Here's How Deckers Looks Just Ahead of Q1 Earnings - Deckers Outdoor (NYSE:DECK)

As Deckers Outdoor CorporationDECK prepares to announce its first-quarter fiscal 2025 earnings results on Jul 25 after market close, investors are keen to assess the company's performance amid ongoing market challenges and opportunities.

Deckers, known for its portfolio, including UGG and HOKA brands, has been navigating a dynamic landscape with strategic initiatives aimed at sustaining growth. The Zacks Consensus Estimate for revenues is pegged at $805.5 million, which indicates an improvement of 19.2% from the prior-year reported figure.

The company is expected to witness a year-over-year increase in its bottom line. The Zacks Consensus Estimate, which has edged up by a couple of cents over the past 30 days to $3.52 per share, calls for 46.1% growth compared to the same period last year.

Deckers has maintained a trailing four-quarter earnings surprise of 42.8%, on average. In the last reported quarter, this Goleta, CA-based company's bottom line outperformed the Zacks Consensus Estimate by a margin of 75.5%.

Key Factors to Note

Deckers' focus on innovation and expanding brand reach are key drivers. The company has been investing in product development across its leading brands, HOKA and UGG, introducing new styles that resonate with consumers and meet the evolving demands of the market. These innovations not only attract new customers but also retain existing ones, fostering brand loyalty and repeat purchases.

We expect strength in the UGG and HOKA brands, with sales anticipated to increase by 9.7% and 25.7% year over year, respectively. However, the Teva brand is likely to face challenges, leading to an estimated 4.8% decline in sales. Additionally, the Sanuk brand is expected to experience a decrease of 7.2%.

Deckers' commitment to expanding its direct-to-consumer channels is another significant factor contributing to revenue growth. The company has been enhancing its online and in-store experiences, making it easier for consumers to access and purchase their favorite products. This strategy not only increases sales volumes but also allows Deckers to capture higher profit margins. We expect direct-to-consumer revenues to increase 30.1% year over year.

The expansion into international markets has been a crucial component of Deckers' growth strategy. By targeting key global regions and tailoring marketing efforts to resonate with local consumers, Deckers has been able to increase its market share and brand recognition outside the United States. We envision an 18.4% jump in international revenues.

Despite the aforementioned tailwinds, we cannot ignore challenges in the SG&A domain that may hurt margins. We anticipate SG&A expenses to rise 20.4% year over year in the quarter. As a percentage of net sales, we expect the metric to increase 70 basis points to 41.5%.

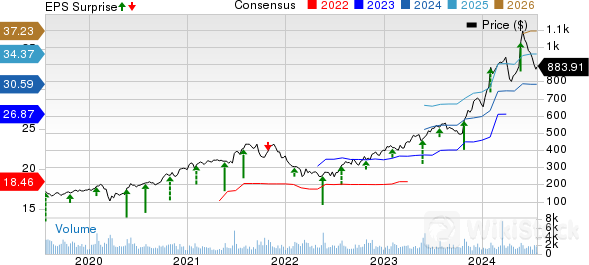

Deckers Outdoor Corporation Price, Consensus and EPS Surprise

Deckers Outdoor Corporation price-consensus-eps-surprise-chart | Deckers Outdoor Corporation Quote

What the Zacks Model Unveils

As investors prepare for Deckers' first-quarter earnings, the question looms regarding earnings beat or miss. Our proven model does not conclusively predict an earnings beat for Deckers this time. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. However, that's not the case here.

Deckers has a Zacks Rank #2 but an Earnings ESP of -3.67%.

3 Stocks With the Favorable Combination

Here are three companies you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat this season:

The Gap Inc.has an Earnings ESP of +4.39% and sports a Zacks Rank of 1 at present. GPS is likely to register top-line growth when it reports second-quarter fiscal 2024 results. The Zacks Consensus Estimate for its quarterly revenues is pegged at $3.63 billion, which suggests 2.2% growth from the figure reported in the year-ago quarter.

The consensus estimate for Gap's fiscal second-quarter earnings is pegged at 41 cents per share, which calls for 20.6% growth from the figure reported in the year-ago quarter. GPS delivered an earnings beat of 202.7%, on average, in the trailing four quarters.

Chewy, Inc.has an Earnings ESP of +1.61% and currently sports a Zacks Rank of 1. CHWY's top line is anticipated to advance year over year when it reports second-quarter fiscal 2024 results. The Zacks Consensus Estimate for its quarterly revenues is pegged at $2.86 billion, which suggests a 2.9% increase from the figure reported in the year-ago quarter.

The company is expected to register an increase in the bottom line. The consensus estimate for CHWY's fiscal second-quarter earnings is pegged at 22 cents a share, up 46.7% from the year-ago quarter. CHWY has a trailing four-quarter earnings surprise of 57.7%, on average.

Costco Wholesale Corporationcurrently has an Earnings ESP of +1.23% and a Zacks Rank of 2. The company is expected to register top and bottom-line growth when it reports fourth-quarter fiscal 2024 numbers. The Zacks Consensus Estimate for COST's quarterly revenues is pegged at $80 billion, which implies growth of 1.3% from the year-ago quarter's reported figure.

The consensus estimate for Costco's earnings has increased by a penny in the past 30 days to $5.02 per share. The consensus estimate for earnings suggests growth of 3.3% from the year-ago quarter's reported figure. COST has delivered an earnings beat of 2.3%, on average, in the trailing four quarters.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Byte refutes rumors of speculation on A-share Doubao concept stocks

How to develop a low-altitude economy

Doubao concept surges, IPO economy booms

5G enters the "second half", which stocks are the best to buy

Check whenever you want

WikiStock APP