Score

Rating Index

Brokerage Appraisal

Influence

C

Influence Index NO.1

United States

United StatesProducts

6

Securities Lending Fully Paid、Futures、Investment Advisory Service、Stocks、ETFs、Mutual Funds

Surpassed 23.29% brokers

Securities license

Obtain 1 securities license(s)

SFCSuspicious Clone

China Hong Kong Securities Trading License

Brokerage Information

More

Company Name

Safe Gold Securities & Futures Limited

Abbreviation

鼎展證券及期貨

Platform registered country and region

Company address

Company website

https://www.safegoldsf.com/Check whenever you want

WikiStock APP

Previous Detection: 2024-12-24

- The China Hong Kong Securities and Futures Commission of Hongkong regulation (License No.: BJH966) claimed by the brokerage firm is suspected to be a clone firm, please be aware of the risks!

- It has been verified that this brokerage firm currently has no effective regulation, please be aware of the risk!

Brokerage Services

Internet Gene

Gene Index

APP Rating

Features of Brokerages

Commission Rate

0.1%

New Stock Trading

Yes

Margin Trading

YES

Regulated Countries

1

| Safe Gold Securities and Futures |  |

| WikiStock Rating | ⭐⭐⭐ |

| Founded Year | 2019 |

| Registered Region | Hong Kong |

| Regulatory Status | SFC |

| Products & Services | Securities/Futures Options Trading |

| Commission | Securities: 0.10%, minimum HK$28 per transaction for electronic orders; 0.15%, minimum HK$100 per transaction for phone orders |

| Hong Kong futures options: HK$4-US$3 per transaction for electronic orders; HK$50- US$16 per transaction for phone orders | |

| Global futures: US$3-US$20 per transaction for electronic orders; US$16-US$40 per transaction for phone orders | |

| Fees | Securities: 0.005% for HKEX Trading Fee; 0.0027% for SFC Transaction Levy; 0.00015% for FRC Transaction Levy; HK$0.50 per transaction for HKEX trading system usage fee etc. |

| Hong Kong futures options: 0- HK$0.54 for SFC levy; HK$1- HK$10 for Exchange Levy; HK$1- RMB12 for Cash settlement/exercise fee etc. | |

| Interest and other charges on outstanding account balances: prime Rate +8% for the interest rate on the outstanding account balance/margin call for overdue interest etc. | |

| App/Platform | Safe Gold Securities and Futures Limited for securities trading, SPTrader Pro HD for futures trading |

| Customer Service | Address: Unit E, 30/F, East Ying You Plaza, 83 Hung To Road, Kwun Tong, Kowloon, Hong Kong |

| Tel: +852 3678 2988; +852 3678 2920; fax: +852 2151 9000 | |

| Email: cs@safegoldsf.com; Whatsapp: +852 961 961 06; Facebook, YouTube |

Safe Gold Securities and Futures Information

Safe Gold Securities and Futures is a distinguished financial firm based in Hong Kong, operating under the supervision and regulation of the China Hong Kong Securities and Futures Commission (SFC) with license no. BJH966.

Specializing in securities and futures trading, the company offers a comprehensive suite of investment products and services. It maintains transparent fee structure for clients to be aware of their trading costs to make informed decisions. Also, it offfers two trading platforms for both securities and futures trading respectively with mobile apps avialable on iOS and Android devices.

For more detailed information, you can visit their official website: https://www.safegoldsf.com/ or contact their customer service directly.

Pros & Cons

| Pros | Cons |

| Regulatory Oversight | Complex Fee Structure |

| Multiple Trading Platforms | Interest and Charges |

| Research Resources |

Pros:

Regulatory Oversight: Safe Gold Securities and Futures is regulated by the China Hong Kong Securities and Futures Commission (SFC), ensuring adherence to strict financial standards and providing a level of credibility and security for investors.

Multiple Trading Platforms: Safe Gold Securities and Futures provides versatile trading platforms for securities and futures trading, accessible via web, iOS, and Android devices.

Research Resources: They offer comprehensive market news, weekly tips, financial decoding, IPO perspectives, and newspaper columns, providing valuable insights and information to assist investors in making informed decisions.

Cons:Complex Fee Structure: The fee structure for Safe Gold Securities and Futures can be complex, with varying commissions, trading fees, transaction levies, and other charges depending on the type of investment product and trading method, which require careful consideration and understanding by investors.

Interest and Charges: They apply interest and other charges on outstanding account balances, which could impact investors who maintain margin accounts or have overdue interest, necessitating careful monitoring of account balances and financial obligations.

Commission

Trading costs/Service fees

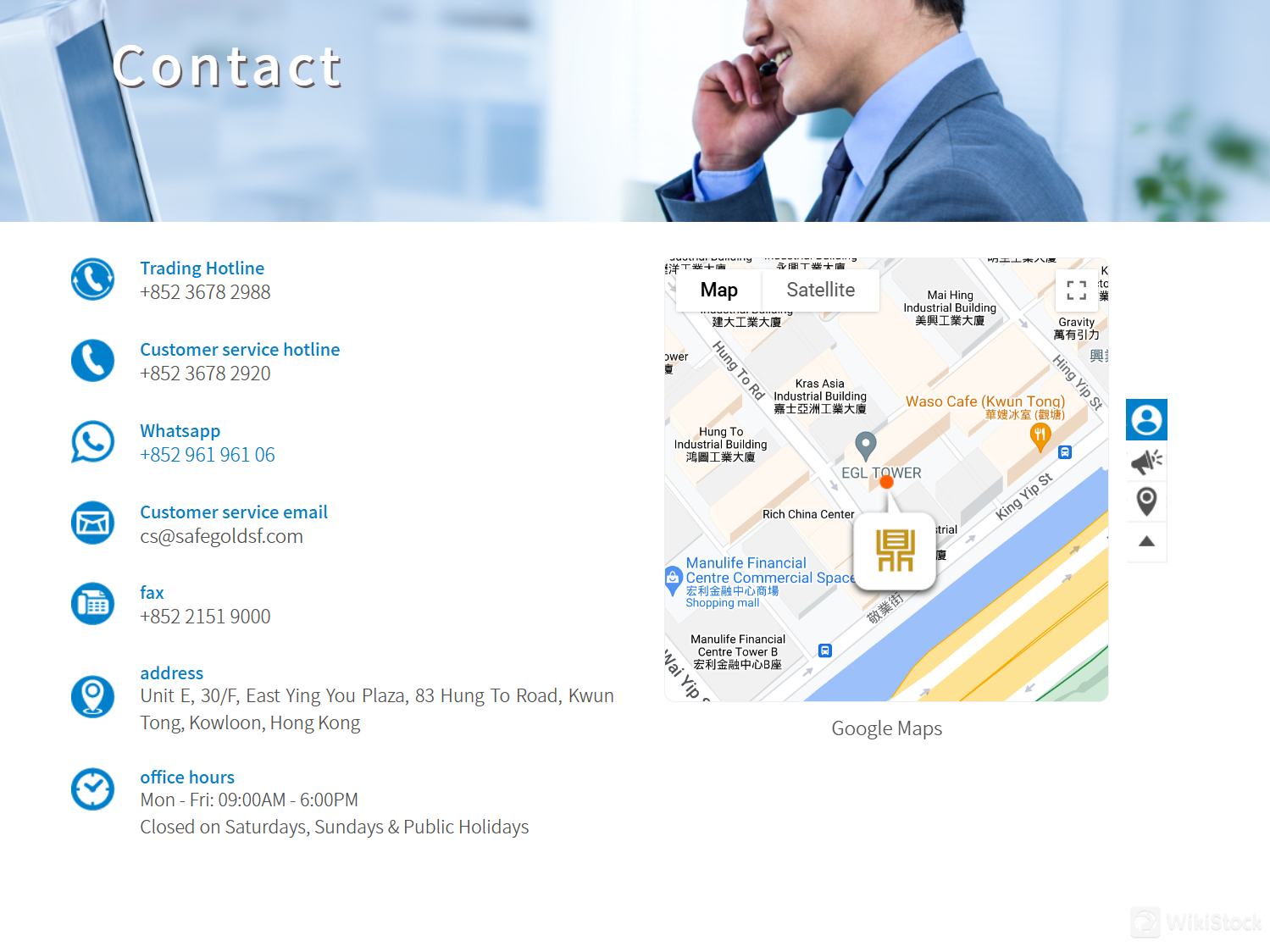

Telephone Support: Clients can reach out via two primary telephone numbers, +852 3678 2988 and +852 3678 2920, during office hours (Mon - Fri, 09:00AM - 6:00PM).

Fax: For formal correspondence, the fax number +852 2151 9000 is available.

Email: The customer service email address, cs@safegoldsf.com, serves as a convenient channel for detailed inquiries, account support, and general information requests.

Whatsapp: Customers can also connect via Whatsapp at +852 961 961 06, providing an alternative messaging platform for quick queries and updates.

Social Media: Safe Gold Securities and Futures maintains an active presence on Facebook and YouTube, enriching client engagement with updates, educational content, and community interaction.

Office Visits: The physical address, Unit E, 30/F, East Ying You Plaza, 83 Hung To Road, Kwun Tong, Kowloon, Hong Kong, welcomes clients during operating hours for in-person consultations, account management, and service inquiries.

Is Safe Gold Securities and Futures regulated by any financial authority?

What types of products and services does Safe Gold Securities and Futures provide?

Is Safe Gold Securities and Futures suitable for beginners?

What are the commission rates for trading on the Safe Gold Securities and Futures platform?

How does Safe Gold Securities and Futures ensure the security of my investments?

Is It Safe?

Regulation:

Safe Gold Securities and Futures operates under the regulatory oversight of the China Hong Kong Securities and Futures Commission of Hongkong (SFC) with license no. BJH966, showcasing its dedication to maintaining the utmost standards in financial operations. This regulatory adherence underscores Safe Gold Securities and Futures's commitment to integrity and credibility in its services.

Safety Measures:

A privacy policy implemented by Safe Gold Securities and Futures serves as a critical security measure by outlining how an organization collects, uses, and protects personal data. It establishes transparency and accountability to ensure compliance with privacy laws and safeguarding user information from unauthorized access, breaches, or misuse.

What are the Securities to Trade with Safe Gold Securities and Futures?

Safe Gold Securities and Futures has established itself in Hong Kong and globally, leveraging its robust group strength to build a strong network in the financial markets.

In addition to active participation in the Hong Kong securities markets, the firm extends its services to multiple international futures and options investment markets, including the CME Group in the US, London Metal Exchange (LME), Intercontinental Exchange (ICE), Singapore Exchange (SGX), Tokyo Commodity Exchange (TOCOM), and Bursa Malaysia Derivatives (BMD). ]

Additionally, the firm provides high-frequency trading services tailored for professional investors, facilitating direct configuration of client trading equipment at the core data center of the Hong Kong Exchange for minimal latency market operations.

Fees Review

Safe Gold Securities and Futures offers a comprehensive fee structure tailored to different types of transactions across various markets.

For securities trading, electronic orders are subject to a commission of 0.10% with a minimum charge of HK$28 per transaction, while phone orders incur a higher commission rate of 0.15% with a minimum of HK$100 per transaction.

In Hong Kong futures options trading, commissions for electronic orders carry fees ranging from HK$4 to US$3 per transaction, whereas phone orders range from HK$50 to US$16 per transaction.

For global futures trading, electronic orders incur commission ranging from US$3 to US$20 per transaction, while phone orders range from US$16 to US$40 per transaction.

Additional fees include a 0.005% HKEX Trading Fee, a 0.0027% SFC Transaction Levy, and a 0.00015% FRC Transaction Levy for securities transactions. There is also an HKEX trading system usage fee of HK$0.50 per transaction, etc.

In the realm of Hong Kong futures options, fees encompass an SFC levy ranging from 0 to HK$0.54, an Exchange Levy ranging from HK$1 to HK$10, and a cash settlement/exercise fee ranging from HK$1 to RMB12 etc.

Clients with outstanding balances are subject to interest charges at Prime Rate +8%, ensuring prompt settlement of overdue amounts and adherence to financial obligations.

Generally speaking, Safe Gold Securities and Futures offers a transparent fee structure, you can visit https://www.safegoldsf.com/fee/securities/others and https://www.safegoldsf.com/fee/futures/others for more detailed and most updated info for different products to ensure you are aware about your trading costs, thus making informed decisions.

App Review

Safe Gold Securities and Futures offers a robust suite of platforms and apps.

For securities trading, clients can utilize the Safe Gold Securities and Futures app, available on web, iOS, and Android platforms. This user-friendly application provides a seamless interface for executing trades, monitoring market trends, accessing real-time data, and managing portfolios securely.

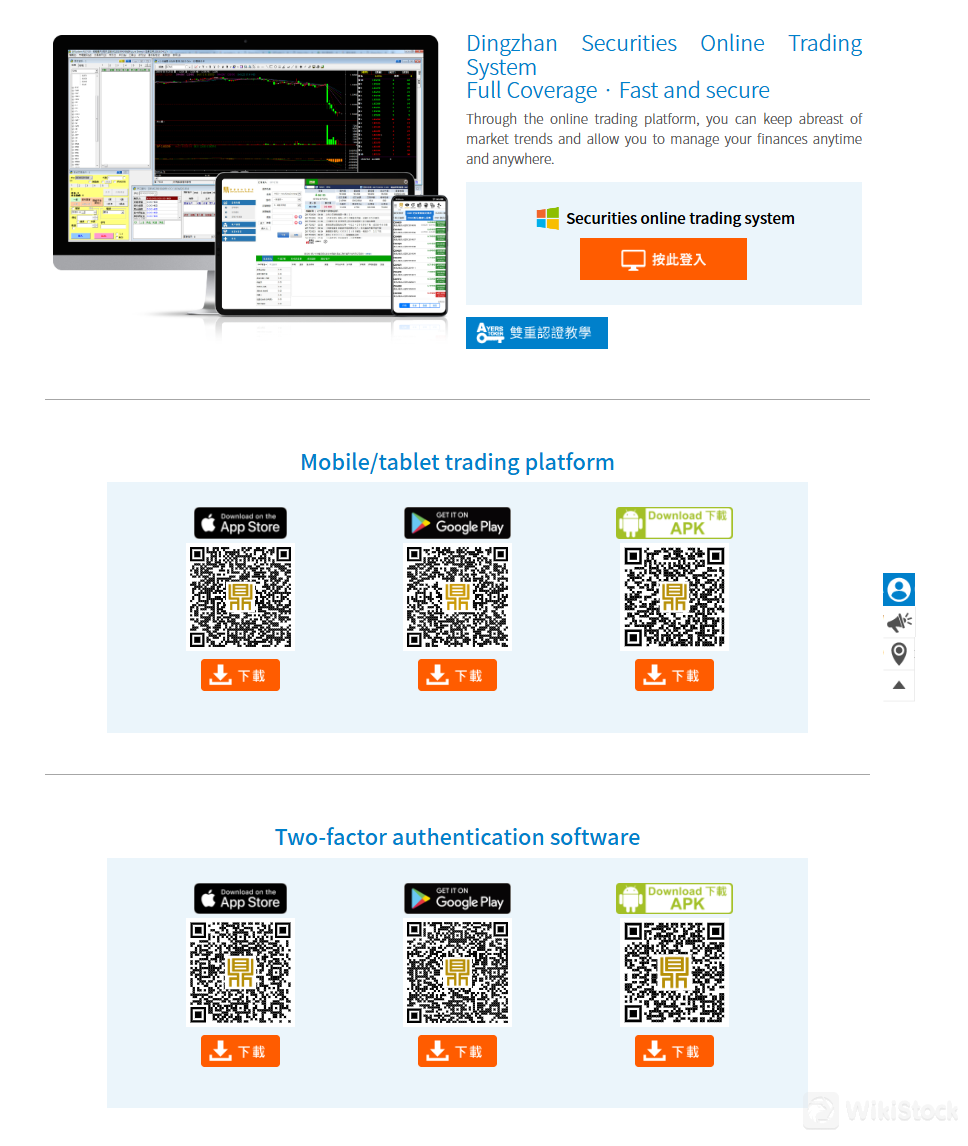

For futures trading enthusiasts, the SPTrader Pro HD platform is available on web, iOS, and Android. This advanced tool caters specifically to futures trading, offering sophisticated features such as advanced charting tools, customizable trading strategies, and direct market access. It enables traders to stay informed with real-time quotes, execute trades swiftly, and manage risk effectively.

To ensure the highest level of security, Safe Gold Securities and Futures implements two-factor authentication using the “Ayers Token” software, accessible on web, iOS, and Android platforms. This additional layer of security enhances account protection by requiring a second form of verification during login, thereby safeguarding client assets and personal information from unauthorized access.

Research & Education

Safe Gold Securities and Futures boasts robust research resources that are pivotal in shaping informed investment decisions.

Their market news delivers timely updates on trends and events impacting financial markets, ensuring clients stay ahead with relevant insights.

Weekly tips provide actionable advice to navigate market complexities effectively, while financial decoding simplifies intricate concepts for confident investment choices.

IPO perspectives offer strategic insights into upcoming offerings, and newspaper columns provide in-depth analysis and expert opinions.

Customer Service

Conclusion

Safe Gold Securities and Futures, regulated by the China Hong Kong Securities and Futures Commission (SFC) under license no. BJH966, stands as a reliable partner in the financial market.

Upholding stringent regulatory standards, the company ensures integrity and credibility in its operations, offering a diverse range of securities and futures trading services.

With a commitment to transparency and customer satisfaction, Safe Gold Securities and Futures remains a trusted choice for investors seeking secure and compliant investment opportunities in Hong Kong.

Frequently Asked Questions (FAQs)

Yes, it is regulated by the China Hong Kong Securities and Futures Commission (SFC) under license no. BJH966.

It specializes in securities and futures trading.

Yes, Safe Gold Securities and Futures' SFC regulatory status and user-friendly interface across its platforms make it accessible for beginners.

Commission rates vary. For securities, it's 0.10% with a minimum of HK$28 per transaction for electronic orders, or 0.15% with a minimum of HK$100 per transaction for phone orders. For Hong Kong futures options, rates range from HK$4 to US$3 per transaction for electronic orders, and HK$50 to US$16 per transaction for phone orders.

It implements robust security measures, including two-factor authentication and encryption protocols, to safeguard client accounts and transactions.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

Others

Registered region

China Hong Kong

Years in Business

5-10 years

Products

Securities Lending Fully Paid、Futures、Investment Advisory Service、Stocks、ETFs、Mutual Funds

Review

No ratings

Recommended Brokerage FirmsMore

OPSL

Score

偉祿亞太證券

Score

鴻昇金融集團

Score

东兴证券

Score

IISL

Score

Elstone

Score

Hooray Securities

Score

SBI China Capital

Score

Sorrento

Score

Sanston

Score