We are a leading and well-diversified North American financial institution committed to creating enduring value for our clients, team, communities and shareholders as we activate our resources to create positive change and contribute to a more secure, equitable and sustainable future.

Note: The details presented in this review are subject to potential modifications due to the ongoing updates to the company's offerings and policy adjustments. Additionally, the relevance of this review's information may be influenced by the original publication date, as service details and policies may have evolved since that time. Hence, it's crucial for readers to seek out the most current information directly from the company prior to making any decisions or initiating actions based on this review. The responsibility for utilizing the information provided herein lies entirely with the individual reader.

Should there be any discrepancies between visual and written materials in this review, the written information takes precedence. Nonetheless, for a more comprehensive understanding and updated details, accessing the company's official website is highly recommended.

What is CIBC Investor Services?

CIBC Investor Services, a division of CIBC Investors Edge, operates as a subsidiary of the Canadian Imperial Bank of Commerce (CIBC) and is regulated by the Investment Industry Regulatory Organization of Canada (IIROC).

Pros & Cons

Pros

Regulated: One of the primary advantages is that CIBC Investor Services operates as a regulated entity. This means it adheres to strict guidelines and standards set by financial regulatory bodies.

IPOs Available: Investors have access to Initial Public Offerings (IPOs), which can be an attractive option for those looking to invest in potential growth stocks from the beginning of their public journey.

Special Offering for Young Investors: CIBC Investor Services offers special programs or accounts tailored for young investors, such as lower commissions and waived account fees.

Cons

Multiple Fees Charged: One of the main drawbacks of using CIBC Investor Services is the array of fees that can be charged for various services. This includes commissions, account fees, telephone trading fees, etc.

Is CIBC Investor Services Safe?

Regulation

CIBC Investor Services operates under the regulation of the Investment Industry Regulatory Organization of Canada (IIROC), with these business scopes regulated: stocks, options, bonds & fixed income, futures, and investment advisory services.

Funds Safety

CIBC Investor Services does not provide extra insurance for its users. In this case, the risks users encounter in investing will not be covered.

Safety Measures

So far, we haven't found any information about the security measures applied for users by CIBC Investor Services.

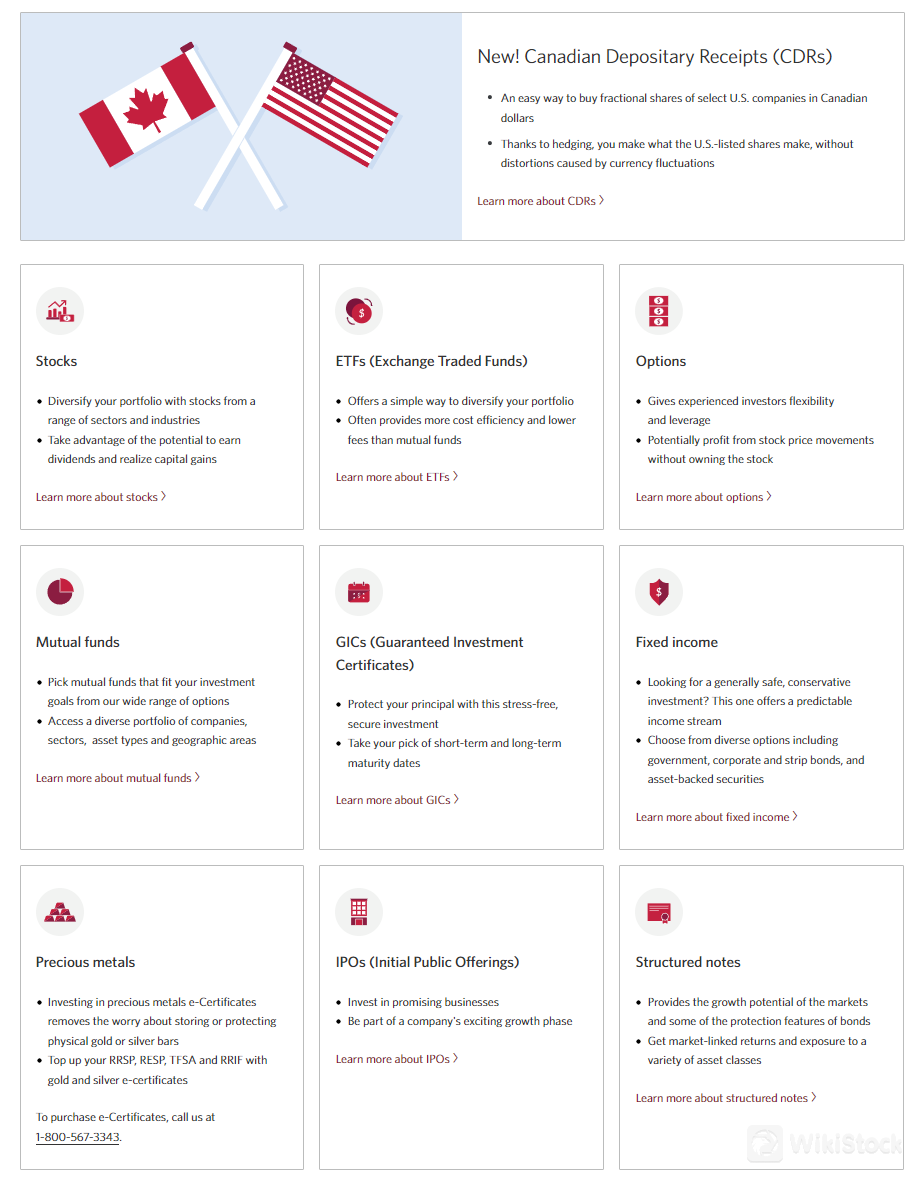

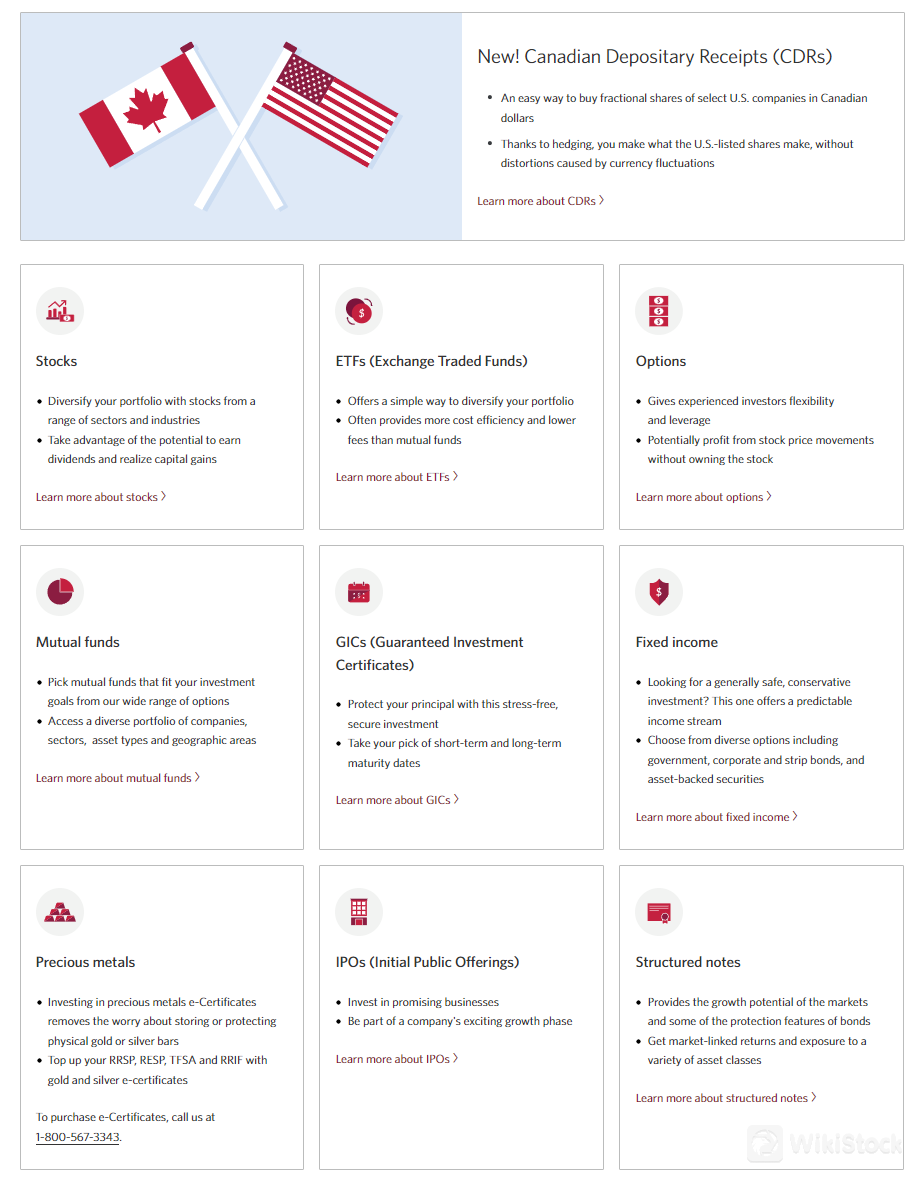

What Securities Can You Trade with CIBC Investor Services?

CIBC Investor Services offers a certain range of securities. These include:

Canadian Depositary Receipts (CDRs): These allow clients to own fractional shares of selected U.S. companies, denominated in Canadian dollars.

Stocks: CIBC offers the ability to buy shares from a diverse range of sectors and industries.

ETFs (Exchange Traded Funds): These are investment funds traded on stock exchanges.

Options: For experienced investors, options provide flexibility and leverage, offering potential profits from stock price movements without the necessity of owning the stock.

Mutual Funds: Investors have access to a wide range of mutual funds that fit various investment goals, offering exposure to diverse portfolios of companies, sectors, asset types, and geographic areas.

GICs (Guaranteed Investment Certificates): These are stress-free, secure investments that protect your principal, with a choice of short-term and long-term maturity dates.

Fixed Income: These conservative investments offer a predictable income stream. Options include government, corporate, and strip bonds, and asset-backed securities.

Precious Metals: CIBC offers e-Certificates for precious metals investing, removing the need for physical storage of gold or silver bars.

IPOs (Initial Public Offerings): This allows investors to participate in promising businesses during their exciting growth phase.

Structured Notes: These provide the growth potential of the markets with some of the protection features of bonds, offering market-linked returns and exposure to various asset classes.

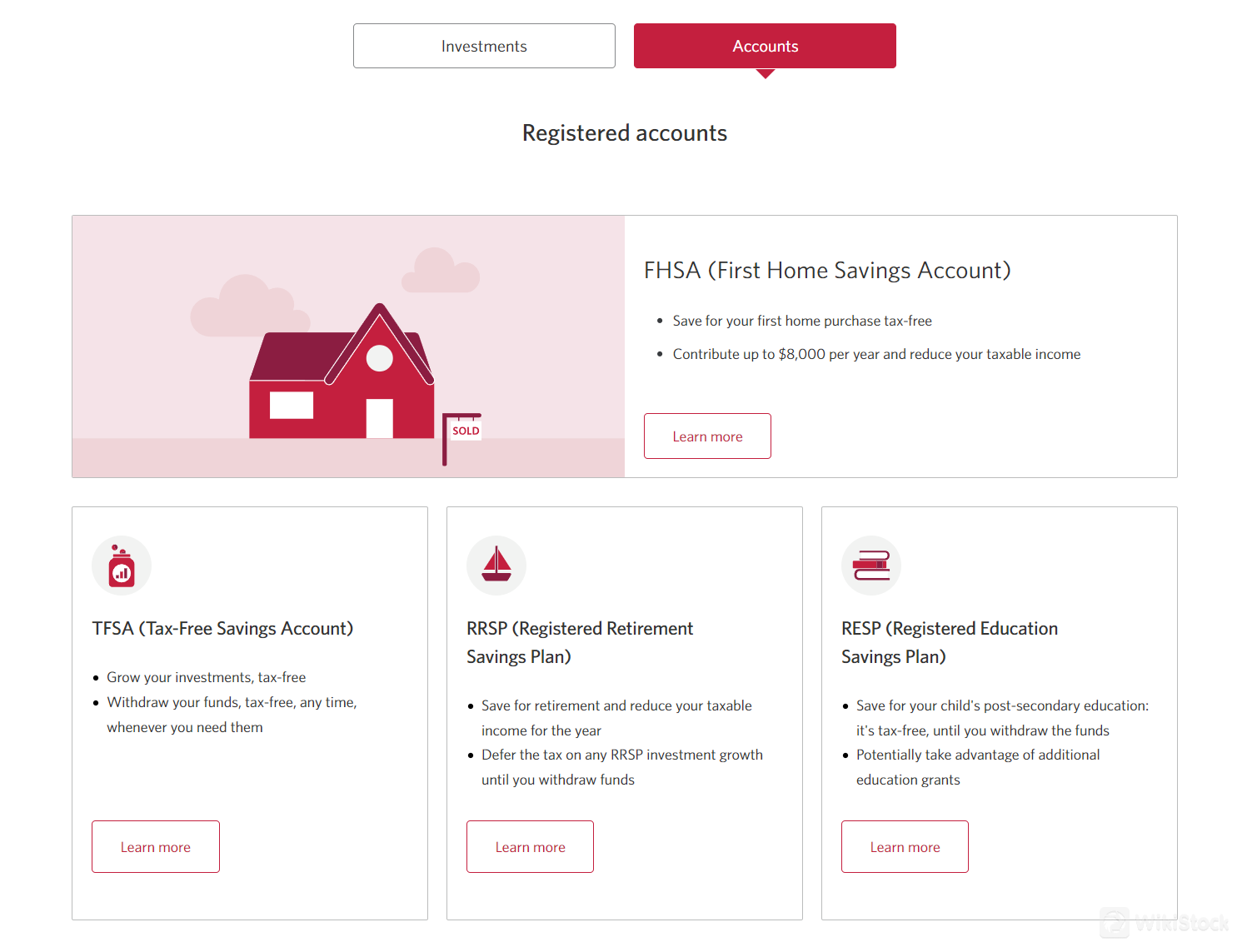

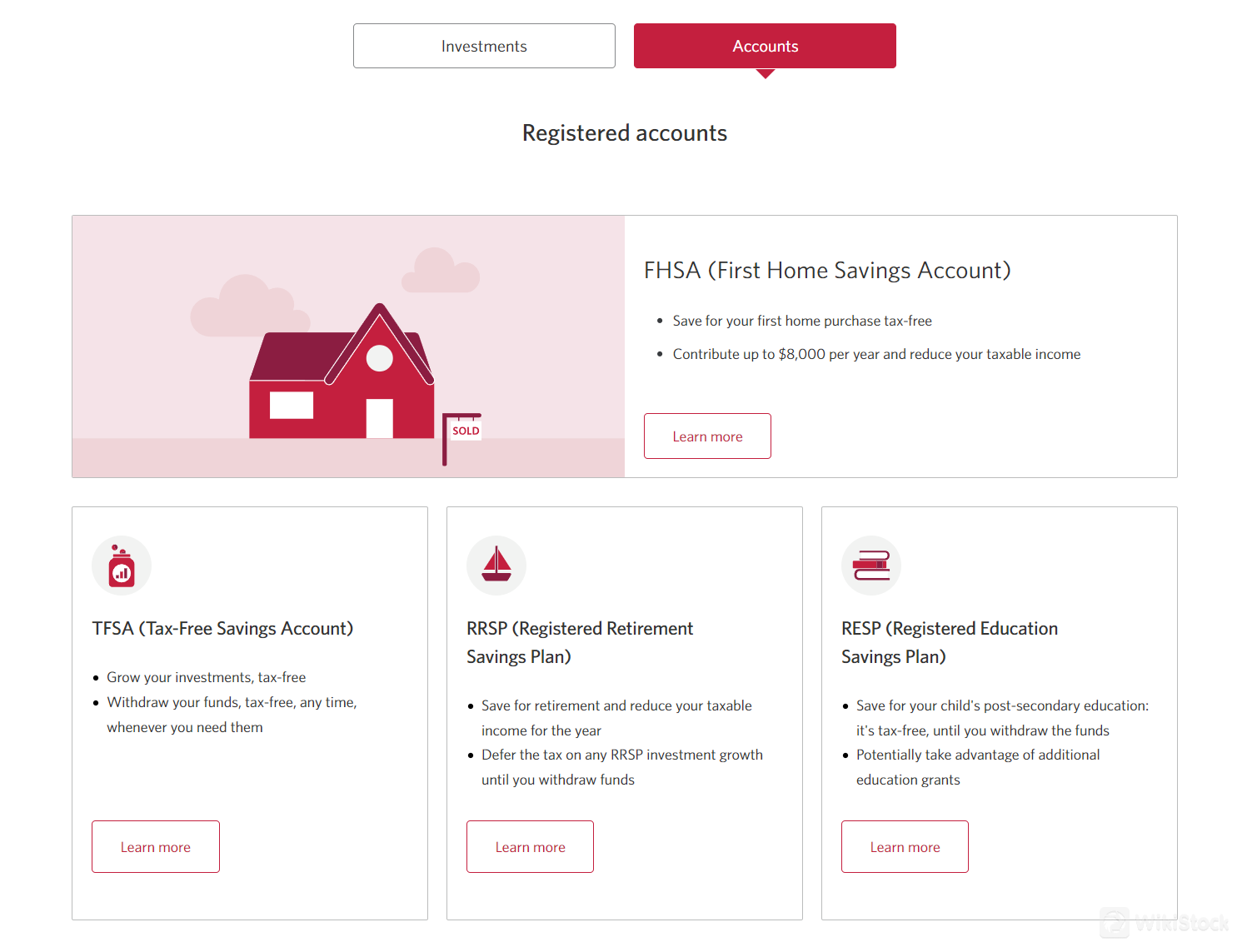

CIBC Investor Services Accounts Review

CIBC Investor Services provides 4 types of accounts:

FHSA (First Home Savings Account): This account is designed to help individuals save for their first home purchase in a tax-free manner. It allows contributions of up to $8,000 per year, helping to reduce taxable income.

TFSA (Tax-Free Savings Account): The TFSA allows individuals to grow their investments tax-free and provides the flexibility to withdraw funds at any time without incurring taxes.

RRSP (Registered Retirement Savings Plan): The RRSP is a retirement savings plan that enables individuals to save for retirement and reduce their taxable income for the year. This plan also allows for the deferral of tax on any RRSP investment growth until funds are withdrawn.

RESP (Registered Education Savings Plan): The RESP is a savings plan aimed at helping individuals save for a child's post-secondary education. The account grows tax-free until funds are withdrawn and may be eligible for additional education grants.

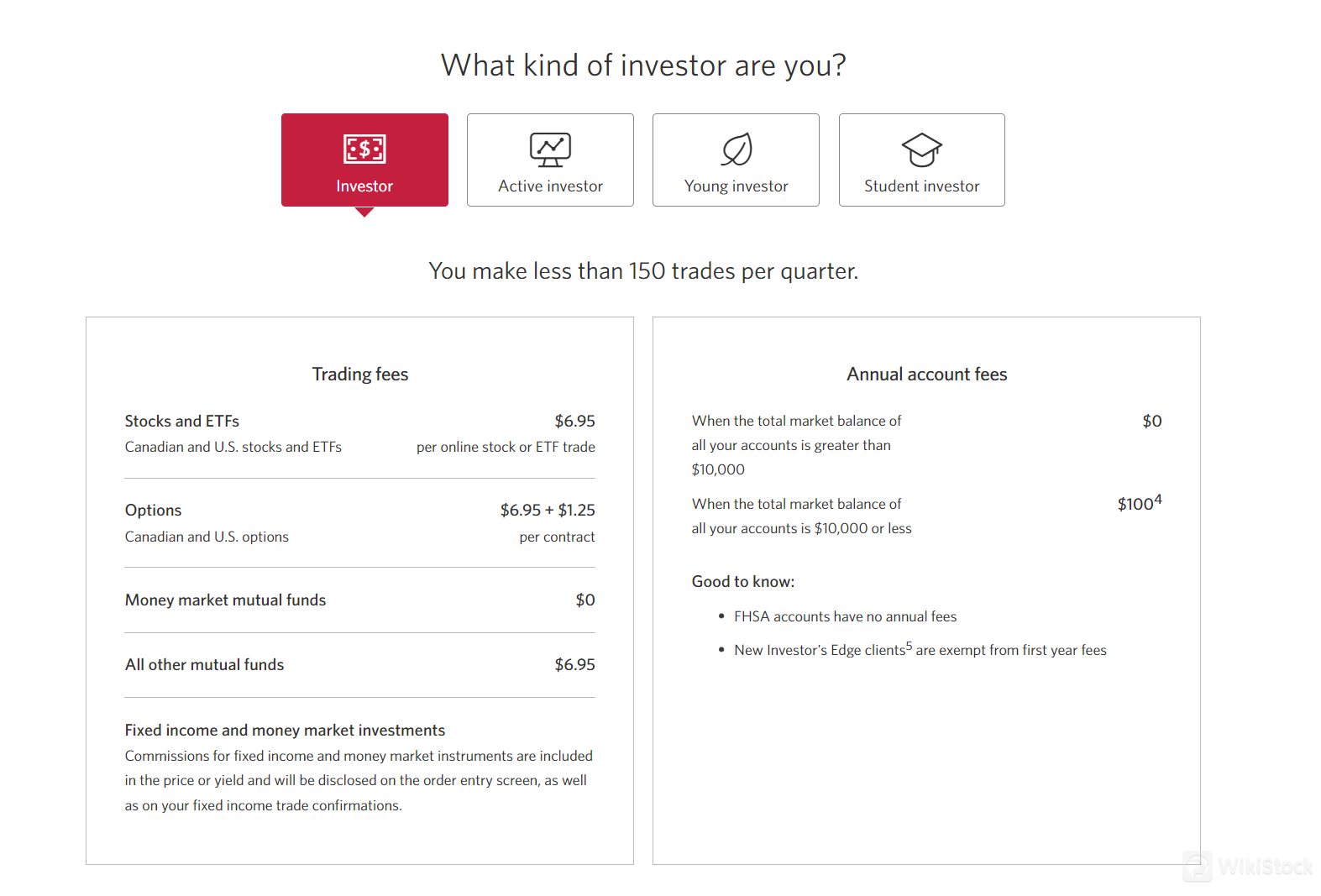

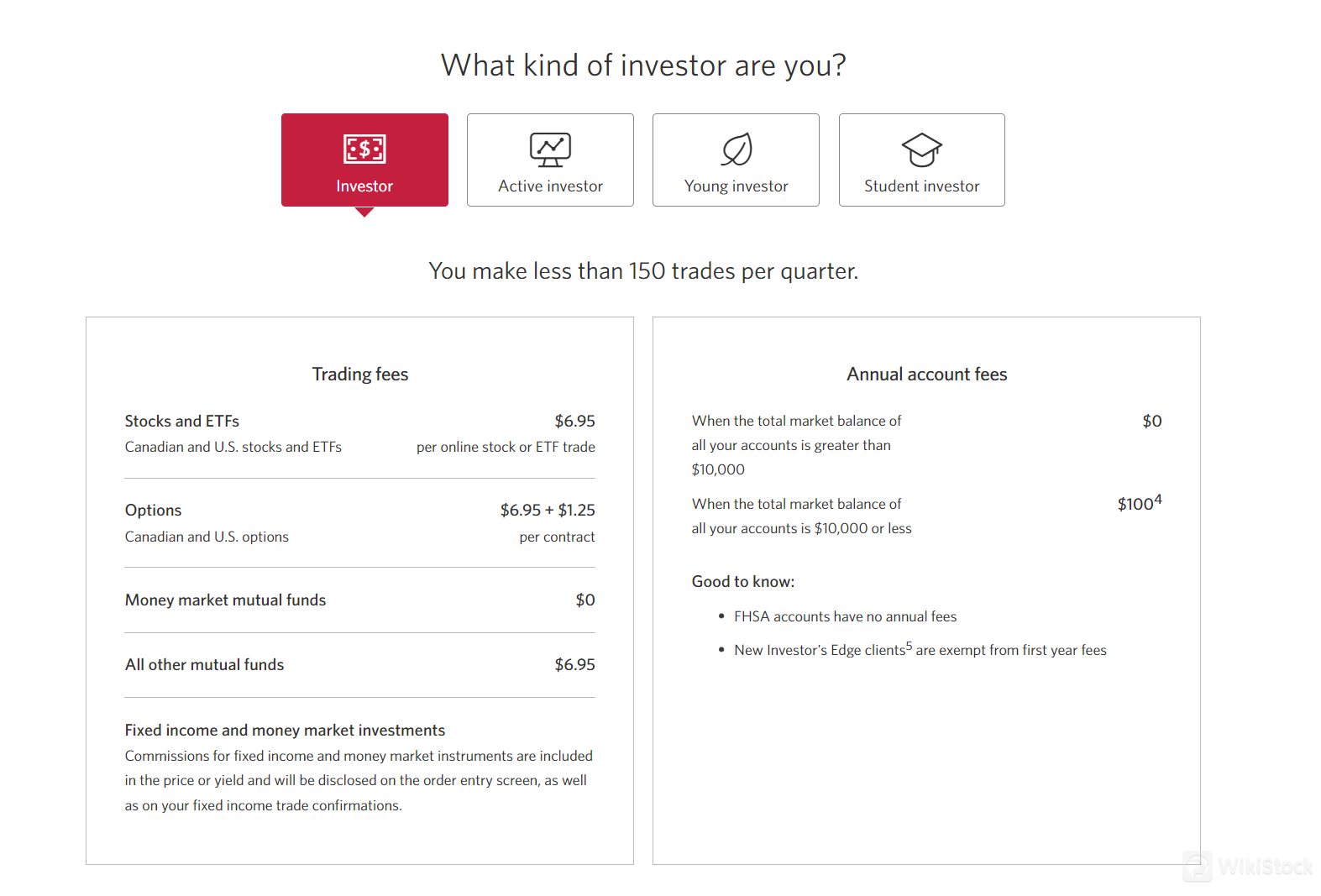

CIBC Investor Services Fees Review

CIBC Investor Services provides incentives and discounts for certain investor demographics, like active traders and young investors, to encourage investment activity. The exact fees can vary based on account types, trading frequency, and investor profile.

Trading Fees:

Stocks and ETFs: CIBC charges a per-trade commission for buying and selling stocks and ETFs. The standard rate is around $6.95 per trade, but this can be lower for active traders or certain demographics (such as young investors).

Options: Options trading comes with a per-trade commission plus a per-contract fee. The standard commission is in the region of $6.95 per trade, with a per-contract fee of approximately $1.25.

Mutual Funds: Trading mutual funds other than money market funds usually incurs a fee of about $6.95, while money market mutual funds often have no trading fee.

Fixed Income: When trading fixed-income securities like bonds, the commission is often built into the price or yield of the investment, so there can not be a separate, visible fee.

Annual Account Fees:

There is an annual fee of around $100 for accounts with a balance below a certain threshold (e.g., $10,000), which is waived if the total balance across all accounts exceeds this amount.

Special groups, such as young investors, students, or first-time clients, can be eligible for waived annual fees.

Special Accounts:

FHSA: This account type does not have an annual fee, aligning with its purpose to encourage savings for a first home.

TFSA, RRSP, RESP: While these accounts benefit from tax advantages, they are still subject to the general trading fees and potential annual fees unless specified otherwise.

Telephone Trading Fees: Regardless of the investment type or the size of the trade, a minimum commission of $50 applies to all orders placed over the phone for both Canadian (CAD) and U.S. (USD) securities.

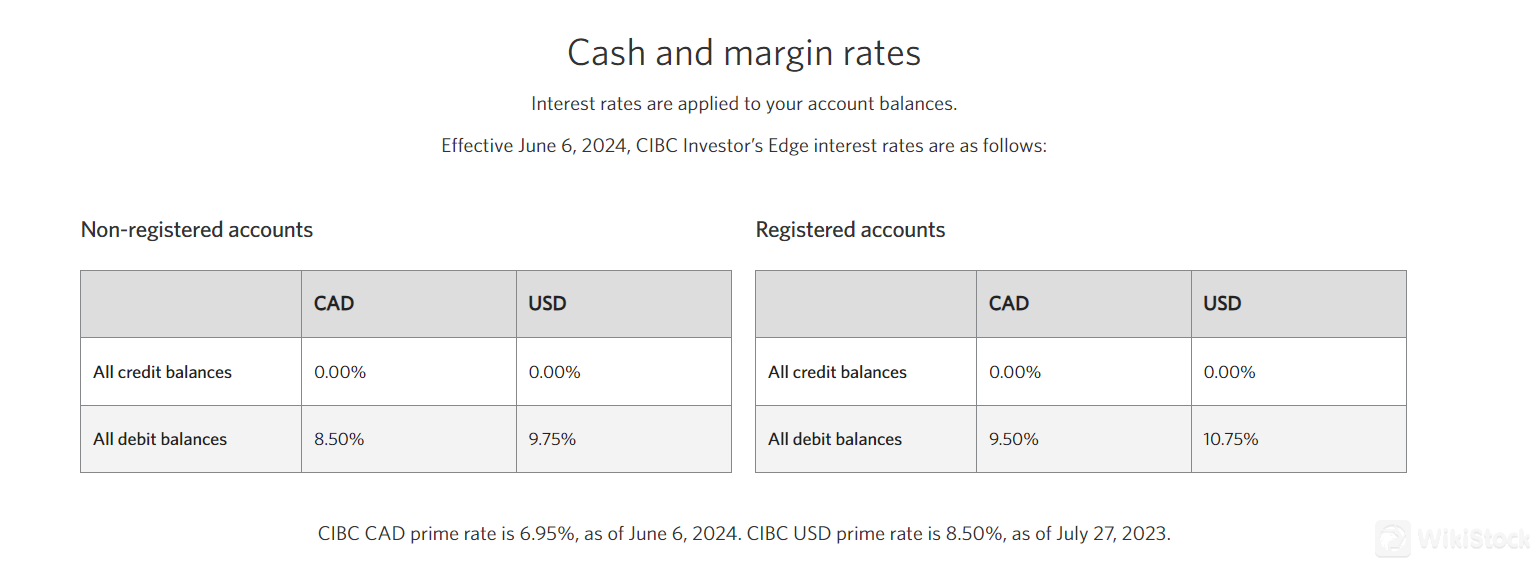

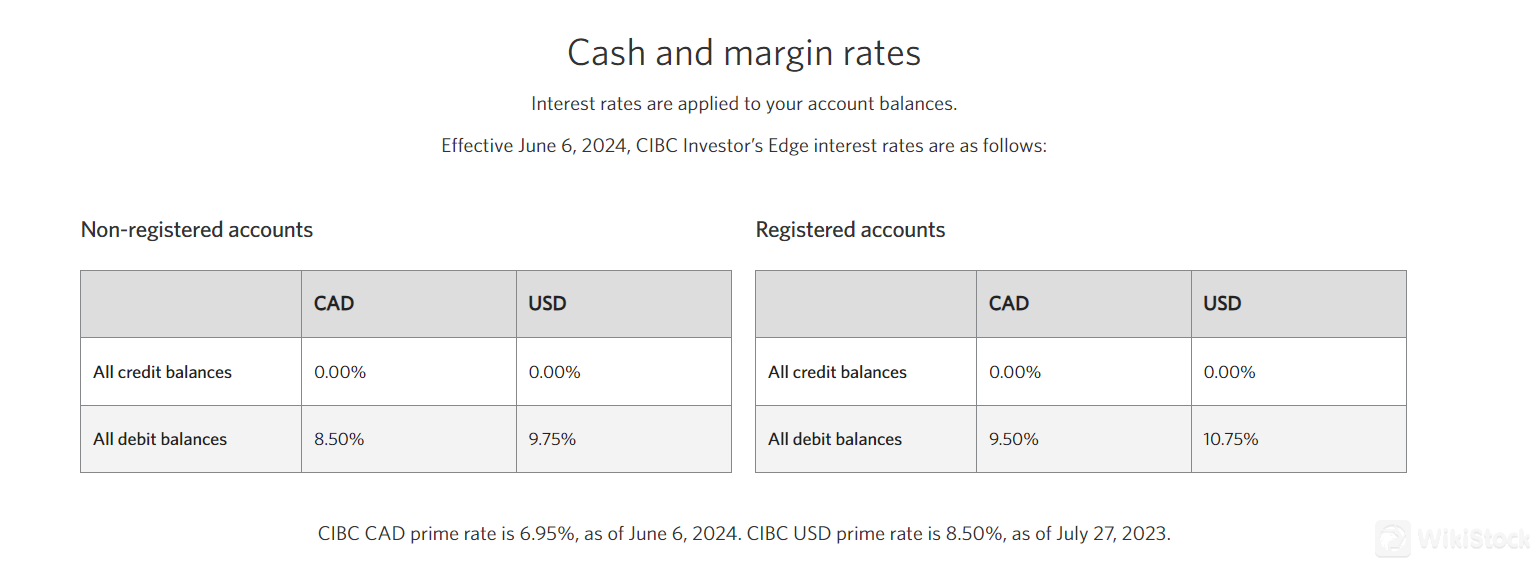

CIBC Investor's Edge applies interest rates to account balances based on the account type and currency:

For non-registered accounts: Credit balances in both CAD and USD do not accrue any interest, with a rate of 0.00%. Debit balances are subject to interest charges. In CAD, the rate is 8.50%, while in USD, it's higher at 9.75%.

For registered accounts: Similar to non-registered accounts, credit balances in both CAD and USD have an interest rate of 0.00%, meaning no interest is earned on uninvested cash. However, debit balances in registered accounts have slightly higher interest rates compared to non-registered accounts. The rate is 9.50% for CAD and 10.75% for USD.

The prime rates for CIBC as of June 6, 2024, are 6.95% for CAD and 8.50% for USD (as of July 27, 2023). These rates often serve as the baseline for setting the interest rates on various products, including the debit balances in investment accounts.

CIBC Investor Services Platform Review

CIBC Investor's Edge offers its own web trader. This is paired with a suite of analytical tools and resources for research and market analysis, including real-time quotes, charts, and market news. The platform also offers educational materials to boost user investment knowledge and understanding.

Research & Education

CIBC Investor Services offers a certain range of educational resources to help investors of all levels enhance their investment knowledge, make informed decisions, and understand the financial market better.

YouTube Channel: Through their official YouTube channel (@CIBCVideos), they share a variety of educational videos. These videos cover a wide range of topics, such as basic brokerage terms, investment strategies, market analysis, and financial planning.

Articles and Videos on Official Website: The CIBC Investor Services website hosts a collection of free articles and videos. These materials include in-depth analysis of market trends, tips on portfolio management, investment research, and more.

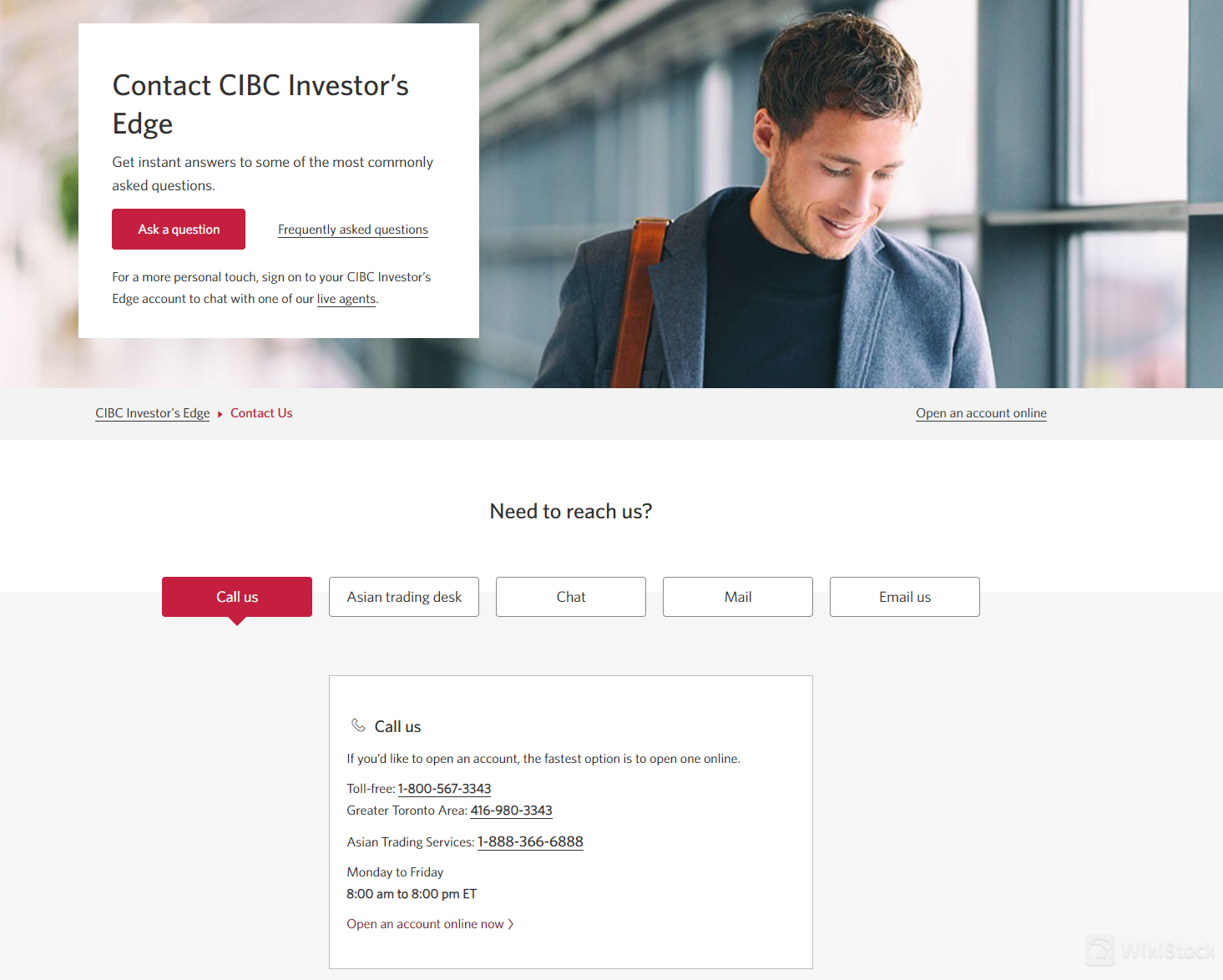

Customer Support

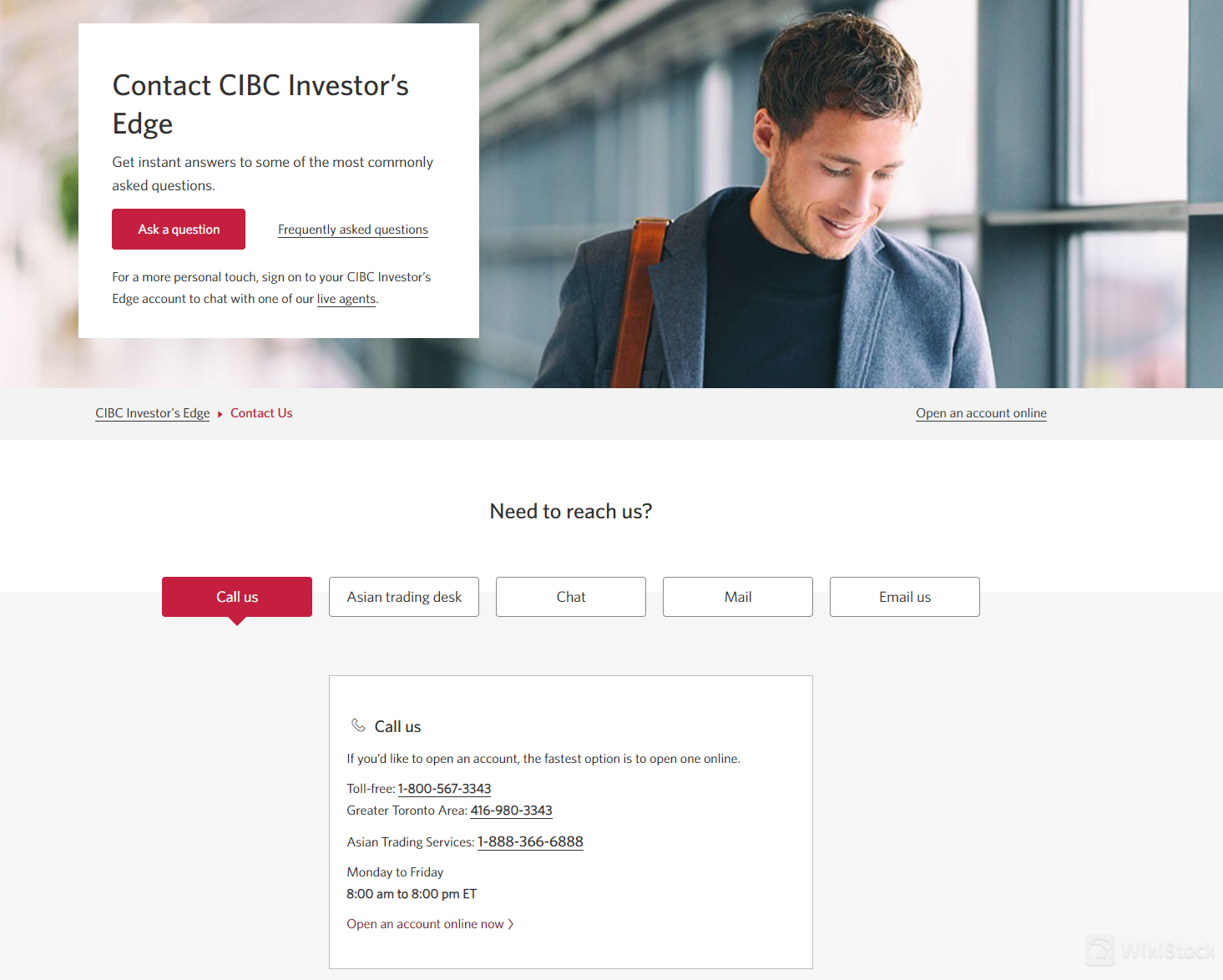

CIBC Investor Services provides a certain range of customer support channels. These include:

Phone Support: Clients can reach out for support via telephone from 8:00 am to 8:00 pm Eastern Time (ET) at 1-800-567-3343 for general inquiries and assistance.

Asian Language Services: An Asian Trading Desk is available offering support in Mandarin and Cantonese for clients who prefer these languages. This service operates from Monday to Friday, 8:30 am to 6:00 pm ET, and can be reached toll-free at 1-888-366-6888.

Live Chat: Clients have the option of live chat for real-time assistance during business hours, providing a convenient way to get help without making a phone call.

Mail Correspondence: For those who prefer or require documentation via mail, or for matters that are not urgent, clients can send mail to CIBC Investor Services at their physical address: 161 Bay Street, 4th Floor, Toronto, Ontario, M5J 2S8.

Contact Form: CIBC Investor Services also provides a contact form on their website, which clients can fill out to get support or have their questions addressed.

FAQs: A Frequently Asked Questions section is available to provide immediate answers to common queries, which can be also found on its official website.

Conclusion

CIBC Investor Services is a regulated broker with IPOs available and special offerings for youngsters. However, multiple fees are charged for trading with CIBC. Users need to check the pricing details carefully on the official website.

FAQs

Is CIBC Investor Services regulated?

Yes, it is regulated by IIROC.

Are there any fees charged for opening an account?

Yes. Usually, an annual fee of $100 will be charged.

Does CIBC Investor Services offer mutual accounts?

Yes.

Will there be interest in uninvested cash?

It depends. For credit cards, the rates will be 0%. For debit cards, the rates will be from 8.50%-10.75%.

Are IPOs available for CIBC Investor Services?

Yes.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Obtain 1 securities license(s)