<Research>M Stanley Raises BOC HONG KONG (02388.HK) and HANG SENG BANK (00011.HK) TPs, Strong 2Q Results Expected

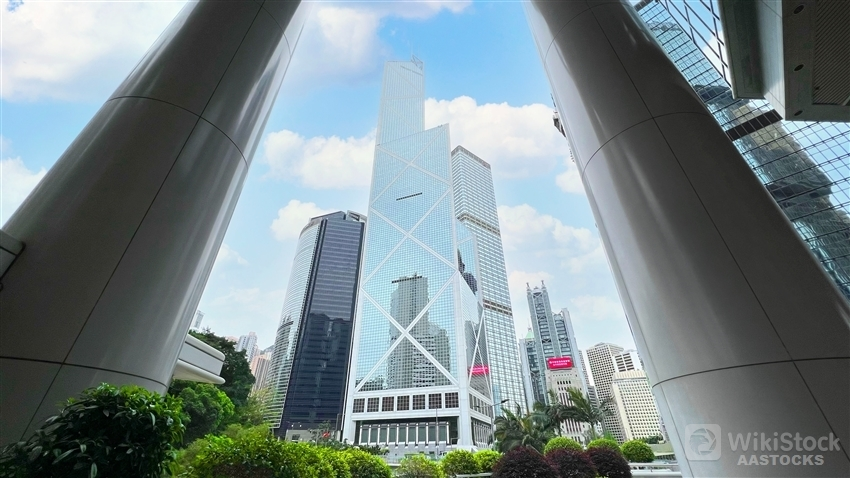

A recent Morgan Stanley report has revealed its expectation for 2Q24 results at Hong Kong banks to stay strong with further share buybacks. Even though earnings momentum is slowing and the market will focus on US rate cuts, the broker still believes that mild cuts will support solid RoE and capital repatriation. It favours HSBC HOLDINGS (00005.HK) +0.400 (+0.603%) Short selling $559.00M; Ratio 36.643% and STANCHART (02888.HK) +0.850 (+1.175%) Short selling $1.10M; Ratio 8.315% , while raising the TP of BOC HONG KONG (02388.HK) +0.200 (+0.883%) Short selling $54.11M; Ratio 47.496% from $22.8 to $23.8 and the TP of HANG SENG BANK from $93.3 to $97.1.

With Hong Kong banks continuing commitment to capital returns, Morgan Stanley expects HSBC HOLDINGS to announce a further share buyback of US$2 billion in its 2Q results announcement, STANCHART to announce a share buyback of US$1 billion, and HANG SENG BANK to have a potential additional share buyback of $2 billion in 4Q and a possible share buyback of $7 billion in each of 2025 and 2026, although at this stage Morgan Stanley has not built these into forecasts.

Related NewsM Stanley: HANG SENG BANK to Announce Interim Results Next Wk; Further Buyback Expected as Shr Price Catalyst

The broker has lowered its loan growth forecast for FY24 as it expects loan growth among Hong Kong banks will have remained under pressure for 2Q and banks confidence about a resumption of loan growth in 2H24 appears to be diminishing. Meanwhile, HK NIM is expected to remain under pressure in 2Q due to falling HIBOR. However, HIBOR has recovered since early June, and average HIBOR levels could remain higher through 3Q.

(HK stocks quote is delayed for at least 15 mins.Short Selling Data as at 2024-07-19 16:25.)

AAStocks Financial News

Byte refutes rumors of speculation on A-share Doubao concept stocks

How to develop a low-altitude economy

Doubao concept surges, IPO economy booms

5G enters the "second half", which stocks are the best to buy

Check whenever you want

WikiStock APP