Top 5 Consumer Stocks That May Explode In Q3 - Nike (NYSE:NKE)

The most oversold stocks in the consumer discretionary sector presents an opportunity to buy into undervalued companies. `

The RSI is a momentum indicator, which compares a stock‘s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

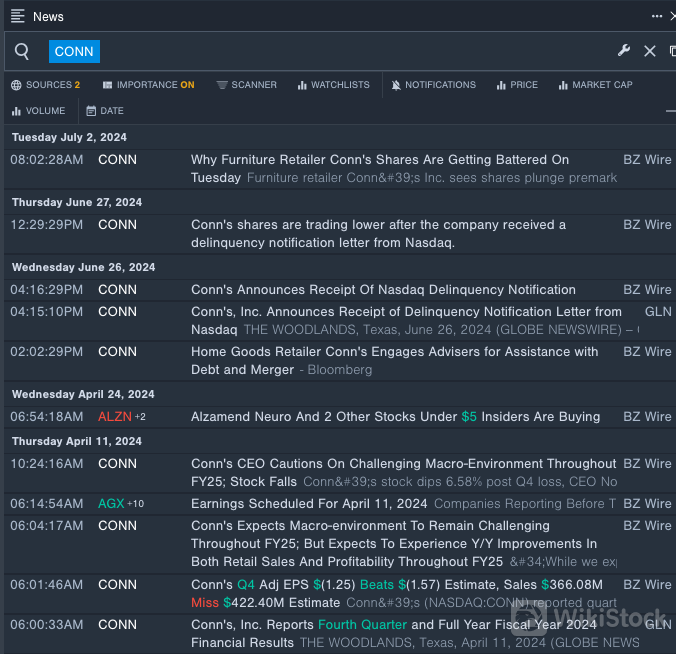

Conns Inc CONN

- On June 26, Conns received a delinquency notification letter from Nasdaq. The company's stock fell around 73% over the past month and has a 52-week low of $0.52.

- RSI Value:17.23

- CONN Price Action:Shares of Conns gained 14.6% to close at $0.66 on Friday.

- Benzinga Pro's real-time newsfeed alerted to latest Conns news.

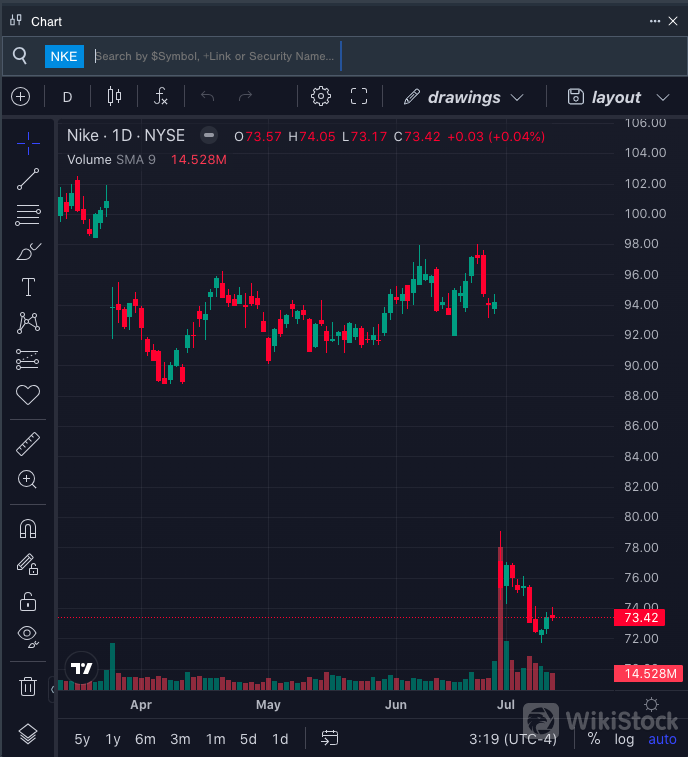

Nike Inc NKE

- On June 27, Nike reported fourth-quarter revenue of $12.6 billion, down 2% year-over-year. The revenue total missed a Street consensus estimate of $12.91 billion, according to data from Benzinga Pro. “We are taking our near-term challenges head-on, while making continued progress in the areas that matter most to NIKEs future – serving the athlete through performance innovation, moving at the pace of the consumer and growing the complete marketplace,” Nike CEO John Donahoe said. The company's stock fell around 22% over the past month. It has a 52-week low of $71.67.

- RSI Value:22.78

- NKE Price Action:Shares of Nike gained 0.04% to close at $73.42 on Friday.

- Benzinga Pro's charting tool helped identify the trend in Nike stock.

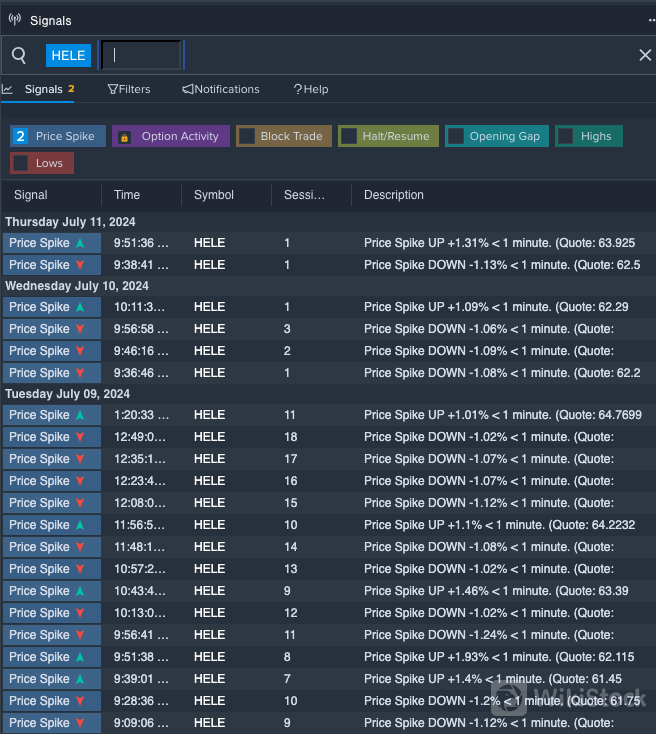

Helen of Troy Limited HELE

- On July 9, Helen Of Troy reported worse-than-expected first-quarter FY25 earnings and lowered the outlook. “We are disappointed with the start to our fiscal year. We battled an unusual number of internal and external challenges in the quarter, which resulted in net sales and adjusted EPS below our outlook,” said CEO Noel M. Geoffroy. The company's stock dipped around 28% over the past five days and has a 52-week low of $60.00.

- RSI Value:16.96

- HELE Price Action:Shares of Helen of Troy fell 0.6% to close at $64.07 on Friday.

- Benzinga Pro's signals feature notified of a potential breakout in Helen of Troy shares.

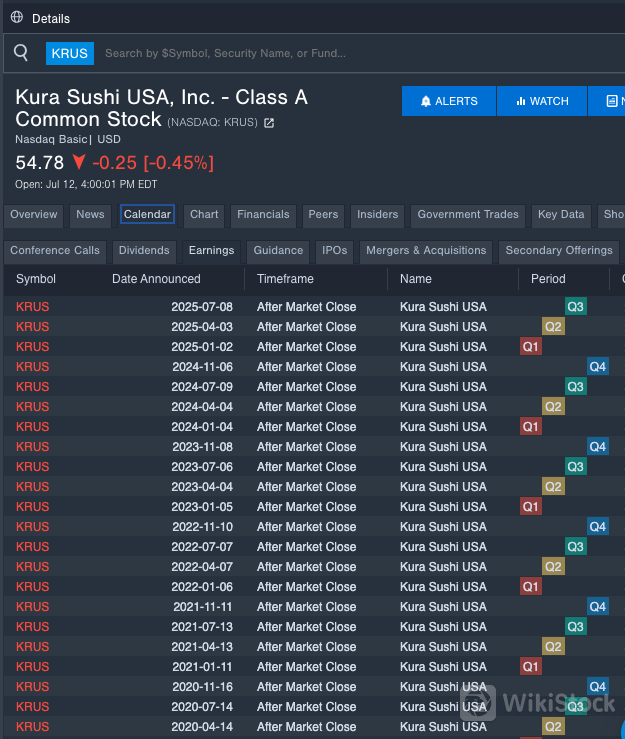

Kura Sushi USA Inc KRUS

- On July 9, Kura Sushi posted downbeat results for its third quarter. The company reported quarterly sales of $63.082 million which missed the analyst consensus estimate of $63.101 million, according to data from Benzinga Pro. The company's shares lost around 34% over the past month. The company's 52-week low is $49.01.

- RSI Value:28.42

- KRUS Price Action:Shares of Kura Sushi fell 0.5% to close at $54.78 on Friday.

- Benzinga Pro's earnings calendar was used to track KRUS upcoming earnings report.

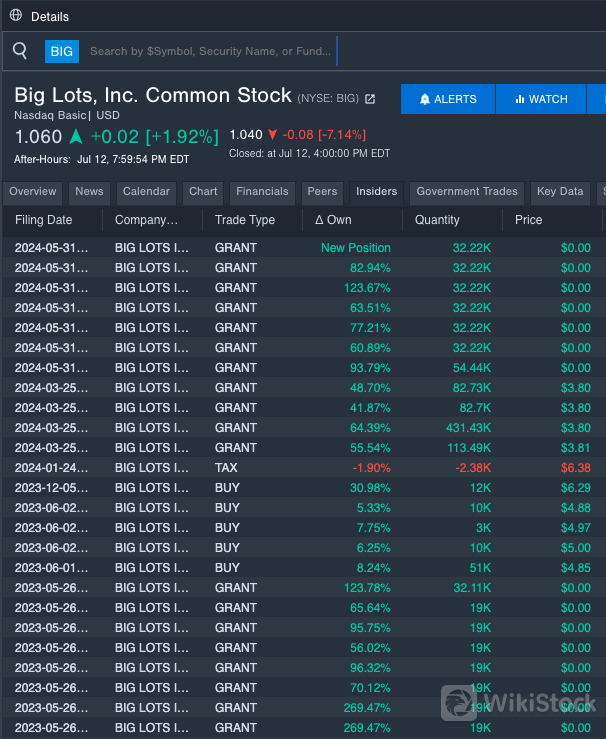

Big Lots Inc BIG

- On June 6, the company reported a first-quarter adjusted loss per share of $4.51, missing the street view for a loss of $3.92. “Our operational initiatives to offer a larger assortment of new and exciting extreme bargains, cut costs, and increase productivity exceeded our targets in Q1,” Bruce Thorn, President and CEO of Big Lots, stated. The company's shares fell around 55% over the past month. The company has a 52-week low of $1.00.

- RSI Value: 22.03

- BIG Price Action:Shares of Big Lots fell 7.1% to close at $1.04 on Friday.

- Insider trades for Big Lots were monitored using Benzinga Pro.

Byte refutes rumors of speculation on A-share Doubao concept stocks

How to develop a low-altitude economy

Doubao concept surges, IPO economy booms

5G enters the "second half", which stocks are the best to buy

Check whenever you want

WikiStock APP