XSpot was founded in 2014 with the aim of democratizing wealth management. We are authorised and regulated by the Cyprus Securities and Exchange Commission (license number 235/14), the supervisory and regulatory authority for investment service firms in Cyprus (CySEC).

What is XSpot Wealth?

XSpot Wealth is a financial institution that offers a wide range of investment opportunities to its clients. Operating under the regulatory oversight of CySEC, XSpot Wealth provides a secure and regulated environment for investors. With a focus on client protection, XSpot Wealth implements robust measures and collaborates with prominent investment banks to enhance its services. Investors can start investing with XSpot Wealth quickly and conveniently, with no entrance or exit fees. However, note that XSpot Wealth does not provide services to residents of the United States.

Pros & Cons of XSpot Wealth

Pros:

Regulated by CYSEC: XSpot Wealth operates under the regulatory supervision of the Cyprus Securities and Exchange Commission (CySEC), ensuring compliance with financial regulations and offering a secure environment for investors.

Client Protection Measures: Implements robust measures such as account segregation and Negative Balance Protection, which safeguard client funds from operational risks and ensure clients do not lose more than their deposited funds.

Investment Variety: Offers a wide range of investment products including stocks, ETFs, bonds, and funds.

Transparent Fee Structure: Emphasizes transparency with a fee structure that includes management fees starting from 1%, and no entrance or exit fees.

Customer Support: Offers multiple channels for customer support including telephone, email, live chat, and various social media platforms.

Cons:

Restricted Services: Does not provide services to residents of the United States, limiting its accessibility to investors from certain regions.

High Minimum Initial Deposits: While starting amounts are reasonable for many investors (e.g., EUR 5,000 for Smart Wealth), higher initial deposits are required for Private Wealth (EUR 50,000).

Is XSpot Wealth Safe?

XSpot Wealth operates under the regulatory oversight of the Cyprus Securities and Exchange Commission (CySEC), holding License No. 235/14. CySEC is an independent authority tasked with supervising Cyprus' investment services market, transactions involving transferable securities within the country, and the collective investment and asset management sectors. This regulatory framework ensures that XSpot Wealth adheres to stringent standards, promoting trust and reliability among its clientele.

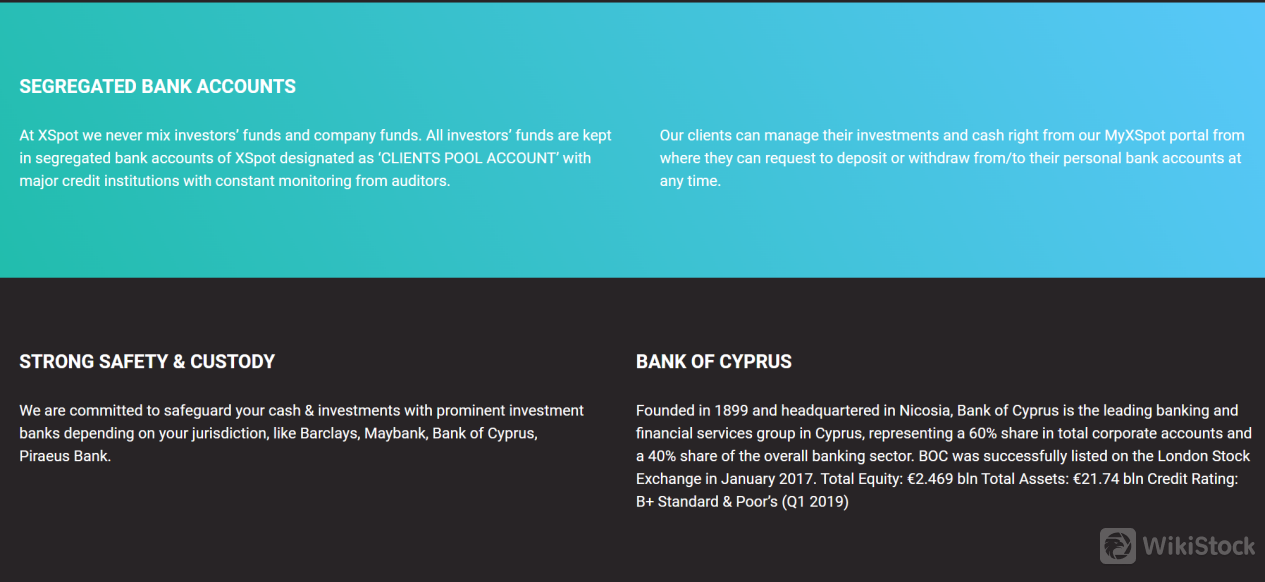

Regarding client protection, XSpot Wealth implements several robust measures. These include account segregation, which ensures that client funds are kept separate from the company's operational funds. Additionally, XSpot Wealth provides Negative Balance Protection, ensuring that clients do not lose more than their deposited funds. Anti Money Laundering (AML) protocols are also integral to XSpot Wealth's operations. Moreover, XSpot Wealth collaborates with prominent investment banks based on the client's jurisdiction, such as Barclays, Maybank, Bank of Cyprus, and Piraeus Bank.

What are Securities to Trade with XSpot Wealth?

XSpot Wealth offers stocks, ETFs, bonds and funds.

Stocks: Investors can trade stocks of publicly listed companies, allowing them to participate in the equity markets and potentially benefit from company growth and dividends.

ETFs (Exchange-Traded Funds): ETFs are available for investors seeking diversified exposure to a specific market, sector, or asset class. These funds trade on exchanges similar to stocks and can provide a cost-effective way to gain broad market exposure.

Bonds: XSpot Wealth offers bonds, which are debt securities issued by governments, municipalities, or corporations. Bonds typically provide fixed income through regular interest payments and are considered lower-risk investments compared to stocks.

Funds (Mutual Funds): Mutual funds pool money from multiple investors to invest in a diversified portfolio of securities, managed by professional portfolio managers. They offer diversification across various asset classes and investment strategies.

XSpot Wealth Fees Review

XSpot Wealth charges various fees and commissions based on the different types of products traded.

Commission: 0.10% with a minimum of $10 for trades on CBOE, NASDAQ, NYSE.

Annual Custody Fee: 0.15% plus VAT, with a monthly minimum fee of EUR 5 per account.

Conversion Fee: Up to 1.00% on the total value of transactions when trading in a different currency.

Mark-up Cost: Up to 5 cents per share or 0.05% to cover execution fees.

Annual Custody Fee: 0.15% plus VAT, with a monthly minimum fee of EUR 5.

Conversion Fee: Up to 1.00% of the total value for transactions in a different currency.

Mark-up Cost: Up to 5 cents per share or 0.05% for execution fees.

Fee: 0.20% inclusive of execution and settlement, with a minimum fee of EUR 70 for primary government and corporate bonds.

Conversion Fee: Up to 1.00% on the total value for transactions in a different currency.

Custody Fee: 0.15% plus VAT, with a minimum fee of EUR 5 per month.

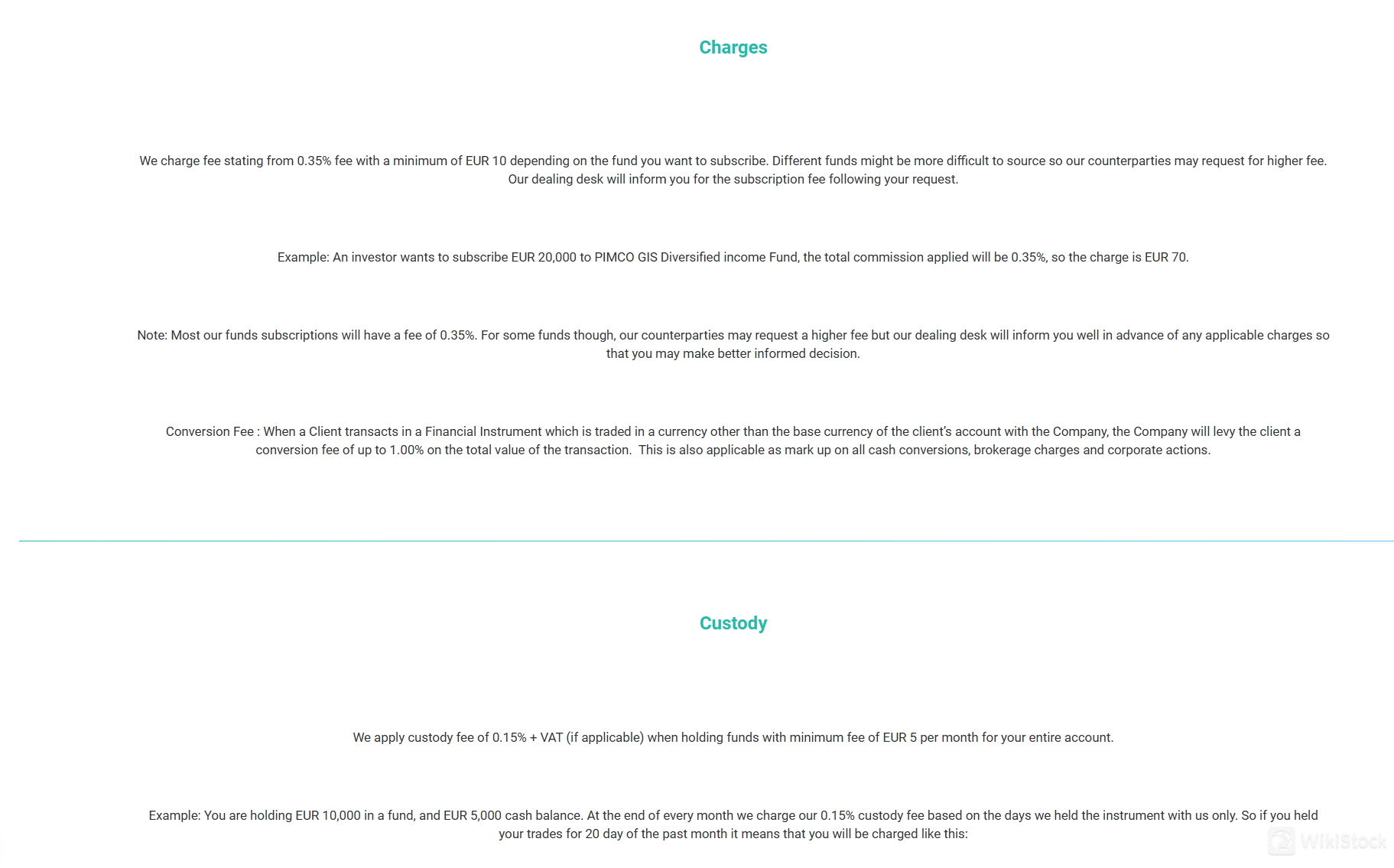

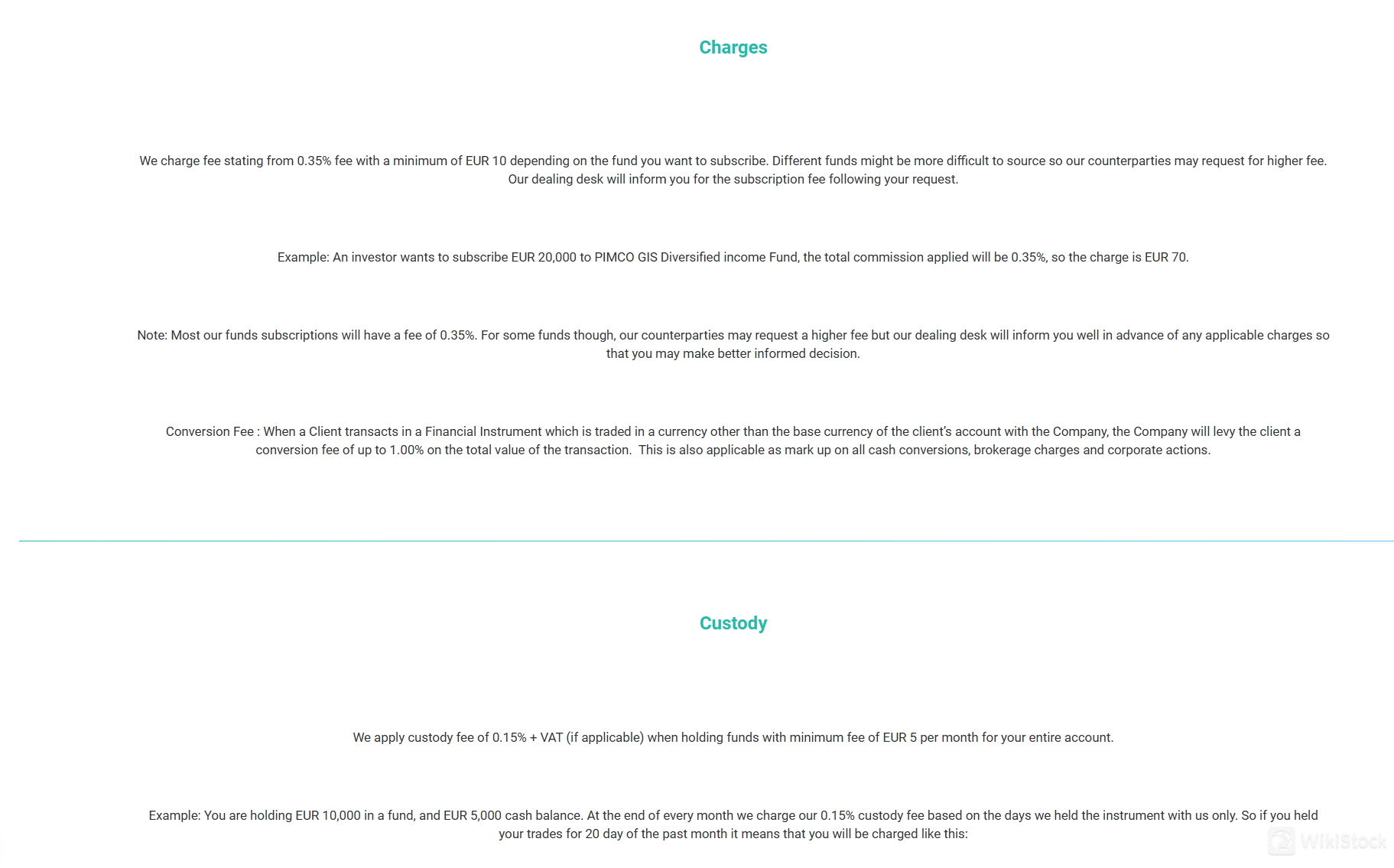

Fee: Starting from 0.35% with a minimum of EUR 10, subject to fund subscription.

Conversion Fee: Up to 1.00% on the total value for transactions in a different currency.

Custody Fee: 0.15% plus VAT, with a minimum fee of EUR 5 per month.

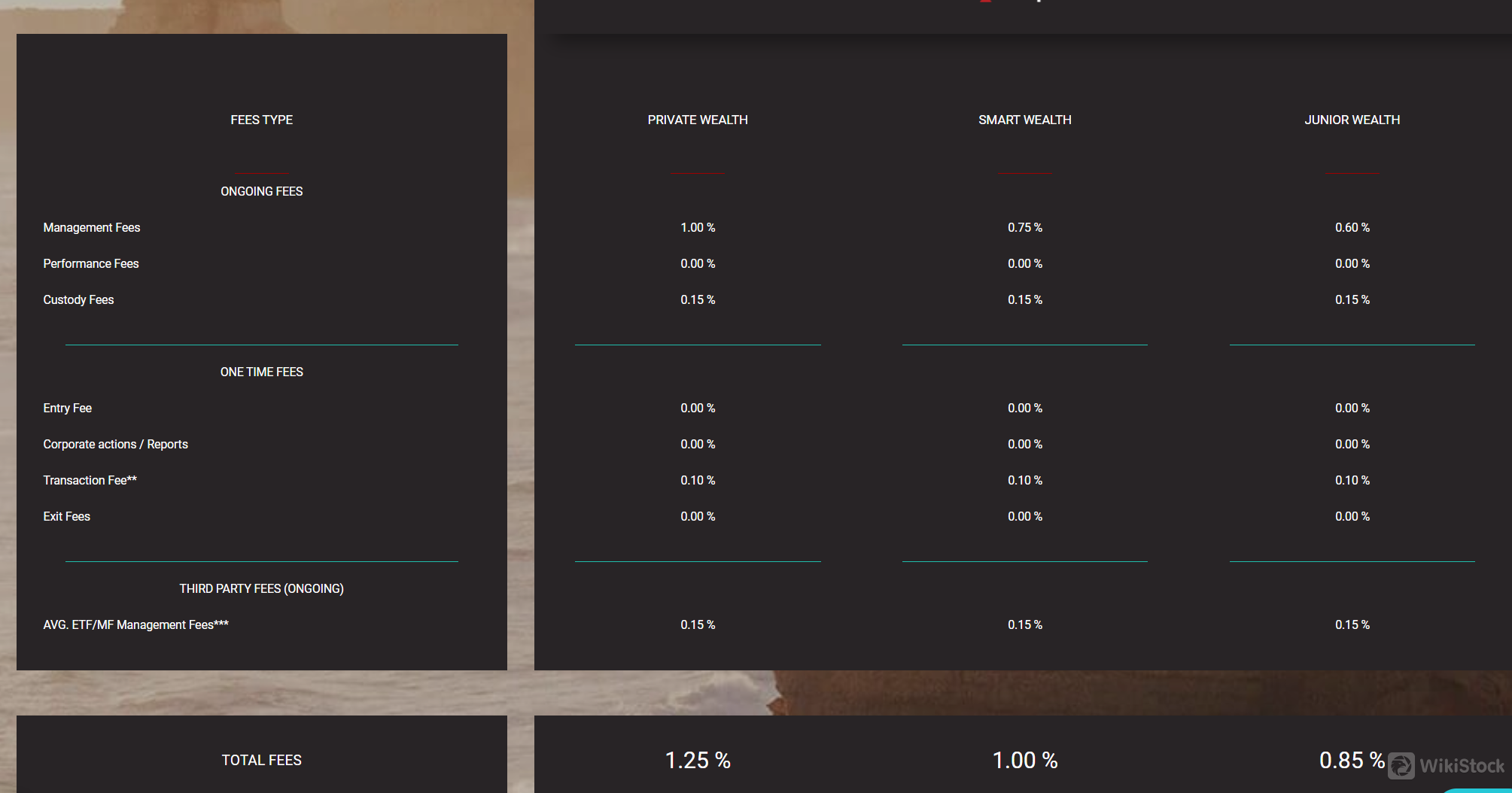

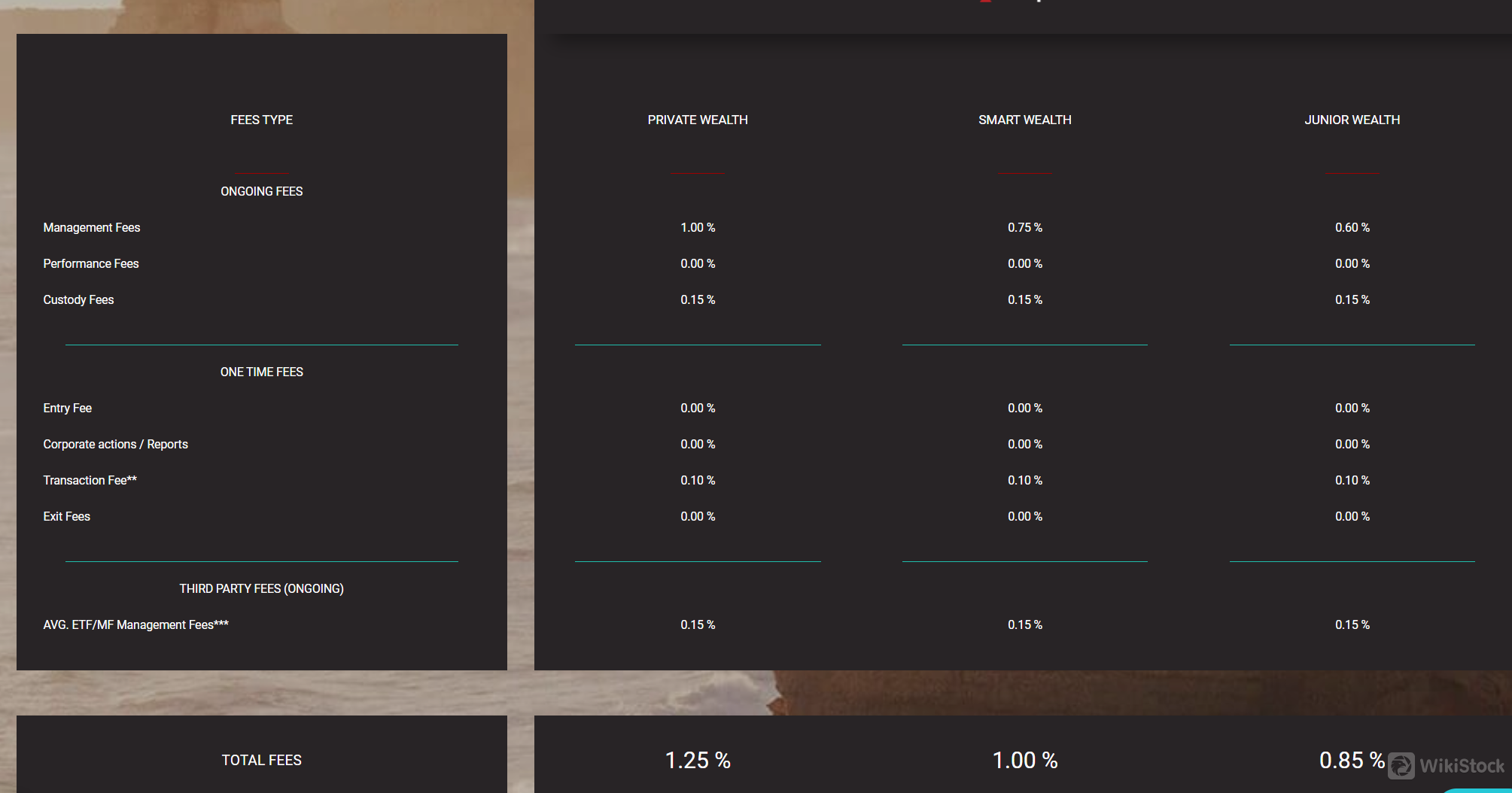

Apart from the fees on each products, it also charges various fees associated with investing in different wealth management categories offered by XSpot Wealth.

Ongoing Fees include management fees, custody fees, and potential performance fees, which are charged periodically for managing investments and safekeeping assets. Performance fees are applied if the investment performance exceeds certain benchmarks.

One-Time Fees encompass entry fees, fees related to corporate actions and reports, transaction fees, and exit fees. These fees are typically charged only once, such as when an investor joins the platform or executes transactions.

Third Party Fees (Ongoing) refer to fees charged by external entities, such as ETFs or mutual funds, for managing their investments.

Total Fees provide an overall percentage of fees investors can expect to pay, including both direct charges from XSpot Wealth and those from third-party entities.

XSpot Wealth Accounts Review

XSpot Wealth offers a variety of investment accounts designed to cater to different investor needs and preferences:

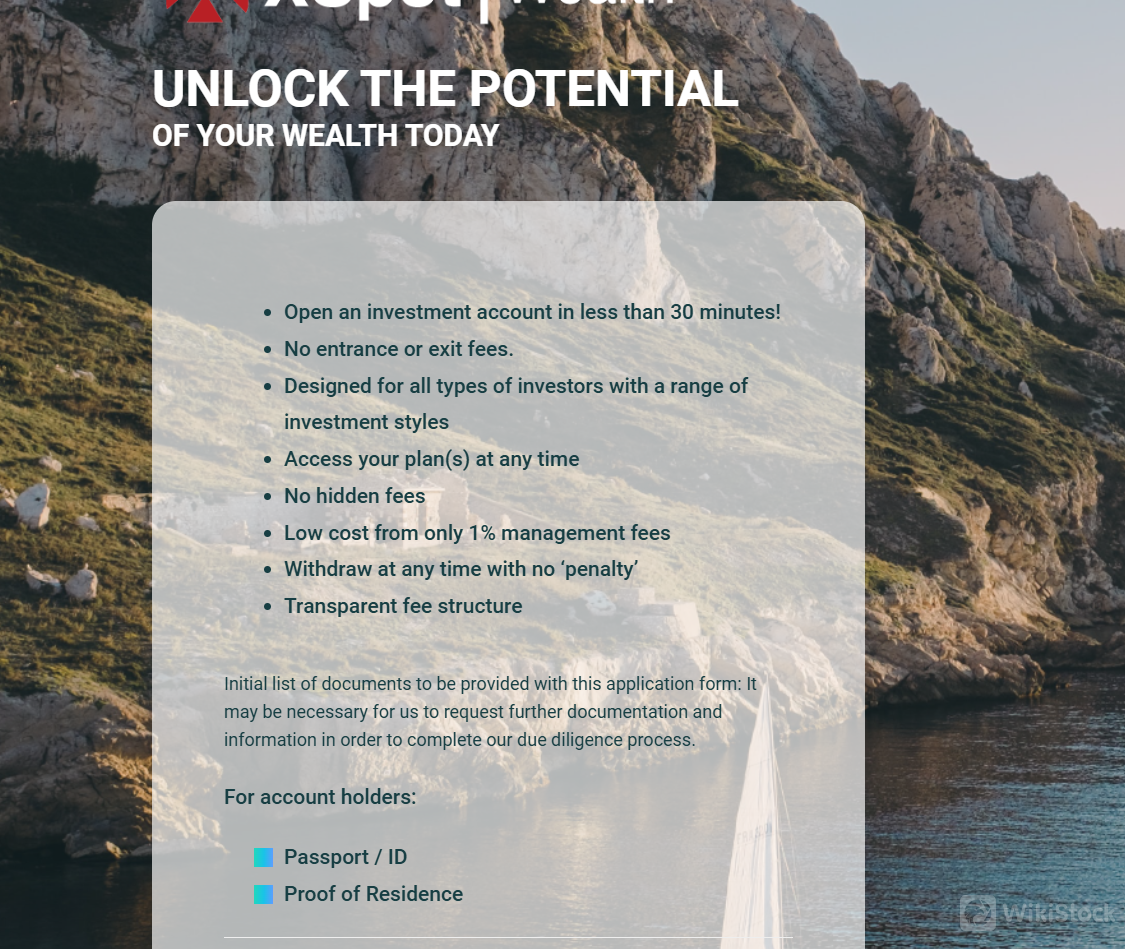

Account Types: XSpot Wealth provides three main account types: Smart Wealth, Junior Wealth, and Private Wealth. Each account type targets investors with varying levels of wealth and investment goals.

Accessibility and Convenience: Opening an account with XSpot Wealth is designed to be quick and straightforward, allowing investors to start investing in less than 30 minutes. There are no entrance or exit fees, making it cost-effective for investors to manage their investments. XSpot Wealth emphasizes transparency with a fee structure that includes management fees starting from 1%.

Minimum Initial Deposit: Each account type has a specific minimum initial deposit requirement, allowing investors to start with as little as:

Smart Wealth: 5,000 EUR or equivalent

Junior Wealth: 1,000 EUR or equivalent

Private Wealth: 50,000 EUR or equivalent

Supported Currencies: XSpot Wealth accepts multiple currencies (EUR, USD, GBP, CHF, CAD, AUD, JPY), offering flexibility for investors around the globe.

Customer Service

XSpot Wealth offers live chat. With live chat, customers can get their questions answered quickly and receive help with any issues they may have.

Customers can visit their office or get in touch with customer service line using the information provided below:

Telephone: +357 25 571044

Email: support@xspotwealth.com

Fax: +357 25 571125

Address: Spyrou Kyprianou Ave 61, Limassol 4003, Cyprus

Moreover, clients could get in touch with this broker through the social media, such as Twitter, Facebook, Instagram, YouTube and Linkedin.

Conclusion

In conclusion, XSpot Wealth emerges as a robust choice for international investors seeking regulated and diversified wealth management solutions. Under the oversight of CySEC, it prioritizes client security with measures like account segregation and Negative Balance Protection. Offering a wide range of investment products and transparent fee structures, XSpot Wealth caters to various investor profiles with tailored account options. While it's not accessible to US residents and has minimum deposit requirements, its global accessibility and strong customer support underscore its appeal as a reliable financial partner.

Frequently Asked Questions (FAQs)

Is XSpot Wealth regulated?

Yes. It is regulated by CYSEC.

What types of securities can I invest in with XSpot Wealth?

You can trade stocks, ETFs, bonds and funds.

How can I contact XSpot Wealth?

You can contact via telephone: +357 25 571044, email: support@xspotwealth.com, fax: +357 25 571125, live chat, Twitter, Facebook, Instagram, YouTube and Linkedin.

On XSpot Wealth, are there any regional restrictions for traders?

Yes. It does not provides services for the residents of the United States.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Greece

GreeceObtain 1 securities license(s)