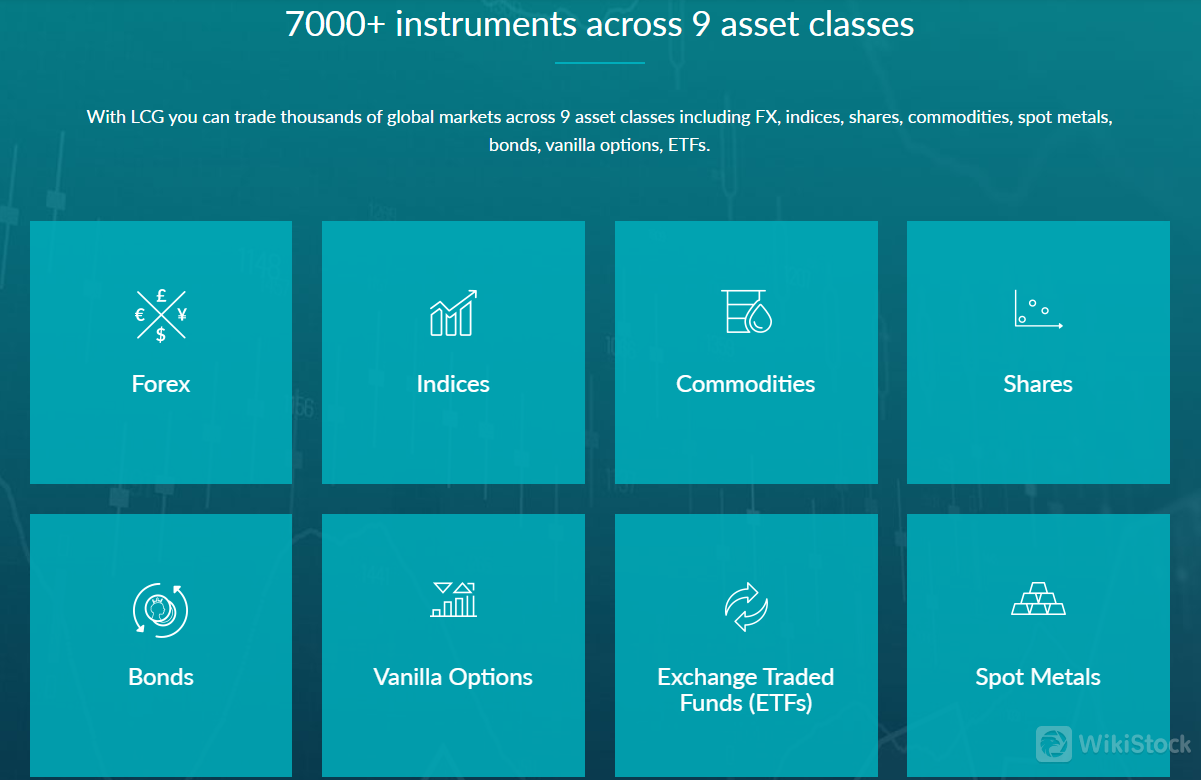

LCG BHS is a global brokerage firm offering a diverse range of trading options across various asset classes. With over 7000 instruments available, including FX, indices, shares, commodities, spot metals, bonds, vanilla options, and ETFs, LCG BHS provides traders with ample opportunities to engage in different markets. Additionally, the company offers Forex Islamic accounts, catering to clients adhering to Sharia law and the Muslim faith by providing swap-free trading options.

Depositing charge: Deposits made via Visa and Mastercard credit cards are subject to a 2% fee, which may deter some clients or increase transaction costs.

Strict regional restriction: Australia, Belgium, Canada, New Zealand, Singapore and United States, and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to the local law or regulation.

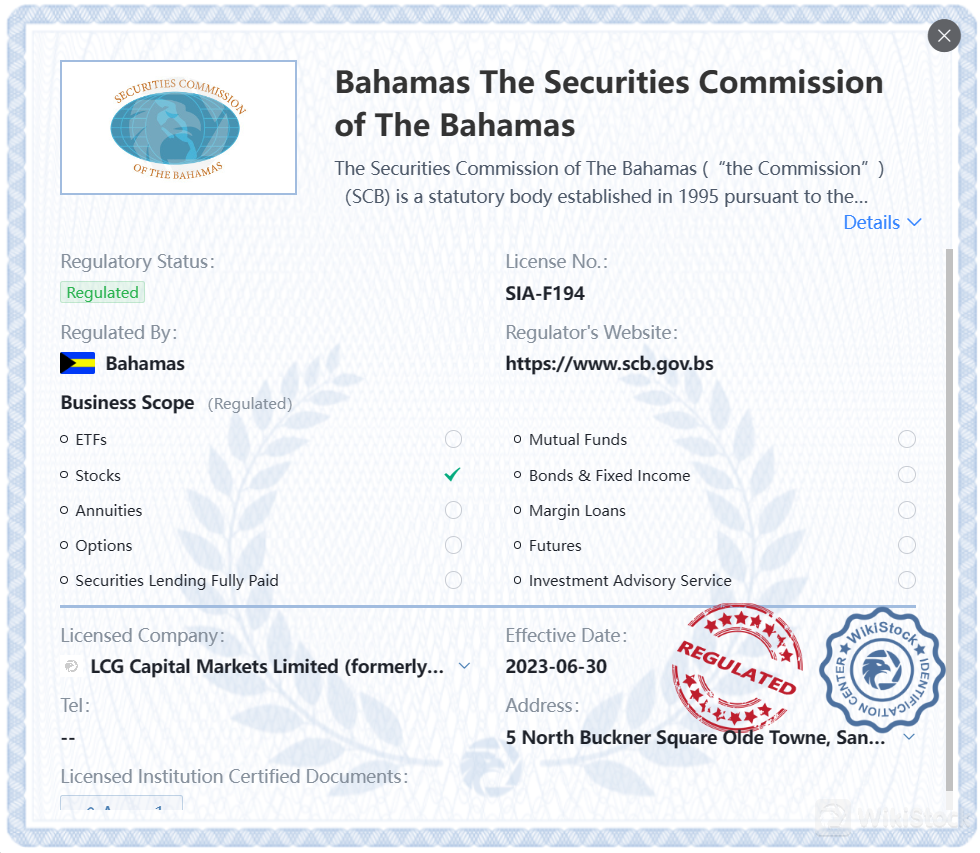

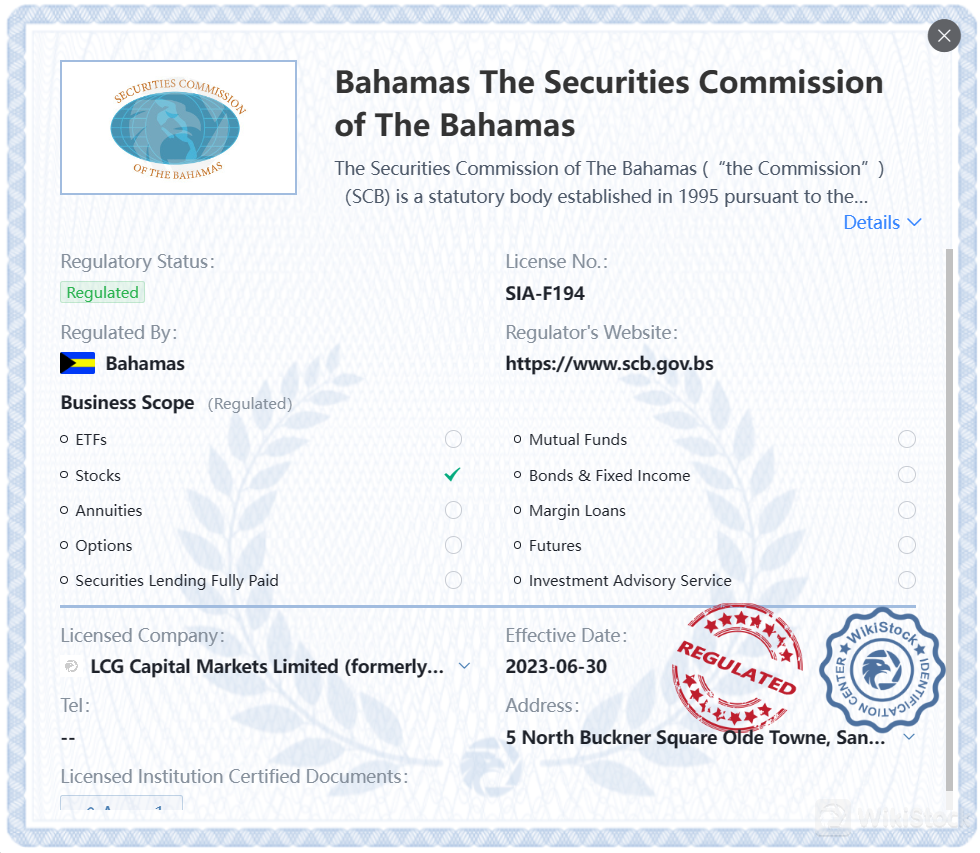

Is LCG BHS Safe?

Regulatory Sight: LCG BHS is offshore regulated by the Securities Commission of The Bahamas (SCB) (No.SIA-F197) and holds a BahamasSecurities Trading License. However, investors should be aware that offshore regulation may not offer the same level of protection as regulations in more established financial centers.

User Feedback: Users should check the reviews and feedback from other clients to gain a more comprehensive sight of the broker, or look for reviews on reputable websites and forums.

Security Measures: So far we haven't found any information about the security measures for this broker.

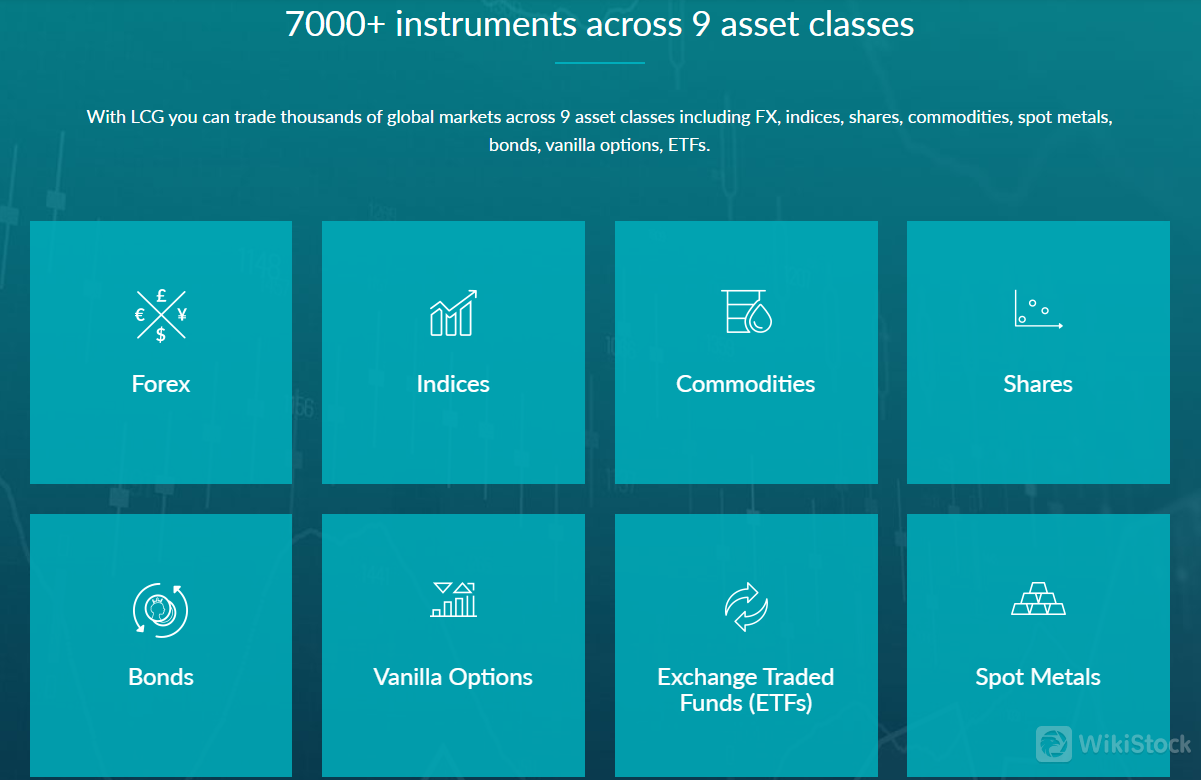

What are Securities to Trade with LCG BHS?

LCG BHS offers a wide range of trading options, boasting over 7000 instruments spanning nine asset classes. These include FX, indices, shares, commodities, spot metals, bonds, vanilla options, and ETFs. This extensive selection provides traders with diverse opportunities to engage in various markets.

LCG BHS Accounts

LCG BHS offers a demo account option for prospective traders seeking to test the platform's functionality before committing to live trading. This feature allows users to explore various trading strategies, familiarize themselves with the platform's interface, and assess market conditions without financial risk.

Aside from offering demo accounts, LCG BHS extends its services with ECN accounts featuring benefits such as trading from 0 pips with no requotes and direct market access, spreads starting from 0 pips, access to unparalleled forex liquidity, a qualification requirement of maintaining a $10,000 account balance, compatibility with world-class LCG BHS Trader and MT4 platforms, and assurance of complete transparency and anonymity for traders.

Additionally, LCG BHS provides Forex Islamic accounts, which are also known as swap-free accounts as they imply no swap or rollover interest on overnight positions. LCG BHS offers Islamic accounts to our clients following the Muslim faith and Sharia law.

LCG BHS Fees Review

LCG BHS imposes a 2% charge on deposits made through Visa and Mastercard credit cards, contrasting with the absence of fees for deposits and withdrawals when utilizing alternative payment methods.

This fee structure reflects a standard practice within the industry, with credit card transactions incurring additional costs due to processing fees. Clients are provided with clarity regarding these charges during the deposit process to enable informed decision-making.

Research & Education

LCG BHS provides a variety of educational resources aimed at assisting traders in enhancing their knowledge and skills in the financial markets. These resources include trading guides, videos, a glossary of terms, frequently asked questions (FAQs), and platform tutorials.

The trading guides offer insights into different aspects of trading, covering topics ranging from basic concepts to advanced strategies.

Similarly, the trading videos provide visual explanations of various trading techniques and market dynamics. The glossary serves as a reference tool for understanding commonly used terms in the trading industry, while the FAQs address common queries that traders may encounter.

Additionally, platform tutorials offer guidance on navigating and utilizing LCG BHS's trading platforms effectively.

Customer Service

LCG BHS BHS offers comprehensive customer support to its clients. This includes being available 24 hours a day, 7 days a week. Clients can reach out to LCG BHS BHS through various channels.

Telephone: Clients can call their number (0) 242 601 6866 for any queries.

Email: The firm offers assistance through email at Customerservices.int@LCG BHS.com.

Live chat

Social Media: LCG BHS BHS also maintains a strong presence on Twitter, Facebook, Instagram, LinkedIn and Youtube, providing clients with a more informal method of communication or for staying updated with the firm's latest news.

Company address: 5 North Buckner Square Olde Towne Sandyport, Sandyport Marina Village, West Bay Street, Nassau, Bahamas.

Conclusion

In summary, LCG BHS offers a range of trading options across various asset classes. However, clients should exercise caution due to offshore regulation potentially offering less protection compared to more established centers. Additionally, the 2% fee on credit card deposits may deter some traders, and the availability of educational resources is somewhat limited. Overall, while LCG BHS may suit certain traders, individuals should carefully assess the pros and cons before engaging with the platform.

FAQs

Is LCG BHS regulated?

No, LCG BHS operates under offshore regulation by the Securities Commission of The Bahamas (SCB).

What are the account types available at LCG BHS?

LCG BHS offers various account types, including standard trading accounts, Forex Islamic accounts (swap-free), and ECN accounts for those seeking direct market access with competitive pricing.

What markets can I trade with LCG BHS?

FX, indices, shares, commodities, spot metals, bonds, vanilla options, and ETFs.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

United Kingdom

United KingdomObtain 1 securities license(s)