The customer's account balance with AJS is not insured. As a brokerage regulated by the Securities and Futures Commission (SFC) of Hong Kong, AJS does not fall under deposit insurance schemes typical of banking institutions.

Safety Measures:

AJS implements robust security measures to safeguard user accounts and transactions. These include encryption protocols to protect data during transmission and storage, ensuring confidentiality. Multi-factor authentication adds an extra layer of verification, preventing unauthorized access. Client funds are held in segregated accounts, separate from the firm's operational funds, enhancing financial security.

What are Securities to Trade with AJS?

AJS offers a range of Tradable Securities including Hong Kong stocks, overseas stocks, and access to Shanghai/Shenzhen-Hong Kong Stock Connect for Northbound trading.

This includes equities listed on both the Main Board and the Growth Enterprise Market (GEM) of the Hong Kong Stock Exchange. The Main Board features established companies meeting stringent profitability and size criteria, while the GEM provides a platform for smaller and emerging enterprises. These securities represent various sectors and industries, presenting investors with targeted opportunities in the vibrant Hong Kong market.

AJS supports trading, clearing, settlement, and brokerage services, ensuring clients can efficiently manage investments across this specialized range of assets.

AJS Accounts

AJS offers 3 account types, including:

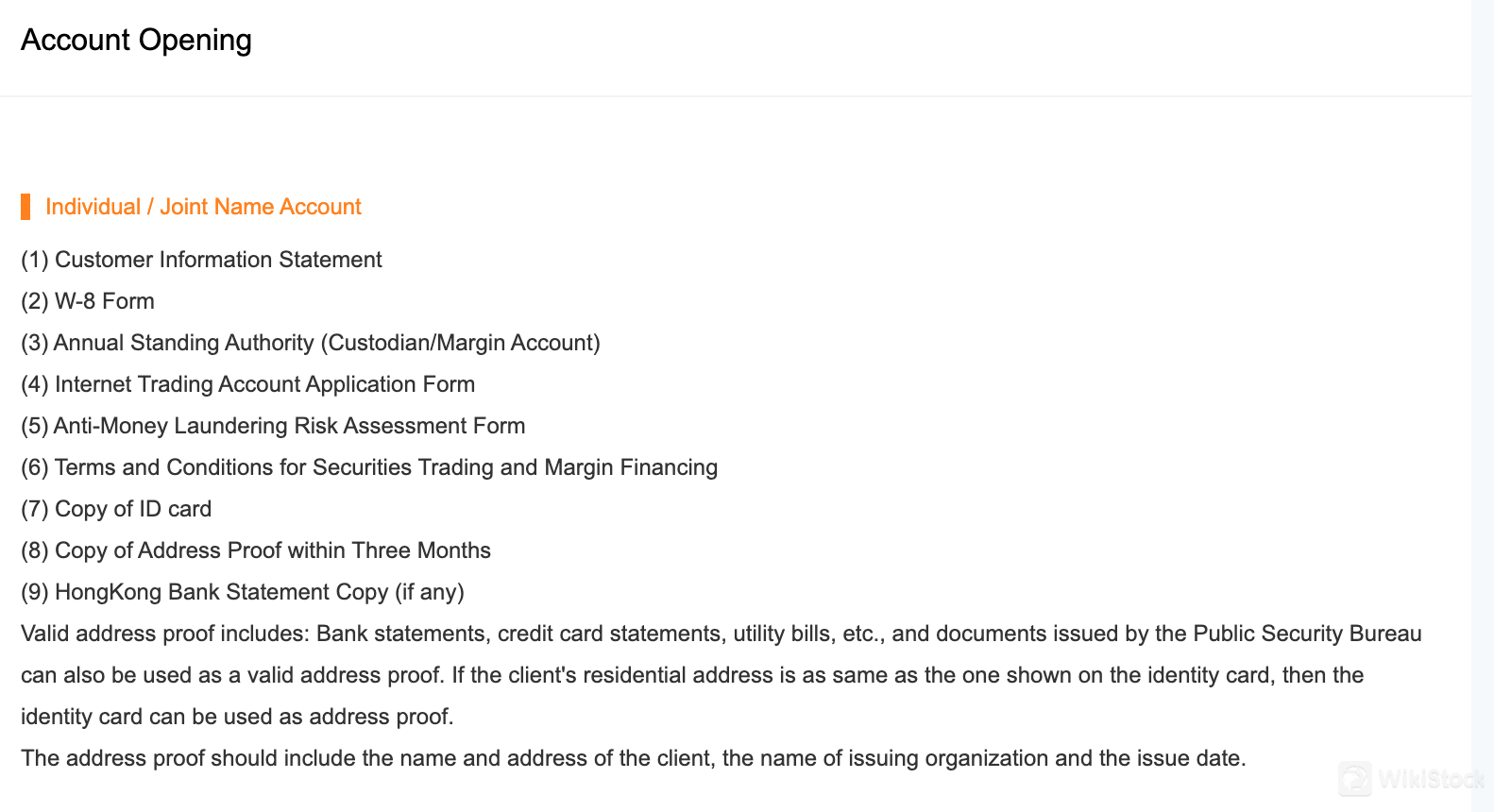

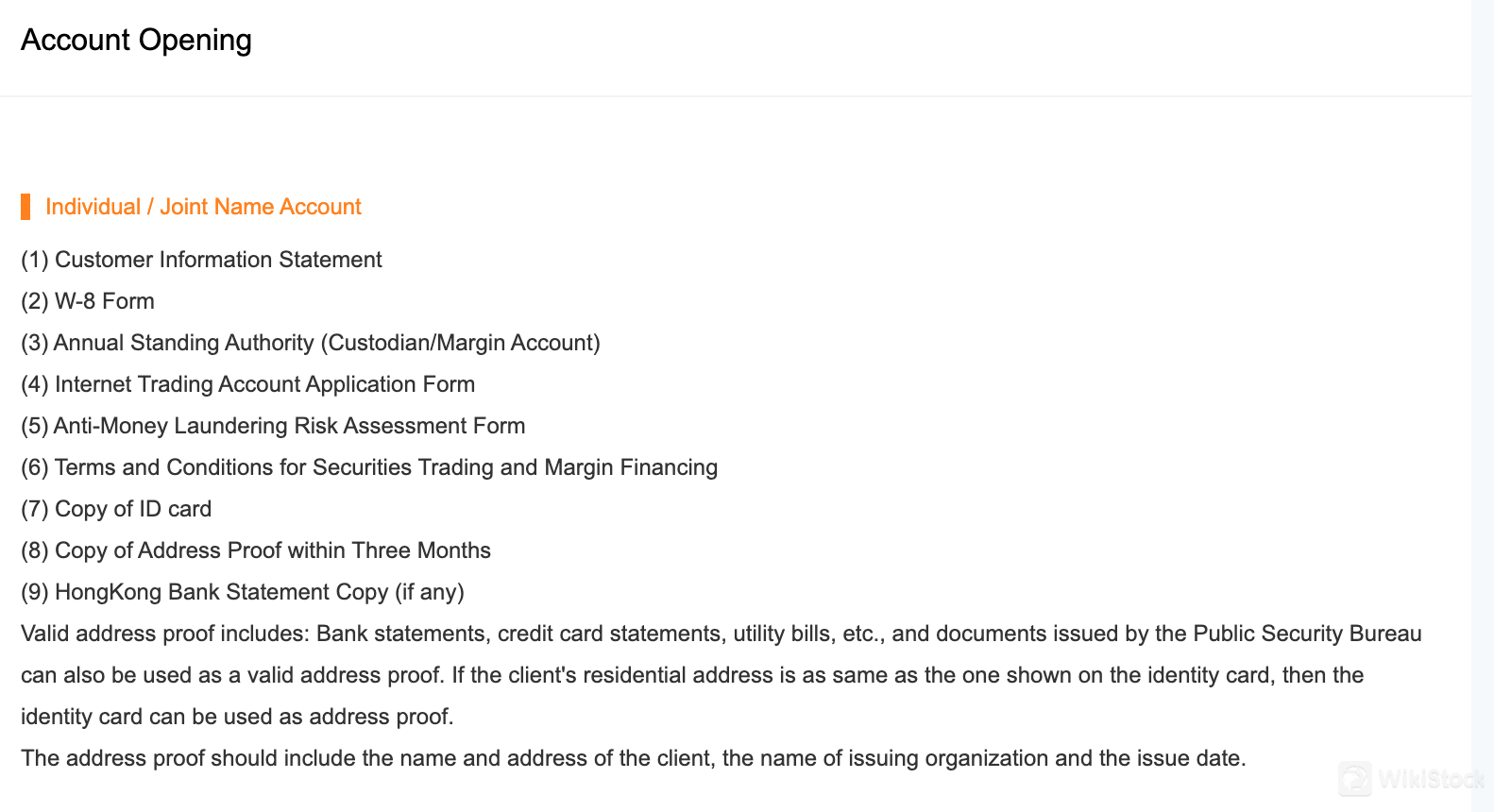

Individual / Joint Name Account:

The Individual / Joint Name Account type requires applicants to submit a comprehensive set of documents including a Customer Information Statement, W-8 Form, and other related forms such as the Annual Standing Authority for Custodian/Margin Accounts and Internet Trading Account Application Form. Additional requirements include an Anti-Money Laundering Risk Assessment Form, ID card copies, and recent address proofs like bank statements or utility bills. This account type is suitable for individual investors or joint account holders who wish to engage in securities trading and margin financing within Hong Kong.

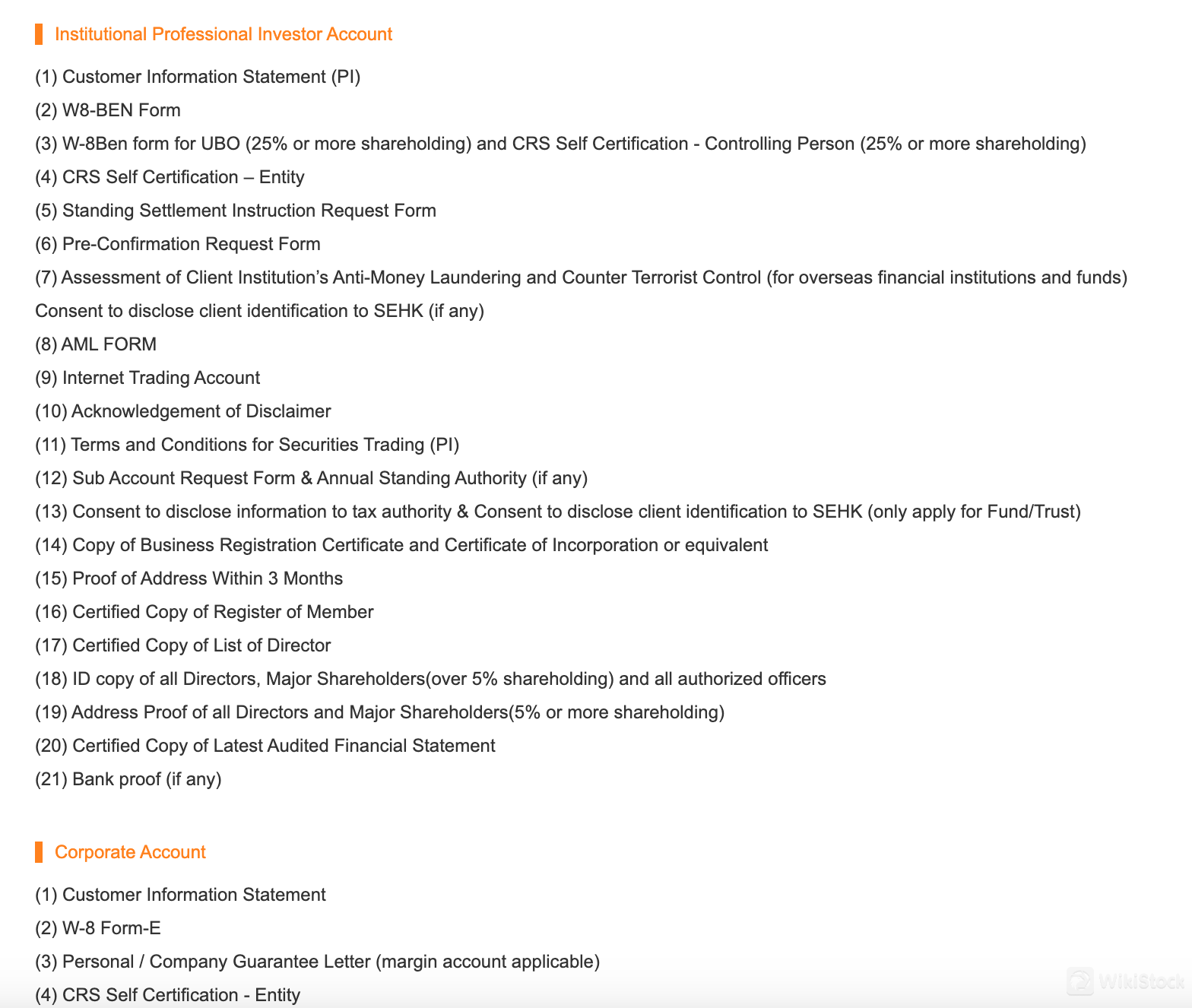

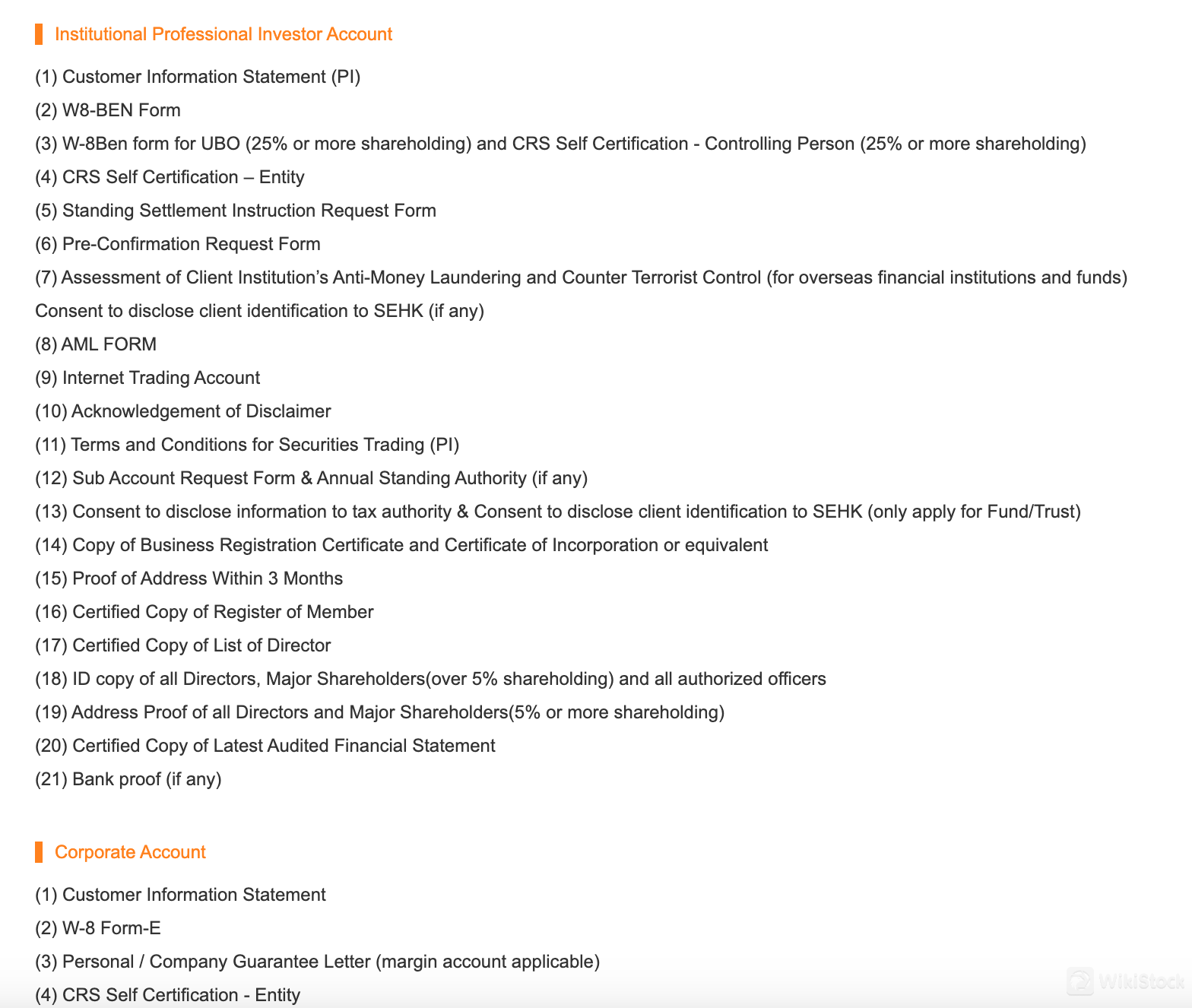

Institutional Professional Investor Account:

The Institutional Professional Investor Account serves institutional investors and requires a detailed submission process. Applicants must provide a Customer Information Statement specific to Professional Investors (PI), along with forms like W8-BEN, CRS Self Certifications, and various attestations related to Anti-Money Laundering and Counter-Terrorist Control measures. Documents such as Business Registration Certificates, Proof of Address, and Certified Copies of financial statements are mandatory. This account type is tailored for overseas financial institutions and funds seeking to trade securities and participate in Hong Kong's financial markets.

Corporate Account:

The Corporate Account type is designed for corporate entities and entails a thorough documentation process. Required documents include a Customer Information Statement, W-8 Form-E, and Personal or Company Guarantee Letter where applicable. Additional certifications such as CRS Self Certifications for Entities and Controlling Persons are mandatory. Certified copies of Business Registration Certificates, identity proofs of directors and major shareholders, and certified copies of constitutional documents are essential. This account type is suitable for companies looking to conduct securities trading and manage corporate investments in Hong Kong, ensuring compliance with regulatory and legal requirements.

AJS Fees Review

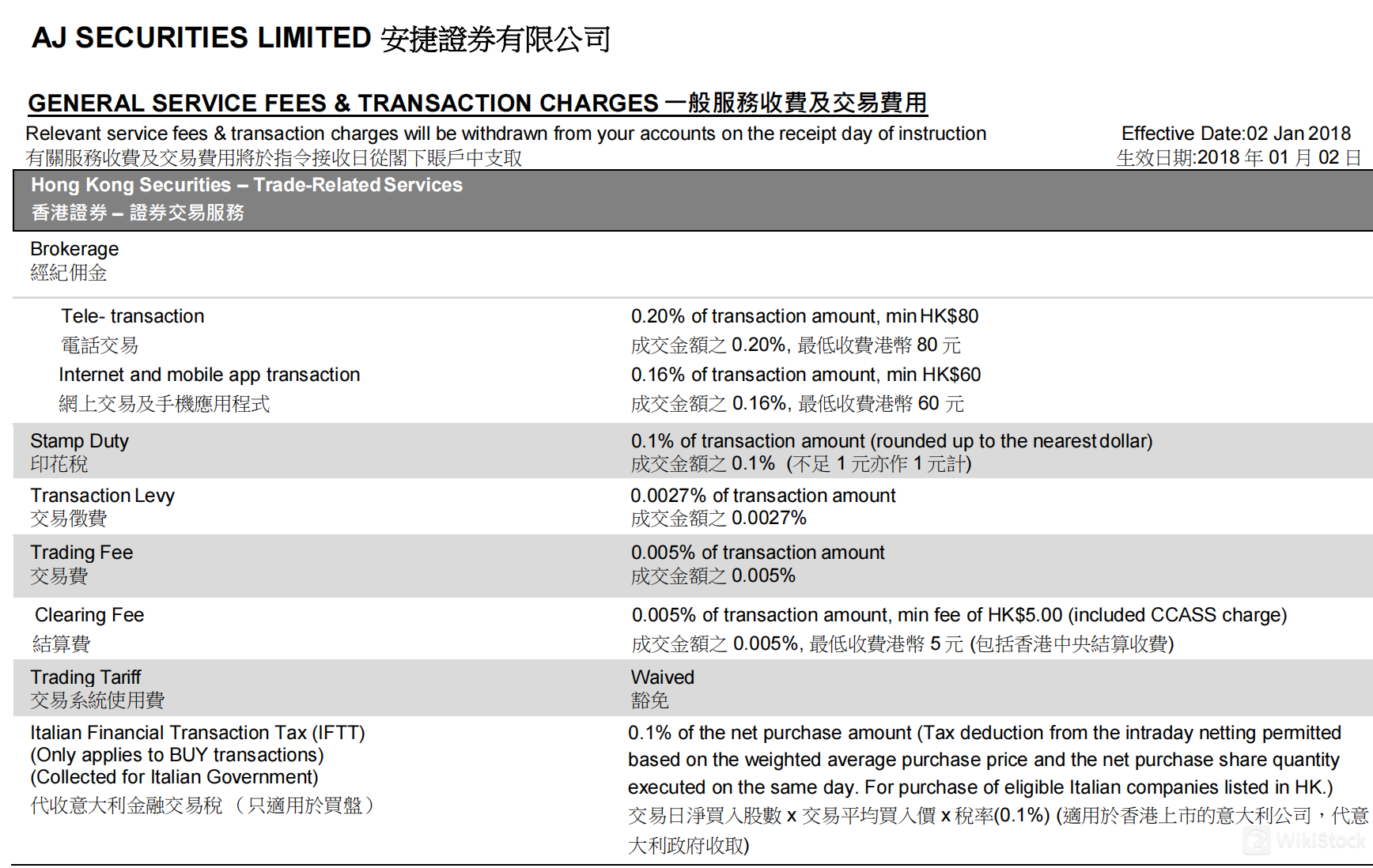

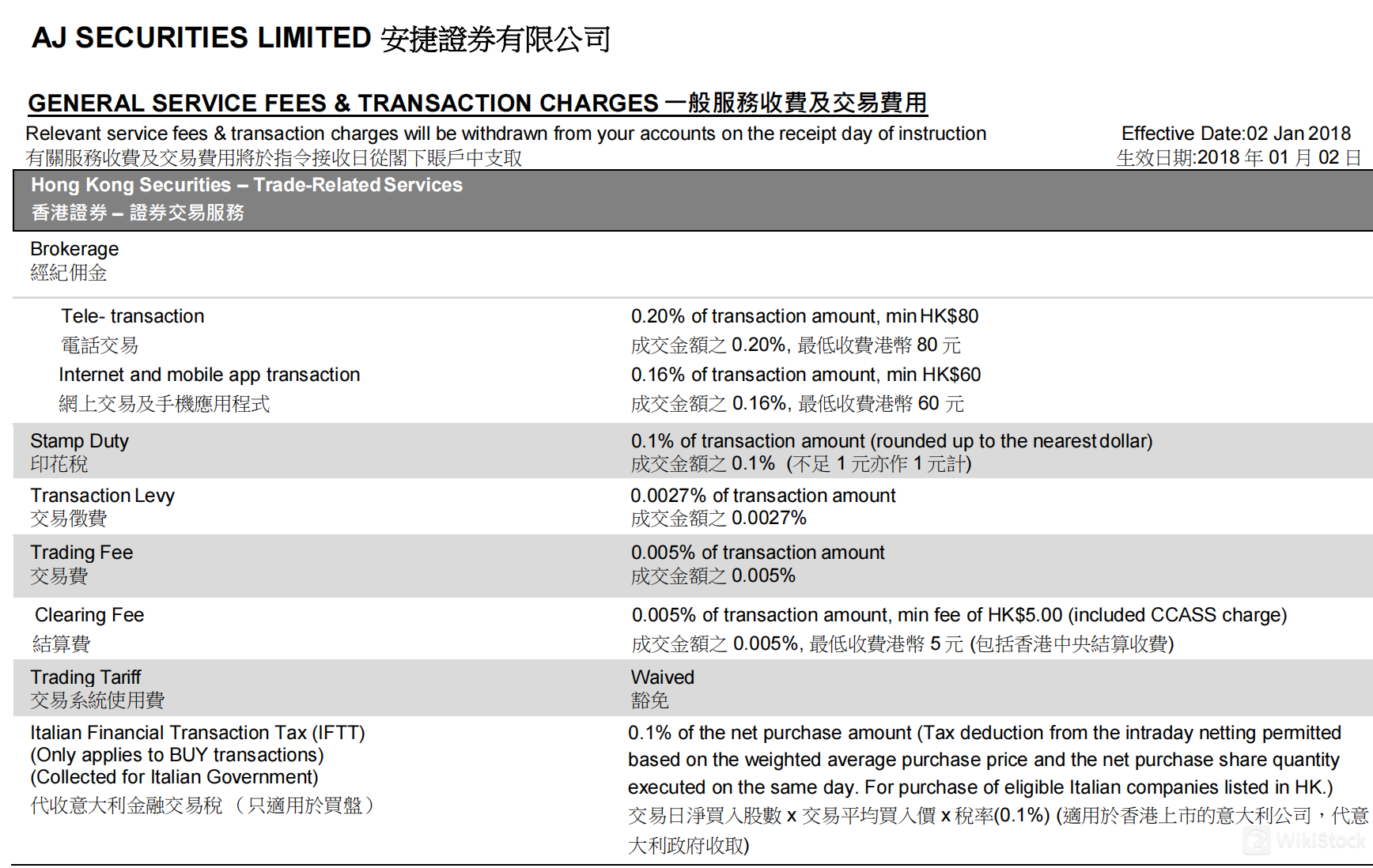

Hong Kong Securities – Trade-Related Services

AJS Securities Limited charges competitive brokerage fees based on transaction amounts. For tele-transaction services, the fee is 0.20% of the transaction amount, with a minimum charge of HK$80. Internet and mobile app transactions incur a lower fee of 0.16% of the transaction amount, with a minimum of HK$60. Stamp Duty is levied at 0.1% of the transaction amount, rounded up to the nearest dollar. Additionally, a transaction levy of 0.0027% and a trading fee of 0.005% are applied, ensuring transparency in transaction costs.

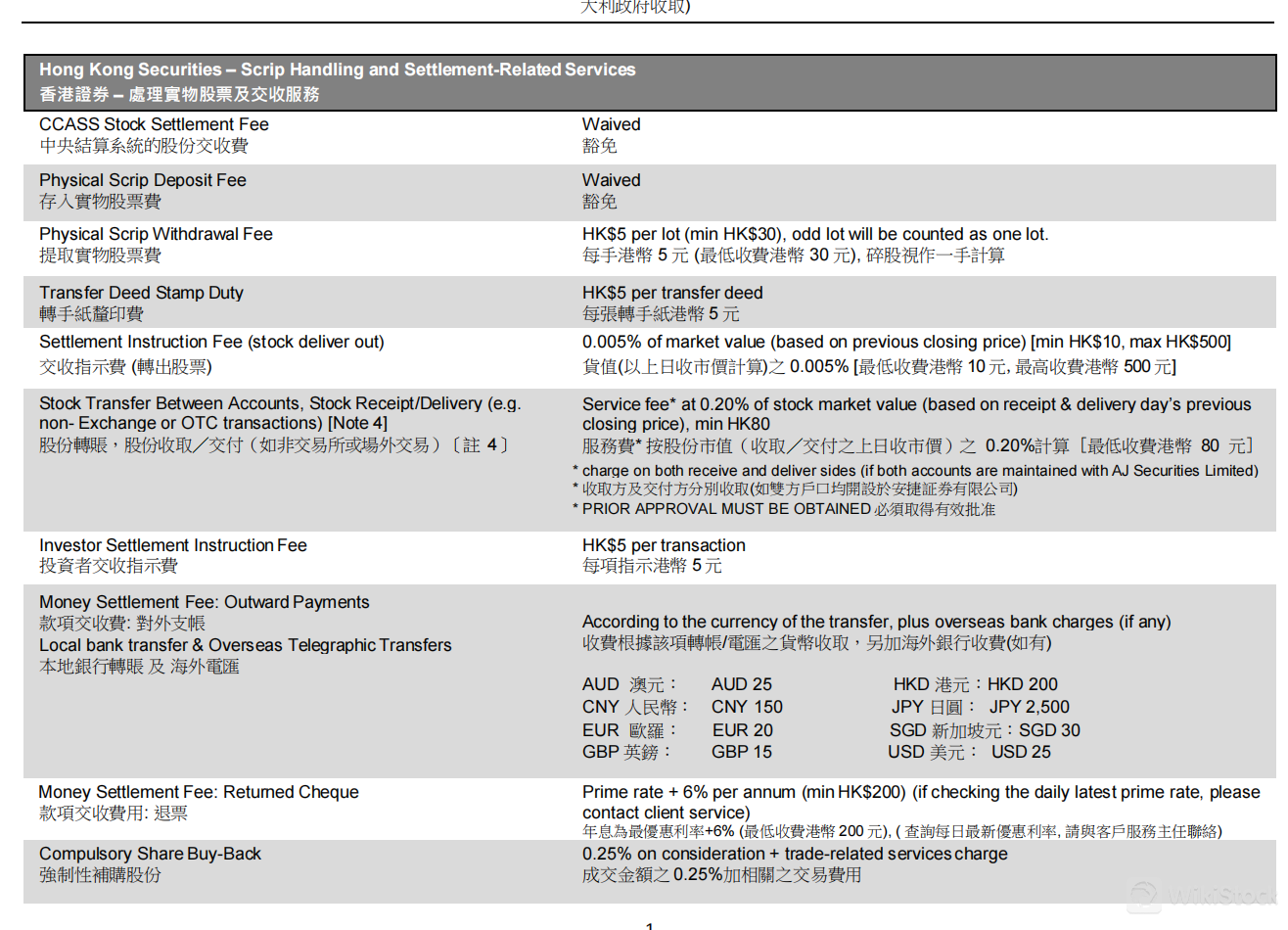

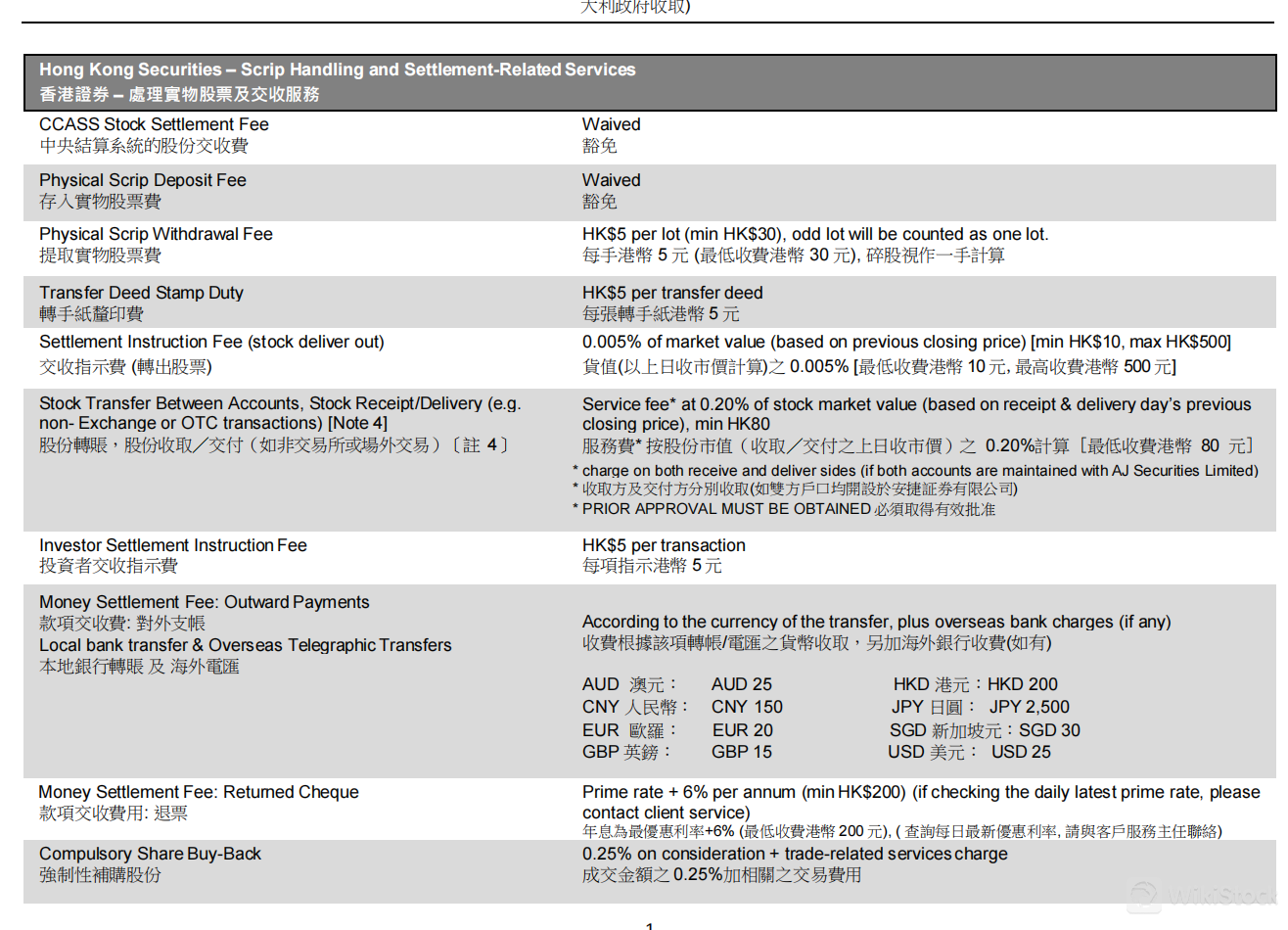

Hong Kong Securities – Scrip Handling and Settlement-Related Services

Handling physical scrip at AJS Securities involves minimal fees. There is no charge for depositing physical scrip, while withdrawing incurs a fee of HK$5 per lot, with odd lots counted as one. Transfer Deed Stamp Duty is HK$5 per transfer deed. For settlement instructions, a fee of 0.005% of the market value (min HK$10, max HK$500) is charged. Transferring stocks between accounts incurs a fee of 0.20% of the stock market value, with a minimum fee of HK$80. Investor settlement instructions are charged at HK$5 per transaction.

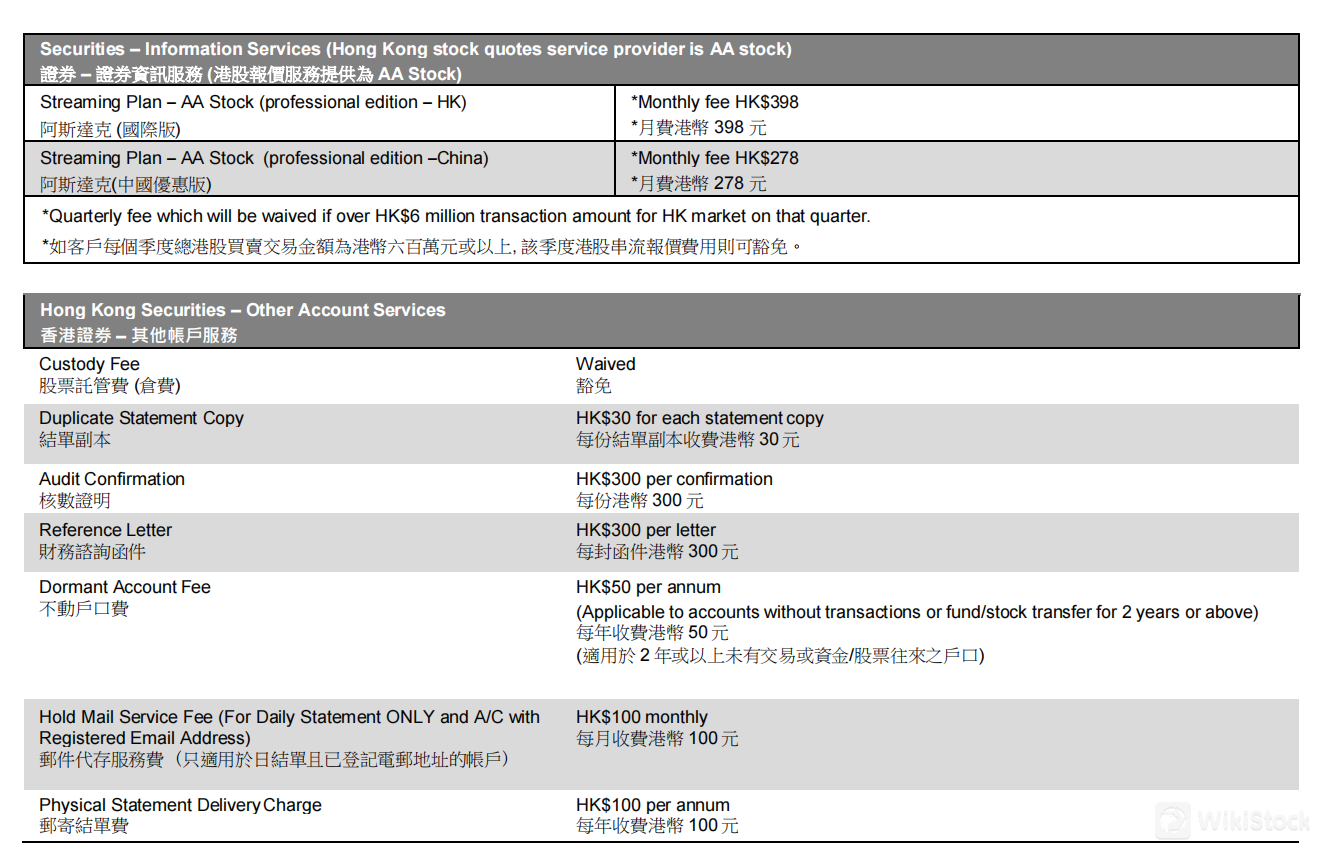

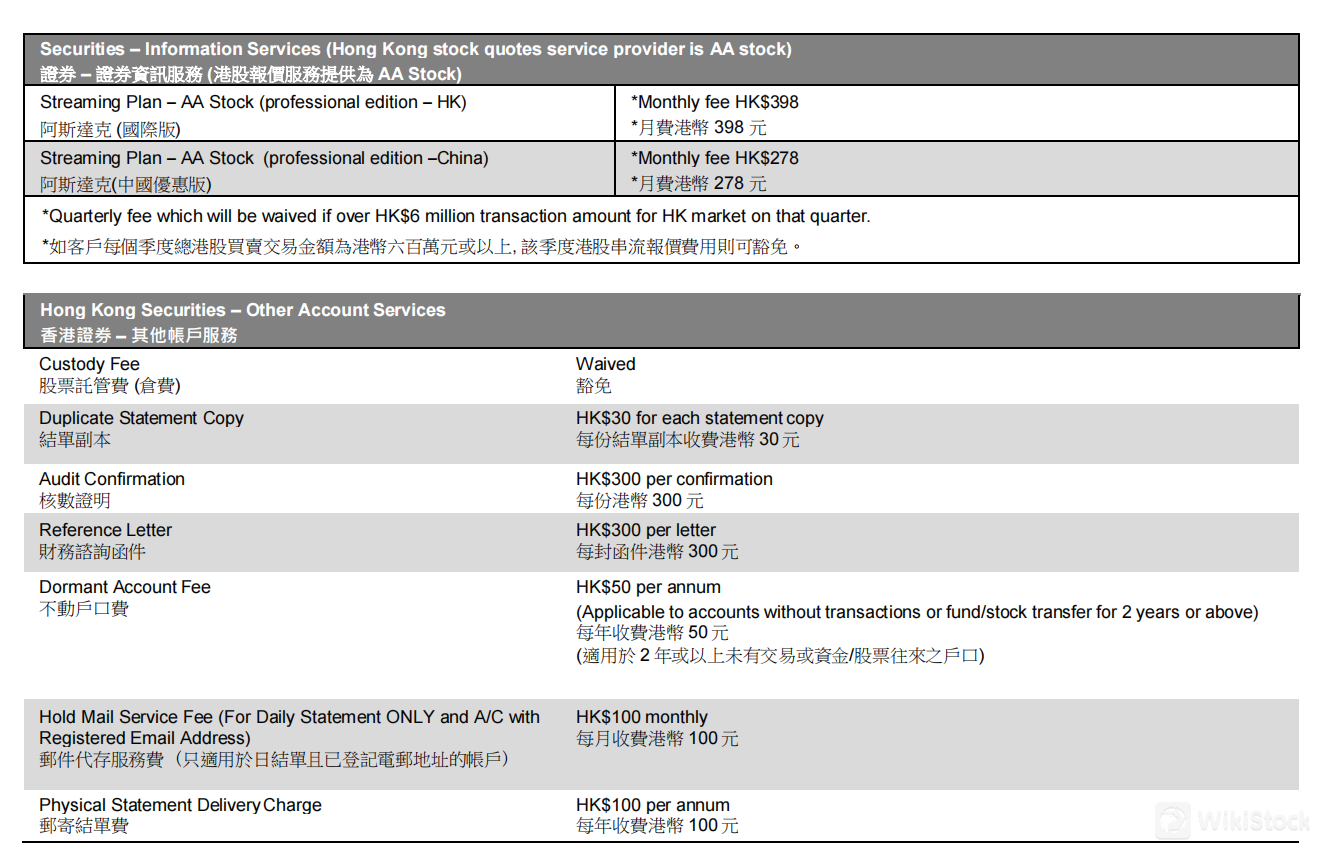

Hong Kong Securities – Other Account Services

AJS Securities imposes a HK$30 fee per duplicate statement copy and charges HK$300 for audit confirmation or reference letters. Dormant accounts are subject to an annual fee of HK$50. Hold mail service costs HK$100 monthly, while physical statement delivery is HK$100 annually.

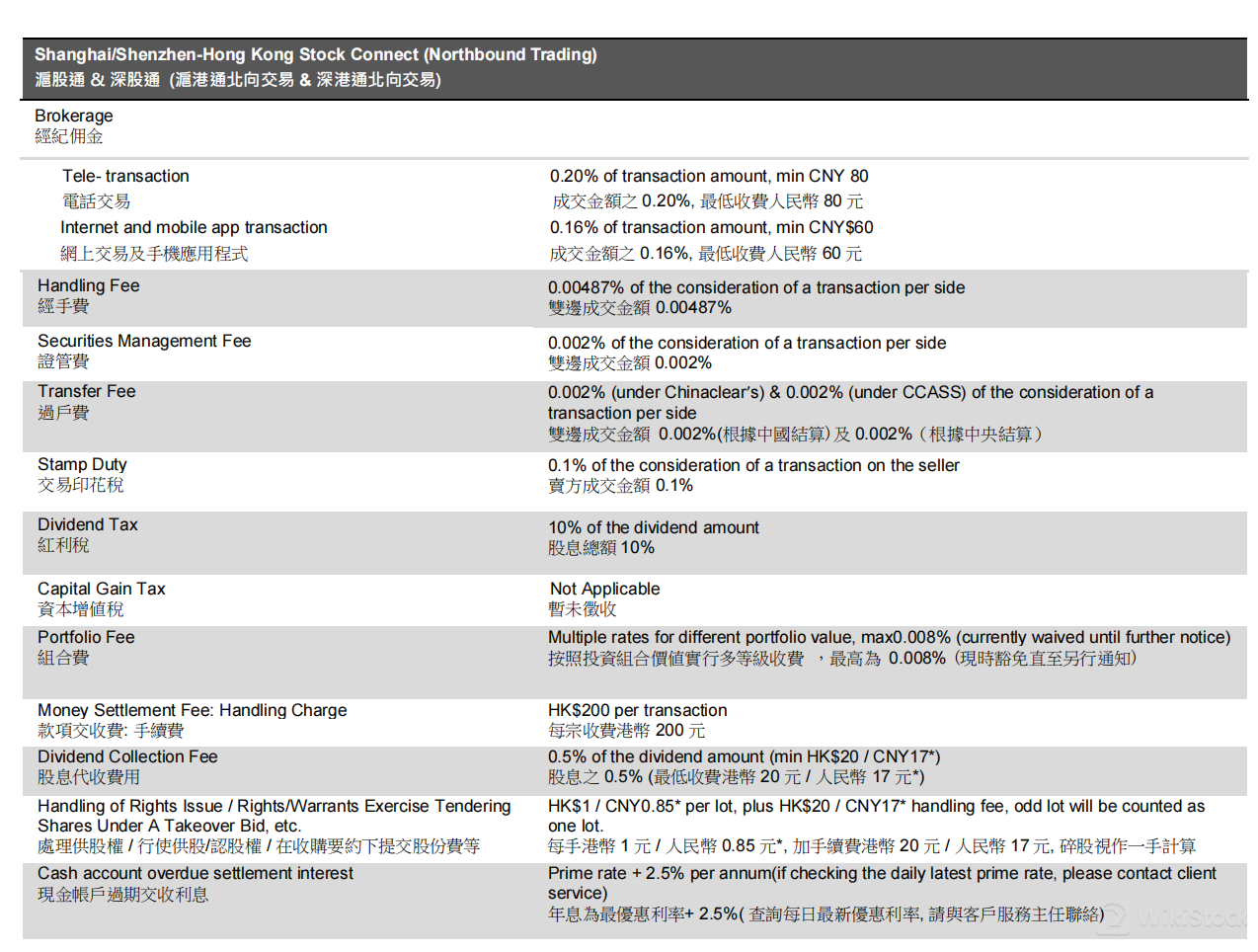

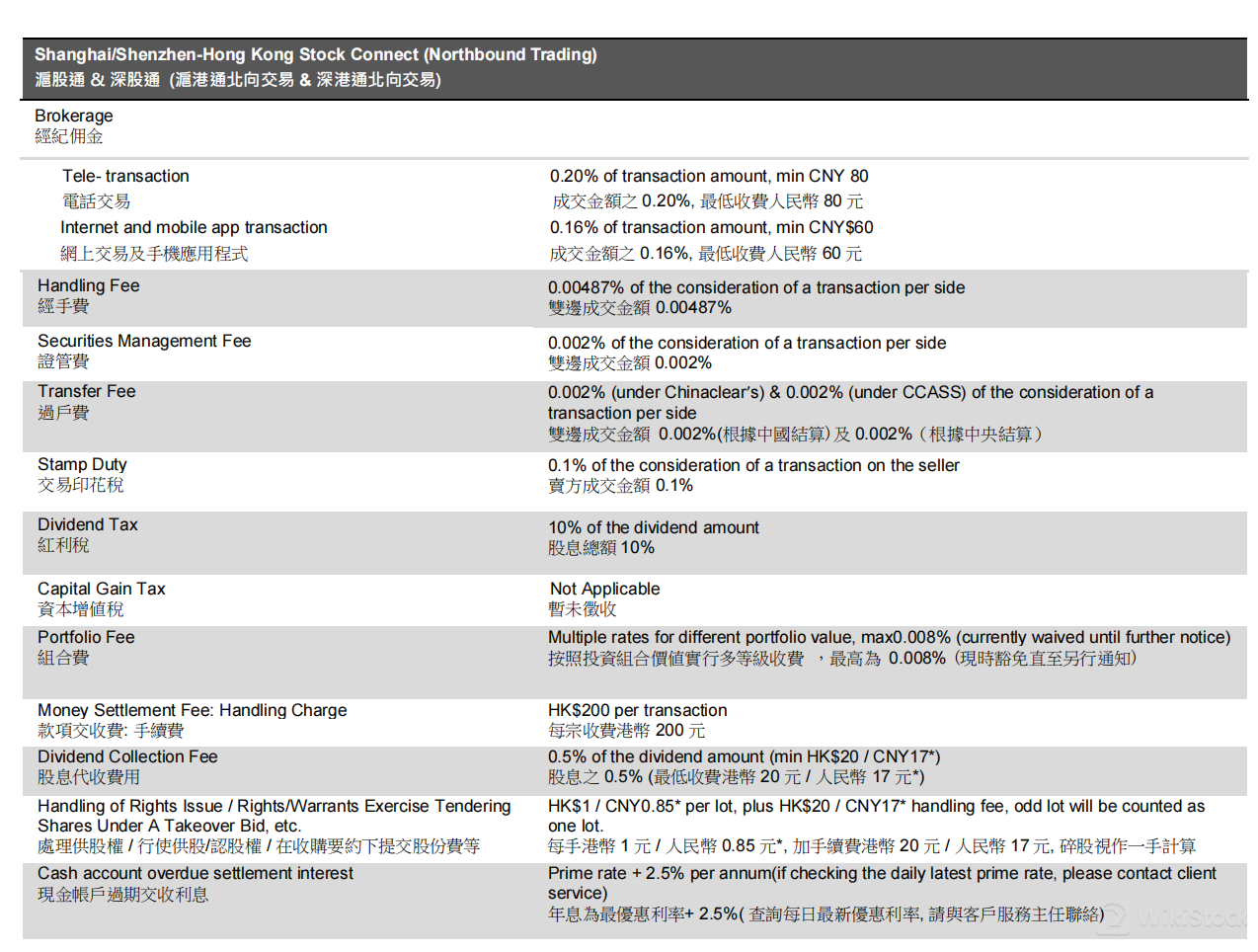

Shanghai/Shenzhen-Hong Kong Stock Connect

For Shanghai/Shenzhen-Hong Kong Stock Connect (Northbound Trading), AJS Securities applies a brokerage fee of 0.25% of the transaction amount, with a minimum of HK$100 for Shanghai stock and USD20 Shenzhen stock. Stamp duty is not applicable for these transactions. The transaction levy remains at 0.00687%, while the clearing fee is 0.05% of the transaction amount, capped at HK$500.

When comparing AJS Securities' fees with those of popular brokers, its commission rates for Hong Kong securities transactions, ranging from 0.16% to 0.20% of the transaction amount, are competitive and generally align with industry standards. These rates position AJS as offering average brokerage fees. For investors considering international transactions, AJS Securities' fees are similarly competitive, ensuring cost-effective trading options across different markets.

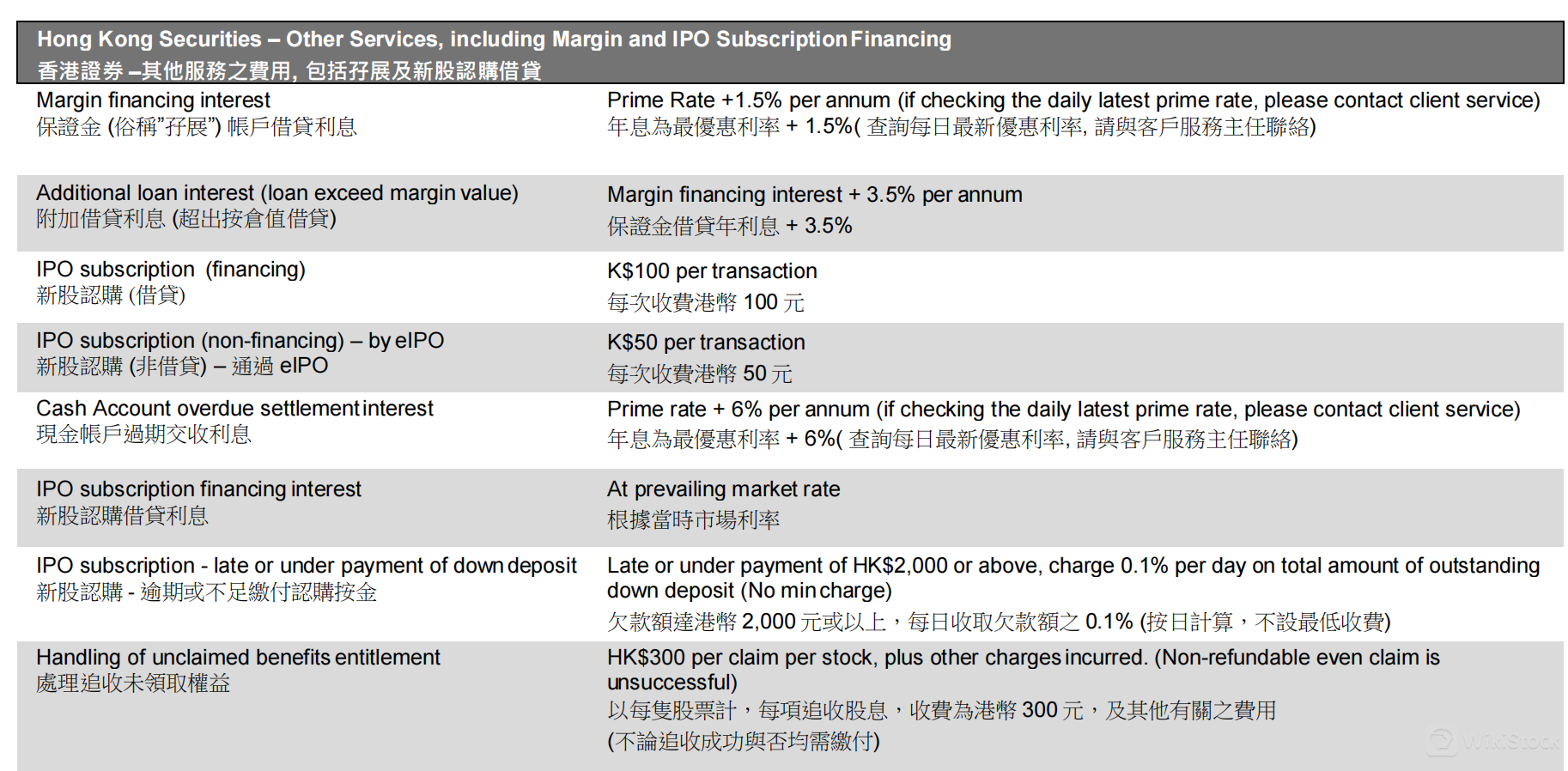

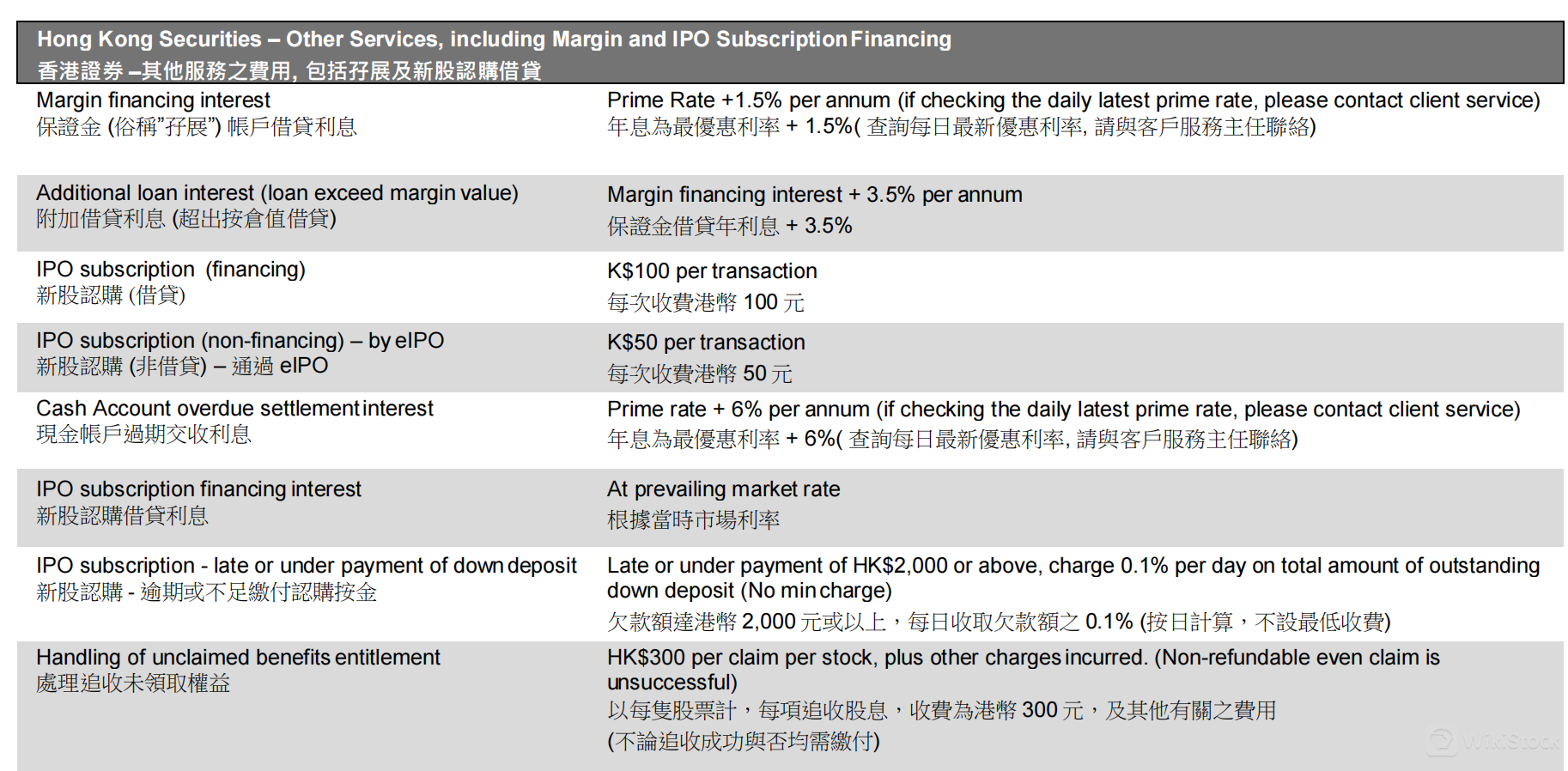

AJS offers margin financing at Prime Rate + 1.5% per annum for standard margin accounts. For loans exceeding the margin value, an additional interest rate of 3.5% per annum applies. Contact client services for the latest Prime Rate adjustments.

AJS App Review

AJS offers a mobile app named AJST accommodating investors with real-time market data and trading capabilities across A-shares, Hong Kong stocks, and U.S. stocks. Key features include a user-friendly interface for easy navigation and efficient trading execution.

To download the app, users can visit the respective app stores for iOS or Android platforms. Simply search for AJST and follow the prompts to install the app onto their mobile devices, enabling convenient access to market insights and trading functionalities on-the-go.

Research & Education

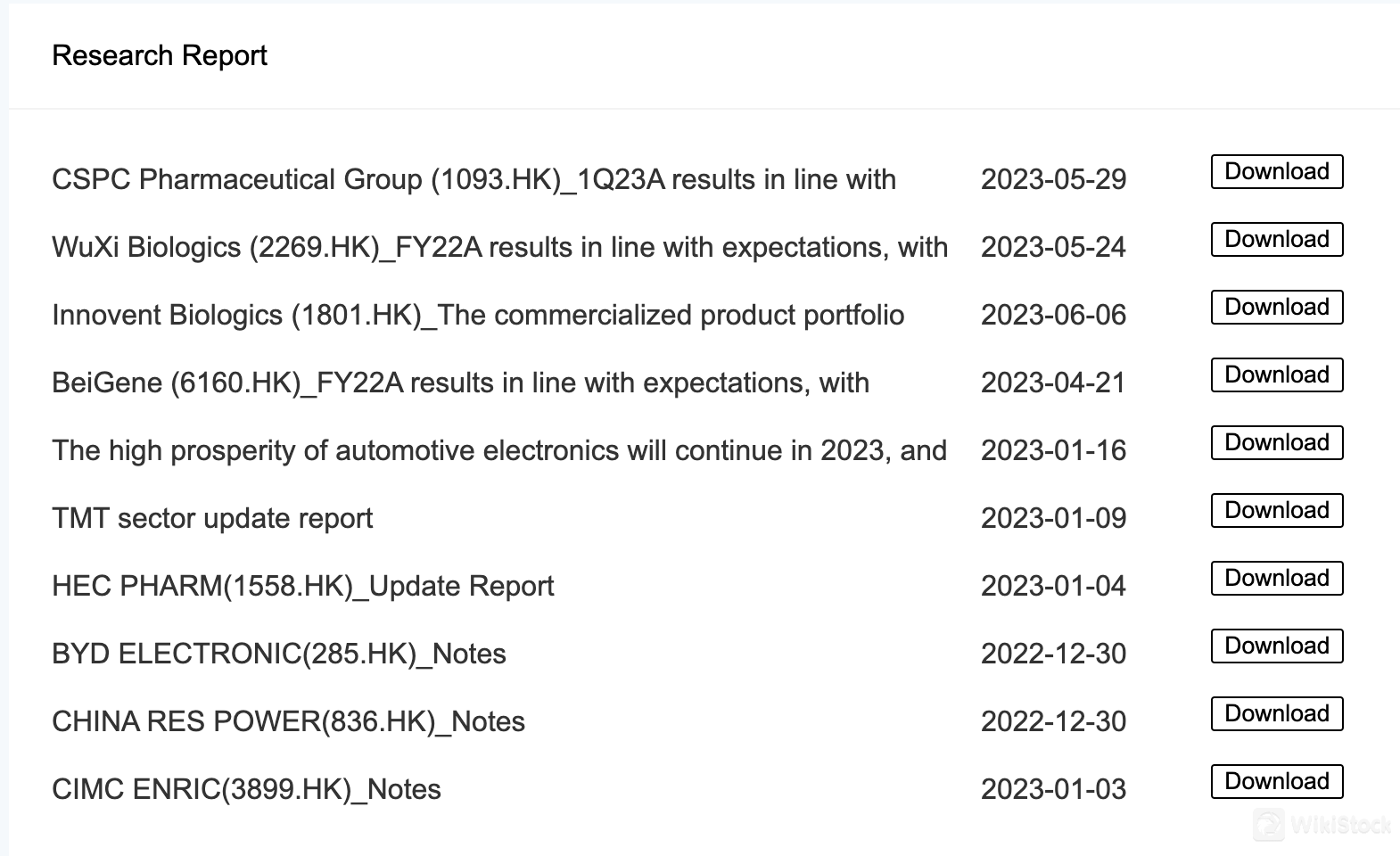

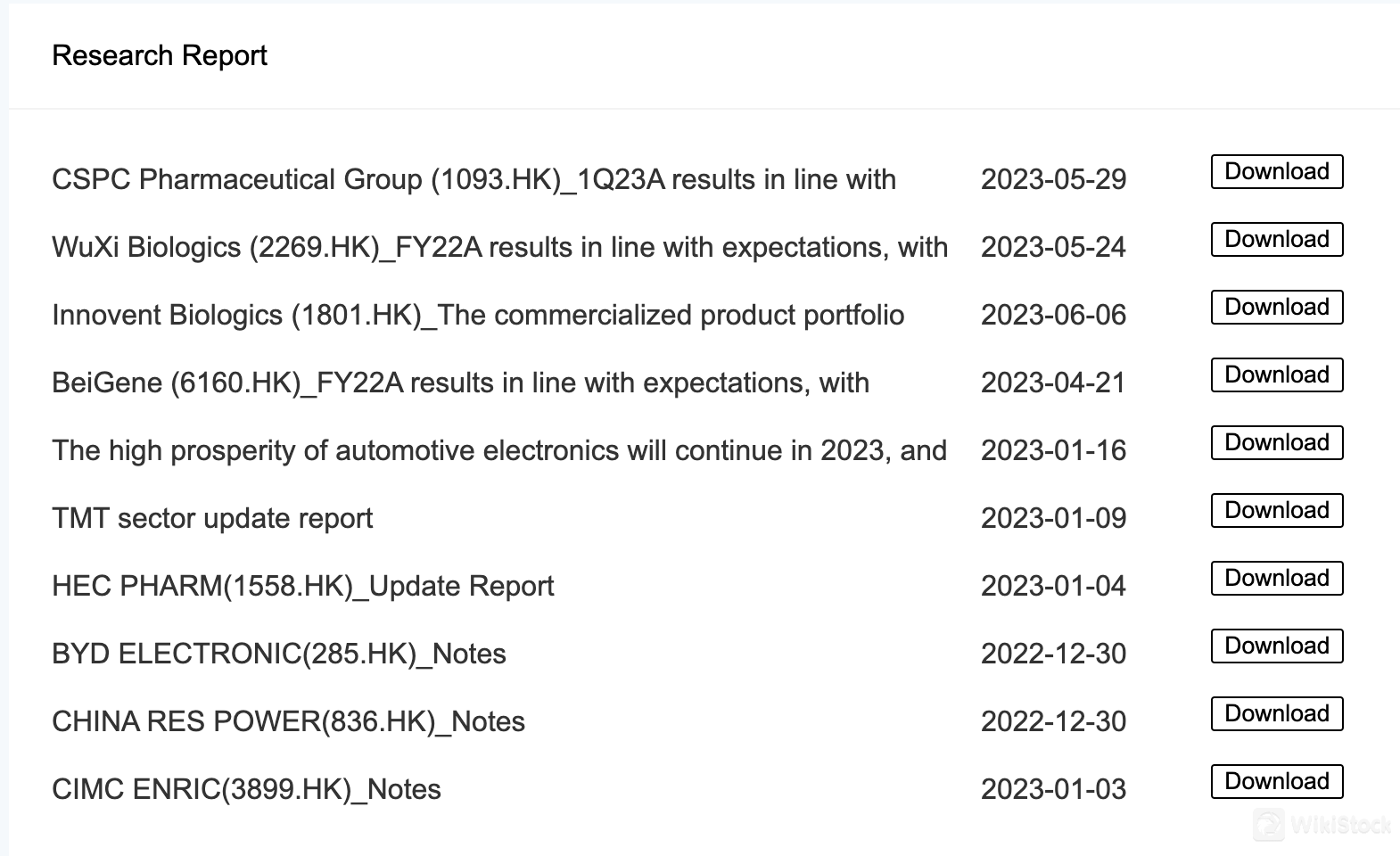

AJS provides comprehensive research reports tailored to investors.

Their research reports cover a wide spectrum of sectors, including pharmaceuticals, biotechnology, automotive electronics, consumer electronics, and more. These reports are timely and insightful, offering detailed analyses of company performances and sector trends.

Customer Service

AJS provides robust customer support through various channels.

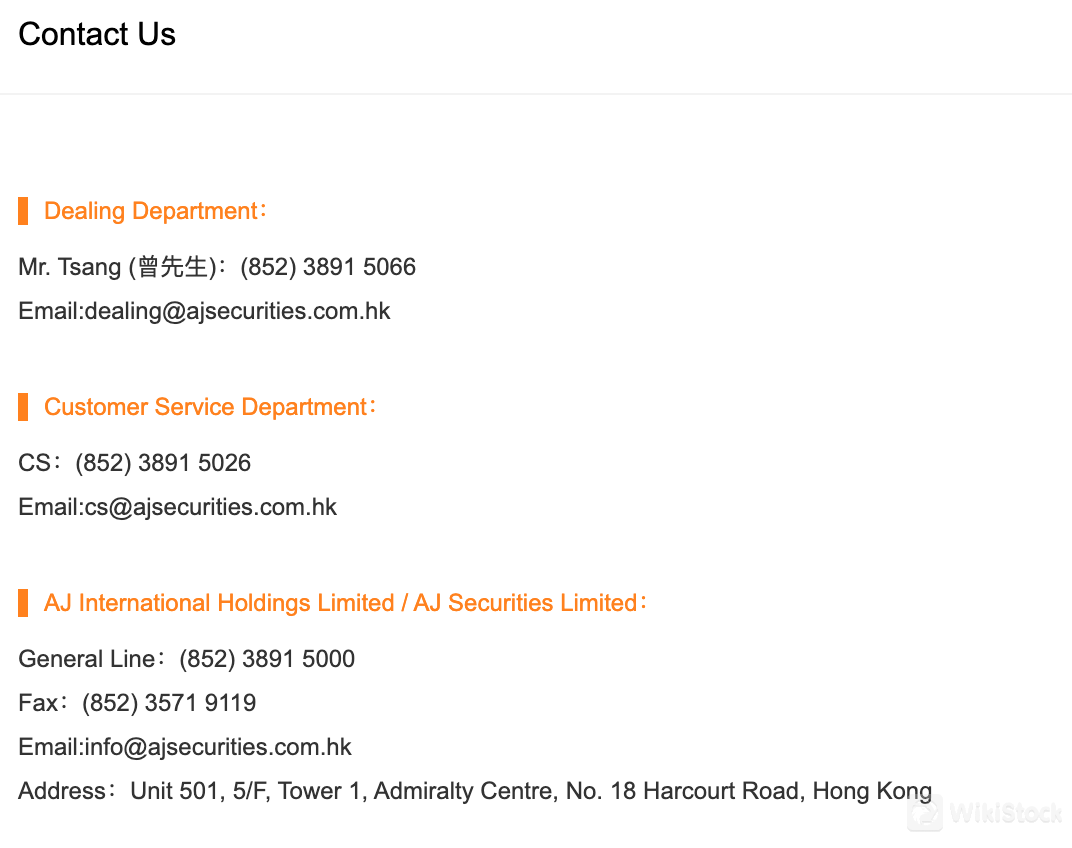

For inquiries related to trading and transactions, customers can contact Mr. Tsang at (852) 3891 5066 or email dealing@ajsecurities.com.hk during business hours.

The Customer Service Department is available at (852) 3891 5026 or cs@ajsecurities.com.hk for assistance with account management and general inquiries.

AJ International Holdings Limited / AJ Securities Limited can be reached at their general line (852) 3891 5000 or via email at info@ajsecurities.com.hk.

Their office is located at Unit 501, 5/F, Tower 1, Admiralty Centre, No. 18 Harcourt Road, Hong Kong. Service hours typically align with standard business operating times.

Conclusion

In conclusion, AJS offers a competitive platform with a user-friendly mobile app and a broad range of tradable securities including Hong Kong, A-share, and U.S. stocks. It is regulated by the SFC, ensuring a level of security for investors. While it imposes higher margin interest rates, its low trading fees for Hong Kong stocks make it attractive for frequent traders.

The platform is suitable for experienced investors and active traders who prioritize access to various markets and efficient trading tools. However, beginners might find the lack of comprehensive educational resources a drawback when starting out with AJS.

FAQs

India

IndiaObtain 1 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)

--