BrokerCreditService (Cyprus) Limited is an investment firm regulated by the Cyprus Securities and Exchange Commission («CySEC»), Authorisation ¹048/04. Since the Company’s incorporation its main objective was the provision of financial services.

BCS Cyprus Information

BCS Cyprus seems to be a financial services provider that offers mutual funds and an interest rate of 3.72% on uninvested cash, highlighting its focus on providing additional value for cash reserves.

However, the lack of detailed information on its fee structure and the absence of a specific trading platform or app limits its appeal to users who prioritize trading tools and transparent costs.

Pros & Cons

Pros:

BCS Cyprus is regulated by CYSEC, ensuring reliable oversight. It offers diverse trading assets like stocks, options, and funds, and a variety of investment services, accommodating different investor preferences. Regular updates to trading terms demonstrate its commitment to current standards.

Cons:

The fee structure at BCS Cyprus is unclear, potentially discouraging some clients. There's no specific trading platform or app, which might hinder trading efficiency. Additionally, stringent regulatory compliance adds complexity to trading activities.

Is BCS Cyprus Safe?

Regulations:

BCS Cyprus is regulated by the Cyprus Securities and Exchange Commission (CySEC), under license number 048/04.

This regulatory framework typically implies adherence to specific standards that safeguard investor interests, contributing to the broker's credibility.

Funds Safety:

BCS Cyprus, being regulated by CySEC, must adhere to strict regulatory requirements that include the segregation of client funds from company funds.

This regulatory practice ensures that client assets are kept in separate bank accounts, which provides protection against the misuse of funds and financial instability of the broker. This segregation is a critical component of client fund safety, ensuring that client assets are not used for the company's operational expenses or liabilities.

Safety Measures:

BCS Cyprus employs standard industry practices such as encryption technologies to protect client data and secure funds.

Additionally, regulated entities are required to have measures in place to prevent unauthorized access and data breaches, which helps in safeguarding personal and financial information.

What are securities to trade with BCS Cyprus?

BCS Cyprus offers a variety of tradable securities across different markets. The securities available for trading include:

Shares & Depositary Receipts: This encompasses trading in company shares and depositary receipts, which represent ownership in stocks of foreign companies.

Bonds & Other Debt Securities: Clients can trade various types of bonds and other debt instruments, offering opportunities for income through interest.

Units in Collective Investment Schemes: These are investments in various types of mutual funds, providing diversification across different asset classes.

Derivatives: This category includes options, futures, and other derivative products, allowing for strategic investments and hedging.

Standardized Options (US markets): Trading in options contracts regulated by U.S. markets that conform to standard specifications.

Securities Futures Contracts (US markets): Futures contracts based on securities, traded in U.S. markets.

Warrants: These are securities that confer the right, but not the obligation, to buy or sell a specific security at a certain price before expiration.

Off-Market Securities Lending and Repurchase Transactions: These involve the lending and borrowing of securities, typically done off-market, and repurchase agreements for short-term borrowing.

Exchange-Traded Derivatives: Although currently not available, this would typically include futures and options traded on standard exchange platforms.

Derivatives on Virtual Currencies: Trading in derivatives that are based on the price movements of virtual currencies.

Research & Education

BCS Cyprus offers a variety of educational resources and research publications designed to support investors in making informed decisions in the securities markets. These include:

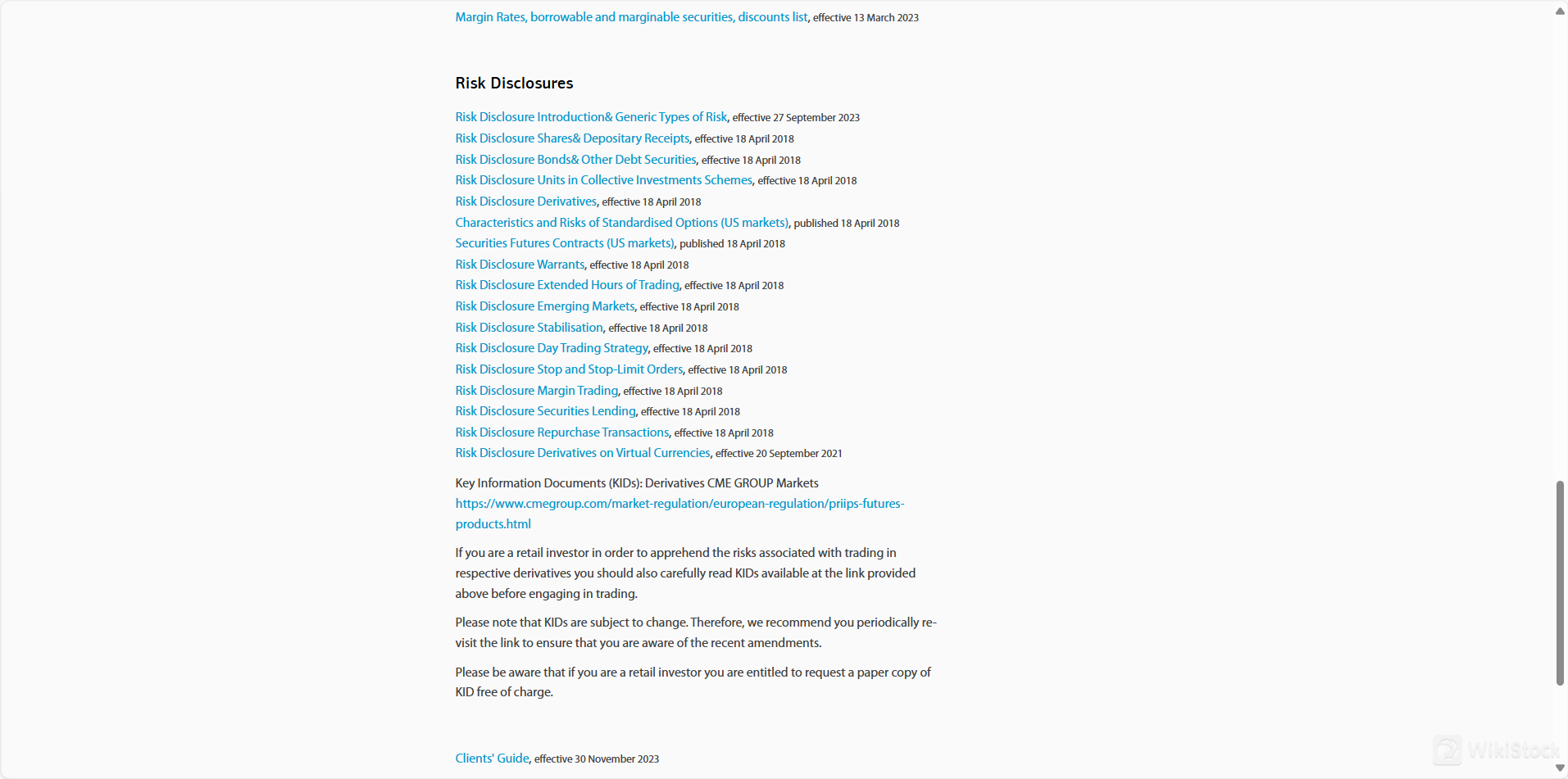

Risk Disclosures: Detailed documents discussing the generic types of risks associated with various financial instruments, such as shares, depositary receipts, bonds, collective investment schemes, derivatives, and others. These documents provide crucial information on the nature of each investment and the associated risks, helping investors understand potential pitfalls and how to mitigate them.

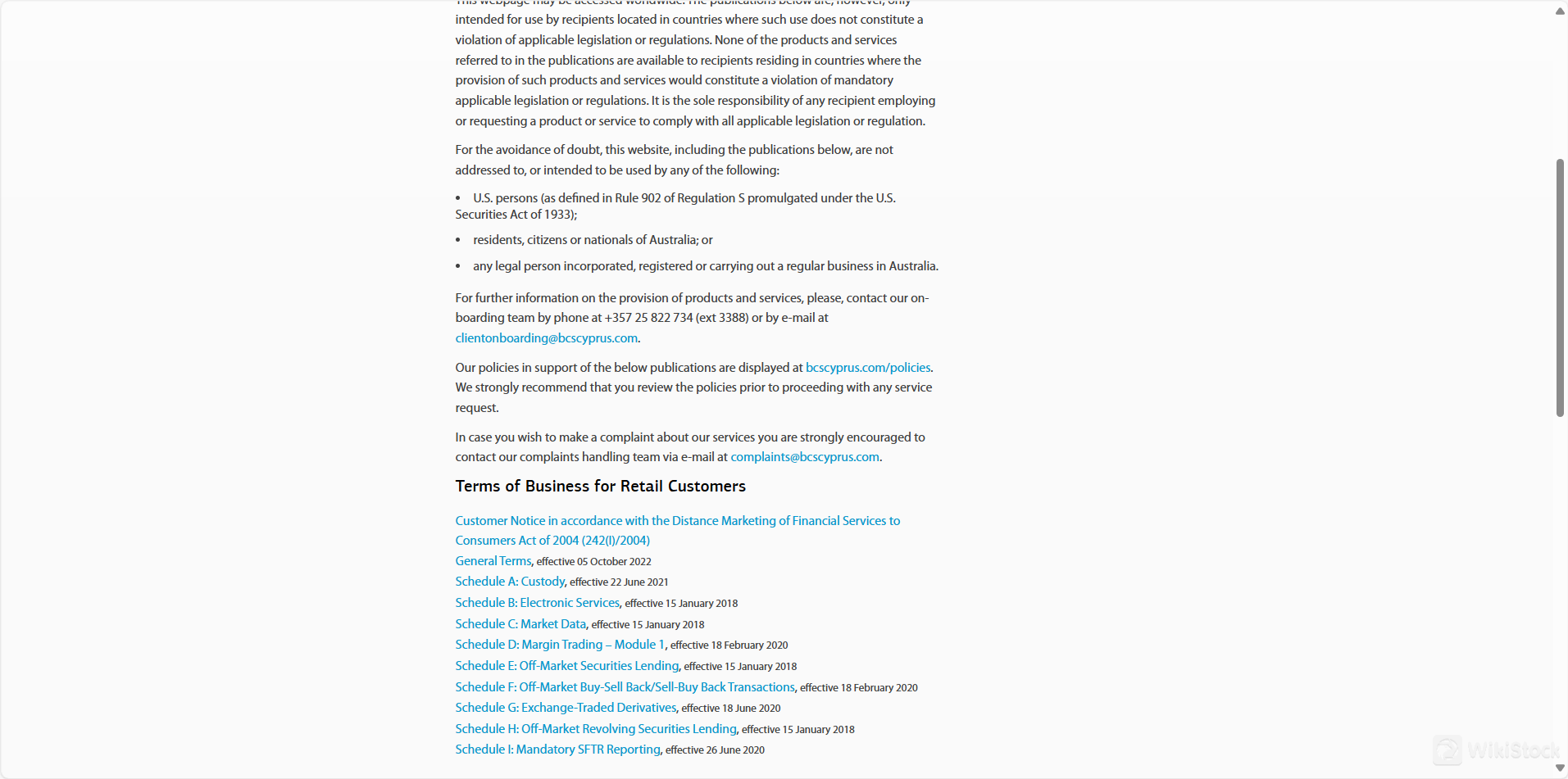

Publications on Trading and Investment: The website hosts publications related to products and services offered to different categories of investors. These publications are educational and inform about the complexities of securities trading, without being treated as a public offer.

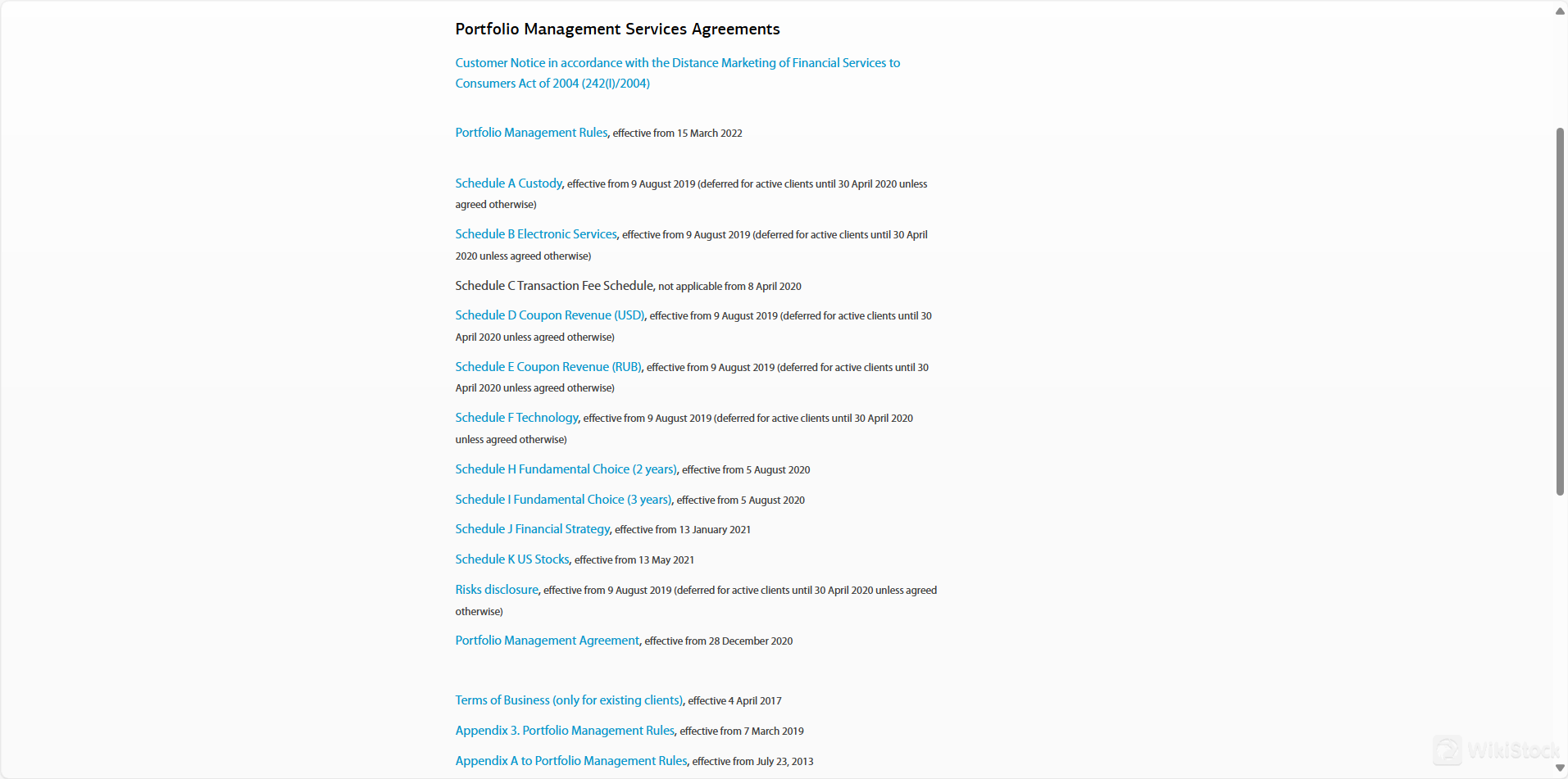

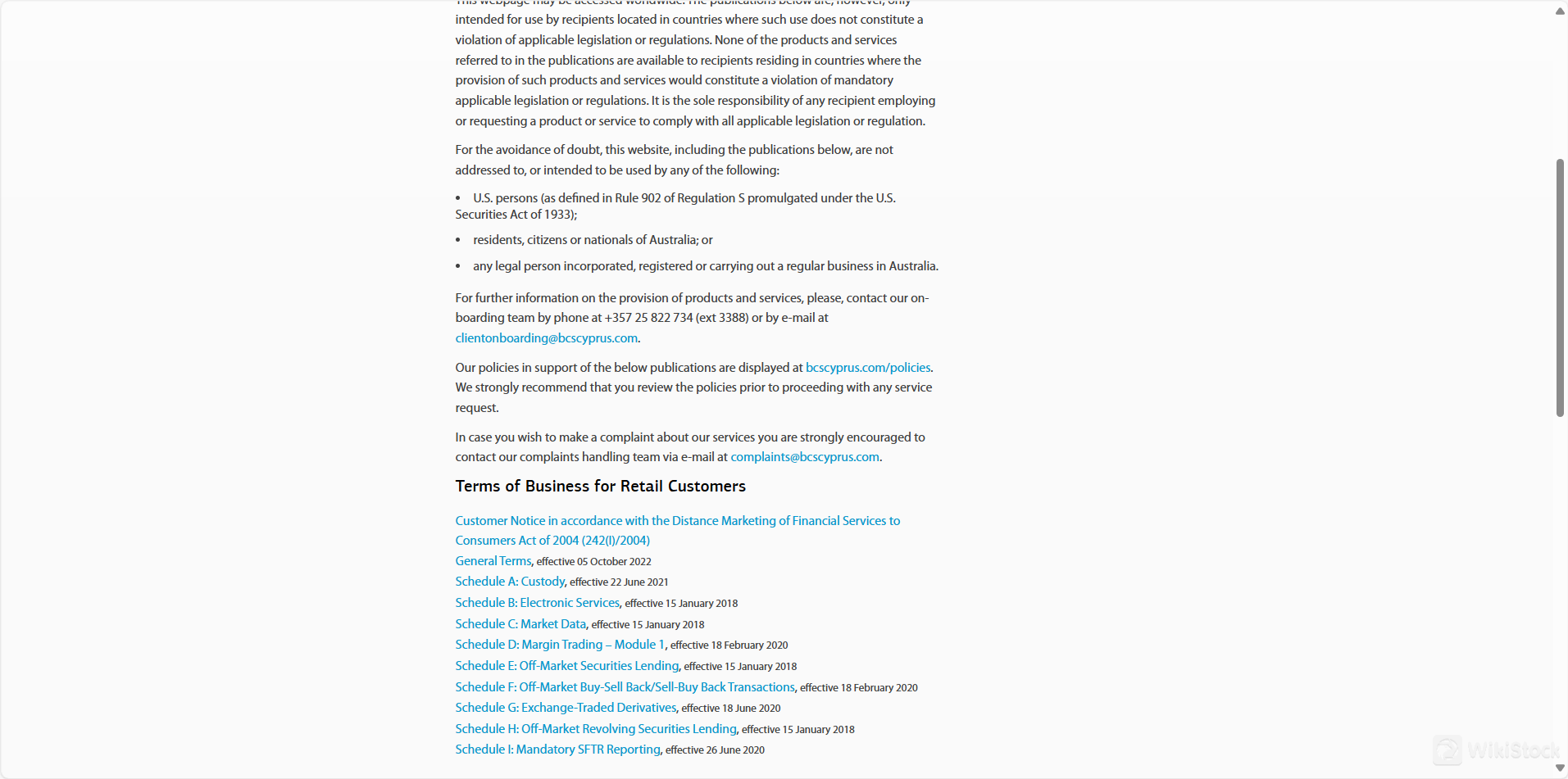

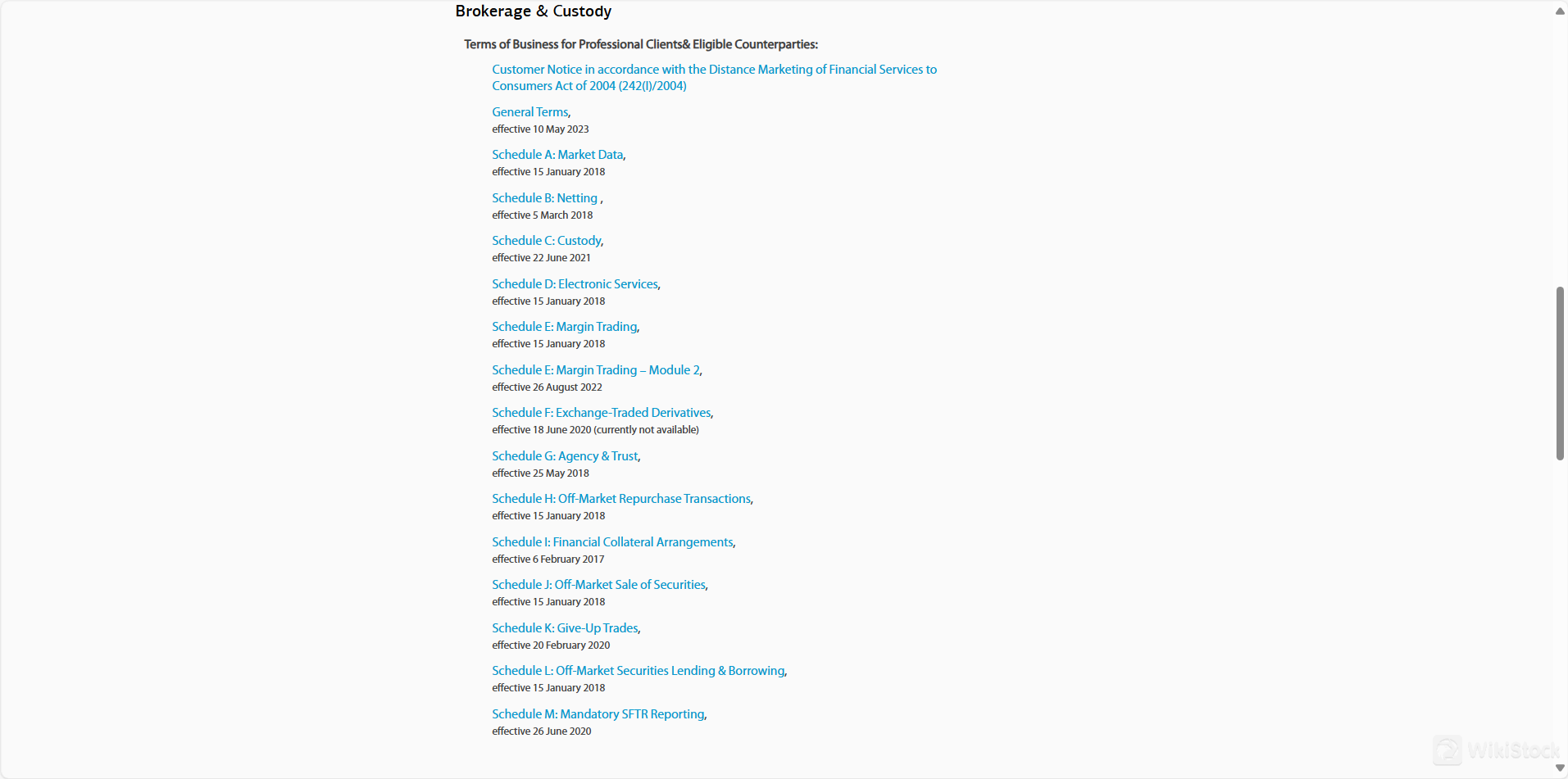

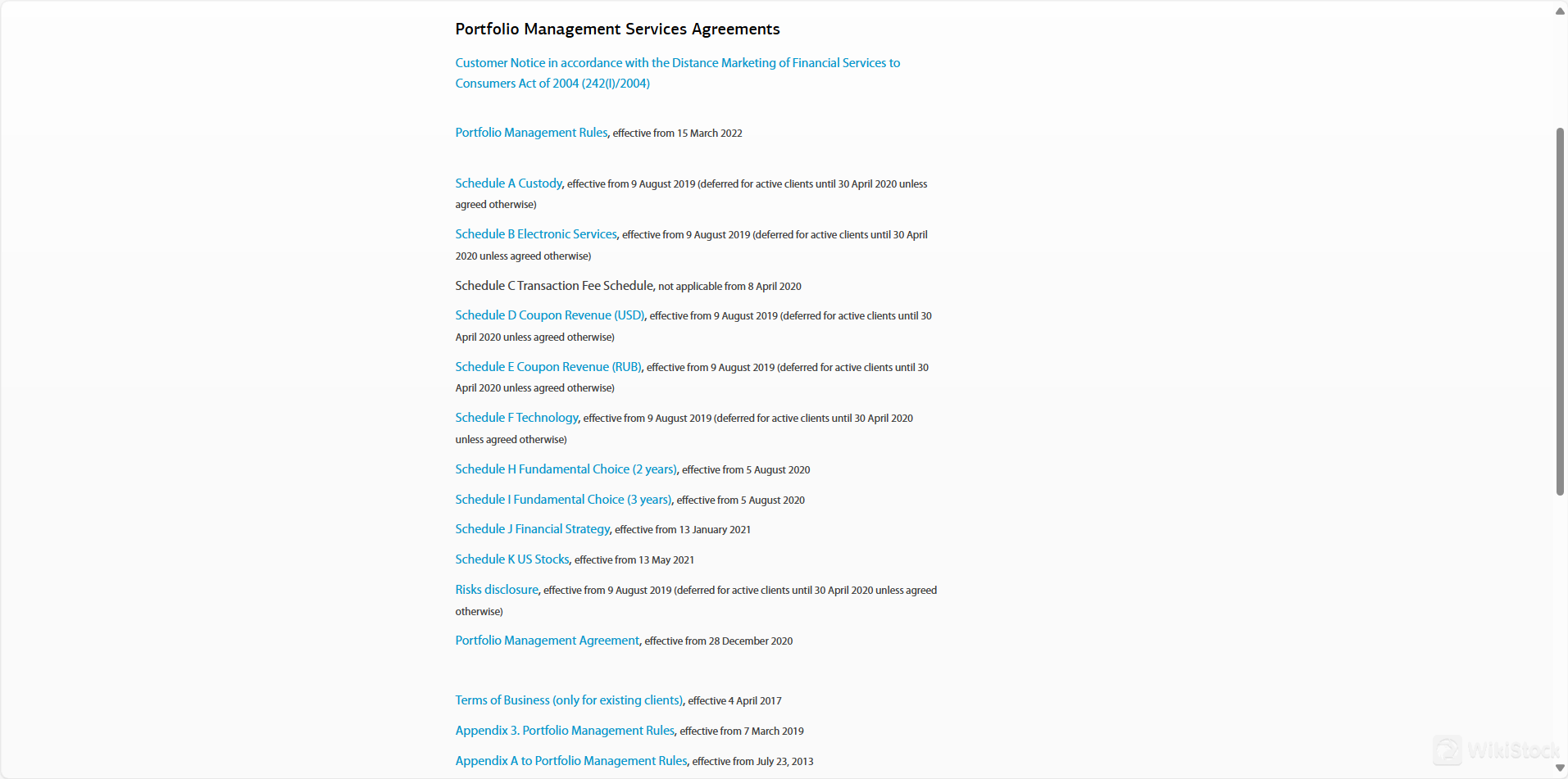

Terms of Business and Customer Notices: These documents are essential for understanding the legal and operational framework within which trading activities are conducted. They include information on brokerage and custody services, electronic services, market data, margin trading, securities lending, and off-market transactions.

Market Analysis and Research Reports: Regular market commentary and analysis provide insights into market trends, economic indicators, and potential investment opportunities. These reports are designed to assist both retail and institutional investors in making strategic investment decisions.

Key Information Documents (KIDs): These documents are specifically designed to inform about the risks and costs associated with derivative products. They are crucial for retail investors considering derivatives trading, providing a clear view of potential returns and risks.

Customer Service

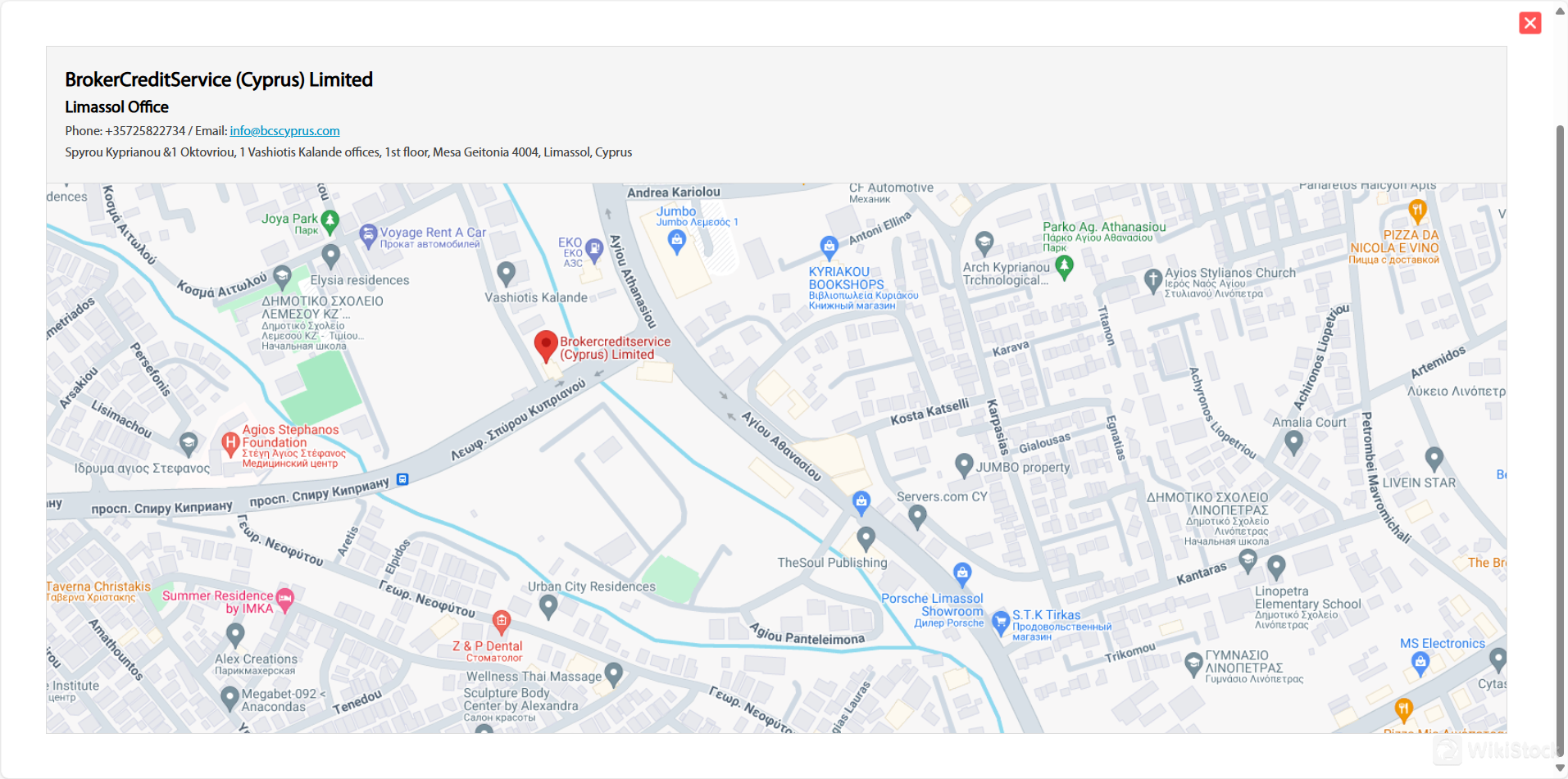

BCS Cyprus provides customer support through its dedicated office in Limassol, Cyprus.

Customers can reach out to the support team via phone at +357 25822734 or through email at info@bcscyprus.com.

The office is located at Spyrou Kyprianou &1 Oktovriou, 1 Vashiotis Kalande offices, 1st floor, Mesa Geitonia, 4004, Limassol, Cyprus, ensuring accessibility for local clients.

This setup underscores BCS Cyprus' commitment to offering direct and effective support channels for addressing customer queries and issues, ensuring a responsive and client-focused service environment.

Conclusion

BCS Financial Group stands as a prominent financial service provider specializing in a variety of market activities including trading, investment solutions, and brokerage services.

With a robust presence in multiple markets, BCS ensures rigorous adherence to regulatory standards and a strong focus on customer support, making it a reliable choice for clients seeking financial services.

The company's commitment to technology and market access further strengthens its position as a leader in the financial services sector.

FAQs

United States

United StatesObtain 1 securities license(s)