Why small caps are showing up the tech titans: Morning Brief

Small caps are solving Wall Street's concentration problem.

Though small caps stumbled Wednesday, in the five prior trading days, the Russell 2000 (^RUT) rocketed an eyewatering 12% as the Nasdaq Composite (^IXIC) barely remained green. It was a surge that had never been surpassed by any of the major US stock indexes, according to Bespoke.

The catalyzing event was last week's dovish Consumer Price Index, which reported an actual decline in prices of 0.1%. The sign change in inflation was enough to convince holdouts on Wall Street that there's more to stocks in 2024 than the well-known cadre of tech titans riding the artificial intelligence wave.

But laggards are once again turning to leaders, bringing to mind the “everything rally” that dominated the fourth quarter last year.

As the Magnificent titans wilt, smaller pockets of strength fill the leadership void. Sector rotation is the lifeblood of bull markets, they say.

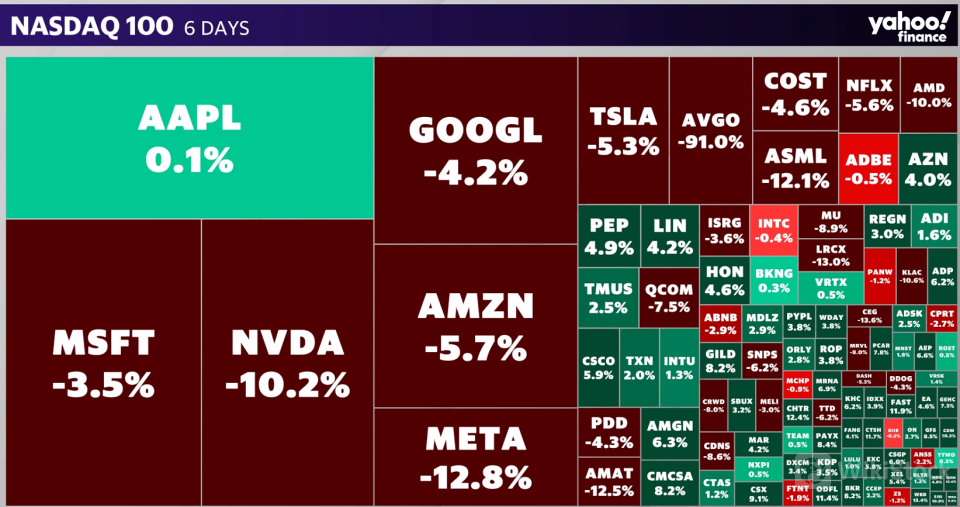

Tech stocks led by megacaps have caused the Nasdaq 100 to underperform since last Tuesday. Meanwhile, the Russell 2000 (not shown) soared 12%.

Since last Tuesday's close, Real Estate has led the large-cap sectors, up 7%. On its heels, cyclicals and values are well represented — as Materials, Industrials, Energy, and Financials are all up about 5%.

The only two losers are also the highest-returning sectors for the year — Tech (XLK) and Communication Services (XLC) — down 4% and 2%, respectively.

Delving into the financial sector, we see the SPDR S&P Regional Banking ETF (KRE) has now clawed its way back to the drop-off point from last year's internet bank crisis. The 16% surge is a notable move for regionals, which have had a rough two years since their 2022 highs.

The SPDR S&P Homebuilders ETF (XHB) also jumped more than 14% on Monday, and notched its first record high since March.

While the prospect of tamer inflation is behind much of the move, Trump's surge in popularity after the weekend assassination attempt is also a factor. Investors believe banks will benefit from a lighter regulatory touch, and the steepening yield curve over the last week also helps.

Then there's crypto. For all the talk about spot ether ETFs, the bitcoin halving, and Gary Gensler, Trump's crypto support has helped bring bitcoin (BTC-USD) back from a nasty sell-off that might have had bearish legs.

After all the gyrations over the last week, the two leading sectors in 2024 remain Tech and Communication Services — each holding on to gains of about 17%. But the handwringing over concentration can finally take a breather — at least, for now.

Byte refutes rumors of speculation on A-share Doubao concept stocks

How to develop a low-altitude economy

Doubao concept surges, IPO economy booms

5G enters the "second half", which stocks are the best to buy

Check whenever you want

WikiStock APP