スコア

ますも証券

https://www.masumo.co.jp/

会社公式HP

レーティング

会社鑑定

影響力

C

影響力指数 NO.1

Japan

Japan取引品種

5

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks

取引商ライセンス

1件ライセンスを保有

FSARegulated

JapanSecurities Trading License

会社情報

More

会社名

Masumo Securities, Inc

社名略語

ますも証券

会社登録国・地域

会社所在地

会社のウェブサイト

https://www.masumo.co.jp/いつでも確認することが可能です

WikiStock APP

インターネット遺伝子

遺伝子インデックス

アプリのスコア

Note: The information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

In this review, if there is a conflict between the image and the text content, the text content should prevail. However, we recommend that you open the official website for further consultation.

| Masumo Securities |  |

| WikiStock Rating | ⭐⭐⭐⭐ |

| Account Management Fees | Free |

| Account Transfers | 1,100 yen (including tax) per issue, maximum: 22,000 yen (including tax) |

| Stock Trading Fees | Domestic Stocks: 1.265% (including tax), minimum: 2,750 yen (including tax) |

| Foreign Stocks: 1.375% (including tax) | |

| Investment Trusts Fees | Application Fees: up to 3.85% (including tax) of the application amount |

| Redemption Fees: up to 0.5% of the redemption value as trust asset retention costs | |

| Trust Fees: up to 2.09% (estimated, including tax, annual rate) of the trusts net asset value | |

| Margin Interest Rates | Not Mentioned |

| Mutual Funds Offered | Not Mentioned |

| App/Platform | Not Mentioned |

| Promotions | Unavailable |

Masumo Securities Information

Masumo Securities is regulated by Japan's Financial Services Agency (FSA). Investors can access a variety of financial instruments through Masumo Securities, including domestic and foreign stocks, investment trusts, and bonds. The firm distinguishes itself through its commitment to organizing cross-industry networking events, fostering professional connections, and facilitating the exchange of valuable market insights.

Pros & Cons

| Pros | Cons |

| Regulated by FSA | Limited Information on Margin Interest Rates |

| Diverse Investment Options | Special Income Tax for Reconstruction |

| No Account Management Fees for Domestic Stocks | Platform Information Not Provided |

| Cross-Industry Networking Events | |

| Comprehensive Customer Support |

Regulated by FSA: Ensures adherence to stringent standards designed to protect investors and maintain market integrity.

Diverse Investment Options: Offers a variety of financial instruments, including domestic and foreign stocks, investment trusts, and bonds.

No Account Management Fees for Domestic Stocks: Free account management for domestic stocks and preferred shares, making it cost-effective for local investors.

Cross-Industry Networking Events: Facilitates professional connections and the exchange of meaningful information through well-regarded networking events.

Comprehensive Customer Support: Provides multiple channels for customer service (phone, fax, address, contact form), enhancing accessibility and convenience.

ConsLimited Information on Margin Interest Rates: Lack of details on margin interest rates can deter investors interested in margin trading.

Special Income Tax for Reconstruction: An additional 2.1% tax on the income tax amount withheld at source until December 2037, impacting returns.

Platform Information Not Provided: There is no detailed information about the trading platform, including its features, usability, and accessibility.

Is Masumo Securities Safe?

Masumo Securities is regulated by the oversight of the oversight of the Financial Services Agency (FSA). This regulatory framework ensures that the company adheres to stringent standards designed to protect investors and maintain the integrity of the financial market. By adhering to the regulations, Masumo Securities ensures that its operations are conducted with the utmost professionalism and accountability, instilling confidence in its clients and stakeholders.

What are Securities to Trade with Masumo Securities?

The firm offers access to domestic stocks, allowing investors to participate in the local market and capitalize on growth opportunities within the country. Additionally, Masumo Securities facilitates trading in foreign stocks, giving clients the chance to diversify their portfolios with international investments.

For those interested in collective investment schemes, the firm offers investment trusts, which pool funds from multiple investors to invest in a diversified portfolio of assets. Furthermore, Masumo Securities provides bond trading services, enabling clients to invest in fixed-income securities that offer regular interest payments and the return of principal at maturity.

Masumo Securities Fees Review

Account Management Fees- Domestic Stocks and Preferred Shares: No account management fee is charged for depositing these securities into your account with Masumo Securities.

- Account Transfers: A fee of 1,100 yen (including tax) per issue, up to a maximum of 22,000 yen (including tax), is charged for transferring stocks and other securities to other companies via the Japan Securities Depository Center.

Please read and understand the “Explanation of the Agreement for Depositing, Recording, and Transferring Money and Securities” before proceeding with any transactions.

Stock Trading Fees- Domestic Stocks: A fee of up to 1.265% (including tax) of the contract amount is charged for buying and selling domestic stocks. If the fee amount is less than 2,750 yen, a minimum fee of 2,750 yen (including tax) applies.

- Foreign Stocks: For overseas transactions, a fee of up to 1.375% (including tax) of the contract amount is charged. Additional fees and public charges may apply in foreign markets, but these amounts vary and cannot be predetermined.

- Purchase Costs: Only the purchase price is required when buying bonds through public offerings, sales, or over-the-counter transactions with Masumo Securities.

- Application Fees: Up to 3.85% (including tax) of the application amount.

- Redemption Fees: Up to 0.5% of the redemption value as trust asset retention costs.

- Trust Fees: Up to 2.09% (estimated, including tax, annual rate) of the trusts net asset value.

- Other Costs: Audit fees, securities transaction fees, and foreign asset custody costs vary by product. The total amount of these costs depends on the holding period and other factors, and thus cannot be predetermined.

- Special Income Tax for Reconstruction: Until December 2037, an additional 2.1% tax will be levied on the income tax amount withheld at source.

Research & Education

Masumo Securities is renowned for its cross-industry networking events, which have become increasingly popular with each successive edition. These events serve as a dynamic platform for professionals from various industries to come together, exchange meaningful information, and foster valuable connections. Masumo Securities' networking events are a testament to their commitment to creating spaces where professionals can gather, share insights, and build lasting human networks.

Customer Service

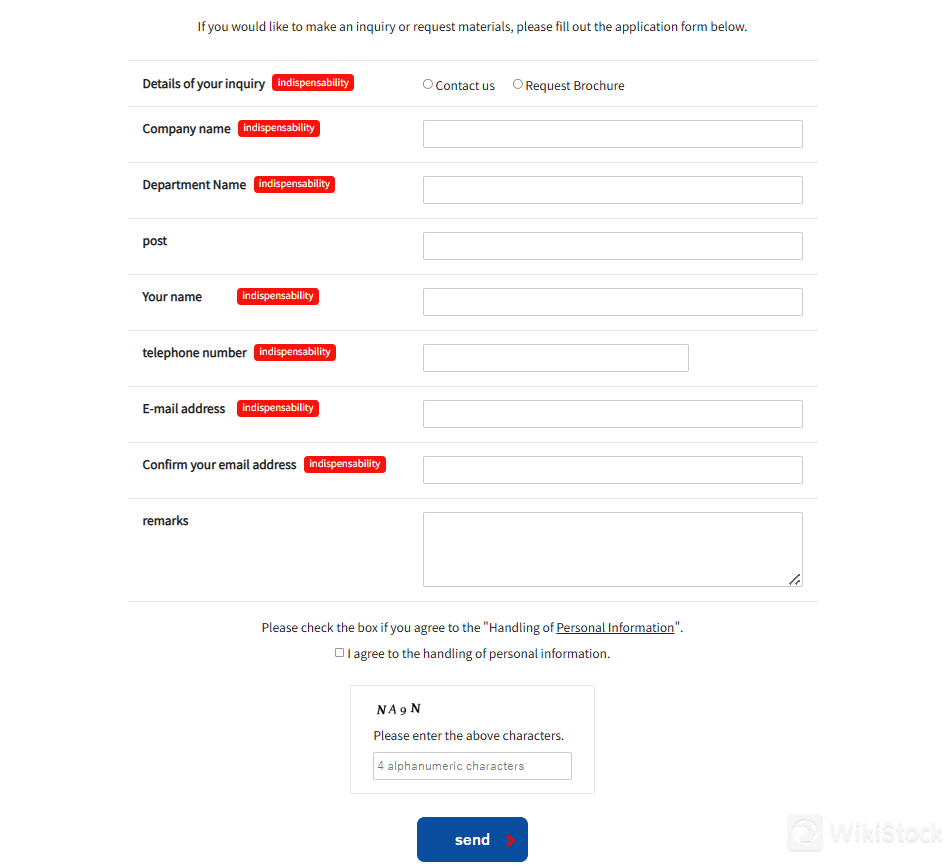

Masumo Securities provides a comprehensive and accessible customer support network. Their support team can be reached through different channels for ultimate convenience.

- Tel: 0776-23-2830

- Fax: 0776-21-9666

- Address: 〒910-0006, Fukui Prefecture Fukui City Chuo 3-5-1

- Contact form

Conclusion

In conclusion, Masumo Securities stands out as a reputable and well-regulated financial institution, offering a comprehensive range of investment options, including domestic and foreign stocks, investment trusts, and bonds. Additionally, Masumo Securities is noted for its cross-industry networking events, which foster valuable professional connections. However, investors should be aware of the additional costs in foreign markets and the lack of detailed platform specifics.

FAQs

Is Masumo Securities suitable for beginners?

Yes, Masumo Securities is suitable for beginners due to its user-friendly platform, educational resources, and comprehensive customer support.

Is Masumo Securities legit?

Yes, Masumo Securities is regulated by FSA.

What types of securities can I trade with Masumo Securities?

You can trade domestic stocks, foreign stocks, investment trusts, and bonds.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

その他情報

Registered region

Japan

Years in Business

15-20 years

Commission Rate

0.319%

Regulated Countries

1

Products

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks

評判

コメントなし

推奨する証券会社More

内藤証券株式会社

スコア

Ichiyoshi Securities

スコア

広田証券

スコア

丸八証券株式会社

スコア

ひろぎん証券

スコア

三木証券

スコア

JTG証券

スコア

JIA証券

スコア

山和証券株式会社

スコア

八十二証券

スコア