Điểm

Money Partners

https://www.moneypartners.co.jp/

Website

Chỉ số đánh giá

Thẩm định sàn chứng khoán

Mức ảnh hưởng

AA

Chỉ số ảnh hưởng NO.1

Japan

JapanSản phẩm giao dịch

5

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks

Giấy phép chứng khoán

Sở hữu 1 giấy phép giao dịch

FSARegulated

JapanSecurities Trading License

Thông tin sàn môi giới

More

Tên công ty

MONEY PARTNERS CO., LTD

Viết tắt

Money Partners

Quốc gia/Khu vực đăng ký

Địa chỉ công ty

Trang web của công ty

https://www.moneypartners.co.jp/Tra cứu mọi lúc mọi nơi chỉ với 1 cú chạm

WikiStock APP

Dịch vụ sàn chứng khoán

Phân tích kinh doanh

Money Partners Lịch báo cáo tài chính

Currency: JPY

Chu kỳ

Q3 FY2024 Earnings

2024/01/30

Revenue(YoY)

1.49B

-3.38%

EPS(YoY)

6.70

-22.63%

Money Partners Ước tính kế toán

Currency: JPY

- NgàyChu kỳDoanh thu/Ước tính

- 2024/01/302024/Q31.486B/0

- 2023/07/302024/Q11.437B/0

- 2023/01/302023/Q31.538B/0

- 2022/07/282023/Q11.390B/0

- 2022/01/302022/Q31.449B/0

Internet GENE

Chỉ số GENE

Xếp hạng ứng dụng

Đặc điểm môi giới

Commission Rate

0.198%

Margin Trading

YES

Regulated Countries

1

Products

5

| Money Partners |  |

| WikiStock Rating | ⭐⭐⭐ |

| Account Minimum | $0 |

| Fees | No purchase fees for internet transactions; Fixed rate fee on total daily trade amounts |

| Account Fees | Monthly securities account maintenance fee of 1,100 yen |

| Mutual Funds Offered | No |

| App/Platform | User-friendly platform accessible from PC, tablet, and smartphone |

What is Money Partners?

Money Partners is a trading platform regulated by the Financial Services Agency (FSA) of Japan, offering a wide variety of trading products, including Forex, stocks, indices, commodities, and cryptocurrencies. It emphasizes robust security measures and client fund safety through trust agreements with major banks. The platform is user-friendly and accessible from multiple devices, supporting extensive research and educational resources. However, fees for certain transactions and account maintenance, along with slow responses to email inquiries, are potential drawbacks.

Pros and Cons of Money Partners

Money Partners offers a robust trading platform with a range of features designed to cater to both advanced and beginner traders. It provides a wide variety of trading products, including Forex, stocks, indices, commodities, and cryptocurrencies. The company emphasizes safety and customer security, being regulated by the Financial Services Agency (FSA) of Japan and safeguarding client funds through trust agreements with major banks. The platform is user-friendly, accessible from multiple devices, and supports extensive research and educational resources. However, there are some drawbacks, such as fees for certain transactions and account maintenance, which might be a consideration for some users. Additionally, while the customer service options are extensive, responses to email inquiries can be slow.

Pros and Cons

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

|

|

|

Is Money Partners safe?

Regulation

Money Partners offers a range of services to suit different trading needs, emphasizing customer-first principles and safety measures. It is regulated by the Financial Services Agency (FSA) of Japan, ensuring compliance with strict financial regulations. Customer funds are safeguarded through trust agreements with Sumitomo Mitsui Banking Corporation and Mizuho Bank, which means client assets are segregated from company assets and insured. Additionally, they implement robust encryption technologies to protect customer data and transactions, enhancing overall security.

What are products to trade with Money Partners?

Money Partners offers a diverse range of trading products across various markets, catering to a wide array of investors and traders:

Forex (Foreign Exchange):Money Partners offers access to the dynamic forex market, where traders can engage in currency trading. With major and minor currency pairs like EUR/USD, USD/JPY, and GBP/USD available, traders can leverage fluctuations in exchange rates to potentially profit. Forex trading provides opportunities for both short-term speculation and long-term investment strategies, with the ability to capitalize on global economic trends and geopolitical developments influencing currency valuations.

Stocks:Money Partners facilitates trading in individual stocks, representing ownership shares of publicly-traded companies. Traders can participate in the equity markets by buying and selling shares of companies listed on various stock exchanges worldwide. Whether it's investing in established blue-chip companies or seeking growth opportunities in emerging markets, stock trading offers a diverse range of options for traders to build their investment portfolios and potentially generate returns through capital appreciation and dividends.

Indices:Money Partners enables traders to speculate on the performance of market indices, which represent baskets of stocks from specific sectors or regions. With indices like the Nikkei 225, S&P 500, and DAX 30 available for trading, investors can take positions on broader market trends without needing to trade individual stocks. Trading indices provides exposure to entire markets or segments, allowing traders to diversify their portfolios and manage risk effectively while capitalizing on macroeconomic factors driving market movements.

Commodities:Money Partners offers trading opportunities in commodities, including raw materials such as oil, gold, and agricultural products. Traders can engage in commodity trading to profit from price fluctuations driven by factors such as supply and demand dynamics, geopolitical events, and macroeconomic trends. Whether it's hedging against inflation, diversifying portfolios, or seeking speculative opportunities, commodity trading provides avenues for investors to navigate global commodity markets and potentially generate returns in various market conditions.

Cryptocurrencies:Money Partners caters to the growing interest in cryptocurrencies by providing trading services for digital assets like Bitcoin. While cryptocurrencies offer unique opportunities for traders, it's important to note that the maximum leverage for cryptocurrency trading is limited to 1:2, which may impact trading strategies compared to other asset classes. Nevertheless, cryptocurrency trading allows investors to capitalize on the volatility and innovation within the digital asset space, with potential opportunities for profit through both short-term speculation and long-term investment strategies.

Money Partners Accounts

Money Partners offers two distinct types of accounts, each designed to cater to different trading preferences and experience levels: Partners FX and Partners FX Nano.

Partners FX Account:Tailored for advanced investors seeking stable FX trading without slippage or contract rejections, and who wish to execute trades with large volumes effortlessly. Features unlimited trading volume per day, enabling traders to execute trades without limitations. Offers a substitute securities service, allowing traders to utilize their stocks as FX margin, providing additional trading opportunities and risk management capabilities. Designed with high contract power, ensuring a secure trading environment for customers. Ideal for seasoned traders looking for a reliable and feature-rich platform to execute trades with confidence.

Partners FX Nano Account:Geared towards beginners and those looking to start trading with smaller amounts. Allows trading from small amounts, with the minimum trading unit set at 100 currencies, enabling even novice traders to enter the FX market with ease. Provides service stability akin to the Partners FX Account, ensuring a reliable trading experience for all users. Particularly suitable for traders interested in trading currency pairs with lower nominal values, where trading can commence with minimal investment. Offers accessibility and ease of use, making it an ideal choice for individuals looking to gain experience in the FX market before committing to larger trades.

Money Partners Fees Review

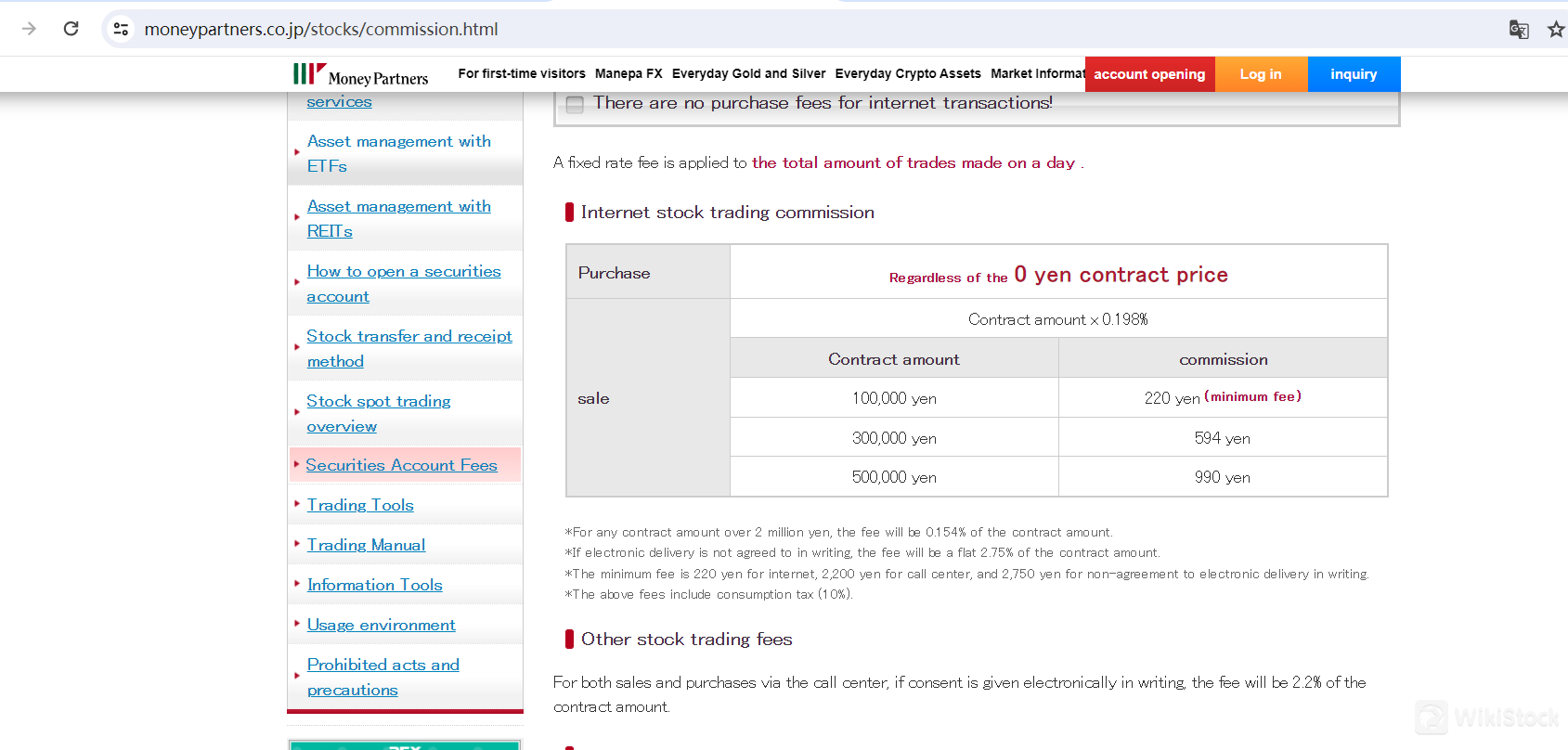

Internet Trading Commission:

Money Partners charges no purchase fees for internet transactions. However, a fixed rate fee is applied to the total amount of trades made in a day. For purchases, regardless of the contract price, the fee remains 0 yen. However, for sales, the fee is calculated as a percentage of the contract amount. For instance, for a contract amount of 100,000 yen, the fee is 220 yen, with a minimum fee requirement. The fee structure continues in increments based on the contract amount, with additional specifications for higher contract amounts and electronic delivery agreements.

Other Stock Trading Fees:

In addition to internet trading, Money Partners also facilitates trading via the call center. For both sales and purchases conducted through the call center, a fixed percentage fee of 2.2% of the contract amount is charged, provided consent is given electronically in writing.

Fees for depositing and withdrawing Stock Certificates:

When it comes to transferring stock certificates, Money Partners offers both free and fee-based services. Transfer of stock certificates from other companies through Japan Securities Depository Center, Inc. incurs no charge. However, transferring stock certificates to another company through Japan Securities Depository Center (JSC) attracts a fee of 1,100 yen per unit per stock, with additional charges per unit up to a maximum amount. These fees include consumption tax.

Securities Account Maintenance Fee:

Money Partners imposes a monthly securities account maintenance fee of 1,100 yen. This fee is inclusive of consumption tax and is withdrawn from the securities account on the 25th of each month. If the cash balance in the account is insufficient to cover the fee, the account may be closed, and the balance charged as a fee. However, certain conditions may exempt clients from this fee.

Other Fees:

Additional fees include a purchase request fee for odd lot shares, along with charges for issuing various certificates such as copies of customer ledgers and transaction certificates. These fees are also inclusive of consumption tax.

| Fee Type | Description | Fee Amount | Additional Notes |

| Internet Trading Commission | No purchase fees for internet transactions. Fixed rate fee applied to total trades made in a day. | Purchase: 0 yen | - Sale: Contract amount × 0.198%, For contract amount over 2 million yen, fee is 0.154% of contract amount, If electronic delivery is not agreed in writing, fee is a flat 2.75% of contract amount |

| Other Stock Trading Fees | 2.2% fee of contract amount for sales and purchases via call center, with electronic consent in writing | 2.2% of contract amount | - For both sales and purchases via call center, Electronic consent in writing required |

| Fees for Depositing and Withdrawing Stock Certificates | Transfer from other companies through Japan Securities Depository Center, Inc.: Free. Transfer to another company through JSC: 1,100 yen per unit per stock, plus additional charges. | Transfer in: Free, Transfer out: 1,100 yen per unit per stock, plus additional charges | - Additional charges: 550 yen per unit up to a maximum of 6,600 yen, Transfer fee includes consumption tax |

| Securities Account Maintenance Fee | Monthly fee of 1,100 yen, inclusive of consumption tax. | 1,100 yen per month | - Fee withdrawn from account on the 25th of each month, Insufficient balance may result in account closure with remaining balance charged as fee |

| Other Fees | Purchase request fee for odd lot shares: 550 yen per stock. Various certificate issuance fees. | Purchase request: 550 yen per stock, Certificate issuance: 1,100 yen per copy | - Certificate issuance includes customer ledger copy, transaction certificate, and balance certificate, Fees include consumption tax |

Money Partners App Review

Money Partners offers a user-friendly online trading platform with these key features:

Accessible Anywhere: Trade stocks easily from your PC, tablet, or smartphone. No special tools needed.

Easy to Use: Buying or selling stocks is simple. Just enter your order details and click “Order.”

Track Your Transactions: Access your transaction history anytime. Review past trades effortlessly.

With Money Partners' platform, trading is hassle-free, whether you're at home or on the go.

Research and Eduation

Money Partners provides extensive research and educational resources for its users, focusing on various aspects of Forex trading. These resources include:

Startup Guides: Step-by-step guides on account opening, making deposits, trading Forex, and withdrawals.

Risk Management: Information on calculating leverage and stop loss, along with tips to mitigate trading risks.

Technical Analysis Dictionary: Detailed explanations of various technical analysis tools and indicators.

Trading Tool Manuals: Download instructions and operation manuals for trading tools like HyperSpeed Touch and HyperSpeed NEXT.

For more details, visit https://www.moneypartners.co.jp/support/ .

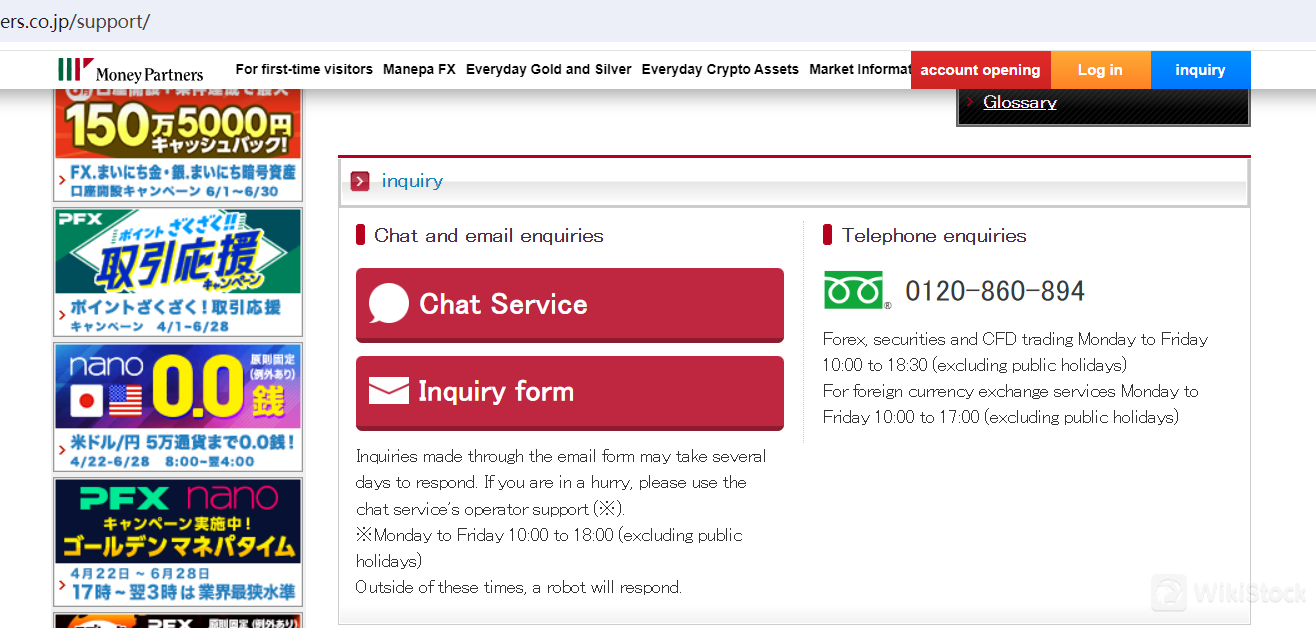

Customer Service

Money Partners provides multiple customer support options to assist clients with their trading and investment needs. The company offers chat services, email inquiries, and telephone support, ensuring that clients can choose the method that best suits their preferences and urgency levels.

The chat service is available from Monday to Friday, between 10:00 and 18:00, excluding public holidays. During these hours, clients can interact with a live operator who can provide real-time assistance. This service is ideal for immediate inquiries that require prompt responses. Outside of these hours, the chat service is managed by automated robots, ensuring continuous availability, although the responses might not be as detailed as those provided by a live operator.

For those who prefer written communication, Money Partners offers an inquiry form for email support. Clients can submit their questions and concerns through this form. However, it is important to note that responses to email inquiries may take several days. This method is best suited for non-urgent matters where clients do not require immediate feedback.

Telephone support is also available for clients who prefer to speak directly with a representative. The contact number for customer support is 0120-860-894. For inquiries related to forex, securities, and CFD trading, support is available from Monday to Friday, between 10:00 and 18:30, excluding public holidays. For foreign currency exchange services, the support hours are slightly shorter, from 10:00 to 17:00 on the same days.

Conclusion

Money Partners is a comprehensive trading platform regulated by Japan's Financial Services Agency (FSA), offering a wide range of trading products including Forex, stocks, indices, commodities, and cryptocurrencies. It emphasizes customer security with robust safeguards and provides extensive educational resources, making it suitable for both advanced and beginner traders. While the platform is user-friendly and accessible across various devices, potential users should consider the fee structures and varying customer service response times.

FAQs

Is Money Partners safe to trade?

Money Partners is a safe trading platform, regulated by the Financial Services Agency (FSA) of Japan. The company safeguards customer funds through trust agreements with Sumitomo Mitsui Banking Corporation and Mizuho Bank, ensuring that client assets are segregated from company assets and insured. Additionally, they implement robust encryption technologies to protect customer data and transactions.

Is Money Partners a good platform for beginners?

Yes, Money Partners is a good platform for beginners. It offers the Partners FX Nano Account, which allows trading with small amounts and provides a reliable trading experience. The platform also includes extensive research and educational resources to help new traders learn and grow in the Forex market.

Is Money Partners legit?

Money Partners is a legitimate trading platform regulated by the Financial Services Agency (FSA) of Japan. It complies with strict financial regulations and implements strong security measures to ensure the safety and integrity of customer funds and data.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Thông tin khác

Registered region

Japan

Years in Business

15-20 years

Products

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks

Tải ứng dụng

Đánh giá

Chưa có bình luận

Sàn giao dịch được đề xuấtMore

インヴァスト証券

Điểm

大万証券株式会社

Điểm

三津井証券株式会社

Điểm

FFG証券

Điểm

岡安証券株式会社

Điểm

丸国証券

Điểm

ばんせい証券株式会社

Điểm

西村証券株式会社

Điểm

永和証券株式会社

Điểm

バークレイズ証券

Điểm