Regulated

0123456789

. 0123456789

0123456789

/10

Score

SageTrader

United States15-20 years

Regulated in United StatesOptions0 Commission

https://www.sagetrader.com/

Website

Rating Index

Brokerage Appraisal

Influence

C

Influence Index NO.1

United States

United StatesProducts

1

Stocks

Surpassed 8.27% brokers

Biz AreaSearch StatisticsAdvertisingSocial Media Index

(646) 837-0050

https://www.sagetrader.com/

282 Grand Avenue, Suite #2 Englewood, New Jersey 07631

Securities license

Obtain 1 securities license(s)

FINRARegulated

United StatesSecurities Trading License

Global Seats

![]() Owns 1 seat(s)

Owns 1 seat(s)

United States Nasdaq

SAGETRADER, LLC

Closed

Brokerage Information

More

Company Name

SageTrader, LLC

Abbreviation

SageTrader

Platform registered country and region

Phone of the company

(646) 837-0050

Company address

282 Grand Avenue, Suite #2 Englewood, New Jersey 07631

Company website

https://www.sagetrader.com/Check whenever you want

WikiStock APP

Brokerage Services

Internet Gene

Gene Index

0

020406080100

The gene index is Poor, worse than 0% of brokerage firms.

APP Rating

0

01.02.03.04.05.0

The APP rating is Poor, worse than 0% of peers.

We offer one of the most flexible execution platforms in the industry coupled with unparalleled trading technology and client service. Our experience has grown over more than three decades, beginning with servicing market makers and traders with Sage Clearing Corp. and continuing today with SageTrader. Our proven professional team has built upon this history to ensure that we cover all the areas that are so important to the success in servicing today’s traders. In everything we do, we listen to our clients and create unique solutions that drive up customer satisfaction. Our technology allows us to customize solutions for each individual client in ways traditional firms cannot or will not. For us, it's simple; we want to exceed your expectations

Others

Registered region

United States

Years in Business

15-20 years

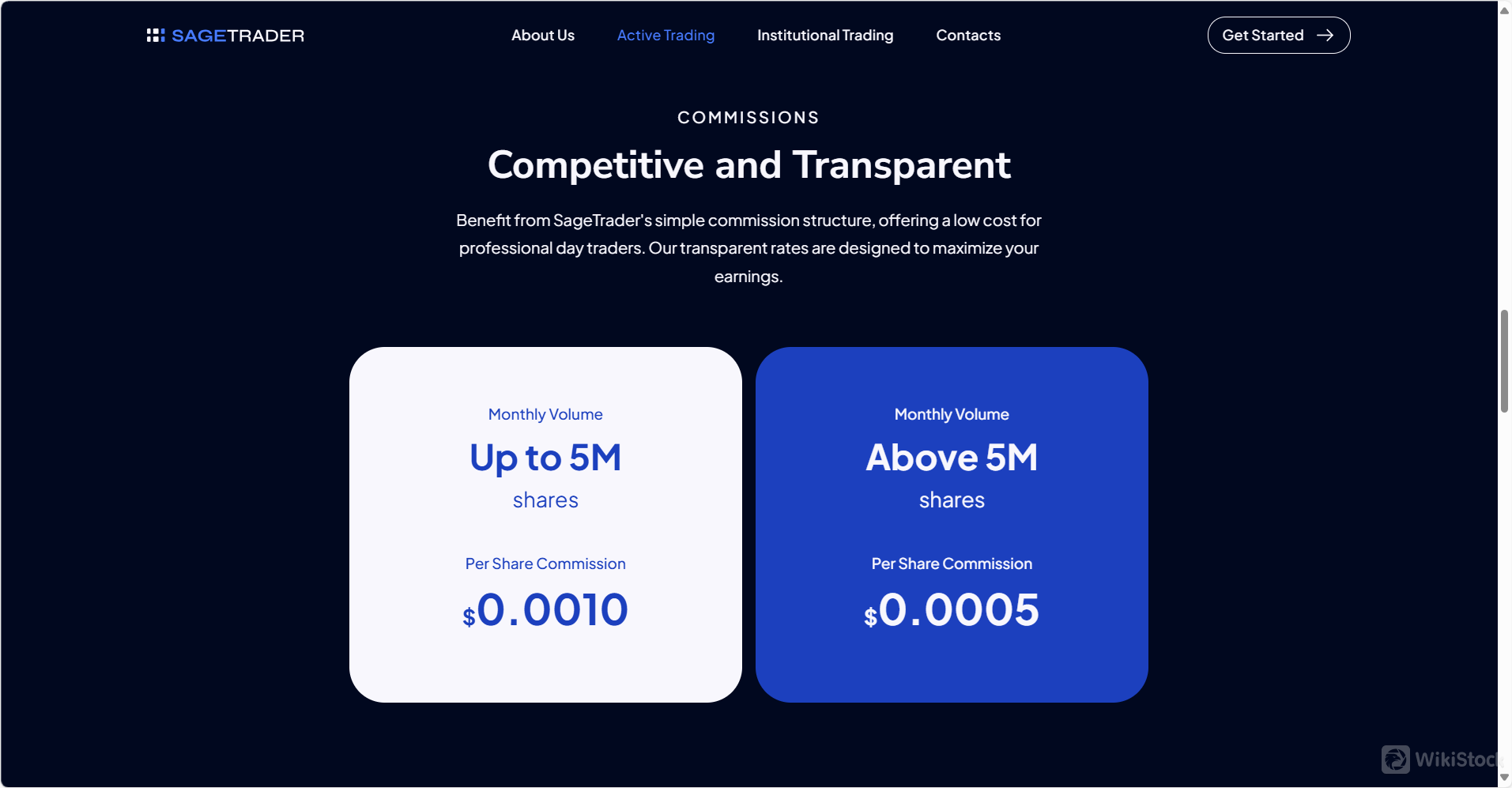

Commission Rate

0%

Regulated Countries

1

Products

Stocks

Review

1 ratings

Write a comment

Sara.

Checked out SageTrader and was impressed by their professional setup and advanced tools, clearly designed for seasoned traders. The custom routing strategies and competitive rates are standout features.

Positive

PositiveUnited Kingdom

2024-06-05 10:50

Recommended Brokerage FirmsMore

Regulated

Trive

License Level AA

Regulated in United KingdomStocks0 Commission

7.66

Score

Regulated

TradeMas

License Level AA

Regulated in United StatesOptions

7.65

Score

Regulated

GTS

License Level AA

Regulated in United StatesOptions

7.64

Score

Regulated

Edward Jones

Custody Scale CLicense Level AA

Regulated in United StatesStocks7M users in totalCommission 0.75%

7.64

Score

Regulated

Alpaca

License Level AA

Regulated in United StatesOptions0 Commission

7.63

Score

Regulated

Puente

License Level AA

Regulated in United StatesOptionsCommission 0.5%

7.61

Score

Regulated

Allaria

License Level AAAA

Regulated in United StatesOptions

7.60

Score

Regulated

Brooklight

License Level AA

Regulated in United StatesBonds & Fixed Income

7.54

Score

Regulated

Western & Southern Life

Custody Scale ALicense Level AA

Regulated in United StatesBonds & Fixed IncomeCustody assets$112.2B

7.53

Score

Regulated

Bancolombia Capital

License Level AAAA

Regulated in United StatesOptions

7.48

Score