Dingxin (Securities) Limited set up pursuant to the Cap. 571, Securities and Futures Ordinance. We are licensed by the Securities and Futures Commissions with the CE number, BOS734. We can conduct Type 1 (dealing in securities) and Type 4 (advising on Securities) regulated activities. We are also an exchange participant of Hong Kong Stock Exchange. The Company will comply with the Securities and Futures Ordinance, the rules and guidance about internal controls and risk management issued by the Securities and Futures Commissions, in order to protect the clients’ assets.

What is Dingxin (Securities)?

Dingxin (Securities) Limited is a Hong Kong-based brokerage firm regulated by the Securities and Futures Commission (SFC). Established in 2019, it offers a range of securities trading services to retail and institutional clients. They operate the LongPort platform for online trading and provide IPO subscription, margin financing, and advisory services. Fees include a 0.25% commission for offline trading, and 0.15% for online trading, plus trading fees, transaction levy fees, and stamp duty. Dingxin offers mutual funds and aims to protect the integrity of Hong Kong's securities and futures markets.

Pros & Cons of Dingxin (Securities)

Pros:

SFC Regulation: Dingxin (Securities) is regulated by the Securities and Futures Commission (SFC) of Hong Kong, ensuring compliance with regulatory standards and investor protection.

Comprehensive Services: The company offers a wide range of financial services, including securities brokerage, IPO subscription, margin financing, and advisory services.

User-Friendly Platform: The LongPort platform provides a user-friendly interface for online trading, allowing clients to access real-time market information and execute transactions conveniently.

Cons:

Limited Information: Some details such as account minimums, account fees, interests on uninvested cash, and margin interest rates are not explicitly mentioned, which makes it challenging for clients to assess the full cost of trading.

Limited History: Being established in 2019, Dingxin (Securities) has a relatively short operating history compared to more established brokerage firms, which hinders some investors.

Is Dingxin (Securities) Safe?

With a license of No.BOS734, Dingxin (Securities) Limited is regulated by the Securities and Futures Commission (SFC) of Hong Kong, which sets high standards for financial institutions. This regulation helps ensure that Dingxin operates in accordance with established guidelines and that client safety is protected to a certain extent.

What are Securities to Trade with Dingxin (Securities)?

Dingxin (Securities) offers a wide range of securities for trading, providing investors with diverse options to suit their investment preferences and risk tolerance.

Stocks: Dingxin allows trading in shares of publicly listed companies, enabling investors to participate in the equity markets and potentially benefit from stock price movements.

Bonds: Investors can trade in bonds, which are fixed-income securities issued by governments or corporations. Bonds provide a regular income stream through interest payments and are typically considered less risky than stocks.

Mutual Funds: Dingxin offers access to mutual funds, which pool money from multiple investors to invest in a diversified portfolio of securities. Mutual funds are managed by professional fund managers and offer a convenient way to invest in a variety of assets.

Options: Dingxin provides trading options, which are financial derivatives that give the holder the right, but not the obligation, to buy or sell an asset at a specified price within a specific timeframe. Options can be used for hedging or speculation.

Futures: Dingxin offers trading in futures, which are standardized contracts to buy or sell an asset at a predetermined price on a specified future date. Futures can be used to hedge against price fluctuations or to speculate on future price movements.

Structured Products: Dingxin offers structured products, which are securities with a complex payout structure determined by the performance of underlying assets. Structured products can provide tailored investment solutions but may also involve higher risks.

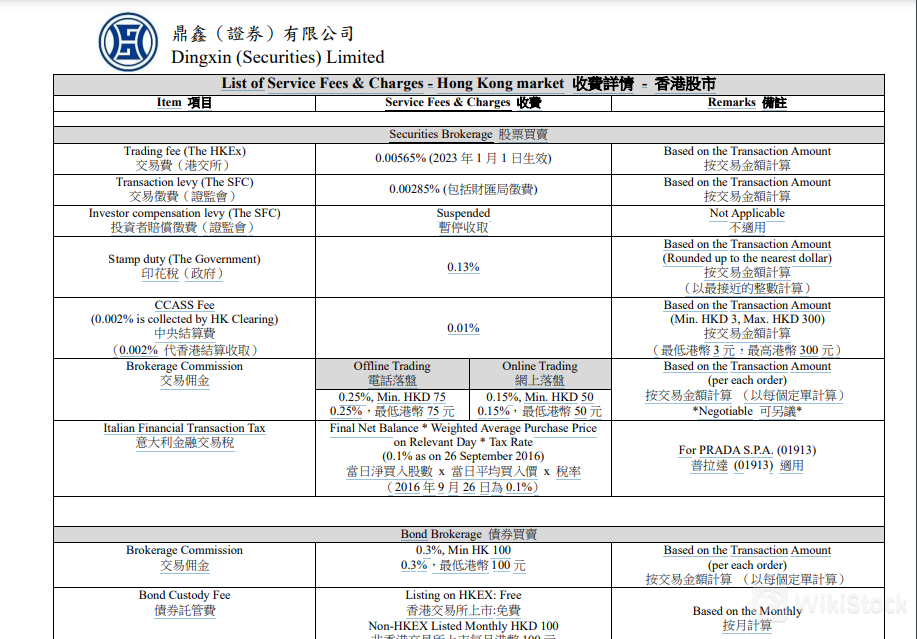

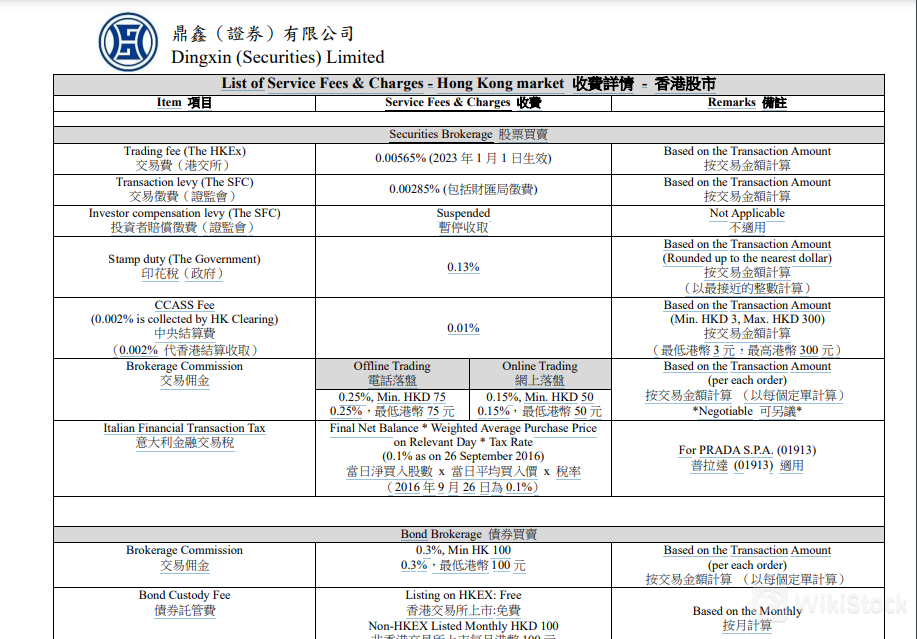

Dingxin (Securities) Fees Review

Dingxin's fee structure is competitive and in line with industry standards for securities trading in Hong Kong.

Dingxin (Securities) charges a range of fees for trading securities in the Hong Kong market. These include the trading fee, transaction levy, stamp duty, and CCASS Fee, all based on the transaction amount. For offline trading, the brokerage commission is 0.25% with a minimum of HKD 75, while for online trading, it is 0.15% with a minimum of HKD 50.

Bond brokerage fees are 0.3% with a minimum of HKD 100 based on the transaction amount. Additionally, there are fees for corporate actions, custody of bonds, and collection of dividends and bonus issues, which vary based on the type of security and the specific service required.

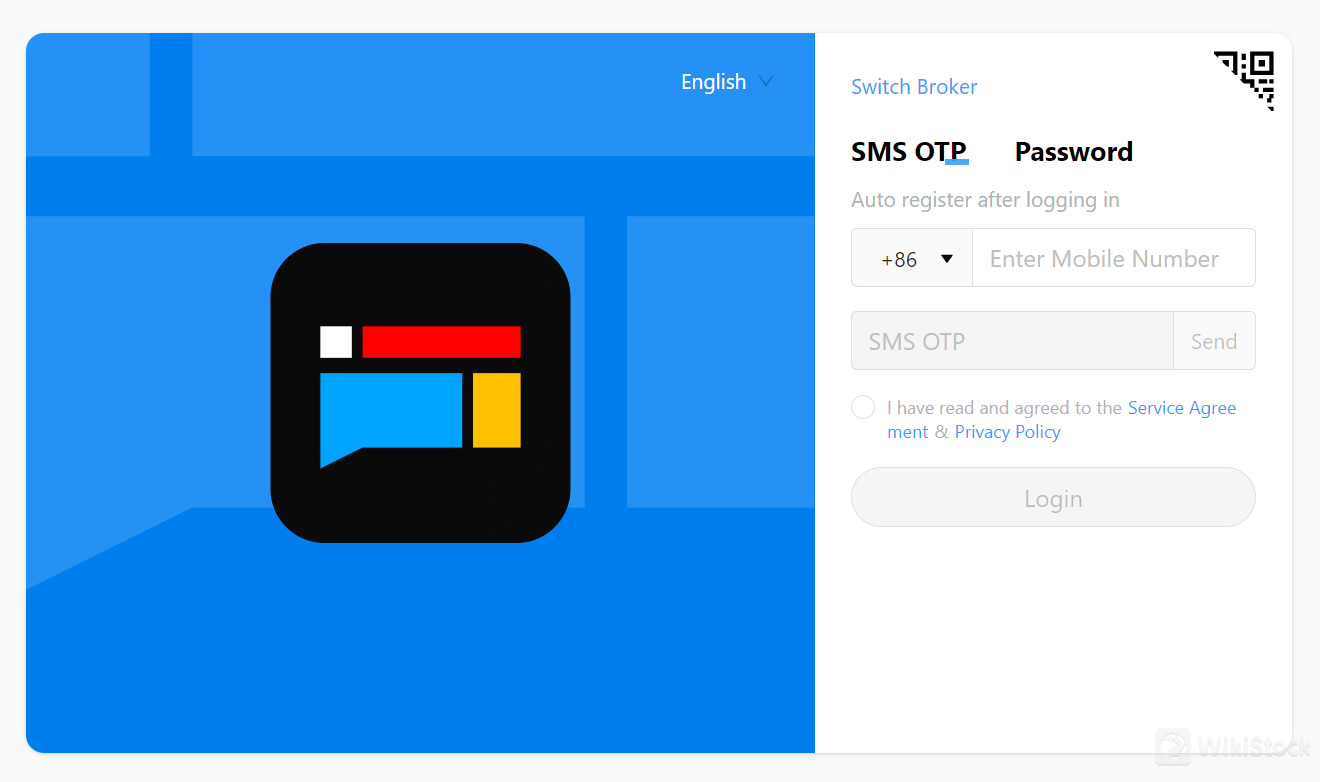

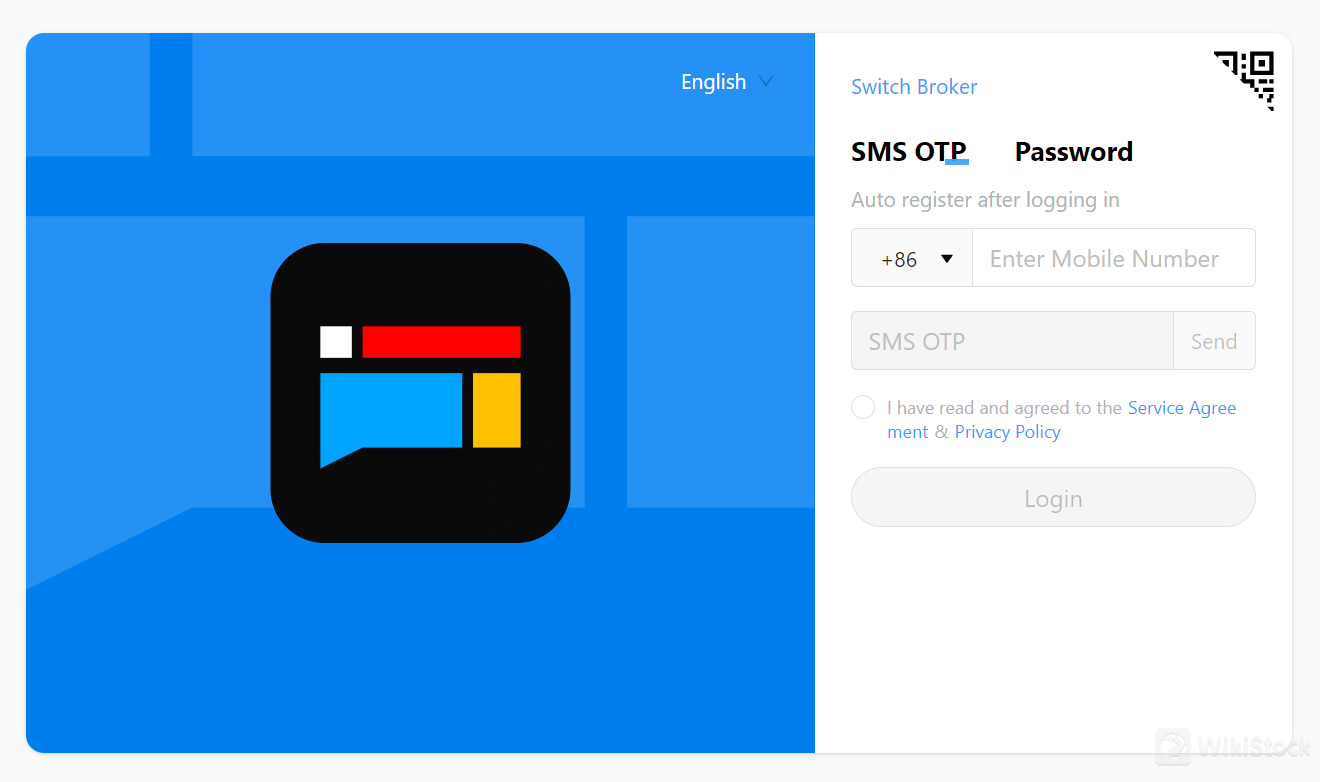

Dingxin (Securities) App Review

LongPort is a trading platform offered by Dingxin (Securities) Limited. It provides users with access to the Hong Kong market for trading various securities. The platform is designed to be user-friendly, allowing investors to manage their portfolios and execute trades efficiently. LongPort offers features such as real-time market data, order placement, portfolio tracking, and research tools to help users make informed investment decisions.

Customer Service

Dingxin (Securities), located at Rm 1301-2A, FWD Financial Centre, 308-320 Des Voeux Rd Central, Sheung Wan, Hong Kong, offers a range of contact options for clients seeking assistance.

You can reach the company by telephone at (852) 2115 2013 or via email at cs@dingxinsec.com. These contact methods provide direct access to customer service representatives who can address inquiries, provide information, or assist with any issues related to trading or account management.

Additionally, Dingxin (Securities) offers a convenient online contact form on its website. You can use this form to submit their name, email address, subject, and message. After completing the form, clients can click Submit button to send their inquiry directly to the company.

Conclusion

In conclusion, Dingxin (Securities) is a regulated brokerage firm based in Hong Kong, offering a range of securities trading services to both retail and institutional clients. It operates the LongPort platform for online trading, providing access to IPO subscription, margin financing, and advisory services. Overall, Dingxin (Securities) is a reliable option for those looking to trade securities in the Hong Kong market, with its SFC regulation providing a level of assurance regarding compliance and investor protection.

Frequently Asked Questions (FAQs)

Is Dingxin (Securities) regulated?

Yes, Dingxin (Securities) is regulated by the Securities and Futures Commission (SFC) of Hong Kong.

What services does Dingxin (Securities) offer?

Wealth management, corporate financing, asset management, and stock exchange.

What trading platform does Dingxin (Securities) use?

LongPort platform.

What securities can I trade with Dingxin (Securities)?

Stocks, bonds, mutual funds, options, futures, and structured products.

What are the fees for trading with Dingxin (Securities)?

Brokerage commissions (0.25% for offline trading, and 0.15% for online trading), trading fees(0.00565%), transaction levy fees(0.00285%), stamp duty(0.13%), and other applicable fees.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

China Hong Kong

China Hong Kong Obtain 1 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)