Stock market today: Nasdaq edges higher as Amazon crosses $2 trillion market cap

US stocks were a mixed bag on Wednesday after the S&P 500 and Nasdaq snapped a three-day losing streak, as investors watched for signs of life in the tech-driven rally and weighed the prospects for rate cuts.

The benchmark S&P 500 (^GSPC) was near flat, while the Dow Jones Industrial Average (^DJI) rose 0.1%. Meanwhile, the tech-heavy Nasdaq Composite (^IXIC) was up about 0.3%.

Treasury yields inched off their 3-month lows. The 10-year Treasury yield (^TNX) added 7 basis points to climb back to 4.31%.

A wobbly last handful of sessions has left investors wondering whether the drag on stocks is temporary or the start of a more solid retreat. The outsize impact of Nvidia stock on broader performance has underlined the question.

At the same time, the market is looking to economic prints for cues ahead of the key PCE inflation release on Friday. Federal Reserve speakers this week have underlined their caution in deciding to make interest-rate cuts, dependent on the data.

Elsewhere, Rivian (RIVN) shares surged more than 20% after the EV maker announced an alliance with Volkswagen (VWAGY) that could boost its coffers by up to $5 billion. FedEx (FDX) stock jumped almost 15% as its 2025 profit forecast topped Wall Street estimates.

Investors will watch how Chipotle (CMG) fares as its 50-for-1 stock split takes effect this morning — the largest in the history of the NYSE. Shares in the burrito seller are up 47% year to date.

Live12 updates

- Thu, June 27, 2024 at 3:02 AM GMT+8

Josh Schafer

Trending tickers on Wednesday afternoon

Amazon (AMZN) led the Yahoo Finance trending tickers page on Wednesday, rising just less than 4% and crossing a $2 trillion market capitalization for the first time ever.

Rivian (RIVN) stock rose more than 20% after the company after the EV maker announced a joint venture deal with Volkswagen (VWAGY), crucially bringing fresh capital into Rivians coffers. Notably, Amazon is the largest shareholder in Rivian.

Chipotle Mexican Grill (CMG) also cracked the trending tickers pages despite a less than 1% move on the day. Wednesday marked the first-day Chipotle began trading following a 50-for-1 stock split that sent the price from $3,283.04 per share to about $65 per share.

- Thu, June 27, 2024 at 2:16 AM GMT+8

Alexandra Canal

Life in the FAST lane? Why more consumers are choosing these free streaming channels

More consumers are choosing to watch free, ad-supported streaming platforms (otherwise known as FAST channels) amid the rapid rise of subscription prices from traditional streamers.

Ad-free streaming plans have become a primary target of price increases as media companies like Netflix (NFLX), Max (WBD), and Amazon (AMZN) raise the costs of their respective offerings. Paramount (PARA) joined the price hike bandwagon on Monday, announcing it will raise the monthly costs of its Paramount+ tiers, both with and without Showtime, beginning Aug. 20.

But as prices rise, consumers are turning to other options. Free options.

FAST providers, which include The Roku Channel (ROKU), Fox affiliate Tubi (FOX), Paramount's Pluto TV, among others, all saw viewership upticks during the month of May, according to the latest data from Nielsen.

Tubi, for example, led year-over-year growth for Fox following a nearly 5% monthly viewing increase. It secured a platform-best 1.8% of total TV usage for the month as a record 1 million viewers tuned in. This represented a 46% year-over-year increase with Tubi's average audience racing ahead of traditional streamers including Disney+, Peacock, Paramount+, and Max, Nielsen confirmed.

Meanwhile, a 1.3% monthly bump in viewing to The Roku Channel led the FAST provider to a platform-best 1.5% share of TV. It was the only company to climb in the rankings for May, nabbing 10th overall.

“We're seeing [the FAST] model resonate more and more with younger audiences because their taste and preferences with what's good and what they want to watch is evolving,” Tubi CEO Anjali Sud said on the Ringers podcast “The Town With Matthew Belloni” in April.

63% of Tubi's audience are “cord cutters” or “cord nevers” while 40% are not on other traditional streamers.

“It is different to be 100% free,” Sud told Belloni. “We're not asking you to subscribe to an ad tier or a subscription tier. We're not trying to upsell you. The fragmentation and friction is reduced.”

It's a similar model to what has made YouTube, owned by parent company Alphabet (GOOGL, GOOG), such a massive success.

According to Nielsen, YouTube amassed 9.7% of overall viewership on connected and traditional TVs in the US during the month of May — the largest share of TV for a streaming platform ever reported by the agency.

Experts say YouTube's growth has led to the increased interest of ad-supported options like FAST channels, especially from younger consumers.

“YouTube is essentially pushing us towards [this] very search-driven experience,” said Vikrant Mathur, co-founder of Future Today, a company that specializes in ad-supported connected TV solutions. “I'm looking for a movie or a TV show. I find it wherever I find it. I go watch it. As long as there's no barriers to that content, I prefer that experience rather than having to subscribe.”

Still, it's not a proven business model. Tubi, which Fox acquired for $440 million in 2020, has yet to turn a profit with its longterm outlook also in question amid the expected re-acceleration of M&A within the industry.

“I'm probably a little bit more cautious than others,” Tim Nollen, analyst at Macquarie, told Yahoo Finance, noting FAST providers must utilize a different strategic approach compared to other streamers given their lack of premium or exclusive content.

“A lack of premium content means they have to be effective at using technology to target the users that they do have,” Nollen said. “It's a large audience, but it may not be a particularly engaged audience. I think they will be successful at using technology to target those users. But it might be in a somewhat different manner.”

- Thu, June 27, 2024 at 1:24 AM GMT+8

Josh Schafer

Amazon stock crosses $2 trillion market cap

Amazon (AMZN) stock rallied more than 4% on Wednesday to surpass a $2 trillion market cap for the first time ever.

Amazon joins Nvidia (NVDA), Microsoft (MSFT), Apple (AAPL) and Alphabet (GOOGL, GOOG) as the only US companies to surpass a $2 trillion market cap. Shares of the e-commerce giant are now up more than 27% year-to-date.

- Thu, June 27, 2024 at 12:42 AM GMT+8

Josh Schafer

The narrow rally isn't 'unprecedented'

Yesterday we highlighted research from BlackRock and other equity strategy teams that largely said they aren't overly concerned with the fact only a few stocks are driving the major indexes higher.

In simple terms, they argued those companies have seen most of the earnings growth, and therefore, it makes sense they're rallying the most.

Still, a common concern is that the market could be at risk if a few large tech companies that have driven the lion's share of the gains stop surprising the upside.

Citi head of equity trading strategy Stuart Kaiser, speaking with Yahoo Finance on Wednesday morning, offered another counterpoint to the concentration debate.

“If you look back historically, this is kind of how equity markets behave,” Kaiser said. “You know, over any 12 month period, you're going to have 40 to 50% of returns come from just ten stocks.”

He added: “It worries you a bit. But again, it's not unprecedented.”

As of Monday's close, AI darling Nvidia (NVDA) had accounted for nearly one-third of the S&P 500's gains this year, and outperformance in quarterly results from large-cap tech continues to be a reason why earnings for the S&P 500 are growing year over year.

Meanwhile, Apple (AAPL), Alphabet (GOOG, GOOGL), Microsoft (MSFT), Amazon (AMZN), Meta (META), and Broadcom (AVGO) had also contributed more than a quarter of the major index's gains.

- Wed, June 26, 2024 at 11:07 PM GMT+8

Josh Schafer

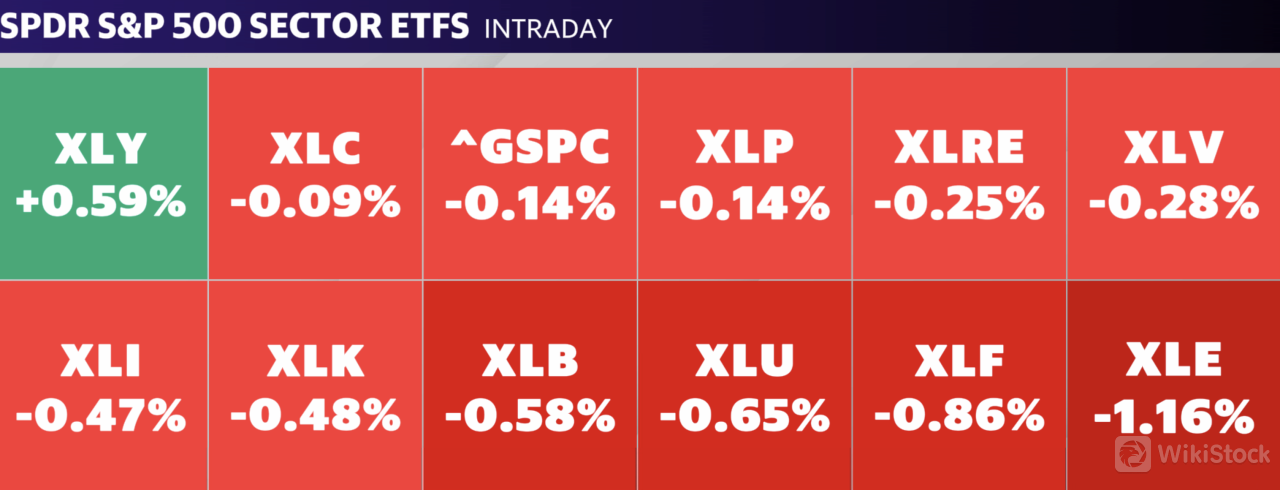

Consumer discretionary is the lone sector in the green

Consumer Discretionary (XLY) was the only of the 11 S&P 500 (^GSPC) sectors to be in the green on Wednesday morning. The sector was up about 0.6% after strong earnings from FedEx (FDX) sent shares of the company up nearly 15%. The positive results also offered a more upbeat read-through on the consumer overall leading into a report from Nike (NKE) expected Thursday after the bell.

Energy (XLE) was leading the losses on Wednesday, falling more than 1%.

Source: Yahoo Finance

- Wed, June 26, 2024 at 11:02 PM GMT+8

Dani Romero

New home sales plummet to 6-month low

New home sales hit a six-month low as high mortgage rates continued to weigh on buyers.

Sales of new single-family homes fell 11.3% to a seasonally adjusted rate of 619,000 units last month from Aprils revised seasonally adjusted annual rate of 698,000, according to Census Bureau data released Wednesday.

May's number was the lowest since November. It also missed consensus expectations of 633,000 units, per Bloomberg data.

Affordability concerns have kept potential buyers from snapping up new homes and sellers, many of whom are locked into lower mortgage rates, from moving. The average weekly rate on the 30-year fixed mortgage still hovers well above 6%, according to Freddie Mac.

Meanwhile, home prices have been hitting new record highs. Prices in the 20 largest US metros increased 7.2% in the last 12 months ending in April, per S&P CoreLogic Case-Shiller data released Tuesday.

The drop in sales activity in May contributed to an uptick in available inventory, Bright MLS chief economist Lisa Sturtevant said in an email. At the end of the month, the seasonally adjusted estimate of new homes for sale was 481,000, marking the highest month-end new home inventory since 2008.

“Homebuilders had been enticing buyers with rate buydowns and other concessions, but for some homebuyers, those financial incentives are no longer enough to get them on the building lot,” Sturtevant said.

She added, With more housing inventory and softening demand, expect the third quarter of 2024 to be a slower new housing market than the second half of 2023. However, while new home inventory is back at 2008 levels, other fundamentals in the market are significantly different than they were 16 years ago. The job market is strong, there is still pent-up demand among Millennials, and for all the increase in inventory, overall supply is still below pre-pandemic levels.

- Wed, June 26, 2024 at 10:21 PM GMT+8

Josh Schafer

Rivian jumps on 'meaningfully positive' investment from Volkswagen

Rivian stock (RIVN) surged nearly 30% on Wednesday after the EV maker announced a joint venture deal with Volkswagen (VWAGY), bringing key fresh capital into Rivians coffers.

Yahoo Finance's Pras Subramanian reports:

Volkswagen announced it intends to work with Rivian to create “next generation software-defined vehicle (SDV) architectures” to be used in both companies‘ future EVs. The joint venture will use Rivian’s “zonal hardware design” and platform as the foundation of future vehicles, as well as Rivians electrical architecture expertise for the vehicles. Rivian will license its existing IP rights to the joint venture.

In exchange, Volkswagen will invest an initial $1 billion in Rivian through an “unsecured convertible note that will convert into Rivians common stock,” with up to $4 billion in additional investment staged through 2026 for a total infusion of $5 billion.

For Rivian, the news of fresh capital allays concerns over the companys runway as it bridges to the release of its next-generation vehicles, the R2 and R3 mass-market SUVs. In terms of its cash cushion, Rivian said it had $5.98 billion at the end of Q1 versus $7.86 billion at the end of Q4.

“This news is meaningfully positive for RIVN as the agreement should provide the company with access to capital to not only fund the ramp-up of production of the R2 at its Normal, IL facility but also to build a new facility in Georgia for its mid-size vehicle platform,” Bank of America analyst John Murphy wrote in a note to clients on Wednesday. “We have assumed RIVN would need to raise more capital, and VW's investments in RIVN will prove valuable in helping it achieve the scale necessary to get to positive free cash flow.”

Murphy also noted potential benefits from cost savings and operating efficiencies in the joint venture deal, which could ultimately lead to higher gross margins.

- Wed, June 26, 2024 at 9:36 PM GMT+8

Josh Schafer

Stocks slide at the open, yields rise

US stocks slipped on Wednesday after the S&P 500 and Nasdaq snapped a three-day losing streak, as investors watched for signs of life in the tech-driven rally and weighed the prospects for rate cuts.

The benchmark S&P 500 (^GSPC) fell around 0.2% while the Dow Jones Industrial Average (^DJI) dropped about 0.4%. Meanwhile, the tech-heavy Nasdaq Composite (^IXIC) slid about 0.1% as Nvidia (NVDA) extended its rebound.

The moves lower in stocks came as Treasury yields inched higher. The 10-year Treasury yield (^TNX) added 6 basis points to climb back to 4.3%.

- Wed, June 26, 2024 at 6:43 PM GMT+8

Brian Sozzi

What's really happening at FedEx and UPS

Within the past four days, investors have witnessed the fundamental remapping of America's two iconic package shippers: FedEx (FDX) and UPS (UPS).

I am just not sure those investors understand how laser-focused each respective management team is on becoming more efficient and driving better margins by unwinding legacy thoughts.

FedEx shares are up 15% in the pre-market as the company surprised the masses by saying it's exploring strategic alternatives for its LTL (less than truckload) business. FedEx has the largest LTL franchise in the US, but growth has slowed and its profit margins lag those at competitors.

Evercore ISI analyst Jonathan Chappell did a little numbers-crunching overnight and came up with an intrinsic value on FedEx of $362 a share. That assumes it no longer operates an LTL business and becomes solely focused on its Ground and Express franchises.

FedEx shares are currently trading at $292 in the premarket.

“There is likely to be a sum of the parts premium in the stock until confirmation of the path forward,” said Chappell.

I underestimated FedEx CEO Raj Subramaniam.

His CEO tenure got off to a rocky start with a few bad quarters, and I thought the near FedEx lifer wasn't going to challenge the status quo. That appears to not be the case as Subramaniam is showing a knack for aggressive cost-cutting and a desire to challenge the status quo even as founder Fred Smith watches over him on the board.

As for UPS, on Sunday it unloaded its logistics business to RXO (RXO) for $1 billion.

I have known UPS CEO Carol Tomé going back to her CFO days at Home Depot (HD). She has always — and I mean always — looked for ways to do business more efficiently while not hurting the core business. That's what she has been doing at UPS since day one, and I suspect she has a few more tricks up her sleeve to drive costs down now that the logistics business is sold.

- Wed, June 26, 2024 at 6:23 PM GMT+8

Brian Sozzi

Electrifying move in Rivian after $5 billion VW deal

Rivian (RIVN) is ripping higher by 39% in the premarket after its buzzy $5 billion deal with Volkswagen (VWAGY).

The deal is broken down into a $3 billion direct equity investment into Rivian and $2 billion investment into a 50/50 owned joint venture.

The company will be holding an investor day Thursday at its Illinois factory, so I suspect the stock could stay volatile into the weekend.

Here are a couple of ways to unpack the new Rivian/VW tie-up.

Implications for Rivian

Rivian goes from having Wall Street be concerned about the need to raise more funding (speculation was north of $4 billion) to removing that risk from the table in the medium term.

“The $3 billion equity injection over the 2024-26 period should keep Rivian funded through the launch of R2 and the build-up of the Georgia facility,” said Jefferies analyst Philippe Houchois in a client note.

What it means for the wider auto industry

Piper Sandler's Alexander Potter thinks the deal sends a key signal to the auto industry at large and its many investors.

“Specifically, it suggests that proprietary ECUs, electrical architectures, and software are necessary for automakers to control themselves. Rivian and Tesla (TSLA) have long advocated for in-house mastery of these technologies, and now Volkswagen is (apparently) attempting to replicate their approach. New Chinese brands are moving at an unprecedented speed, and only through vertical integration can other automakers hope to keep pace,” Potter said.

Spotlight on Lucid

Citi's Itay Michaeli is calling out Lucid as a derivative trade off the deal.

“We‘d highlight Lucid (where shares are down 41% YTD) as one name that could come into greater focus given its leading battery efficiency and openness to licensing to other automakers. It’s also conceivable that the proposed VW-Rivian JV could improve EV sentiment more broadly,” said Michaeli.

Lucid shares are up 9% premarket. The company's ticker page is on top of the Yahoo Finance trending ticker page.

- Wed, June 26, 2024 at 5:59 PM GMT+8

Brian Sozzi

It's Chipotle stock-split day

Full disclosure on Chipotle (CMG) stock-split day.

Having done this for 21 years, I know a stock split doesn't change the intrinsic value of the company whose stock is being split. But I must admit, going onto Chipotle's ticker page on Yahoo Finance this morning and seeing $65 a share as opposed to $3,283 (yesterday's closing price) initially made me think “Wow, the stock is cheaper — time to buy!”

I suspect others will have that initial feeling as well. But I remind you that the company is no different fundamentally than yesterday at the close.

Yahoo Finance's Brooke Dipalma reports here on what the stock split means to investors.

Key areas for mutual funds to make money in 2025

Yushu Technology's robot dog explodes the market!

Byte refutes rumors of speculation on A-share Doubao concept stocks

How to develop a low-altitude economy

Check whenever you want

WikiStock APP