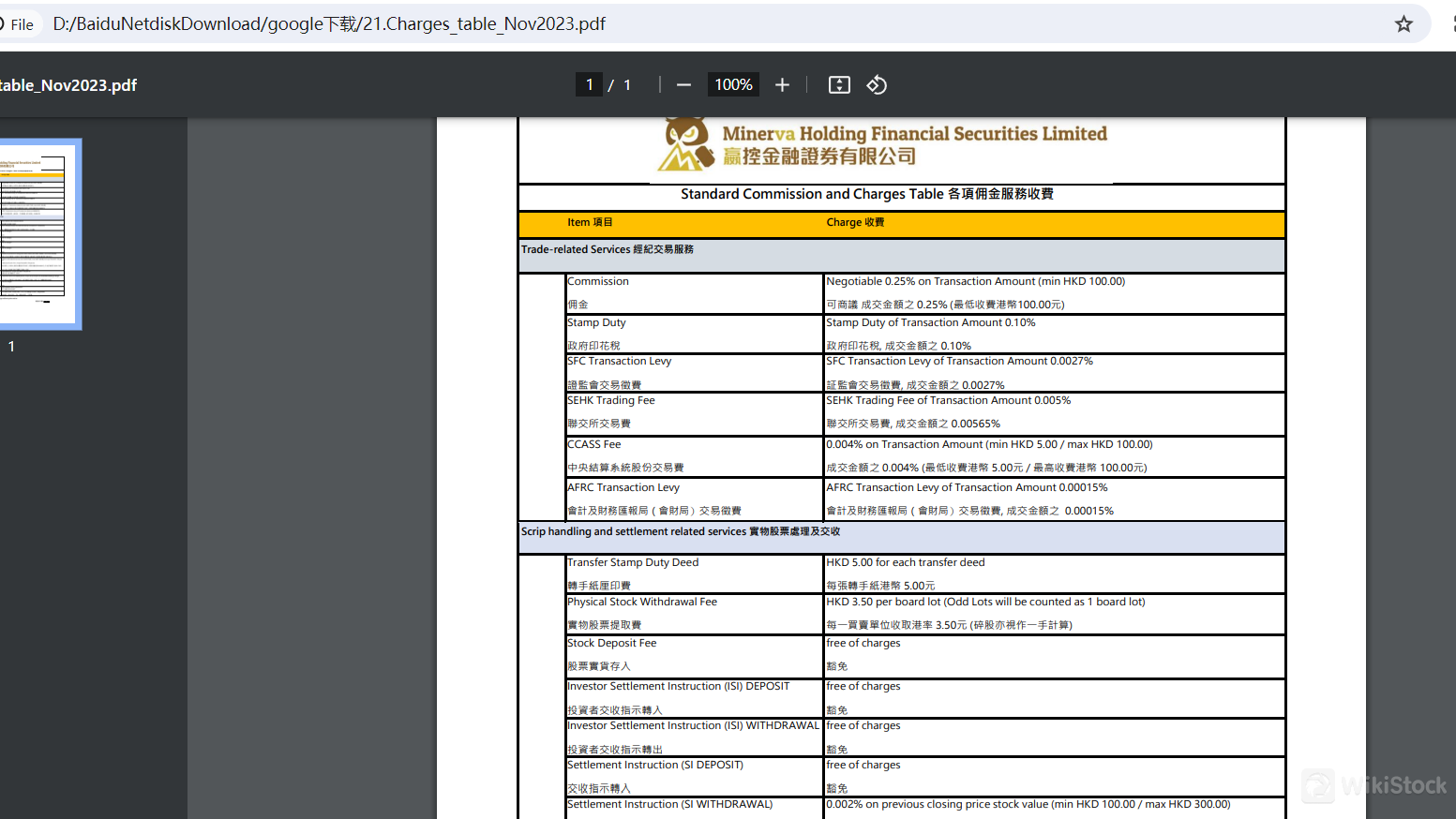

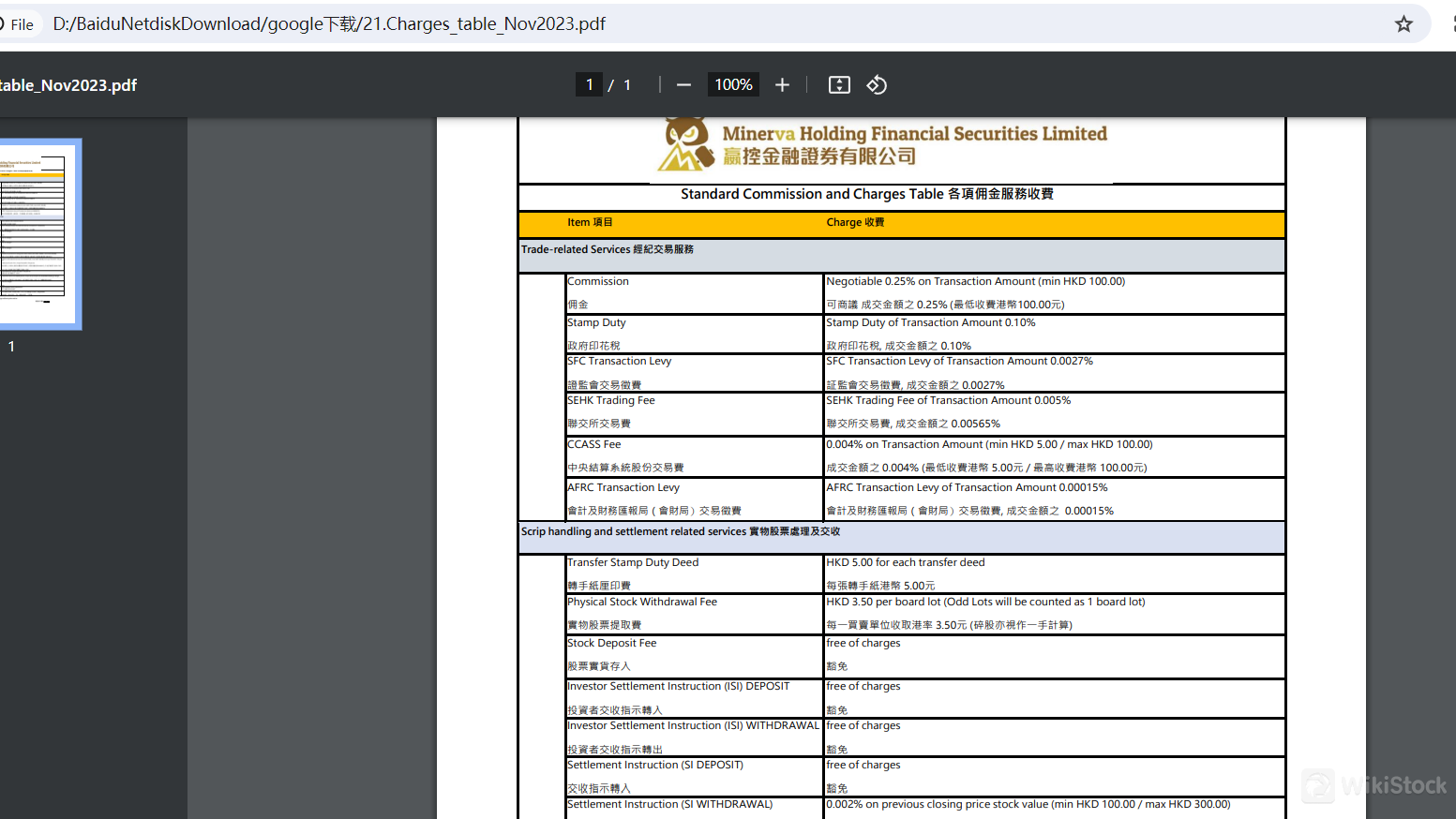

Minerva Holding Financial Securities Fees Review

Minerva Holding Financial Securities Limited offers a detailed fee structure for its various services.

For trade-related services, the commission is negotiable but typically set at 0.25% of the transaction amount with a minimum charge of HKD 100.00. Additionally, clients incur a stamp duty of 0.10% on the transaction amount, an SFC transaction levy of 0.0027%, an SEHK trading fee of 0.005%, and a CCASS fee of 0.004%, which ranges between a minimum of HKD 5.00 and a maximum of HKD 100.00. An AFRC transaction levy of 0.00015% is also applied.

In terms of scrip handling and settlement services, there is a transfer stamp duty of HKD 5.00 per transfer deed and a physical stock withdrawal fee of HKD 3.50 per board lot, with odd lots being counted as one board lot. Depositing stock is free of charge. Investor Settlement Instruction (ISI) deposits and withdrawals are also free. However, settlement instruction withdrawals incur a fee of 0.002% of the previous closing price of the stock value, with a minimum charge of HKD 100.00 and a maximum of HKD 300.00. Dividend collection attracts a fee of 0.38% of the dividend amount, with minimum and maximum charges of HKD 25.00 and HKD 100.00 respectively, plus a script fee of HKD 1.50 per lot.

The fee for exercising warrants, rights issues, or open offers includes a corporate action fee of HKD 0.80 per lot, a script fee of HKD 1.50 per lot, and a handling charge of HKD 20.00. Custody fees are free, while electronic IPO applications cost HKD 20.00 per transaction. Overdue interest for cash clients is charged at the prime rate plus 7%, whereas for margin clients, it is negotiable.

These charges are for reference and are subject to change without prior notice. The updated charges are effective from December 2023.

Minerva Holding Financial Securities App Review

Minerva Holding Financial Securities Limited offers two key mobile applications to enhance the trading experience: the Trading App and the Token App.

The Trading App is designed to provide users with a seamless, fast, and efficient platform for trading a variety of securities. It offers real-time market data, easy order placements, and portfolio management tools. This app is tailored to meet the needs of both novice and experienced traders, ensuring they have all the necessary tools to make informed trading decisions.

The Token App focuses on the security and convenience of the trading process. It provides a secure way to manage and authenticate transactions, ensuring that all trading activities are protected against unauthorized access. The app employs advanced encryption and authentication methods to safeguard user data and transactions.

Both apps are integral to Minerva's commitment to creating a simple, fast, and diversified trading experience, aiming to satisfy the needs of their diverse client base.

Research and Eduation

Minerva Holding Financial Securities Limited emphasizes robust research and education to support its clients. The Market section in their platform offers comprehensive news coverage, including Finance News, Local News, Greater China News, World News, and IPO News. This ensures that traders stay informed about market trends and significant financial events.

Additionally, Minerva provides an Education Centre, accessible here, which is a valuable resource for both new and experienced investors. The Education Centre includes tutorials, guides, and detailed articles to help users understand various aspects of trading and investment strategies. This focus on education and up-to-date information helps clients make informed decisions and enhances their overall trading experience.

Customer Service

Minerva Holding Financial Securities Limited provides comprehensive customer support to ensure client satisfaction. Their contact options include a dedicated phone line (3741 8000), a fax number (2530 4054), and an email address (cs@minervasec.hk). For instant messaging, they offer WhatsApp (852-65266548), WeChat, and LINE services.

Their support team is located at Unit 1804, 18/F, Far East Finance Centre, 16 Harcourt Road, Admiralty, Hong Kong. Additionally, their website (www.minervasec.hk) is protected by reCAPTCHA, ensuring the security of user interactions.

This extensive array of contact methods reflects Minerva's commitment to accessible and responsive customer service.

Conclusion

Minerva Holding Financial Securities is a regulated broker offering a secure and user-friendly trading environment. They provide a range of securities, including stocks, bonds, mutual funds, and ETFs. The platform features advanced mobile apps, comprehensive customer support, and extensive educational resources. However, some fees may be higher compared to other brokers, and specific details on fund insurance coverage are not clearly provided.

FAQs

Is Minerva Holding Financial Securities safe to trade?

Yes, Minerva Holding Financial Securities is regulated by the Securities and Futures Commission (SFC) of Hong Kong, ensuring compliance with stringent financial regulations. They also implement advanced encryption technologies and robust account security measures to protect client funds and data.

Is Minerva Holding Financial Securities a good platform for beginners?

Yes, Minerva offers user-friendly mobile apps and extensive educational resources, including tutorials and guides, making it suitable for beginner traders.

Is Minerva Holding Financial Securities legit?

Yes, Minerva Holding Financial Securities is a legitimate company regulated by the SFC, providing a secure and compliant trading environment.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Colombia

ColombiaObtain 1 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)