Điểm

光証券株式会社

https://www.hikarishoken.com/

Website

Chỉ số đánh giá

Thẩm định sàn chứng khoán

Mức ảnh hưởng

C

Chỉ số ảnh hưởng NO.1

Japan

JapanSản phẩm giao dịch

7

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks、ETFs、Mutual Funds

Giấy phép chứng khoán

Sở hữu 1 giấy phép giao dịch

FSARegulated

JapanSecurities Trading License

Thông tin sàn môi giới

More

Tên công ty

HIKARI SECURITIES CO.,LTD

Viết tắt

光証券株式会社

Quốc gia/Khu vực đăng ký

Địa chỉ công ty

Trang web của công ty

https://www.hikarishoken.com/Tra cứu mọi lúc mọi nơi chỉ với 1 cú chạm

WikiStock APP

Dịch vụ sàn chứng khoán

Internet GENE

Chỉ số GENE

Xếp hạng ứng dụng

Đặc điểm môi giới

Commission Rate

1.15%

New Stock Trading

Yes

Margin Trading

YES

Regulated Countries

1

| Hikari Securities |  |

| WikiStock Rating | ⭐⭐⭐ |

| Account Minimum | Not Mentioned |

| Fees | Not Mentioned |

| Interests on Uninvested Cash | Not Mentioned |

| Margin Interest Rates | Not Mentioned |

| Mutual Funds Offered | Not Mentioned |

| App/Platform | Not Mentioned |

| Products | Investment trust, Japanese stocks, US stocks, life insurance |

Hikari Securities Information

Hikari Securities Co., Ltd., founded in Kobe in 1948, positions itself as an independent securities company offering asset management, investment trusts, and trading in Japanese and international stocks. Regulated by the Japan Financial Services Agency, Hikari Securities claims to provide tailored investment strategies to clients, aiming to help them navigate the challenging economic landscape and boost their assets.

Pros & Cons of Hikari Securities

| Pros | Cons |

| Personalized Investment Strategies | Limited Investment Variety |

| Long-standing Reputation | Lack of Transparency |

| Regulatory Oversight |

Personalized Investment Strategies: Hikari Securities offers individualized investment proposals to cater to clients' specific needs and preferences, potentially providing a more tailored investment approach.

Long-standing Reputation: With over 70 years in the industry, Hikari Securities boasts a solid reputation and longevity, signaling stability and experience.

Regulatory Oversight: Hikari Securities operates under the regulatory oversight of the Japan Financial Services Agency and holds a Japan Securities Trading License. This regulatory oversight can provide clients with a sense of security and assurance that the firm operates within the bounds of official regulations and standards.

ConsLimited Investment Variety: Hikari Securities primarily focuses on Japanese and American stocks, potentially limiting clients' opportunities for diversification across different asset classes or regions.

Lack of Transparency: Hikari Securities does not provide clear information about crucial aspects such as fee structures, account types, and trading platforms, which can hinder clients' ability to make informed decisions.

Is Hikari Securities Safe?

- Regulatory Sight: Hikari Securities operates under the regulatory oversight of the Japan Financial Services Agency (No.30), holding a JapanSecurities Trading License. This regulatory authority ensures that financial institutions comply with relevant laws and regulations to protect investors and maintain market integrity.

- User Feedback: Users should check the reviews and feedback from other clients to gain a more comprehensive sight of the broker, or look for reviews on reputable websites and forums.

- Security Measures: So far we haven't found any information about the security measures for this broker.

What are Securities to Trade with Hikari Securities?

With Hikari Securities, you can trade in Japanese and US stocks, offering a gateway to major stock markets and the opportunity to diversify your portfolio internationally.

Additionally, the firm offers investment trusts, which are great for those looking to invest in a pooled fund managed by professionals, allowing access to a broader range of assets that might be difficult to manage individually. For those interested in a more stable and long-term investment, Hikari Securities also provides life insurance products, blending investment with protection.

Customer Service

Realord Asia Pacific Securities offers comprehensive customer support to its clients.Clients can reach out to Realord Asia Pacific Securities through various channels.

- Telephone: 078-391-2305

- Fax: 078-391-5580

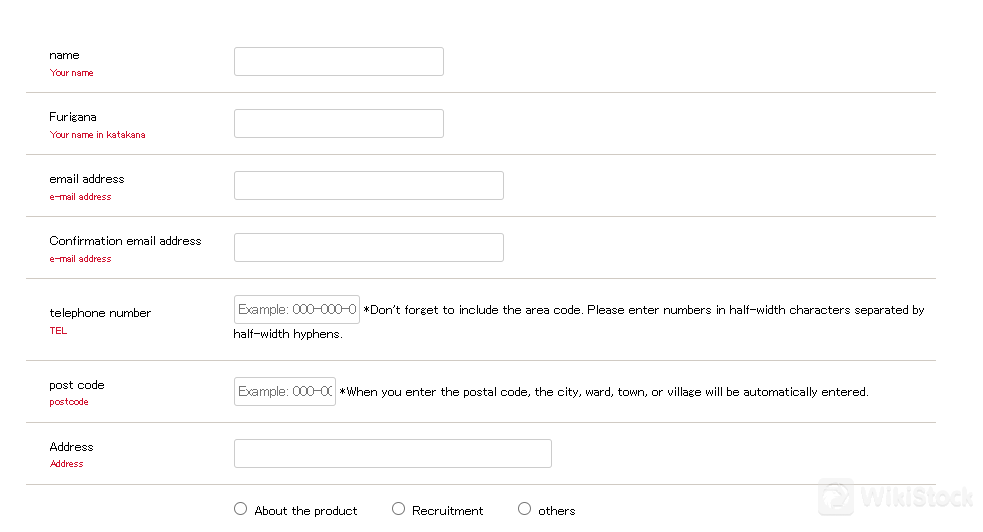

- Contact From

- Physical address: 4-2, Kano-machi 3-chome, Chuo-ku, Kobe 650-0001, Japan

Conclusion

Hikari Securities, as an independent securities company in Kobe, appears to have a longstanding presence in the industry and emphasizes tailored investment strategies. However, the lack of transparency in crucial areas such as fee structures, account types, and available services poses challenges for clients looking to assess the firm comprehensively. Potential clients may want to seek additional information and clarifications before considering Hikari Securities as their investment partner.

FAQs

Is Hikari Securities regulated?

Yes. Hikari Securities operates under the regulatory oversight of theJapan Financial Services Agency (FSA).

What investment products can I trade with Hikari Securities?

Hikari Securities offers trading in Japanese and American stocks, focusing on individual stock stories and market performance analysis.

Does Hikari Securities provide personalized investment advice?

Yes.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Thông tin khác

Registered region

Japan

Years in Business

10-15 years

Products

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks、ETFs、Mutual Funds

Đánh giá

Chưa có bình luận

Sàn giao dịch được đề xuấtMore

西村証券株式会社

Điểm

野畑証券

Điểm

大山日ノ丸証券

Điểm

バークレイズ証券

Điểm

FPG証券

Điểm

Japan Private Asset Securities

Điểm

三豊証券

Điểm

頭川証券

Điểm

静岡東海証券

Điểm

明和證券株式会社

Điểm