What's Going On With Nvidia Stock Thursday? - NVIDIA (NASDAQ:NVDA)

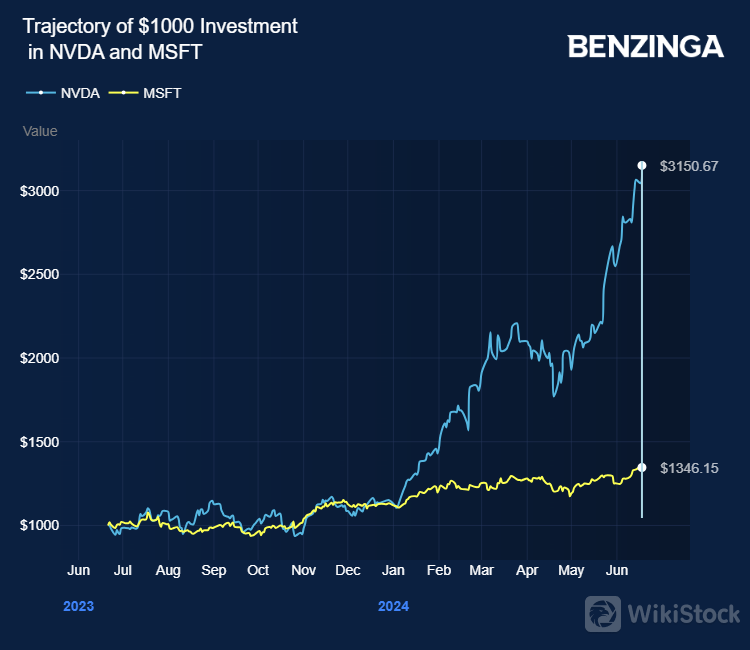

Nvidia‘s revenue soared to $26 billion in the latest quarter, more than triple the same period a year earlier. The company’s stock has more than tripled in value over the past 12 months, making it the best performer in the S&P 500 in 2023. Nvidia also recently split its shares.

Meanwhile, key Nvidia supplier Taiwan Semiconductor Manufacturing CoTSM is weighing a new method of advanced chip packaging to meet the growing AI-driven demand for computing power.

TSMC is collaborating with equipment and material suppliers on this new technique. The innovation involves using rectangular panel-like substrates instead of the traditional round wafers, enabling more chip sets per substrate, the Nikkei Asia reports.

The transition will require extensive development efforts and equipment upgrades.

Semiconductor analysts maintained Nvidia as the key AI beneficiary citing potential from Hopper platform and Blackwell B100/200 and 3nm/Rubin the company announced at Computex for 2026.

Nvidia stock gained close to 210% in the last 12 months. Investors can gain exposure to the stock via Vanguard S&P 500 ETFVOO and Invesco QQQ Trust, Series 1QQQ.

Price Action: NVDA shares traded higher by 2.62% at $139.13 premarket at the last check Thursday.

Key areas for mutual funds to make money in 2025

Yushu Technology's robot dog explodes the market!

Byte refutes rumors of speculation on A-share Doubao concept stocks

How to develop a low-altitude economy

Check whenever you want

WikiStock APP