TCS provides brokerage services for securities listed on TPEx, such as margin trading, short sale, futures trading, consigned trading of foreign securities, securities investment consulting and proprietary trading of securities-related futures. It also develops products approved by the Financial Supervisory Commission and APP trading systems.

TCS Infomation

Established in 1962, TCS is a wholly-owned subsidiary of TCFHC, a major financial holding company in Taiwan. TCS specializes in brokerage services for securities listed on the Taiwan Stock Exchange (TPEX). This includes services like margin trading, short selling, futures trading, and securities investment consulting. They offer proprietary trading of securities-related futures and have developed their own APP trading systems. Notably, 80% of their clients utilize TCS's APP trading systems, indicating a focus on digital accessibility.

Pros & Cons of TCS

Pros: Formal Regulation: TCSis regulated by the China Taiwan Securities and Futures Bureau (CTSFB) under license number 1020.

Variety of Investment Options: TCS suits diverse investment strategies with stocks, bonds, futures, and other foreign securities.

Mobile App: “Jinku E Securities” app provides market data, technical analysis tools, and financial news.

Customer Service Options: Multiple channels exist for customer support, including dedicated hotlines for seniors and anti-fraud concerns.

Discounted Electronic Trading: TCS offers a discounted commission rate for electronic trades.

Cons: Limited Educational Resources: TCS offers limited materials about education and research tools for beginners.

Limited Geographic Focus: TCS primarily focuses on the Taiwanese market. This limits investment options for those seeking global diversification.

Is TCS Safe?

Regulation

Taiwan Cooperative Securities (TCS) is regulated by the China Taiwan Securities and Futures Bureau (CTSFB) under license number 1020. This regulatory oversight helps ensure TCS operates within a defined framework and adheres to established standards in Taiwan's securities and futures market.

Safety Measures

TCS offers a dedicated anti-fraud advisory hotline alongside their general customer service channels. This allows clients to report suspicious activity and receive assistance regarding account security.

What are Securities to Trade with TCS?

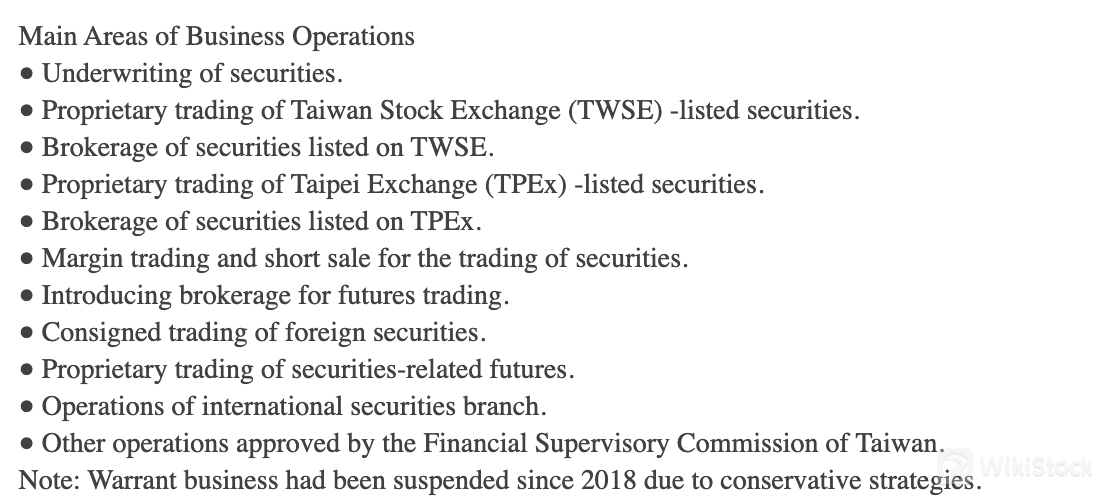

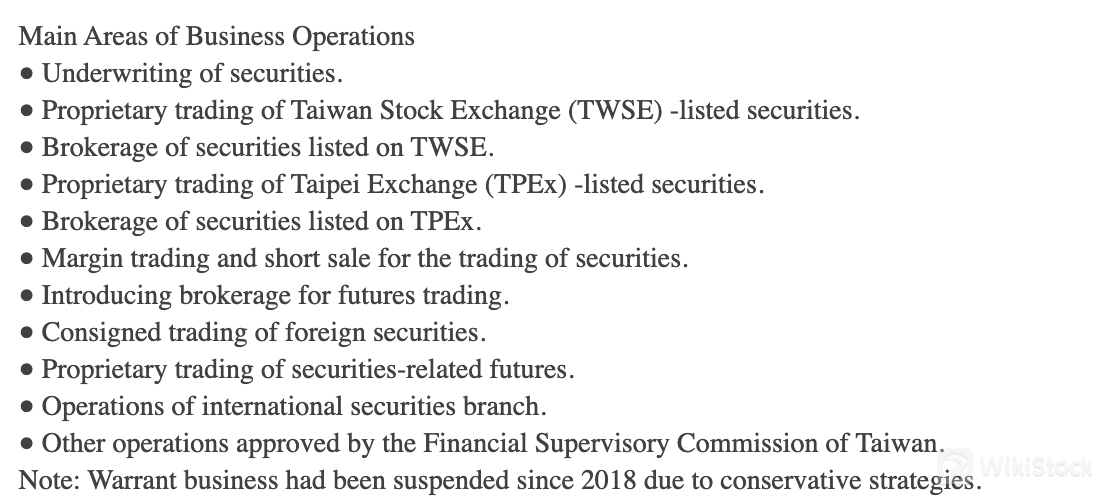

Taiwan Cooperative Securities (TCS) offers a wide range of securities trading options for investors in Taiwan.

Equity Trading: Customers can trade stocks listed on both the Taiwan Stock Exchange (TWSE) and the Taipei Exchange (TPEx) through TCS. This allows customers to invest in a vast selection of companies across various industries.

Margin Trading and Short Selling: TCS facilitates margin trading and short selling for stock trades, which can be advanced investment strategies.

Futures Trading: While TCS doesn't directly offer futures trading, they can introduce customers to a broker specializing in futures contracts. This allows customers to profit from price movements in underlying assets like commodities or indexes.

Foreign Securities: TCS offers the option for consigned trading of foreign securities. This means they can handle the process of customers buying or selling securities listed on international exchanges.

Proprietary Trading: TCS engages in proprietary trading of both listed securities and securities-related futures.

TCS Accounts

Taiwan Cooperative Securities (TCS) offers a variety of account types to suit the diverse investment needs of their clients:

Securities Account: This is a basic account that allows clients to buy and sell stocks, bonds, and other securities listed on the Taiwan Stock Exchange (TWSE) and Taipei Exchange (TPEx).

Futures Account: If clients are interested in futures trading, TCS provides a dedicated futures account. This lets them trade contracts based on the future price of underlying assets like commodities or indexes.

Margin Trading Account: With a margin trading account, clients can borrow funds from TCS to amplify their trading potential.

Comprehensive Entrusted Account: For those seeking a more comprehensive investment solution, TCS offers a comprehensive entrusted account.

TCS Fees Review

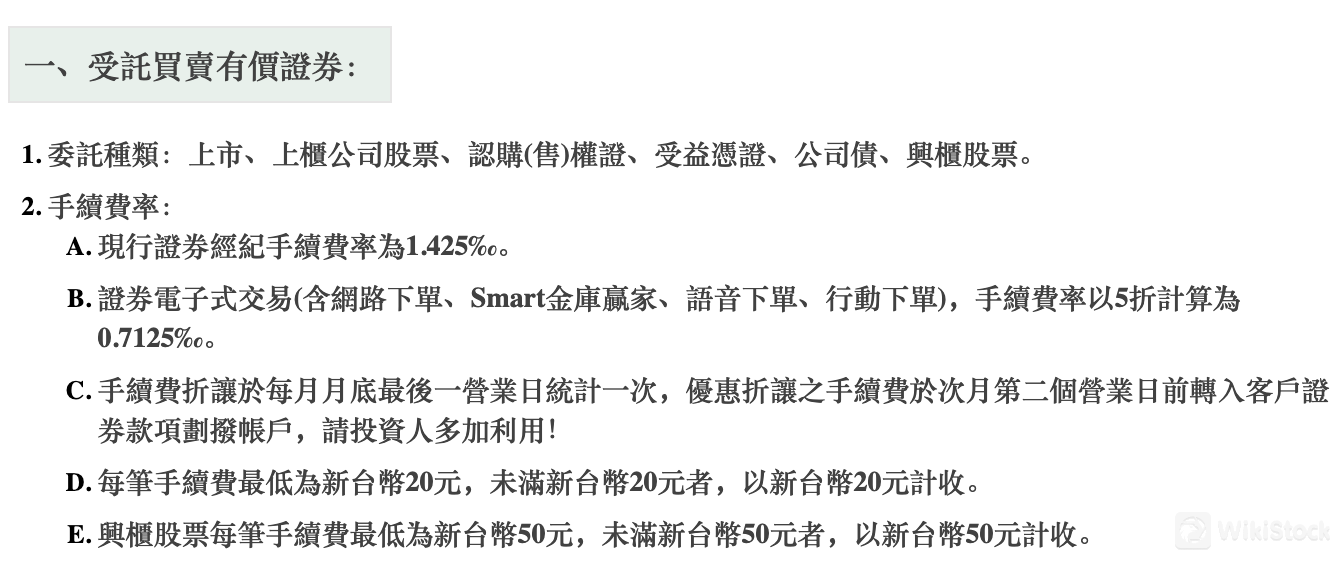

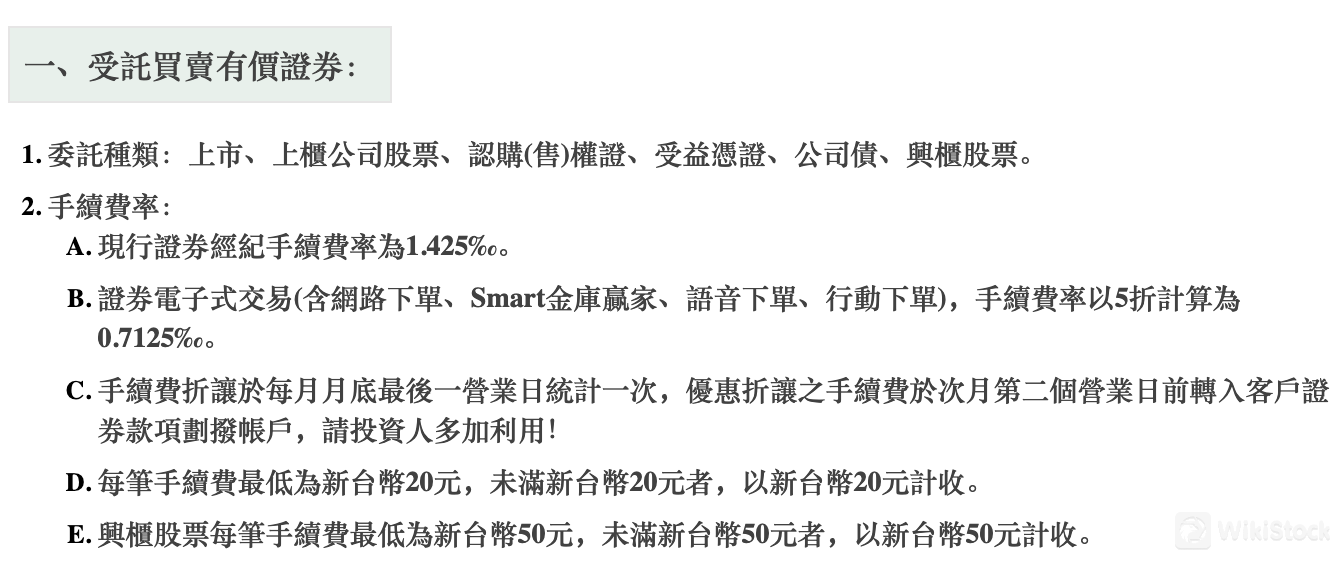

Taiwan Cooperative Securities (TCS) offers two main commission structures for securities trading:

Standard Commission: The current standard brokerage fee is 1.425‰ of the transaction value. This means customers pay 1.425 New Taiwan Dollars (NTD) for every NTD 1,000 worth of securities they buy or sell.

Discounted Electronic Trading Fee: For trades placed electronically (online, Smart Vault winner orders, voice, or action orders), TCS offers a discounted rate of 0.7125‰. This translates to a 50% discount compared to the standard fee.

Minimum Fee: There is a minimum commission fee of NTD 20 per trade. If customers' calculated commission falls below NTD 20, they will be charged NTD 20 instead.

Emerging Stock Market Stocks: Trading Emerging Stock Market Stocks incurs a minimum fee of NTD 50, regardless of the transaction value.

TCS App Review

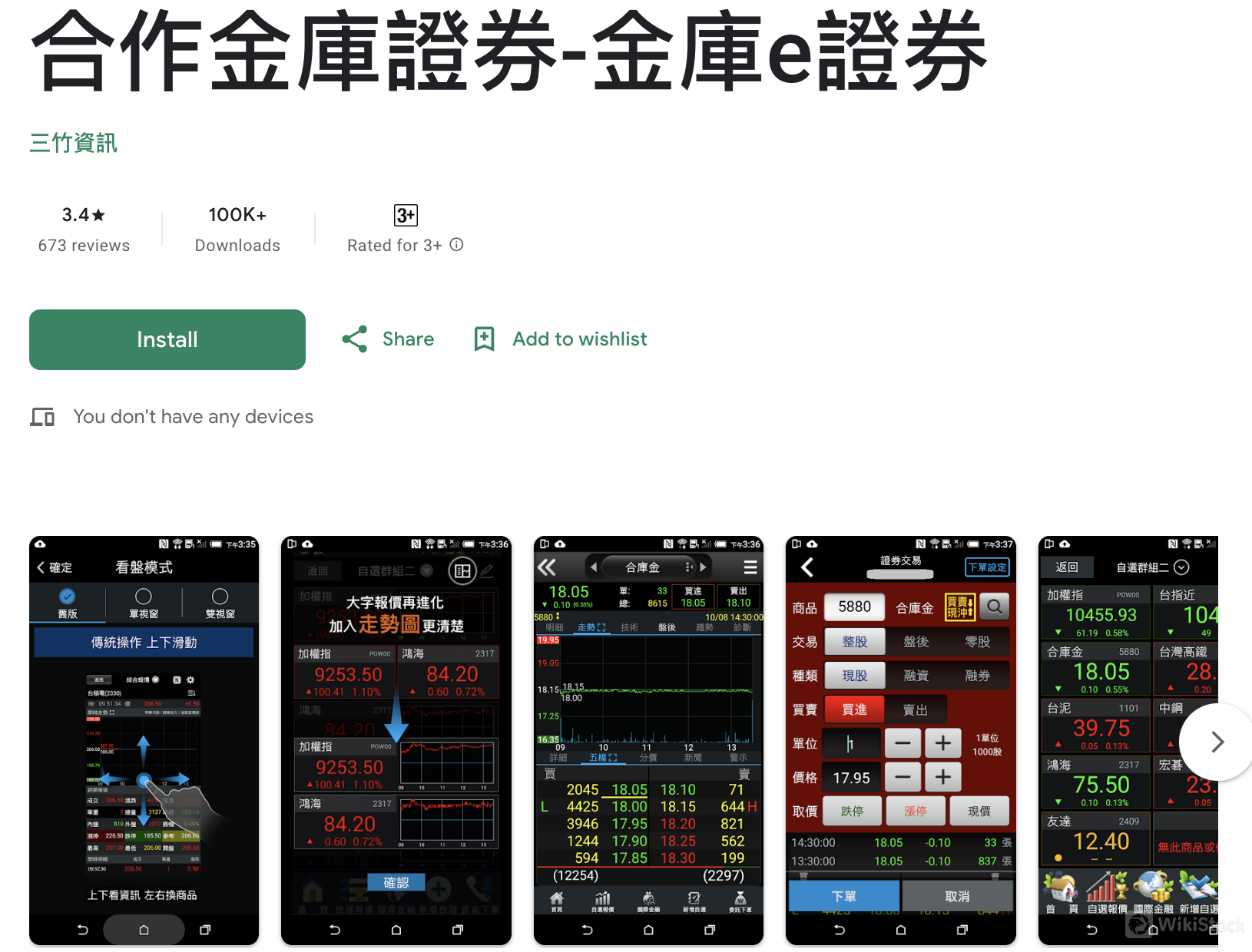

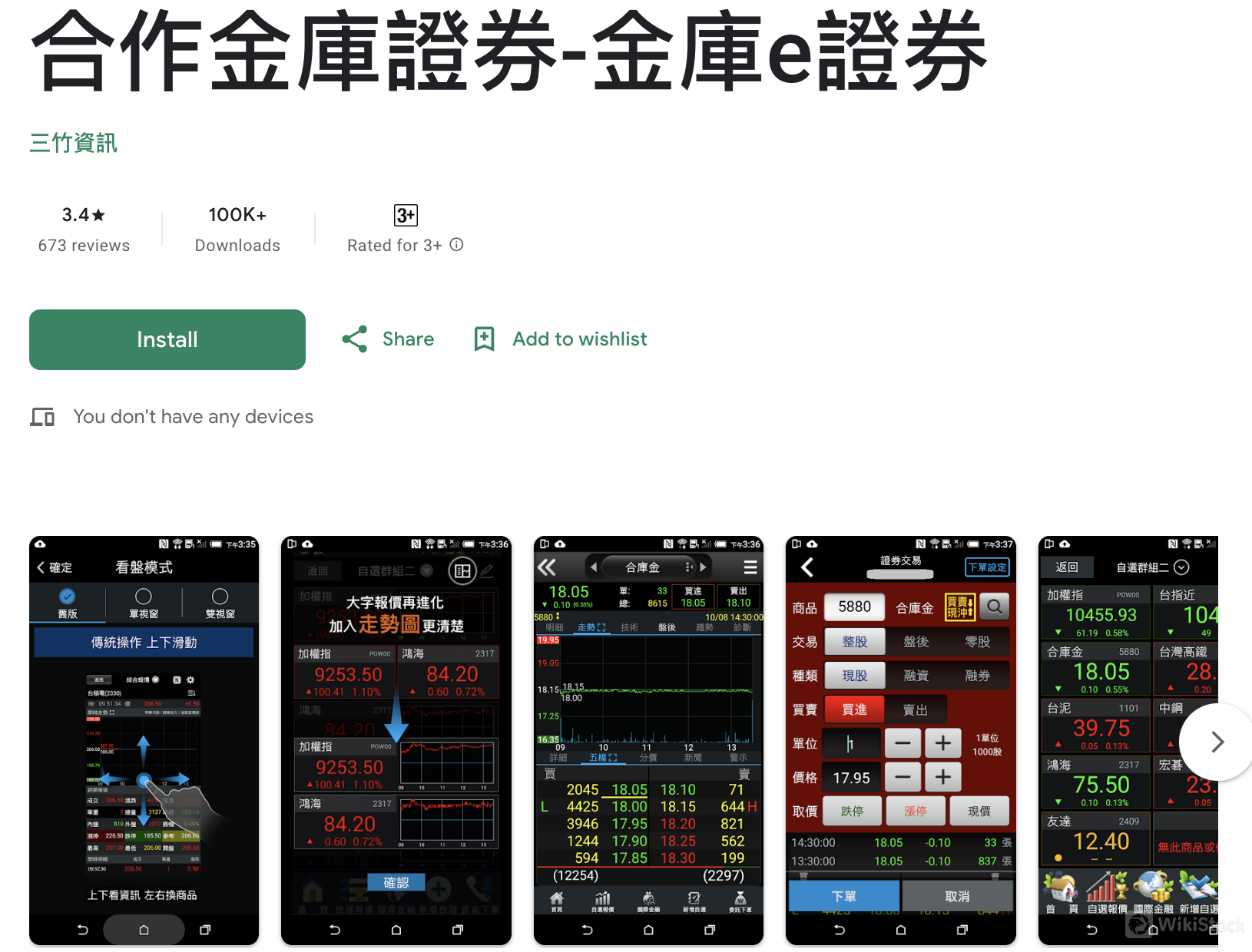

TCS offers an app called “Jinku E Securities” for investors in Taiwan. This app is available for download on both iOS and Android devices through the Google Play Store and Apple App Store.

Market Data: Jinku E Securities provides real-time quotes for a variety of financial instruments. This includes 60 different types of financial products across 10 categories. It offers five types of quotes, including last price, bid-ask spread, and change in price.

Technical Analysis Tools: The app allows investors to analyze market trends using technical indicators and charting tools.

Financial News & Information: Jinku E Securities delivers daily live news updates on international and Taiwanese financial markets. It also provides after-hours information, keeping users informed about market developments outside of regular trading hours.

Trend Diagnosis: The system offers a free trend diagnosis function.

Research & Education

The Jinku eE Securities app provides market data, technical analysis tools, and financial news. The extent to which this translates to in-depth research reports or educational materials for beginners remains unclear.

Customer Service

Taiwan Cooperative Securities (TCS) offers a variety of customer service channels to assist their clients:

General Customer Service: Customers can reach TCS's general customer service center by calling (02)2752-5050.

Elderly Service Hotline: TCS offers a dedicated hotline, (02)8772-8585, for inquiries from elderly clients.

Anti-Fraud Advisory Hotline: If customers suspect fraudulent activity related to their account, TCS provides an anti-fraud advisory hotline at (02)2752-5050.

Voice Order Telephone: TCS offers a phone number, 4050-8989 (02-4050-8989 for mobile phones) for placing voice orders.

Conclusion

Taiwan Cooperative Securities (TCS) emerged as a Taiwanese brokerage firm regulated by the CTSFB, offering a variety of investment products and services. Their “Jinku E Securities” app provides market data, technical analysis tools, and financial news, aiding investment decisions. Multiple channels exist for customer support, including dedicated hotlines for seniors and anti-fraud concerns. Additionally, TCS offers a discounted commission rate for electronic trades.

FAQs

Is TCS a good platform for beginners?

Yes. TCS offers a variety of investment products (stocks, bonds, futures), and multiple channels exist for customer support, including dedicated hotlines for seniors and anti-fraud concerns, which are friendly for beginners.

Is TCS legit?

Yes. TCS has been operating for a while (founded in 2019) and is regulated by SFB.

Is TCS good for investing/retirement?

TCS offers equity, futures and foreign securities, which are suitable for various investment strategies, including long-term investing for retirement.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

China Taiwan

China TaiwanObtain 1 securities license(s)

--

--