Is it Wise to Retain Welltower Stock in Your Portfolio? - Alexandria Real Estate (NYSE:ARE), Americold Re

Welltower Inc.WELL is well-poised to benefit from its diversified portfolio of healthcare real estate assets amid favorable industry fundamentals. An aging population and a rise in healthcare expenditure by senior citizens are likely to aid the senior housing operating portfolio's growth. Moreover, portfolio restructuring initiatives and capital-recycling efforts augur well. However, competition in the senior housing market and high interest rates pose key concerns.

What's Aiding it?

The senior citizen population is expected to escalate in the coming years. This age cohort constitutes a major customer base of healthcare services and incurs higher healthcare expenditures than the average population. Hence, given the expected rise, they are likely to end up spending more on healthcare services in the upcoming period, poising Welltower's SHO portfolio well to capitalize on this positive trend.

Muted new supply has also been a tailwind for the senior housing industry. Hence, given these circumstances, Welltower's SHO portfolio remains well-poised to benefit, boosting the segment's performance. With a supply-demand imbalance, the portfolio is expected to experience sustained occupancy growth in 2024 and the coming years.

Capitalizing on these positive aspects, Welltower's SHO portfolio is well-prepared for compelling multiyear revenue growth. In 2024, management anticipates the same-store SHO NOI to grow at the midpoint of 19.5%, driven by favorable revenue and expense trends.

With respect to Welltower's outpatient medical portfolio, its efforts to leverage the favorable outpatient visit trend compared with in-patient admissions, expand relationships with health system partners and deploy capital in strategic acquisitions are encouraging.

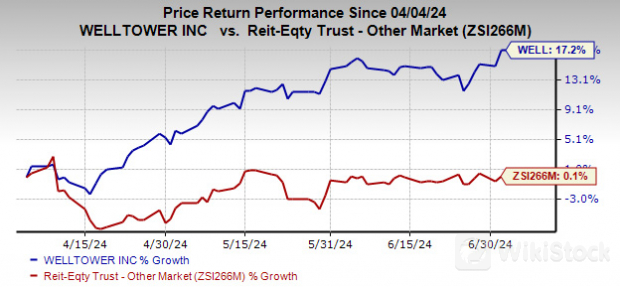

Image Source: Zacks Investment Research

What's Hurting it?

Welltower faces competition from national and local healthcare operators regarding factors such as quality, price and the range of services provided. It also competes with respect to reputation, location and demographics of the population in the surrounding area, and the financial condition of its tenants and operators. Such competition is likely to limit the company's pricing power and ink deals at attractive rates. Also, tenant concentration in the triple-net portfolio is concerning.

Given a high interest rate environment, Welltower may find it difficult to purchase or develop real estate with borrowed funds as the cost of borrowing will likely be on the higher side. Further, the dividend payout may seem less attractive than the yields on fixed-income and money-market accounts due to the high interest rates still in place.

Stocks to Consider

Some better-ranked stocks from the broader REIT sector are Alexandria Real Estate EquitiesARE and Americold Realty TrustCOLD, each carrying a Zacks Rank #2 (Buy) at present.

The Zacks Consensus Estimate for ARE's 2024 FFO per share stands at $9.49, indicating an increase of 5.8% from the year-ago reported figure.

The Zacks Consensus Estimate for COLD's 2024 FFO per share is pinned at $1.44, suggesting year-over-year growth of 13.4%.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO), a widely used metric to gauge the performance of REITs.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Byte refutes rumors of speculation on A-share Doubao concept stocks

How to develop a low-altitude economy

Doubao concept surges, IPO economy booms

5G enters the "second half", which stocks are the best to buy

Check whenever you want

WikiStock APP