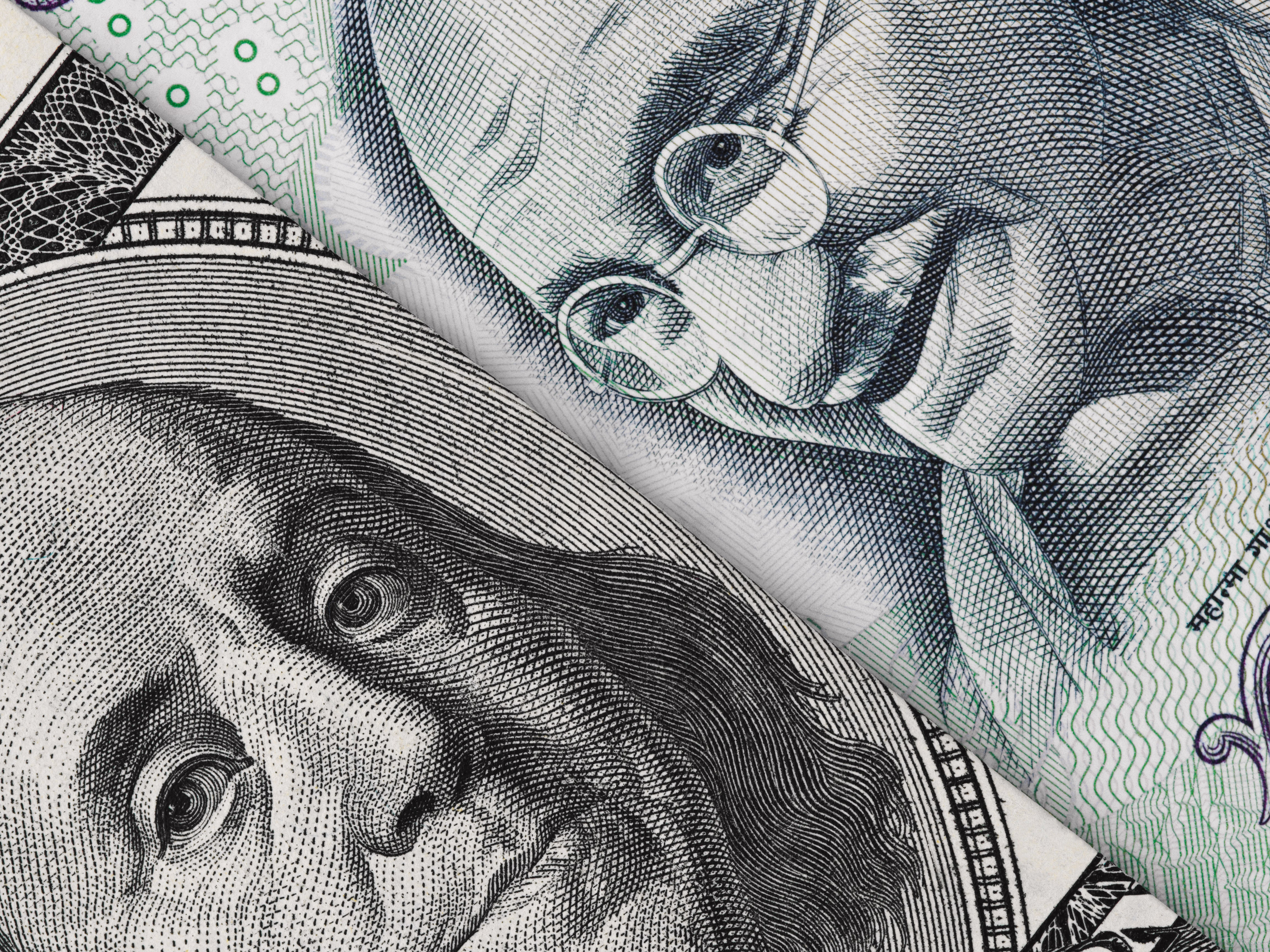

Indian Rupee Plummets To Historical Low Against US Dollar Amid Strong Oil Demand

This story was initially published on the Benzinga India Portal.

The Indian rupee plummeted to a historic low on Thursday, driven by strong dollar demand from local importers and likely capital outflows.

What Happened: The rupee sank to an all-time low of ₹83.65 against the U.S. dollar, marking a decline from its previous close of 83.4550.

Despite the central banks routine interventions via state-run banks to curb rupee depreciation, there were no such dollar offers on Thursday. This absence allowed the rupee to slide to its record low, according to foreign exchange experts.

Contributing to the rupees decline was a robust U.S. dollar, coupled with weakness in the Chinese yuan, which added pressure on the currency throughout the day.

The rise in crude oil prices may have put a dent in the Indian rupee as India is the third-largest consumer of crude oil in the world, after the US and China.

However, large recent inflows into Indian stocks and bond markets could lift the rupee in the near term. At the same time, speculations around two U.S. Federal Reserve interest rates in 2024 starting near the end of the next quarter could crimp the U.S. dollars growth and support the rupee.

Key areas for mutual funds to make money in 2025

Yushu Technology's robot dog explodes the market!

Byte refutes rumors of speculation on A-share Doubao concept stocks

How to develop a low-altitude economy

Check whenever you want

WikiStock APP