We strive daily to better ourselves and be one of the safest brokers in the industry. We offer a wide range of assets, leading platforms, and generous trading terms. FinPros is committed to delivering a place where people can invest and trade with confidence. An innovative and reliable environment, offering first-class personal service and uncompromising honesty.

What is FinPros?

FinPros is a forex and CFD broker based in the Seychelles, regulated by the Seychelles Financial Services Authority. They offer a range of trading services and features, including tradable currencies, stocks, metals, energies, and indices, multiple account types, and competitive fees.

Pros & Cons of FinPros

Pros: Wide range of assets: FinPros provides access to a diverse range of investment products and services, including currencies, stocks, metals, energies, and indices.

Advanced trading platforms: FinPros utilizes the award-winning MT5 platform with advanced charting tools and automated trading capabilities.

Social trading features: Customers are able to connect with other traders, view their portfolios, and potentially copy their trades through the FinPros Social App.

Rich educational resources: Access a blog, FAQ section, seminars, and a glossary to learn more about trading and develop traders' skills'

Cons: Restricted regions: FinPros does not offer services to residents of various countries, including the United States, Russia, and several others due to legal and regulatory restrictions.

Is FinPros Safe?

Regulations

FinPros operates under the regulatory oversight of the Seychelles Financial Services Authority (FSA). This regulatory body sets and enforces rules for financial institutions operating within the Seychelles jurisdiction, ensuring adherence to financial regulations and investor protection measures. Their license number, SD087, further confirms their authorization to act as a Securities Dealer.

Fund Safety

FinPros maintains client money in separate bank accounts, distinct from their own operating funds. This segregation helps to protect assets in case of unforeseen circumstances. Additionally, they have professional indemnity insurance in place, complying with regulatory requirements. This insurance provides coverage for potential claims arising from the conduct of current and past employees, offering an extra layer of protection for financial assets.

Safety Measures

FinPros offers a secure trading environment with a multi-layered approach to protecting data and accounts. They utilize top-level data encryption for all online interactions, employ a two-factor authentication process for added login security, and allow customers to set a personal PIN for further control within their account. These measures, combined with regulatory oversight by the Seychelles Financial Services Authority, provide peace of mind and a safe platform for your trading activities

FinPros utilizes a robust trading engine with a built-in failsafe mechanism. This involves a duplicate trading engine located in a separate data center within mainland Europe. This backup system ensures real-time trade mirroring, providing additional security and minimizing potential disruptions in the event of technical issues

What are Securities to Trade with FinPros?

FinPros offers a diverse range of securities for trading, including currencies,stocks, metals, energy, and indices.

However, they don't provide bonds or futures.

Currencies: Trade major and minor currencies, allowing you to capitalize on currency fluctuations and potentially hedge against foreign exchange risk.

Stocks: Gain exposure to companies across all major market sectors, including energy, technology, healthcare, communications, financials, real estate, and materials. This provides access to a broad universe of investment opportunities.

Metals: Invest in precious metals like gold and silver, which can act as a safe haven during market volatility.

Energy: Trade energy commodities like oil and natural gas, which are essential resources and can be influenced by global economic conditions.

Indices: Gain exposure to a basket of assets through index trading, offering diversification and potentially mirroring the performance of specific markets or sectors.

FinPros Accounts

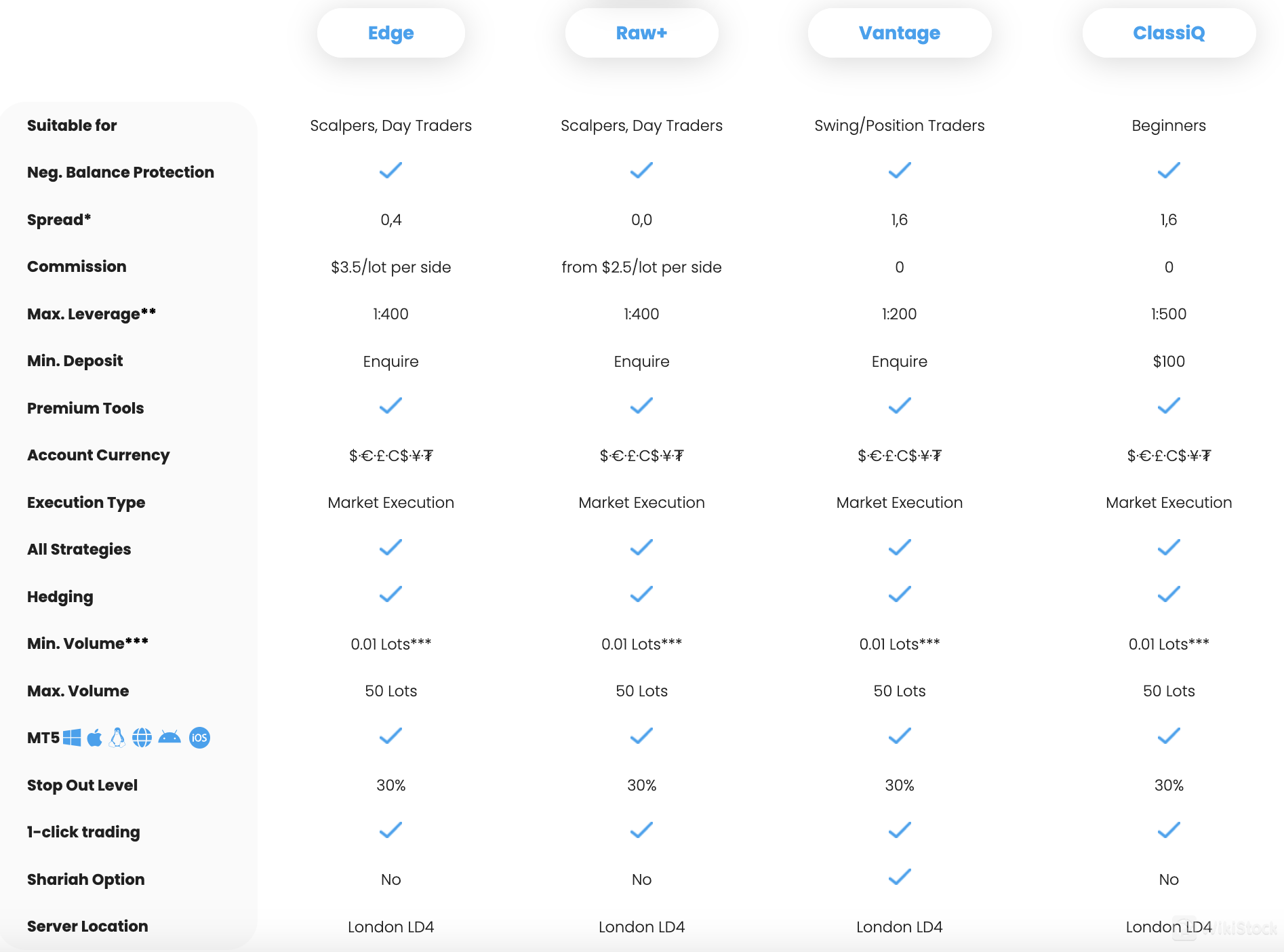

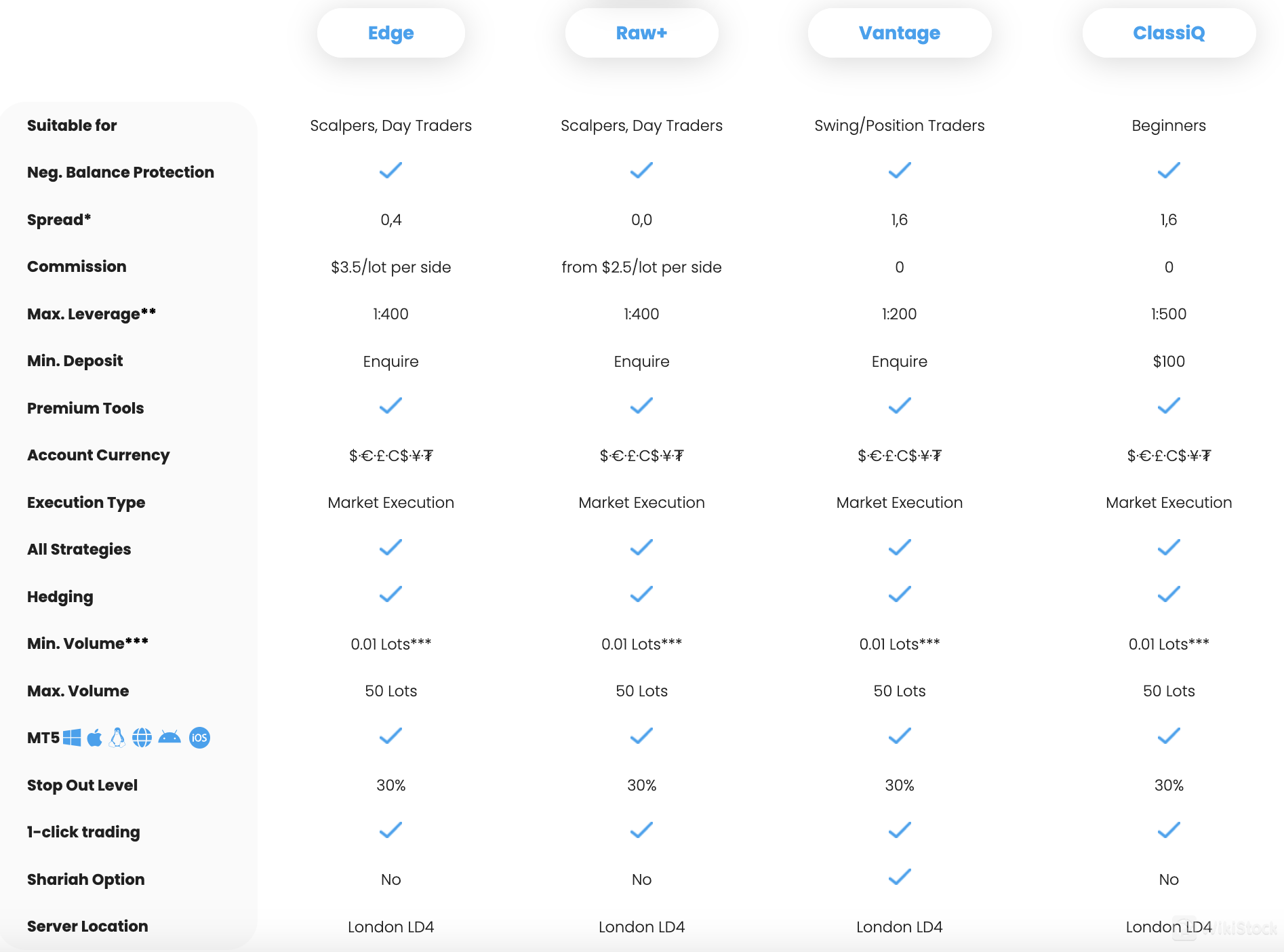

FinPros offers a variety of account types for different trading styles and risk appetites:

Edge and Raw+: These accounts are designed for scalpers and day traders who prioritize tight spreads and high leverage. Edge offers the tightest spreads (0.4 pips) but has a higher commission ($3.5/lot per side) compared to Raw+ (from $2.5/lot per side) with slightly wider spreads (1.6 pips).

Vantage: This account is suitable for swing and position traders who hold positions for longer periods. It offers commission-free trading and the tightest spreads (0.0 pips), but with lower maximum leverage (1:400) compared to Edge and Raw+.

ClassiQ: This account is ideal for beginners due to its low minimum deposit ($100) and commission-free trading.However, it has wider spreads (1.6 pips) and the highest maximum leverage (1:500), which can amplify potential losses.

FinPros Fees Review

FinPros offers a varied fee structure depending on the chosen account type. Some accounts, like ClassiQ, have no commission fees, while others like Edge and Raw+ charge commissions starting from $2.5/lot per side. Spreads also vary, with Edge offering the tightest at 0.4 pips, Vantage at 0.0 pips, and ClassiQ and Raw+ starting from 1.6 pips.

Minimum margin requirements, however, will also vary based on other factors. Account type, account size, market instrument, trading style, and market conditions at the time.

The minimum margin requirement for stocks is 10%.

FinPros App Review

inPros offers a comprehensive trading experience through its mobile app and the MT5 platform.

FinPros Social App: Available on iOS and Android devices, the FinPros Social App connects customers with a vast community of traders. Customers can view portfolios, analyze stats, and copy trades.

MT5 Platform: FinPros utilizes the award-winning MetaTrader 5 platform, known for its advanced charting tools, automated trading, and user-friendly interface.

Research & Education

FinPros recognizes the importance of education and provides a range of resources to support traders of all levels. Their educational offerings include:

Blog: Regularly updated with articles and insights on various trading topics, market trends, and investment strategies.

FAQ: A comprehensive section addressing common questions and concerns about trading with FinPros, platform features, and account management.

Seminars: Educational webinars and seminars covering diverse trading topics, often hosted by experienced professionals and analysts.

Glossary: A helpful resource defining key financial terms and concepts relevant to trading.

Customer Service

FinPros offers a dedicated customer service team to assist clients with their inquiries and concerns. Customers can reach them through:

Email: SupportPros@FinPros.com

Address: CT House, Office 4A, Providence, Mahe, Seychelles

Conclusion

FinPros offers a diverse range of trading services and features. It prioritizes security with robust data encryption, two-factor authentication, and personal PINs. Its educational resources, including a blog, FAQ, seminars, and glossary, empower traders to make informed decisions and develop their skills.

FAQs

Is FinPros safe to trade?

Yes, FinPros operates under the regulatory oversight of the Seychelles Financial Services Authority (FSA). Additionally, FinPros utilizes security measures like data encryption and two-factor authentication.

Is FinPros a good platform for beginners?

Yes, FinPros offers educational resources like a blog, FAQ, and glossary, which can be helpful for beginners.

Is FinPros legit?

Yes, FinPros is a legitimate brokerage firm regulated by the FSA.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Japan

JapanObtain 1 securities license(s)

--