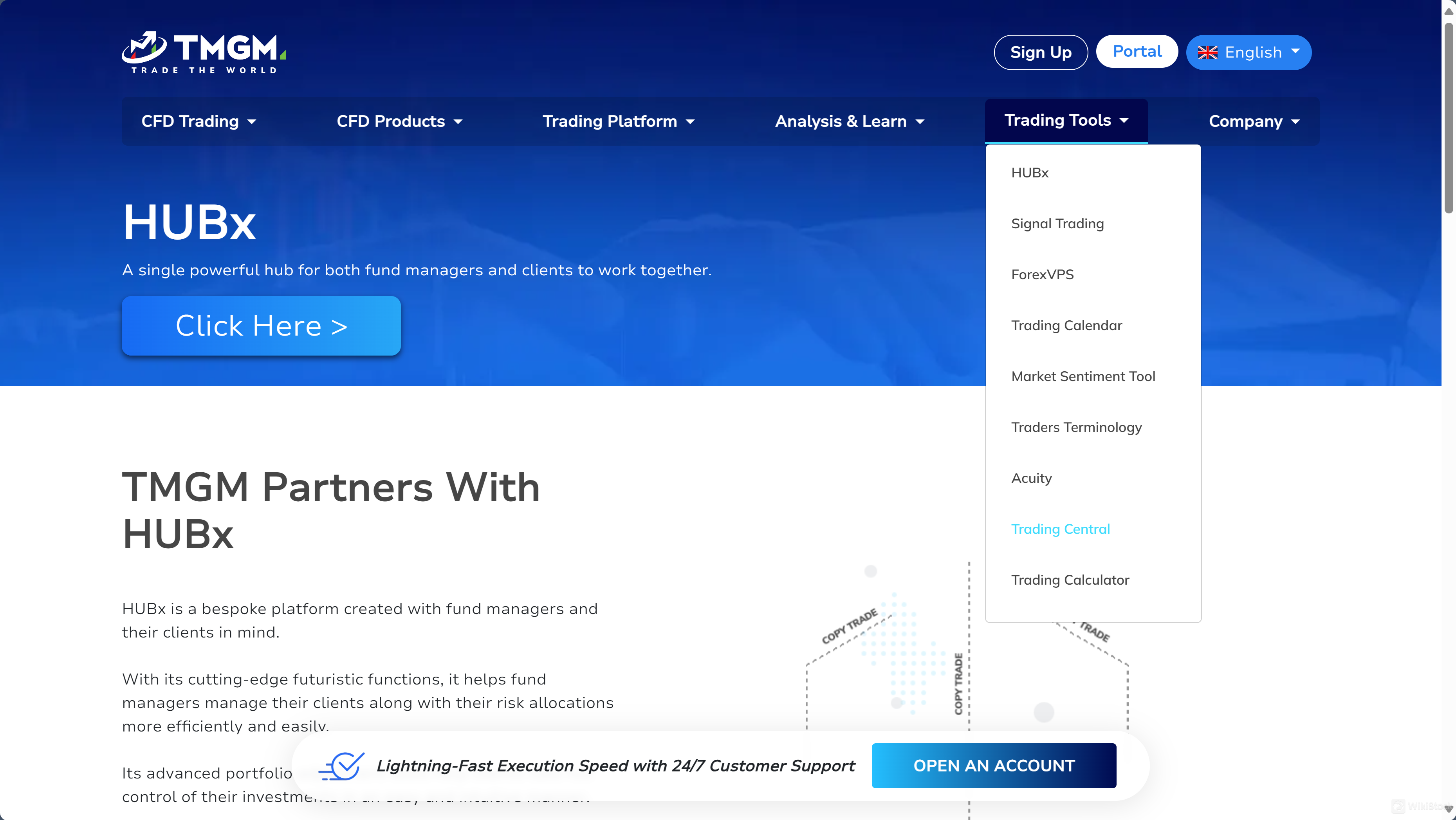

HUBx:HUBx is TMGMs advanced trading platform feature designed to provide an efficient trading experience. It integrates various trading functionalities and tools into a single interface, allowing traders to manage their trades, monitor the markets, and execute orders with ease.

Signal Trading:TMGM offers Signal Trading tools and services that provide trade signals to guide traders in making informed decisions. These signals are generated by experienced analysts and automated systems, offering insights into potential trading opportunities based on technical and fundamental analysis.

ForexVPS:ForexVPS is a Virtual Private Server service provided by TMGM to ensure uninterrupted trading operations. This service is especially beneficial for traders who use automated trading systems, as it provides a stable and fast connection to the trading servers, reducing latency and the risk of downtime.

Trading Calendar:TMGMs Trading Calendar is a useful resource that lists all important trading events, economic releases, and key dates that can affect the markets. Traders can use this calendar to stay informed about upcoming events and plan their trading strategies accordingly.

Market Sentiment Tool:The Market Sentiment Tool offered by TMGM provides insights into the prevailing market sentiment, helping traders gauge the mood of the market. This tool can be invaluable in understanding the collective behavior of traders and anticipating potential market movements based on sentiment analysis.

Traders Terminology:TMGM provides a glossary of trading terms through its Traders Terminology resource. This glossary helps traders familiarize themselves with the language of the market, ensuring they can understand and communicate effectively within the trading community.

Acuity:Acuity is a set of tools provided by TMGM that offer additional market analysis and insights. These tools use advanced algorithms and data analysis techniques to provide traders with valuable information that can aid in making more informed trading decisions.

Trading Central:Trading Central is a resource that offers technical analysis and trading strategies to TMGM clients. It provides detailed charts, indicators, and trading signals that help traders identify potential trading opportunities and develop effective trading strategies.

Trading Calculator:TMGMs Trading Calculator is a useful tool that helps traders calculate potential profits, losses, and margin requirements for their trades. By using this calculator, traders can better manage their risk and make more informed decisions about their trades.

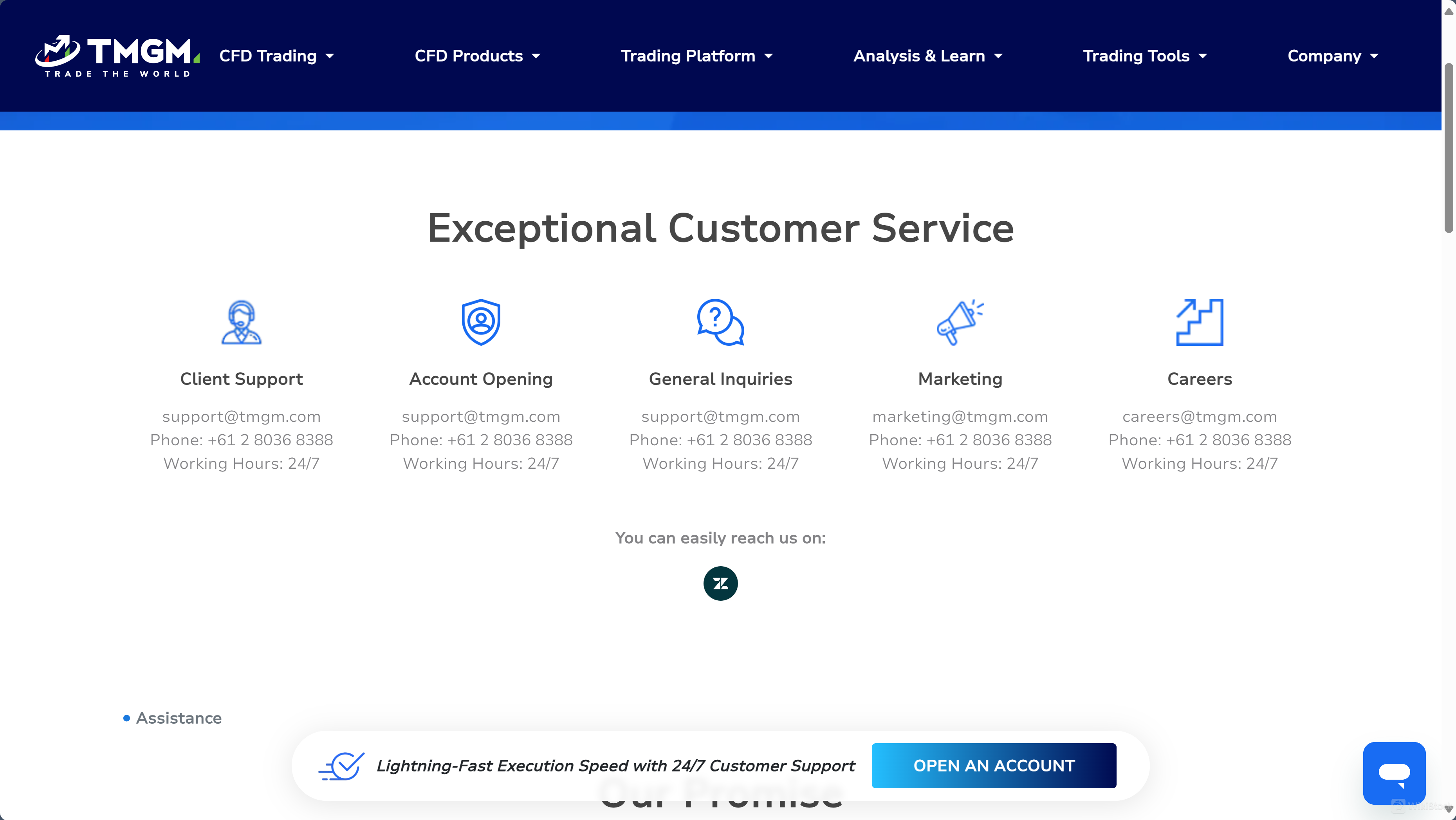

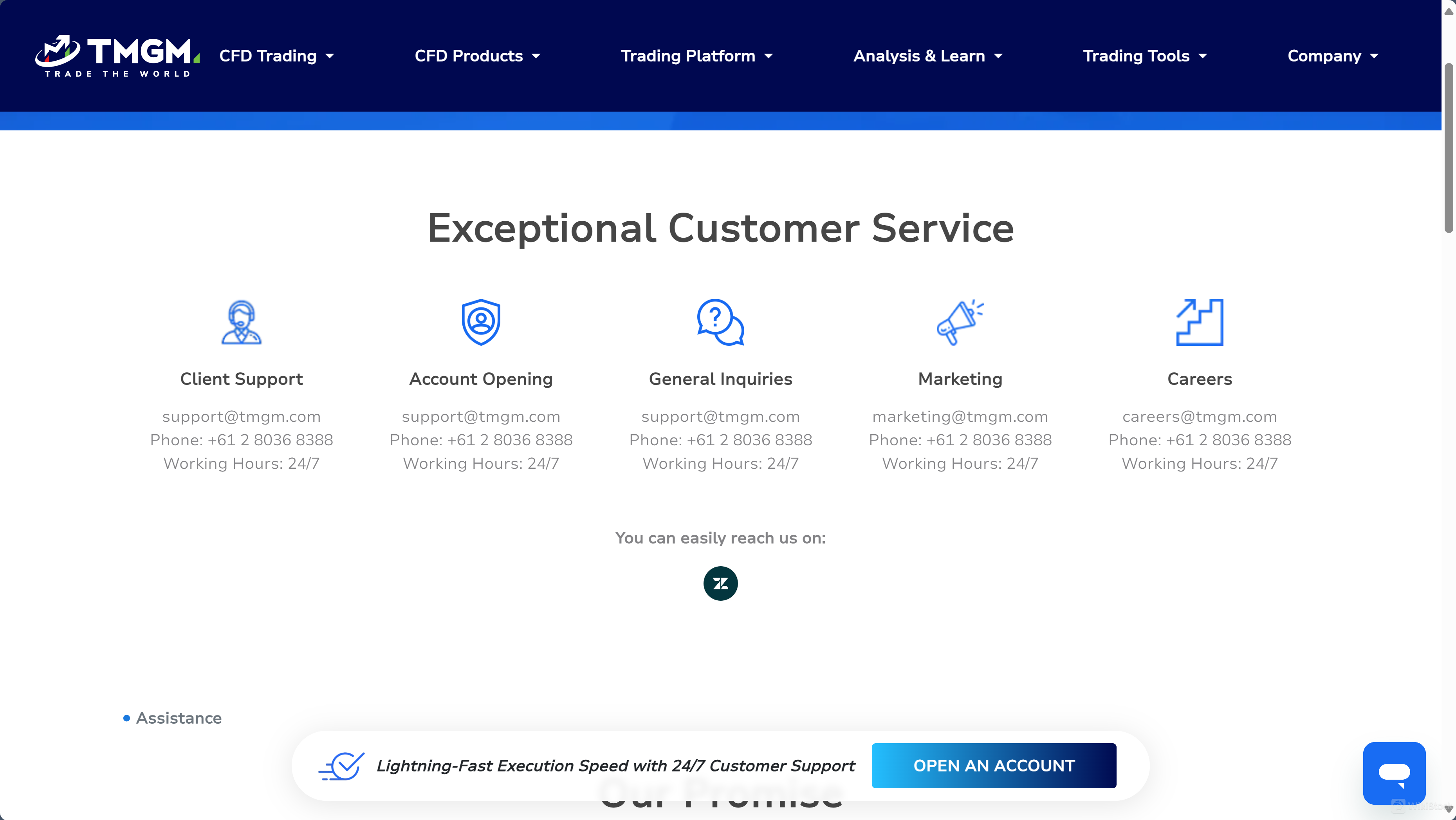

Customer Service

TMGM provides efficient customer support to address various needs and inquiries. The support team is available 24/7, ensuring that assistance is always at hand, regardless of the time or day.

Client Support is available 24/7 to assist with any trading-related inquiries. You can reach them via email at support@tmgm.com or by phone at +61 2 8036 8388, ensuring help is always at hand whenever needed.

Account opening assistance is provided around the clock to help new clients set up their trading accounts. Contact them via email at support@tmgm.com or by phone at +61 2 8036 8388 for support with the account registration process.

For General Inquiries, TMGM offers 24/7 support through the same contact points. Email support@tmgm.com or call +61 2 8036 8388 for any questions or information about their services.

The Marketing team is available to discuss promotional activities and marketing-related queries. They can be contacted at marketing@tmgm.com or by phone at +61 2 8036 8388, with support available 24/7.

For those interested in careers at TMGM, the HR team is available to answer any job-related questions. Reach out to them at careers@tmgm.com or by phone at +61 2 8036 8388, with support available 24/7.

Conclusion

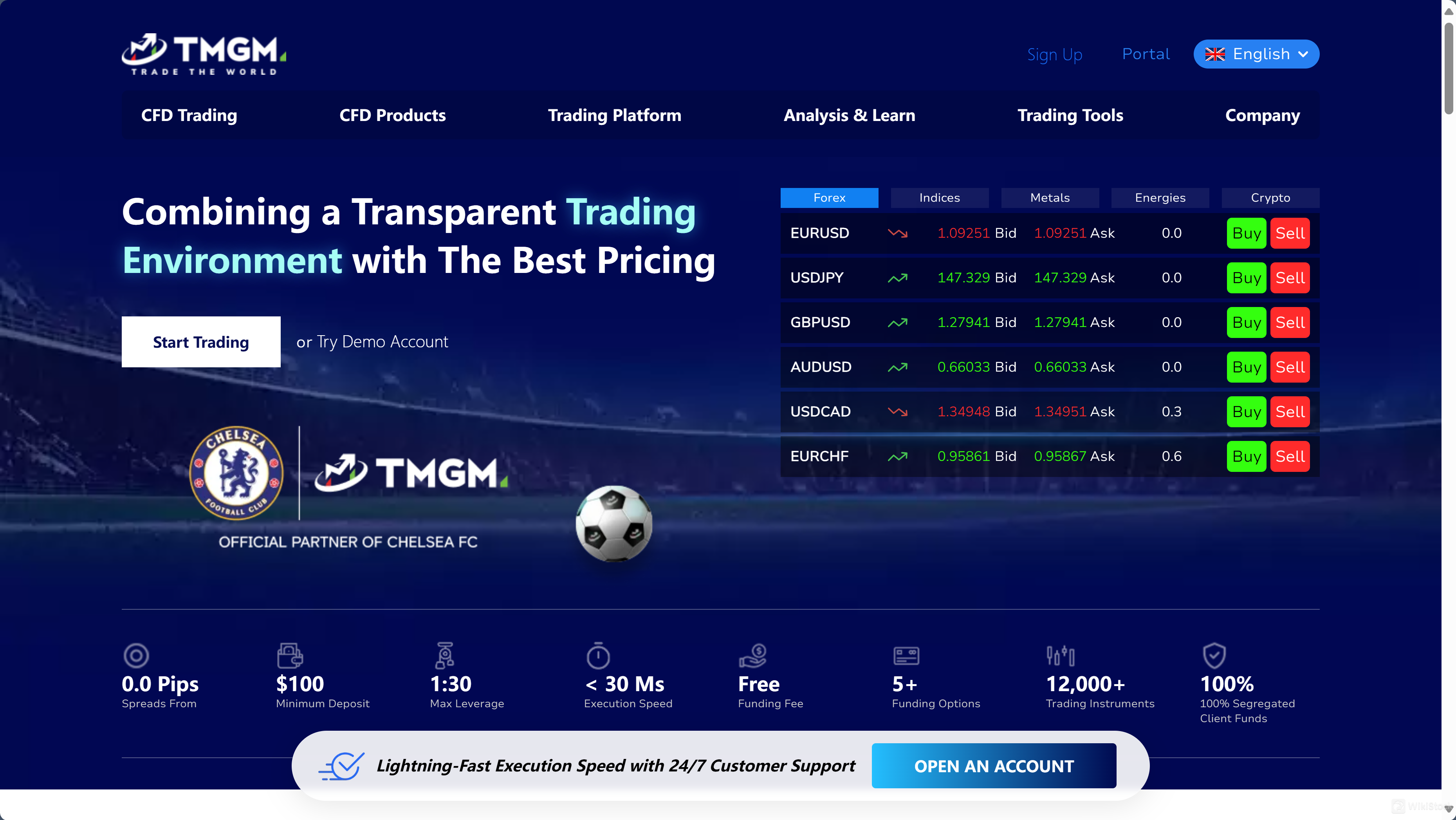

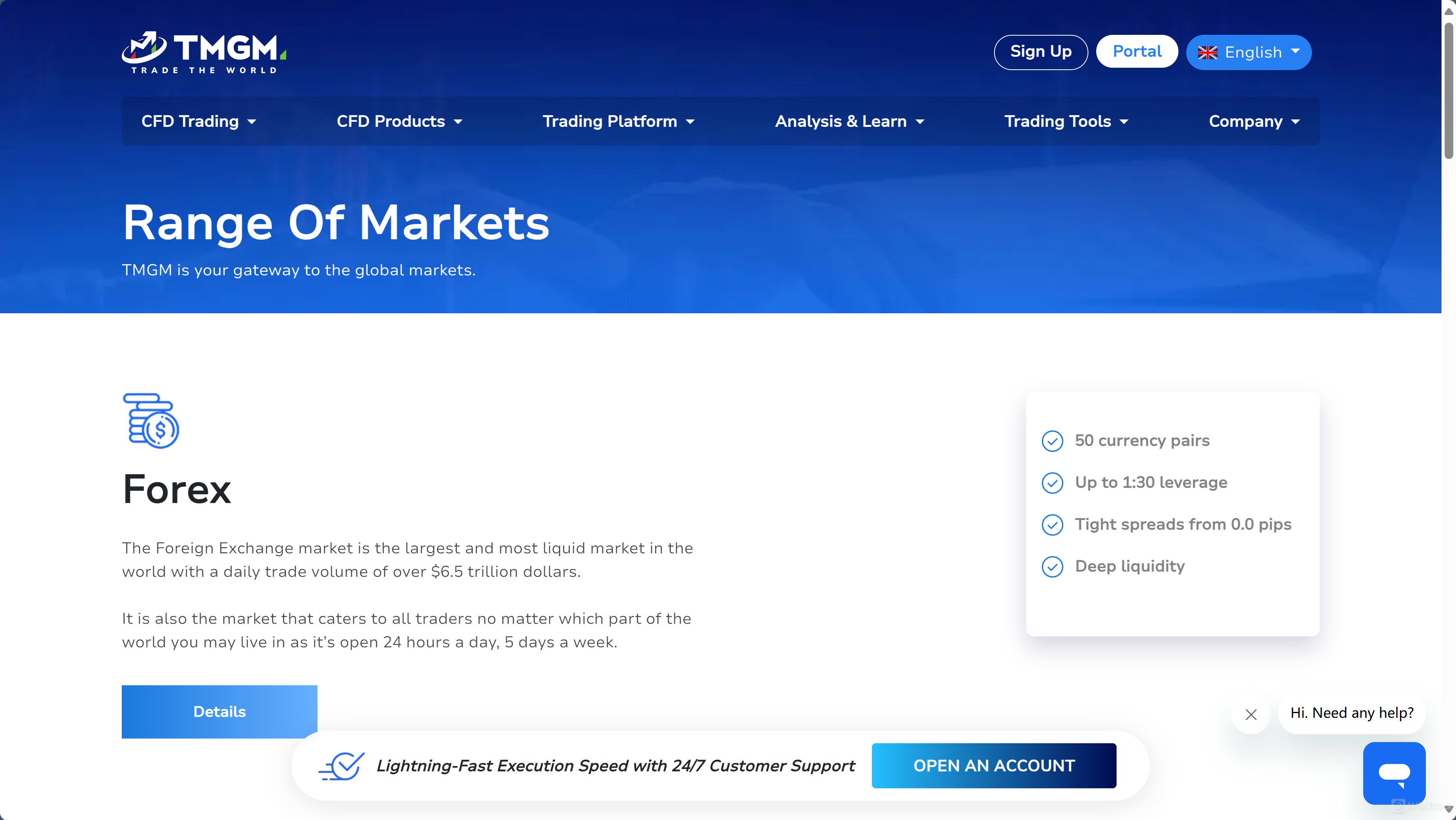

TMGM is a trading platform offering a wide range of financial instruments including Forex, shares, precious metals, energies, cryptocurrencies, and indices.

With competitive fee structures, advanced trading tools, robust customer support, and educational resources, TMGM attracts both novice and experienced traders.

Regulated by ASIC, TMGM ensures a secure and transparent trading environment, making it a reliable choice for traders seeking diverse investment opportunities.

FAQs

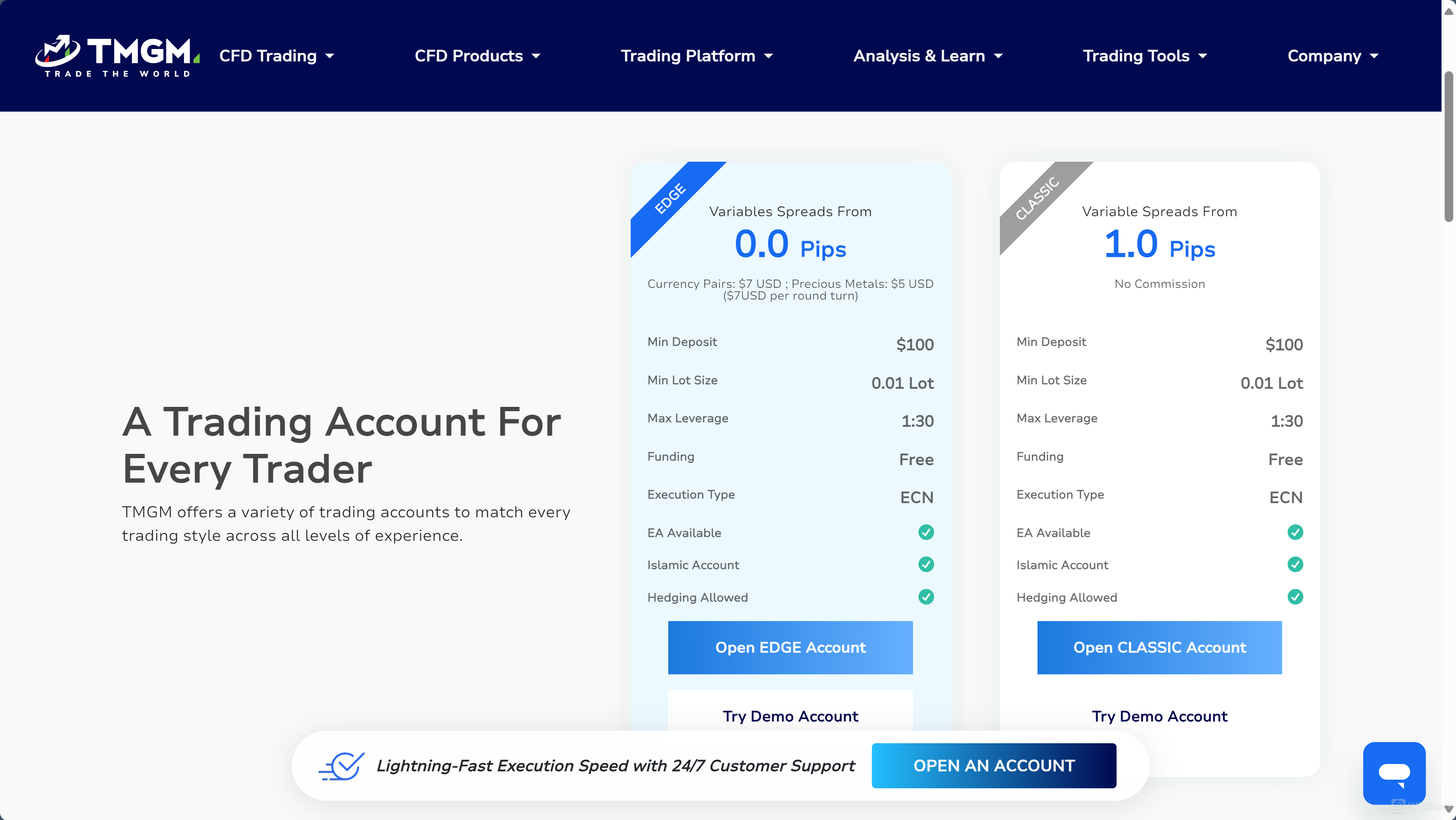

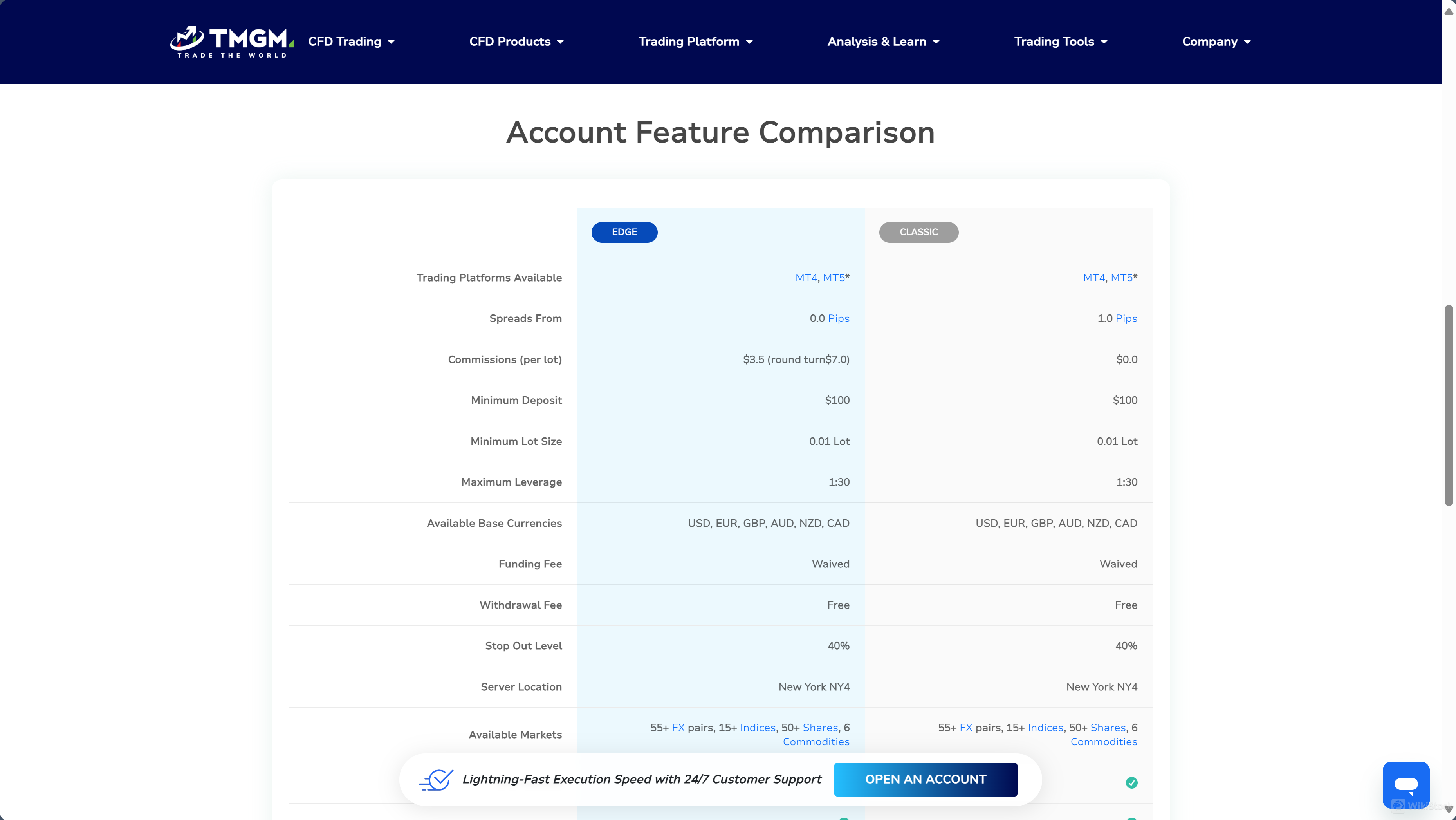

Question: What types of accounts does TMGM offer?

Answer: TMGM offers EDGE and CLASSIC accounts.

Question: What trading platforms are available at TMGM?

Answer: TMGM offers MetaTrader 4, MetaTrader 5, and iRESS.

Question: How can I contact TMGM customer support?

Answer: Email support@tmgm.com or call +61 2 8036 8388, available 24/7.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Indonesia

IndonesiaObtain 2 securities license(s)