Disney Develops Tech to Rival Netflix and Boost Streaming Profits: Report - Netflix (NASDAQ:NFLX), Walt D

In a May earnings call, CEO Bob Iger described Netflix as the “gold standard” in streaming and emphasized the importance of developing technology to rival Netflix IncNFLX and boost streaming profitability.

Disney is developing personalized algorithms to recommend content based on user preferences, customized promotional art, and emails prompting users to finish incomplete series.

The company is also creating pop-up live channels to entertain viewers without requiring them to browse for content. These features are expected to roll out within six months.

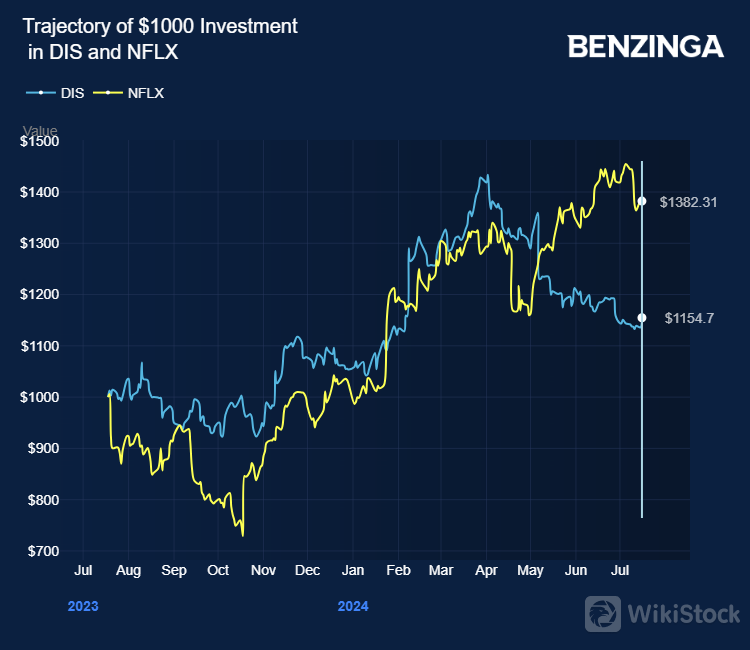

In May, Walt Disney reported second-quarter revenue growth of 1% year-on-year to $22.08 billion, marginally missing the analyst consensus estimate of $22.11 billion.

Adjusted EPS of $1.21 beat the analyst consensus estimate of $1.09. Disney expects a fiscal 2024 adjusted EPS growth target of 25%.

In April, Netflix reported first-quarter revenue growth of 14.8% year-on-year to $9.37 billion, beating the analyst consensus estimate of $9.28 billion. EPS of $5.28 beat the analyst consensus estimate of $4.51.

Netflix added 9.33 million paid net new subscribers in the first quarter, reaching total subscribers of 269.60 million, up by 16.0% year-over-year. Disney serves nearly 230 million streaming customers worldwide through its various services.

Price Actions:DIS shares are trading lower by 1.39% at $97.11 at the last check on Wednesday.

Byte refutes rumors of speculation on A-share Doubao concept stocks

How to develop a low-altitude economy

Doubao concept surges, IPO economy booms

5G enters the "second half", which stocks are the best to buy

Check whenever you want

WikiStock APP