- Insurance: iFAST offers investment-linked insurance products that provide both coverage and investment growth. These products combine the benefits of insurance protection with the potential for investment returns. Policyholders can invest in a range of underlying assets, such as stocks, bonds, and funds, to grow their wealth while enjoying insurance coverage for life, health, or other risks.

iFAST Global Markets Account Review

iFAST Global Markets offers a variety of account types tailored to meet the diverse needs of investors, including Self-Served, Individual/Joint, Corporate Wrap, and Discretionary accounts.

Self-Served Account: This account type is ideal for investors who prefer to take control of their investment decisions and manage their portfolios independently. With a self-served account, investors have the freedom to choose and execute their own investment strategies without relying on financial advisors. The platform offers a wide range of investment options, including stocks, bonds, mutual funds, and ETFs. The self-service model allows for flexibility, control, and lower fees, making it suitable for those who are knowledgeable and confident in managing their own investments.

Individual/Joint Account: Designed for personal and joint investors, this account type allows individuals or couples to manage their investments together. It provides access to a broad selection of financial products and investment options, enabling users to diversify their portfolios according to their risk tolerance and financial goals. The individual/joint account offers transparency and convenience with real-time access to account performance and market data.

Corporate Wrap Account: This account type is specifically tailored for businesses and organizations. It offers a suite of services and solutions to meet the unique needs of corporate entities. Whether a small business or a multinational corporation, the corporate wrap account provides tools and resources to optimize corporate investments and achieve financial objectives. It includes customized investment solutions, global market access, enhanced security and compliance, and efficient cash management features.

Discretionary Account: The discretionary account is perfect for investors who prefer to delegate the day-to-day management of their investments to professional portfolio managers. This account type allows the portfolio manager to make investment decisions on behalf of the client, based on thorough research and analysis. It provides a hands-off approach, freeing up the client's time and ensuring that investments are managed by seasoned professionals. The discretionary account includes proactive monitoring, ongoing support, and customized solutions tailored to the client's financial goals and risk tolerance.

iFAST Global Markets Fee Review

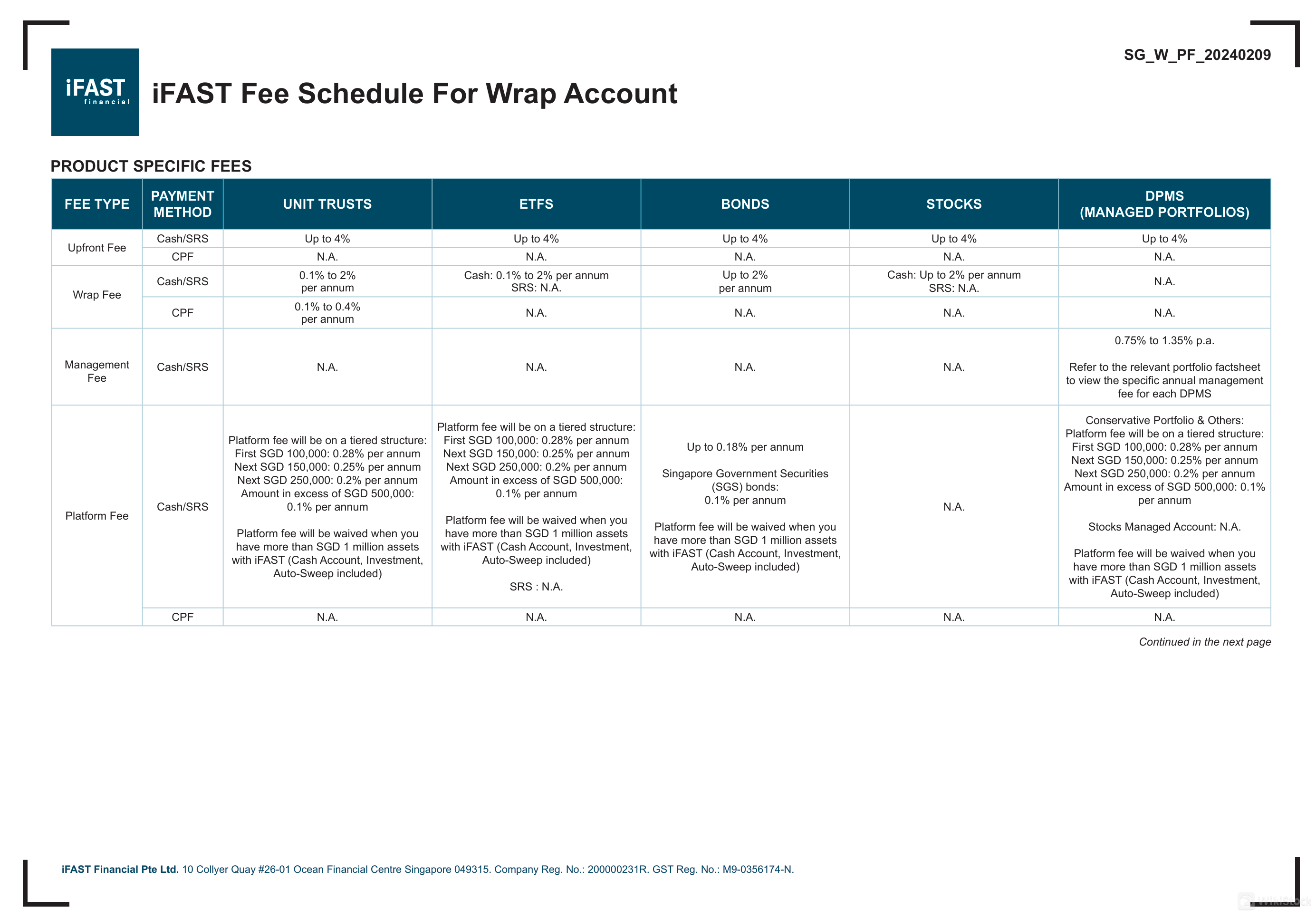

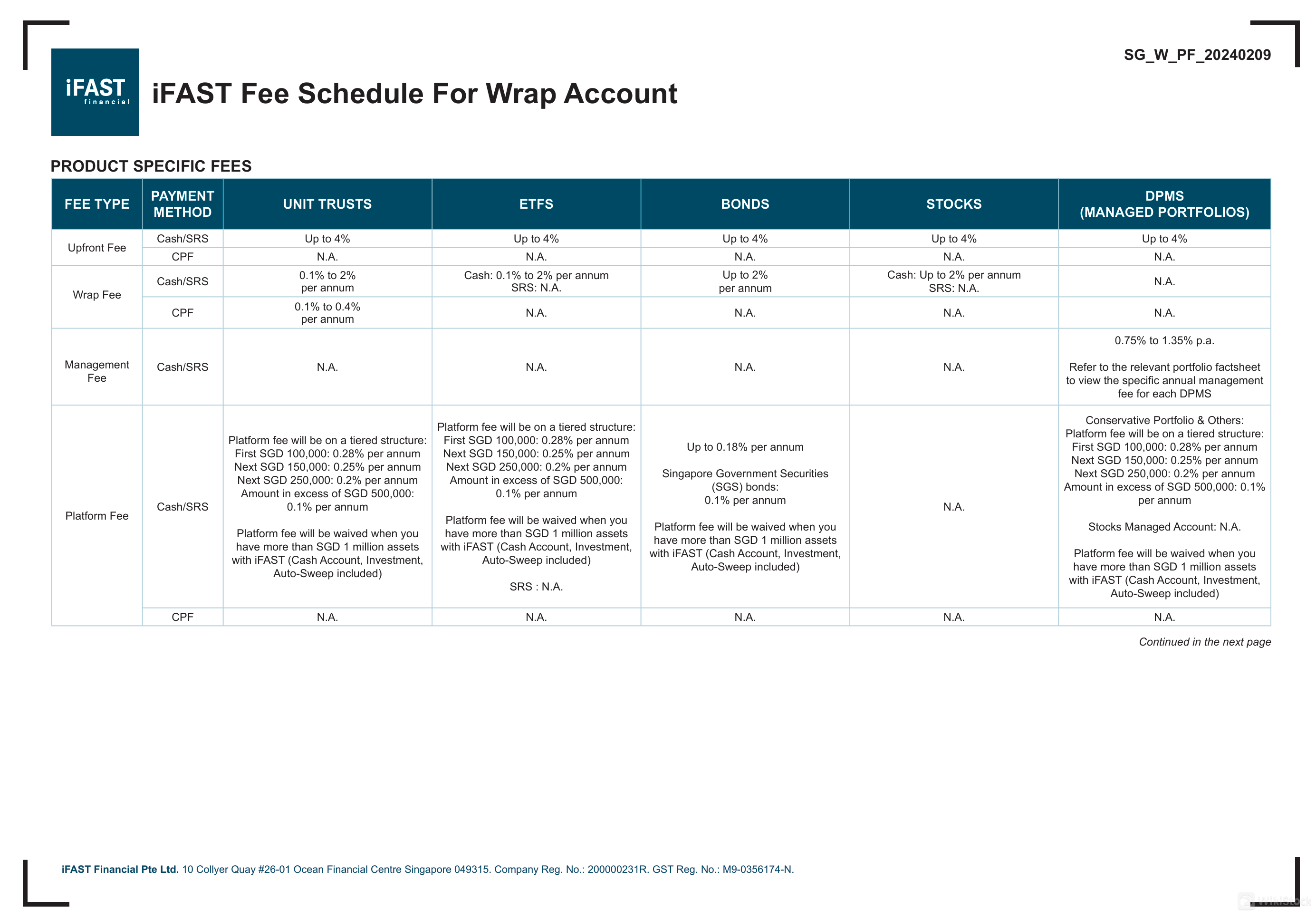

The fee structure for iFAST Global Markets is detailed below, covering various financial products and services.

Upfront Fee:

- Unit Trusts, ETFs, Bonds, Stocks, DPMS: Up to 4% for Cash/SRS payments.

- CPF: Not applicable to these products.

Wrap Fee:

- Unit Trusts, ETFs, Bonds: 0.1% to 2% per annum for Cash/SRS, up to 2% per annum.

- Stocks: 0.1% to 2% per annum for Cash, not applicable for SRS.

- DPMS: Up to 2% per annum for Cash, not applicable for SRS.

Management Fee:

- DPMS (Managed Portfolios): 0.75% to 1.35% per annum, specific rates detailed in the portfolio factsheet.

Platform Fee:

- Unit Trusts, ETFs, DPMS: Tiered structure based on investment amount, with the first SGD 100,000 charged at 0.28% per annum, reducing to 0.1% for amounts exceeding SGD 500,000. Platform fee waived for assets over SGD 1 million.

- Bonds: Up to 0.18% per annum for Singapore Government Securities (SGS).

- Stocks: Not applicable.

- CPF/SRS: Not applicable.

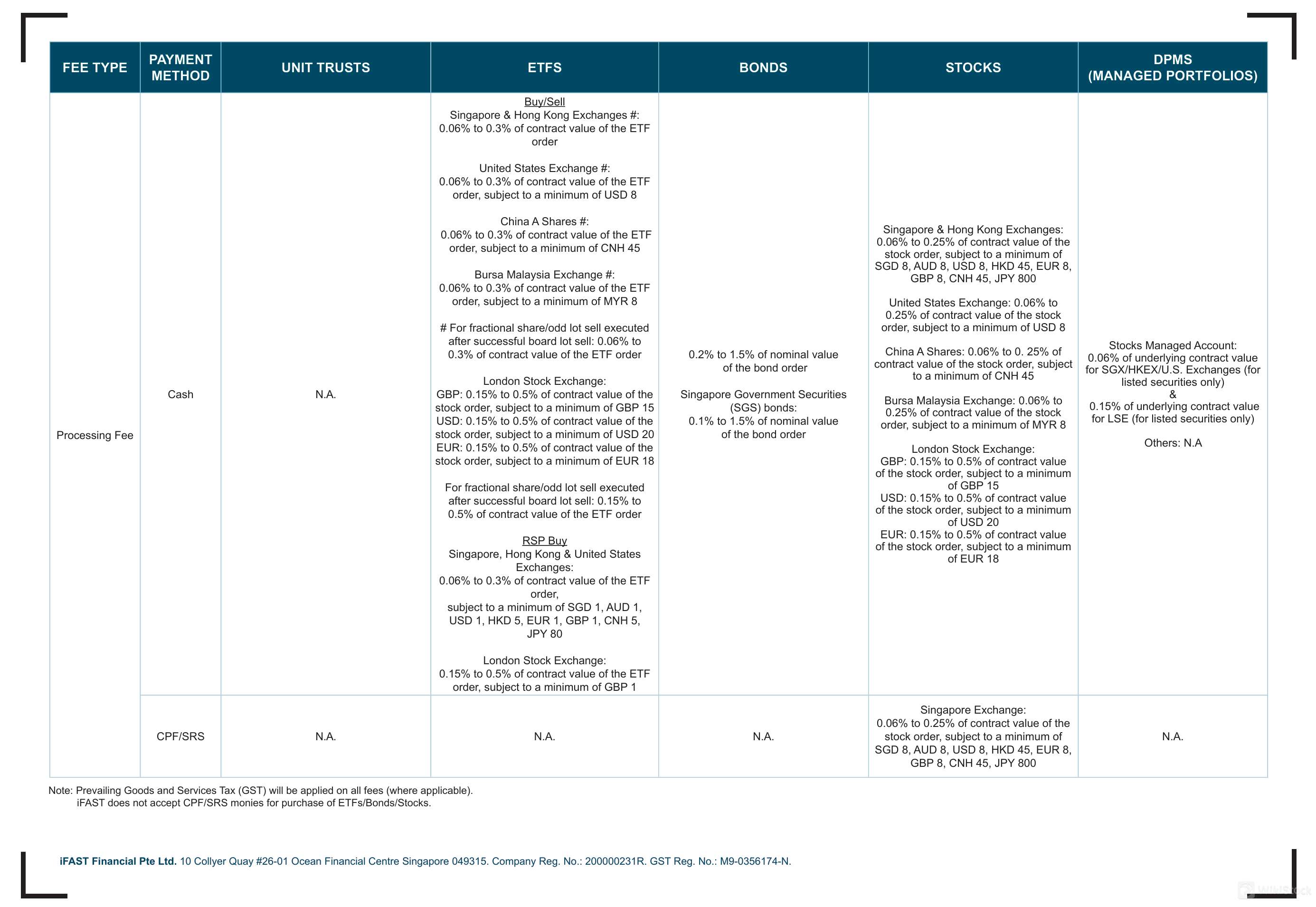

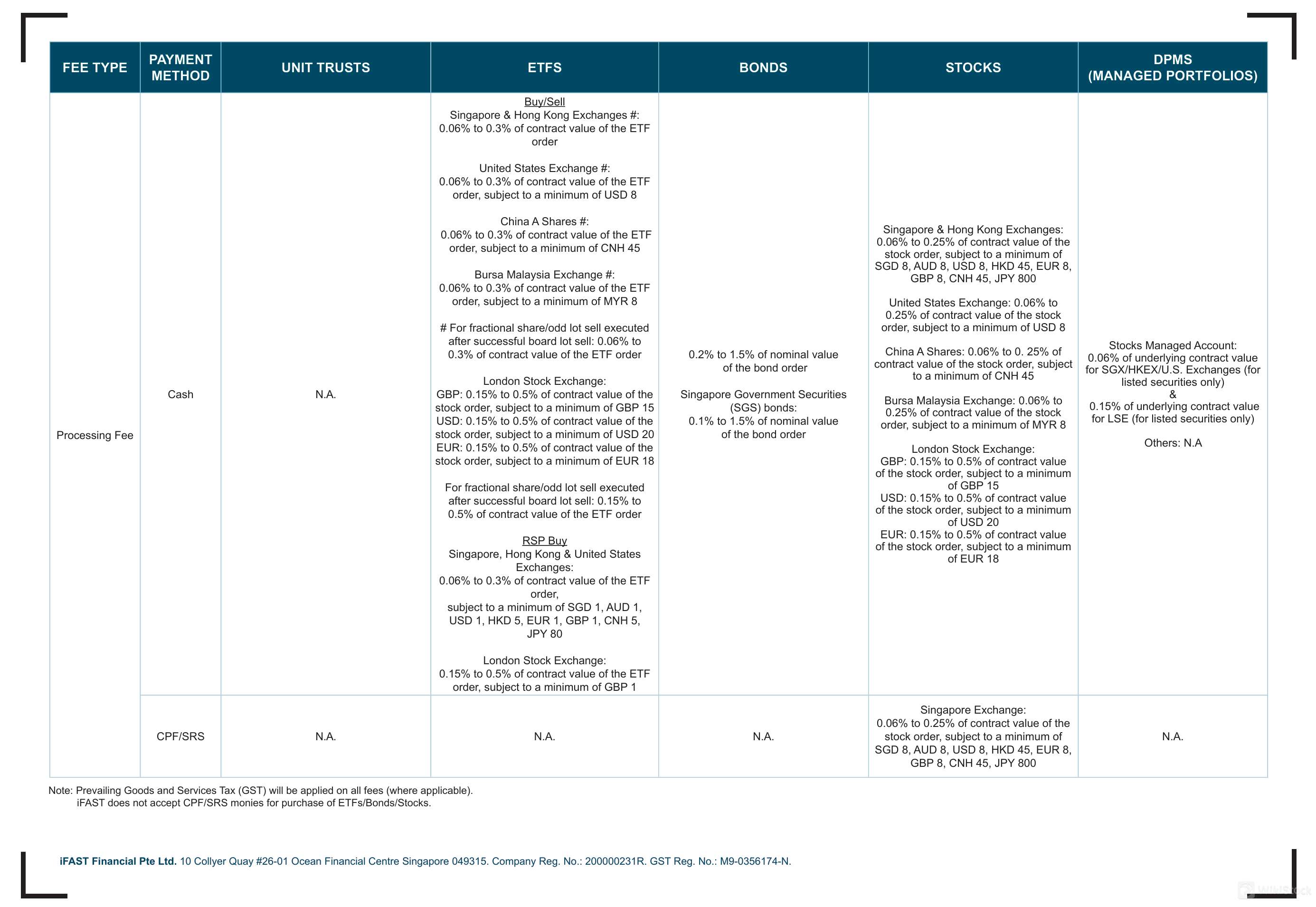

Processing Fee:

- ETFs: 0.06% to 0.3% of contract value, with specific minimums for different exchanges.

- Bonds: 0.2% to 1.5% of nominal value, 0.1% to 1.5% for Singapore Government Securities (SGS) bonds.

- Stocks: 0.06% to 0.25% of contract value, with minimum fees based on exchange and currency.

- DPMS: 0.06% to 0.5% of underlying contract value for listed securities.

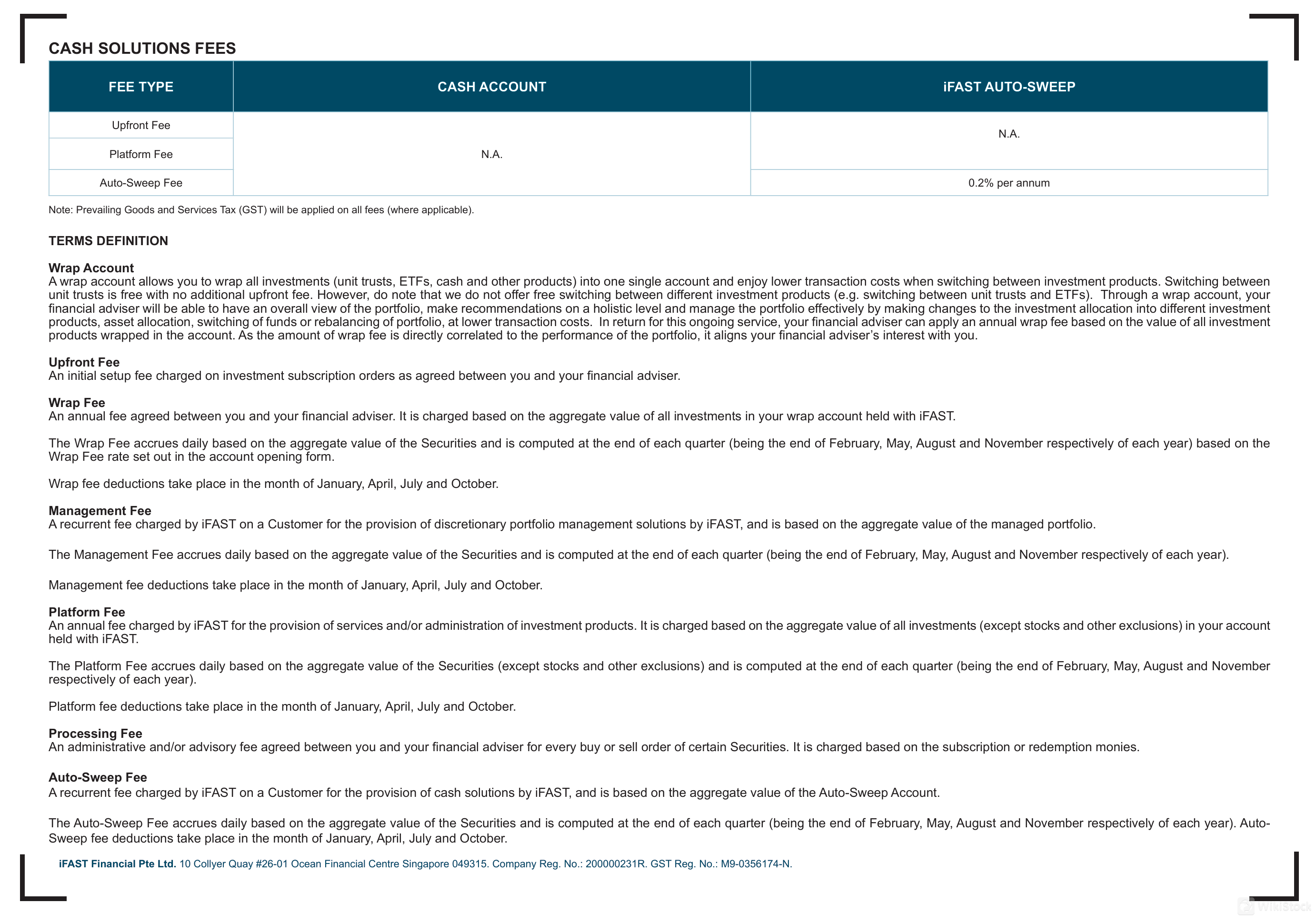

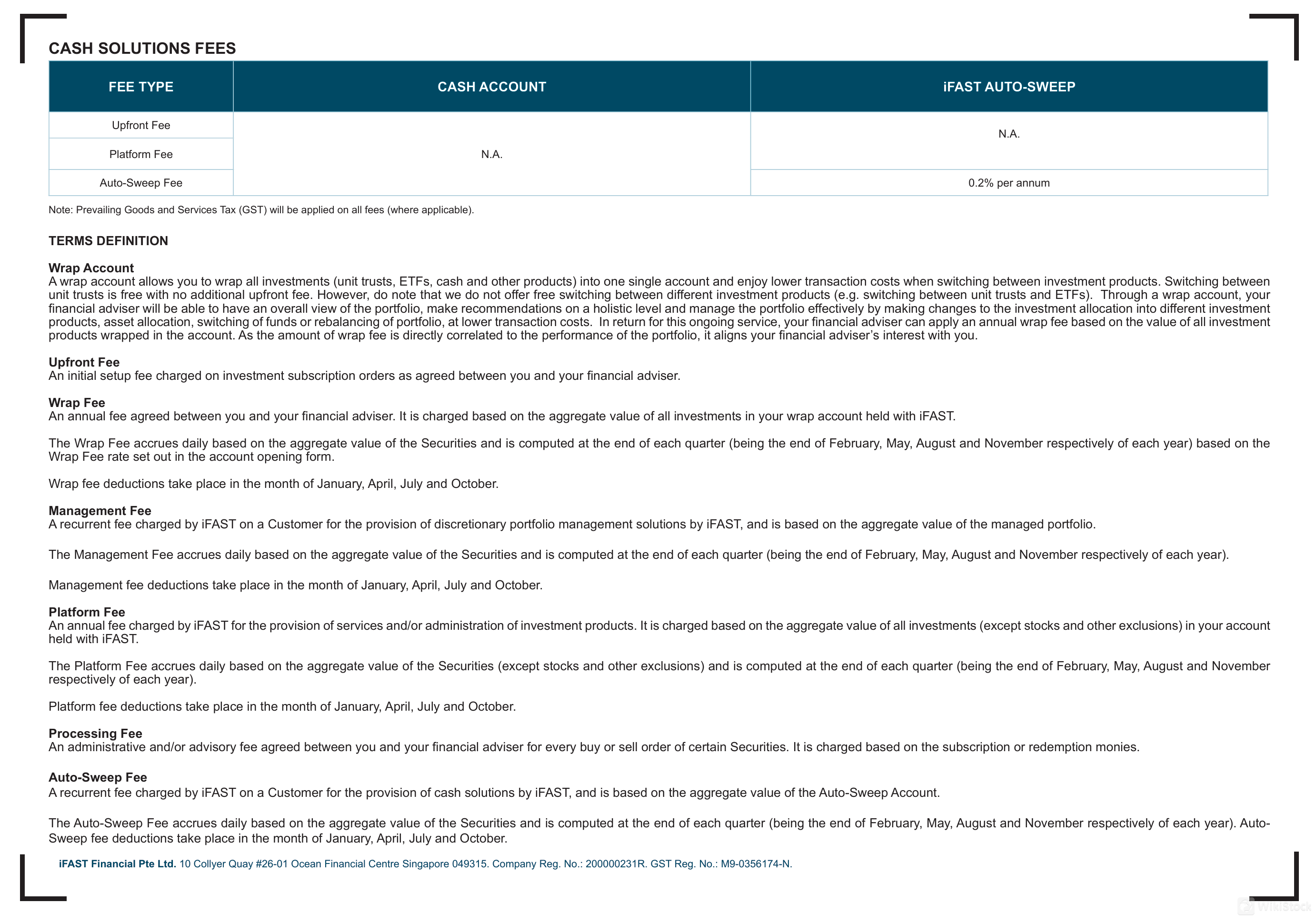

Cash Solutions Fees:

- Upfront Fee: Not applicable.

- Platform Fee: Tiered structure with specific rates for investment amounts, waived for assets over SGD 1 million.

- Auto-Sweep Fee: Not applicable.

Definitions:

- Wrap Account: Combines various investments into one account, offering lower transaction costs for switching between investment products, with an annual wrap fee based on total investment value.

- Upfront Fee: Initial setup fee for investment subscription orders.

- Wrap Fee: Annual fee based on aggregate investment value, deducted quarterly.

- Management Fee: Recurrent fee for discretionary portfolio management solutions, based on portfolio value, deducted quarterly.

- Platform Fee: Annual fee for administration of investment products, based on aggregate investment value, deducted quarterly.

- Processing Fee: Administrative/advisory fee for each buy/sell order of certain securities.

- Auto-Sweep Fee: Recurrent fee for cash solutions, based on aggregate value, deducted quarterly.

iFAST Global Markets Trading Platform Review

Trading Platform

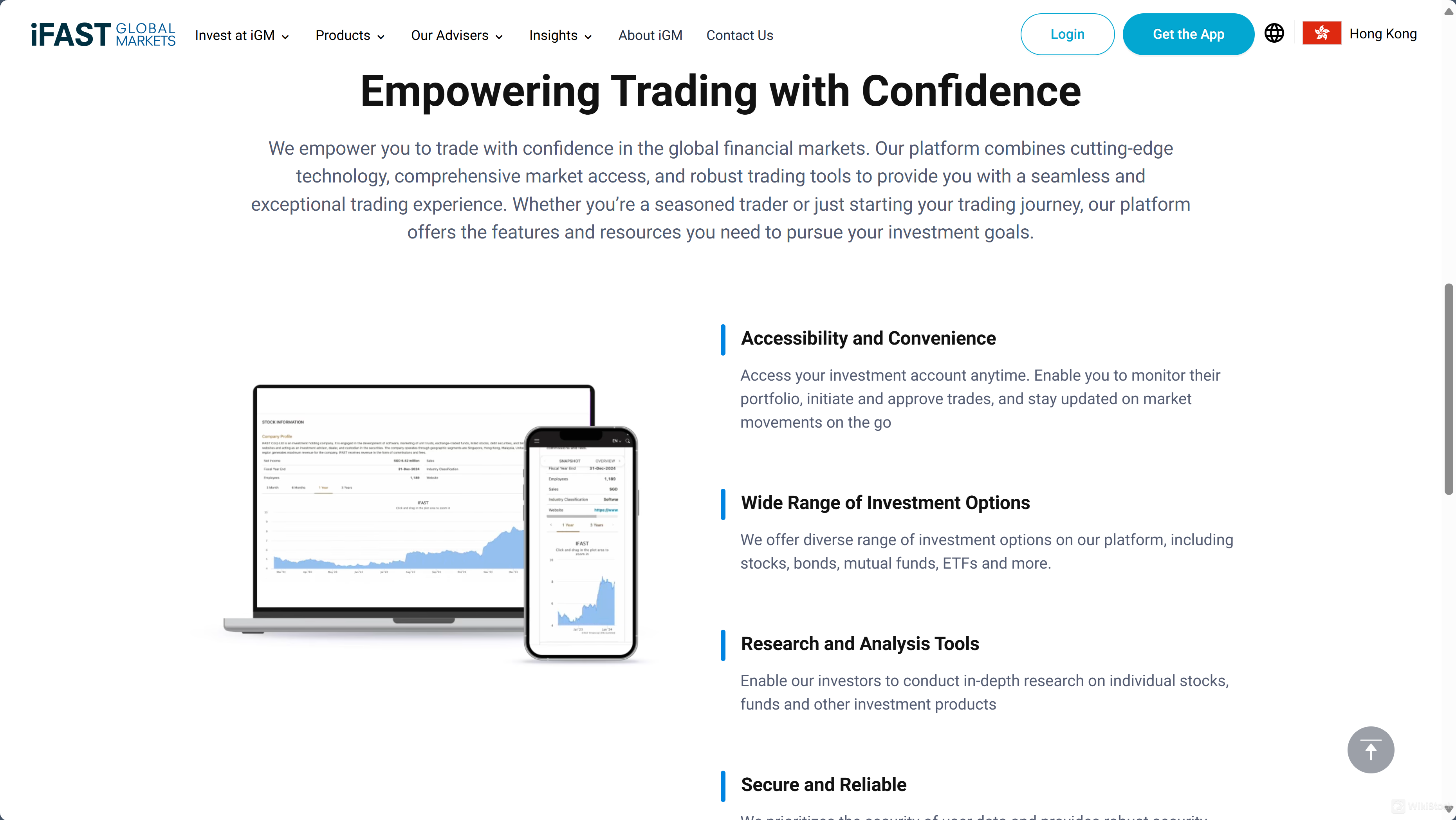

iFAST Global Markets provides a and robust trading platform designed to empower users with an exceptional trading experience. The platform combines cutting-edge technology, market access, and robust trading tools. Key features of the trading platform include:

- Accessibility and Convenience: Users can access their investment accounts anytime and monitor their portfolios, initiate and approve trades, and stay updated on market movements on the go.

- Wide Range of Investment Options: The platform offers a diverse range of investment options including stocks, bonds, mutual funds, ETFs, and more.

- Research and Analysis Tools: The platform enables investors to conduct in-depth research on individual stocks, funds, and other investment products.

- Secure and Reliable: The platform prioritizes the security of user data and provides robust security measures to protect investor information and transactions.

- Propose Transactions: Users can easily propose transactions for subscription, switching, and redemption.

- Fee Adjustment: Users can adjust their fees anytime with the help of their advisor.

- View Holdings: Users can monitor their investments on the go.

- Funding and Withdrawals: The platform offers secure and convenient options for funding accounts and withdrawing funds.

iGM Mobile App

The iGM Mobile App integrates advanced technological innovations to manage financial activities easily. It offers a user-friendly experience and provides access to global markets at the user's fingertips.

It offers a investment toolkit, including a broad range of options like stocks, bonds, and ETFs, coupled with high security to protect user data. It enhances user convenience by allowing account access on the go, supports real-time portfolio monitoring, and simplifies transactions with features for opening accounts, proposing trades, and adjusting fees.

Research & Education

iFAST Global Markets provides a suite of research and educational resources designed to empower investors with the knowledge and insights needed to make informed investment decisions. The platform offers a wide range of articles, videos, and in-depth analysis on various investment products including funds, bonds, stocks, ETFs, and managed portfolios.

Articles:

iFAST publishes regular articles that provide the latest market insights and independent research analysis. These articles cover a broad spectrum of topics, from market trends and investment strategies to sector-specific updates. Examples include weekly ETF trend reports and analyses of newly issued bonds, helping investors stay updated on market developments and capture investment opportunities.

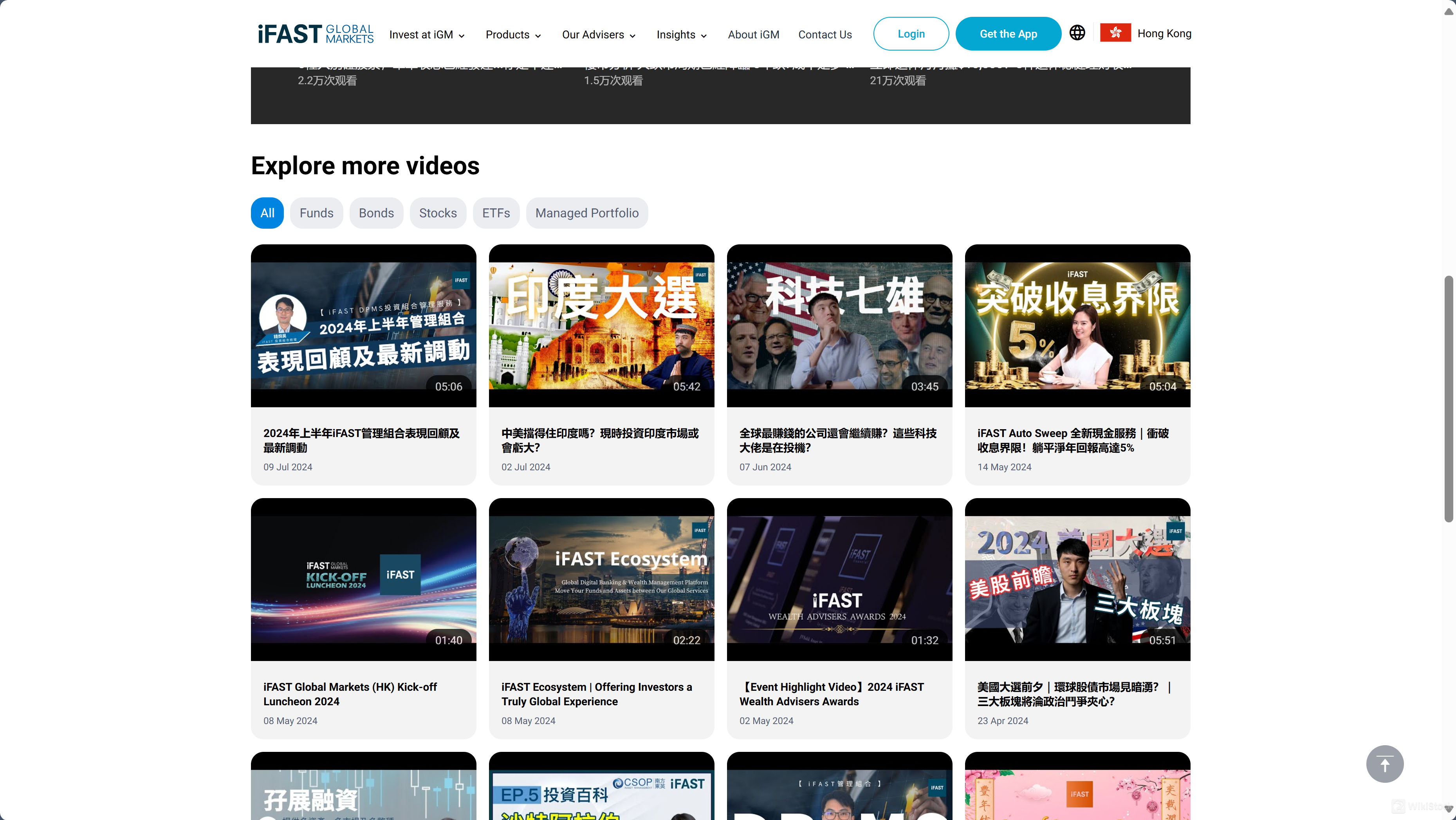

Videos:

The iFAST Global Markets HK YouTube Channel is a valuable resource for investors seeking expert insights and market analysis. The channel features a variety of content, including investment strategies tailored for the Hong Kong market, performance reviews of managed portfolios, and highlights from iFAST events. These videos meet both seasoned investors and those new to the investment landscape, offering tools and information to make informed decisions and seize profitable opportunities.

Customer Support

iFAST Global Markets offers customer support through various channels to ensure clients receive assistance with their queries and services. The help desk operates from Monday to Friday, 8:30 am to 5:30 pm, excluding public holidays.

Clients can reach the support team via the helpline at +852 3766 4334 or email at service@ifastgm.com.hk. The office is located at Suite 702, Tower 5, The Gateway, Tsim Sha Tsui, Hong Kong.

Additionally, for more specific inquiries regarding investment, insurance, or general questions, clients can fill out a contact form on the website, and the expert team will respond promptly.

Conclusion

iFAST Global Markets is a wealth management platform that leverages cutting-edge fintech innovation to provide a wide range of investment options, including stocks, bonds, mutual funds, and ETFs.

The platform ensures accessibility, security, and convenience, empowering investors with robust research tools and personalized advisory services. Regulated across multiple jurisdictions, iFAST offers tailored solutions to meet diverse financial goals while maintaining a strong focus on investor protection and data security.

FAQs

1. What types of investments can I make with iFAST Global Markets?

You can invest in stocks, bonds, mutual funds, ETFs, and more.

2. Is my personal and financial information secure on iFAST?

Yes, iFAST employs robust security measures to protect user data and transactions.

3. How can I contact iFAST Global Markets customer support?

You can reach customer support via the helpline at +852 3766 4334 or email at service@ifastgm.com.hk.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

United States

United StatesObtain 1 securities license(s)

China Hong Kong

China Hong Kong

China Hong Kong

Malaysia

United Kingdom

Singapore

China

--