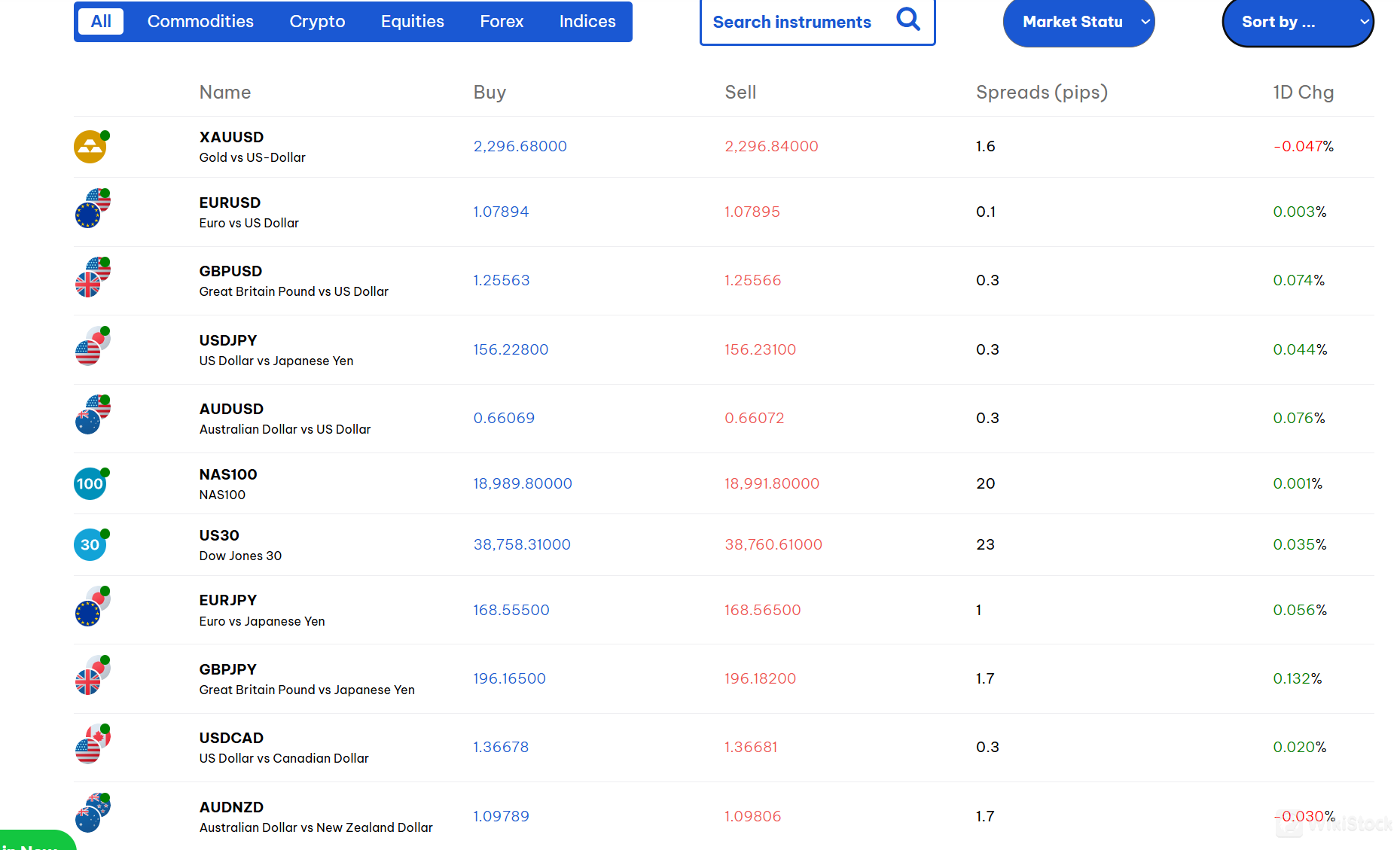

BlackBull Markets offers a range of securities within different asset classes to traders.

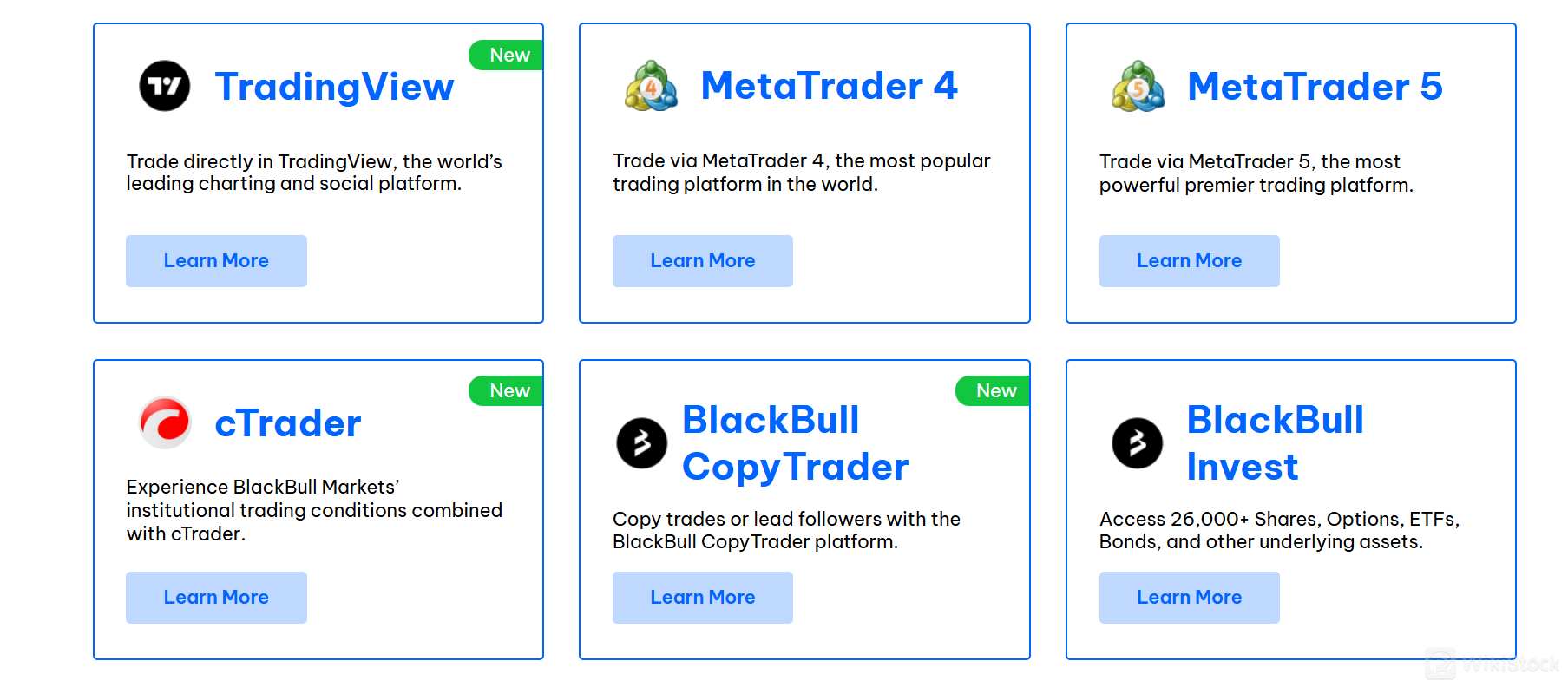

BlackBull Markets offers a diverse range of trading platforms to cater to the varying needs and preferences of traders.

- TradingView: BlackBull Markets allows traders to trade directly on TradingView, a renowned charting and social platform. This integration enables users to access advanced charting tools, real-time market data, and the ability to trade seamlessly within the TradingView interface, combining analysis and trading on a single platform.

- MetaTrader 4 (MT4): As the most popular trading platform globally, MetaTrader 4 offered by BlackBull Markets provides traders with a user-friendly interface, a wide range of technical analysis tools, and automated trading capabilities through Expert Advisors (EAs). Traders can access various markets and execute trades efficiently using MT4.

- MetaTrader 5 (MT5): BlackBull Markets offers MetaTrader 5 as a premier trading platform, known for its advanced features and enhanced trading capabilities. MT5 provides additional asset classes, trading instruments, and a more sophisticated trading environment for traders looking for a comprehensive trading experience.

- cTrader: With cTrader, traders can experience institutional trading conditions combined with the innovative features of the cTrader platform. cTrader offers a customizable interface, advanced order types, in-depth market analysis tools, and a user-friendly trading environment tailored for both novice and experienced traders.

- BlackBull CopyTrader: The CopyTrader platform by BlackBull Markets allows users to either copy trades of successful traders or lead followers by sharing their trading strategies. This social trading platform enables traders to engage in copy trading, mirror trading, or become strategy providers, fostering a community-driven approach to trading.

- BlackBull Invest: Through BlackBull Invest, traders have access to a wide range of financial instruments, including shares, options, ETFs, bonds, and other underlying assets. This platform caters to investors seeking to diversify their portfolios and explore investment opportunities beyond traditional trading markets.

BlackBull Markets Accounts Review

BlackBull Markets Accounts Review

BlackBull Markets provides account types, including:

Minimum Deposit: $0

Leverage: Up to 1:500

Commissions: No commissions

This account type is suitable for traders looking to start trading without any minimum deposit requirement. With leverage of up to 1:500 and no commissions charged, traders can access the markets efficiently and cost-effectively through the ECN Standard Account.

Minimum Deposit: $2,000

Leverage: Up to 1:500

Spreads: From 0.1 pips

The ECN Prime Account is designed for traders who prefer tighter spreads and are willing to deposit a minimum of US$2,000. With spreads starting from 0.1 pips, this account type offers competitive pricing and enhanced trading conditions for those seeking optimal trading execution.

- ECN Institutional Account:

Minimum Deposit: $20,000

Leverage: Up to 1:500

Spreads: From 0.0 pips

The ECN Institutional Account caters to professional and institutional traders with higher trading capital requirements. With a minimum deposit of US$20,000 and spreads from 0.0 pips, this account type offers ultra-competitive pricing and premium trading conditions for sophisticated traders.

Account Type: Swap Free

Account Opening Time: Less than 5 minutes

Available with: Standard and Prime Accounts

Leverage: Up to 1:500

Access: All tradeable instruments

The Swap Free Account is suitable for traders who adhere to Islamic finance principles and require interest-free trading. By offering freedom from swaps and access to all tradeable instruments, this account type accommodates traders looking to trade in compliance with Sharia law.

BlackBull Markets Tools Review

BlackBull Markets Tools Review

BlackBull Markets' suite of trading tools, including BlackBull CopyTrader, VPS Trading, FIX API Trading, ZuluTrade, and Myfxbook.

- BlackBull CopyTrader: This platform allows traders to either copy trades of successful traders or become strategy providers themselves. With BlackBull CopyTrader, users can access a social trading network to follow and replicate the trading strategies of experienced traders, enabling them to potentially benefit from their expertise and performance.

- VPS Trading: BlackBull Markets offers Virtual Private Server (VPS) hosting services, allowing traders to run automated trading strategies uninterrupted on a remote server. By utilizing VPS Trading, traders can ensure their trading platforms are always connected to the markets, execute trades swiftly, and avoid downtime associated with internet connectivity issues.

- FIX API Trading: For institutional clients and advanced traders, BlackBull Markets provides FIX API Trading, which offers direct market access and high-speed trade execution. FIX API Trading allows for seamless integration with external systems and provides a reliable and secure connection to the financial markets for executing trading strategies efficiently.

- ZuluTrade: As a social trading platform, ZuluTrade offered by BlackBull Markets enables users to follow and copy the trades of experienced traders automatically. Traders can benefit from the insights and strategies of top-performing traders on the ZuluTrade network, diversify their portfolios, and potentially improve their trading results through this platform.

- Myfxbook: BlackBull Markets integrates Myfxbook, a popular third-party platform for analyzing trading performance and sharing trading results transparently. Traders can link their trading accounts to Myfxbook to track and analyze their trading activity, monitor performance metrics, and showcase their trading statistics to the community.

Research & Education

Research & Education

BlackBull Markets provides a Research and Education platform to empower traders with the knowledge and resources needed to make informed trading decisions.

- Education Hub: The Education Hub serves as a central resource for traders to access a wide range of educational materials, including articles, videos, webinars, and guides covering various aspects of trading in the financial markets.

- Forex Tutorials: BlackBull Markets offers Forex tutorials that cater to traders of all levels. These tutorials cover topics such as market analysis, technical and fundamental analysis, trading strategies, risk management, and more.

- Shares Tutorials: Traders interested in trading shares can benefit from BlackBull Markets Shares tutorials, which provide insights into stock market trading, company analysis, market trends, and other relevant topics.

- Commodities Tutorials: The platform also offers tutorials on trading commodities, including explanations of different commodity markets, price trends, factors influencing commodity prices, and trading strategies for commodities.

- Trading Opportunities: BlackBull Markets Research team provides regular updates on trading opportunities in various financial markets, highlighting potential trade setups based on their market analysis and insights.

- Economic Calendar: The Economic Calendar helps traders stay informed about upcoming economic events, such as economic data releases, central bank meetings, and geopolitical developments that could impact the financial markets.

- Demo Trade: BlackBull Markets allows traders to practice their trading skills and test strategies in a risk-free environment through its demo trading platform. This feature enables traders to gain hands-on experience without risking real money.

Customer Service

Customer Service

BlackBull Markets offers live chat. With live chat, customers can get their questions answered quickly and receive help with any issues they may have.

Customers can visit their office or get in touch with customer service line using the information provided below:

24/7

Telephone: New Zealand: +64 9 558 5142

New Zealand Free: 0800 BB Markets

Cyprus: +357 22 279 444

México: +52 338 526 2705

Argentina: +54 113 986 0543

Email: support@blackbull.com

Address: JUC Building, Office F7B, Providence Zone 18, Mahe, Seychelles

Conclusion

In conclusion, BlackBull Markets is a reputable and regulated brokerage firm that offers a range of trading options across various asset classes to clients worldwide. With a focus on regulatory compliance and fund security, the company provides assurance to traders regarding the safety of their investments.

The absence of a minimum deposit requirement makes it accessible to traders of all levels, and the innovative trading tools and platforms enhance the overall trading experience. However, BlackBull Markets does have limitations such as regional restrictions. Overall, BlackBull Markets is a popular choice for traders looking for a reliable and trustworthy broker in the forex and securities market.

Frequently Asked Questions (FAQs)

Is BlackBull Markets regulated?

Yes. It is regulated by FSA.

What are platforms offered by BlackBull Markets?

It provides TradingView, cTrader, MT4, MT5, BlackBull CopyTrader and BlackBull Invest.

What is the minimum deposit for BlackBull Markets?

There is no minimum initial deposit to open an account.

At BlackBull Markets, are there any regional restrictions for traders?

Yes. It does not provides services for the residents of the European Union, the United Kingdom nor any non-resident of New Zealand.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

United States

United StatesObtain 1 securities license(s)

United Kingdom

--

--