Ares Management in Talks on Merger With GLP Capital - Ares Management (NYSE:ARES), LPL Finl Hldgs (NASDAQ

Ares Management CorporationARES is in talks on a possible merger with real estate investment firm GLP Capital Partners Ltd. The news was first reported by Bloomberg, citing people with knowledge of the matter who asked not to be identified because the information is private.

There is no certainty yet that the talks will lead to a deal. Representatives for ARES and GLP Capital declined to comment on the matter.

If finalized, the merger will rank as one of the biggest combinations in the alternative asset management industry over the past few years.

According to the people with knowledge of the matter, ARES is exploring a potential merger with GLP Capital's operations outside China. The transaction could add $66 billion of assets under management spread across Japan, Southeast Asia, Europe, the United States and Brazil.

GLP Capital runs dozens of funds that deploy money into real assets and private equity with a focus on logistics property, digital infrastructure and renewable energy. The real estate firm has grown out of Singapore-based GLP Pte, a developer and operator of warehouses.

Notably, Ares Management has been growing via acquisitions over the past few years. Last year, the Los Angeles-based firm agreed to buy Asia-based private equity firm Crescent Point Capital. Also, ARES acquired BootstrapLabs, an AI-focused venture capital firm.

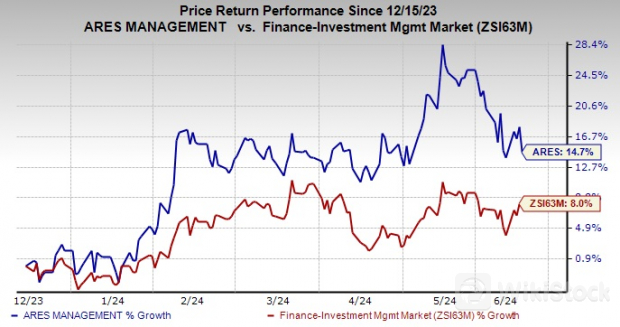

Over the past six months, ARES shares have gained 14.7% compared with the industry's 8% growth.

Currently, Ares Management carries a Zacks Rank #3 (Hold).

Inorganic Growth Efforts by Other Finance Firms

A couple of days ago, Blue Owl Capital Inc.OWL announced the completion of its acquisition of Prima Capital Advisors from funds managed by Stone Point Capital LLC. The move aims to boost the company's presence in the real estate market and further diversify its offerings on the platform.

The deal, announced in April 2024, also led to the formation of Blue Owl's Real Estate Finance strategy. Per the terms of the transaction, the company paid roughly $157 million in equity and $13 million in cash. An additional earnout of up to $35 million will be paid in the form of equity upon the fulfillment of certain targets. Prima's employees will join OWL.

Likewise, LPL Financial Holdings Inc.LPLA completed the acquisition of Crown Capital Securities, L.P. The deal, announced in July 2023, expands the company's footprint in the California market and solidifies its wealth management business.

The acquisition signifies a strategic move for LPLA, reinforcing its position as a leading wealth management service provider. The company's industry-leading platform is expected to provide Crown Capital advisors with enhanced operational support, streamlined processes and access to cutting-edge technology and integrated advisor tools.

Why is the oil rally heating up in the new year?

Precious metals rise, how to allocate in the medium and long term

Key areas for mutual funds to make money in 2025

Yushu Technology's robot dog explodes the market!

Check whenever you want

WikiStock APP