Điểm

木村証券

https://www.kimurasec.co.jp/

Website

Chỉ số đánh giá

Thẩm định sàn chứng khoán

Mức ảnh hưởng

C

Chỉ số ảnh hưởng NO.1

Nhật Bản

Nhật BảnSản phẩm giao dịch

5

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks

Giấy phép chứng khoán

Sở hữu 1 giấy phép giao dịch

FSACó giám sát quản lý

Nhật BảnGiấy phép giao dịch chứng khoán

Ghế thành viên toàn cầu

![]() Sàn môi giới sở hữu 1

Sàn môi giới sở hữu 1

Nhật Bản NSE

木村証券株式会社

Thông tin sàn môi giới

More

Tên công ty

KIMURA SECURITIES CO.,LTD.

Viết tắt

木村証券

Quốc gia/Khu vực đăng ký

Địa chỉ công ty

Trang web của công ty

https://www.kimurasec.co.jp/Tra cứu mọi lúc mọi nơi chỉ với 1 cú chạm

WikiStock APP

Dịch vụ sàn chứng khoán

Internet GENE

Chỉ số GENE

Xếp hạng ứng dụng

Đặc điểm môi giới

Tỷ lệ hoa hồng

0.11%

Margin Trading

YES

Các quốc gia được quản lý

1

Sản phẩm giao dịch

5

| Kimura Securities |  |

| Đánh giá WikiStock | ⭐⭐⭐⭐ |

| Thành lập | 1944 |

| Vùng đăng ký | Nhật Bản |

| Tình trạng quản lý | FSA |

| Sản phẩm | Cổ phiếu trong nước, cổ phiếu nước ngoài, trái phiếu chính phủ cho cá nhân, quỹ đầu tư, bảo hiểm phi nhân thọ |

| Phí giao dịch | Cổ phiếu niêm yết trong nước: 0,11-1,265% + tỷ lệ cố định tùy thuộc vào khối lượng giao dịch, tối thiểu 2750 yen |

| Cổ phiếu niêm yết có quyền mua cổ phiếu mới: 0,165-1,1% + tỷ lệ cố định tùy thuộc vào khối lượng giao dịch | |

| Cổ phiếu niêm yết nước ngoài: 0,33-11% + tỷ lệ cố định tùy thuộc vào khối lượng giao dịch | |

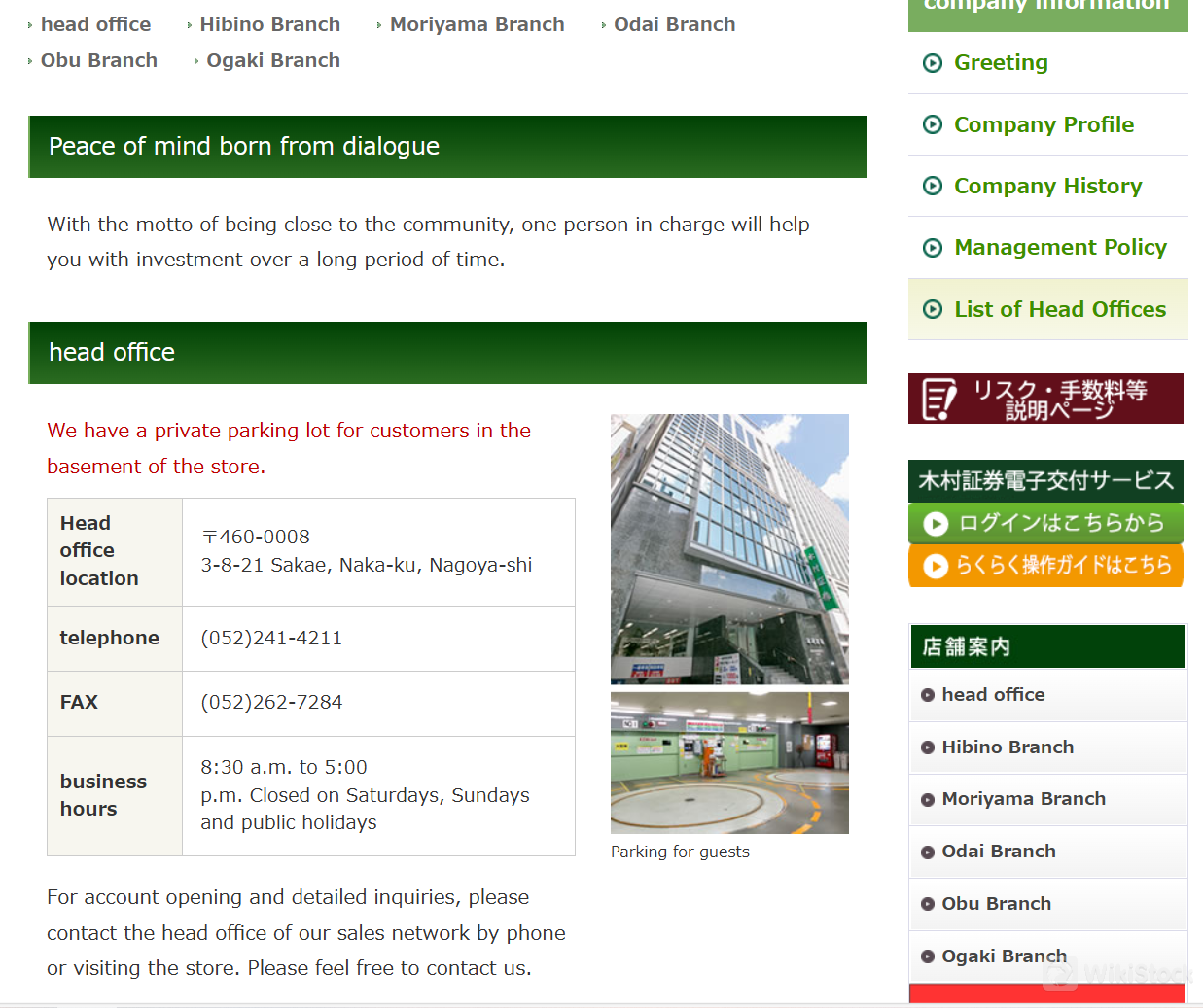

| Dịch vụ khách hàng | Trụ sở chính: 〒460-0008, 3-8-21 Sakae, Naka-ku, Nagoya-shi |

| TEL: (052)241-4211; fax: (052)262-7284 |

Thông tin Kimura Securities

Thành lập năm 1944, với nguồn gốc truy vấn từ năm 1893, Kimura Securities là một tổ chức tài chính nổi tiếng hoạt động trên khắp Nhật Bản, có trụ sở chính tại Nagoya và 5 văn phòng chi nhánh.

Chuyên về một loạt các sản phẩm đầu tư đa dạng, Kimura Securities cung cấp cổ phiếu trong nước và nước ngoài, trái phiếu chính phủ cho cá nhân, quỹ đầu tư và bảo hiểm phi nhân thọ. Công ty nổi tiếng với cấu trúc phí minh bạch, bao gồm các khoản phí giao dịch dao động từ 0,11% đến 11% tùy thuộc vào loại chứng khoán và khối lượng giao dịch.

Được quản lý bởi Cơ quan Dịch vụ Tài chính Nhật Bản (FSA) theo số giấy phép Giám đốc Cục Tài chính Tokai (Kinsho) số 6, Kimura Securities tuân thủ các tiêu chuẩn nghiêm ngặt về đạo đức và uy tín.

Để biết thêm thông tin chi tiết, bạn có thể truy cập trang web chính thức của họ: https://www.kimurasec.co.jp/ hoặc liên hệ trực tiếp với dịch vụ khách hàng của họ.

Ưu điểm & Nhược điểm

| Ưu điểm | Nhược điểm |

| Được quản lý bởi FSA | Hạn chế kênh dịch vụ khách hàng |

| Sản phẩm đầu tư đa dạng | |

| Lịch sử thành lập |

- Giám sát quản lý: Được quản lý bởi Cơ quan Dịch vụ Tài chính Nhật Bản (FSA), đảm bảo tuân thủ các tiêu chuẩn tài chính nghiêm ngặt và bảo vệ nhà đầu tư.

- Sản phẩm đầu tư đa dạng: Kimura Securities cung cấp một loạt các lựa chọn đầu tư bao gồm cổ phiếu trong nước và nước ngoài, trái phiếu chính phủ cho cá nhân, quỹ đầu tư và bảo hiểm phi nhân thọ.

- Lịch sử thành lập: Với nguồn gốc truy vấn từ năm 1893 và thành lập chính thức vào năm 1944, Kimura Securities mang đến kinh nghiệm và uy tín rộng rãi trong ngành dịch vụ tài chính. Nhược điểm:

- Hạn chế kênh dịch vụ khách hàng: Mặc dù công ty cho phép khách hàng liên hệ thông qua địa chỉ văn phòng, điện thoại và fax, nhưng các lựa chọn trực tuyến và hiện đại hơn như trò chuyện trực tiếp, email hoặc các nền tảng truyền thông xã hội không có sẵn, hạn chế các lựa chọn của khách hàng.

- Super Jump (Bảo hiểm Cháy trả về khi đến hạn): Bảo hiểm cháy một lần trả về đầy đủ và trả về khi đến hạn.

- Home Assist (Bảo hiểm Nhà ở Toàn diện): Bảo hiểm cháy cho các tòa nhà dân cư với các tùy chọn phạm vi bảo hiểm có thể tùy chỉnh.

- Bảo hiểm Động đất: Bảo vệ chống lại thiệt hại liên quan đến động đất cho các tòa nhà và nội dung hộ gia đình, bao gồm núi lửa và sóng thần.

- Văn phòng chính: 〒460-0008, 3-8-21 Sakae, Naka-ku, Nagoya-shi.

- Chi nhánh Hibino: 〒456-0072, Tầng 1, Tòa nhà Shiratori, 2-16 Kawanami-cho, Quận Atsuta, Thành phố Nagoya

- Chi nhánh Moriyama: 〒 463-0042, 13-14, nohagi-cho, quận Moriyama, thành phố Nagoya.

- Chi nhánh Odai: 〒 452-0815, 68 yasuji-cho, quận Nishi, thành phố Nagoya

- Chi nhánh Obu: 〒 474-0036, 30 tsukimi-cho, thành phố Ofu

- Chi nhánh Ogaki: 〒 503-0852, thành phố Ogaki, kasumoricho 2-74.

- Kimura Securities có được quy định bởi bất kỳ cơ quan tài chính nào không?

- Có, Kimura Securities hoạt động dưới sự giám sát của Cơ quan Dịch vụ Tài chính Nhật Bản (FSA), với số giấy phép Giám đốc Tổng cục Tài chính Tokai (Kinsho) số 6.

- Kimura Securities cung cấp loại sản phẩm nào?

- Cổ phiếu trong nước, cổ phiếu nước ngoài, trái phiếu chính phủ dành cho cá nhân, quỹ đầu tư và bảo hiểm phi nhân thọ.

- Kimura Securities phù hợp cho người mới bắt đầu không?

- Có, công ty được quy định tốt bởi FSA và cung cấp cấu trúc phí minh bạch thân thiện với người mới bắt đầu.

- Cấu trúc phí dịch vụ của Kimura Securities như thế nào?

- Kimura Securities cung cấp cấu trúc phí rõ ràng và minh bạch. Ví dụ, cổ phiếu niêm yết trong nước có hoa hồng dao động từ 0,11-1,265% cộng với một tỷ lệ cố định, với mức phí tối thiểu là 2750 yen.

- Kimura Securities cung cấp các sản phẩm bảo hiểm phi nhân thọ nào?

- Super Jump (Bảo hiểm cháy trả về khi đến hạn), Home Assist (Bảo hiểm nhà ở toàn diện) và Bảo hiểm động đất.

Đây có phải là một nơi an toàn không?

Quy định:

Kimura Securities hoạt động dưới sự giám sát quy định của Cơ quan Dịch vụ Tài chính Nhật Bản (FSA) với số giấy phép số. Tổng cục Tài chính Tokai (Kinsho) số 6, thể hiện sự tận tâm của mình trong việc duy trì các tiêu chuẩn tối đa trong hoạt động tài chính. Sự tuân thủ quy định này nhấn mạnh cam kết của Kimura Securities với tính chính trực và uy tín trong dịch vụ của mình.

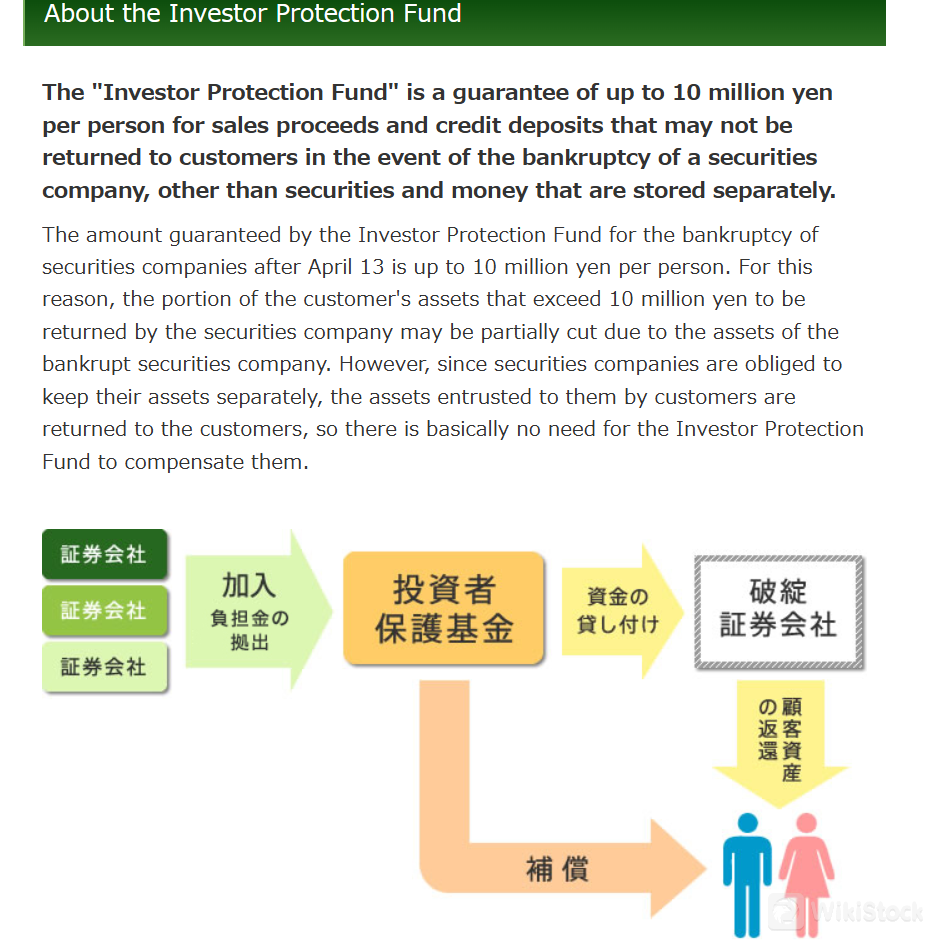

An toàn Quỹ:

Kimura Securities ưu tiên an toàn quỹ của khách hàng thông qua Quỹ Bảo vệ Nhà đầu tư, đảm bảo lên đến 10 triệu yên cho mỗi người đối với tiền thu từ bán hàng và tiền gửi tín dụng nếu công ty đối mặt với phá sản.

Biện pháp an toàn:

Kimura Securities đảm bảo an toàn và bảo mật tài sản của khách hàng thông qua hệ thống quản lý được phân tách. Hệ thống này yêu cầu tất cả tiền mặt và chứng khoán được gửi cho công ty bởi khách hàng được quản lý riêng biệt với tài sản riêng của công ty.

Các chứng khoán để giao dịch với Kimura Securities?

Kimura Securities cung cấp một loạt các sản phẩm tài chính toàn diện trong nhiều danh mục:

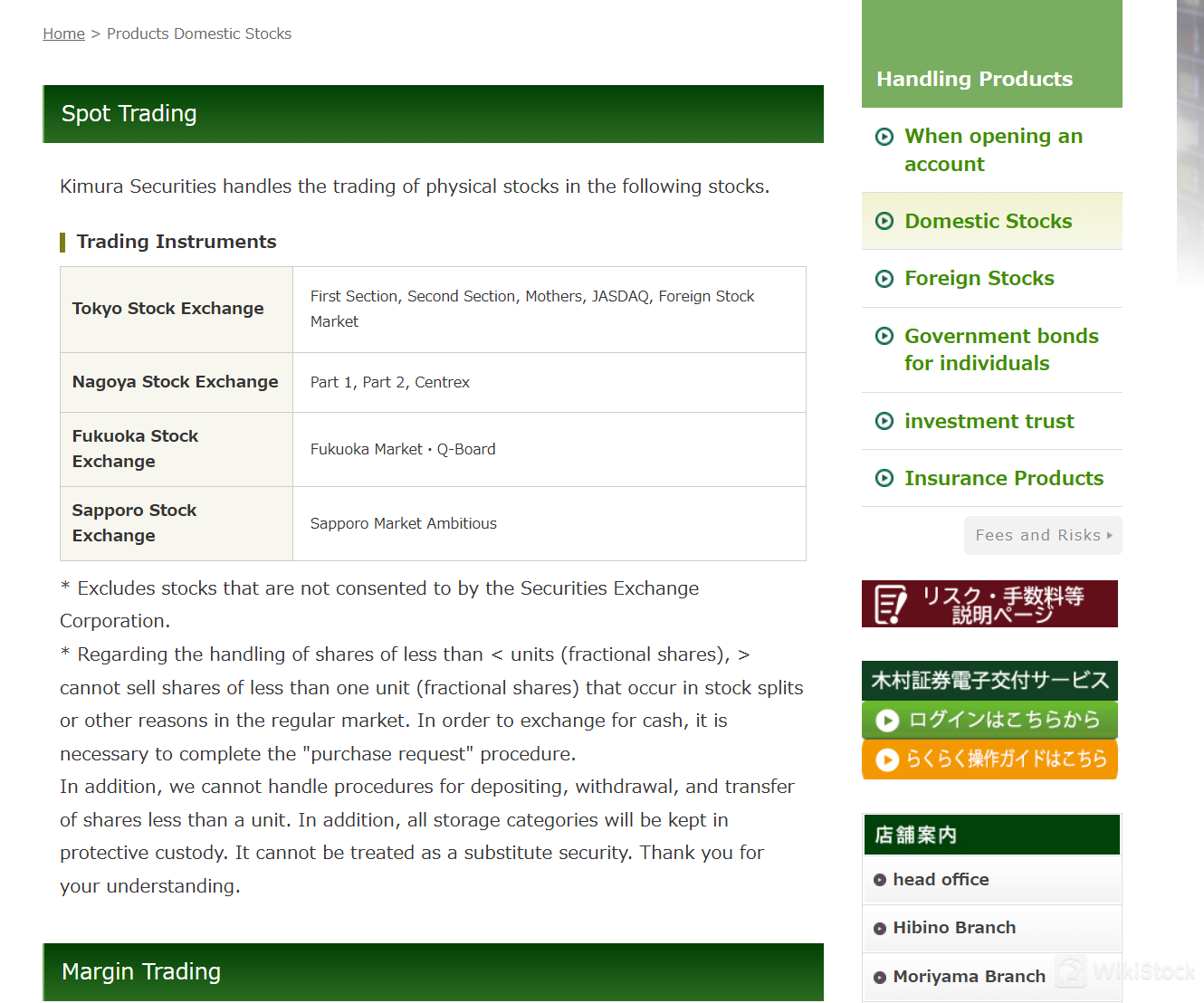

Cổ phiếu trong nước: Kimura Securities cung cấp quyền truy cập vào thị trường cổ phiếu trong nước của Nhật Bản, cho phép nhà đầu tư giao dịch và đầu tư vào nhiều công ty niêm yết khác nhau thông qua giao dịch chốt và giao dịch ký quỹ.

Cổ phiếu nước ngoài: Đối với những người quan tâm đến cơ hội đầu tư toàn cầu, Kimura Securities cung cấp quyền truy cập vào cổ phiếu nước ngoài. Khách hàng có thể đa dạng hóa danh mục đầu tư bằng cách đầu tư vào thị trường Mỹ và Trung Quốc, tận dụng tiềm năng tăng trưởng và cơ hội thị trường ở nước ngoài.

Trái phiếu Chính phủ dành cho Cá nhân: Kimura Securities cho phép cá nhân đầu tư vào trái phiếu Chính phủ, cung cấp một lựa chọn đầu tư ổn định và an toàn. Những trái phiếu này được bảo đảm bởi Chính phủ Nhật Bản, mang lại lợi nhuận đáng tin cậy và đóng góp vào chiến lược đầu tư cân bằng.

Quỹ Đầu tư: Kimura Securities cung cấp quỹ đầu tư tổng hợp, tụ hợp vốn từ nhiều nhà đầu tư để đầu tư vào danh mục chứng khoán đa dạng. Điều này cho phép khách hàng tiếp cận cơ hội đầu tư được quản lý chuyên nghiệp trên các lớp tài sản khác nhau, phù hợp với nhu cầu rủi ro và mục tiêu tài chính khác nhau.

Bảo hiểm phi nhân thọ: Ngoài các sản phẩm đầu tư, Kimura Securities cung cấp các giải pháp bảo hiểm phi nhân thọ. Ví dụ như sau:

Xem xét Phí

Kimura Securities áp dụng cấu trúc phí minh bạch cho từng sản phẩm, dưới đây là chi tiết:

Cổ phiếu niêm yết trong nước| Số tiền giao dịch | Phí hoa hồng |

| Lên đến 1 triệu yên | 1,26500% số tiền giao dịch |

| Từ 1 triệu yên đến 3 triệu yên | 0,90750% + 3.575 yên |

| Từ 3 triệu yên đến 5 triệu yên | 0,89650% + 3.905 yên |

| Từ 5 triệu yên đến 10 triệu yên | 0,69300% + 14.080 yên |

| Từ 10 triệu yên đến 20 triệu yên | 0,55000% + 28.380 yên |

| Từ 20 triệu yên đến 30 triệu yên | 0,49500% + 39.380 yên |

| Từ 30 triệu yên đến 50 triệu yên | 0,30250% + 97.130 yên |

| Từ 50 triệu yên đến 180 triệu yên | Phí cố định 248.380 yên |

| Trên 180 triệu yên | 0,11000% + 50.380 yên |

| Áp dụng phí tối thiểu 2.750 yên nếu nhỏ hơn 1,26500% | |

| Số tiền giao dịch | Phí hoa hồng |

| Lên đến 1 triệu yên | 1,10000% số tiền giao dịch |

| Từ 1 triệu yên đến 5 triệu yên | 0,99000% + 1.100 yên |

| Từ 5 triệu yên đến 10 triệu yên | 0,77000% + 12.100 yên |

| Từ 10 triệu yên đến 30 triệu yên | 0,60500% + 28.600 yên |

| Từ 30 triệu yên đến 50 triệu yên | 0,44000% + 78.100 yên |

| Từ 50 triệu yên đến 100 triệu yên | 0,27500% + 160.600 yên |

| Từ 100 triệu yên đến 1 tỷ yên | 0,22000% + 215.600 yên |

| Trên 1 tỷ yên | 0,16500% + 765.600 yên |

| Số tiền giao dịch | Phí hoa hồng |

| Lên đến 55.000 yên | 11,000% số tiền giao dịch |

| Từ 55.000 yên đến 300.000 yên | Phí cố định 6.050 yên |

| Từ 300.000 yên đến 1 triệu yên | 1,100% + 2.750 yên |

| Từ 1 triệu yên đến 3 triệu yên | 0,990% + 3.850 yên |

| Từ 3 triệu yên đến 5 triệu yên | 0,880% + 7.150 yên |

| Từ 5 triệu yên đến 10 triệu yên | 0,770% + 12.650 yên |

| Từ 10 triệu yên đến 30 triệu yên | 0,660% + 23.650 yên |

| Từ 30 triệu yên đến 50 triệu yên | 0,550% + 56.650 yên |

| Từ 50 triệu yên đến 100 triệu yên | 0,440% + 111.650 yên |

| Trên 100 triệu yên | 0,330% + 221.650 yên |

Lưu ý: Số tiền giao dịch được chuyển đổi thành đồng yên dựa trên giá trị thị trường địa phương, với các khoản phí bổ sung cho thuế tem và các khoản phí khác được áp dụng theo quy định địa phương.

Để biết thông tin cập nhật và chi tiết nhất về tất cả các sản phẩm của mình, khách hàng được khuyến khích truy cập trang web của Kimura Securities tại https://www.kimurasec.co.jp/fee.php.

Dịch vụ khách hàng

Kimura Securities cung cấp hỗ trợ khách hàng qua địa chỉ văn phòng, điện thoại và fax, đảm bảo khách hàng có thể liên hệ để được hỗ trợ và tư vấn.

Điện thoại: (052)241-4211; FAX: (052)262-7284.

Điện thoại: (052)682-3911; FAX: (052)682-3915.

Điện thoại: (052)791-6341; FAX: (052)793-1914.

Điện thoại: (052)502-6511; FAX: (052)504-2750.

Điện thoại: (0562)46-7715; FAX: (0562)46-7718.

Điện thoại: (0584)74-1171; FAX: (0584)74-1175.

Giờ làm việc: Từ 8:30 sáng đến 5:00 chiều. Đóng cửa vào thứ Bảy, Chủ Nhật và các ngày lễ.

Kết luận

Kimura Securities, thành lập năm 1944 và được quy định bởi Cơ quan Dịch vụ Tài chính Nhật Bản (FSA) theo số giấy phép Giám đốc Tổng cục Tài chính Tokai (Kinsho) số 6, cung cấp một loạt sản phẩm đầu tư đa dạng, bao gồm cổ phiếu trong nước, cổ phiếu nước ngoài, trái phiếu chính phủ dành cho cá nhân, quỹ đầu tư và bảo hiểm phi nhân thọ. Với cấu trúc phí minh bạch và tình trạng được quy định, Kimura Securities vẫn là một tổ chức đáng tin cậy đối với các nhà đầu tư, duy trì các tiêu chuẩn cao về tuân thủ quy định, tính chính trực và dịch vụ khách hàng trong lĩnh vực tài chính.

Câu hỏi thường gặp (FAQs)

Cảnh báo rủi ro

Giao dịch trực tuyến có rủi ro đáng kể và bạn có thể mất toàn bộ vốn đầu tư. Nó không phù hợp cho tất cả các nhà giao dịch hoặc nhà đầu tư. Vui lòng đảm bảo rằng bạn hiểu rõ các rủi ro liên quan và lưu ý rằng thông tin được cung cấp trong bài đánh giá này có thể thay đổi do việc cập nhật liên tục các dịch vụ và chính sách của công ty.

Thông tin khác

Registered region

Nhật Bản

Số năm kinh doanh

Hơn 20 năm

Sản phẩm giao dịch

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks

Tải ứng dụng

Đánh giá

Chưa có bình luận

Sàn giao dịch được đề xuấtMore

丸近證券

Điểm

光世証券

Điểm

第四北越証券

Điểm

ニュース証券

Điểm

百五証券

Điểm

山形證券

Điểm

Tachibana Securities Co., Ltd.

Điểm

北洋証券

Điểm

リテラ・クレア証券株式会社

Điểm

大万証券株式会社

Điểm