ASA Securities Limited is based in Hong Kong and proud to be one of the participants in Hong Kong’s financial industry. We always prioritise our clients in the first place and compromise to provide excellent service quality. In the coming future, we will strive to be one of the best all-rounded financial service providers in Hong Kong.

ASA Securities Information

ASA Securities Limited is a prominent financial service provider in Hong Kong, regulated by the Securities and Futures Commission (SFC). It offers a user-friendly mobile trading app, comprehensive customer support, and strong security measures to protect client investments. However, some of its services can incur relatively high fees.

Pros and Cons of ASA Securities

ASA Securities Limited has several strengths, including robust regulatory oversight, comprehensive security measures, and a user-friendly mobile application. These features ensure a high level of safety and convenience for clients. However, there are some drawbacks, such as potentially high fees for certain services and limited physical locations for in-person support.

Is ASA Securities safe?

When considering the safety of ASA Securities Limited, there are three key areas to look at: regulations, funds safety, and security measures.

Regulation

ASA Securities Limited is regulated by the Securities and Futures Commission (SFC) of Hong Kong. This means they must follow strict rules designed to protect investors and ensure fair market practices.

Security Measures

ASA Securities takes several steps to ensure the safety of your funds and personal information:

Encryption Technology: They use strong encryption to protect your data and transactions.

Two-Factor Authentication (2FA): To log into your trading account, you need to use 2FA, which adds an extra layer of security.

Account Security Measures: They have multiple safeguards in place to prevent unauthorized access and protect your information.

What are securities to trade with ASA?

ASA Securities Limited offers a diverse range of financial investment products designed to address market fluctuations and fulfill customer needs.

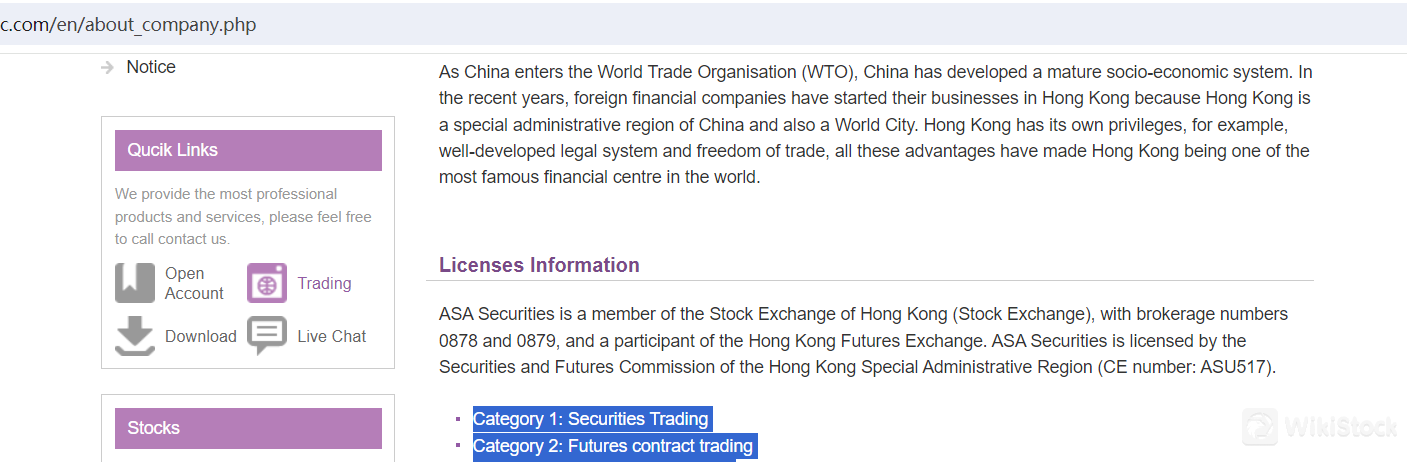

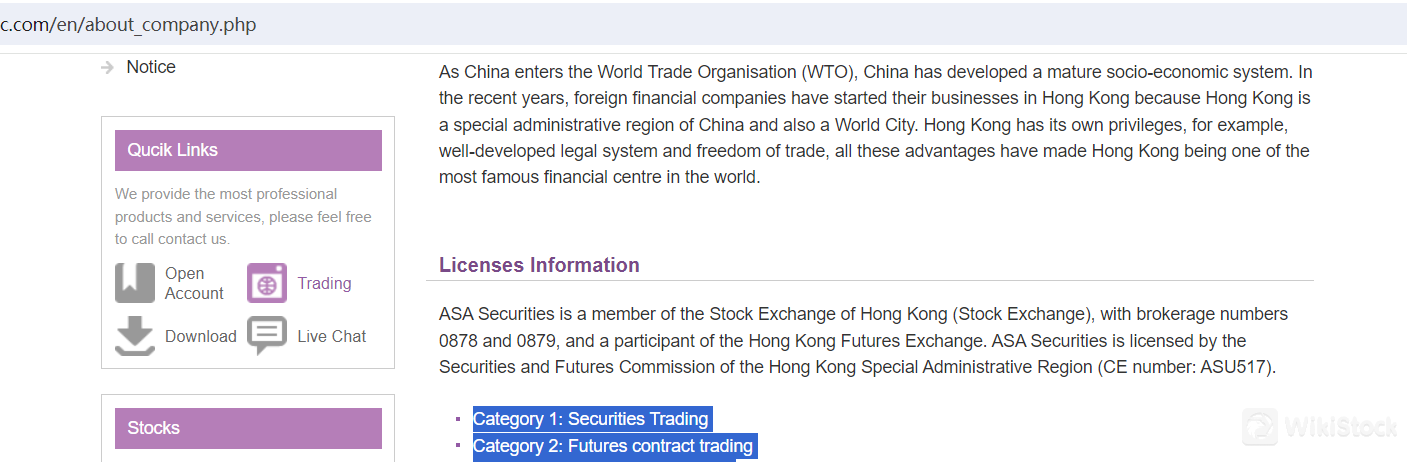

One of the primary services provided by ASA Securities is securities trading. As a licensed entity by the Securities and Futures Commission of the Hong Kong Special Administrative Region (CE number: ASU517), ASA Securities holds brokerage numbers 0878 and 0879 and is a participant of the Hong Kong Futures Exchange. This licensing enables ASA Securities to engage in a variety of financial activities, including Securities Trading, which involves the buying and selling of stocks and other securities on behalf of their clients.

In addition to securities trading, ASA Securities is also involved in Futures Contract Trading. This service allows clients to trade futures contracts, which are agreements to buy or sell assets at a future date for a predetermined price. This can be a useful tool for hedging against market volatility and managing investment risk.

ASA Accounts

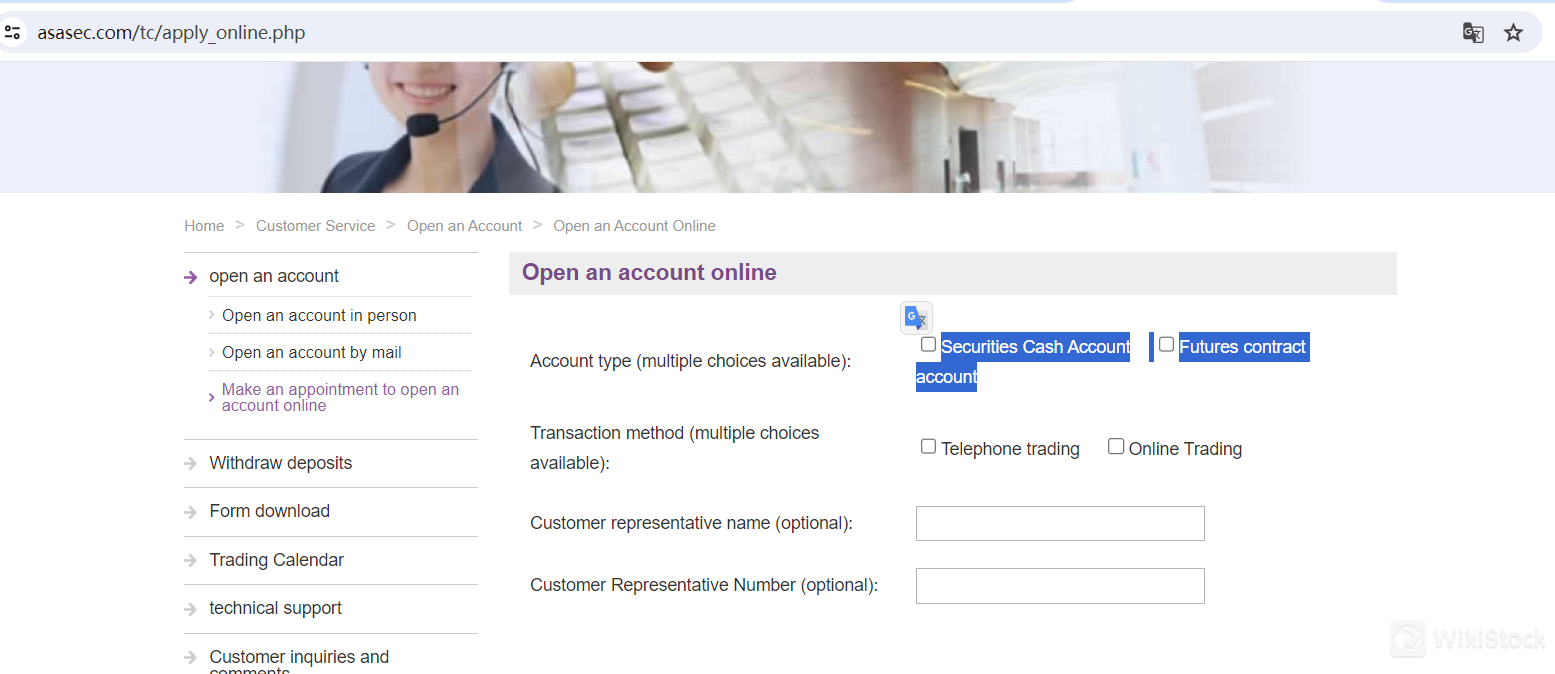

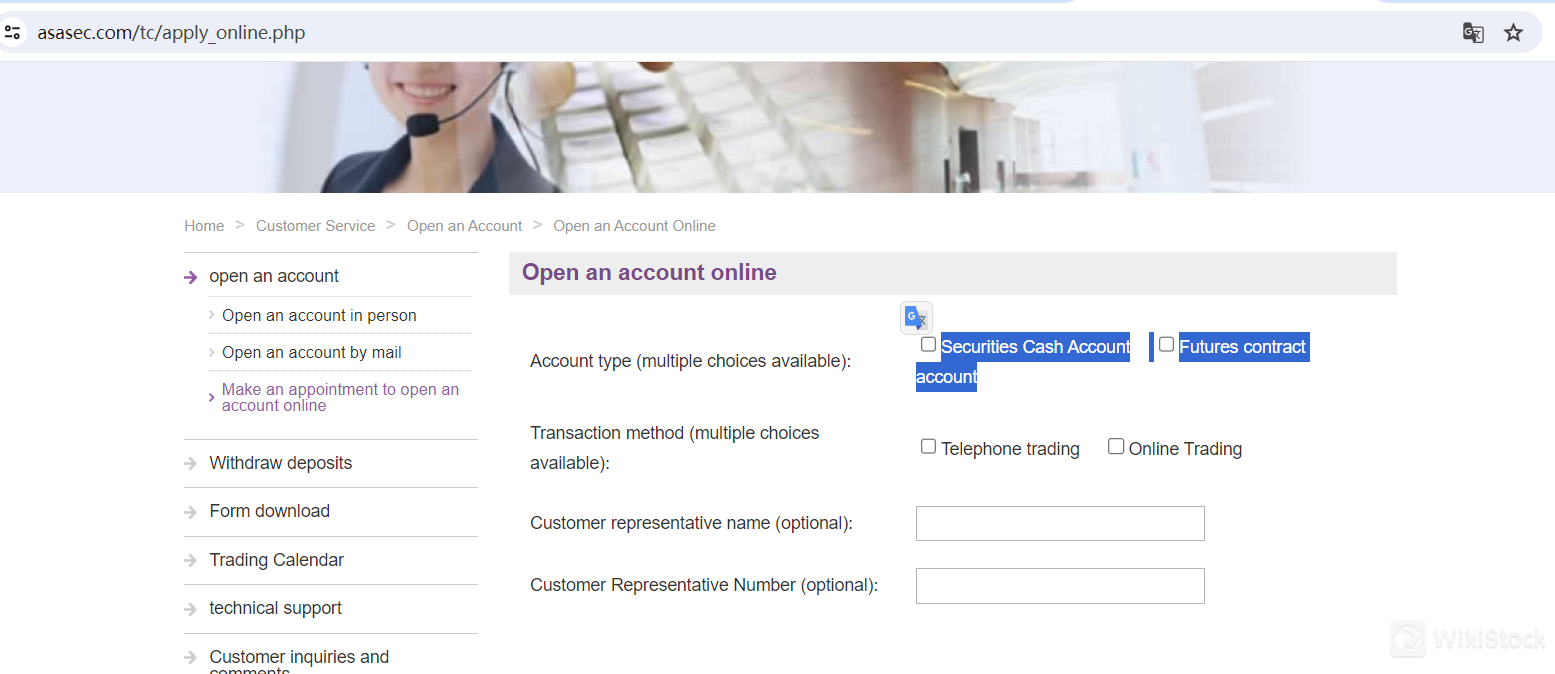

ASA Securities Limited offers various account types to cater to the diverse needs of its clients, particularly focusing on Securities Cash Accounts and Futures Contract Accounts.

Securities Cash Account

A Securities Cash Account is designed for clients who prefer to manage their investments with a straightforward approach. This account type allows clients to buy and sell securities, such as stocks, without borrowing funds from the brokerage. Key features include:

Direct Ownership: Clients directly own the securities they purchase, providing them with dividends and voting rights associated with their holdings.

No Margin Requirements: Unlike margin accounts, securities are bought using available cash in the account, eliminating the risks associated with borrowing funds.

Transparency: Transactions are clear and straightforward, making it easy for clients to track their investments and understand their financial standing.

Suitable for Long-term Investors: Ideal for those looking to invest in the stock market with a focus on long-term growth without the complexities of margin trading.

Futures Contract Account

The Futures Contract Account is tailored for clients interested in trading futures contracts. Futures contracts are agreements to buy or sell an asset at a future date for a predetermined price, and they can be used for hedging or speculative purposes. Key features include:

Leverage: Clients can trade large positions with a relatively small amount of capital, amplifying potential gains (and losses).

Diverse Investment Opportunities: Futures contracts are available on a wide range of assets, including commodities, indices, and financial instruments.

Hedging Capabilities: Investors can use futures to hedge against potential losses in their portfolios, providing a risk management tool.

Market Access: Futures trading provides access to various global markets, allowing clients to diversify their investment strategies.

Advanced Trading Tools: ASA Securities offers robust trading platforms with advanced analytical tools to support futures trading, helping clients make informed decisions.

ASA Fees Review

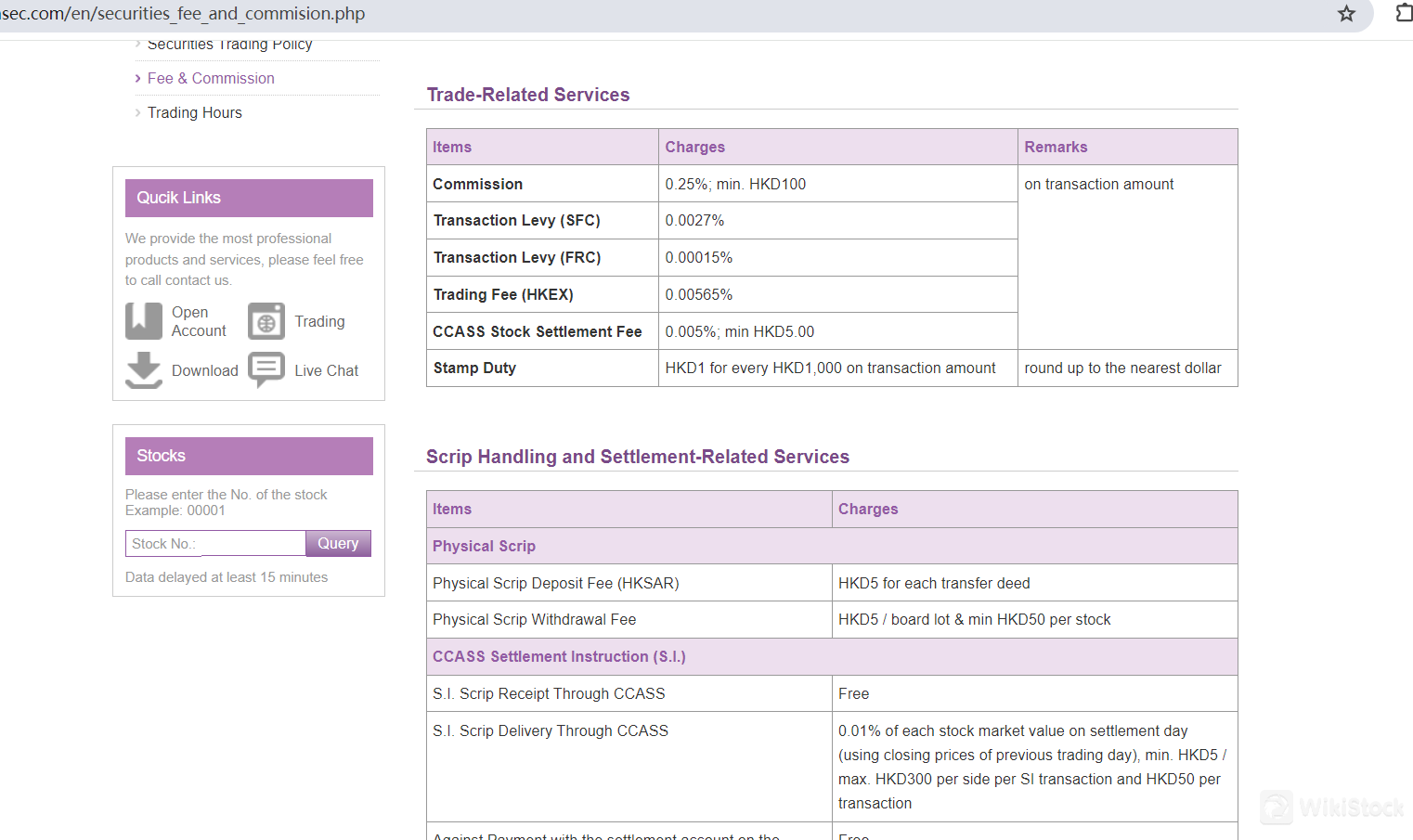

ASA Securities Limited offers detailed fee structures for its various financial services, focusing on transparency and client satisfaction.

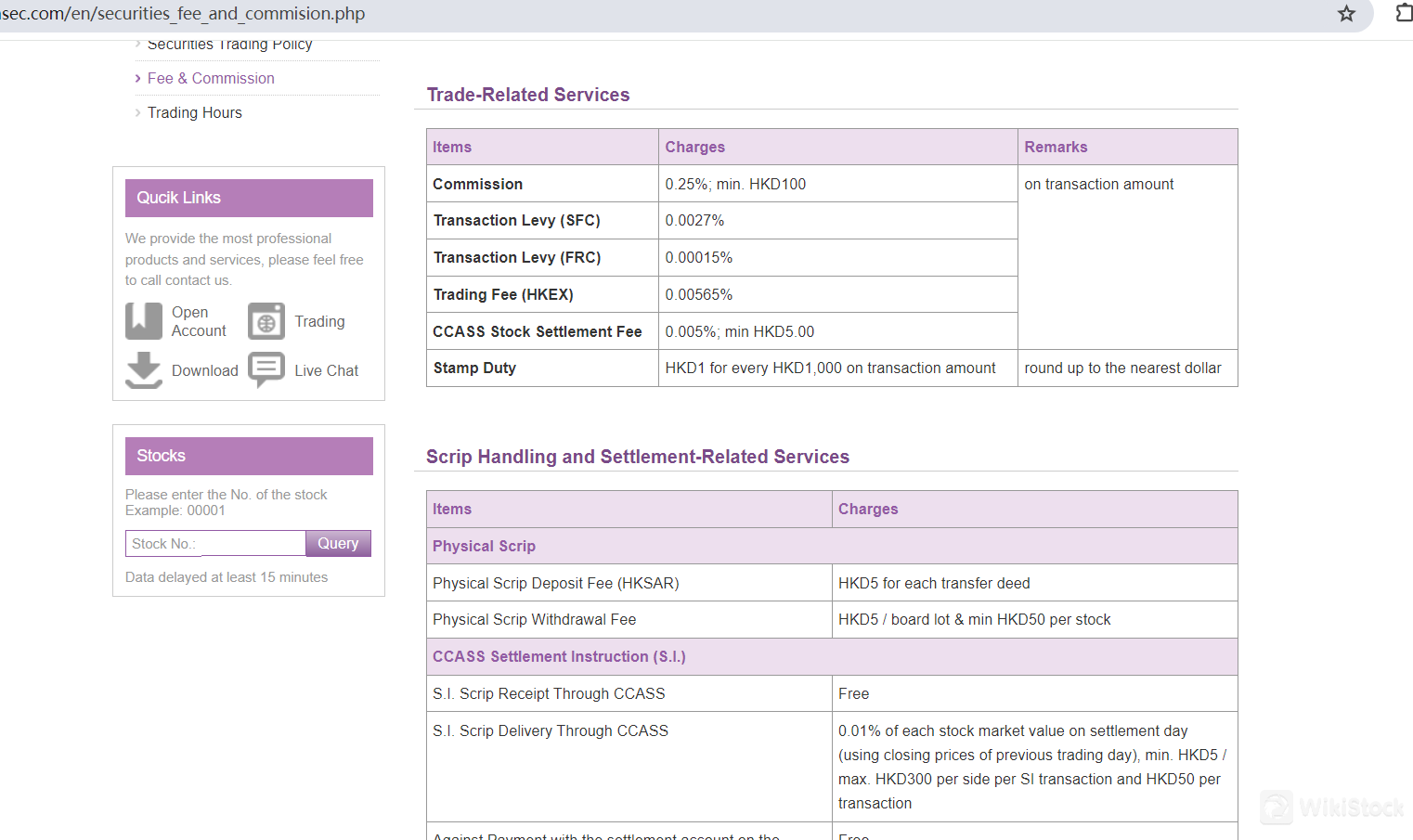

For securities trading, ASA charges a commission of 0.25% of the transaction amount, with a minimum fee of 100 Hong Kong dollars. Trading levies include a 0.0027% fee for the Securities and Futures Commission and a 0.00015% fee for the Financial Reporting Council. Additionally, there is a trading fee of 0.00565% for transactions handled by the Hong Kong Exchanges and Clearing Limited (HKEX). The Central Clearing and Settlement System (CCASS) settlement fee is 0.005% of the transaction amount, with a minimum charge of 5 Hong Kong dollars. Stamp duty is applied at a rate of 1 Hong Kong dollar per 1,000 Hong Kong dollars of the transaction amount, with a minimum charge of 1 Hong Kong dollar for transactions below this threshold.

When handling physical stock, ASA Securities imposes a deposit fee of 5 Hong Kong dollars per transfer deed for the Hong Kong government. The withdrawal fee is 5 Hong Kong dollars per board lot, with a minimum of 50 Hong Kong dollars per stock. For CCASS settlement instruction (S.I.) fees, stock deposits are free, while stock withdrawals incur a charge of 0.01% of the stock value, based on the previous closing price, with a minimum fee of 5 Hong Kong dollars and a maximum of 300 Hong Kong dollars plus a handling fee of 50 Hong Kong dollars. Delivery versus Payment (DvP) on the settlement day is free, but immediate DvP settlement costs 300 Hong Kong dollars. Investor settlement instruction (I.S.I.) fees include a free stock deposit and a 20 Hong Kong dollars fee per stock withdrawal, with free DvP on settlement day.

Agent services and corporate actions also have specific charges. The stock transfer registration fee is 2.5 Hong Kong dollars per board lot. For dividend collection, cash or stock dividends are subject to a 0.5% fee of the dividend amount, with a minimum charge of 20 Hong Kong dollars. Collecting bonus shares incurs a fee of 20 Hong Kong dollars per stock. Rights issue collection is free, but subscription or rights application costs 0.8 Hong Kong dollars per board lot plus a handling fee of 50 Hong Kong dollars. Exercising warrants and handling private company shares involves a fee of 1 Hong Kong dollar per board lot.

ASA Securities imposes various account and other service charges. Overdue interest on a cash account is calculated at the banks prime rate + 10%. The handling fee for new share subscription is 100 Hong Kong dollars per application. A forced purchase fee, determined by CCASS, is 0.5% of the stock value on the settlement day. Applying to recover dividends costs 0.5% of each dividend period amount, with a minimum of 20 Hong Kong dollars plus a handling fee of 300 Hong Kong dollars per stock and a CCASS handling fee of 200 Hong Kong dollars. Reissuing monthly statements is free for the recent three months, but older statements incur charges ranging from 50 to 500 Hong Kong dollars per month, depending on the period. There is a postal administration fee of 50 Hong Kong dollars per account per month, and obtaining an account balance certificate costs 200 Hong Kong dollars. However, there is no charge for stock custody. The annual handling fee for the Capital Investment Entrant Scheme is 10,000 Hong Kong dollars.

Banking services also have associated fees. Telegraphic transfers cost 200 Hong Kong dollars per transaction, plus additional bank charges deducted from the remittance. Handling a returned check incurs a fee of 100 Hong Kong dollars.

ASA App Review

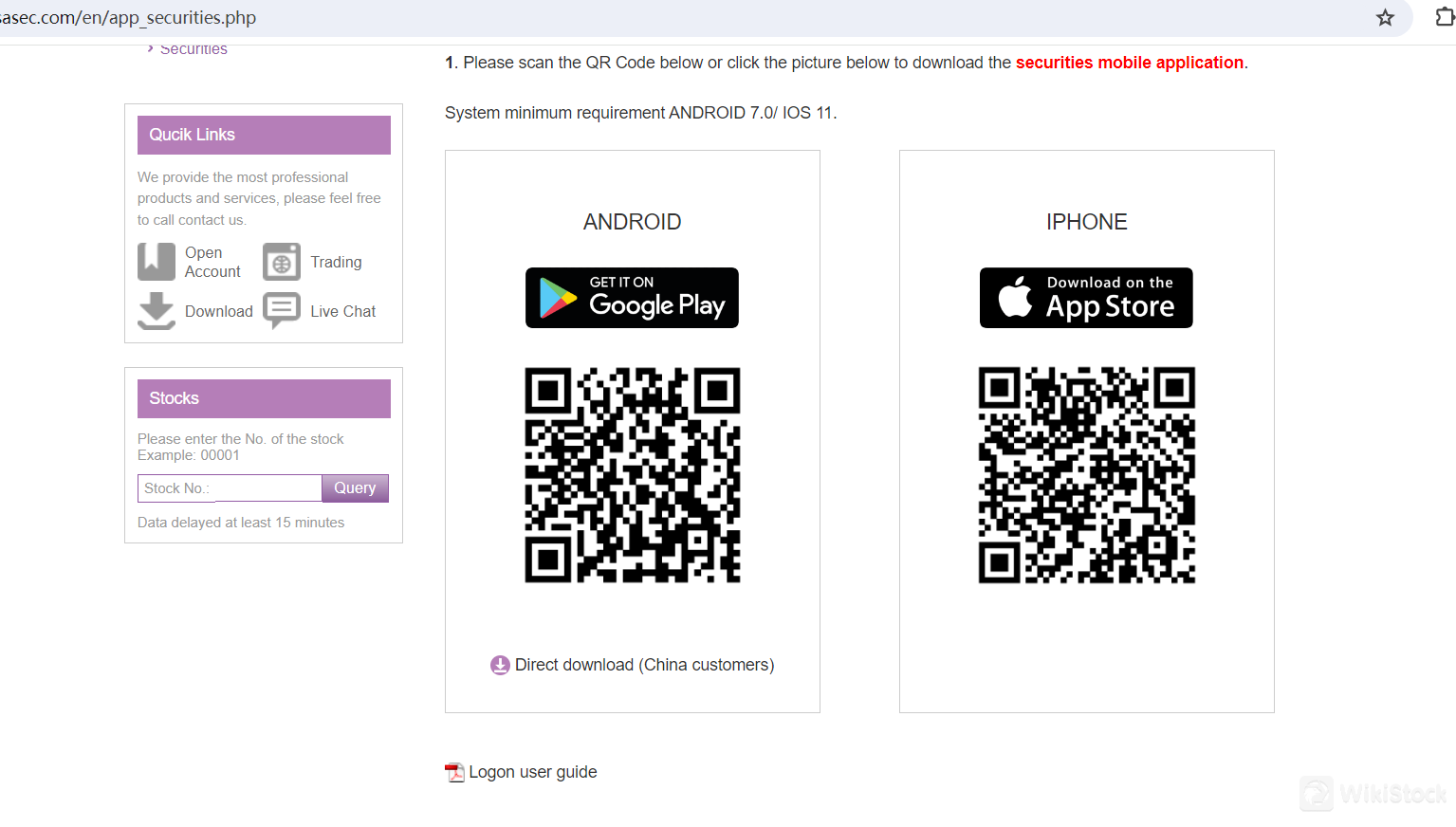

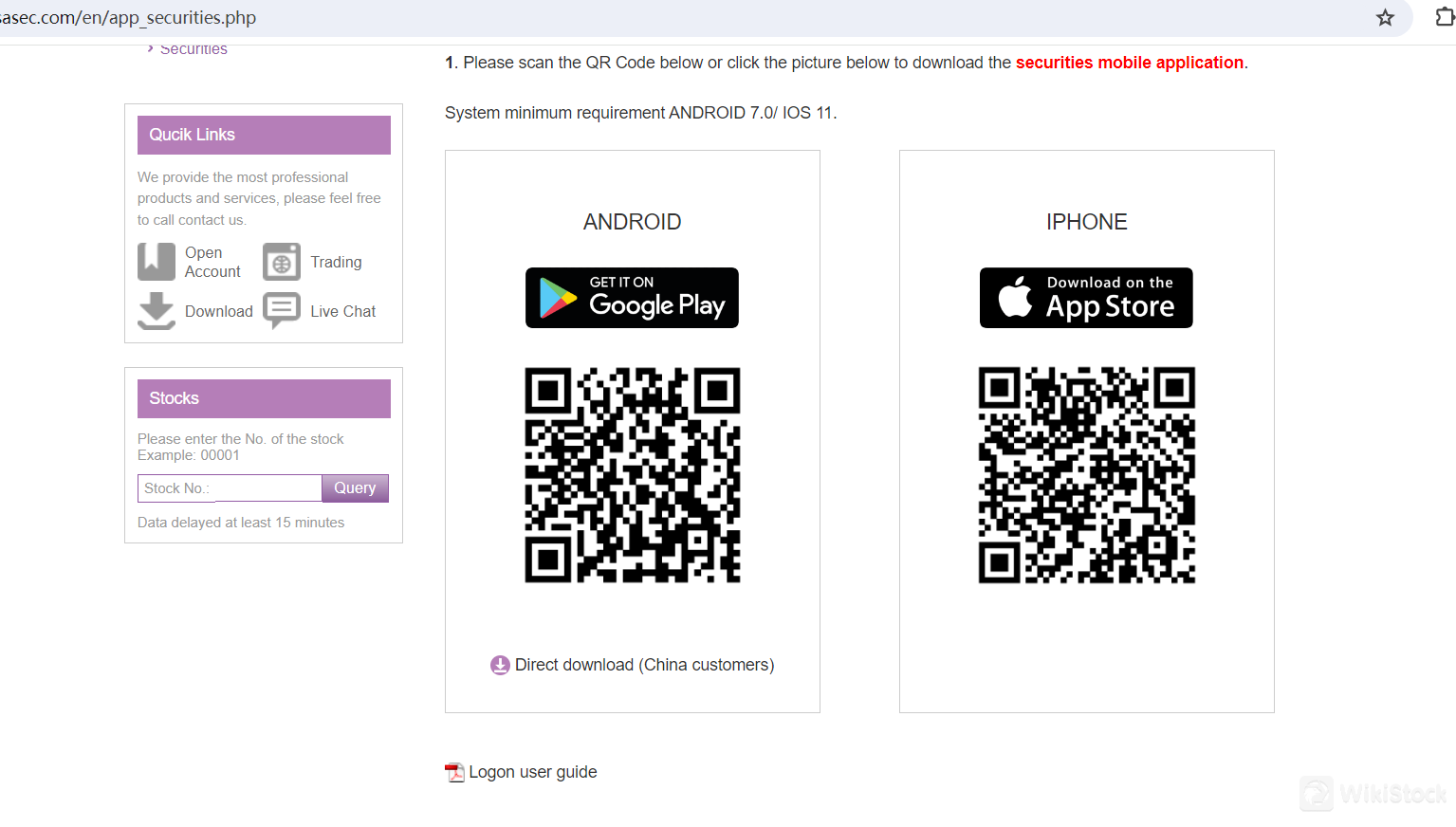

ASA Securities Limited offers a user-friendly mobile application for securities trading, accessible through both Android and iOS devices. The mobile app is designed to provide customers with seamless access to their trading accounts, allowing them to manage their investments efficiently on the go. To download the app, customers can scan the provided QR code or click the designated picture link.

The system minimum requirements for using the mobile application are Android 7.0 or higher and iOS 11 or higher. For Android users, there is a direct download option specifically for customers in China. This ensures that domestic users can easily obtain the application without navigating through international app stores.

Upon downloading the app, customers are required to follow the “Software Security Code User Manual” to download and install the necessary security software. This security code is essential for logging into their online accounts. Android users in China can download the APK file separately via a provided URL or QR code, ensuring they have access to the latest version of the app.

Starting April 27, 2018, the Securities and Futures Commission (SFC) implemented two-factor authentication measures for clients logging into internet trading accounts. This added security layer requires customers to use both their existing password and the two-factor authentication method to access their accounts. This ensures a higher level of security and protection for client information and transactions.

Customer Service

ASA Securities Limited provides comprehensive customer support services to ensure clients receive timely and efficient assistance for all their trading needs.

For those interested in opening an account or requiring customer service in Hong Kong, ASA Securities offers a dedicated hotline at (852) 3971 3668. Clients in China can reach the customer service team at 400 120 2067, ensuring that support is accessible for both local and international clients. Additionally, customers can send inquiries via fax to (852) 3971 3600 or email at cs@asasec.com.

The companys customer service team is stationed at Room 1803-07, 18/F, China Insurance Group Building, 141 Des Voeux Road Central, Hong Kong. This central location is easily accessible for clients who prefer face-to-face consultations or need to visit the office for specific services.

The office operates from Monday to Friday, with business hours from 9:00 AM to 6:00 PM. During these hours, clients can expect prompt and professional assistance with their account-related queries, technical support, and other service needs.

ASA Securities Limited is committed to providing excellent customer service, ensuring that clients have multiple channels to reach out for help, and receive comprehensive support throughout their trading journey.

Conclusion

ASA Securities Limited is a reputable financial services provider in Hong Kong, known for its strong regulatory compliance, comprehensive security measures, and user-friendly mobile trading platform. It offers a variety of financial products, including mutual funds and margin trading, with a transparent fee structure. While some services may incur higher fees, ASA's robust customer support and advanced security features make it a reliable choice for investors.

FAQs

Is ASA Securities Limited safe to trade?

Yes, ASA Securities Limited is safe to trade. It is regulated by the Securities and Futures Commission (SFC) of Hong Kong, ensuring strict compliance with investor protection rules. Additionally, it employs strong security measures, including encryption and two-factor authentication, to protect client funds and personal information.

Is ASA Securities Limited a good platform for beginners?

ASA Securities Limited is a good platform for beginners due to its user-friendly mobile app, comprehensive customer support, and straightforward account setup with no minimum balance requirement. The app provides easy access to trading and investment tools, making it suitable for new investors.

Is ASA Securities Limited legit?

Yes, ASA Securities Limited is a legitimate financial services provider. It is fully licensed and regulated by the Securities and Futures Commission (SFC) of Hong Kong, ensuring it adheres to high standards of regulatory compliance and operational integrity.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

United States

United StatesObtain 1 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)