Lei Shing Hong Limited (“LSH”) is a major international conglomerate with headquarters in Hong Kong SAR. Our four core businesses comprise Automobile Distribution, Machinery & Equipment Distribution, Property Investment & Development and Financial Services. Incorporated in Hong Kong SAR in 1993, Lei Shing Hong Securities Limited is a proud member of the HKEx since 1996 and has been providing brokerage services and margin financing to our customers including both corporate and individuals clients. On top of the Hong Kong SAR market ( including Stock Connect and China B shares ), we also cover major markets in other regions.

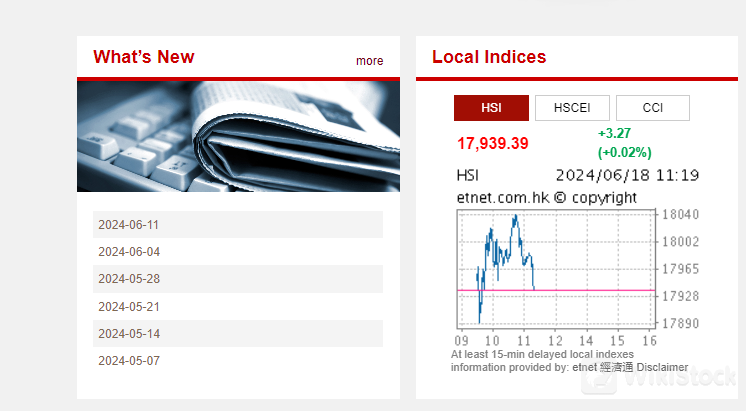

Prime China Securities Information

Prime China Securities is a brokerage firm known for its low commission rate of 0.25% per trade, with a minimum charge of HK $100, making it a cost-effective choice for trading.

The company offers a user-friendly trading app available on both Google and iOS app stores, along with a web trading platform and mobile app, meeting the modern investor's need for accessibility and convenience.

However, it does not currently offer any promotions, which will be a drawback for potential clients looking for initial incentives.

Pros & Cons

Pros:

Prime China Securities is regulated by the SFC, enhancing trust and compliance. It offers a unique trading app available on both web and mobile platforms, provides access to a wide variety of securities, and supports diverse account types for individual and corporate clients. The firm is well-connected with both Hong Kong and Mainland trading markets.

Cons:

The firm charges high commissions of HK$100 per trade, which may deter frequent traders. Additionally, it offers a low interest rate of 1.47% on uninvested cash, less attractive compared to potential market returns.

Is Prime China Securities Safe?

Regulations:

Prime China Securities is regulated by the Securities and Futures Commission (SFC) of Hong Kong, which is an independent statutory body responsible for regulating the securities and futures markets in Hong Kong.

The SFC operates independently of the Hong Kong government and is financed by levies and fees charged under the Securities and Futures Ordinance and its subsidiary legislation. The license number is:BHG557

Funds Safety:

Prime China Securities adheres to the regulatory guidelines set by the Securities and Futures Commission (SFC) of Hong Kong, which mandates the separation and protection of client funds.

These regulations ensure that client assets are held in segregated accounts, distinct from the company's funds, providing a layer of safety against the misuse of client money and financial stability risks.

Safety Measures:

Prime China Securities employs standard security measures to protect the integrity and confidentiality of client information and financial transactions. These typically include the use of encryption technologies to secure fund storage and data transmission.

Additionally, they are likely to implement various account safety measures to prevent unauthorized access and information leakage, although specific methods are not detailed.

Clients are advised to contact the firm directly for more detailed information on their security practices and measures to protect client assets and data.

What are securities to trade with Prime China Securities?

Prime China Securities offers trading in a variety of securities that meet diverse investment needs.

This includes equities in major companies listed on both Hong Kong and Mainland China markets, providing investors with ample opportunities to invest in leading and emerging businesses across a wide range of industries. The brokerage allows access to these markets through both its unique web and mobile trading platforms, facilitating an efficient trading experience for both individual and institutional clients.

The firm also supports trading in derivatives, which can include options and futures, offering clients additional financial instruments to hedge their investments or speculate on future prices. These derivatives are valuable tools for managing risk or taking advantage of market movements without necessarily owning the underlying assets.

Furthermore, Prime China Securities enables the trading of mutual funds, offering investors a way to gain exposure to a diversified portfolio of assets managed by professionals. Mutual funds are a popular choice for those who prefer to invest in a collection of assets that are managed by experts, potentially reducing the risk and complexity involved in individual stock selection.

Lastly, the platform provides access to bonds, which can be an attractive investment for those looking for steady income and lower risk compared to stocks. Bonds issued by corporations and governments are available, allowing investors to lend money in return for regular interest payments, along with the principal amount at the bonds maturity.

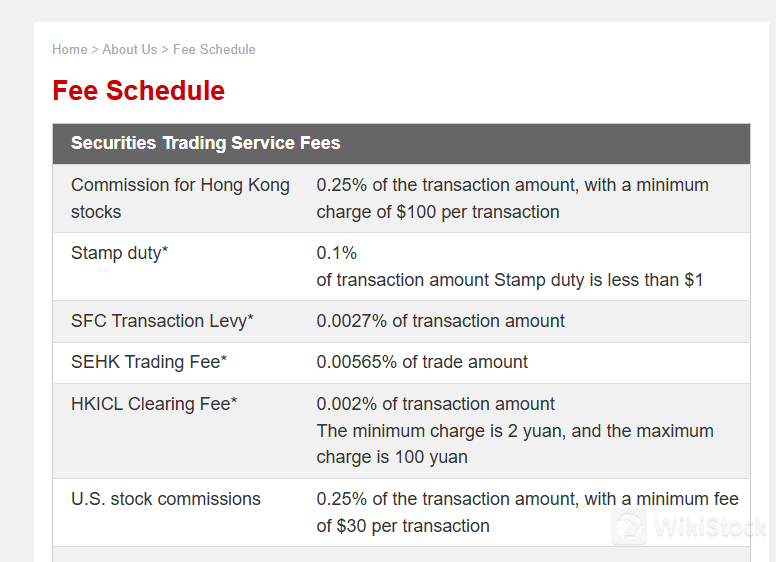

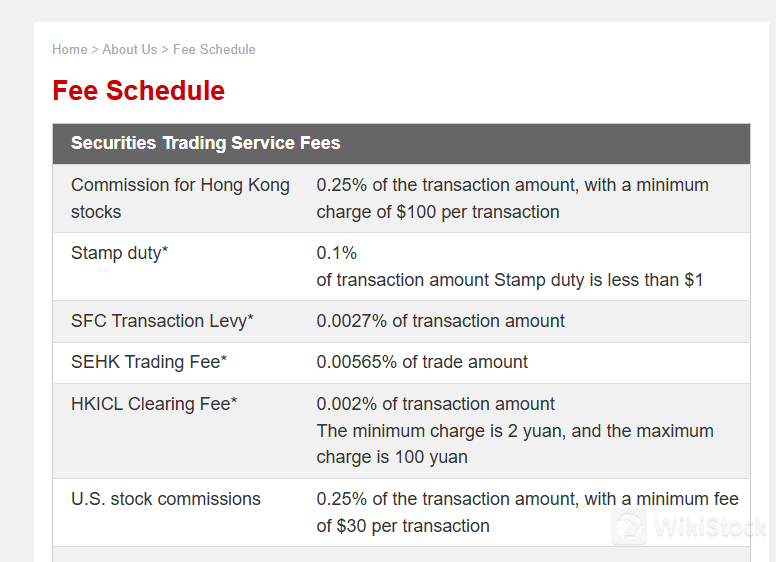

Prime China Securities Fee Review

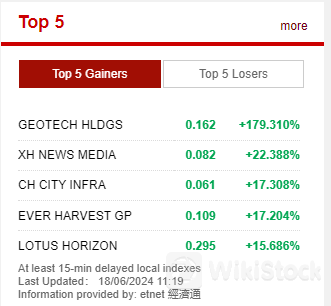

Prime China Securities offers a detailed and varied fee structure for different services and markets, outlined as follows:

Hong Kong Stock Transactions:

Commission is charged at 0.25% of the transaction amount, with a minimum fee of 100 yuan per transaction.

Additional costs include stamp duty at 0.1%, SFC transaction levy at 0.0027%, SEHK trading fee at 0.00565%, and a settlement company settlement fee at 0.002% (minimum 2 yuan, maximum 100 yuan).

US Stock Transactions:

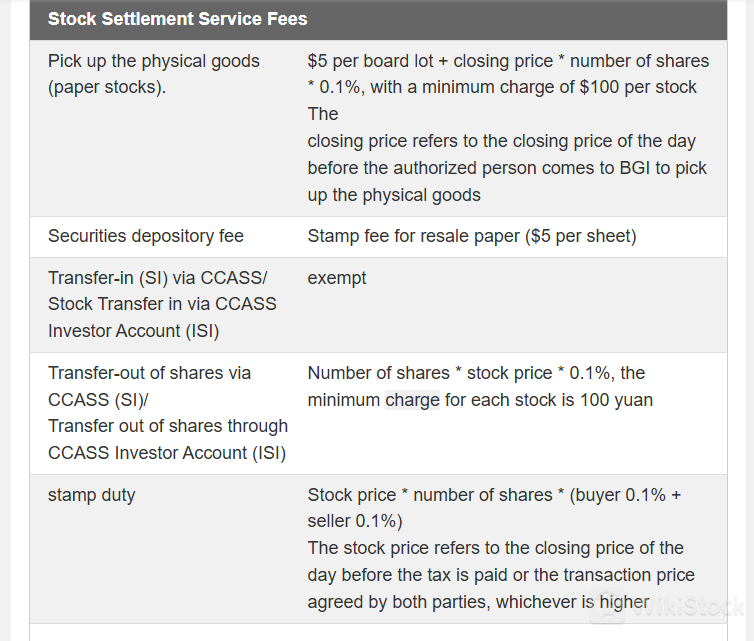

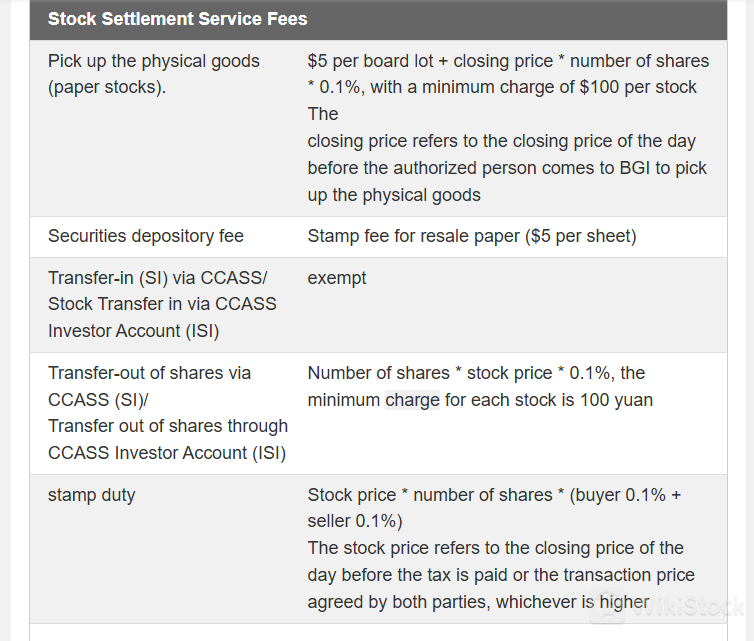

Stock Settlement Service Fees:

For withdrawing physical stocks, the fee is 5 yuan per lot plus 0.1% of the closing price times the number of shares, with a minimum charge per stock of 100 yuan.

Securities storage is charged at 5 dollars per piece for resold paper stocks.

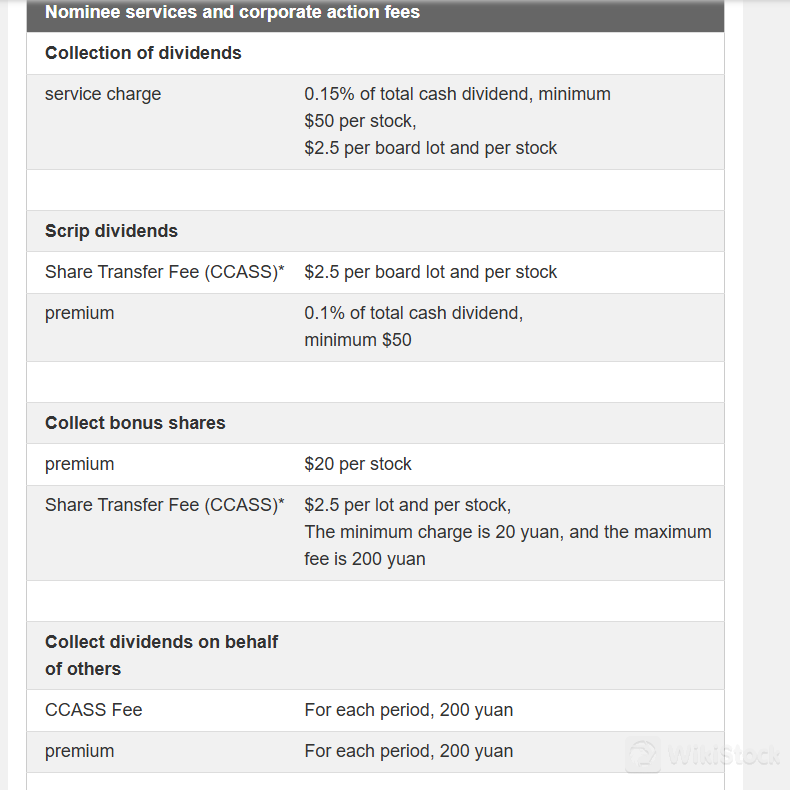

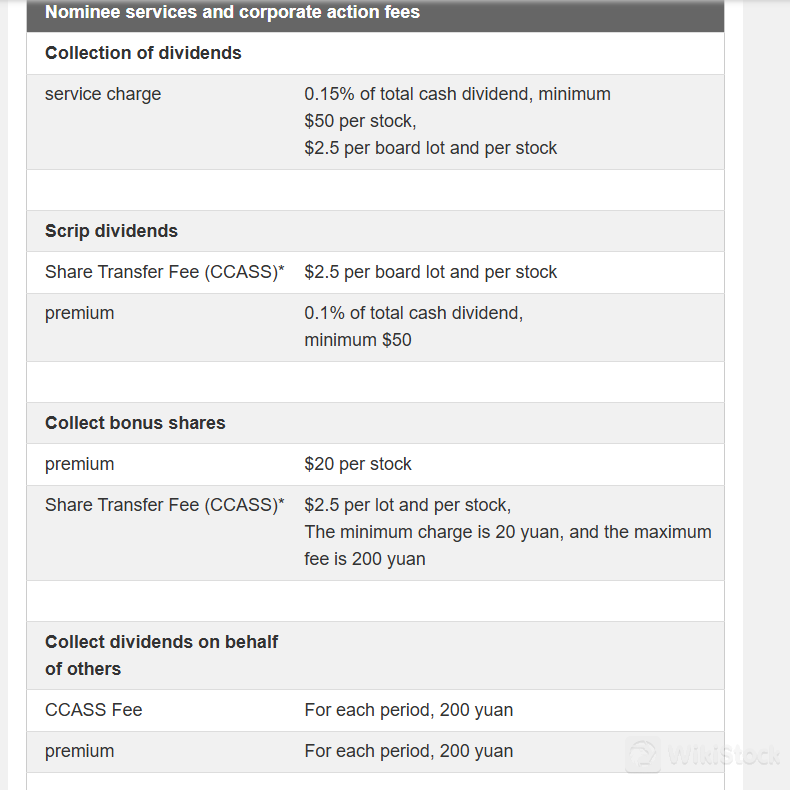

Agency Services and Corporate Action Fees:

Dividend collection is subject to a service charge of 0.15% of the total cash dividend, with a minimum charge of 50 yuan per stock.

Handling fees for scrip dividends and bonus shares collection are 0.1% of total dividends with a minimum of 50 yuan and 20 yuan per stock respectively

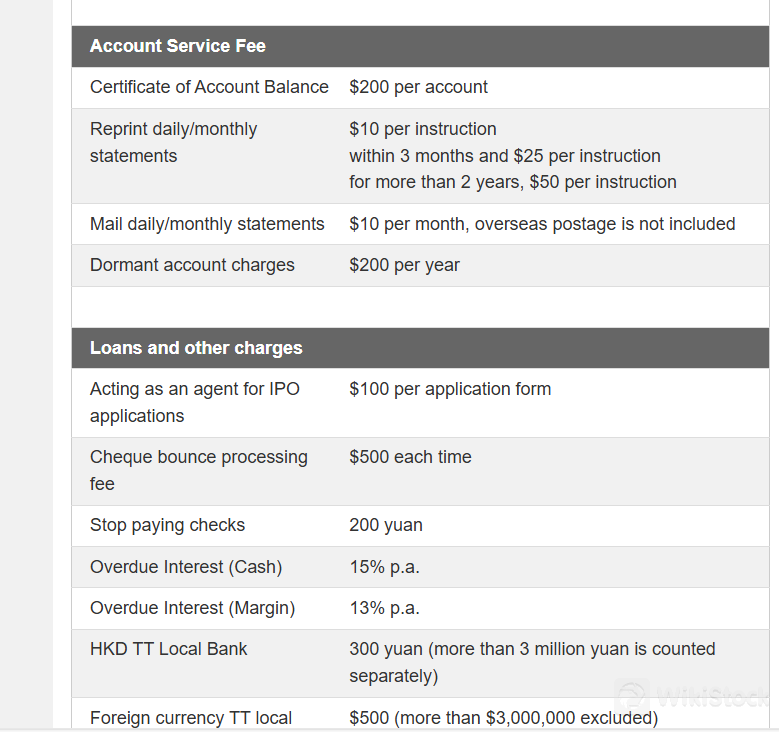

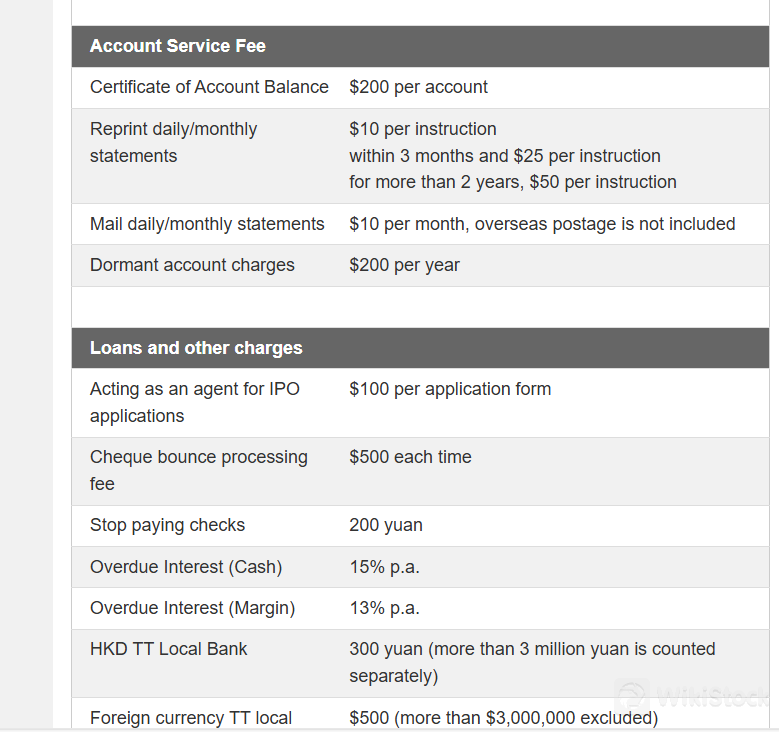

Account Service Fees:

Loans and Other Charges:

Shanghai-Hong Kong and Shenzhen-Hong Kong Stock Connect:

China B Shares (Settled in Hong Kong dollars):

Miscellaneous Fees:

| Category |

Details |

Fees |

| A. Trade-related Services |

|

|

| Brokerage Commission |

Standard rate for transactions |

0.25% of transaction amount, Min: HK$100.00 per transaction |

| Stamp Duty |

|

0.10% on transaction amount ($1.00 per $1,000 of trading amount), rounded up |

| Transaction Levy |

|

0.0027% on transaction amount, Min: HK$0.01 |

| Trading Fee |

|

0.00565% on transaction amount |

| FRC Transaction Levy |

|

0.00% |

| CCASS Fee |

|

0.01% on transaction amount, Min: HK$3.00, Max: HK$300 |

| B. Scrip Handling and Settlement-Related Services |

|

|

| Settlement Instruction (S.I.) / Investor Settlement Instruction (I.S.I) |

For stocks transferred out |

0.01% of total consideration using closing price on the previous trading date, rounded up, Min: HK$100 per stock |

| Stocks transferred in |

|

Free |

| Compulsory Share Buy-Back Fee |

|

HK$500.00 per stock |

| Withdrawal of Physical Scrip |

|

Min charge: HK$100.00 per stock; HK$5.00 per board lot (1st to 100th), HK$6.00 per board lot (101st or above) |

| Deposit of Physical Scrips |

|

HK$5.00 per board lot for stamp duty |

| Administration Fee – Physical Script Deposit in Bulk Quantity |

More than 10 physical deeds of the same stock in a single day |

HK$10.00 per deed from the 11th deed onward |

| C. Nominee Services and Corporate Actions |

|

|

| Collection of Dividends (cash and scrip) |

|

HK$30.00 per item, Min: HK$30.00, Max: HK$10,000.00; CCASS Services Fee: 0.12% of cash dividend amount |

| Share Consolidation / Split |

|

HK$30.00 per action |

| Registration and Transfer Fee |

First registration with CCASS |

HK$2.0 per lot |

| Dividend / Bonus Shares Claim |

|

HK$500.00 per stock per distribution plus HK$200.00 CCASS charges if necessary |

| Exercise Warrants / Rights |

|

HK$100.00 per instruction, HK$0.80 per board lot, Max: HK$10,000.00 |

| D. Financing and Other Services |

|

|

| Penalty for Late Settlement Transaction |

|

Interest at Chong Hing Bank Lending rate + 3% on total late settlement amount |

| Margin Account Financing Charge |

|

Interest at Chong Hing Bank Lending rate + 2.8% on total loan amount |

| I.P.O. Handling Charges |

Cash subscription and financing subscription |

HK$40.00 (cash), HK$100.00 (financing) |

| Fund Withdrawal |

Cheque (local banks), Transfer/T.T./CHATS (local and overseas banks) |

Free for cheque; HK$200.00 per instruction (in English), HK$350.00 per instruction (in Chinese) plus additional bank charges |

| Return Cheque Handling Charges |

|

HK$150.00 per return cheque |

Prime China Securities Trading Platform Review

The trading platform of Prime China Securities Limited is accessed through the “Prime China Securities APP,” which is available on both Google Play and the iOS App Store.

This platform allows clients to engage in online trading, providing a convenient and accessible way to manage transactions and monitor the Hong Kong stock market.

Research & Education

Prime China Securities offers extensive market research and potential educational resources, focusing on the latest economic trends, international relations, and sector-specific analyses.

Recent articles indicate a keen insight into issues like the Taiwan Strait tensions and the strategic maneuvers between China and the U.S., suggesting a depth of analysis that could benefit both seasoned and novice investors.

Customer Service

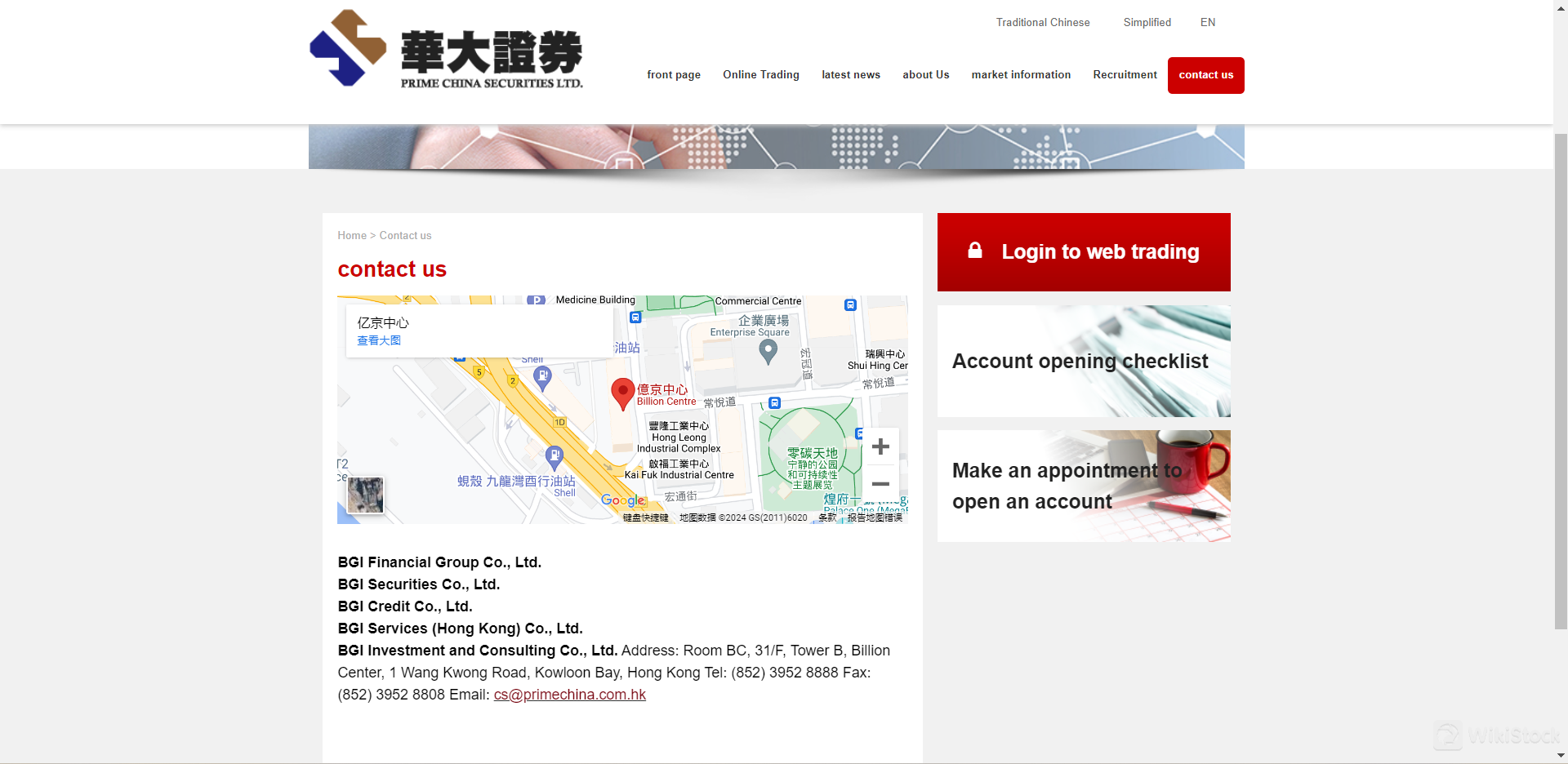

Prime China Group provides customer support through its various subsidiaries including Securities Co., Ltd., Credit Co., Ltd., Services (Hong Kong) Co., Ltd., and Investment and Consulting Co., Ltd. Located at Room BC, 31/F, Tower B, Billion Center, 1 Wang Kwong Road, Kowloon Bay, Hong Kong, the company offers multiple channels for client communication.

Customers can contact BGI via phone at (852) 3952 8888, by fax at (852) 3952 8808, or through email at cs@primechina.com.hk, ensuring a range of options for support, inquiries, and services.

Conclusion

Prime China Securities is a financial services firm based in Hong Kong, known for its robust online and mobile trading platforms that facilitate easy access to both local and international markets.

The company offers competitive brokerage fees and provides a diverse range of account types for individual and corporate clients, enhancing connectivity between Hong Kong and Mainland China trading markets.

FAQs

China

ChinaObtain 1 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)

--

--