Score

德信證券

http://www.rsc.com.tw/

Website

Rating Index

Brokerage Appraisal

Influence

B

Influence Index NO.1

China Taiwan

China TaiwanProducts

2

Futures、Stocks

Securities license

Obtain 1 securities license(s)

SFBRegulated

China TaiwanSecurities Trading License

Brokerage Information

More

Company Name

Reliance Securities Co.

Abbreviation

德信證券

Platform registered country and region

Company address

Company website

http://www.rsc.com.tw/Check whenever you want

WikiStock APP

Brokerage Services

Internet Gene

Gene Index

APP Rating

Note: The information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

In this review, if there is a conflict between the image and the text content, the text content should prevail. However, we recommend that you open the official website for further consultation.

| Reliance Securities |  |

| WikiStock Rating | ⭐⭐⭐⭐ |

| Hong Kong Transactions | Stamp Duty: 0.13%, minimum HKD 1, rounded up to the nearest dollar |

| Levy: 0.00835% of the transaction amount | |

| Settlement Fee (CCASS): 0.002% of the transaction amount, minimum HKD 2, maximum HKD 100 | |

| Financial Reporting Levy - Management Fee: 0.00015% of the transaction amount, rounded to the second decimal place | |

| Handling Fee: Manual Orders: 0.50% of the transaction amount, minimum HKD 100. Electronic Orders: 0.25% of the transaction amount, minimum HKD 60 | |

| US Transactions | SEC Fee: 0.00229% of the transaction amount, minimum USD 0.01, charged to seller |

| Transaction Activity Fee (TAF Fee): 0.000145 per transaction volume, minimum USD 0.01, maximum USD 7.27, charged to seller | |

| Pink Sheets Fee: 0.001% of the transaction amount, minimum USD 0.01, applicable if stock price is below USD 0.01 | |

| Financial Service Fee: French ADRs: 0.3% of the transaction amount, minimum USD 0.01, charged to buyer, calculated to the second decimal place. Italian ADRs: 0.1% of the transaction amount, minimum USD 0.01, rounded up. | |

| Handling Fee: Manual Orders: 1.00% of the transaction amount, minimum USD 50. Electronic Orders: 0.50% of the transaction amount, minimum USD 30. | |

| App/Platform | Futures Kai Desheng APP, DXN |

| Promotions | Unavailable |

Reliance Securities Information

Reliance Securities is a regulated financial services firm that offers a wide array of financial services, which include brokerage for stocks, futures, and options, complemented by advanced trading platforms like Futures Kai Desheng and DXN, catering to both PC and mobile users. The firm also provides comprehensive educational resources, timely market insights, and expert consultations aimed at empowering investors with the knowledge needed to make informed decisions.

Pros & Cons

| Pros | Cons |

| Regulated by SFB | Margin Interest Rates Not Specified |

| Diverse Trading Instruments | |

| Advanced Trading Platforms | |

| Comprehensive Educational Resources | |

| Professional Customer Service |

Pros

Regulated by SFB: Securities operates under the oversight of the Securities and Futures Bureau (SFB), providing assurance of adherence to regulatory standards.

Diverse Trading Instruments: Offers a wide range of trading instruments including stocks, futures, options, and foreign securities.

Advanced Trading Platforms: Provides sophisticated trading platforms like Futures Kai Desheng and DXN, equipped with advanced tools and accessibility for PC and mobile users.

Comprehensive Educational Resources: Offers up-to-date news, market insights, and educational materials to empower investors with knowledge for informed decision-making.

Professional Customer Service: Emphasizes refined management and real-time information delivery, ensuring high standards of customer satisfaction and support.

Cons

Margin Interest Rates Not Specified: Lack of specific information regarding margin interest rates requires investors to directly inquire or consult additional documentation for details on borrowing costs associated with margin trading.

Is Reliance Securities Safe?

Reliance Securities is regulated by the oversight of the oversight of the Securities and Futures Bureau (SFB), holding license No. 6910. This regulatory framework ensures that the company adheres to stringent standards designed to protect investors and maintain the integrity of the financial market. By adhering to the regulations, Reliance Securities ensures that its operations are conducted with the utmost professionalism and accountability, instilling confidence in its clients and stakeholders.

What are Securities to Trade with Reliance Securities?

Reliance Securities offers a diverse array of trading instruments. Their brokerage services prioritize refined management, real-time information, and professional customer service, ensuring client satisfaction amidst regulatory constraints in the securities and financial industry. For corporate clients, DXN's specialized team provides real-time corporate services, offering various investment channels and expert consultations to optimize fund flexibility.

In futures trading, Reliance Securities equips investors with comprehensive tools for futures commodities, hedging, and arbitrage through futures and options operations. They also facilitate re-entrustment services for trading foreign securities, particularly focusing on Hong Kong stock markets, thereby broadening trading opportunities across Greater China.

Moreover, their domestic and overseas fund distribution services enable consignment sales of diverse financial products, enhancing investment diversity and wealth management options.

Reliance Securities Fee Review

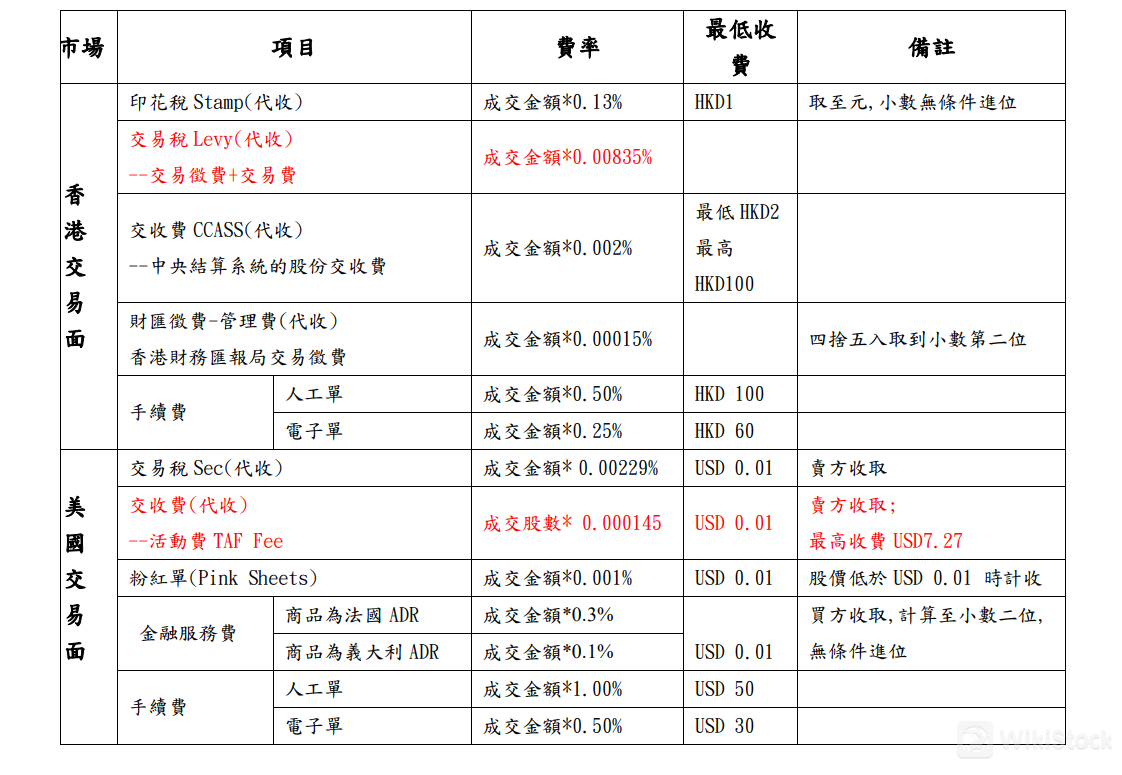

Hong Kong Transactions

For transactions in Hong Kong, Reliance Securities charges several fees. The Stamp Duty, which is collected on behalf, is calculated as 0.13% of the transaction amount with a minimum fee of HKD 1. This fee is rounded up to the nearest dollar. The Levy, also collected on behalf, includes the transaction levy and trading fee, and is calculated as 0.00835% of the transaction amount.

The Settlement Fee for the Central Clearing and Settlement System (CCASS) is 0.002% of the transaction amount, with a minimum fee of HKD 2 and a maximum fee of HKD 100. Additionally, there is a Financial Reporting Levy - Management Fee of 0.00015% of the transaction amount, rounded to the second decimal place.

Reliance Securities also charges a Handling Fee based on the type of order. For manual orders, the fee is 0.50% of the transaction amount with a minimum fee of HKD 100. For electronic orders, the fee is 0.25% of the transaction amount with a minimum fee of HKD 60.

US Transactions

For US transactions, the SEC Fee collected on behalf is 0.00229% of the transaction amount, with a minimum fee of USD 0.01, and is charged to the seller. The Settlement Fee, specifically the Transaction Activity Fee (TAF Fee), is 0.000145 per transaction volume with a minimum fee of USD 0.01, charged to the seller, and has a maximum fee of USD 7.27.

For transactions involving Pink Sheets, the fee is 0.001% of the transaction amount with a minimum fee of USD 0.01, applicable if the stock price is below USD 0.01.

The Financial Service Fee varies depending on the type of ADRs (American Depositary Receipts). For French ADRs, the fee is 0.3% of the transaction amount with a minimum fee of USD 0.01, charged to the buyer and calculated to the second decimal place. For Italian ADRs, the fee is 0.1% of the transaction amount with a minimum fee of USD 0.01, rounded up.

The Handling Fee for US transactions also varies based on the order type. For manual orders, the fee is 1.00% of the transaction amount with a minimum fee of USD 50. For electronic orders, the fee is 0.50% of the transaction amount with a minimum fee of USD 30.

Reliance Securities App Review

Reliance Securities provides a comprehensive suite of trading platforms.

Their flagship offering, Futures Kai Desheng, caters specifically to futures and options trading, equipped with advanced analytical tools and features accessible through a PC interface.

For those preferring agility and mobility, Reliance Securities offers DXN, a versatile platform available on both mobile devices and tablets. DXN supports trading in stocks, futures, and options, emphasizing speed and efficiency for users on the go.

Research & Education

Reliance Securities stands out for its commitment to empowering investors through comprehensive educational resources. Their offerings include up-to-date news coverage, providing insights into global stock exchanges and economic trends crucial for informed decision-making.

The Quick Facts section serves as a valuable resource, offering concise summaries of key developments in the international stock market landscape. Additionally, the Announcement Area of the Underwriting Department keeps investors informed about new offerings and opportunities in the market.

Customer Service

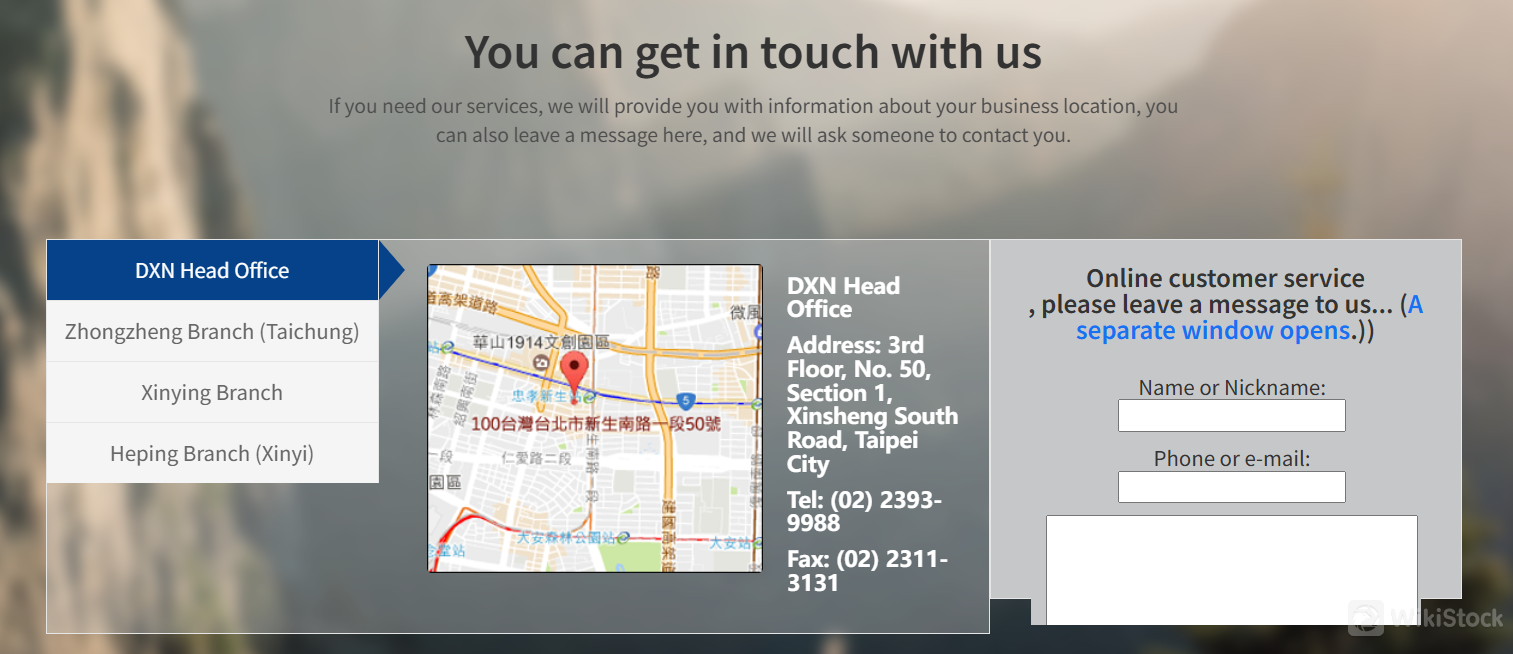

Reliance Securities provides a comprehensive and accessible customer support network. Their support team can be reached through different channels for ultimate convenience.

Address: 3rd Floor, No. 50, Section 1, Xinsheng South Road, Taipei City

Tel: (02) 2393-9988

Fax: (02) 2311-3131

Contact form

Conclusion

In conclusion, Reliance Securities presents itself as a regulated and comprehensive trading platform, offering a diverse range of investment services with advanced platforms and comprehensive educational resources tailored to meet the varying needs of investors and portfolio managers. However, the lack of specific information regarding margin interest rates can hinder a trader's decision-making process.

FAQs

Is Reliance Securities suitable for beginners?

Yes, Reliance Securities is suitable for beginners due to its user-friendly platform, educational resources, and comprehensive customer support.

Is Reliance Securities legit?

Yes, Reliance Securities is regulated by SFB.

What trading instruments does Reliance Securities offer?

Reliance Securities offers equities, bonds, ETFs, mutual funds, futures commodities, hedging and arbitrage tools, re-entrustment services for foreign securities (especially Hong Kong stocks), and domestic and overseas fund distribution services.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Others

Registered region

China Taiwan

Years in Business

More than 20 year(s)

New Stock Trading

Yes

Regulated Countries

1

Products

Futures、Stocks

Review

No ratings

Recommended Brokerage FirmsMore

KGI

Score

TCBS

Score

中農證券

Score

基富通

Score

口袋證券

Score

盈溢證券

Score

京城證券

Score

美好

Score

日茂證券

Score

元大期貨

Score