BlackBerry Q1 Earnings Beat Estimates, Revenues Down Y/Y - BlackBerry (NYSE:BB), Woodward (NASDAQ:WWD)

BlackBerry Limited BBreported first-quarter fiscal 2025 (ended May 31) adjusted loss per share of 3 cents, narrower than the company's estimate of a loss per share of 4-6 cents.

In the year-ago quarter, it reported non-GAAP earnings of 6 cents per share. The Zacks Consensus Estimate was pegged at a loss of 4 cents per share.

Quarterly revenues were $144 million compared with the prior-year quarter's figure of $373 million. However, the top line surpassed the company's guidance of $130-$138 million. Software product revenues contributed 85% to total revenues, while professional services contributed 15%.

BlackBerry Limited Price, Consensus and EPS Surprise

BlackBerry Limited price-consensus-eps-surprise-chart | BlackBerry Limited Quote

The company expects fiscal second-quarter revenues to be in the $136-$144 million range. For the Cybersecurity business, revenues are estimated to be in the band of $82-$86 million.

For the Internet of Things (IoT) business, revenues are expected to be in the range of $50-$54 million for the current quarter. The company's top line is likely to gain from continued strength in royalties, along with an improvement in development seat license revenues. Licensing & Other revenues are expected to be $4 million.

The company reiterated its fiscal 2025 revenue projection in the band of $586-$616 million. For the Cybersecurity business, revenues are estimated to be in the $350-$365 million range despite weak macroeconomic conditions that continue to elongate sales cycles.

Revenues are estimated to be in the band of $220-$235 million for the IoT business. Management added that challenges faced by automakers in delivering software development programs should remain an overhang on the QNX business.

Licensing & Other revenues are expected to be $16 million.

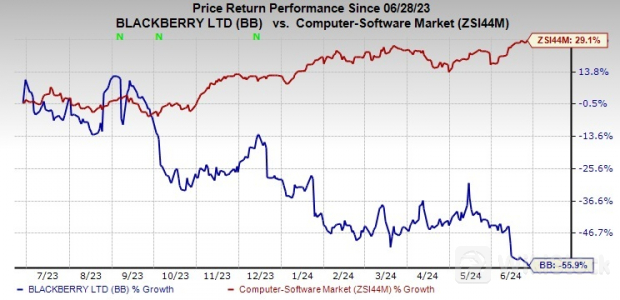

Following the announcement, the company's shares have risen 7.7% in the pre-market trading on Jun 27, 2024. The stock has lost 55.9% in the past year compared with the sub-industry's growth of 29.1%.

Quarter in Details

Revenues from the Cybersecurity business totaled $85 million, which was down 8.6% year over year. However, it exceeded the company's revenue guidance of $78-$82 million. Revenues were driven by improved annual recurring revenue and strength in the SecuSmart business. Cybersecurity ARR increased 2% sequentially to $285 million.

Revenues from the IoT business totaled $53 million, which was up 18% year over year, and surpassed the company's guidance. BB had projected IoT revenues in the first quarter to be $48-$52 million. The uptick was attributed to strong revenues from royalties and professional services. Owing to the timing of OEM programs, development seat revenues came in lower than the previous quarter.

Licensing and Other contributed $6 million, which was down from $235 million a year ago. BB projected the segment to deliver revenues of approximately $4 million in the fiscal first quarter.

Other Details

Gross profit declined 46.4% from the year-ago quarter to $96 million. Gross margin improved to 66.7% from 48% in the prior-year quarter.

However, non-GAAP gross margin was 67.4% compared with 48.3% on a year-over-year basis.

Total non-GAAP operating expenses were $109 million, which was down 24.8%. Adjusted operating loss was $12 million against an adjusted operating income of $35 million a year ago.

Adjusted EBITDA loss came in at $7 million against an adjusted EBITDA of $41 million in the year-ago quarter. The company had projected adjusted EBITDA loss to be $15-$25 million.

Cash Flow & Liquidity

For the quarter that ended on May 31, 2024, BlackBerry used $15 million of net cash in operating activities compared with $99 million cash generated in the prior-year quarter.

As of May 31, BlackBerry had $283 million in cash, cash equivalents, short-term and long-term investments.

Zacks Rank & Stocks to Consider

At present, BlackBerry carries a Zacks Rank #3 (Hold).

Some better-ranked stocks worth consideration in the broader technology space are NVIDIA Corporation, Arista Networksand Woodward WWD, currently sporting a Zacks Rank #1 (Strong Buy) each.

The Zacks Consensus Estimate for NVIDIA's fiscal 2025 EPS is pegged at $2.68, which increased 12.1% in the past 60 days. NVIDIA's earnings beat the Zacks Consensus Estimate in each of the last four quarters, the average surprise being 18.4%. The long-term earnings growth rate is 37.6%. Shares of NVDA have risen 207.4% in the past year.

The Zacks Consensus Estimate for Arista Network's 2024 EPS is pegged at $7.92, which increased 5.7% in the past 60 days. The long-term earnings growth rate is 16.1%. ANET's earnings beat the Zacks Consensus Estimate in each of the last four quarters, the average surprise being 15.4%. Shares of ANET have gained 114.7% in the past year.

The Zacks Consensus Estimate for Woodward's fiscal 2024 EPS has increased 11.6% in the past 60 days to $5.88. WWD's earnings beat the Zacks Consensus Estimate in each of the last four quarters, the average surprise being 26.1%. The long-term earnings growth rate is 16.5%. Shares of WWD have risen 51.2% in the past year.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Check whenever you want

WikiStock APP