天眼评分

评分指数

券商鉴定

影响力

C

影响力指数 NO.1

日本

日本交易品种

5

现金业务、债券/固收、衍生品、期权、股票

交易牌照

拥有1个交易牌照

日本FSA证券交易牌照

券商信息

更多

公司全称

OKAYASU Securities CO.,LTD

公司简称

岡安証券株式会社

平台注册国家、地区

公司地址

随时想查就查

WikiStock APP

互联网基因

基因指数

APP评分

券商特色

佣金率

0.275%

最低入金门槛

$0

新股交易

是

杠杆交易

是

| Okayasu Securities |  |

| WikiStock Rating | ⭐⭐⭐⭐ |

| Fees | 1.26500% of the contract price (min 2,750 yen) |

| Margin Interest Rates | Bidding interest rate: 1.95% per year (+0.18% from the current rate) |

| Selling interest rate: 0.00% per year |

Okayasu Securities Information

Okayasu Securities是一家受日本金融服务机构(FSA)监管的金融机构。该公司的金融工具业务专注于提供适合的金融产品,如股票、债券和投资信托。他们强调他们的社区参与和适应不断变化的市场环境的承诺。该公司以以客户为中心的方法和基于社区的销售活动为傲。

Okayasu Securities的优点和缺点

| 优点 | 缺点 |

| 透明的费用结构 | 有限的保证金交易选择 |

| 基于社区的销售活动 | 缺乏在线交易性能 |

| 受FSA监管 | |

| 提供各种金融服务 |

优点

- 透明的费用结构:该公司清晰透明的费用结构使客户全面了解与其金融交易相关的成本。

- 基于社区的销售活动:通过参与基于社区的销售活动,该公司展示了与当地社区建立牢固关系的承诺。

- 受FSA监管:受日本金融服务机构监管,增加了该公司运营的可信度,并向客户保证符合行业标准和法规。

- 提供各种金融服务:这种多样化的服务使客户能够访问全面的金融产品套件。

缺点

- 有限的保证金交易选择:该公司可能在保证金交易方面的选择有限,可能限制客户利用其投资并最大化回报的能力。

- 缺乏在线交易性能:该公司不提供强大的在线交易平台或工具。

Okayasu Securities安全吗?

- 监管情况:Okayasu Securities在日本金融服务机构(No.8)的监管下运营,持有日本证券交易许可证。这个监管机构确保金融机构遵守相关法律和法规,以保护投资者并维护市场的完整性。

- 用户反馈:用户应该查看其他客户的评论和反馈,以更全面地了解经纪人,或在值得信赖的网站和论坛上寻找评论。

- 安全措施:到目前为止,我们还没有找到关于该经纪人的安全措施的任何信息。

Okayasu Securities可以交易的证券有哪些?

Okayasu Securities提供多种投资产品。

这些产品包括股票,如日本国内交易的国内股票,新发行公司的首次公开募股(IPO)股票,衍生品交易的期货和期权,多元化投资的交易所交易基金(ETF),投资房地产的房地产投资信托基金(REITs),杠杆投资的保证金交易,以及在国际市场上交易的外国股票。

此外,他们还提供各种类型的债券,包括日本政府发行的政府债券,地方政府发行的公开募集地方债券,以及增加安全性的政府担保债券。

最后,Okayasu证券为寻求投资专业管理投资组合的客户提供一系列投资信托。

Okayasu证券账户

Okayasu证券提供两种主要类型的账户:普通证券账户和保证金账户。

在普通证券账户中,资金以货币储备基金(MRFs)的形式进行管理,该基金由国内和国外公共债券等高信用短期证券组成。购买股票或债券时,任何不足都会自动通过从MRF中提取资金来弥补。

另一方面,保证金交易账户涉及向公司提供作为抵押品的担保(客户保证金),以借入交易股票的资金。有系统性和普通保证金交易两种类型,公司处理上市股票的系统性保证金交易。保证金交易可能带来可观的利润,但如果价格波动与预期不符,也会带来巨大的损失风险。

Okayasu证券费用回顾

Okayasu证券提供透明的股票经纪佣金费率(基本)(含税)结构。

| 合同价格 | 佣金费率 |

| 80万日元或以下 | 合同价格的1.26500% |

| 超过80万日元,不超过100万日元 | 0.99000% + 2,200日元 |

| 超过100万日元,不超过200万日元 | 0.93500% + 2,750日元 |

| 超过200万日元,不超过300万日元 | 0.90200% + 3,410日元 |

| 超过300万日元,不超过500万日元 | 0.88000% + 4,070日元 |

| 超过500万日元,不超过1000万日元 | 0.56540% + 19,800日元 |

| 超过1000万日元,不超过3000万日元 | 0.48730% + 27,610日元 |

| 超过3000万日元,不超过5000万日元 | 0.33000% + 74,800日元 |

| 超过5000万日元 | 0.27500% + 102,300日元 |

| 最低费用 | 2,750日元 |

客户服务

- 电话:06-7637-0001(总机),06-7637-0030(总公司销售部),06-7637-0020(审计部)

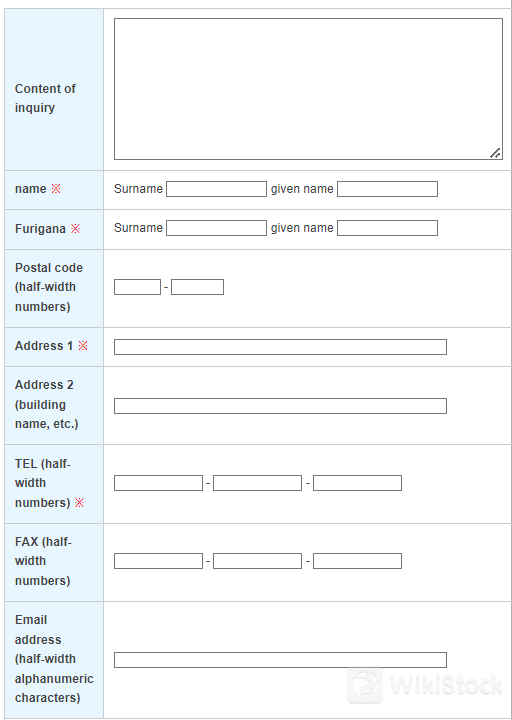

- 查询表单

- 公司地址:大阪市中央区平野町2-1-2沢の鶴ビル,大阪541-0046,日本

结论

总之,Okayasu证券提供广泛的金融服务,包括普通证券账户和保证金交易选项。他们注重以客户为中心,参与社区,并提供透明的费用结构,这是值得称赞的。通过提供详细的服务和要求信息,Okayasu证券展示了与客户建立透明关系的承诺。在决定是否适合选择Okayasu证券之前,请仔细考虑个人需求和偏好。

问答

Okayasu Securities提供哪些类型的账户?

- 它为客户提供普通证券账户和融资交易账户。

Okayasu Securities提供哪些可交易资产?

股票、债券、投资信托、外国债券、外国股票等。

Okayasu Securities是否受监管?

是的。Okayasu Securities在日本金融厅(FSA)的监管下运营。

风险警示

所提供的信息基于WikiStock对经纪公司网站数据的专业评估,可能会有变化。此外,网上交易存在重大风险,可能导致投资资金的全部损失,因此在参与之前了解相关风险至关重要。

其他信息

注册地

日本

经营时间

10-15年

可交易品类

现金业务、债券/固收、衍生品、期权、股票

评价

暂无评价

推荐券商更多

静銀ティーエム証券

天眼评分

丸近證券

天眼评分

光世証券

天眼评分

第四北越証券

天眼评分

ニュース証券

天眼评分

百五証券

天眼评分

山形證券

天眼评分

Tachibana Securities Co., Ltd.

天眼评分

北洋証券

天眼评分

リテラ・クレア証券株式会社

天眼评分